Politics

Politics Home | How Out of Home advertising helped unlock creative careers across the UK

Images courtesy of 23red creative agency

The success of the UK’s creative industries depends on a strong and diverse talent pipeline. That’s why in November, the Department for Culture, Media and Sport ran a pilot campaign as part of the Discover! Creative Careers programme. It focused on six key regions identified in the Industrial Strategy: Greater Manchester, Liverpool City Region, the North East, the West of England, the West Midlands and West Yorkshire. These areas already have growing creative sectors, including major advertising hubs.

The advertising industry was proud to support the campaign as one of DCMS’s priority sectors. Working with Creative UK and partners, we helped reach the target areas and support from the Out of Home (OOH) industry was exceptional. Through Outsmart and WPP Media, the Advertising Association convened OOH partners including Alight Media, Bauer Media Outdoor UK, JCDecaux, Limited Space, Ocean Outdoor UK, Open Media UK, Outdo and SmartOutdoor. Their donated inventory enabled the campaign to reach millions of young people, parents and carers across the North of England and beyond.

The figures speak for themselves: the campaign’s combined online and OOH advertising activity generated more than 100 million impressions and achieved 18.5 million total video views. This visibility translated directly into record engagement on the Discover! Creative Careers platform.

This support helped spotlight real stories from young people thriving in creative roles. It also demonstrated what OOH advertising contributes to society. A report by PwC shows that the OOH sector reinvests more than 40% of advertising revenue into local communities, public services and employees. Many of the partners who backed the campaign are themselves major employers who contribute to this growth.

The campaign launched in response to Government research showing strong interest in creative careers among young people. Nearly one in three 11- to 18-year-olds have expressed an interest in working in the creative industries, yet almost half do not know what skills or qualifications are required. It is also concerning that 23% believe there are no creative jobs where they live. Discover! Creative Careers has helped address this gap by showing the scale and diversity of roles available.

This work supports the wider Creative Industries Sector Plan, which identified advertising as one of the priority growth sectors. We know this to be the case from our Advertising Pays report, which demonstrates how the industry supports 1.7 million jobs up and down the UK. What’s more, 60% of UK advertising and marketing jobs are based outside of London. Employment in the North West has risen from 8% in 2017 to 12% in 2024, with similar growth in Yorkshire and the Humber.

It is important for the future of our industry that young people see creative opportunities exist on their doorstep. In advertising alone, they include a range of employers, such as creative agency McCann Manchester, media agency Republic of Media based in both Manchester and Edinburgh, production company LS Productions in Edinburgh, not to mention UK broadcaster Channel 4 in Leeds.

To build on the success of the Discover! campaign, there are practical steps Government can take.

First, apprenticeship programmes in advertising and marketing play a vital role in ensuring that people can live and work in any area of the UK. Greater flexibility within the Growth and Skills Levy would help employers increase apprenticeship opportunities available. We believe that allowing unused levy funds to support new apprentices, for instance by covering the first 12 months of entry-level apprentice salaries, would reduce the financial barriers to taking on an apprentice for SMEs in particular.

Second, business rates for local media operators should be removed for out of home advertising estates, particularly those that support social infrastructure, like bus shelters and defibrillators. OOH companies invest significantly in this social infrastructure within communities, so a fairer system would help sustain this contribution to essential services, like public transport.

It’s clear that the Discover! Creative Careers pilot showed what can be achieved when industry and Government work together with a clear purpose. Continued support for the advertising industry, including Out of Home, will help more young people see a future for themselves in the creative industries and strengthen the growth we all want to see across the UK.

If you are interested in finding out more about the Advertising Association’s work, please email [email protected].

Politics

Water companies are taking us all for a ride

Campaigner and singer Feargal Sharkey has, once again, dressed down the privatised water companies.

Water companies: taking the p*ss

On social media, Sharkey said:

You’ll want to be sitting down for this bit. Water companies are currently £82.7 billion in debt, have paid themselves £85 billion in dividends, leak over a trillion of litres of water per year, dump sewage for almost 4 million hours per year, have been convicted of over 1,200 criminal acts since 1989 and an average of 35% of your bill goes on nothing but paying more interest and yet more dividends. And not a single company has ever lost their operating licence.

When the water companies were privatised in 1989 under Margaret Thatcher, they were debt free. Since then, they have accumulated £82.7 billion in debt, as Sharkey notes. At the same time, they have failed to invest in infrastructure to fix our dated sewage system. Instead, they dump sewage in our rivers and the ocean for millions of hours a year. And they haven’t just creamed cash rather than investing. Water companies sold off 35 reservoirs in just five years, making £26 million from flogging what were public assets.

On top of that, as Sharkey points out, a University of Greenwich study for We Own It found a “privatisation tax” of 35% on our water bills. In other words, we’re spending over one-third more than we need to every time we turn on the taps.

Privatisation: 140 years into the past

Water was brought into public ownership in the late 1800s. Even back then, people knew it was a natural monopoly and a daily essential for all humans. Selling it off just means one then rents it at higher cost.

Thatcher’s government and then the neoliberals in Labour, Reform and the Tories maintaining privatisation of water, have brought us 140 years into the past.

Sharkey is spot on to take down the polluting profiteers.

Featured image via the Canary

Politics

Homeless children in Scotland pass 10,000 mark

The number of children who are homeless and in temporary accommodation in Scotland has passed 10,000.

The latest figures from the Scottish Government show that, in the six months to 30 September 2025, 10,480 children were in temporary accommodation.

People experiencing homelessness increasing

In total, there were 18,092 households in temporary accommodation, a 9% increase from 16,634 in 2024. This is also a new record high. Households spent an average of 237 days in temporary accommodation.

There was also a 4% increase in the total open homeless applications. The figure now stands at 33,006.

The number of people sleeping rough has also reached its highest in over a decade – at 1,083. This means that one in 10 applicants was sleeping outside.

One notably higher figure is the number of households not being offered temporary accommodation. The number has risen from 7,565 in 2024 to 10,710 in 2025. Most of these were in Glasgow (6,815 out of 10,710). The local authority also reported high numbers in Edinburgh – with 3,585 instances over the six months.

A figure that has improved is the number of breaches of the unsuitable accommodation order. This states that:

the maximum number of days that local authorities can use unsuitable accommodation for any homeless person is 7 days and has the effect of ending stays in unsuitable accommodation, such as B&Bs, apart from in emergency situations.

In the last 6 months, there were 3,635 breaches, which is a 12% improvement.

Changing characteristics

Of the homeless applicants, 16% were from households that had been granted either refugee status or leave to remain. This allows non-UK nationals to stay lawfully in the UK following an application made from within the country.

In total, 2% of all applications cited “left asylum accommodation” as the reason for them being homeless.

There was also a decrease in the number of white applicants, specifically white Scottish applicants. Conversely, there was an increase in the number of African, Caribbean, Black, Asian, and Arab applicants.

This comes as the number of refugees experiencing homelessness across the UK has more than doubled in the last two years. In total, 4,434 refugees and migrants were accommodated from 2024-25, the largest number on record. Of these, 2,008 were refugees — a 106% increase on the previous year.

In September, Màiri McAllan, Scottish Cabinet Secretary for Housing, pledged funding for affordable housing, along with measures to support people in moving out of temporary housing.

Additionally, the Scottish government said it planned to invest up to £4.9bn over the next four years. This would help it achieve its target of delivering 36,000 affordable homes by 2030.

In a statement, McAllan said:

The figures do speak to the severe pressure that services are under due to the Home Office’s mismanagement of the asylum system, particularly in Glasgow.

Politics

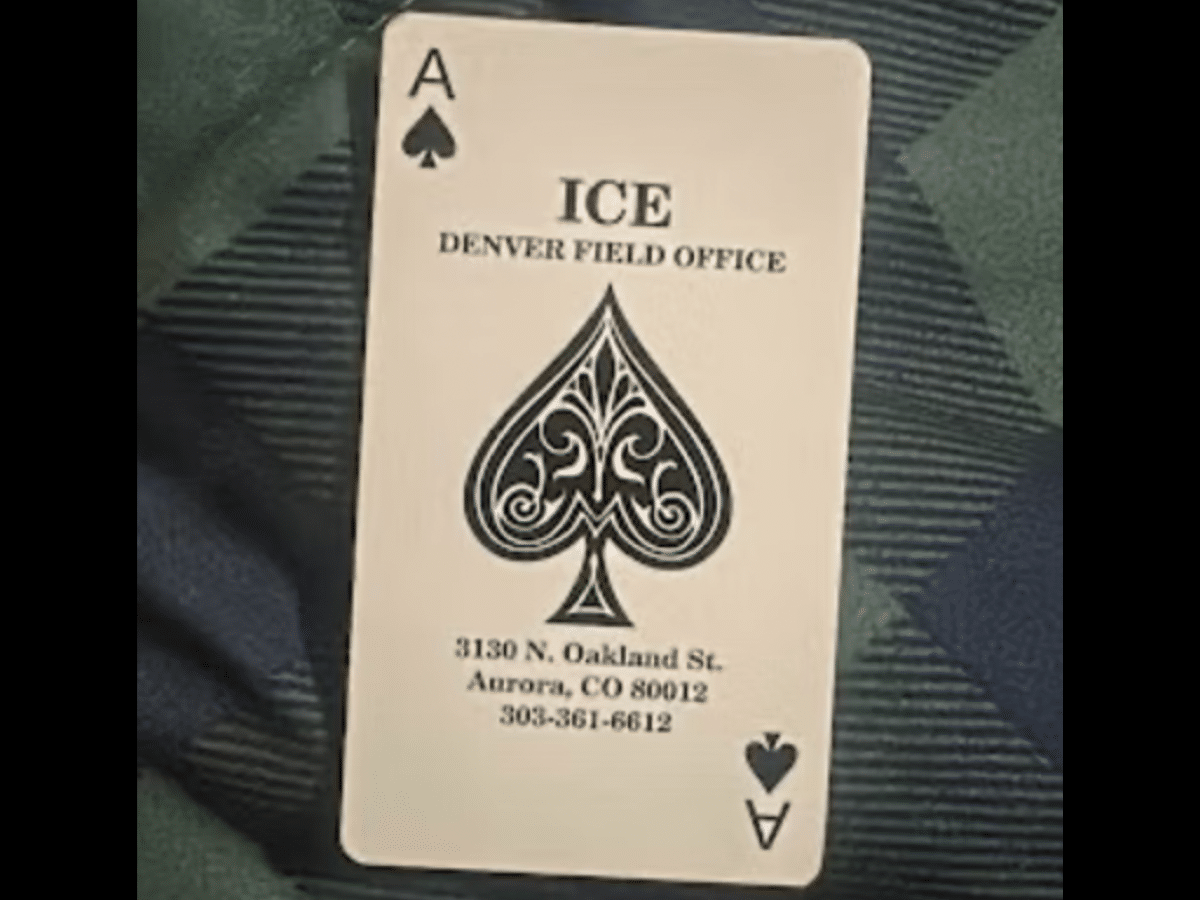

ICE leave imperial ‘death cards’ behind

Immigration and Customs Enforcement (ICE) paramilitaries are leaving custom-made ace of spades ‘death cards’ at the scene of migrant snatch operations. The ghoulish practice has imperial origins. US troops used to stuff cards into the mouths of the Vietnamese dead. The practice – consider yourself trigger warned here, please – was even filmed for use in official military propaganda.

The truth is this isn’t the first example of long-ago wars inflecting US immigration policy. America’s imperial past and present is so deeply interwoven into Trumpian policy that we don’t always see it. Yet these cards are one of several crystal-clear examples lately.

ICE leave death cards

The Intercept’s Nick Turse picked up the story on 3 February. It appears to have originally been reported on 22 January 2025 by Latino community organisation Voces Unidas. After a snatch mission in Eagle Country, Colorado, relatives searching for their kidnapped family members found the cards at the scene:

After detaining 10 Latino community members, ICE agents left ace of spades cards—widely known as the “death card”—inside the abandoned vehicles. The cards, later found by family members, clearly identify ICE’s Denver Field Office.

The US used the ace of spades design because it supposedly had particular cultural power in Vietnam.

As Turse explained:

During the Vietnam War, U.S. troops regularly adorned Vietnamese corpses with “death cards” — either an ace of spades or a custom-printed business card claiming credit for their kills.

Adding:

A 1966 entry in the Congressional Record noted that due to supposed Vietnamese superstitions regarding the ace of spades, “the U.S. Playing Card Co. had been furnishing thousands of these cards free to U.S. servicemen in Vietnam who requested them.”

After Vietnam, as Voces Unidas pointed out, the cards were adopted:

by white supremacist groups to demean people of color.

On the face of it, this makes a lot of sense. ICE’s recruiting strategy is less about nods to racism and more about openly using fascist imagery, mottosm and even songs to attract recruits who align with a mission to ethnically purify the US.

Long history of racial violence

Alex Sánchez, president and CEO of Voces Unidas said:

We are disgusted by ICE’s actions in Eagle County. Leaving a racist death card behind after targeting Latino workers is deliberate intimidation rooted in a long history of racial violence.

He added:

This is an abuse of power, and it has no place in any society that claims to value human dignity.

Sanchez said family members of the disappeared had the cards in their possession. He confirmed they appeared custom-made and meant to terrify ICE’s targets:

These were not from a doctored deck of cards. These were designed with this legacy in mind. They were printed on some sort of stock paper and cut in the dimensions of a card.

Neither ICE nor the Department of Homeland Security deigned to explain the cards.

The term ‘imperial boomerang’ has used liberally to describe what is happening in the US – and correctly so. Trump’s war on immigration is a cover for a war on the left and on migrant labour. He seeks to both create an enemy and eliminate rivals, not just at home but also abroad, as we’ve seen with Venezuela and Iran.

But there is more to it. Let’s not forget that a senior Border Patrol official invoked the Confederacy – the slave-owning losers of the Civil War – in a recently discovered email chain.

In truth, the whole spectacle is alive with fascist nostalgia about lost wars. It feels like fascists – many of whom are clearly now in ICE – are trying to correct various imperial and colonial emasculations through racist violence. Trump has given them the permission, the weapons and the authority to do so. At the very least, they are drawing on those vengeful energies.

From the War on Terror to the Confederate fantasy of a ‘lost cause’ and, now, Vietnam, the ghosts of America’s violent past are restless.

Featured image via Voces Unidas

Politics

Palantir have major ties to Epstein

Evil tech giant and NHS leech Palantir has links with wealthy sex offender Jeffrey Epstein. And Labour MP Dawn Butler has rightly called for scrutiny.

Butler insisted we should “not ignore” the connection between Palantir co-founder Peter Thiel and Epstein, particularly because it has infiltrated our public health system:

We can not ignore the fact that Peter Thiel co-founder of Palantir is featured numerous times in the Epstein files https://t.co/QXoz6C94D1

— Dawn Butler ✊🏾💙 (@DawnButlerBrent) February 3, 2026

She had previously highlighted how the Conservatives let dodgy tech giants Palantir, Google, Microsoft, and Amazon get their grubby hands during the Covid-19 pandemic on our health data. In 2021, she expressed concern over the lack of transparency and the consequences for our data privacy.

Palantir embeds within the US, the UK, and Israel

As the Canary has reported, Palantir:

- Is staunchly pro-Israel.

- Has “deep ties to British and American security agencies”.

- Has gained lots of experience helping to smear progressives, back right-wing causes, and mistreat vulnerable people.

- Had links to the dodgy campaigning surrounding Brexit.

- Is already deep within the UK’s military and police establishment.

- Received investments from the shady multimillionaire donor behind Keir Starmer’s Labour Party.

- Has just got a £240m deal to give services to the British military, as Starmer has cosied up even further to the company (with help from Epstein friend and general prince of darkness Peter Mandelson).

- Had Epstein in its corner, encouraging close friend and Israeli war criminal Ehud Barak to learn more about the company. It later ended up profiting from Israel’s genocide in Gaza.

- Is getting deeper and deeper into the US government, and is a key part of Donald Trump’s dystopian domestic terror campaign.

- Co-founder Thiel powered US vice-president JD Vance’s rise to prominence.

- CEO and co-founder Alex Karp is a vile warmonger, arrogant gaslighter, and misanthropic authoritarian. He seems to think war crimes are fine, that the West has “obvious, innate superiority”, and that violence (rather than ideas) is the path to dominance.

Neocolonialism

Palantir has latched onto the US imperial project and is now a prominent part of it. By extension, this means entering junior partners in the UK and Israel too. And apparent intelligence assets like Epstein helped to ensure companies like Palantir become part of this system of racist brutality and dominance.

Journalist Whitney Webb has written about:

The Sordid Union Between Intelligence and Organized Crime That Gave Rise to Jeffrey Epstein

And because of developments like artificial intelligence, mass surveillance, and drones, the baton has passed from people like Epstein to companies like Palantir. As Webb said in 2025:

you don’t really need Epstein in the Surveillance Era…

[Israel and others] don’t really need blackmail anymore…

Palantir, Peter Thiel’s company… that’s the new Jeffrey Epstein…

“They don’t…need blackmail anymore…Palantir…[is] the new Jeffrey Epstein…if they want to blackmail [you]…they…access…your finances, tweets you’ve liked…[&] the disturbing thing about Palantir is…it’s…about pre-crime. [They’re] pioneers of predictive policing”… pic.twitter.com/3Il0l3IhuR

— Sense Receptor (@SenseReceptor) August 1, 2025

Countries around the world have already started to realise the importance of technological independence from the US and its dystopian corporations like Palantir. And if UK politicians don’t heed calls to do the same, they need to lose their jobs.

Because for the sake of humanity and our future, we should not only “not ignore” all of this, as Dawn Butler rightly said. We also need to actively campaign to kick companies like Palantir out once and for all.

Featured image via the Canary

Politics

Fox hunt ‘desecrates’ tranquil burial site

A pack of hounds from the Middleton fox hunt has run amok through a woodland burial site in North Yorkshire. The incident happened during the last week of January 2026.

Footage captured by national animal welfare charity the League Against Cruel Sports shows the hounds marauding through the Mowthorpe Garden of Rest within the Howardian Hills Area of Outstanding Natural Beauty. The hounds ran across graves with the hunt failing to stop or divert them.

This is the same Middleton Hunt that the Canary witnessed a couple of weeks earlier. On that occasion, the hunt was behaving violently and showing no sign of laying a trail. Unless the law changes, and it may do before long, fox hunts can still ride out. But, legally, they can only ‘trail hunt’. This means following a scent trail, rather than actual foxes.

However, until the government moves decisively to ban them for good, fox hunts are continuing to cause havoc across the countryside.

The League’s chief executive Emma Slawinksi has slammed the hunt for its actions:

It beggars belief that the hunt would have laid a trail through a burial site so either the Middleton Hunt has no regard for the sanctity of this site or, as is more likely, the hounds were on the trail of a fox.

They have desecrated this burial site in a bid to carry on with a blood sport that was banned 20 years ago.

Hunts are behaving in an appalling way, intent on chasing and killing foxes and not caring about their anti-social behaviour and the impact they are having on local communities and the people who live in the countryside.

The hounds were also caught terrorising local wildlife with two deer filmed fleeing for their lives.

‘Trail hunting a smokescreen for fox hunts’

The footage of the Middleton Hunt is being released the day after Channel 4 News aired footage gathered by the League of the same hunt’s hounds chasing a fox on Christmas Eve 2025.

The League released figures ahead of Boxing Day showing an increase in the number of reports of hunts chasing foxes and wreaking havoc on rural communities.

Chief superintendent Matt Longman, the national lead on fox hunting crime, has described trail hunting as a “smokescreen for illegal fox hunting”. He also described illegal hunting as “prolific”.

The government has announced it will launch a consultation to ban trail hunting, though this has suffered delays.

Slawinksi added:

I would urge the public who are sick and tired of the behaviour of fox hunts to take part in the government’s hunting consultation.

The time for change is now. We want to see trail hunting banned, the loopholes in the law removed, the end of so-called ‘accidental’ hunting, and jail sentences introduced to act as a deterrent for those who would break new stronger fox hunting laws.

Featured image via the Canary

Politics

Choppier seas await Mamdani-backed candidates after Diana Moreno's landslide win

NEW YORK — New York City Mayor Zohran Mamdani’s pick to succeed him in the state Assembly cruised to an easy victory Tuesday night. But Diana Moreno’s win in that Queens special election is likely the last cakewalk we’ll see from a Mamdani-backed candidate in the near future.

The new mayor has endorsed Brad Lander in his quest to unseat Rep. Dan Goldman in New York’s 10th Congressional District and Assemblymember Claire Valdez for the NY-07 seat being vacated by Rep. Nydia Velázquez.

The pair of Democratic congressional primaries is expected to be far more competitive than Moreno’s race, raising a central question: How far can a Mamdani endorsement get you?

“We’re testing that out,” said Grace Mausser, co-chair of the Democratic Socialists of America’s New York City chapter, which has endorsed both Moreno and Valdez, but not Lander. “He has a lot of hard resources that come with an endorsement: his impressive volunteer and donor lists, his strong reach on social media … There’s also the soft power that we’re testing out now, right? Who is the leader of left and progressive politics in New York right now?”

Mamdani has so far been more involved in boosting Valdez than Lander.

The mayor appeared with Valdez — a Queens lawmaker, former United Auto Workers union organizer and the first elected official to stand with Mamdani in his campaign for mayor — at an event the day after she launched her bid. He also filmed a whimsical social media video set in a subway station to boost her fundraising.

Valdez is running against Antonio Reynoso, the Brooklyn borough president who Velázquez has endorsed as her preferred successor. Queens City Council Member Julie Won also recently entered the race in the progressive Brooklyn and Queens district.

The mayor has been largely hands-off in Lander’s campaign after endorsing the former city comptroller on the day of his launch for Congress. Lander, who cross-endorsed Mamdani in last year’s mayoral race, is running in Brooklyn and Manhattan against an incumbent with more than three times as much campaign cash on hand and the backing of Democratic House leadership, including Minority Leader Hakeem Jeffries.

A political adviser to Mamdani said his team is still assessing how much to get involved in the two congressional contests and cautioned against reading anything into the fact that the mayor has been more involved in Valdez’s race so far. The adviser said the Mamdani team is waiting to make major moves in NY-10 pending the outcome of a court case that could scramble the lines of the district in such a way that Goldman may run in the neighboring 11th District instead.

Regardless, the Mamdani adviser, who was granted anonymity to discuss internal strategy, said the mayor simply lending his name to Lander and Valdez “already carries a lot of weight that these campaigns can make the most of.”

“His direct involvement is always going to be second to governing,” said the aide. “Ninety-nine percent of his energy is going to be focused on running the city.”

The politics-versus-governance balance is part of Mamdani’s clash with Velázquez, the highly respected progressive who effectively warned him in a New York Times interview to stay in his lane.

And the mayor does have a lot of work to do at the helm of the country’s largest city. June’s congressional primaries fall around the same time he and the City Council will be putting finishing touches on the city budget amid serious fiscal headwinds.

“I don’t know if that was the wisest thing for him to do because the job of being mayor is so big,” Democratic strategist Lupe Todd-Medina said, arguing Mamdani could end up in a situation where he’s not able to stump for Lander and Valdez as much as they want and need him to due to the sheer burden of governing New York City.

As June’s primaries still loom more than four months away, a Lander campaign official, granted anonymity to share sensitive considerations, said his team is also still waiting to see if a court decision could rip up the lines of NY-10.

But if the race ends up competitive, the Lander aide said his team is confident Mamdani will help fundraise and campaign for the former comptroller. The fact that Mamdani hasn’t done so yet, the aide said, is understandable since the mayor has been focused on governing in his first month in office.

The two House primaries have different dynamics but they’ll determine whether Mamdani can replicate the magic that catapulted him from relative obscurity to the nation’s second toughest job.

“He has a lot at stake by pushing in some chips on two fronts, but I think he has more at stake in the 7th District,” said Michael Lange, an analyst who specializes in progressive politics. Valdez “is a really close ally who comes from his political movement and his political home.”

Politics

LIVE: Commons Debates and Votes on Mandelson Files

The latest: Labour is preparing an archaic last-minute manuscript amendment to its own amendment to cave in to some of its MPs’ demands with regard to how much information on Mandelson should be released. It’s bedlam behind the scenes…

Politics

Why has Mandy been given such an easy ride in the media?

UK prime minister Keir Starmer is far from the only one who stuck by Peter Mandelson long after the scandal surrounding him became impossible to ignore. In the past few weeks, despite new evidence of Mandelson’s relationship with Jeffrey Epstein being made public, the BBC continued to offer him a platform. And still today, even as the extent of Mandelson’s alleged corruption, betrayal of trust and potentially criminal activity is made clear, it seems that the commentariat is prepared to come to his defence in sympathetic tweets, interviews and newspaper columns.

Starmer appointed Mandelson British ambassador to the US in 2024, despite knowing that the architect of New Labour had twice been forced to resign in disgrace from cabinet posts and had maintained a close association with Epstein. It took until September last year for Starmer to finally give him the boot, after emails were published showing Mandelson urging Epstein to ‘fight for early release’ from jail, following his conviction for soliciting prostitution from a minor.

But while Starmer may have finally decided Mandelson was no longer fit for public life, the BBC took a different stance. Even after we had been treated to creepy photos of him in a bathrobe, casually chatting to his ‘best pal’ Epstein, Mandelson continued to be offered a cosy platform on the BBC. Just three weeks ago, on 11 January, he appeared on the BBC’s flagship Sunday morning politics show, where he was interviewed by presenter Laura Kuenssberg. Mandelson was given over half an hour to offer his take on the Trump administration, Greenland, Ukraine and the British government.

It was only in the final 10 minutes of the interview that Mandelson was asked about his relationship with Epstein. Even then, Kuenssberg threw him softball questions. This gave him a chance to offer a perfunctory apology to ‘the victims’, before giving his excuses. He told a credulous Kuenssberg that because he is gay, ‘he was kept separate from the sexual side of Epstein’s life’. Worse still, Mandelson – always the spin doctor – was able to present himself as a victim. He just happened to be in the wrong place at the wrong time as a maelstrom of sex and scandal happened all around him.

This interview was no one-off. Just days later, Mandelson was at Broadcasting House again, this time being interviewed by Sarah Montague for Radio 4’s World at One. Once again, Mandelson got to present himself as an elder statesman turned commentator on global events, with the promise of moral rehabilitation via apologies and disclaimers. We have to ask why. Why did BBC producers and presenters think Mandelson worthy of this reprieve?

But the media’s special treatment of Mandelson does not stop at the BBC. Even now, when we know that the real scandal in the relationship between Mandelson and Epstein was not sex but money, knowledge and power, he is being fawned over by some commentators. This week, the former Conservative MP turned Times columnist, Matthew Parris, has been gushing over Mandelson, describing him as ‘a man of wisdom and judgement in all but the conduct of his personal affairs’. ‘Within his party he has been a seminal influence for good’, Parris continues, ‘on the right side of every important argument in the politics of the left’.

Labour’s one-time spin doctor, Alastair Campbell, has been defending him as ‘talented’. ‘There’s no doubt. If you push to one side the reasons for his resignations, he was an effective cabinet minister,’ says Campbell on the latest edition of his Rest is Politics podcast. Despite Mandelson being implicated in the biggest scandal to hit the British government in decades – allegedly engaged in corruption that makes ‘partygate’ seem like the tea party it really was – neither Campbell nor Parris can summon up the words to wholeheartedly condemn him.

There’s a reason for this treatment of Mandelson. His role in orchestrating New Labour’s success under Tony Blair means that, even today, he is given a free pass by establishment centrists. They either refuse to believe he has done anything terribly wrong, or think that the sleaze, alleged corruption and seeming acts of treachery were a price worth paying for getting their men into power.

The Mandelson affair raises questions not just about the prime minister’s judgement but about Britain’s entire political and media class. Far too many decades-old stalwarts of the Westminster-media pipeline are implicated in defending Mandelson long after his failings were manifest. Either they have grown so used to shouting ‘scandal’ over every cake crumb and undeclared payment, that they can no longer spot the real thing. Or they so firmly believe in the moral rightness of the centrist, technocratic political project that they see corruption as a price worth paying. In either case, it’s not just Mandelson, Starmer and the Labour government that Britain needs to be shot of, but their sympathisers and hangers-on in the media, too.

Politics

Farage runs scared from Polanski debate

Reform leader Nigel Farage is running scared of Green leader Zack Polanski. And, in the run-up to the Gorton and Denton by-election, the clash between the two parties could well be a sign of things to come in the British political landscape.

Of course, Farage is refusing a challenge to a face-to-face debate with Polanski. After all, the far-right figurehead is far batter at manufacturing glib soundbites than he is at answering probing questions.

Politics UK posted on social media:

🚨 WATCH: Nigel Farage rejects Zack Polanski’s request for a one-to-one debate

“I generally find that if you pick a fight with a chimney sweep you get covered in soot, so I might just leave that alone”

“But he’s got a fan club – all the heroin smokers and everything” pic.twitter.com/e5F6H80eV4

— Politics UK (@PolitlcsUK) February 3, 2026

Farage is a glutton for punishment

In the clip, the interviewer reminded Farage that Polanski had expressed interest in a debate with him. However, that’s not the whole story.

Rather, Reform had previously challenged the Green leader to debate Zia Yusuf, the party’s head of policy. However, that’s not exactly an even matchup, is it?

Yusuf is an unelected benchwarmer for the far-right party who’ll get ditched as soon as another ex-Tory shows up to replace him. Meanwhile, Polanski is a serving member of the London Assembly.

Likewise, Polanski is the leader of his party, rather than being ‘head of policy’ for a party that only has one real policy.

Then, of course, there’s the fact that Yusuf has already debated Polanski. The two both appeared on BBC’s Question Time in December of last year. As I recall, Yusuf got booed for being a slimy little tosser.

The fact Yusuf appears eager to repeat the experience is his own business. However, Polanski was eager to debate – but against a fellow party leader:

Dear @ZiaYusufUK,

As I keep saying, I would be more than happy to debate, leader to leader, with Nigel Farage.

I’m starting to get the impression he might not be keen?

Maybe you could be kind enough to pass this message on?

Hugs, Zack.

— Zack Polanski (@ZackPolanski) February 2, 2026

‘Hugs, Zack’

Addressing Yusuf on social media, the Green leader wrote:

As I keep saying, I would be more than happy to debate, leader to leader, with Nigel Farage.

I’m starting to get the impression he might not be keen?

Maybe you could be kind enough to pass this message on?

Polanski then signed off with a cheeky little “Hugs, Zack”.

However, Farage was far less willing to face Polanski in a head-to-head debate. When he was reminded of the Green leader’s challenge, Farage tried to brush it off, stating:

No, I generally find that if you pick a fight with a chimney sweep you get covered in soot, so I might just leave that alone for now.

And that’s the nearest to an insult I’ll ever come, alright?

But you know, he’s got a fan club – all the heroin smokers and everything think he’s absolutely marvelous.

Apparently, calling a fellow schoolmate a “stupid Yid” doesn’t count as an insult. But anyway.

Running scared

Of course, it’s not surprising that Farage is running scared from a debate – he’s shite at them. In 2024, the Reform leader threw a tantrum and announced that he was boycotting the BBC after getting thrashed on Question Time himself.

Attendees grilled the party leader on immigration, health care, and his campaign activists’ racist and homophobic remarks. In return, Farage accused the BBC of rigging the audience.

As a side note, Farage seems to love boycotting the BBC – especially when people point out that he’s a racist sack of shit. Likewise, he’s also made a habit of accusing debate audiences of being left-wing plants whenever he starts losing.

You see, like most members of the far right, Farage can’t hold up in a debate he can’t control. He pulls stunts and generates headlines, but his ideas fall down under basic scrutiny.

Given his obvious ambition to install himself as the UK’s prime minister, Farage had better get comfortable in the hot seat pretty sharpish. Otherwise, the public might start to notice that he’s a hollow, bigoted authoritarian with no real answers. And we’d hate to see that now, wouldn’t we?

Featured image via the Canary

Politics

families speak out after acquittal

In the aftermath of the acquittal of six of the Filton 24, pressure groups and the families of the vindicated prisoners have spoken about what the verdict could mean.

Pressure group CAGE responds

The refusal to convict any of the six defendants of any charges, including on the most serious of charges, is a powerful affirmation of jury equity and brings to a humiliating end one of the most politically charged trials of this year thus far.

The decision made by the jury critically undermines the rationale used to proscribe Palestine Action, and underscores the urgent need for that ban to be lifted. This case was the most significant test of the government’s claim that acts of conscience against arms companies constitute a threat to public safety.

An independent jury, guided by conscience and moral clarity, rejected that narrative despite extraordinary political pressure, ministerial intervention, and an environment shaped to shield Israeli state-aligned interests from scrutiny.

The verdict echoes a wider public rejection of Zionist impunity, and growing support for direct action against companies complicit in genocide.

The trial has exposed how pre-trial detention and public spectacle were used to punish the defendants in advance and to deter others from challenging Israel’s largest arms manufacturer. The proscription of Palestine Action must now be lifted, and all those held as a result of this political process in prison should be released immediately.

The trial demonstrated that counter-terrorism and national security frameworks are being used in line with their established purpose: to silence dissent and shield state complicity in crimes from accountability. Context was excluded, and scrutiny of Elbit systems – Israel’s largest weapons manufacturer – supplying an ongoing genocide was treated as a matter to be suppressed rather than examined.

Naila Ahmed, Head of Campaigns at CAGE, said:

This is a huge victory for the movement but nationally and abroad who campaigned on behalf of the defendants, and a powerful affirmation of jury independence and moral courage in the face of extraordinary political pressure.

Though they cannot get back the 17 months of their life taken from them unlawfully, they should all be compensated and the remaining 18 defendants of the Filton 24 should also be released on bail. This case was used to justify the ban against Palestine Action, a decision that should now be overturned.

CAGE calls for full compensation for those acquitted, a lifting of the ban on Palestine Action, an independent review into the political handling of the case, and the abolition of terror laws. The acquittal should prompt serious reflection on how easily due process can be eroded when political interests are at stake.

Filton24 Defence Committee

lisa minerva luxx, a representative of the Filton24 Defence Committee said:

Today’s significant victory delivered by the jury has vindicated the six defendants, who are the first six on trial from the Filton 24.

There are still 18 more defendants imprisoned across the UK in connection with this case. They are being held under joint enterprise which means they each have the same 3 charges whether they are accused of being present at the action or not. Now that the first 6 have been liberated of the most serious charge, Aggravated Burglary, and none were convicted of a single offence, it follows that the rest must immediately have this charge dropped against them, and be granted bail.

This was a trial by media. Yvette Cooper and Keir Starmer took evidence in this case out of context and broadcast it on televisions and tabloids across the country in order to justify proscribing Palestine Action as a terrorist organisation, despite forewarning that this will prejudice the trial.

By acquitting the defendants of aggravated burglary, the Jury aligned with the defence case that the items taken in to the warehouse were not weapons, but were tools used to dismantle and neutralise Israeli weapons.

Now that a court of law have vindicated the first six of the Filton 24 of the exaggerated charges against them [and found that the actions against Elbit Systems that night were reasonable], we should all expect Shabana Mahmood to do the reasonable thing herself and lift the ban on Palestine Action.

It’s time for the British state to accept that the movement for a liberated Palestine has been, and will continue to be, justified.

Filton 24 relatives respond

Clare Rogers, mother of Zoe Rogers said:

Our loved one’s action against Elbit Systems and the state’s brutal response have exposed the true values of the government. The government is determined to do business with Israel and protect its weapons industry at any cost. Our loved ones dared to poke this beast – and no expense has been spared in policing prosecuting and imprisoning them without trial. Imagine if the government had put the same amount of money, resources and political will into preventing a genocide.

As the court heard, these are six young people of conscience and compassion. They took action against Israeli weapons manufacturer Elbit Systems in Filton, Bristol, because they could not sit by and do nothing while their country armed Israel’s genocide. They had tried everything else – marches, petitions, writing to MPs, encampments – and they could see that the government was not only breaking international law but was ignoring the will of its own people. They felt they had no option but to take action themselves, to try to save as many lives as they could.

Inside the Elbit facility, they found deadly quadcopter drones packed up ready for export, and were able to destroy some of them with crowbars and sledgehammers. These are the type of drones the Israeli military uses in Gaza to drop explosives, typically after a bomb has been dropped, to target survivors.

Emma Kamio, mother of Leona (Ellie) Kamio said:

The police strategically released selected clips of footage during the trial, including the incident where Sam had struck a police officer. This was devoid of all context. The public were not told that Sam had just been blinded by PAVA spray and acted to protect my daughter while unable to see.

Ellie had been tasered twice at this point, the second time by accident, and the police officer who did so was dragging her up off the ground in one handcuff while standing on her abdomen and screaming at her to stay down. The whole time she had painful tazor barbs still in her arm and thigh as he dragged her around.

So she was screaming in pain, and was never resisting arrest. At this point, Samuel Corner had witnessed a security guard strike his co-defendant with a sledgehammer, and had witnessed excessive force repeatedly by the security. Whilst blinded by PAVA spray, and hearing screams from Ellie, screams which even the police described as “blood curdling”, he could only make out what he thought was a security guard, causing more pain, and did what he could to make it stop.

Striking the police officer was a terrible mistake that I’m sure Sam deeply regrets, but he simply reacted to protect Ellie when he heard the blood curdling scream that came from the second electrical current passing through her body, and all this after having witnessed the violence they experienced from the security guards that night.

Sukaina Rajwani, mother of Fatema Zainab Rajwani said:

‘When they are told, “Do not spread corruption in the land”, they reply, “We are only peace-makers”. Indeed it is they who are the corruptors, but they fail to perceive it.’ (Holy Quran 2:11-12)

I am grateful for every heart that has turned towards this movement, for every hand that has raised in prayer for us, and for every word that has amplified our voice in seeking justice for the Filton 24. Despite the state’s best efforts to silence us and oppress our loved ones; we stand united in strength and power against a corrupt government and an unjust legal system.

Our fight does not end here. We will continue to expose Elbit Systems and British complicity in genocide.

Brogan Devlin, sister of Jordan Devlin said:

Despite having all the odds stacked against them, I can now say with the biggest smile that Jordan has been acquitted of aggravated burglary and violent disorder, and none of the defendants have been convicted of a single offence. The jury could see through the state lies, the political interference and the corruption.

Today we celebrate, tomorrow we rest, but this is not over – Angelo Volante is the name of the Elbit Systems security guard who assaulted my brother multiple times. My heart sank watching the footage of my brother unarmed, being attacked by Volante with a sledgehammer. Jordan was attempting to deescalate the situation when Angelo Volante kicked, choked, struck and even attempted to bit my brother.

The jury was shown Jordan’s black eye, bruised body and sledgehammer marks. Why was this never released to the media? Throughout the trial we have been silenced by reporting restrictions in a bid to protect Elbit Systems and its violent employees.

Angelo Volante and Elbit Systems should be the ones on trial, not my brother. Thankfully ordinary citizens of the jury could see that and so we leave today with our heads held high and our loved ones by our side.

Featured image supplied

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech8 hours ago

Tech8 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World17 hours ago

Crypto World17 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards