Crypto World

Will BTC Slide Under $80K Next?

Bitcoin has pulled back sharply, slipping roughly 10% from midweek into Thursday and testing the $81,000 level for the first time in more than two months. The move comes as traders digest a wave of outflows from spot BTC exchange-traded funds, alongside a broader risk-off tone that coincided with gold’s retreat from its own all-time high. The backdrop is a market increasingly focused on hedging and liquidity, with options markets flashing notable fear metrics just as leveraged bets have been unwound. The price action also underscores a crucial test for the $80,000 support area, which—while still intact—faces renewed scrutiny as investors weigh macro risks and the possibility of renewed volatility.

Bitcoin (BTC) experiences a pullback after a period of outsized moves, and the tissue of market signals suggests traders are cooling risk exposure in the near term. The drop comes on the back of US-listed spot Bitcoin ETFs showing material net outflows, while gold prices have dipped from their Wednesday peak. In this context, the market’s nervous undertone is evident in the options market, where fear is elevated and hedging activity appears more pronounced than at any point in recent months.

The latest data shows US-listed spot Bitcoin ETFs have recorded about $2.7 billion in net outflows since January 16, representing roughly 2.3% of total assets under management. This backdrop has raised questions about institutional demand and whether investors are layering into safer havens or stepping back from risk assets altogether. At the same time, gold has declined about 13% from its Wednesday high, reminding traders that multi-asset markets can move in tandem when liquidity tightens and macro narratives shift. The combination of ETF redemptions and precious metal dynamics has contributed to a cautious mood that could extend into the near term, even as some investors point to longer-term value cases for BTC as a potential hedge against inflation and currency risk.

Key takeaways

- Bitcoin options delta skew rose to 17% on Friday, its highest level in more than a year, signaling extreme fear and heightened hedging activity as market makers prepare for further downside protection.

- Net outflows from US-listed spot BTC ETFs totaled about $2.7 billion since Jan 16, equating to roughly 2.3% of assets under management and raising questions about institutional demand.

- The price correction reached about 10%, with BTC retesting the $81,000 area—the first proximity to that level in over two months—raising the specter of a soft test of the psychological $80k support.

- Approximately $860 million in leveraged long BTC futures positions were liquidated between Thursday and Friday, while aggregate BTC futures open interest fell to about $46 billion from around $58 billion three months prior, indicating deleveraging across the market.

- Stablecoin dynamics in cross-border flows suggested moderation rather than a rush for cash, with a 0.2% discount for USDT/CNY versus the US dollar/CNY, contrasting with traditional parity expectations and signaling cautious liquidity conditions.

Tickers mentioned: $BTC

Sentiment: Bearish

Price impact: Negative

Market context: The current dynamics sit at the intersection of risk-off trading, ETF outflows, and macro uncertainty. As traditional risk assets face persistent headwinds, investors have favored liquidity and short-duration exposures, which often translate into pressure on highly leveraged crypto positions and volatility spikes in liquid markets like BTC.

Why it matters

The surge in BTC options fear, mirrored by a jump in delta skew, points to a market structure that is increasingly sensitive to downside risk. When put options carry a premium relative to calls, market makers hedge with heightened caution, amplifying price swings in times of stress. The 17% delta skew suggests that the market is more willing to pay for downside protection than to bet on further upside, a condition that can feed upon itself if macro catalysts continue to weigh on sentiment. In this environment, traders must monitor not just price levels but the pace and direction of hedging activity, as it can create feedback loops that drive rapid short-term moves.

ETF flows are a useful lens into the institutional appetite for BTC as an asset class. The reported $2.7 billion of net outflows since mid-January, representing 2.3% of AUM, signals institutional demand softness even as retail participants can remain active. Outflows from spot BTC ETFs can compress price durability if buyers do not re-enter in meaningful size, particularly when risk-off sentiment is reinforced by other macro variables. This backdrop also coincides with gold’s multi-month rally being tempered by short-term retracements, underscoring a broader competition for capital across safe-haven assets. In this light, BTC’s price action becomes a barometer for risk sentiment in the crypto space and a gauge of how quickly demand can swing in response to macro cues.

Beyond the price action, the risk narrative extends into the realm of technology risk like quantum computing. While some market participants remain skeptical about imminent disruption to the cryptographic foundations of blockchains, others warn that long-term security considerations must be taken seriously. Independent research and ongoing dialogue within the industry—highlighted by initiatives such as Coinbase’s advisory board aimed at evaluating quantum threats with public research slated for early 2027—add a layer of forward-looking risk assessment to the conversation. The broader takeaway is that risk considerations—whether macro, technological, or liquidity-driven—are increasingly intertwined in shaping crypto markets.

Analysts note that a cooling in leverage can be a double-edged sword. On one hand, a deleveraging phase can reduce systemic risk and limit cascading liquidations, potentially stabilizing prices after a sharp correction. On the other hand, if risk appetite does not return, the market could remain range-bound with occasional reversals as participants digest incoming data and reassess risk premium. The combination of a lower open interest and notable liquidations suggests a shift toward a more conservative posture among traders, even as some investors argue that the long-term bull case for BTC remains intact. The ongoing debates around quantum security and the ongoing debate about institutional appetite will likely shape how quickly the market can stage a renewed rally if macro and crypto-specific catalysts align.

The futures market remains a useful lens into risk sentiment. With open interest sliding to $46 billion from a prior $58 billion, and with a substantial portion of long positions liquidated, the market appears to be purging excess leverage. This process can improve resilience over the longer term, but it can also prolong volatility in the near term if demand remains tepid or if new catalysts emerge. The broader ecosystem will watch how quickly liquidity returns, how ETF flows evolve, and whether macro narratives shift back toward risk-on or risk-off dynamics. In this context, BTC’s ability to reclaim momentum will hinge on more than just price—it will require a rebalancing of demand across institutions, traders, and retail participants alike.

As markets calibrate to these dynamics, traders will keep an eye on stablecoin liquidity signals as a proxy for overall risk appetite. The ratio of USDT to yuan and the implied USDT/CNY vs USD/CNY relationship offer a barometer of capital flight and the willingness of traders to move into on-chain assets or exit to cash. In the current climate, a modest 0.2% discount suggests a measured outflow rather than a rush for liquidity, reinforcing the narrative of caution rather than panic selling. This nuanced picture—combining price action, leverage cycles, and cross-asset flows—frames BTC as a barometer of risk sentiment rather than a standalone driver of returns in the near term.

What to watch next

- BTC price action around the $81,000–$87,000 band, with a focus on whether the asset can reclaim momentum and establish a new upside base.

- New ETF net flow data over the coming weeks, to determine whether institutional demand resumes or remains tepid.

- Deribit and other derivatives gauges (delta skew, volatility surfaces) for signs of fading fear or renewed hedging pressure.

- Any fresh developments on macro frontiers that could alter risk appetites, including inflation data and policy signals.

Sources & verification

- Bitcoin price retest near $81,000 and related market moves (price page and price data references).

- US-listed spot Bitcoin ETF net outflows totaling about $2.7 billion since Jan 16 (2.3% of AUM).

- Gold’s three-month performance and its interaction with crypto markets (gold-related article referencing divergence).

- BTC options delta skew reaching 17% (Deribit delta skew data; laevitas.ch source).

- Reported leveraged long BTC futures liquidations around $860 million; open interest decline from $58B to $46B (CoinGlass and related charts).

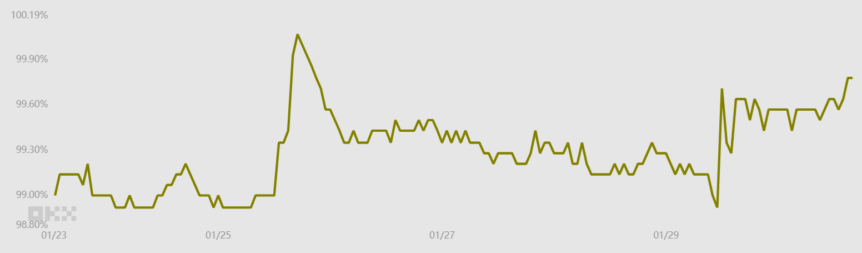

- Stablecoin liquidity indicators and USDT/CNY dynamics (OKX-based data visuals and captions).

- Coinbase advisory board on quantum computing risks and public research planned for early 2027.

- Related market analysis on potential “liquidation revenge” dynamics and BTC price catalysts.

Bitcoin market dynamics: options fear, ETF flows, and macro risk

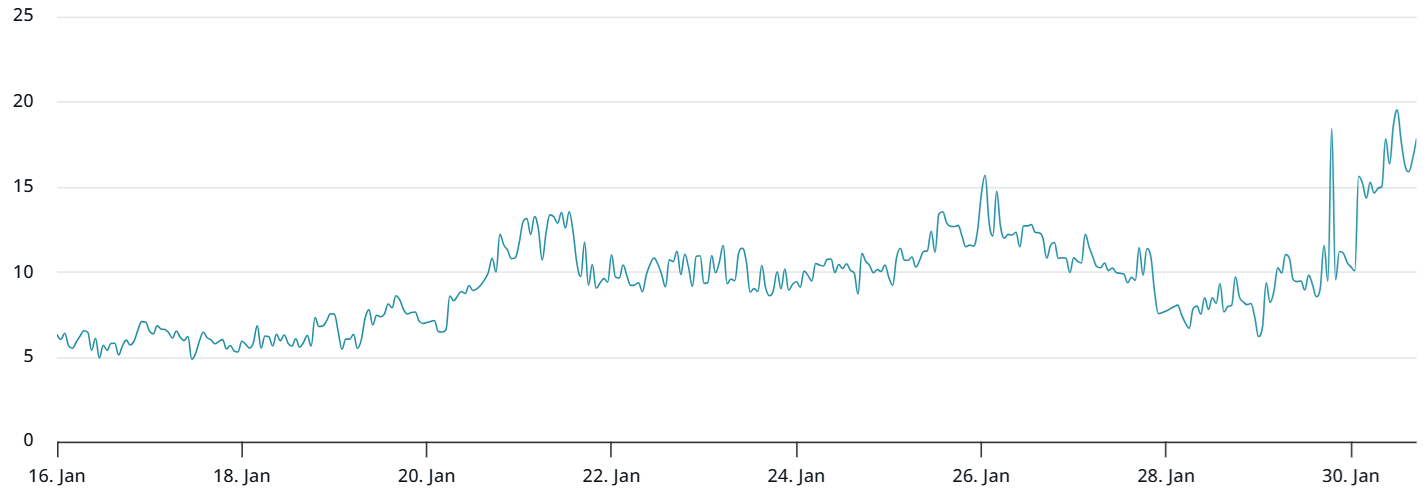

Bitcoin (CRYPTO: BTC) has found itself navigating a confluence of hedging-driven activity, ETF liquidity, and broader macro risk signals. The most notable marker is the jump in the delta skew of BTC options to 17%—the highest in more than a year—indicating an elevated demand for downside protection that can feed into heightened volatility as market makers hedge. This condition often materializes when traders anticipate more downside or when liquidity is contracting, even if the immediate price path appears uncertain. The practical upshot is that any negative surprise—be it a policy shift, macro data release, or unexpected liquidity shock—can trigger outsized moves as hedges unwind or recalibrate in a hurry. The Deribit delta skew metric depicted in the chart below, with its sourcing from laevitas.ch, offers a window into the market’s fear gauge and the distribution of risk bets across the spectrum of options contracts.

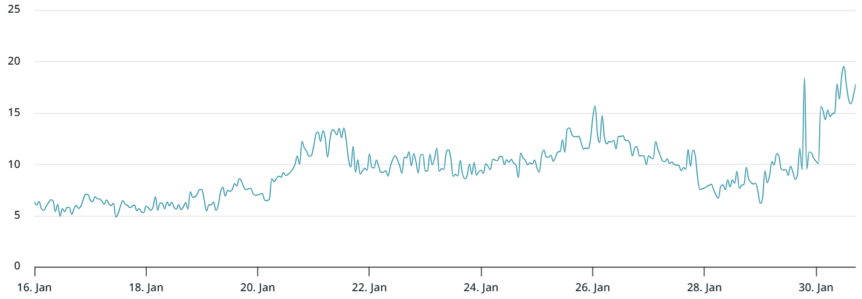

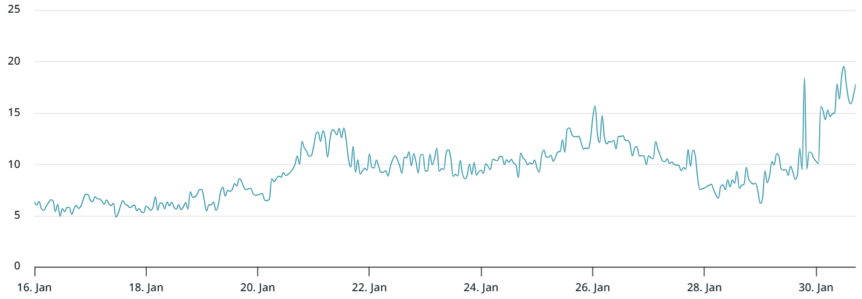

The recent price action, meanwhile, reflects not only fear but real liquidity dynamics. Leverage in the system has been purged to some degree, with approximately $860 million in leveraged long BTC futures liquidations observed between Thursday and Friday. While this purge reduces systemic risk in the near term, it also underscores how fragile short-term sentiment can become when a dramatic price swing occurs. At the same time, aggregate BTC futures open interest slipped to about $46 billion, down from roughly $58 billion three months ago, signaling a cautious tilt among market participants and a shift away from highly leveraged bets. The chart below from CoinGlass illustrates the current open interest landscape and helps contextualize the scale of deleveraging occurring in the market.

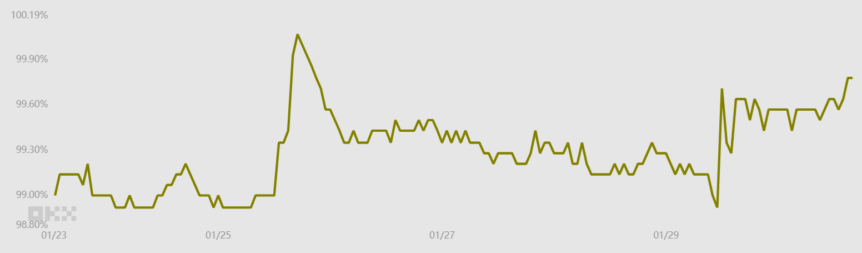

Beyond outright price risk, the market is watching cross-asset flow signals, especially stablecoins, as a proxy for risk appetite. The current data indicate a modest shift in the USDT/CNY dynamic, with a 0.2% discount to the US dollar/CNY rate, indicating moderate outflows rather than an abrupt liquidity crunch. This stands in contrast to a typical 0.5%–1% premium and suggests that, at least in the near term, investors remain selective about their allocation to on-chain assets. Taken together with the price correction and the outflows from spot BTC ETFs, these indicators paint a cautious portrait: BTC could reclaim momentum if flows stabilize and risk sentiment improves, but the near-term path remains tethered to macro twists and the pace of institutional adoption.

In the broader context, investors should consider the potential implications of quantum computing risks on long-term security models for blockchains. While the field remains in early stages, industry observers emphasize the importance of ongoing research and preparedness. As Coinbase has signaled through its independent advisory board and forthcoming public research, this is a risk factor that could influence long-horizon holdings, even if it does not pose an immediate threat to today’s networks. At the same time, the market continues to watch for catalysts, such as potential policy shifts, ETF inflows, or regulatory developments, that could tilt risk sentiment in either direction. For now, the narrative is one of measured caution, with a focus on liquidity, hedging, and the durability of BTC’s longer-term value proposition in a rapidly evolving crypto landscape.

https://platform.twitter.com/widgets.js

Crypto World

JPMorgan Issues Bold Bitcoin Prediction Amid Crash

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee and settle in — the market’s been on a rollercoaster lately. Bitcoin is moving, stocks are shifting, and headlines are coming fast. While some investors are hitting pause, others are watching closely, trying to read the signals beneath the noise.

Crypto News of the Day: Bitcoin Slides Below $68,000 Amid Forced Deleveraging

Bitcoin fell below $70,000 on Thursday, before extending a leg down to levels below $68,000, an area last tested on October 28, 2024. The move came as intensified selling swept across crypto markets.

Sponsored

Sponsored

The decline marks roughly a 45% drop from October highs, fueled by ETF outflows, fading demand, and a “forced deleveraging” phase in futures markets.

“…with demand fading, ETF inflows drying up, and futures markets entering a “forced deleveraging” phase. Analysts say weak volumes and sustained selling are prompting investors to exit at a loss, despite technical indicators signaling oversold conditions,” wrote Walter Deaton.

Weak volumes and sustained selling pressure have prompted many investors to exit positions at a loss, even as technical indicators signal oversold conditions.

Despite the short-term turbulence, JPMorgan is increasingly bullish on Bitcoin’s long-term potential relative to gold.

The bank highlighted that BTC is now trading well below its estimated production cost of $87,000, a level historically considered a soft floor, and that its volatility relative to gold has dropped to record lows.

“…large outperformance of gold vs. Bitcoin since last October, coupled with the sharp rise in gold volatility, has left Bitcoin looking even more attractive compared to gold over the long term,” MarketWatch reported, citing JPMorgan’s quantitative strategist Nikolaos Panigirtzoglou.

According to the bank, this improved risk-adjusted profile suggests significant upside for investors willing to hold over a multi-year horizon.

Market stress metrics highlight the fragility of the current environment. Glassnode data shows that Bitcoin’s capitulation metric has recorded its second-largest spike in two years. This reflects sharp forced selling and accelerated de-risking by market participants.

Sponsored

Sponsored

Meanwhile, it is worth noting that Bitcoin has erased all gains since Donald Trump won the election, wiping out a 78% post-election rally and highlighting ongoing volatility.

Crypto Stocks Tumble Amid Bitcoin Sell-Off and Rising Economic Uncertainty

Crypto equities mirror the broader weakness in Bitcoin. Shares of Coinbase, Riot, Marathon, and Strategy fell between 5% and 7% premarket after the drop below $70,000, with ETF holdings also down more than 5%.

The crypto downturn comes amid broader macroeconomic headwinds. US January layoffs surged 205% year-over-year to 108,435, the highest January total since 2009, according to Challenger, Gray & Christmas.

Job cuts were concentrated in transportation — led by UPS — and tech, with Amazon announcing 16,000 layoffs. Healthcare also saw notable reductions.

Sponsored

Sponsored

Meanwhile, federal job protections were overhauled, with the Trump administration finalizing reforms affecting 50,000 civil service workers. Continuing claims remain elevated at 1.84 million, highlighting ongoing economic uncertainty.

Equity markets are also witnessing a similarly complex backdrop, with the BMO Capital Markets projecting the S&P 500 could reach 7,380 by the end of 2026, implying an 8% expected return.

The firm favors cyclical sectors such as industrials, materials, energy, and financials, while underweighting defensive sectors. Inflation remains a principal risk, though global monetary and fiscal stimulus provide support.

With all these in mind, Bitcoin and broader financial market investors face a delicate balancing act:

- Technical oversold conditions and low relative volatility suggest a long-term opportunity

- Yet, immediate pressures from leveraged positions, ETF outflows, and macro uncertainty continue to weigh on sentiment.

JPMorgan’s analysis points to potential gains for patient holders, but the short-term outlook remains volatile, reflecting a market in the midst of recalibration.

Sponsored

Sponsored

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

Crypto Equities Pre-Market Overview

| Company | Close As of February 4 | Pre-Market Overview |

| Strategy (MSTR) | $129.09 | $120.78 (-6.58%) |

| Coinbase (COIN) | $168.62 | $159.42 (-5.46%) |

| Galaxy Digital Holdings (GLXY) | $20.16 | $19.10 (-5.26%) |

| MARA Holdings (MARA) | $8.28 | $7.81 (-5.68%) |

| Riot Platforms (RIOT) | $14.14 | $13.36 (-5.51%) |

| Core Scientific (CORZ) | $16.15 | $15.50 (-4.02%) |

Crypto World

Aave Delegate Platform Proposes Pausing Three L2 Deployments Citing Weak Revenue

The proposal also includes requiring any new deployment to guarantee at least $2 million in annual revenue to Aave.

A governance delegation platform for Aave, the largest decentralized lending platform, with more than $29 billion in total value locked (TVL), has proposed pausing three underused Layer 2 deployments of Aave V3.

In a Jan. 29 governance proposal that moved to a snapshot vote on Feb. 3, the Aave Chan Initiative (ACI) proposed that Aave freeze its V3 deployments on Ethereum L2s zkSync Era, Metis, and Soneium to cut costs.

“Over time, it has become clear that a small subset of instances contributes very little user activity, TVL, and revenue, while still requiring a non-trivial amount of attention from service providers and governance participants,” ACI wrote in the prospal.

The proposed reduction in L2 deployments aims “to reduce operational overhead and governance burden by addressing instances that are clearly non viable today.”

Among the three networks, zkSync currently has the largest TVL at about $26 million, followed by Soneium with $21.6 million and Metis with $11.7 million, according to DefiLlama data.

Over the past 30 days, Aave generated just $714 in revenue on zkSync, $679 on Metis, and just $150 on Soneium, per DefiLlama. For comparison, within the same timeframe Aave made over $7.7 million on Ethereum and nearly $298,000 on Base.

Now, ACI is pushing for stricter terms on future expansions. The proposal calls for any new chain deployment to guarantee Aave a minimum of $2 million in annual revenue, arguing that the protocol’s liquidity is often underpriced given the “upfront and recurring costs.”

The snapshot vote on the proposal, which runs through Feb. 7, has so far drawn unanimous support, with 257,300 votes in favor and none against.

Voting kicked off the same day that Ethereum’s broader scaling strategy came under renewed scrutiny. As The Defiant reported earlier this week, Ethereum co-founder Vitalik Buterin published an X post arguing that the rollup-centric roadmap for the network “no longer makes sense,” and arguing that L2s should focus on other use cases.

Crypto World

Roubini Predicts a ‘Crypto Apocalypse’ Amidst Bitcoin’s Plunge Under Trump-Era Policies

Roubini said that Bitcoin behaves like a leveraged bet, rising and falling alongside high-risk equities rather than hedging uncertainty.

Economist Nouriel Roubini, who is known for his anti-crypto rhetoric, predicted a looming “crypto apocalypse.” He explained that the future of money and payments will evolve gradually rather than undergo the revolutionary transformation promised by cryptocurrency advocates.

In a recent post, Roubini said Bitcoin and other cryptocurrencies’ latest price plunge demonstrates the extreme volatility of what he calls a “pseudo-asset class,” and expressed hope that policymakers recognize the risks before further damage occurs.

He recalled that one year earlier, Donald Trump had returned to the US presidency after courting retail crypto investors and receiving significant backing from crypto industry figures. This led several evangelists to predict that Bitcoin would reach at least $200,000 by the end of 2025 and become “digital gold.”

Roubini: Bitcoin Isn’t a Hedge

According to Roubini, Trump followed through by dismantling most crypto regulations, signing the Guiding and Establishing National Innovation for US Stable Coins (GENIUS) Act, pushing the Digital Asset Market Clarity (CLARITY) Act, profiting from domestic and foreign crypto deals, promoting a meme coin bearing his name, pardoning crypto criminals allegedly linked to terrorist organizations, and hosting private White House dinners for crypto insiders.

Roubini noted that crypto was also expected to benefit from macroeconomic and geopolitical risks, including rising public debt, fiat currency debasement, trade wars, and increased tensions involving the US, Iran, and China, factors that coincided with gold rising more than 60% in 2025.

Bitcoin, however, fell 6% that year and, as of the time of writing, was down 42% from its October peak and below its level at Trump’s election, while the TRUMP and MELANIA meme coins had dropped 95%. Roubini said Bitcoin repeatedly declined during periods when gold rallied, and argued that it behaves as a leveraged risk asset correlated with speculative stocks rather than a hedge.

He reiterated his long-standing view that crypto does not function as a currency, as it is neither a unit of account, a scalable payment system, nor a stable store of value, while citing El Salvador’s experience, where Bitcoin accounts for less than 5% of transactions. He further argued that crypto is not a true asset because it lacks income streams or real-world utility.

You may also like:

On Stablecoins and Regulations

Roubini said the only widely adopted crypto application after 17 years is the stablecoin, which he described as a digital form of fiat money already replicated by traditional finance, and maintained that most blockchain-based systems are centralized, permissioned, and privately controlled. He asserted that fully decentralized finance will never scale because governments will not permit anonymous transactions, and that AML and KYC requirements undermine claims of lower costs.

While speaking about regulation, Roubini warned the GENIUS Act risks recreating the instability of 19th-century free banking, as stablecoins lack narrow bank regulation, lender-of-last-resort access, or deposit insurance, making them vulnerable to runs. He also criticized proposals allowing stablecoins to pay interest, and claimed that this could destabilize fractional reserve banking unless payments and credit creation are structurally separated.

Roubini’s comments come as Bitcoin continues its downward trajectory, falling a fresh 6% on Thursday and trading below $71,600 at the time of writing. The latest decline has added to broader market unease, and analysts are warning that continued weakness in BTC could have wider implications. Market experts have increasingly raised concerns that firms holding large BTC reserves may face massive balance-sheet stress and systemic risk if prices continue to slide.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Sovcombank launches bitcoin-backed loans for Russian miners and businesses

Sovcombank, the ninth-largest Russian bank by assets, said it became the first financial institution in the country to offer bitcoin-backed loans to individuals and corporations who legally own digital assets.

The move follows a pilot program by state-owned Sberbank, which in late December issued the first such product to mining firm Intelion Data. While crypto-secured lending remains limited amid regulatory uncertainty, Russian banks have increasingly shown interest in borrowing against bitcoin as mining firms and crypto-holding businesses look to unlock liquidity while retaining their digital assets.

“Specifically, we offer bitcoin-secured lending, allowing our clients to raise financing for business development without having to sell their assets,” Marina Burdonova, Sovcombank’s compliance director, said in a statement. Only companies and individuals who legally own digital assets will have access to the bitcoin-backed lending products, she said.

Crypto mining in Russia became legal Nov. 1, 2024 after the government introduced a law allowing legal entities and entrepreneurs registered with the Ministry of Digital Development to engage in the activity. Unregistered miners could operate only if they do not exceed energy consumption limits.

A month later, the government imposed a six-year ban on crypto mining in 10 regions due to the industry’s high power consumption. In December 2025, it reopened the cryptocurrency market to the public with new rules laid out by the country’s central bank.

“Mining has ceased to be a niche ‘bitcoin mining’ activity. It has become an investment class with predictable returns, a payback period and manageable risks,” Burdonova said. “Sovcombank sees potential in partnerships with all crypto industry participants, from miners and data center operators to crypto exchanges and money changers.”

Crypto World

Binance price eyes $615 fibonacci support as oversold conditions build

Binance’s price is approaching the $615 support zone as oversold conditions intensify, placing it at a critical technical inflection point.

Summary

- $615 is a major confluence support combining the 0.618 Fibonacci, VWAP, and prior value area high

- Rejection at $932 confirms bearish structure, keeping pressure on price in the short term

- Oversold conditions raise bounce probability, but confirmation is needed for reversal

Binance (BNB) price has entered a sharp corrective phase following its recent swing high, with bearish momentum accelerating across multiple timeframes. After failing to sustain upside continuation, price has rotated lower in an impulsive fashion, signaling a clear shift in short- to medium-term market structure.

As BNB continues to unwind recent gains, attention is now turning toward a key high-timeframe support region near $615, where technical confluence suggests this level may play a decisive role in determining the next directional move.

Binance price key technical points

- $615 marks a major confluence support zone, aligning with the 0.618 Fibonacci retracement and VWAP support

- High-timeframe resistance at $932 remains intact, reinforcing the broader corrective structure

- Oversold conditions increase the probability of a relief bounce, provided structural support holds

The current corrective move began after Binance Coin established a new high at a time-frame resistance near $932.

This level acted as a decisive rejection point, where bullish momentum stalled and sellers regained control.

The failure to reclaim acceptance above this resistance confirmed a structural low and initiated the current impulsive move to the downside.

Since that rejection, price action has remained consistently bearish, with lower highs and expanding downside candles reflecting aggressive selling pressure. This behavior suggests that the move lower is not merely a shallow pullback, but a broader corrective rotation within the prevailing market cycle.

$615 support zone comes into focus

As price continues to decline, the $615 region has emerged as the most important technical level in the near term.

This zone represents a high-confluence area where multiple technical factors align, including the 0.618 Fibonacci retracement of the broader move and VWAP-based support.

Additionally, this region sits above the previous range value area high, strengthening its relevance as a structural support level.

Historically, when price revisits such confluence zones after an impulsive move, the market often pauses to reassess value. If buyers step in to defend this area, it increases the likelihood that prices will stabilize and form a base for a corrective rebound.

Oversold conditions signal potential exhaustion

Momentum indicators are now beginning to reflect oversold conditions following the extensive selling seen over recent days and weeks. While bearish trends can persist longer than expected, oversold readings often signal that downside momentum may be nearing exhaustion, especially when price approaches major support.

Importantly, oversold conditions alone do not confirm a reversal. However, when combined with strong structural support, they increase the probability of at least a short-term relief bounce. Any such bounce would likely be corrective in nature unless accompanied by a clear reclaim of higher resistance levels.

What to expect in the coming price action

From a technical, price action, and market structure perspective, the $615 region represents a critical make-or-break level for Binance Coin. A successful defense of this support could allow BNB to establish a higher low and trigger a rotation back toward higher price targets. Conversely, failure to hold this zone would expose the market to deeper corrective levels and extend the bearish structure.

Until confirmation emerges, traders should closely monitor volume behavior and price reaction around support. A strong bullish response would signal improving demand, while continued weakness would reinforce downside risk. For now, all eyes remain on $615 as the market approaches a pivotal moment in Binance Coin’s corrective cycle.

Crypto World

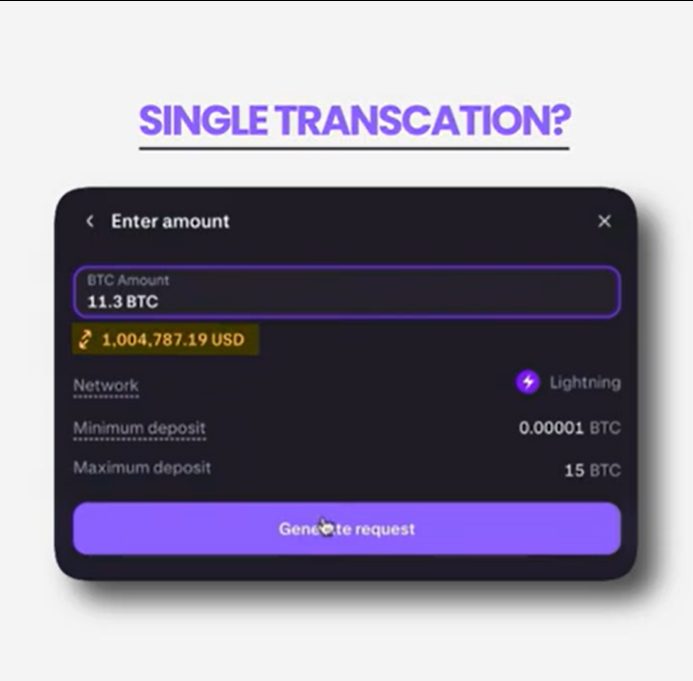

$1M Lightning Payment Tests Bitcoin’s Institutional Rails

Institutional trading and lending desk Secure Digital Markets (SDM) said it sent a $1 million payment to cryptocurrency exchange Kraken over the Lightning Network on Jan. 28.

SDM claimed in a Thursday statement shared with Cointelegraph that it is the largest publicly reported Lightning transaction to date and a proof‑of‑concept for seven‑figure transfers between regulated counterparties.

The payment cleared in 0.43 seconds and was routed via Voltage’s managed Lightning infrastructure, which provides node management, pre‑provisioned liquidity, and uptime guarantees aimed at exchanges and trading desks.

The previously publicized “record” single payment milestone was about 1.24 Bitcoin (BTC), roughly $140,000 at the time, highlighting the rarity of six‑figure Lightning payments, let alone a clean, seven‑figure transfer in one shot.

Voltage CEO Graham Krizek called the transaction an “important moment for Lightning and for institutional Bitcoin payments,” saying that a $1 million Lightning transfer highlighted the “its ability to meet enterprise requirements.”

Related: Lightning Network could nab 5% of stablecoin flows by 2028: Voltage CEO

Lightning metrics remain small, but growing

The transfer comes against a backdrop of mixed Lightning metrics. Capacity on public Lightning channels fell from over 5,400 BTC in late 2023 to about 4,200 BTC by mid 2025, before rebounding to a new all-time high capacity of over 5,600 BTC by December.

That’s still a small pool of capital relative to Bitcoin’s market value, and most documented usage has skewed toward smaller payments.

Bitfinex, for example, had long capped Lightning deposits at 0.04 BTC before recently lifting limits to 0.5 BTC per payment and 2 BTC per channel.

In a statement shared with Cointelegraph, Paolo Ardoino, CEO of Tether and chief technology officer at Bitfinex, called the Lightning Network a “powerful solution for all Bitcoin users” that began as a retail payments experiment

He said that Bitfinex had seen Lightning handle higher volumes with predictable settlement, lower costs and reduced onchain congestion, “all of which matter for institutional use cases.”

Fidelity and Blockstream see institutional potential

Fidelity Digital Assets, which published a 2025 report on Lightning using Voltage data, argued that the Lightning Network not only enhanced Bitcoin’s utility but also bolstered its investment case.

Related: Tether leads $8M funding for Lightning startup focused on stablecoins

Fidelity noted that average Lightning capacity had increased by 384% since 2020, adding that the network presented a “transformative opportunity for both new and existing financial institutions.”

Blockstream, a Bitcoin‑focused infrastructure company, pushed a similar narrative in its Q4 2025 quarterly update.

The company highlighted Core Lightning releases focused on latency reduction and Lightning Service Provider (LSP) support, and pitched its Greenlight platform as a way for apps, exchanges and services to offer trust‑minimized Lightning functionality with minimal infrastructure burden, with an explicit roadmap for enterprise‑focused Lightning deployments.

Big questions: Would Bitcoin survive a 10-year power outage?

Crypto World

How Borderless Markets Are Unlocking Frictionless Access and Liquidity via Digital Asset Tokenization

For decades, global financial markets have been shaped by geographic boundaries, jurisdiction-specific regulations, and legacy infrastructure designed for localized participation. Even in mature economies like the United States, access to high-value or alternative assets is often restricted by capital requirements, lengthy settlement cycles, and reliance on multiple intermediaries. While digitization has improved operational efficiency, it has not eliminated the structural friction that limits who can participate in markets or how freely capital can move across borders.

While digitization increased operational efficiencies, it did not remove the structural impediments to market participation or the unfettered ability of capital to move cross-border. With emerging borderless markets, financial institutions will overcome these barriers by providing a shared digital infrastructure, rather than siloed regional systems. In essence, borderless markets create an ecosystem where assets will be accessible, transferable, and traded on a global scale; additionally, these new types of markets will enable continuous accessibility, transparency of ownership, and seamless participation from all participants relative to each asset.

Central to this recent transformation of who can access the market, or what level of liquidity is available in the market, is the digital asset tokenization. Through the development of sophisticated tokenizing assets, real-world and financial assets can be converted from physical form to a programmable digital representation that can be transacted across multiple markets without being subject to geographic limits. Tokenizing assets, combined with the use of enterprise-level tokenization platforms and the pending development of specialized tokenization development services, creates a mechanism for frictionless access to the market and provides the necessary level of liquidity to maintain a level of market efficiency.

What Are Borderless Markets and Why Do They Matter to U.S. Investors?

Borderless markets are financial ecosystems where assets are created, accessed, and traded without being constrained by geography or legacy financial rails. These markets rely on digital asset tokenization to standardize ownership, enable real-time settlement, and allow global participation through a unified digital infrastructure. Rather than operating through fragmented regional systems, borderless markets are built on tokenized frameworks that support seamless access and liquidity across jurisdictions.

For U.S. investors and enterprises, borderless markets are increasingly relevant because they align directly with modern capital efficiency and scalability goals. Through structured asset tokenization development, traditionally restricted or illiquid assets can be redesigned to support broader participation while maintaining transparency and control.

1. Expanded Market Access

The traditional investment paradigm has limited participation due to the high minimum thresholds associated with investments, jurisdiction restrictions, and complicated procedures for onboarding investors. Tokenization enables borderless marketplaces, providing Americans access to multiple asset classes around the world—like real estate, private credit, infrastructure, etc.—through fractional digital ownership models.

2. More Accessible Capital Movement

capital currently invested in legacy markets are usually tied up for long periods, depending on how long each transaction takes to settle and all intermediate steps in the process between the time a person sends money and receives it back. Borderless marketplaces facilitate capital mobility in that they accelerate – or complete – transaction processing so there is less time between transaction completion, and since they allow investors to redeploy capital across the entire marketplace, they shorten traditional holding periods.

3. Increased Liquidity Opportunities

Because the liquidity of an asset is no longer dependent on a specific location and only one buyer and instead can be accessed through a tokenized asset’s availability on multiple marketplaces globally for anyone to buy at any time, it necessarily increases the velocity of transactions being completed, leading to improved price discovery.

Competitive Advantage for U.S.-based Enterprise

U.S. companies employing borderless market principles to attract financing will not only have access to potential sources of capital, but also will be able to conduct business with that capital in a manner aligned with the laws and regulations of the state or country where they were originally incorporated: creating a significant competitive advantage when it comes to raising funds, monetizing an asset, and expanding into international markets.

Therefore, borderless markets are not just about monetary access; instead, they redefine how markets are structured by providing the infrastructure for establishing market operations through tokenized assets across all geographic regions.

Build a Tokenization Platform with Antier

How Digital Asset Tokenization Enables Borderless Market Access

Digital asset tokenization involves representing ownership rights, economic value, and transfer conditions of an asset as blockchain-based tokens governed by smart contracts. Unlike traditional digitization, tokenization embeds access and transferability directly into the asset’s design.

Tokenization for Improved Market Access

Tokenization for improved market access transforms participation models in several critical ways:

- Lower Investment Thresholds: High-value assets can be divided into smaller units, allowing broader participation from both retail and institutional investors.

- Always-On Accessibility: Tokenized assets operate on blockchain networks that function continuously, removing time-zone and market-hour restrictions.

- Direct Asset Interaction: Investors can engage with assets through digital wallets and platforms, reducing reliance on layered intermediaries.

- Global Distribution: Asset issuers can reach international investors without duplicating infrastructure or market-specific issuance processes.

For U.S.-based issuers, digital asset tokenization enables controlled global exposure while preserving governance, reporting, and transparency standards.

Asset Tokenization Development as the Foundation for Liquidity

Liquidity challenges are often embedded in the structural design of assets rather than market demand. Many traditional assets are illiquid due to high unit values, long settlement cycles, and limited secondary trading opportunities. Asset tokenization development addresses these limitations by redesigning assets specifically for liquidity.

How Tokenization Improves Liquidity

Understanding how tokenization improves liquidity requires examining its impact on market mechanics:

- Expanded Buyer Participation: Fractional ownership increases the number of potential buyers, creating deeper and more active markets.

- Secondary Market Enablement: Tokenized assets are inherently compatible with digital trading venues, supporting ongoing liquidity beyond primary issuance.

- Reduced Settlement Risk: Near-instant settlement minimizes counterparty risk and capital lock-up, encouraging higher transaction volumes.

- Programmable Liquidity Controls: Smart contracts automate compliance, transfer restrictions, and corporate actions, enabling liquidity without regulatory compromise.

For U.S. enterprises managing traditionally illiquid assets, asset tokenization development unlocks liquidity while maintaining institutional-grade controls.

Tokenization Platform Development for Seamless Global Participation

While tokenized assets form the foundation, scalable borderless markets rely on sophisticated tokenization platform development. Platforms serve as the operational layer that manages issuance, onboarding, trading, and lifecycle events.

Core Capabilities of Enterprise Tokenization Platforms

Effective tokenization platforms support frictionless access through:

- Integrated Investor Onboarding: Identity verification and eligibility checks aligned with U.S. regulatory expectations.

- Automated Issuance Workflows: Streamlined token creation, allocation, and distribution processes.

- Cross-Border Trading Infrastructure: Support for global participation without duplicating regional systems.

- Real-Time Transparency: Continuous visibility into ownership records, transaction history, and asset performance.

Tokenization platform development ensures that borderless markets operate reliably at scale, supporting both institutional performance and long-term growth.

Why Enterprises Choose Tokenization Development Services in the U.S.

Implementing tokenization is not a plug-and-play initiative. It requires deep expertise across blockchain engineering, asset structuring, compliance alignment, and scalability planning. As a result, enterprises increasingly rely on specialized tokenization development services.

Role of a Tokenization Development Company

Partnering with an experienced tokenization development company enables organizations to:

- Design asset-specific token models aligned with liquidity and access goals

- Build scalable tokenization platforms capable of supporting multiple asset classes

- Align tokenization strategies with U.S. regulatory expectations

- Accelerate deployment timelines while maintaining security and performance

For U.S. enterprises, tokenization development services provide the foundation needed to operationalize borderless market strategies with confidence.

Use Cases Driving Borderless Markets Through Tokenization

Tokenized Real-World Assets

Real estate, commodities, and infrastructure assets benefit from fractional ownership, improved liquidity, and global investor participation.

Private Markets and Alternative Investments

Tokenization improves access to traditionally opaque private assets while enabling secondary trading opportunities.

Cross-Border Capital Formation

Issuers can raise capital globally while maintaining centralized governance and reporting frameworks.

These use cases demonstrate how borderless markets move from concept to execution through structured tokenization initiatives.

Strategic Considerations for U.S. Enterprises Entering Borderless Markets

Before launching tokenization initiatives, enterprises must evaluate:

- Asset suitability for tokenization

- Target investor demographics

- Platform scalability requirements

- Long-term liquidity and governance strategy

A structured approach to asset tokenization development ensures sustainable outcomes rather than short-term experimentation.

Frictionless Access and Liquidity as the New Market Standard

Borderless markets are redefining how value is accessed, transferred, and monetized in the global economy. Through digital asset tokenization, enterprises can overcome geographic limitations and legacy inefficiencies that have historically constrained participation and liquidity. By investing in robust asset tokenization development, scalable tokenization platform development, and expert tokenization development services, U.S. enterprises can unlock frictionless access and sustainable liquidity across global markets. Tokenization is no longer a future concept—it is the infrastructure shaping the next generation of borderless financial markets.

Crypto World

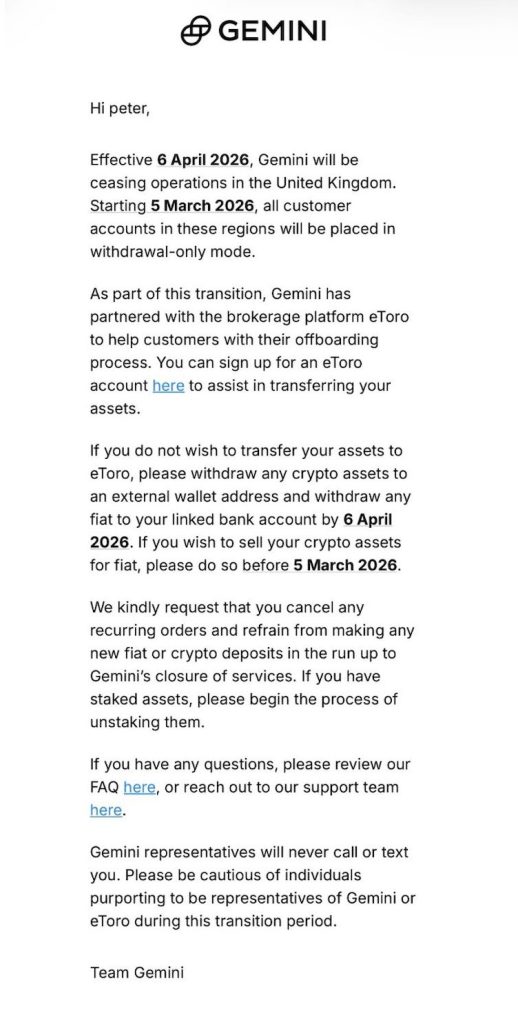

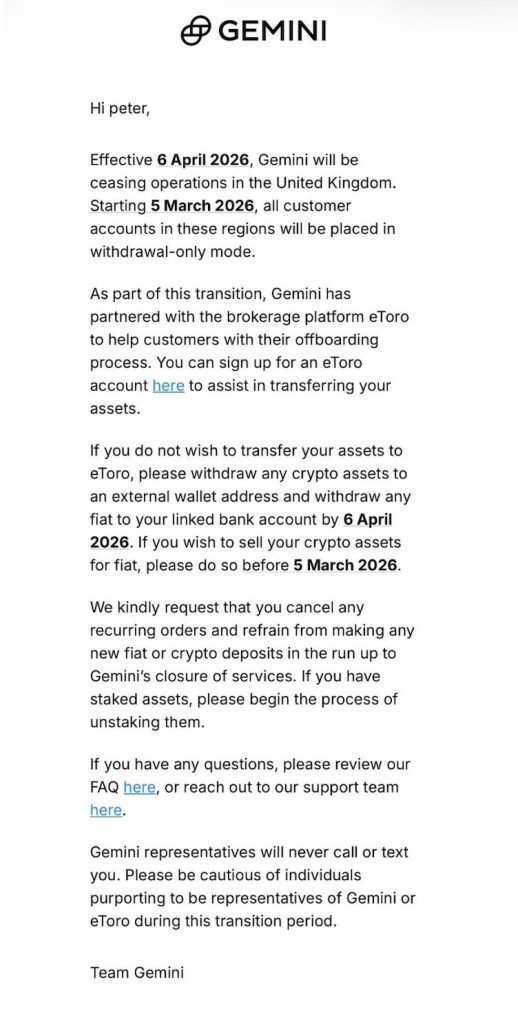

Gemini to Exit UK Market, Shifts Accounts to Withdrawal-Only From March 5

Gemini has announced it will cease operations in the United Kingdom, marking another high-profile exit as the country transitions to a stricter regulatory regime for digital asset firms.

In a notice sent to customers, Gemini said UK operations will formally end on 6 April 2026, with all UK customer accounts placed into withdrawal-only mode from 5 March 2026.

The exchange advised users to either transfer assets to an external wallet or offboard via a partner platform ahead of the deadline.

Accounts Shift to Withdrawal-Only Mode

Under the transition plan, Gemini said customers will no longer be able to trade or make new deposits after 5 March. Users who wish to liquidate crypto holdings into fiat must do so before that date, while all crypto and fiat withdrawals must be completed by 6 April.

As part of the offboarding process, Gemini has partnered with eToro, offering customers the option to open an eToro account to assist with transferring assets. Gemini also urged users to cancel recurring orders and begin unstaking any staked assets ahead of the shutdown.

The company warned customers to remain vigilant against potential scams, stating that Gemini representatives will not contact users directly by phone or text during the transition.

Regulatory Pressure in the UK Market

Gemini’s exit comes as the UK moves from an interim crypto registration regime into full authorisation under the Financial Services and Markets Act (FSMA). The shift represents a material tightening of expectations around governance, operational resilience, and senior management accountability for digital asset firms operating in the country.

While the UK has positioned itself as open to financial innovation, the new framework introduces deeper regulatory scrutiny and ongoing supervisory engagement — a dynamic that has prompted several global crypto firms to reassess their UK footprint.

A Selective Regime Takes Shape

“Gemini’s decision to exit the UK raises a bigger question than any single firm’s strategy,” said one industry observer. “What does participation look like once the UK moves from a registration regime into full FSMA authorisation?”

The transition, they noted, is not merely about meeting higher standards on paper, but about sustained oversight, historical scrutiny, and personal accountability at the senior management level. For global firms, the calculus increasingly hinges on whether the UK market justifies that level of regulatory exposure in a fast-evolving sector. Some firms will decide the trade-off makes sense. Others may not.

Implications for the UK Crypto Landscape

Gemini’s departure does not necessarily signal failure of the UK’s regulatory approach, but it does suggest the regime is intentionally selective. As authorisation moves from theory into delivery, success may depend less on scale and more on regulatory experience, judgement, and willingness to operate under continuous supervision.

Gemini was contacted for comment at press time but did not respond.

The post Gemini to Exit UK Market, Shifts Accounts to Withdrawal-Only From March 5 appeared first on Cryptonews.

Crypto World

Kalshi expands surveillance, enforcement efforts ahead of Super Bowl 60

The Kalshi logo arranged on a laptop in New York, US, on Monday, Feb. 10, 2025.

Gabby Jones | Bloomberg | Getty Images

Kalshi on Thursday announced new initiatives to expand its surveillance and enforcement frameworks as skepticism builds around the booming predictions market space.

The announcement comes days before Super Bowl 60, which has already drawn more than $160 million in prediction market trading volume, according to Kalshi. The platform and its peers allow users to buy event contracts for outcomes in politics, pop culture, financial markets and sports.

Prediction trades on predetermined outcomes — like, for example, on which companies will air Super Bowl ads on Sunday — have prompted questions of possible insider trading. New York Attorney General Letitia James on Monday issued a warning about what she called “unregulated prediction markets.”

“Being federally regulated means that Kalshi bans market manipulation, insider trading, has limits on the types of markets it lists, runs Know-Your-Customer (KYC) and Anti-Money Laundering (AML) checks on every user before they can trade, and publicly reports all trades to the CFTC daily,” the company said in a release. “Kalshi also spent years building custom prediction market trade surveillance and enforcement systems that are similar to those used in the stock market.

Kalshi said Thursday it has taken further steps, forming an independent surveillance advisory committee, which will provide quarterly analysis to the company’s outside counsel and publish statistics on investigations into suspicious activity on its platform. The company also announced surveillance partnerships with Solidus Labs and the Director of the Wharton Forensic Analytics Lab.

The prediction market will also now work with the former Under Secretary of the Treasury for Terrorism and Financial Intelligence to advise Kalshi on “market integrity, trading surveillance and financial compliance matters.”

Kalshi lawyer Robert DeNault has also been appointed to the role of Head of Enforcement, where the company said he will work with the advisory committee to identify insider trading and market manipulation.

Lastly, Kalshi said it has created hubs on its website to provide resources for consumers on responsible trading and market integrity.

In a post on X, CEO Tarek Mansour said if the company finds any wrongdoing, the penalties include fines and referrals to the Commodity Futures Trading Commission — which regulates event contracts in the U.S. — and the Department of Justice for prosecution.

“In the past year, we ran over 200 investigations and froze relevant accounts,” Mansour wrote. “Of these, over a dozen have become active cases and several have been referred to law enforcement.”

Mansour added that Kalshi has based its market surveillance system on those used by the New York Stock Exchange and the Nasdaq, flagging suspicious behavior by running trades through pattern recognition models.

“All industries have bad actors and no system is perfect, Kalshi’s included,” Mansour wrote. “But we are committed to improving daily. Lots of work ahead!”

Disclosure: CNBC has a commercial relationship with Kalshi.

Crypto World

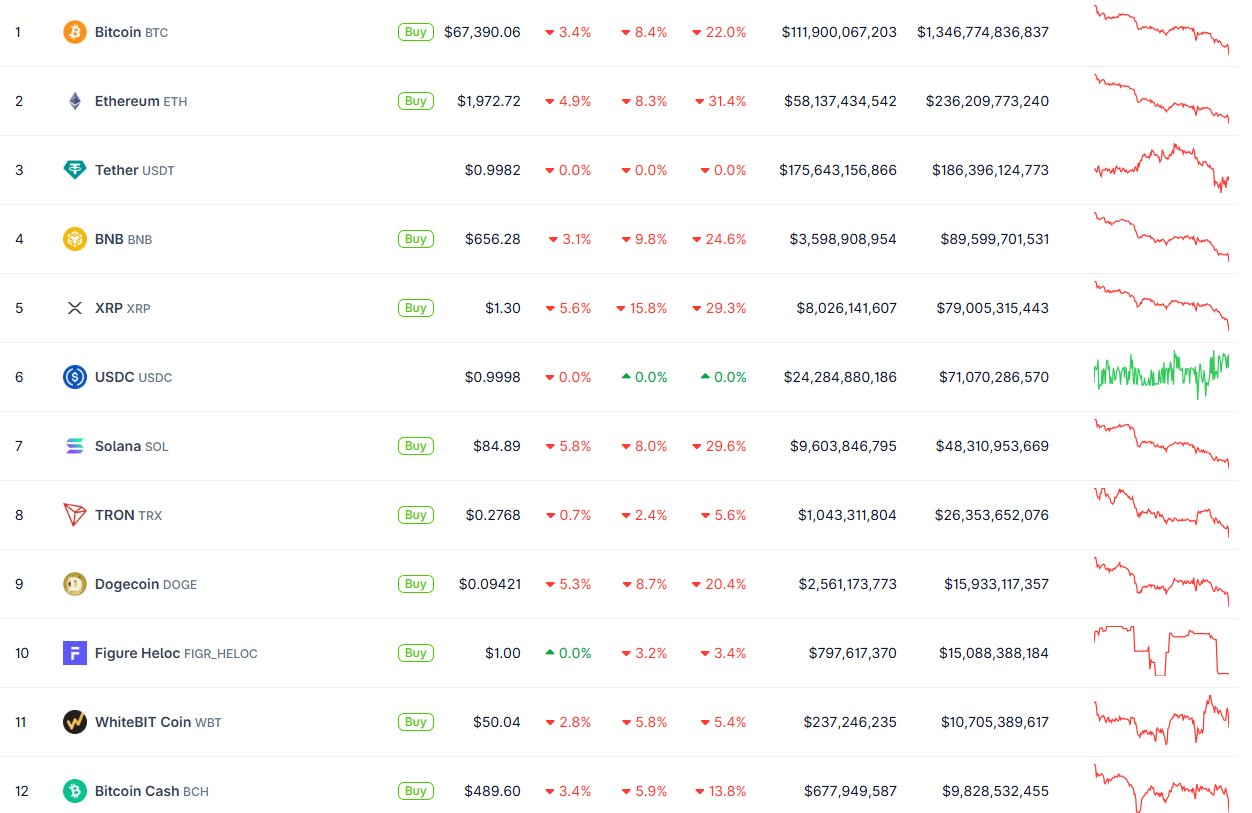

Liquidations Top $1.3 Billion as BTC Plummets Below $67K, ETH Loses $2K Support

Most other altcoins like BNB and XRP have joined the ride south with massive declines of their own.

Bitcoin can’t catch a break in the past several days, marking consecutive multi-month lows, with the latest coming minutes ago at well under $67,000.

The last time the cryptocurrency traded at such low levels was in early November, just as the US presidential elections took place and the country elected the so-called ‘crypto president,’ Donald Trump.

The past few weeks have been brutal for BTC. It challenged $90,000 just eight days ago, last Wednesday, but the rejection at that level brought unimaginable pain for the market leader and most of the altcoin followers.

Bitcoin first dumped to $81,000 last Thursday, then continued south to under $75,000 during the weekend, but the bears kept the pressure on. The past several hours have been violent as well, with BTC plunging to $66,900 (as of press time). This means that the asset has lost well over $20,000 in just over a week.

The altcoins have not been spared. ETH continues with its massive decline, with another 9% daily decline to under $2,000 – its lowest level since last April. BNB has plunged by 10% to $660, while XRP is down by a whopping 15% in the past 24 hours alone to $1.32.

Further losses are evident from the likes of ZEC (-19%), MORPHO (-14%), NEXO (-14%), XMR (-12%), LEO (-12%), SUI (-11%), and many others. As such, it’s no wonder that over-leveraged traders have been harmed severely.

Data from CoinGlass shows that the 24-hour liquidations have rocketed to over $1.3 billion. In the past hour alone, the wrecked positions are up to $350 million. The number of wiped out traders is close to 300,000 daily, with the single-largest position taking place on Aster, which was worth over $11 million.

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World7 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World7 days ago

Crypto World7 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech1 day ago

Tech1 day agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

NewsBeat5 hours ago

NewsBeat5 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report