Video

Don’t Wait for a Crisis: Start Financial Planning & Money Conversation Today

Some lessons in life arrive quietly. Others arrive through experience unexpected, overwhelming, and deeply transformative.

For Asha, financial awareness wasn’t a concept, a conversation, or even a plan. It was a responsibility that appeared suddenly, at one of life’s most difficult crossroads. Like many families, the assets existed. The savings existed. The intentions existed. But the conversations did not.

Across Indian homes, especially in families where one person manages most financial decisions and financial planning, an uncomfortable truth emerges:

Financial planning without communication often leaves families searching for answers when clarity is needed the most.

This video captures a powerful, real, and emotional story of Asha and her son Sajal, as they navigate what many households silently experience. The journey from confusion to clarity begins not with documents, but with knowledge that is shared, explained, and passed on.

Why This Story Matters

In countless Indian households, financial matters are handled with sincerity but not with openness. We save, we invest, we buy Life Insurance plan, and we do life goal planning for the future. Yet somewhere in the process, the essential step of sharing information is missing.

Asha’s words—

“I had no idea. No one had told me.”

—are more common than we think.

This video is not just a conversation between a mother and son. It is a reflection of what many families today recognize but seldom discuss.

Because financial management and financial planning isn’t only about creating assets.

It is about building clarity.

It is about ensuring continuity.

It is about empowering every family member with awareness.

Financial Awareness Is Not Inherited It Is Taught

The idea behind the Promises Forever initiative by Canara HSBC Life Insurance is simple yet powerful:

✔ Financial awareness must be intentional

✔ Families must talk

✔ Protection grows when information is shared

The Life Insurance benefits are fully realised only when your loved ones know what you have secured for them and how it protects their future.

This message forms the heart of the Promises Forever pledge an invitation to Indian families to start meaningful, transparent, and timely money conversations.

How This Story Connects with Life Insurance?

Life Insurance is not just a financial product but a promise for long term investment.

A promise that a family will remain protected even if life takes unexpected turns.

A promise of financial continuity during uncertainty.

A promise that responsibilities will be handled, even in your absence.

But for these promises to work, the people you love must know:

• What policies exist

• Who the nominees are

• Where documents are kept

• How much financial protection is available

• How to access benefits

• Whom to contact

• What to do next

This clarity is as important as the plan itself.

Canara HSBC Life Insurance encourages every policyholder to ensure that:

Information is shared

Documents are accessible

Dependents are aware

Conversations are ongoing

Because a Life Insurance plan protects your family best when they understand it.

Why Money Conversations Are Essential in Indian Families?

Money conversations are often delayed, avoided, or kept too private.

Many families experience:

• Hesitation to discuss finances in front of children

• Anxiety about mentioning investments or policies

• Discomfort in discussing income, savings, or protection

• Lack of awareness about tools like Life Insurance

• One person handling all responsibilities silently

Through stories like Asha and Sajal’s, the campaign highlights how conversations today create clarity for tomorrow for best Financial Planning for Families

🔗 To take a pledge today visit https://promisesforever.in/

Speak to our financial experts to know more about term insurance, unit linked insurance plan for wealth creation, life insurance as an investment, choosing the right insurance plan, Financial Advice for family financial planning and best long term investment options.

Learn more: https://tinyurl.com/Promises-Forever

Keywords: Life Insurance, Family Financial Planning, Long Term Investment, Financial Planning, Financial Management, Life Insurance Policy, Financial Planning for Families, Financial Advice, Life Insurance Benefits, Insurance Policy, Choosing the Right Insurance Plan, Life Insurance Plan, Life Goal Planning, Life Insurance As An Investment, Term Insurance , Unit Linked Insurance Plan, Retirement Planning, Wealth Creation

#PromisesForever #MoneyConversations #FinancialAwareness #FamilyClarity #CanaraHSBCLifeInsurance #PromisesKaPartner #TakeThePledge #ParentsAndPartners #FamilyConversations #ConversationsThatMatter #FamilyLegacy #TheUnspoken #LifeInsurance #FamilyProtection

source

Video

Money, Money, Money || Gacha Nox #gachaclub #gachatrend #gachalife #shorts #gachameme #gacha

Video

Why No Financial Help from Vivian? | Neena Gupta | Shubhankar Mishra

Video

White House Emergency CRYPTO MEETING!! XRP Was on The Table?!?! (INSIDER LEAK?)

💰 XRP: New Millionaires Are About to Be Minted! | You’re Either In… or Left Behind 💰

Subscribe for the latest news on xrp, xrp price prediction, and commentary. Inspired by NCashOfficial, MickleXRP, Digital Asset Investor, Levi, crypto sensei, Moon Lambo, exrtavod, Digital Perspectives, Thinking Crypto.

🚨 Don’t be the one watching from the sidelines. The next crypto success story could be yours — if you’re ready.

👇 Comment below: Are YOU all in on XRP, or still waiting?

🔔 LIKE, SUBSCRIBE & HIT THE BELL for XRP price action, predictions & wealth-building insights!

#XRP #XRPToTheMoon #XRPMillionaire #Ripple #CryptoMillionaire #XRPNews #XRPArmy #CryptoWealth #Altcoins #Bitcoin #Ethereum #XRPBreakout #Crypto2025 #FinancialFreedom

Keep watching to see xrp news today, ripple xrp news today, xrp news, xrp news today now, ripple xrp news, xrp today, xrp,xrp ripple news ,latest xrp news, xrp price prediction, xrp crypto,xrp ripple, crypto news, xrp price, crypto news today, ripple xrp, ripple news, ripple xrp price, xrp lawsuit, xrp prediction ,xrp coin,xrp update, xrp xlm, xrp analysis ,ripple news today, cryptocurrency news, xrp crypto news, xrp price update, what is xrp, xrp latest news, ripple today

source

Video

Prayer To Break Financial Strongholds

The devil wants to keep you in lack, delay, and survival mode. But this prayer breaks financial strongholds and releases supernatural provision.

I declare: Poverty is broken. Blockages are removed. Doors are opening. Favor is finding you. And the provision that’s been delayed is about to be delivered.

✨ SAVE this and SHARE it with the first person God puts on your heart.

FOLLOW @joewoodstuff for more prayers the devil hates.

And if you’ve been facing financial attack, delay, or limitation, check out my book (link in bio):

HUNTED: Why Your Life Has Been Under Attack and What You Must Do To Stop It.

#pray #prayers #dailyprayer #financialbreakthrough #spiritualwarfare #provision #jesus #faith #huntedbook #jehovahjireh

source

Video

Coins for Kids | #shorts #mathforkids #maths #money #coins

What is the value/worth of each US coin? If your kids or students need a refresher, here’s a quick short to help them remember! Pennies are worth 1 cent, and 100 pennies equals a dollar. Nickels are worth 5 cents, and 20 nickels equals a dollar. Dimes are worth 10 cents, and you need 10 dimes to make a dollar. Quarters are 25 cents, meaning you need 4 to make a dollar. You need 2 half-dollar coins to make a dollar because they’re worth 50 cents. And finally, obviously, the dollar coin is a dollar, so you only need one.

For the full video, click here: https://youtu.be/13FUtlLK6p8

We hope you and your student(s) enjoyed learning about coins! If you want even more information, head over to our website and download one of our many free lesson plans, full of activities, worksheets, and more!

Thank you for watching and learning with us! We’re constantly releasing new content and videos, so click that “Subscribe” button and you’ll get notified.

Find and Follow Us Online:

Facebook: https://www.facebook.com/LearnBright/

Instagram: https://instagram.com/LearnBrightEducation

Pinterest: https://pinterest.com/LearnBrightEducation

YouTube: @LearnBright

Website: https://learnbright.org/

*Teachers and Parents! Did you know? In addition to these great videos, we have also created a library of high-quality and engaging lessons for your elementary aged student(s). Visit us and sign up for a free account, and you’ll instantly have access to thousands of lesson plans, learning materials, teaching instructions, activities, and assignments that your kids will really enjoy! We hope to see you soon!

Browse our entire collection of Math lesson plans:

https://learnbright.org/lessons/?filter_subject=math

#coins

#money

source

Video

The XRP Table Is Set , Ripple & Another “Island Guy” Crypto Figure

Buy & Sell Crypto With iTrustCapital

https://www.itrustcapital.com/xrparmy

Get Your Tickets To XRP Las Vegas 2026

http://www.xrplasvegas.com

Open A Caleb & Brown Account(Institutional Custody & A Personal Rep)

Click Here: https://xrpwealth589.com

Become An Official Member Of The Digital Asset Investor Channel

Youtube

https://tinyurl.com/ycx9ases

Patreon

http://www.daixrp.com

Diversify Your PORTFOLIO with Gulf of America Oceanfront Real Estate.

http://www.gulfofamericaXRP.com

Digital Asset Investor Email

digitalassetinvestor2018@gmail.com

#xrp #ripple #bitcoin #ethereum #litecoin

#paid #promotion #sponsorships The above links are either affiliate links or paid promotions and deals.

___________________________________________

Disclaimer:

I am not a licensed financial advisor. All videos on this channel are intended for entertainment purposes only. You should not buy, sell, or invest in any asset based on what I say in these videos. You should know that investing carries extreme risks. You could lose your entire investment. This is not trading advice and I am in no way liable for any losses incurred.

source

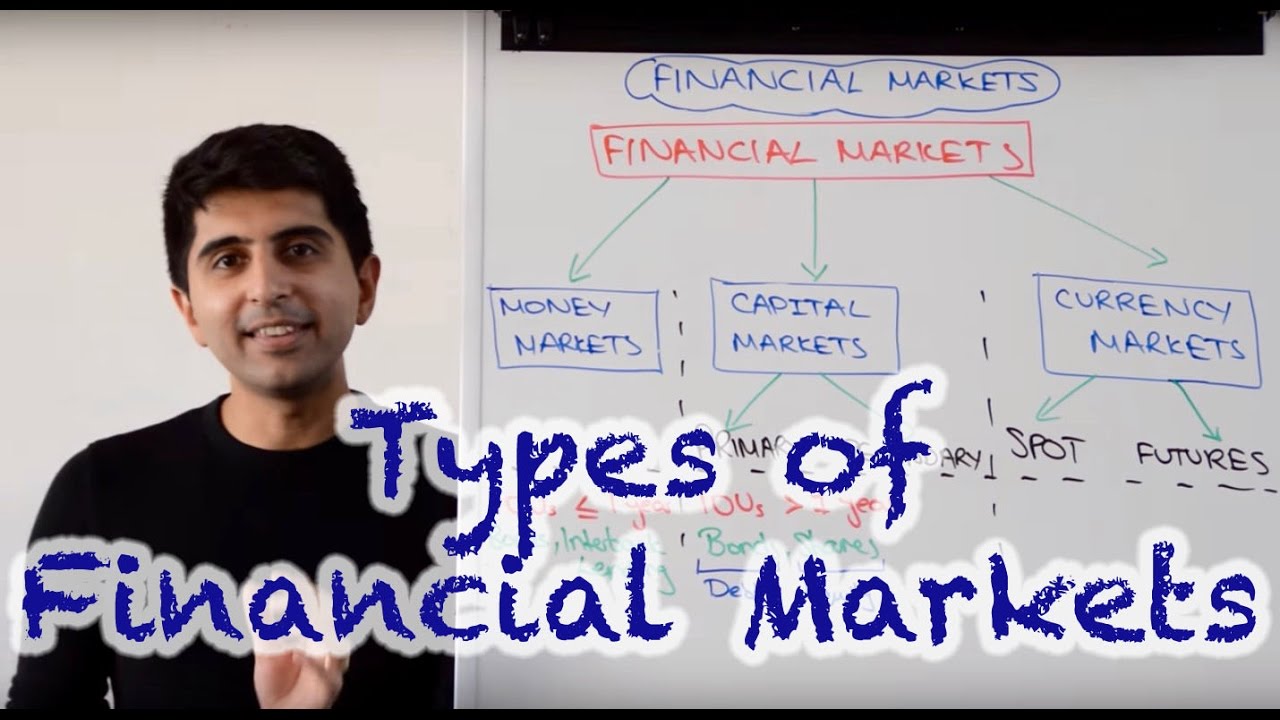

Video

Types of Financial Markets – Money Market, Capital Market, Currency Markets

Types of Financial Markets – Money Market, Capital Market, Currency Markets. A video covering Types of Financial Markets – Money Market, Capital Market, Currency Markets

Twitter: https://twitter.com/econplusdal

Facebook: https://www.facebook.com/EconplusDal-1651992015061685/?ref=aymt_homepage_panel

source

Video

EXPECT XRP PULLBACKS & SHAKEOUTS ON THE WAY UP – WARNING GET YOUR XRP OFF EXCHANGES – XRP NEWS

EXPECT XRP PULLBACKS & SHAKEOUTS ON THE WAY UP – WARNING GET YOUR XRP OFF EXCHANGES – XRP NEWS

NEW OFFICIAL CSC CRYPTO SHOP IS HERE:

https://officialcryptoshop.com/

⭐ FOLLOW ME ON X – https://x.com/TheCSCrypto ⭐

This video is about XRP. This video is about XRP and Ripple. Huge XRP update you need to see.

XRP Update, Ripple Update, Ripple XRP News: Latest News

⭐DCENT WALLET EXCLUSIVE DISCOUNTS ⭐

Wallet – https://store.dcentwallet.com/products/biometric-wallet-affiliates?bg_ref=Ka4GjOgJZa&utm_source=youtube&utm_medium=affiliate&utm_campaign=yt_CommonSenseCryptoYT_v01

2 Pack Wallet – https://store.dcentwallet.com/products/biometric-wallet-2x-package-affiliates?bg_ref=Ka4GjOgJZa&utm_source=youtube&utm_medium=affiliate&utm_campaign=yt_CommonSenseCryptoYT_v01

All in One Card – https://store.dcentwallet.com/products/all-in-one-card-wallet-backup-card-package-affiliates?bg_ref=Ka4GjOgJZa&utm_source=youtube&utm_medium=affiliate&utm_campaign=yt_CommonSenseCryptoYT_v01

⭐$1,000 SIGN UP BONUS ON MEXC: https://bit.ly/3P8NBq7⭐

Hey, I am Rich from Common Sense Crypto, bring you crypto news & information regarding the cryptocurrency market. The content on my channel will focus on news, common sense, insights and overall guides regarding XRP, Bitcoin, Ethereum, HBAR, & various altcoins.

DISCLAIMER: I am not a financial adviser, & all information given in my videos or on my social media platforms is for entertainment purposes only and is not financial advice.

Description Tags (Ignore)

#xrp #ripple #crypto

source

Video

Manchu Lakshmi Quits Film Production After Financial Losses and Debts#shortsfeed

Manchu Lakshmi | Lakshmi Manchu interview | film production debts | Tollywood news | Telugu cinema latest | Manchu Lakshmi quits producing | financial struggles in film industry | Sree Lakshmi Prasanna Pictures | Mohan Babu daughter | movie producer losses | acting career focus | cinema production challenges | Manchu Lakshmi comments | Telugu movie updates | film industry debts | producer journey | movie production risks | Daksha movie | Pookie movie | Lakshmi Manchu family | career shift | actor vs producer | filmmaking struggles | Telugu entertainment news | celebrity financial news | industry insights | filmmaking debt | cinema business #ManchuLakshmi #LakshmiManchu #Tollywood #TeluguCinema #FilmProduction

#MovieProducer #FinancialStruggles #IndustryNews #TeluguNews #ActingCareer #CinemaUpdates

#BreakingNews #FilmIndustry

#SreeLakshmiPrasannaPictures #MohanBabu #Daksha #Pookie #TrendingNow #ViralNews #CinemaLife #ProducerProblems #CareerShift #TollywoodUpdates #MovieBusiness #FilmJournalism #TeluguActress #EmpoweredWomen #TruthHurts #FinancialDiscipline #MovieNews #BehindTheScenes #LifelnCinema

source

Video

How to Make VIRAL AI Inspirational Finance Videos (FREE AI Course)

How to Make VIRAL AI Inspirational Finance Videos (FREE AI Course)

👉GOOGLE DOC – https://docs.google.com/document/d/1Q4WLa4E232OObQgpmSGX6wPErg6G54u4JeqGLgpmPjU/edit?usp=sharing

😈YOUTUBE AUTOMATION PLAYLIST: https://www.youtube.com/playlist?list=PL3BjyaYb8jhvdU9ruocTT_jdJVKoHFJ7g

💸Viral New Niche for content creators https://www.youtube.com/playlist?list=PL3BjyaYb8jhsxKEC5KCz6DAbAhnjfX4O-

❤️Subscribe https://www.youtube.com/channel/UCiYAKzdOrNQJZdoxP4gZlPg?sub_confirmation=1

💎Telegram Channel: https://t.me/+1J7-eJ8WJzY3NTk1

source

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video13 hours ago

Video13 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports1 day ago

Sports1 day agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World18 hours ago

Crypto World18 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat6 days ago

NewsBeat6 days agoUK construction company enters administration, records show

-

Crypto World7 days ago

Crypto World7 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery