Crypto World

Solana price breaks bearish structure, $95 target in focus

Solana price has broken its short-term bearish structure, signaling a potential momentum shift that could open the door for a bullish expansion toward the $95 resistance zone.

Summary

- Local bearish trend invalidated, signaling a shift in short-term momentum

- Holding above the value area low supports higher-low formation

- $95 high-timeframe resistance is the next target, if bullish structure persists

Solana (SOL) price action is showing a notable improvement in structure after breaking out of a local bearish downtrend that had controlled price movement for much of the week. This shift marks an important technical development, as Solana has now printed a new high, signalling a potential transition away from short-term bearish control.

While broader market conditions remain mixed, the change in local structure suggests that downside momentum is weakening. If Solana can continue to build acceptance above key value levels, the probability of a sustained move toward higher resistance increases.

Solana price key technical points

- Local bearish market structure has been broken, confirming a higher high

- Value area low remains intact, supporting higher-low formation

- $95 high-timeframe resistance is the next upside target, if momentum persists

The recent price action on Solana has produced a clear break in market structure on the lower timeframes. After a prolonged period of lower highs and lower lows, Solana has now pushed above prior resistance and established a new swing high. This move invalidates the immediate bearish trend and shifts short-term momentum back in favor of buyers.

Market structure breaks are often early signals of trend transitions, particularly when they follow extended consolidations or corrective phases. In Solana’s case, the breakout suggests that sellers are losing control, at least in the short term, and that buyers are becoming more aggressive at current levels.

Holding value area low is critical

Despite the bullish development, confirmation will depend on Solana holding above the value area low. This level represents the lower boundary of fair value within the current range and often serves as a key decision point for whether to continue or fail.

As long as price action remains above this level, Solana has the opportunity to establish a higher low. A higher low would further reinforce the bullish shift in structure and increase confidence that the breakout is sustainable rather than a short-lived reaction.

Failure to hold this level, however, would return Solana to balance and reopen the risk of renewed consolidation or downside rotation.

Higher highs and higher lows shift bias

If Solana continues to print higher highs while defending higher lows, the broader narrative within the current trading range will begin to shift. Multiple higher highs and higher lows would negate the prior bearish bias and suggest that the market is transitioning into a more constructive phase.

Such transitions often occur in stages, with initial breakouts followed by retests and consolidations before larger expansions take place. This underscores the importance of patience, as short-term pullbacks remain healthy within a developing bullish structure.

$95 resistance comes into focus

With the local bearish structure broken, attention now turns to the next major upside level. The $95 region represents a significant high-timeframe resistance area where price previously faced rejection. A move toward this level would align with typical follow-through behavior after a successful structure break.

Reaching $95 would also place Solana back into the upper portion of its broader trading range. How price behaves around this level will be critical in determining whether the rally extends further or transitions into another consolidation phase.

What to expect in the coming price action

From a technical, price action, and market structure perspective, Solana is showing early signs of a bullish continuation. As long as price holds above the value area low and maintains the newly established higher high, the probability favors further upside exploration.

In the near term, traders should expect some volatility as the market digests the structure break. Controlled pullbacks that hold above support would strengthen the bullish case, while a loss of value could delay continuation.

For now, the evidence suggests that Solana’s recent breakout is meaningful. If momentum continues to build, the $95 resistance level stands out as the next key upside target in the current market phase.

Crypto World

BlackRock Raises BitMine Immersion Technologies Stake to Over 9 Million Shares

TLDR:

- BlackRock increased BitMine holdings to 9,049,912 shares, up 165.6% from last quarter

- The total position is valued at roughly $246 million according to the latest 13F filing

- BitMine controls about 4.3 million ETH, or nearly 3.5% of Ethereum’s circulating supply

- Institutional investors continue adding exposure through crypto-linked public equities

BlackRock increased its ownership in BitMine Immersion Technologies during the latest reporting period. A new regulatory filing shows the asset manager raised its stake to 9,049,912 shares, marking a 165.6% quarterly jump and valuing the position at roughly $246 million.

Institutional Allocation Grows

The updated position appeared in BlackRock’s most recent 13F disclosure filed with U.S. regulators. These filings list equity holdings managed across the firm’s broad investment portfolios.

The document shows a sharp rise from the prior quarter’s reported share count.The latest total now exceeds nine million shares of BitMine common stock.

The company trades publicly under the ticker BMNR. It operates immersion-based mining facilities and manages digital assets on its balance sheet.

Shortly after the filing surfaced, crypto-focused accounts shared the figures on social media. One widely circulated post noted that BlackRock had loaded up on BitMine shares.

The message cited the same increase and valuation metrics from the official filing. It framed the purchase as another move by institutions toward crypto-related equities.

BlackRock oversees trillions of dollars across global markets and sectors. Movements of this scale often draw attention from traders and analysts.

Ethereum Treasury Strategy

BitMine’s business model combines mining infrastructure with long-term cryptocurrency holdings. Its treasury includes approximately 4.3 million ETH accumulated through operations and reserves.

That amount represents around 3.5% of Ethereum’s circulating supply. The figure places the company among the larger known corporate holders of the asset.

Holding such reserves ties company performance closely to digital asset prices. Changes in Ethereum’s value can influence both revenue expectations and balance sheet strength.

BlackRock’s expanded position increases institutional exposure to that structure. It links traditional capital management with companies directly tied to blockchain assets.

Quarterly disclosures offer measurable data for tracking these allocations. They provide concrete numbers rather than market rumors or short-term speculation.

The latest filing presents a clear snapshot of BlackRock’s current commitment. With over nine million shares, BitMine becomes a larger piece of its public equity holdings.

The increase arrives as crypto-focused strategies continue attracting institutional capital. Public filings now serve as a key source for monitoring that steady accumulation.

Crypto World

BlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

BlackRock made its first formal move into decentralized finance this week, listing its tokenized Treasury fund on Uniswap, with Bitcoin and Ether staging only modest rebounds amid heavy ETF outflows.

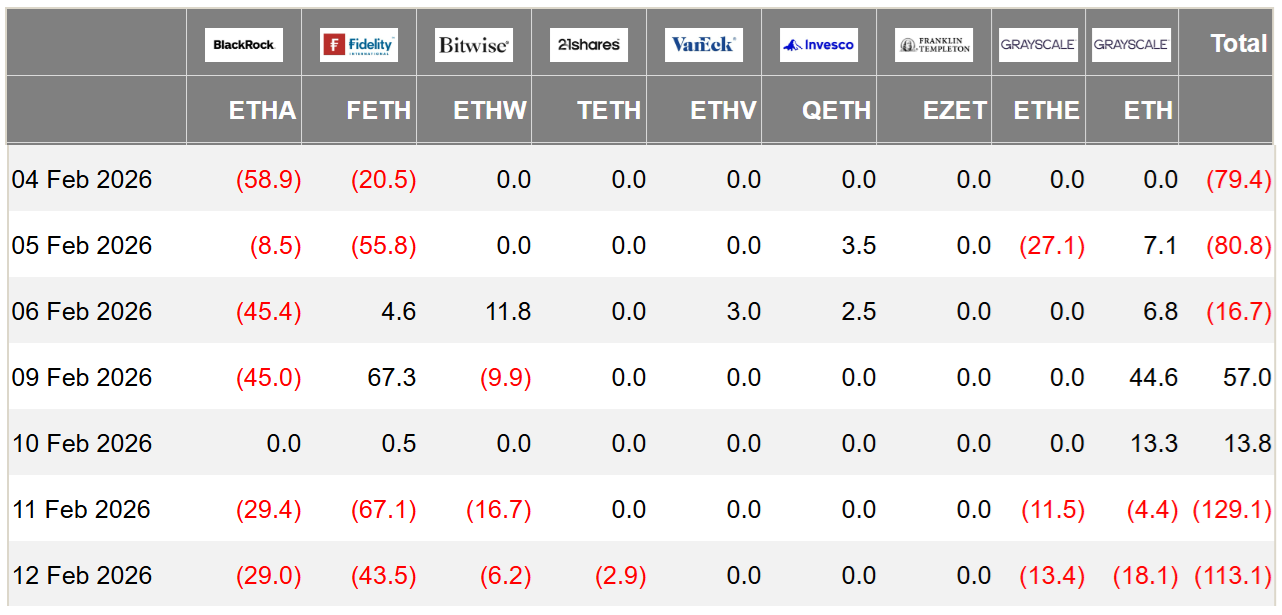

Bitcoin (BTC) and Ether (ETH) each rose about 2.5% during the past week but were unable to cross key psychological levels due to mixed exchange-traded fund (ETF) flows and crypto investor sentiment sinking to record lows.

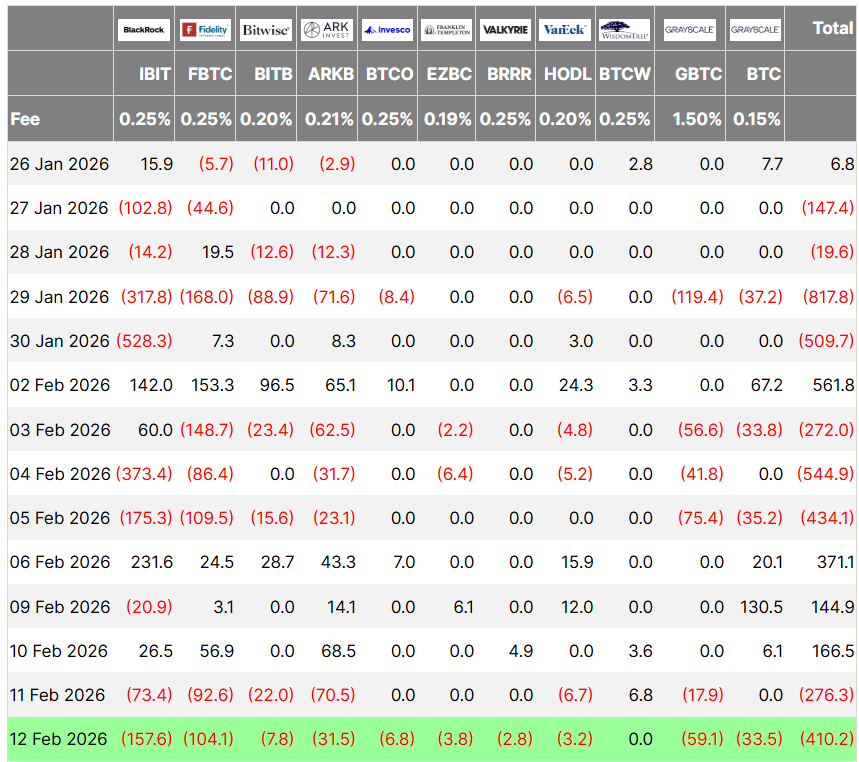

Bitcoin ETFs started the week with two consecutive days of inflows, but they quickly reversed with $276 million in outflows on Wednesday and $410 million on Thursday.

Ether ETFs saw similar flows, with two modest days of inflows, followed by $129 million in outflows on Wednesday and $113 million on Thursday, according to Farside Investors data.

In a silver lining to the correction, Bitcoin’s sharp drawdown to $59,930 may have marked a critical “halfway point” in the current bear market, as markets are now sitting at a critical inflection point that will determine the relevance of the four-year cycle theory, according to Kaiko Research.

Despite sliding crypto valuations, large institutions continue exploring cryptocurrency adoption, including the world’s largest asset manager, BlackRock, which announced its first foray into decentralized finance (DeFi) on Wednesday.

BlackRock enters DeFi, taps Uniswap for institutional token trading

Asset management giant BlackRock is making its first formal move into decentralized finance by bringing its tokenized US Treasury fund to Uniswap, marking a milestone moment for institutional adoption of DeFi.

According to a Wednesday announcement, BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) will be listed on the Uniswap decentralized exchange, allowing institutional investors to buy and sell the tokenized security.

As part of the arrangement, BlackRock is also purchasing an undisclosed amount of Uniswap’s native governance token, UNI, the announcement said.

The collaboration is being facilitated by tokenization company Securitize, which partnered with the world’s biggest asset manager on the launch of BUIDL.

According to Fortune, trading will initially be limited to a select group of eligible institutional investors and market makers before expanding more broadly.

“For the first time, institutions and whitelisted investors can access technology from a leader in the decentralized finance space to trade tokenized real-world assets like BUIDL with self-custody,” said Securitize CEO Carlos Domingo.

BUIDL is the biggest tokenized money market fund, with more than $2.18 billion in total assets, according to data compiled by RWA.xyz. The fund is issued across multiple blockchains, including Ethereum, Solana, BNB Chain, Aptos and Avalanche.

In December, BUIDL reached a key milestone, surpassing $100 million in cumulative distributions from its Treasury holdings.

Trump family’s WLFI plans FX and remittance platform: Report

World Liberty Financial (WLFI), a decentralized finance (DeFi) platform backed by the family of US President Donald Trump, announced on Thursday that it will launch foreign currency exchange (FX) and remittance services for its users.

The planned foreign exchange and remittance platform, called World Swap, seeks to challenge traditional remittance and FX service providers with lower fees and a simplified user interface, according to Reuters.

Daily global FX trading volume surpassed $9.6 trillion in April 2025, according to a report from the Bank for International Settlements (BIS), and the personal remittances market topped $892 billion in annual volume in 2024, according to data from the World Bank.

No exact timeline was given for the rollout. Cointelegraph reached out to World Liberty Financial but did not receive a response by the time of publication.

The expansion into FX and remittances follows WLFI’s application for a national trust bank charter in January and the launch of World Liberty Markets, a lending platform, as WLFI continues to grow while attracting scrutiny from Democratic lawmakers in the US.

Uniswap scores early win as US judge dismisses Bancor patent suit

A New York federal judge dismissed a patent infringement lawsuit brought by Bancor-affiliated entities against Uniswap, ruling that the asserted patents claim abstract ideas and are not eligible for protection under US patent law.

In a memorandum opinion and order on Tuesday, Judge John G. Koeltl of the US District Court for the Southern District of New York granted the defendant’s motion to dismiss the complaint filed by Bprotocol Foundation and LocalCoin Ltd. against Universal Navigation Inc. and the Uniswap Foundation.

The court found that the patents are directed to the abstract idea of calculating crypto exchange rates and therefore fail the two-step test for patent eligibility established by the US Supreme Court.

The ruling marks a procedural win for Uniswap, but it is not final. The case was dismissed without prejudice, giving the plaintiffs 21 days to file an amended complaint. If no amended complaint is filed, the dismissal will convert to one with prejudice.

Shortly after the ruling, Uniswap founder Hayden Adams wrote on X, “A lawyer just told me we won.”

“Uniswap Labs has always been proud to build in public — it’s a core value of DeFi,” a Uniswap Labs spokesperson told Cointelegraph. “We’re pleased that the court recognized that this lawsuit was meritless.”

Cointelegraph reached out to representatives of Bprotocol Foundation for comment but had not received a response by publication.

Binance completes $1 billion Bitcoin conversion for SAFU emergency fund

Binance completed the $1 billion Bitcoin conversion for its emergency fund, committing to holding Bitcoin as its core reserve asset.

Binance purchased another $304 million worth of Bitcoin (BTC) on Thursday, completing the conversion of $1 billion in Bitcoin for its Secure Asset Fund for Users (SAFU) wallet, according to Arkham data.

The fund now holds 15,000 Bitcoin, worth over $1 billion, acquired at an average aggregate cost basis of $67,000 per coin, Binance said in a Thursday X post.

“With SAFU Fund now fully in Bitcoin, we reinforce our belief in BTC as the premier long-term reserve asset.”

The last tranche of BTC came three days after Binance’s previous $300 million acquisition on Monday.

The exchange first announced it would convert its $1 billion user protection fund into Bitcoin on Jan. 30, initially pledging a 30-day window for the acquisitions, which were completed in less than two weeks.

The exchange said it would rebalance the fund if volatility pushes its value below $800 million.

Vitalik draws line between “real DeFi” and centralized yield stablecoins

Ethereum co-founder Vitalik Buterin drew a clear boundary around what he considers “real” decentralized finance (DeFi), pushing back against yield-driven stablecoin strategies that he says fail to meaningfully transform risk.

In a discussion on X, Buterin said that DeFi derives its value from changing how risk is allocated and managed, not simply from generating yield on centralized assets.

Buterin’s comments come amid renewed scrutiny over DeFi’s dominant use cases, particularly in lending markets built around fiat-backed stablecoins like USDC (USDC).

While he did not name specific protocols, Buterin took aim at what he described as “USDC yield” products, saying they depend heavily on centralized issuers while offering little reduction in issuer or counterparty risk.

DeFi market overview

According to data from Cointelegraph Markets Pro and TradingView, most of the 100 largest cryptocurrencies by market capitalization ended the week in the green.

The Pippin (PIPPIN) token rose 195% as the week’s biggest gainer in the top 100, followed by the Humanity Protocol (H) token, up 57% during the past week.

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us next Friday for more stories, insights and education regarding this dynamically advancing space.

Crypto World

Is A Short Squeeze Next?

Ether (ETH) traded back above $2,000 on Friday, and its gains extended after the US Consumer Price Index (CPI) print came in cooler than expected.

The recovery put ETH/USD on track for its first bullish weekly candle close since mid-January, fueling speculation for a rally toward $2,500.

Key takeaways:

-

Ether futures’ open interest fell by 80 million ETH in 30 days, and funding rates hit three-year lows, indicating a weakening bearish trend.

-

ETH price has established strong support around $2,000, a level that must hold to secure the recovery.

Ether open interest falls by 80 million ETH

CryptoQuant data shows Ether futures open interest (OI) across all major exchanges has dropped by over 80 million ETH in the past 30 days.

Binance, the world’s largest cryptocurrency exchange by trading volume, recorded the largest decline of about 40 million ETH (50%) over the last 30 days.

Related: ETH ETF holders in ‘worse position’ than BTC ETF peers as crypto market looks for bottom

Ether’s OI on Gate exchange fell by more than 20 million ETH (25%), while Bybit and OKX saw declines of 8.5 million ETH and 6.8 million ETH, respectively. Cumulatively, the four major platforms saw a total decline of about 75 million ETH, while other platforms accounted for the remaining five million ETH, confirming that the phenomenon is widespread and not limited to a single exchange.

This suggests that leverage traders are “reducing their exposure rather than opening new positions,” CryptoQuant analyst Arab Chain said in a Quicktake analysis.

This significant drop in OI amid dropping prices can be “viewed as a clean-up of weaker positions, thereby reducing the likelihood of sharp forced liquidations later on,” the analyst said, adding:

“This environment may pave the way for a period of relative stability or the formation of a more solid price base for Ethereum in the near future.”

Ether futures funding rates on Binance have plunged deep into negative territory at -0.006, marking the lowest value recorded since early December 2022.

“It indicates that the bearish sentiment has reached an extreme peak not seen in the last three years,” CryptoQuant contributor CryptoOnchain said in a Thursday Quicktake analysis.

Historically, extreme negative funding rates at major price support levels often precede a short squeeze.

“When the crowd is this convinced that prices will fall further, the market tends to move in the opposite direction to liquidate late bears,” the analyst said, adding:

“Current data suggests we may be witnessing a classic capitulation event, mirroring the bottom formation of late 2022, potentially setting the stage for a sharp recovery.”

As Cointelegraph reported, Ether’s surging network activity and rising institutional investor inflows are significant tailwinds for any short-term ETH price gains.

ETH price technicals: Bulls must keep Ether above $2,000

The ETH/USD pair broke out of a falling wedge on the four-hour chart, to trade at $2,050 at the time of writing.

The measured target of the falling wedge, calculated by adding the wedge’s maximum height to the breakout point at $1,950, is $2,150.

Higher than that, the price may rise to retest the 100-period simple moving average (SMA) at $2,260 and later toward $2,500.

On the downside, a key area to hold is the $2,000 psychological level, embraced by the 50-period SMA, as shown in the chart below.

The Glassnode cost basis distribution heatmap reveals a significant support area recently established between $1,880 and $1,900, where investors acquired approximately 1.3 million ETH.

As Cointelegraph reported, Ether accumulation addresses witnessed a surge in daily inflows as ETH dropped below $2,000 last week, signalling strong investor confidence in its long-term potential.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Tokenized Gold Market Surpasses $6 Billion as XAUT and PAXG Dominate Sector Growth

TLDR:

- Tokenized gold market cap surpasses $6B, adding $2B year-to-date growth.

- Over 1.2 million ounces of physical gold are now back on-chain tokens.

- XAUT and PAXG control nearly 96.7% of the total sector market share.

- Rising gold prices near $5,000 are driving demand for tokenized assets.

The tokenized gold market has crossed $6 billion in total market value this year. The sector added nearly $2 billion year-to-date as gold prices approached $5,000 per ounce.

More than 1.2 million ounces of physical gold are now back on-chain tokens.

Market Expansion Tracks Rising Gold Prices

Posts shared by Coin Bureau on X reported that tokenized gold recently crossed the $6 billion mark. The update noted that the sector added roughly $2 billion in 2026 alone. Growth has accelerated as bullion prices climbed toward $5,000 per ounce.

Investors have increasingly turned to tokenized real-world assets for exposure to commodities. Gold-backed tokens allow users to hold allocated bullion through blockchain networks. As prices advanced, demand for digital representations of gold also strengthened.

Data shared in the posts showed that more than 1.2 million ounces of physical gold are locked to back these tokens.

Each token reflects ownership of a portion of stored gold reserves. Holders can therefore gain gold exposure without managing physical storage.

Tokenized gold trades continuously across supported platforms. This structure enables transfers at any time, unlike traditional bullion markets with fixed trading hours. As a result, market access has expanded to a broader base of participants.

XAUT and PAXG Maintain Strong Market Control

The market remains highly concentrated between two issuers. Tether Gold (XAUT) and Paxos Gold (PAXG) account for approximately 96.7% of the total market share. Other tokenized gold products represent only a small fraction of the supply.

XAUT is backed by gold stored in Swiss vaults. PAXG, in comparison, is supported by allocated gold audited monthly in London. Both tokens are designed to track the price of physical bullion closely.

Supporters cite around-the-clock trading and compatibility with decentralized finance platforms as key features. Tokenized gold can integrate with wallets and blockchain applications. This structure allows users to transfer or utilize gold-backed assets efficiently.

At the same time, the sector’s heavy reliance on two issuers remains clear. Concentration levels leave limited diversification within the tokenized gold market. Even so, the asset class continues to expand as gold prices remain elevated.

With bullion near historic levels and blockchain adoption growing steadily, tokenized gold maintains strong alignment between physical reserves and digital markets.

Crypto World

XRP price could double if BlackRock files for ETF, analyst suggests

XRP price could rally 100% if BlackRock files for an XRP ETF, as analysts flag a shift in institutional allocations beyond Bitcoin and Ethereum into alternative assets.

Summary

- Analyst Zach Rector argues that today’s market differs from prior cycles as institutions diversify beyond Bitcoin and Ethereum, with early inflows into XRP-priced products seen as a sign of shifting allocations.

- Rector says a formal BlackRock XRP ETF filing would be a structural catalyst, potentially doubling XRP by expanding regulated access, liquidity, and portfolio integration for large investors.

- He notes that short-term pullbacks remain likely, but views current conditions as longer-term accumulation territory ahead of possible regulatory clarity, new products, and broader altcoin rotation.

A cryptocurrency analyst has projected that XRP (XRP) price could rally 100% if BlackRock Inc., the world’s largest asset manager, files for an XRP exchange-traded fund, according to statements reported by Finbold.

Zach Rector, a crypto market commentator who has followed digital asset markets for several years, stated that the current institutional environment represents a departure from previous market cycles. Rector cited growing diversification in institutional cryptocurrency allocations as evidence of changing investment patterns.

Recent fund flow data indicates selective outflows from certain Bitcoin and Ethereum investment products, while alternative cryptocurrency vehicles, including XRP-linked instruments, have begun attracting capital inflows. Market analysts have characterized this activity as potential evidence that institutional investors may be expanding exposure beyond Bitcoin and Ethereum, the two largest cryptocurrencies by market capitalization.

Rector stated that a formal ETF filing from BlackRock would constitute a structural shift in institutional access to XRP exposure. “And we’ll see XRP double when that happens,” Rector said, according to the report.

An ETF backed by BlackRock could expand institutional access to XRP, improve market liquidity, and strengthen the cryptocurrency’s positioning within traditional investment portfolios, according to market observers. Major ETF product launches have historically served as catalysts in cryptocurrency markets, particularly when associated with globally recognized asset management firms.

Rector noted that short-term price pullbacks remain possible as the broader cryptocurrency market moves toward stabilization. The analyst emphasized that longer-term positioning appears increasingly focused on accumulation ahead of potential institutional catalysts.

Regulatory clarity, new financial product launches, and sustained capital rotation into alternative digital assets could determine whether XRP becomes a primary beneficiary of institutional allocation trends, according to market analysts.

Crypto World

Polymarket Launches 5-Minute Crypto Markets and Teases Airdrop

The leading prediction market is leaning into rumors of a future $POLY token airdrop.

Decentralized prediction market Polymarket is catering to its high-risk audience by introducing 5-minute crypto markets and teasing an airdrop for power users.

The new 5-minute markets allow users to bet on whether or not BTC’s 5-minute candles will close up or down, while providing market maker rebates to liquidity providers.

Following the launch, Polymarket’s “senior intern” and developer, Mustafa Aljatery, responded to one of the platform’s power users in a post saying “1m markets and $POLY next.”

This is not Aljatery’s first time leaning into token and Layer 2 speculation; however, the prediction market began the month by filing a trademark for the $POLY ticker, and Polymarket’s growth lead, William Legate, seemingly confirmed the airdrop after responding “no” to a user who wondered if the platform’s snapshot was already taken.

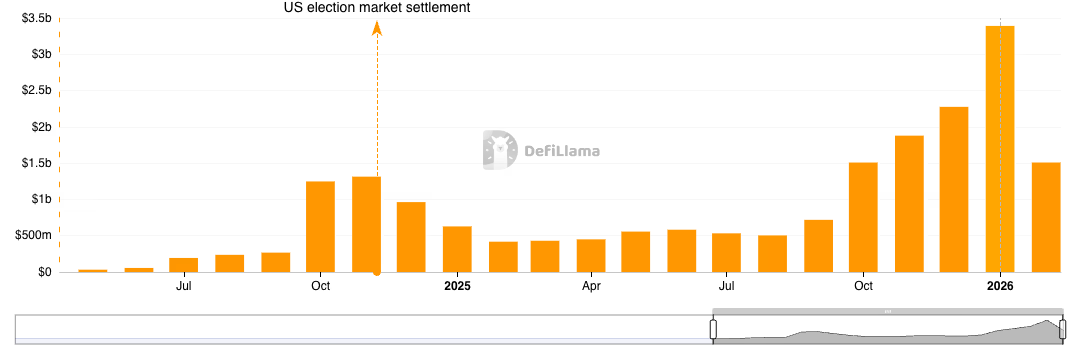

The speculation comes as Polymarket’s volumes continue to surge to new all-time highs, with almost $3.4 billion traded in January alone.

It took more than three years for Polymarket to reach $3.4 billion in volume; now it is clearing that in a single month. So far, $4.9 billion of volume has been traded on Polymarket in 2026.

Despite all the rumors surrounding a potential token and Layer 2 launch, Polymarket has yet to publicly disclose any information about its future structure and whether investors will receive tokens or equity.

The platform’s most recent funding round valued Polymarket at $9 billion, with a $2 billion investment led by Intercontinental Exchange (ICE), the owner of the New York Stock Exchange (NYSE).

Crypto World

Altcoins won’t recover previous highs: analyst

Cryptocurrency markets have undergone structural changes that may prevent most alternative digital assets from reaching their previous all-time highs.

Summary

- Most altcoins are unlikely to reach previous all-time highs due to liquidity issues and capital being concentrated in large-cap assets.

- The current market may be undergoing a mid-cycle reset, with most of the price decline already completed, followed by about 200 days of sideways consolidation before price expansion resumes.

- Traditional four-year cycle models may no longer apply, with the market showing faster declines and a potential earlier recovery than anticipated by the consensus view of a prolonged bear market.

Institutional capital has fundamentally altered market dynamics that previously characterized retail-driven cycles tied to Bitcoin halving events.

In 2018, approximately 1,000 cryptocurrencies traded in markets that exhibited more predictable patterns, according to the analyst. Traders typically rotated between altcoin-to-Bitcoin pairs and exited positions following post-halving bull runs. Market behavior through 2021 remained largely retail-led, with halving events carrying significant psychological influence and price patterns repeating with consistency.

That framework has since changed, according to market analyst Inmortal. Institutional investors have directed billions of dollars primarily toward Bitcoin, Ether, and Solana, along with select large-cap assets. Thousands of new tokens launched in 2025 alone, dispersing available capital across a broader range of assets.

The analyst stated that retail investors anticipated institutional capital inflows would benefit the broader market. Instead, large institutional players concentrated holdings in major assets while retail capital pursued short-term investment narratives. As liquidity is distributed across numerous tokens, potential gains for most altcoins diminished.

Under these conditions, 99% of altcoins may never return to prior all-time highs, according to the analyst’s projection. The four-year cycle models that previously guided market participants may no longer function as reliable indicators.

What happened?

The crypto market is experiencing a shift that could leave most altcoins permanently below their previous all-time highs. With liquidity spread across thousands of tokens, the chances of altcoins recovering are slim. The traditional four-year cycle models, which once guided market predictions, may no longer hold up as reliable indicators.

In the past, these cycle models worked because they were based on factors like Bitcoin halvings and limited market awareness, which made the cycles easier to predict. However, as these patterns became widely recognized, their predictive value diminished. A 2022 projection had anticipated a cycle peak around late 2025, and this was largely aligned with the market high seen in October 2025. But the current market structure is showing signs of deviation from previous cycles.

Unlike the 2018-2021 cycle, where the market saw a sharp 75% price decline followed by over a year of sideways movement, today’s decline is happening much faster. Despite this, long-term support levels, such as the 200-week moving average, have remained intact, suggesting that the market is more resilient than a typical cycle-end scenario would imply.

Instead of expecting a prolonged downturn followed by 600 days of sideways movement, the analyst believes the market may already have completed 80-90% of the expected price decline. After that, about 200 days of consolidation may occur before price expansion resumes. This suggests a mid-cycle reset, challenging the consensus view that a traditional bear market and significant losses are still on the horizon.

If this scenario plays out, the market could see an earlier-than-expected recovery, as the price compression will likely resolve more quickly than many anticipate. However, for altcoins, the outlook remains bleak, with most failing to reach their previous highs due to the concentration of capital in larger assets. Until the market decisively breaks through current support levels, the downtrend is expected to persist within a broader expansion phase.

Crypto World

MANTRA Jumps 33% after MEXC Supports Token Swap

After a fall from grace last year, Mantra is seemingly attempting a comeback with a rebrand.

Less than a year after Mantra’s OM token inexplicably plummeted 90% in minutes, the real-world asset (RWA) protocol is rebranding to a new token, and OM is up 33% today after MEXC announced its support for the token swap.

OM’s market capitalization jumped from $55 million to $72 million after the crypto exchange said it would support the upcoming migration from OM to MANTRA. MEXC will accept deposits of OM, which will be swapped 1:4 to MANTRA.

Despite rallying 33%, OM is still down 99% from its all-time high of $8.5 in February 2025 and currently trades at $0.06.

The rebranding comes just one month after Mantra announced staff cuts amidst a company restructuring.

While it remains to be seen whether this restructuring and token migration will help restore Mantra’s tarnished image, other protocols that have taken the token migration route have not fared well.

The most notable examples include Polygon’s migration from MATIC to POL, and Fantom’s migration and pivot from FTM to Sonic and its S token.

MATIC reached an all-time high fully diluted valuation (FDV) of $29.2 billion in December 2021, and POL now trades at a $1 billion FDV. FTM also reached its previous all-time high in December 2021, achieving an $11 billion FDV, but S now trades at just $171 million.

Crypto World

FedEx Joins Hedera Council to Transform Global Supply Chain Through Distributed Ledger Technology

TLDR:

- FedEx will operate a Hedera network node and hold equal voting rights with other council members.

- Hedera’s enterprise-grade distributed ledger enables secure data verification across organizations.

- FedEx executive calls digital supply chain transformation inevitable, requiring neutral trust layers.

- Partnership aims to reduce cross-border commerce friction through interoperable data verification.

FedEx Corp. announced its membership in the Hedera Council on February 13, 2026. The logistics giant will contribute operational expertise to support distributed ledger technology for global supply chains.

Hedera Council consists of leading organizations governing the Hedera network’s enterprise-grade infrastructure. FedEx will operate a network node and participate in governance decisions alongside other council members.

This partnership aims to reduce friction in cross-border commerce through secure data verification.

Strategic Focus on Digital Infrastructure

FedEx’s entry into the Hedera Council aligns with its broader digital transformation strategy. The company seeks to enable global commerce to operate at data speed rather than paper-based processes.

Vishal Talwar, executive vice president and chief digital officer at FedEx Corp., addressed this transition directly. He serves as president of FedEx Dataworks alongside his corporate role.

Talwar emphasized the inevitable nature of supply chain evolution. “The digital transformation of global supply chains is inevitable,” he stated.

Supply chains are becoming increasingly digital-native environments requiring new trust mechanisms. “Trusted data must be shared and verified across many parties without increasing risk or centralizing control,” Talwar explained.

The executive highlighted Hedera’s specific advantages for enterprise operations. “Hedera provides a neutral, enterprise-grade trust layer that enables verification at global scale,” he noted.

The platform allows organizations like FedEx to build differentiated capabilities on established infrastructure. Companies maintain control over sensitive operational data within their own environments.

The distributed ledger technology supports interoperable digital ecosystems across multiple platforms. FedEx can develop proprietary services while participating in shared verification standards.

This balance between collaboration and competition defines the council’s approach. Equal voting rights ensure no single member dominates governance decisions.

Enabling Cross-Border Commerce Efficiency

Tom Sylvester, president of the Hedera Council, welcomed the partnership announcement. “We are proud to welcome FedEx to the Council,” Sylvester said.

He recognized the company’s extensive experience in global logistics and commerce. “FedEx brings deep operational insight into global logistics and commerce,” the council president stated.

Sylvester emphasized the value of FedEx’s perspective during the industry transition. “Their perspective will be valuable as the industry transitions toward digitally native supply chains,” he explained.

The council anticipates productive collaboration on infrastructure standards. “We look forward to working together to advance trusted, interoperable data verification,” Sylvester added.

The partnership addresses growing complexity across jurisdictions and regulatory frameworks. Hedera’s verification capabilities enable secure data sharing between organizations.

Automation and digital visibility become more feasible with trusted infrastructure foundations. The technology supports continuous compliance requirements across international trade environments.

FedEx brings decades of logistics experience to infrastructure discussions. This operational knowledge helps shape practical applications for distributed ledger technology.

The focus remains on real-world implementation, addressing actual supply chain challenges. Hedera’s enterprise-grade design supports high-volume transactions while maintaining governance controls.

The partnership reflects broader industry recognition of decentralized infrastructure’s importance. Supply chain digitization requires trust mechanisms spanning organizational boundaries.

The Hedera Council model allows enterprises to collectively govern shared infrastructure. Members compete on services while cooperating on foundational technology standards.

Crypto World

ETH ETF Outflows Top $242M Despite Ether Holding $2K

Ether holds $2,000, but may remain under pressure as traders watch corporate earnings, US government debt and growing global tensions.

Key takeaways:

-

Institutional demand for Ether is cooling as investors shift toward the safety of short-term US government bonds.

-

High interest rates and rising ETH supply make the current staking yield less attractive for long-term holders.

Ether (ETH) price has failed to sustain levels above $2,150 since Feb. 5, leading traders to fear a further correction. Investor sentiment deteriorated following outflows from Ether exchange-traded funds (ETFs) and increased demand for put (sell) options.

US-listed Ether ETFs saw $242 million in net outflows between Wednesday and Thursday, reversing the trend from the prior two days. The institutional demand that followed the 20% Ether price recovery after the $1,744 bottom on Feb. 6 has faded as investors noted inconsistency in US economic growth—evident by the growing demand for short-term US government bonds.

Yields on the US 2-year Treasury declined to 3.42% on Friday, nearing the lowest levels seen since August 2022. The higher demand for government-backed debt reflects traders’ expectations of further interest rate cuts by the US Federal Reserve (Fed) throughout 2026. Signs of economic stagnation reduce inflationary risks, paving the way for expansionist measures.

Regardless of macroeconomic trends, Ether has underperformed the broader cryptocurrency market, causing traders to question if Ethereum still has what it takes to compete against networks that offer base layer scalability and faster onchain activity.

Traders fear that ETH price is destined for more downside, but data seems to reflect the recent price weakness rather than the anticipation of a further crash.

Ether price declined 38% in 30 days, which negatively pressures the network’s fees and ultimately reduces incentives for staking. Long term holding is a critical component for sustainable price growth, and the current 2.9% staking yield is far from appealing, considering the US Fed target rate stands at 3.5%. Furthermore, the ETH supply is growing at an 0.8% annualized rate.

ETH derivatives metrics reflect traders’ fear of further price drops

Professional traders are not comfortable holding downside price exposure according to ETH derivatives metrics, which further reinforces the bearish sentiment.

The ETH options delta skew stood at 10% on Friday, meaning put (sell) options traded at a premium. The increased demand for neutral-to-bearish strategies causes the indicator to move above the 6% threshold, which has been the norm for the past two weeks. Traders’ mood reflects a six-month bear market as ETH trades 58% below its all-time high.

Related: Crypto investor sentiment will rise once CLARITY Act is passed–Bessent

From a broader perspective, a mere $242 million in Ether ETF outflows represents less than 2% of the total $12.7 billion in assets under management; hence, traders should not assume that ETH price has entered a death spiral. Investors’ morale will eventually recover as the network remains the absolute leader in Total Value Locked (TVL).

Traders’ attention will likely remain centered on corporate earnings results and whether the US government will be able to refinance its debt amid growing global socio-economic tensions. Under this scenario, ETH price will likely remain pressured regardless of onchain and derivatives metrics.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports7 days ago

Sports7 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech3 days ago

Tech3 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Video14 hours ago

Video14 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports5 days ago

Sports5 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Business6 days ago

Business6 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video2 days ago

Video2 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World4 days ago

Crypto World4 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat5 days ago

NewsBeat5 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports4 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World4 days ago

Crypto World4 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?