Crypto World

Explore the most cutting-edge non-custodial crypto wallets of 2026

“In 2026 and thereafter, Non-Custodial Wallets Will Be Critical to Your Strategy.”

Think of two users:

User A stores all of their cryptocurrency on the exchange and third-party services.

User B has complete control of their private keys, can automate DeFi strategies, and connects directly to Web3-native solutions.

This elucidates the reason why non-custodial crypto wallets are becoming so important to the infrastructure market –

“Retail as well as large-scale crypto users are demanding it because of its expected benefits.”

They are no longer a fringe technology; they are now becoming part of the foundational structure—as significant as your identity access management, treasury systems, and security keys.

According to industry research studies, the non-custodial wallet industry will be approximately $1.5-2.5 billion by the year 2026, and the anticipated growth rate over the next decade is expected to be very high as well, often exceeding 20-25% compound annual growth rate (CAGR), varying by report methodology.

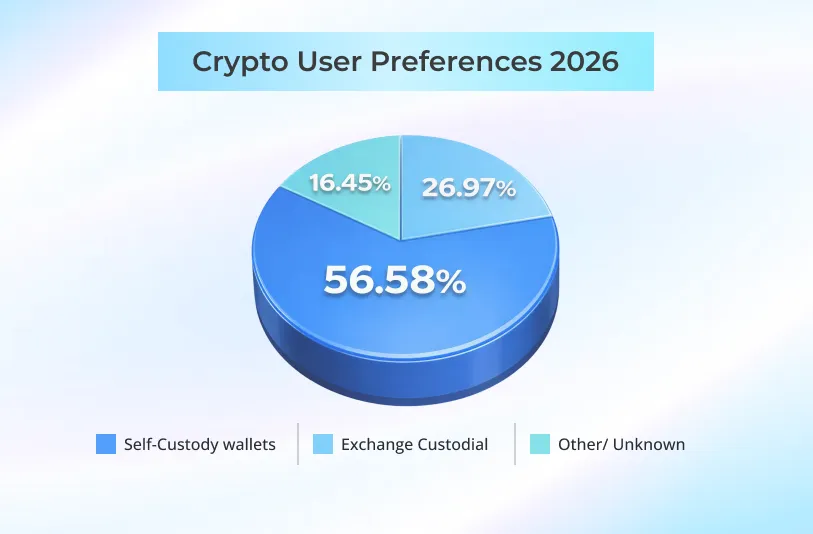

Various recent studies show that the bulk of all cryptocurrency wallets being used today are self-custodial, indicating a growing trend toward individual control over assets and financial transactions as a whole.

Source: https://coinlaw.io/self-custody-wallet-statistics/

For enterprise leaders currently planning to roll out their own Web3 crypto wallet, the extreme diversity of self-custodial wallet options — from hardware air-gapped wallets to smart contract-based wallets — presents an important question:

- What trends and tactics should your enterprise’s wallet strategy look at moving forward?

Now that we have defined an overall strategic environment, let’s look at the wallets that you came to evaluate.

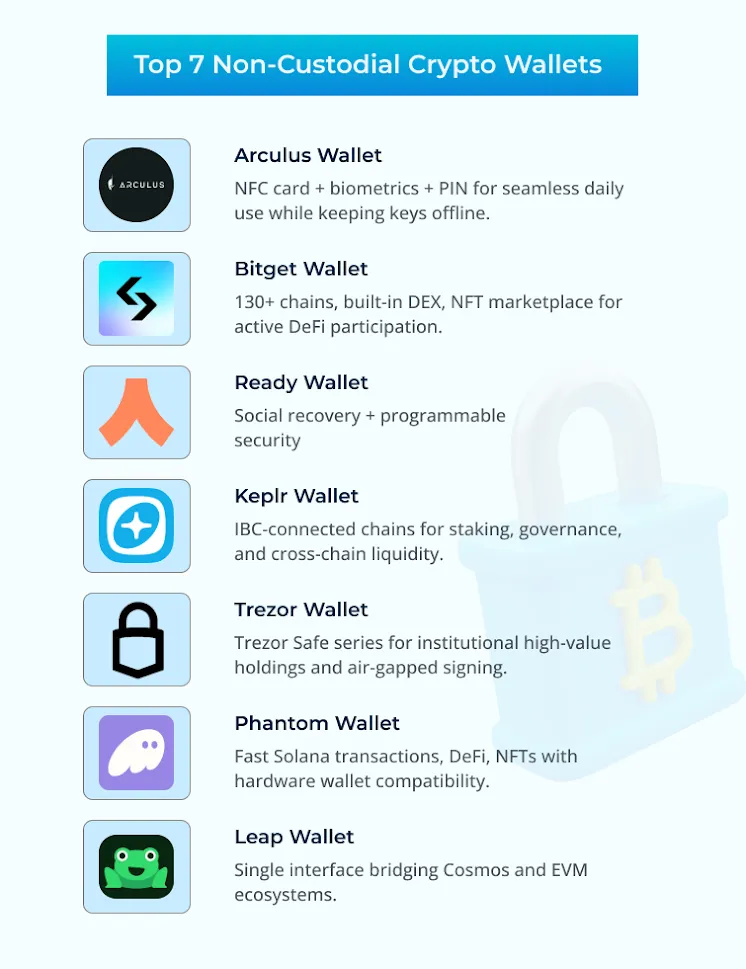

A Look at Today’s Peak Value Non-Custodial Crypto Wallets

Here, we will analyze the top self-custodial wallets of 2026, not just simply by looking at a list of ‘features,’ but instead from an enterprise perspective: how relevant is each wallet’s use case for you? What security models do they utilize? How do they compare in the overall ecosystem, and how can developing similar wallets give you a competitive advantage?

1. Arculus Wallet

The Arculus wallet offers a unique solution for securing digital assets.

The Arculus card, using NFC technology, connects to the user’s smartphone through an app. The private keys are stored offline on the card.

As a result, consumers are able to use the wallet daily without handling private keys or seed phrases frequently (though a one-time recovery phrase is generated at setup).

To use crypto in day-to-day use, the users will be required to first unlock the app using biometrics, enter their 6-digit PIN when prompted, and then tap their NFC-enabled Arculus card against the back of their phone.

For enterprise teams, launching an Arculus-like wallet will provide the following merits:

- When a user’s interaction with their wallet is limited to their hardware card or application, the user’s exposure to their written seed phrases (physically/electronically stored) or chances of losing possession of the seed phrase during routine usage (such as for migrating devices or support issues) are greatly reduced.

- It helps facilitate an authentication consumer experience that feels similar to existing payment processes with a physical card plus phone journey.

- A physical NFC-enabled card that functions as a hardware wallet helps maintain mobile accessibility.

The Rationale Behind This Trend:

Self-custodial wallets like Arculus aim to minimize how often users must interact with their recovery phrase and front-load their access using hardware, digital PIN numbers, and biometric means.

Why This Is Important for You:

Reimagining how users store their keys and recover them can potentially lead to new user experience innovation opportunities; your goal should not be to replicate other wallet solutions; rather, you should focus on solving the challenges that users face with current wallets.

2. Bitget Wallet

The Bitget Wallet is a multi-chain wallet with a built-in DEX aggregator that offers customers access to NFT marketplaces, too, where they can buy, sell, and trade. This non-custodial crypto wallet provides multiple DeFi integrations with support for 130+ chains (Ethereum, Solana, Polygon, etc.) – hence encouraging direct user participation in the broader ecosystem.

Bitget Wallet is designed with integrative value for users, providing an aggregated view of assets and activity across EVM networks, non-EVMs’ Layer-1, and Layer-2 chains.

DEX integrations reduce time lost switching between applications.

MARK

Native NFT marketplace support is valuable for targeting users pursuing content ownership, loyalty rewards, and digital goods strategies.

Critical Insight For Web3 Wallet Businesses

Based on projections of future digital wallet usage, white label crypto wallets that combine the functions of “secure storage” and “active finance”—trading, staking, liquidity participation, and governance—will be the most successful in helping you capture long-term adoption.

3. Ready Wallet (formerly Argent)

Ready is typically characterized as an Ethereum-focused smart contract wallet, with the goal of improving user experience by incorporating concepts like social recovery, programmable security, and DeFi-compatible functionality.

Specific features that align with this are

- The use of social recovery methodologies leads to lower total cost of support due to being more streamlined than traditional recovery methods that only rely on seed phrases.

- Programmable security through policy-based controls (e.g., daily transfer limits, whitelisted addresses, and other guardrails) provides a clear, consistent, and adaptable level of protection for wallet operations.

- Native capabilities for staking on L2 systems and connection to DeFi protocol features cement the idea that the wallet is intended to serve as a facilitator of financial actions.

Enterprise Lens

Crypto wallet development with account abstraction and configurable defense will become a critical enabler of automated financial flows within Web3-based applications.

4. Keplr Wallet

Keplr is one of the major wallets used by those actively engaged with the Cosmos ecosystem. It is a self-custodial hub for IBC-connected chains.

In addition to participating in staking and governance on their native protocol, consumers can move value in a multitude of ways between other Cosmos chains as well as across the entire Cosmos ecosystem.

Web3 leaders need to take notice of what this can mean for your audience if you engineer a Keplr-grade wallet:

- A way to engage on a large scale in governance (both as validators and via delegations in DAO votes) rather than relying on ad hoc participation.

- When linking to other blockchain networks, IBC-enabled assets allow for a higher level of liquidity movement & redirection.

- This will be possible using a method that does not require customers to retain custody of their relevant assets on any one blockchain within the Cosmos universe.

A Signal To Watch

As cryptocurrency wallet development initiatives continue to create more tools and data services over diverse Cosmos blockchains, wallets that promote interactivity & interoperability among users will spur the ongoing development of both DeFi & app-specific chains.

5. Trezor Wallet

Hardware wallets are becoming an integral part of many institutions’ high-security operations, and Trezor wallets (Trezor Safe 3, Trezor Safe 5, Trezor Safe 7) are considered to be one of the best non-custodial hardware wallets available for the safe storage of numerous types of digital assets.

Trezor offers high-security, isolated keys that can be stored offline and are ideal for longer-term or treasury-type holdings.

- The ability to integrate with a desktop suite and 3rd party applications helps facilitate policy enforcement & audit workflows.

- Offline signing adds a strong security shield for high-value or high-risk transactions.

A Thought to Carry Forward

Security professionals often refer to hardware security modules, cold wallets, and air-gapped signing technology when it comes to developing treasury-based wallet systems.

Get Your Enterprise’s Crypto Wallet Launch Checklist Now

6. Phantom Wallet

Phantom is one of the premier decentralized wallets for the Solana ecosystem. It provides people with a non-custodial wallet experience with all of the key features for staking. interacting with DeFi directly within the wallet and managing NFTs while prioritizing UX.

This wallet product is compatible with hardware wallet integrations, adding extra security for end-users.

Why should you care?

- Solana wallets serve as transaction engines that empower high volume, low fees, and fast settlement.

- Enterprise use cases include gaming and loyalty programs, payroll experiments, and cross-chain financial services.

An Industry Cue

Solana-centric crypto wallet development as a whole is increasing in volume and velocity across multiple verticals; thus, the trend is towards active wallet activity instead of passive storage.

7. Leap Wallet

Leap Wallet supports both the Cosmos network and the EVM environment, enabling users to bridge the gap between these two through a single interface.

The Core Message

Wallets that reduce their operational footprint across Cosmos + EVM or other multi-technology stacks will position themselves for success when catering to corporate clients willing to adopt seamless workflows.

Decoding 2026’s Self-Custodial Wallet Success Codes – X-Factors Enterprises Can Use

| Wallet | Core Trend | Build Inspiration For You | Security Innovation |

|---|---|---|---|

| Arculus | NFC mobile payments | Card+phone UX like traditional finance | NFC card + biometrics + 6-digit PIN |

| Bitget | Multi-chain DeFi hub | DEX aggregator eliminates app switching | Unified risk control across 130+ chains |

| Ready | Account abstraction | Social recovery cuts support costs | Programmable security through policy-based controls |

| Keplr | Cosmos interoperability | IBC enables governance at scale | Security-hardened IBC cross-chain liquidity hub |

| Trezor | Institutional cold storage | Air-gapped treasury operations | Offline hardware isolation |

| Phantom | High TPS transaction engine | Solana gaming/loyalty enablement | Hardware wallet compatibility |

| Leap | Multi-stack unification | Single UI for Cosmos+EVM workflows | Fail-safe cross-ecosystem bridging |

Conclusion: The wallet is not the ultimate objective; it’s just the base level

If your organization is creating a non-custodial wallet & you are currently or will be looking for the ideal technical or product partner to help you achieve your vision for your project, make sure they help you navigate the security, compliance & UX trade-offs first.

Whether you want to create crypto wallets like the ones discussed above or want to create an AI smart crypto wallet with features like cross-chain composability, physical key storage, reg-ready governance core, or customized functionalities, Antier’s properly designed tech stack will help you craft a top-tier solution. That would grow into a durable component of your Web3 infrastructure, not just an application included in your product portfolio.

Schedule a tactical meeting to architect a self-custodial wallet product with the potential to be in a league of its own.

Frequently Asked Questions

01. Why are non-custodial wallets becoming critical for cryptocurrency users?

Non-custodial wallets are essential because they provide users with complete control over their private keys, enabling automation of DeFi strategies and direct connections to Web3-native solutions, which are increasingly demanded by both retail and large-scale crypto users.

02. What is the projected market size for non-custodial wallets by 2026?

The non-custodial wallet industry is expected to reach approximately $1.5-2.5 billion by 2026, with a high anticipated growth rate often exceeding 20-25% compound annual growth rate (CAGR).

03. What factors should enterprises consider when developing their own Web3 crypto wallet strategy?

Enterprises should evaluate the diversity of self-custodial wallet options, the relevance of each wallet’s use case, the security models they utilize, and how developing similar wallets can provide a competitive advantage in the overall ecosystem.

Crypto World

ETH, XRP, ADA, BNB, HYPE flash mixed signals this week

ETH, XRP, ADA, BNB, HYPE sit near key levels after a choppy week of failed breakouts and fragile supports.

Summary

- TON embeds its wallet in Telegram, enabling payments, gifts, and asset transfers without traditional crypto UX, targeting over 1B users.

- CEO Max Crown says TON is “built to serve everyday users,” focusing on distribution, onboarding, and UX rather than just technical specs.

- Telegram gifts and NFT stickers have driven nine‑figure NFT volume, over 500k wallets, and rapid Toncoin (TON) account growth, signaling rising institutional and retail interest.

Ethereum (ETH) traded relatively flat over the period, with buyers maintaining key support levels as selling momentum decreased, according to technical analysts. The cryptocurrency faces resistance at higher price points, and analysts noted that recent weekly losses could precede a relief rally testing those resistance levels. Technical indicators suggest Ethereum may be completing a second downward movement in an ABC correction pattern.

Ripple closed the week with slight gains, though the advance proved insufficient to reverse bearish chart patterns. An attempt to break through resistance was rejected by sellers, a signal that the downtrend may persist, according to market observers. Analysts indicated that continued selling momentum could drive prices to lower support levels, with price reactions at nearby support expected to provide direction signals.

Cardano remained near key support levels but showed signs of weakness that could result in a breach of that level, according to technical analysis. The cryptocurrency’s price action reflected patterns similar to Ripple, with bearish momentum persisting as buyers and sellers contest support levels. Cardano has underperformed during the current year, with analysts noting that sustained gains would require reclaiming materially higher price levels.

Binance Coin (BNB) held near support levels over the past week, with selling pressure appearing to ease, though analysts cautioned the selloff may not be complete. Higher resistance levels remained untested, indicating buyer hesitation despite substantially decreased selling volume. Technical analysts stated that maintaining current support could encourage buyers to challenge resistance levels, while renewed selling pressure could push prices to lower support zones.

Hype (HYPE) closed the week lower following rejection at resistance levels. Buyers remained defensive, with analysts projecting potential further declines to key support. A loss of that support level would constitute an extremely bearish signal and could result in new yearly lows, according to market observers. Conversely, holding that level could be interpreted as a higher low formation, potentially encouraging buyer re-entry. Analysts characterized the cryptocurrency as being in a pullback phase that may extend for an indeterminate period.

Crypto World

BitMine Is Confident in Ethereum’s Recovery: Here’s Why

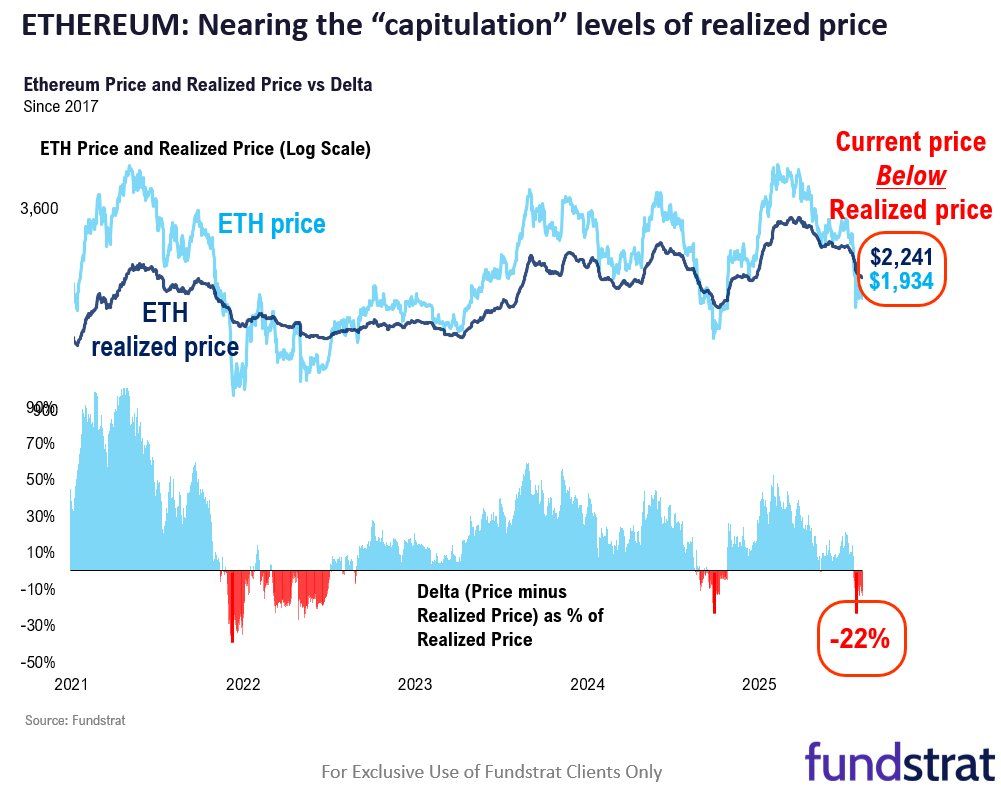

Ethereum (ETH) is holding below $2,000, leaving many investors underwater as the downtrend extends into February 2026.

Despite the sustained weakness, BitMine has maintained a bullish stance on Ethereum. This raises a key question: Is their confidence driven by narrative or sentiment, or is there another factor behind their conviction?

Ethereum’s Pain Reaches 9th Decile: What Does That Mean For The Price?

In a detailed post on X (formerly Twitter), BitMine highlighted the research by Sean Farrell, Fundstrat’s Head of Digital Asset Strategy, focusing on Ethereum’s realized price. This is an on-chain valuation metric that reflects the average acquisition cost of all coins currently in circulation.

According to the data, Ethereum’s realized price stands at $2,241. At the time of the analysis, the asset was trading near $1,934.

This leaves the average holder in the red. According to Fundstrat’s model, the “loss for realized price was 22%.”

The analysis compared the current drawdown to prior cycle lows. During the 2022 bear market, Ethereum traded as much as 39% below its realized price. In 2025, the discount reached approximately 21%.

“If we apply this ‘loss’ to the current realized ETH price of $2,241, we get implied ‘lows’ for ETH. Using 2022, this implies $1,367. Using 2025, this implies $1,770,” the analysis noted.

Using a decile analysis, the post revealed that the current drawdown falls into the 9th decile (extremely high). For context, a decile analysis is a quantitative method used in statistics, finance, and marketing to segment a dataset into 10 equal-sized groups (deciles) based on the distribution of a specific variable.

The data suggests that the median 12-month forward return in this decile was approximately 81%, with a 12-month win ratio of 87%. In other words, in most historical instances when ETH reached similar drawdown levels, it was trading higher one year later.

“Is this the bottom? Seems like we are closing in on that low. Looking beyond the near-term, the risk/reward for ETH is positive,” the post read.

BitMine Chairman Tom Lee previously emphasized that sharp drawdowns are a recurring feature of Ethereum’s price history. Since 2018, ETH has experienced eight separate declines of 50% or more from local highs, suggesting that corrections of this magnitude have occurred roughly once per year.

In 2025, Ethereum fell 64% between January and March. Despite that steep drop, the asset later rebounded significantly.

“ETH sees V-shaped recoveries from major lows. This happened in each of the 8 prior declines of 50% or more. A similar recovery is expected in 2026. The best investment opportunities in crypto have presented themselves after declines. Think back to 2025, the single best entry points in crypto occurred after markets fell sharply due to tariff concerns,” Lee said.

Ethereum Recovery Could Be Critical for BitMine’s $7 Billion Underwater Position

If Ethereum delivers a sustained recovery with strong upside returns, it could represent a meaningful inflection point for investors, particularly BitMine. The company’s unrealized losses have expanded to approximately $7 billion, according to CryptoQuant data.

At the same time, BitMine appears to be reinforcing its bullish stance through continued accumulation. Lookonchain reported that the firm purchased 10,000 ETH from Kraken today.

This transaction followed a much larger single-day acquisition of 35,000 ETH. BitMine acquired 20,000 ETH from BitGo and 15,000 ETH from FalconX.

Taken together, the purchases suggest that despite mounting unrealized losses, BitMine is positioning for a potential upside scenario rather than reducing exposure.

Crypto World

Crypto Miner Bitdeer Slumps 17% After $300M Debt Offering

Bitdeer Technologies Group (NASDAQ: BTDR), a Singapore-based operator of data centers and Bitcoin (CRYPTO: BTC) mining infrastructure, unveiled a private placement of US$300 million in convertible senior notes, with an option for purchasers to subscribe to an additional US$45 million. The offering marks Bitdeer’s second convertible debt sale since a US$150 million issue in April 2024, a move that coincided with a notable decline in the stock price at the time. The notes are scheduled to mature in 2032, carry semiannual interest payments, and can be converted into cash, shares, or a combination of both. Proceeds are earmarked for data-center expansion, AI cloud growth, the development of mining rigs, and general corporate purposes. Bitdeer operates globally, with data centers in the United States, Norway, and Bhutan, while maintaining its headquarters in Singapore.

Key takeaways

- The company is offering US$300 million in convertible senior notes, with a potential additional US$45 million via private placement.

- These notes mature in 2032, are senior unsecured, and pay semiannual interest; holders may convert to cash, stock, or a mix.

- The funds will support data-center expansion, AI cloud initiatives, mining-rig development, and general corporate purposes.

- This is Bitdeer’s second convertible-note sale, following a US$150 million offering in April 2024 that coincided with a roughly 18% drop in the stock at the time.

- To offset potential dilution, the deal includes capped-call transactions and a concurrent registered direct share offering aimed at repurchasing notes due in 2029.

- Traders punished Bitdeer shares on the news, with the stock down about 17% on the session before closing near the year’s lows.

Tickers mentioned: $BTDR, $BTC

Sentiment: Bearish

Price impact: Negative. Bitdeer’s stock fell roughly 17% on the news, underscoring dilution concerns and investor sensitivity to capital-structure changes.

Trading idea (Not Financial Advice): Hold. The combination of convertible issuance and dilution-offset mechanisms warrants caution, even as the proceeds underpin ambitious expansion plans.

Market context: The transaction reflects a broader pattern among crypto miners financing growth with convertible debt, a structure that can dilute equity if notes convert and that often arrives with offsetting strategies to manage equity dilution.

Why it matters

The planned private placement of convertible notes signals Bitdeer’s continued appetite for aggressive expansion in a capital-intensive sector. By targeting data-center capacity and AI cloud services alongside mining-rig development, the company is positioning itself to scale its infrastructure footprint in multiple jurisdictions. The convertible structure offers investors upside if the stock appreciates, while providing downside protection through bond characteristics. However, the potential for future dilution remains a live concern for existing shareholders, especially if the notes are converted as Bitdeer’s equity price strengthens.

From a corporate-finance perspective, the use of convertible debt aligns with investor demand for instruments that balance debt-like safety with equity-like upside. The inclusion of capped-call transactions is designed to mitigate dilution, but it does not eliminate the fundamental trade-off between raising capital and preserving share value. The concurrent share offering intended to repurchase notes due in 2029 adds another layer of capital-management activity, signaling a deliberate attempt to optimize the capital stack while pursuing growth objectives.

For market participants, the development underscores how mining-focused operators are navigating a landscape where capital-structure decisions can materially impact stock performance. As miners race to expand capacity and enter adjacent growth areas like AI cloud services, financing decisions—particularly those involving convertibles—will continue to draw scrutiny from investors who weigh dilution risk against potential long-term value creation. The broader environment for crypto equities remains sensitive to macro signals, sector volatility, and regulatory developments, making the next steps for Bitdeer—such as the final terms of the private placement and the effectiveness of dilution-offset strategies—worth watching closely.

What to watch next

- Closing terms and timing of the US$300 million convertible note offering, including whether the additional US$45 million private placement is exercised.

- Results and milestones tied to data-center expansion and AI cloud initiatives, including capacity additions and any operational KPIs.

- Details of the capped-call transactions and how they are structured to offset dilution, along with the timing and terms of the concurrent registered direct share offering to repurchase 2029 notes.

- Any further commentary from Bitdeer on its use of proceeds and how debt financing affects its capital-structure strategy amid ongoing market volatility for crypto equities.

Sources & verification

- Bitdeer announces proposed private placement of US$300 million convertible notes. https://ir.bitdeer.com/news-releases/news-release-details/bitdeer-announces-proposed-private-placement-us3000-million-0

- Strategy to equitize convertible debt over next 3-6 years: Saylor. https://cointelegraph.com/magazine/strategy-plans-equitize-convertible-debt-over-next-3-6-years-saylor

- What are convertible senior notes? How MicroStrategy uses them to buy Bitcoin. https://cointelegraph.com/explained/what-are-convertible-senior-notes-how-microstrategy-uses-them-to-buy-bitcoin

- Bitdeer Ohio mining facility fire stock coverage. https://cointelegraph.com/news/bitdeer-ohio-mining-facility-fire-stock

- Bitdeer 150m notes offering expansion stock drop. https://cointelegraph.com/news/bitdeer-150m-notes-offering-expansion-stock-drop

Debt financing and expansion goals drive Bitdeer’s latest convertible note offering

Bitdeer Technologies Group (NASDAQ: BTDR), a Singapore-based operator of data centers and Bitcoin (CRYPTO: BTC) mining infrastructure, has unveiled a private placement of US$300 million in convertible senior notes, with a potential extension of up to US$45 million via a private placement. The move marks Bitdeer’s second foray into convertible debt after a US$150 million offering in April 2024, an issue that coincided with a sharp retreat in the company’s share price. The newly proposed notes carry a maturity date in 2032, and they are described as senior unsecured obligations with semiannual interest payments. In a convertible arrangement, investors can choose to convert their holds into cash, shares, or a combination of both, depending on the terms at issue and market conditions at the time of conversion.

The use of convertible notes taps into a common financing channel for crypto miners seeking to fund rapid capacity expansion without immediately diluting equity. Bitdeer’s stated use of proceeds—data-center expansion, AI cloud growth, mining-rig development, and general corporate purposes—highlights a strategy focused on bolstering both scale and diversification beyond strictly mining revenues. The company’s operations span multiple geographies, with data centers in the United States, Norway, and Bhutan, underscoring the geographic footprint often required to manage energy costs, regulatory considerations, and resilience in a capital-intensive industry.

The market’s reaction to the announcement was swift. Bitdeer’s stock moved lower on the news, underscoring investor anxiety around potential dilution and the timing of a sizable capital raise. The announcement also references the company’s earlier convertible-note activity; the April 2024 US$150 million offering previously produced an 18% slide in the share price, illustrating how these structures can be priced into equity performance even when the underlying business objectives are growth-oriented. To partially counteract dilution, Bitdeer plans to employ capped call transactions as part of the convertible-note framework, a technique often used to mitigate the dilution impact when notes convert to equity. In parallel, the company is pursuing a registered direct share offering tied to a program to repurchase a portion of its existing convertible notes due in 2029, highlighting an ongoing effort to manage the capital stack in a way that blends financing flexibility with equity preservation.

In the broader context, this approach mirrors a recurring theme among mining and crypto infrastructure players who rely on convertible debt to finance expansion while attempting to shield existing shareholders from excessive dilution. Market observers will be watching not only the terms of the 2032 notes but also the practical effectiveness of the capped-call strategy and the impact of the 2029-note repurchase plan on Bitdeer’s future earnings and share count. The situation also sits within a larger narrative about how crypto-focused companies balance growth ambitions with the need for disciplined capital management amid fluctuating crypto prices and evolving regulatory signals.

Crypto World

If War With Iran Is Almost Certain, How Might Bitcoin Price React?

Bitcoin price is on the edge again.

Price swings are getting crazy, and it’s sitting around $67,400 like it’s not sure which way to jump. Traders are nervous. Really nervous.

On Polymarket, bettors now put the odds of a U.S. strike on Iran this month at 61%. Crypto felt it fast. Liquidations rolled in. Risk-off mode kicked on. And suddenly, everyone’s playing defense.

Key Takeaways

The Signal: Polymarket bettors price in a 61% chance of imminent US military action.

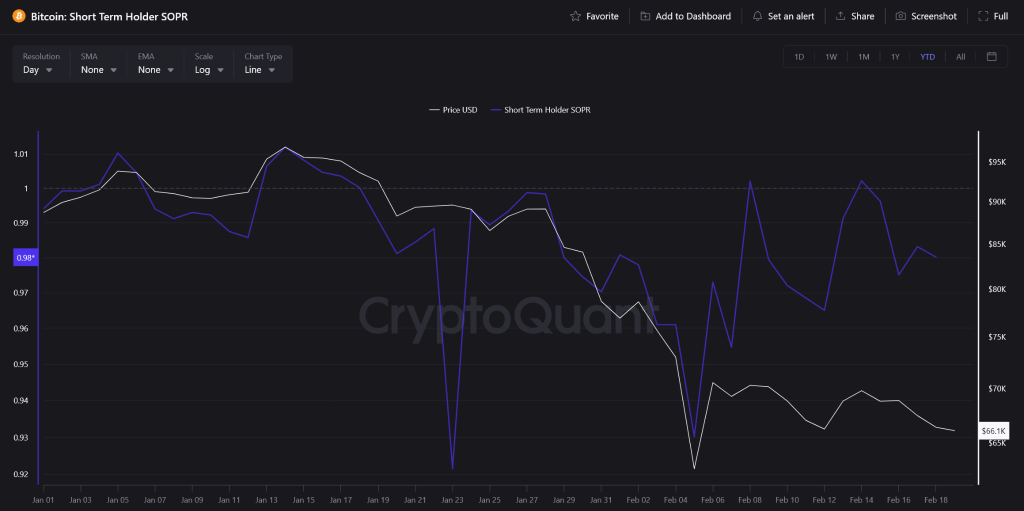

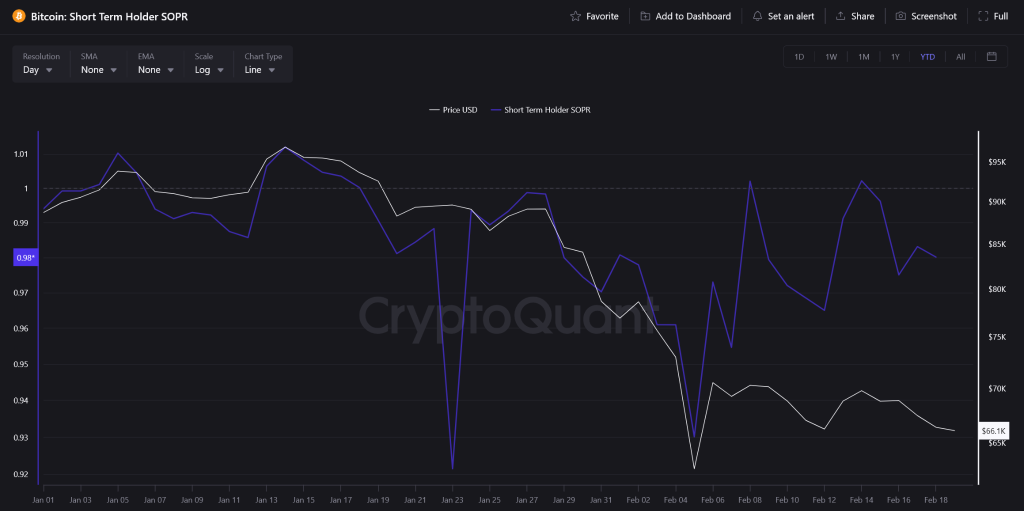

The Risk: Short-Term Holder SOPR has dipped below 1.0, indicating panic selling at a loss.

The Impact: Bitcoin risks breaking critical $65,000 support if conflict escalates this weekend.

Why Is This Happening Now?

Tensions between Washington and Tehran feels almost certain now.

Reports say the Pentagon has strike options ready after nuclear talks stalled. That kind of headline pushes investors straight into gold and cash. Risk assets get dumped first.

On chain data backs it up. The Short Term Holder SOPR is below 1. That means recent buyers are selling at a loss just to get out.

Add in uncertainty around possible Fed policy tweaks and you get a messy mix. Geopolitics plus macro pressure. While the US Iran story dominates, Bitcoin is trading like a classic risk asset, with sharp intraday drops and fragile sentiment.

What Does This Mean for Bitcoin Price?

Bitcoin is leaning hard on the $66,000 to $65,729 support zone. Lose that on a daily close and $60,000 comes into focus fast.

The short term Sharpe ratio has flipped negative, showing ugly risk adjusted returns during the panic. Nearly $80M in longs have already been wiped out since the drop from $70,000.

While retail is dumping, some political insiders are floating massive long term targets. That hints whales may see this dip as opportunity. Arthur Hayes also pointed to Treasury liquidity dynamics that could support crypto once the dust settles.

Volatility into the weekend looks guaranteed. But talks in Oman on Friday could change the tone. If tensions cool, a sharp relief rally could trap late shorts.

Discover: Here are the crypto likely to explode!

The post If War With Iran Is Almost Certain, How Might Bitcoin Price React? appeared first on Cryptonews.

Crypto World

MYX Price Skyrocketed 90% In Less Than 12 Hours, Here’s Why

MYX Finance delivered one of the most aggressive intraday rallies in the crypto market this week. After nearly two weeks of persistent decline, the altcoin surged 90% in less than 12 hours. The sharp reversal caught short sellers off guard and reignited speculative interest.

The rally followed news of MYX Finance’s strategic funding round led by Consensys, with participation from Consensys Mesh and Systemic Ventures. The announcement came ahead of the MYX V2 launch. Investors interpreted the backing as a validation of long-term viability, triggering immediate demand.

MYX Finance’s Recovery Was Foretold

BeInCrypto’s analysis highlighted how a rebound was already likely. The Money Flow Index, which measures buying and selling pressure using price and volume, fell below the 20.0 threshold. This marked the first time MYX entered extreme oversold territory since launch.

Oversold readings often indicate selling exhaustion. When MFI drops under 20.0, downside momentum typically weakens. The data suggested that panic-driven distribution had reached saturation. As selling pressure faded, fresh accumulation began, creating the conditions for a sharp recovery.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Derivatives positioning reinforces the bullish shift. The liquidation map shows MYX contracts currently skewed toward long exposure. Approximately $2.46 million in long positions are active, reflecting growing optimism among traders.

Funding rates have also turned positive. Positive funding indicates that long traders are paying to maintain positions. This dynamic signals confidence in continued upside. However, elevated leverage can increase volatility if momentum stalls.

MYX Price Needs To Breach a Few Barriers

MYX price surged 90% on Friday, pushing the 24-hour gain to 70.6%. At the time of writing, the token trades at $1.74. The move partially offsets the 87% correction recorded over the previous 12 days.

The next resistance stands at $1.82. A decisive break above this level could open the path toward $2.28. Sustained volume and capital inflows will be necessary to validate the breakout. Without confirmation, upside may remain fragile.

If the rally was fueled primarily by speculation surrounding the funding round, selling pressure could return quickly. A failure to sustain gains may send MYX back toward $1.01. Such a decline would invalidate the bullish thesis and erase much of the recent recovery.

Crypto World

Blockchain Data May Predict Drug Overdose Surges, Chainalysis Says

Blockchain transaction data tied to cryptocurrency payments may provide an early signal of emerging drug crises, according to a new report from blockchain analytics firm Chainalysis.

The study, which examined illicit market activity across darknet drug and fraud ecosystems, found that crypto flows connected to darknet markets reached nearly $2.6 billion in 2025, showing that online drug markets continue to operate at scale despite repeated law-enforcement takedowns. Vendors typically receive payments from personal wallets and centralized exchanges.

Beyond measuring criminal activity, Chainalysis argued that the data can track real-world health outcomes. Crypto payments to suppliers of fentanyl precursor chemicals declined sharply beginning in mid-2023. Months later, overdose deaths also fell in the United States and Canada after peaking in 2023.

According to the report, monitoring transactions linked to precursor suppliers could provide three to six months of advance warning before overdose trends appear in official public-health statistics.

Crypto drug purchases linked to higher hospitalizations

The analysis also compared transaction data with Canadian hospital records. Small payments of less than $500 showed no clear relationship with emergency visits or deaths. Larger transfers were associated with rising stimulant-related hospitalizations and fatalities, suggesting the transactions likely reflect bulk purchasing or redistribution rather than personal consumption.

Related: Crypto launderers are turning away from centralized exchanges: Chainalysis

“Money moves before the crisis hits. People buy drugs before they redistribute them, and users consume them before they overdose and require medical care,” the report said, adding that since blockchain records update instantly, they can serve as a high-fidelity “early warning system.”

The report also revealed that following the closure of Abacus Market in July 2025, activity quickly migrated to successor platforms such as TorZon. It said that vendors routinely resupply across platforms and relocate after disruptions.

Related: Moonwell hit by $1.78M exploit as AI vibe coding debate reaches DeFi

Fraud shop volumes drop to $87.5 million

Fraud marketplaces showed a different trend. Onchain volumes fell from about $205 million to $87.5 million year-over-year after infrastructure takedowns, but activity shifted toward wholesale operations, particularly Chinese-language networks operating on Telegram that handle large bulk sales of stolen payment data.

Chainalysis reported Friday that crypto transactions linked to suspected human-trafficking networks rose 85% in 2025, reaching hundreds of millions of dollars. The activity was largely tied to Southeast Asia and closely connected to scam compounds, online casinos and Chinese-language money-laundering groups, per the report.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum — BIP-360 co-author

Crypto World

Crypto payments tied to alleged sale of Five Eyes cyber secrets to Russian broker

An Australian executive has been accused of accepting cryptocurrency payments in exchange for selling sensitive cyber tools that threatened the national security of Five Eyes allies.

Summary

- An Australian executive received $1.26 million in crypto for selling eight protected cyber tools to a Russian broker.

- Prosecutors said the breach caused $35 million in losses and threatened the security of Five Eyes allies.

For those unaware, Five Eyes is a long-standing intelligence sharing alliance between the United States, the United Kingdom, Canada, Australia, and New Zealand.

According to a report from the Daily Telegraph, the accused Peter Williams sold eight protected cyber exploit components, including zero-day capabilities, to one of Russia’s most notorious exploit brokers for roughly $1.26 million worth of cryptocurrencies.

Williams later diverted these funds through anonymized crypto transactions to fund a lavish lifestyle of luxury cars, jewellery, and holidays, including a $1.5 million down payment for a Washington property.

Williams is a former Australian Air Force staffer and defence contractor who resided in the United States.

A sentencing memo published earlier this month claims Williams was set to receive additional payments of up to $4 million under his cooperation agreements with the Russian broker.

It added that Williams’ actions have resulted in losses amounting to $35 million as he repeatedly sold exploits through July 2025 even after he knew that the FBI had launched an investigation into the matter.

Prosecutors are pushing for a nine-year prison sentence and $35 million in mandatory restitution alongside a $250,000 fine and three years of supervised release.

Cryptocurrencies, due to their borderless nature and privacy features, allow transactions to be conducted outside of traditional financial surveillance frameworks. Multiple cases of crypto-linked espionage have surfaced over the past year.

Last year, Poland’s national security chief Sławomir Cenckiewicz alleged that Russia was using cryptocurrencies to fund espionage operations across European countries by recruiting local operatives.

Across the globe, an Israeli man was arrested in June 2025 for accepting crypto payments to spy on public officials in the country.

Meanwhile, U.S. Federal agencies began investigating a Beijing-based crypto mining firm in November over concerns around potential surveillance.

Crypto World

100M FXRP bridged into Flare DeFi stack

FXRP supply tops 100M, ~70% deployed in XRPFi DeFi via staking, lending, vaults.

Summary

- Nearly 100M XRP bridged as FXRP, with ~70% actively deployed in DeFi.

- Firelight holds about 21% of FXRP staked, while Upshift vaults scaled from ~$6M to ~$25M capacity.

- Lending via Kinetic and Morpho saw roughly $39M and $8M in early borrowing, deepening onchain liquidity.

Flare’s bid to become the execution layer for “XRPFi” just cleared a hard milestone: nearly 100 million XRP has now been bridged to the network as FXRP, with close to 70% of that capital actively deployed in DeFi rather than sitting idle.

Flare frames FXRP as ‘growing capital deployment’

Flare frames the 100 million FXRP mark as “growing capital deployment into XRPFi infrastructure rather than speculative bridging activity,” pointing to three concrete demand drivers. First is Firelight, an XRP staking and DeFi cover protocol where “21% of FXRP is currently staked,” with a fresh capital raise slated for this month. Second is structured vaults such as Upshift, where initial vault capacity “filled quickly, expanding from $6M to $25M in response to demand.” Third is lending across protocols like Kinetic and Morpho, which “saw roughly $39M and $8M in borrowing activity respectively within weeks of launch.”

Flare executives insist the pitch is full‑stack rather than a simple wrapped‑asset bridge. The network is “building an integrated XRPFi execution layer,” where FXRP “transforms XRP into programmable collateral that can move across lending markets, DEX liquidity, structured vaults, and cross‑chain environments.” Crucially, they emphasize that FXRP “is not confined to a single execution domain” and can extend into environments such as HyperEVM and Ethereum while maintaining “onchain collateralization and issuance transparency.” Wallet, custody, and DeFi integrations are being designed to “reduce operational friction for both crypto‑native and institutional participants,” a posture Flare says has already made it “the largest EVM ecosystem for XRP DeFi activity today,” a representative told crypto.news.

Recent integrations appear to be changing network behavior, not just narrative. Lending on Morpho and vault allocations via Upshift have “materially deepened onchain liquidity,” with structured strategies drawing “interest from exchanges and wallet providers” and pushing adoption “beyond individual users and into platform‑level capital allocation.” Firelight’s staking and risk‑coverage layers further “increase capital efficiency by allowing XRP to secure infrastructure while remaining economically productive.”

Looking ahead, Flare points to “continued lending expansion, deeper stablecoin liquidity, and additional vault integrations” as levers to “bridge onchain liquidity with regulated financial instruments” and push XRPFi into institutional territory.

Broader macro headwinds

This push comes as digital assets continue to trade as one of the purest expressions of macro risk appetite. Bitcoin (BTC) changes hands near $67,830, with a 24‑hour range between roughly $65,700 and $67,900 on more than $32.8B in volume. Ethereum (ETH) trades around $1,960, having swung between about $1,915 and $1,981 over the last day. XRP (XRP) sits close to $1.42, with a 24‑hour low near $1.35 and a recent high around $1.64 as liquidity thins. Solana (SOL) is quoted around $81.67, down about 4.5% on the day on more than $3.3B in turnover.

Additional crypto.news reporting on Flare’s FXRP rollout and XRP yield products can be found via Genfinity’s breakdown of the 100 million FXRP milestone, Phemex’s coverage of Flare’s mint, and CoinMarketCap’s look at the earnXRP vault strategy.

Crypto World

Here’s what crypto traders should watch in PCE inflation data release today

Crypto traders are bracing for fresh volatility as the U.S. prepares to release December Personal Consumption Expenditures (PCE) data, the Federal Reserve’s preferred inflation gauge, later today.

Summary

- Forecasters anticipate both headline and core PCE rising 0.37% in December (4.5% annualized), pushing core to 3.0% year-over-year — the highest since February 2025 — and headline to 2.9%, the highest since March 2024.

- BTC is trading around $67,852, up 1.27% on the day, with RSI at 36.86, recovering from oversold levels but still showing muted momentum as traders await macro direction.

- The BTC/ETH ratio stands at 34.5806, reflecting continued Bitcoin dominance as investors remain defensive ahead of the inflation print.

According to Wall Street Journal chief economics correspondent Nick Timiraos, forecasters expect both headline and core PCE to rise 0.37% month-over-month in December, equivalent to a 4.5% annualized pace. That would lift core PCE to 3.0% year-over-year, the highest since February 2025, while headline PCE is estimated at 2.9%, the highest since March 2024.

The median forecast aligns with those expectations: 0.37% month-over-month for both headline and core readings, compared with November’s softer 0.21% headline and 0.16% core increase.

For crypto markets, the implications are clear: a hotter-than-expected print could reinforce higher-for-longer rate expectations, pushing Treasury yields and the U.S. dollar higher, typically a headwind for risk assets including Bitcoin (BTC) and altcoins.

A cooler print, however, could revive rate-cut bets and trigger a relief rally.

Bitcoin’s technical setup ahead of PCE inflation data

Bitcoin is trading at $67,852, up 1.27% on the day, according to the daily BTC/USDT chart on Binance. Price action shows consolidation following a sharp early-February drop that briefly pushed BTC toward the low-$60,000s before rebounding.

Since that recovery, Bitcoin has been ranging just below the $70,000 psychological level.

The daily RSI stands at 36.86, with its moving average at 33.81, suggesting momentum remains weak but no longer deeply oversold. The indicator has been gradually recovering from sub-30 levels earlier this month.

The balance of power indicator remains negative at -3,298, highlighting that sellers still hold a slight edge despite the recent stabilization.

For traders, a hot inflation surprise could send BTC back toward the mid-$60,000 support zone, while a softer reading may open the door for a renewed test of $70,000 resistance.

Watch the Bitcoin–Ethereum ratio

Another key signal is relative strength within crypto. The BTC/ETH daily chart shows Bitcoin trading at 34.5806 ETH, up 0.69% on the session.

The pair recently surged from below 30 in late January to above 34 in early February, indicating strong Bitcoin outperformance versus Ethereum (ETH) during the broader market pullback. The recent consolidation around the 34–35 region suggests capital remains defensive, favoring BTC over higher-beta altcoins.

If inflation comes in hot and macro risk aversion rises, Bitcoin dominance could extend further. A cooler print, however, may encourage rotation back into Ethereum and altcoins.

Macro reaction is key

Beyond the headline number, traders should watch the immediate reaction in the U.S. 10-year Treasury yield and the dollar index. Crypto has remained highly sensitive to shifts in rate expectations, particularly as inflation data tests the narrative that price pressures are easing sustainably.

With core PCE potentially rising to 3.0% year-over-year, its highest level in nearly a year, today’s print could shape expectations for the Fed’s next move and set the tone for digital assets into March.

For now, Bitcoin is coiling below resistance. The PCE release may decide whether it breaks higher or rolls.

Crypto World

Blockdaemon Outlines Solana’s 2026 Path to Institutional Adoption Through Executive Guide and Technical Roadmap

TLDR:

-

- Blockdaemon’s executive guide frames Solana’s 2026 roadmap around the Internet Capital Market vision for institutions.

- Alpenglow and IBRL target predictable sub-second finality, narrowing the gap between blockchain and exchange-style settlement.

- ACE introduces application-level transaction control, reducing MEV exposure and aligning execution with best-execution standards.

- Validator client diversity across Agave, Firedancer, and Rakurai builds network resilience for custody, ETFs, and treasuries.

Blockdaemon has published a comprehensive two-part series on Solana’s 2026 outlook, targeting financial institutions evaluating on-chain infrastructure.

The release includes an executive guide and a technical roadmap, each addressing a different layer of institutional readiness.

The series examines Solana’s shift from a high-throughput retail chain to a network built for predictable finality and execution integrity.

It arrives as institutions move closer to production-grade deployment of tokenized assets and on-chain settlement systems.

Executive Guide Positions Solana Around the Internet Capital Market Vision

Blockdaemon’s executive guide opens with Solana’s broader strategic ambition: becoming an Internet Capital Market.

This concept describes an internet-native environment where listings, trading, and settlement operate entirely on-chain.

For financial institutions, it reframes Solana less as a crypto network and more as specialized financial infrastructure.

“Solana has moved beyond its early reputation as ‘the fast retail chain.’ Its ambition to become an Internet Capital Market reframes it as a potential backbone for next-generation on-chain finance.” — Blockdaemon, Solana in 2026: A Guide for Financial Institutions

The guide outlines four institutional traits that Solana’s 2026 roadmap prioritizes. These are predictable low-latency finality, order-flow privacy, deterministic execution, and application-level control.

Each trait maps directly to operational requirements that traditional trading and treasury teams already work within.

Blockdaemon further notes that Solana’s 2026 upgrades address three critical institutional pillars. On compliance, ACE enables protocol-level identity checks before trade execution takes place.

On liveness risk, validator client diversity, and the Alpenglow upgrade together reduce fault sensitivity across the network.

Technical Roadmap Details Four Pillars of Institutional-Grade Infrastructure

Blockdaemon’s technical roadmap centers on Alpenglow as the foundation for consensus stability. Alpenglow is Solana’s next consensus protocol upgrade, designed to stabilize block production under heavy network conditions.

It reduces uncertainty in transaction ordering and confirmation times, which matter most to funds and market operators.

“Rather than chasing headline TPS, the focus shifts to predictable finality, execution integrity, and redundancy.” — Blockdaemon, Solana in 2026: Technical Roadmap

IBRL, standing for Increase Bandwidth, Reduce Latency covers the broader performance improvement effort. It groups bandwidth, scheduler, and latency upgrades under one coordinated program alongside Alpenglow.

Trading and treasury systems gain more consistent confirmation windows that align with traditional financial service-level expectations.

ACE, or Application Controlled Execution, addresses the MEV problem that has long affected institutional adoption. Without ACE, validators and builders control transaction ordering, creating room for exploitative sequencing.

ACE allows financial applications to define their own sequencing rules, batching logic, and matching behavior for compliance and risk reasons.

Block Building Infrastructure and Validator Diversity Round Out the Roadmap

Blockdaemon’s series covers the full validator client ecosystem currently active on Solana. Clients include Agave, Firedancer, Frankendancer, Jito-Solana, and Rakurai, each operating on independent codebases.

This diversity means no single software failure can bring down the network, which is critical for staking that supports custody, ETFs, or corporate treasuries.

“For leading, network-conscious infrastructure providers like Blockdaemon, client diversity means resilience, performance optimization, and investor confidence.” — Blockdaemon, Solana in 2026: Technical Roadmap

Firedancer, developed by Jump Crypto, is a ground-up reimplementation in C targeting maximum throughput and fault isolation.

Frankendancer provides a hybrid approach, combining Firedancer’s networking stack with Agave’s execution runtime.

Rakurai achieves 5x higher TPS and up to 35% greater block rewards through proprietary scheduling and pipeline optimizations.

On the block building side, Blockdaemon covers JitoBAM and Harmonic as early ACE implementations. JitoBAM operates through Trusted Execution Environments, creating encrypted mempools that keep transactions private until execution.

This reduces sandwich attacks and other exploitative MEV practices that conflict with institutional best-execution standards.

“ACE’s promise is infrastructure-level fairness, giving institutional applications predictable, auditable control over how trades, payments, or transactions are realized on-chain.” — Blockdaemon, Solana in 2026: Technical Roadmap

Harmonic turns block building into a competitive marketplace by aggregating proposals from multiple independent builders.

Builders include Jito, Temporal, JitoBAM, and Paladin, with validators selecting from their proposals in real time. This model lowers concentration risk and makes order flow more transparent and auditable for regulated institutions.

Blockdaemon also maps the roadmap to concrete strategic use cases for financial institutions. Tokenized money markets benefit from sub-second settlement that removes intraday timing risk.

On-chain FX, derivatives, structured products, and institutional staking all gain from deterministic execution and improved network resilience across the upgraded Solana infrastructure.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video8 hours ago

Video8 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Video7 days ago

Video7 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports1 day ago

Sports1 day agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Crypto World7 days ago

Crypto World7 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World12 hours ago

Crypto World12 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market