Crypto World

US DOJ Obtains Legal Ownership of $400 Million Tied to Infamous Bitcoin Mixer Helix

The U.S. Department of Justice has seized over $400 million in crypto, cash, and real estate connected to the Helix Bitcoin Mixer.

The U.S. Department of Justice (DOJ) has officially seized more than $400 million in cryptocurrencies, real estate, and cash linked to the Helix Bitcoin Mixer.

The forfeiture was finalized in late January 2026, concluding years of litigation against Helix’s operator, Larry Dean Harmon.

Helix’s Illegal Activity and Harmon’s Case

Helix, which operated from 2014 to 2017, was marketed as a tumbling service designed to anonymize Bitcoin transactions. Investigators found that it had become a major hub for laundering funds connected to drug trafficking, hacking, and other illegal activities. Court filings show that Helix processed more than 354,468 Bitcoin, valued at approximately $300 million at the time, for its users.

Harmon, who also created the darknet search engine Grams, made the platform to integrate directly with major darknet markets. Its Application Programming Interface (API) allowed them to connect the service to their Bitcoin withdrawal systems, earning them a percentage of each transaction as commission and fees. Investigators also traced tens of millions of dollars in illicit proceeds from several darknet markets through the mixing service.

The Ohio-based operator of Helix was first charged in 2020 with money laundering conspiracy and operating an unlicensed money transmitting business. In August 2021, he pleaded guilty to conspiracy to commit money laundering and was sentenced in November 2024 to 36 months in prison, three years of supervised release, a monetary forfeiture judgment, and seized assets.

On January 21, 2026, Judge Beryl A. Howell of the U.S. District Court for the District of Columbia issued a final forfeiture order, officially transferring the assets to the government.

Regulators Ease Crackdown on Crypto Mixers

The Helix case is part of a broader regulatory crackdown on cryptocurrency mixers and privacy tools. Platforms such as Tornado Cash have also faced sanctions and enforcement actions in recent years. While crypto advocates maintain that these services can offer legitimate privacy protections, authorities continue to focus on their potential use in criminal activity.

You may also like:

In a related development, blockchain entrepreneur and Coin Center fellow Michael Lewellen filed a lawsuit last year challenging the DOJ, seeking a ruling that his non-custodial crypto crowdfunding platform, Pharos, does not violate money transmission laws. The legal action argues that software developers creating non-custodial privacy tools are being unfairly targeted.

The Justice Department later announced it would no longer pursue criminal cases against crypto exchanges, developers, or users for regulatory violations. This development follows the disbanding of the National Cryptocurrency Enforcement Team (NCET), the specialized unit responsible for investigating crypto-related criminal activity.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

DeepSnitch AI Holders Capitulate to Join Digitap ($TAP) Presale: Best Crypto to Buy

Market behavior during drawdowns often forces a hard reset. Tools that help traders react faster lose relevance when volatility compresses opportunity, and liquidity dries up. This is why attention is moving away from analytics-heavy platforms toward structures that preserve value and generate utility regardless of market direction.

For DeepSnitch AI holders, the current environment has created a clear inflection point. Capital is rotating out of signal-based products and into fixed-entry opportunities with real usage and cash-flow logic.

That rotation explains why Digitap ($TAP) is seen as the best crypto to buy now, positioned as a defensive crypto presale built for recessionary conditions. As risk appetite contracts, the conversation around altcoins to buy favors platforms that move money, not just data.

Why DeepSnitch AI Holders Should Move to Digitap

DeepSnitch AI was built to solve information asymmetry. Its AI-driven agents monitor wallets, contracts, liquidity shifts, and sentiment across multiple chains, delivering alerts designed to improve trading outcomes. In active markets, that value proposition resonates. In slow, risk-off conditions, actionable signals become scarce, and analytics lose leverage as capital prioritizes preservation over precision.

The platform’s reliance on constant market activity creates a dependency on volatility. When fewer trades occur and narratives stall, demand for premium alerts softens. Token utility becomes concentrated around access rather than economic throughput, leaving holders exposed to sentiment cycles rather than structural demand.

Digitap operates from a different foundation. Instead of optimizing decision-making within the market, it serves as infrastructure for price discovery outside the market. Payments, settlements, conversions, and storage continue regardless of volatility. That distinction matters when trading edges compress and capital seeks stability over timing.

For holders exiting signal-based exposure, Digitap represents a pivot from observation to utility. It facilitates day-to-day financial operations, creating demand that does not rely on speculation. This independence is why capital migration is accelerating.

How Digitap Works and What It Actually Is

Digitap is the world’s first omni-bank, designed to unify crypto and traditional finance within a single platform. It allows users to quickly exchange crypto for fiat and fiat for crypto, bridging on-chain assets with real-world banking rails through a live, downloadable app.

At the core of the ecosystem sits the $TAP token, built around fixed supply and utility-driven demand. Total supply is capped at 2 billion tokens, with no inflation, no buy or sell tax, and no hidden minting mechanisms. Circulating supply is engineered to move in one direction only: downward, as buyback and burn activity removes tokens from the market.

$TAP is woven directly into platform functionality. The token powers staking programs, unlocks fee discounts, enables governance participation, and grants access to premium account tiers. $TAP functions as the economic engine of the ecosystem.

Demand for $TAP is tied to usage of the platform itself, not to market sentiment or trading frequency. As the app scales, token utility scales alongside it.

Crypto Presale Structure, Fees, and Real Usage

Digitap’s relevance increases in recessionary conditions, where fees and friction compound financial stress. Traditional remittance channels often charge more than 6% per transfer. Digitap compresses cross-border costs to under 1%, keeping more value in circulation and reducing erosion during periods of economic pressure.

The platform also serves freelancers and remote earners who receive income in crypto. Funds can be converted to cash and routed toward rent, utilities, or daily expenses without navigating multiple applications or intermediaries. This turns crypto into spendable income rather than dormant capital.

Privacy and flexibility are embedded through a tiered KYC structure. No-KYC wallet options coexist with higher-limit accounts, allowing different levels of access without forcing a single compliance model. Offshore banking partnerships further reduce geographic concentration risk.

The current crypto presale price stands at $0.0467, with the next stage set at $0.0478 and a defined listing price of $0.14. This staged structure introduces predictability at a time when most assets lack clear valuation anchors. Nearly $5 million has been raised, with more than 213 million tokens sold.

Why $TAP Is the Best Altcoin to Buy Now

The market is no longer rewarding speed or signal density. It is rewarding resilience. Platforms that generate economic value outside price speculation are gaining ground as liquidity remains constrained and volatility fails to translate into opportunity.

Digitap fits this environment precisely. It replaces high-frequency decision-making with structural utility, positioning itself as a financial layer that functions regardless of market direction. That is why it continues to surface in discussions around the best crypto to buy now.

Compared to analytics-driven tokens, $TAP benefits from real usage cycles tied to payments, remittances, and income conversion. This creates persistent demand and separates it from assets dependent on trader sentiment.

As capital rotates out of reactive tools and into foundational infrastructure, Digitap’s presale structure amplifies its appeal. With fixed pricing, growing adoption, and clear economic logic, $TAP defines what a crypto to buy now looks like in defensive conditions.

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Top AI Crypto Wallet Development Companies in 2026 for Serious Businesses

Investors with enterprise ambitions need more than marketing slides and checklists. They need clarity about which Web3 crypto wallet providers can deliver secure, compliant, and future-proof infrastructure that supports scalable revenue models. In 2026, the winning wallet partners combine hardened cryptography, account abstraction for superior UX, and production-grade AI that meaningfully reduces operational risk and customer friction. This article is written for well-informed investors evaluating strategic bets in web3 infrastructure. It focuses on technical differentiators, observable production capabilities, and the commercial trade-offs that matter when moving from proof of concept to live financial rails. Read on for a concise technical framework, the top vendor shortlist, a head-to-head feature comparison, and a rigorous 10-question crypto wallet development company evaluation.

Why 2026 Is a Defining Year for AI-Smart Crypto Wallets?

The market dynamics making 2026 pivotal are technical, regulatory, and behavioral. On the technical side, account abstraction and smart account primitives have matured into usable production tooling, enabling programmable wallets that solve long-standing UX and recovery problems. This shift changes how cryptocurrency wallet solutions are built and consumed because it decouples signature management from the user experience and enables sponsored gas, batched operations, and policy-driven approvals. At the same time, multi-party computation and threshold signature schemes are moving from academic proofs into operational custody solutions, offering enterprises key-management alternatives that reduce single-point risk and regulatory exposure.

AI is no longer an experimental add-on. Leading teams embed machine learning for real-time anomaly detection, risk scoring, and personalized usage assistance, which materially lowers fraud losses and onboarding friction. Finally, enterprise demand is rising as financial institutions and high-net-worth services adopt tokenized assets and require wallets that can integrate with existing KYC, treasury, and audit systems. The intersection of account abstraction, MPC-class key management, and production AI is why investors should re-evaluate wallet vendors in 2026 with technical scrutiny.

Top 7 AI Cryptocurrency Wallet Development Companies of 2026

1. Antier Solutions

Antier has evolved into a platform-first provider for enterprise crypto wallets that fuse production AI, multi-model custody, and broad chain interoperability. Their white-label AI smart crypto wallet product emphasizes intelligent transaction processing, behavioral recovery flows, and predictive risk analytics designed for high-compliance environments. Antier presents architecture and runbook artifacts aimed at enterprise buyers, showing an operational approach to MPC and hybrid custody and clear support for multi-chain EVM ecosystems. For investors, Antier’s strength is not only in delivery speed but also in a repeatable architecture that embeds AI into the signing and policy layers so that fraud detection, onboarding automation, and recovery are measurable features rather than add-ons. This makes Antier the most compelling partner for institutional-grade wallet infrastructure.

2. Oodles Blockchain

Oodles brings a decade of blockchain engineering to mobile crypto wallet development projects with a service model built for custom enterprise implementations. Their wallet practice focuses on cross-platform wallets, DeFi integrations, and NFT support, and they have published explorations of AI in wallet monitoring and personalized insights. Oodles is strongest where deep integration with enterprise systems is required, including payment rails and legacy back ends. For investors, this firm is a reliable engineering house capable of producing robust non-custodial and custodial wallets quickly; their AI positioning is currently oriented toward transaction monitoring and fee optimization rather than embedded MPC. Use Oodles when you need platform engineering and rapid, audit-ready delivery for multi-chain wallets.

- Real-time transaction monitoring with rule-based AI alerting.

- Fee optimization suggestions driven by transaction pattern analysis.

- Personalized in-wallet recommendations using market and user signals.

- Integration patterns for embedding AI outputs into enterprise reporting.

Choose Wallet Infrastructure That Scales With Demand

3. PixelPlex

PixelPlex positions itself at the intersection of blockchain and intelligent assistants, offering wallets that act as “co-pilots” for users. Their public material highlights proactive scam detection, predictive insights for asset management, and an emphasis on UX that reduces human error in transactions. This renowned crypto wallet provider has experience scaling projects and building wallet layers that integrate with exchanges, DeFi rails, and custodial services. From an investor standpoint, PixelPlex is attractive where productized AI features, such as proactive scam alerts and contextual recommendations, are required alongside professional-grade engineering and proven delivery for consumer and institutional clients. Expect a strong UX and AI pairing, but validate custody model specifics for enterprise risk tolerance.

- Client-side assistive AI that reduces user error and improves retention.

- Proactive scam detection leveraging behavioral and network signals.

- Predictive portfolio insights that feed in-wallet recommendations.

- Plug-and-play AI modules for rapid feature integration.

4. BlocktechBrew

BlocktechBrew is a pragmatic wallet developer focused on white-label blockchain wallet apps with a strong emphasis on security and time to market. Their offering is oriented toward entrepreneurs and enterprises seeking complete wallet stacks, browser extensions, and mobile clients. BlocktechBrew’s AI footprint is currently focused on analytics and automated security checks that are integrated into the development lifecycle. For investors, the company represents a cost-effective engineering partner able to deliver MVPs and iterate rapidly; their strength is execution velocity rather than platformized AI governance. For portfolio companies that need fast, secure shipping of wallet products with AI-powered monitoring, BlocktechBrew is a sensible operational choice.

- Automated security and integrity checks during development and CI.

- Transaction analytics modules for post-deployment monitoring.

- White-label AI hooks for swapping in enterprise models.

- Lightweight fraud detection pipelines for early production stages.

5. BlockchainX

BlockchainX markets end-to-end Web3 cryptocurrency wallet solutions and white-label products aimed at businesses that need rapid deployment and rebranding. Their products emphasize multi-asset support and customization for local regulatory environments. BlockchainX is best for enterprises that want a full productized wallet stack with roadmap acceleration rather than heavy R&D in cryptographic custody. Their AI claims are more conservative and typically implemented as analytics and reporting layers to aid compliance and support teams. Investors should view BlockchainX as a commercial, modular provider suitable for scaling standard wallet features quickly across geographies.

- Compliance and reporting dashboards powered by analytics.

- Customer support augmentation via AI-summarized event logs.

- Automated KYC/AML signal enrichment feeding the wallet audit trail.

- Configurable AI alerts for operational monitoring.

6. Rapid Innovation

Rapid Innovation focuses on secure blockchain wallet development with an emphasis on UX, authentication, and integrations for web and mobile. Their public material highlights features such as multi-factor authentication, QR flows, and session controls. Rapid Innovation complements AI with applied analytics and automation that strengthen onboarding and reduce support costs. For investors, Rapid Innovation is a reliable engineering partner when robust authentication and solid engineering practices are primary goals and when you prefer to integrate third-party or bespoke AI services. Verify their custody posture and ask for AI performance metrics during diligence.

- AI-assisted onboarding flows to reduce drop-offs.

- Analytics-driven session and fraud detection.

- Modular AI connectors for third-party risk engines.

- Emphasis on secure authentication with AI-backed anomaly detection.

How Does Antier Stand Out From Other Vendors?

In 2026, market leaders will be defined by products users actually adopt, not those that are merely deployed. We build with that outcome in mind.

You must have heard Investors asking often, what does a company they hire bring them that others do not? Well, Antier has all the answers to it. Below is the curated list of capabilities that Antier holds rather than marketing claims.

| Feature area | Antier | Typical other vendors |

|---|---|---|

| AI-powered transaction analytics | Productionized predictive analysis & UX personalization. Public docs reference AI-native wallet modules. | Most vendors offer fraud detection or analytics, but many present these as integrations or roadmaps. |

| Key management options | Multi-model: seedless experiences, MPC and hybrid custody options, enterprise recovery flows. | Predominantly, seed phrase, multisig, HSM options. Few demonstrate integrated MPC in public collateral. |

| Multi-chain support | Claims broad EVM coverage and chain integrations; designed for cross-chain wallet UX. | Many vendors support multiple chains but often with narrower out-of-the-box integrations. |

| Account abstraction readiness | Focus on smart-wallet flows and sponsored transactions | Many provide ERC-4337 support as part of engineering engagements, but adoption varies. |

| Enterprise compliance & audit support | Emphasizes enterprise controls, audit readiness and recoverability | Most firms offer integration support; investors should request SOC2 and third-party audit evidence |

| Turnkey vs custom | Balance of white-label products and custom integrations | Several vendors focus primarily on white-label or custom, based on business needs |

It is always suggested that you partner with an experienced team of blockchain experts who are adept at crafting impactful and successful customized cryptocurrency wallet solutions.

How to Evaluate a Wallet Development Company in 10 Questions?

For investors doing diligence, these 10 technical and operational questions reveal whether a crypto wallet service provider is enterprise-grade or merely marketing-first.

- What is your key management model in production, and can you provide architecture diagrams and a failure mode analysis?

- Do you offer MPC or TSS-based signing? If so, provide a public audit or third-party review.

- How do you support account abstraction and ERC-4337 user operations? Provide sample UserOperation flows and bundler integration details.

- How is AI used in the stack, and what are measurable production outcomes for fraud reduction or onboarding improvements?

- Which chains and L2s are supported natively, and what is the process to integrate new chains?

- Provide SOC2 type II, ISO, or third-party audit evidence and recent penetration test results.

- What are your SLAs for transaction throughput, incident response, and key compromise scenarios?

- How is regulatory compliance built in, specifically AML tooling, on-chain metadata retention, and explainability for AI decisions?

- What is the upgrade and migration path for wallet contracts and key-management components?

- Provide client references where you implemented a production wallet with live volumes, and share anonymized KPIs.

Use these answers to rank vendors against the architecture and risk appetite of the target business.

Final Verdict: Choosing Antier for Serious Business Impact

For institutional investors and enterprise product owners, architecture and operational proof trump feature lists. Prioritize crypto wallet development companies that can demonstrate production MPC or hardened custody, an ERC-4337 smart account strategy, and measurable AI outcomes for fraud and UX.

Antier, as positioned in public product material, claims mature AI wallet modules, multi-chain coverage, and enterprise controls; these are the traits investors should seek and verify.

Our experience building and advising regulated web3 projects shows the following pattern. Projects succeed when businesses choose partners who deliver three things: a security-first signing model, programmable accounts for frictionless UX, and an AI stack that is auditable and measurable. Legal and compliance expertise is critical during architecture and vendor selection because custody, AML, and data residency requirements directly influence design choices. We help institutional teams navigate these trade-offs by validating cryptographic proofs, confirming audit evidence, and shaping deployment plans that map to local regulatory regimes. If you are evaluating strategic investments into blockchain wallet development infrastructure, focus your diligence on architecture diagrams, third-party audits, and production AI performance. Those artifacts distinguish long-term infrastructure from short-term launches.

Let’s move from intent to execution. Talk to our experts to understand where and how to begin.

Frequently Asked Questions

01. Why is 2026 considered a pivotal year for AI-smart crypto wallets?

2026 is pivotal due to advancements in account abstraction, smart account primitives, and the integration of AI for real-time anomaly detection and risk scoring, which enhance user experience and reduce operational risks in cryptocurrency wallet solutions.

02. What are the key technical differentiators investors should consider when evaluating crypto wallet providers?

Investors should focus on hardened cryptography, account abstraction for improved user experience, production-grade AI capabilities, and the ability to integrate with existing KYC, treasury, and audit systems.

03. What does the article provide for investors looking to evaluate crypto wallet development companies?

The article offers a concise technical framework, a shortlist of top vendors, a head-to-head feature comparison, and a rigorous 10-question evaluation guide for assessing crypto wallet development companies.

Crypto World

Canaccord slashes price target as stock tumbles to multi-year low

With crypto winter clearly having set in, bulls are now left looking for signs that the bearishness has become so embedded that a bottom might form.

One case in point might be a note from Canaccord’s Joseph Vafi on Wednesday, slashing his price target on Strategy (MSTR) by a whopping 61% to $185 from $474.

Vafi, who lifted his outlook on Strategy as recently as November (to that $474 level), still maintains a buy rating on the stock, and his new $185 target suggests about 40% upside from last night’s close of $133.

Strategy is now down 15% year-to-date, 62% year-over-year, and 72% from its record high in November 2024.

Bitcoin, said Vafi, is in the midst of an “identity crisis,” still fitting the profile of a long-term store of value but increasingly trading like a risk asset. That tension came into focus during October’s crypto flash crash, when forced liquidations accelerated selling.

Though frequently cast as “digital gold,” bitcoin has failed to keep pace with the recent surge in precious metals, he continued. As gold has climbed on geopolitical tensions and macro uncertainty, bitcoin has lagged, underscoring its ongoing dependence on liquidity and risk appetite rather than safe-haven demand.

Strategy is built to weather volatility, the report said. The company holds more than $44 billion in bitcoin against roughly $8 billion in convertible debt, including a $1 billion tranche puttable in 2027 that remains in the money. Preferred dividends are manageable through modest share issuance, even with MSTR’s market cap no longer commanding much of a premium to the value of its BTC holdings.

Quarterly results are coming this week, but they have become largely immaterial given Strategy’s near-complete dependence on BTC, Vafi continued. A sizable unrealized loss tied to bitcoin’s fourth-quarter selloff is expected.

Vafi’s new $185 target assumes a 20% rebound in bitcoin prices and a recovery in the company’s mNAV to about 1.25x.

Read more: ETF that feasts on carnage in bitcoin-holder Strategy hits record high

Crypto World

Bitcoin Price Falls to a New Low

As the BTC/USD chart shows, prices dropped below $74,000 yesterday. This marks the lowest level since November 2024, when the cryptocurrency was rallying on news of Trump’s election victory.

At the same time, sentiment indicators are signalling “extreme fear” across the market. This was reinforced by the break below the key April 2025 low near $74,450.

The media has been circulating increasingly alarming headlines:

→ Michael Burry, well known for his bearish calls, has suggested that a drop below the $70k level could create problems for the largest coin holder, MicroStrategy (MSTR);

→ Matt Hougan, Chief Investment Officer at Bitwise, warns that the market may be heading for a “full-blown” crypto winter rather than a simple correction.

Technical Analysis of the BTC/USD Chart

The price continues to move further away from the support level whose break we highlighted on 30 January.

At the same time, the market appears extremely oversold:

→ the price has fallen below the lower boundary of the previously drawn descending red channel;

→ the RSI indicator is forming bullish divergences.

Under these conditions, it is reasonable to assume that the market may be setting up for a technical rebound. This scenario looks particularly plausible given the scale of long position liquidations — around $2.5 billion were wiped out on 31 January alone.

If a recovery does unfold, a key test of bullish intent will be the psychological $80k area, where bears previously held clear control while breaking below the lower boundary of the descending channel.

FXOpen offers the world’s most popular cryptocurrency CFDs*, including Bitcoin and Ethereum. Floating spreads, 1:2 leverage — at your service (additional fees may apply). Open your trading account now or learn more about crypto CFD trading with FXOpen.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

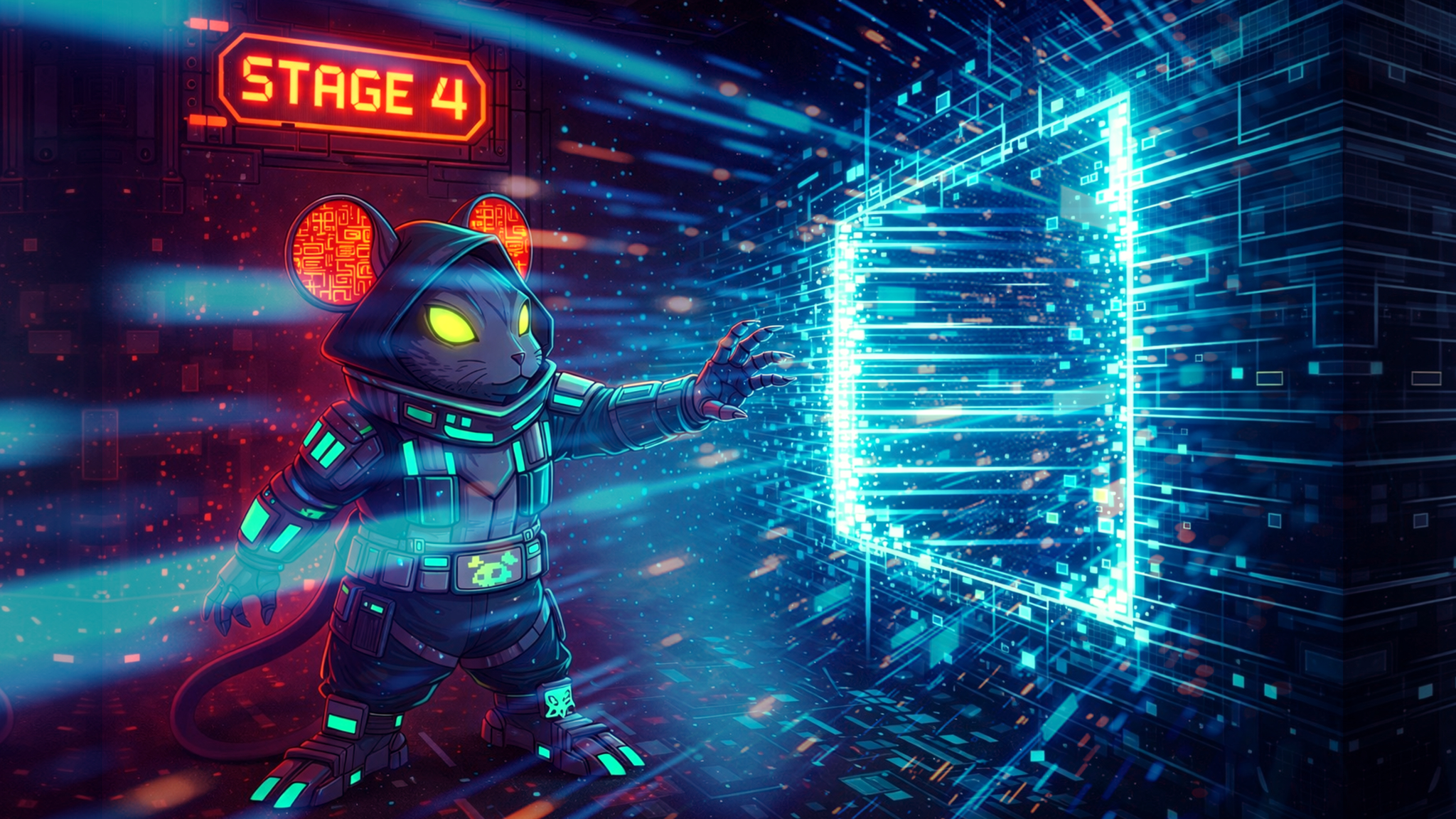

Survey Shows Crypto Investors Favor Infrastructure Over DeFi

A survey of senior crypto investors and executives suggests capital priorities are shifting away from decentralized finance (DeFi) and toward core infrastructure, as decision-makers focus on liquidity constraints and market plumbing.

The findings come from a new report published by the digital asset conference CfC St. Moritz, based on responses from 242 attendees of its invitation-only event in January. Respondents included institutional investors, founders, C-suite executives, regulators and family office representatives.

According to the survey, 85% of respondents selected infrastructure as their top funding priority, ahead of DeFi, compliance, cybersecurity and user experience.

While expectations for revenue growth and innovation remain broadly positive, respondents flagged liquidity shortages as the industry’s most pressing risk. The results suggest that investor interest remains, but capital deployment is becoming more selective.

Infrastructure takes priority as liquidity concerns persist

Respondents pointed to market depth and settlement capacity as key bottlenecks preventing larger pools of institutional capital from entering crypto markets.

About 84% of respondents described the macroeconomic backdrop as better than neutral for crypto growth, though many said existing market infrastructure remains insufficient for large-scale capitalization.

The survey also showed a change in innovation expectations. While a majority expects innovation to accelerate in 2026, fewer respondents anticipate a sharp increase compared to last year, suggesting a shift away from more speculative expectations toward execution-focused development.

This shift aligns with broader industry trends, including a focus on custody, clearing, stablecoin infrastructure and tokenization frameworks rather than consumer-facing applications.

Related: CoreWeave shows how crypto-era infrastructure quietly became AI’s backbone

US sentiment improves as IPO expectations cool

The survey found a sharp improvement in perceptions of the US regulatory environment, with respondents ranking the country as the second-most favorable jurisdiction for digital assets, behind the United Arab Emirates.

CfC St. Moritz attributed the shift to stablecoin legislation and clearer rules for banks and regulated market participants.

At the same time, expectations for crypto initial public offerings cooled after what respondents described as a record year in 2025. While most still expect listings to continue, fewer expressed high confidence, citing valuation resets and liquidity constraints.

Magazine: Crypto loves Clawdbot/Moltbot, Uber ratings for AI agents: AI Eye

Crypto World

Bitcoin Traders Eye 200-Week Trendlines for a BTC Price Bottom

Bitcoin (BTC) traders see its ultimate support trendline coming into play as part of a new macro BTC price bottom.

Key points:

-

Bitcoin is nearing a long-term trendline retest for the first time since late 2023.

-

Weekly moving averages are on the radar as a BTC price safety net should the market fall again.

-

Market outlooks place emphasis on trader resilience despite a 40% drawdown.

BTC 200-week trend line “should be the bottom”

The latest analysis increasingly expects Bitcoin to test its 200-week exponential moving average (EMA) at $68,400.

After four straight red monthly candles, BTC price is fielding fresh downside targets, which include sub-$50,000 levels.

Despite dropping to its lowest levels since late 2024 this week, BTC/USD may be rescued by classic support trend lines in the end.

“We’re currently trading at Strategy’s cost basis & are close [to] the April lows at $74.4k. If we break below, the next key level is $70k which is just above the previous ATH of $69k,” Nic Puckrin, CEO of crypto education resource Coin Bureau, wrote in an X post Wednesday.

“Breaking below that means we head to a bear market low target. The area to watch here $55.7k – $58.2k. That’s just between the average realised price of all coins & the 200w MA. That should be the bottom.”

Puckrin referenced the 200-week simple moving average (SMA), which forms a $10,000-wide support band with the EMA equivalent, data from TradingView shows.

Trader Altcoin Sherpa, meanwhile, said that it would “make sense” for the price to drop to at least the 200-week EMA.

on 1 hand it makes sense for $BTC to tap the 200W EMA, an indicator that hasn’t been touched since 2023. This would be around 68k.

On the other, this is still an interesting level as the 2025 low.

Either way, the bottom is closer than we think imo pic.twitter.com/93DO4s4qlu

— Altcoin Sherpa (@AltcoinSherpa) February 4, 2026

“Every time Bitcoin has lost 100W EMA, it has retested the 200W EMA,” trader BitBull continued on the topic.

“Right now, 200W EMA is at $68,000 and this will most likely be retested. Once the retest happens, you could start accumulating for the long-term.”

Bitcoin investors resist full capitulation

Other market synopses are also offering hope to panicking BTC investors.

Related: BTC price heads back to 2021: Five things to know in Bitcoin this week

Fresh analysis released Tuesday by Matt Hougan, chief investment officer of crypto asset manager Bitwise, predicted that the current “crypto winter” would soon be over.

“Retail crypto has been in a brutal winter since January 2025. Institutions just papered over that truth for certain assets for a while,” he argued, noting that the average “winter” lasted around 14 months.

Cointelegraph further reported on strong conviction among Bitcoin derivatives traders after enduring a drawdown of more than 40%.

The US spot Bitcoin exchange-traded funds (ETFs) have seen net outflows of $3.2 billion since mid-January — just 3% of their total assets under management.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

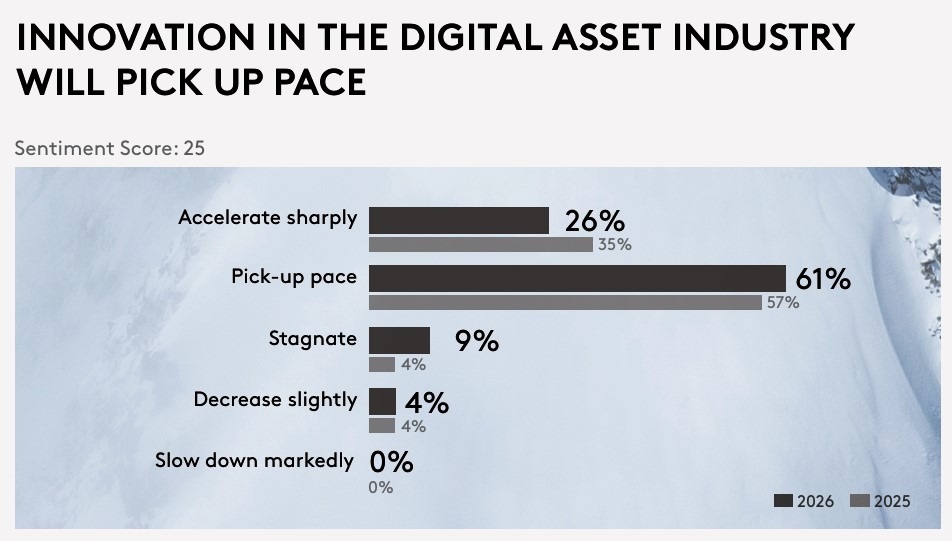

Solana (SOL) drops 5.3% as nearly all assets decline

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 2201.13, down 1.9% (-43.33) since 4 p.m. ET on Tuesday.

One of 20 assets is trading higher.

Leaders: CRO (+1.4%) and HBAR (-0.4%).

Laggards: SOL (-5.3%) and UNI (-3.6%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

Is Tesla (TSLA) Stock a Buy as Optimus Robot Production Nears?

TLDR

- Tesla stock was flat at $421.80 on Wednesday as investors awaited developments on the Optimus humanoid robot with production planned for 2026.

- An X poll showed Optimus winning as investors’ most anticipated Tesla product for the year, beating Cybercab and semi-truck options.

- Tesla is converting its Fremont Model S and Model X production space into an Optimus factory targeting one million units annually.

- The company will discontinue the Model S and Model X to make room for Optimus production lines at the California facility.

- Tesla stock trades at 259 times earnings with a $1.4 trillion market cap as the company transitions from electric vehicles to AI robotics.

Tesla stock held steady at $421.80 on Wednesday morning. The lack of movement came as investors digested recent developments around the company’s humanoid robot project.

S&P 500 and Dow futures traded higher by 0.3% and 0.2% respectively. No analyst rating changes or price target adjustments hit the stock during the session.

The most interesting development came from social media. A poll on X asked investors which Tesla product excited them most for the year ahead.

Optimus won by a landslide. The humanoid robot beat out the Cybercab, semi-truck, and stationary storage in voting. Over 16,000 votes were tallied by early Wednesday.

The poll reflects growing anticipation around Tesla’s robotics push. CEO Elon Musk has repeatedly called Optimus the company’s future.

A Factory Transformation Underway

Musk outlined specific plans during Tesla’s January 28 earnings call. The company will convert Model S and Model X production space at its Fremont, California factory.

That space will become an Optimus manufacturing facility. The long-term target is one million robot units per year from that location alone.

Production should begin in 2026. Musk said Tesla plans to unveil the third generation robot in “a few months.”

The decision to retire legacy vehicle models shows serious commitment. Model S and Model X currently represent a small portion of Tesla’s sales. But discontinuing them marks a clear pivot point for the company.

Tesla is moving resources from traditional electric vehicles to AI-powered products. This includes both Optimus and the Robotaxi ride-hailing service.

The Numbers Tell a Stretched Story

Tesla’s market cap sits at $1.4 trillion. The stock trades at $430 per share based on recent pricing.

The company finished its 2025 fiscal year with non-GAAP earnings of $1.66 per share. That puts the stock at 259 times earnings.

Analysts project earnings of $2.12 per share for 2026. They forecast $3.00 per share by 2027. Even using those future estimates, Tesla trades above 100 times earnings two years out.

Tesla stock has gained 10% over the past 12 months. But it dropped about 2% following the January earnings report.

The earnings call generated one downgrade from Battleroad Research analyst Ben Rose. He cited higher capital spending on AI projects as a concern.

Tesla plans to spend $20 billion on new plants and equipment in 2026. That’s up from less than $9 billion in 2025.

The average analyst price target rose by about $4 after earnings. That increase represents less than 1% movement.

Experts believe the humanoid robotics market could reach $5 trillion by 2050. Musk wants Tesla positioned as an early mover in that space.

Other companies are already training humanoid robots for factory work. Some industry watchers speculate Optimus could perform real-world applications later in 2026.

Tesla’s vehicle business has declined as the company shifts focus. Musk appears comfortable with this transition.

The stock reflects a loyal shareholder base willing to wait for long-term potential. Whether current prices leave room for near-term gains remains unclear.

Tesla plans to unveil the third generation Optimus robot in the coming months.

Crypto World

Enterprise Stablecoin Development in Hong Kong: HKMA Licensing Guide

Hong Kong is not waiting for consensus. The Hong Kong Monetary Authority is shifting from rulemaking to licensing, which changes the game for anyone planning a regulated stablecoin.

If you are a bank, fintech leader, or institutional issuer considering a compliant launch, this guide explains exactly what the HKMA will test, what delays or blocks approval, and how to structure stablecoin development for long-term regulatory confidence. This is written for decision-makers who want clarity, not speculation.

Why Hong Kong’s Stablecoin Licensing Framework Changes Everything

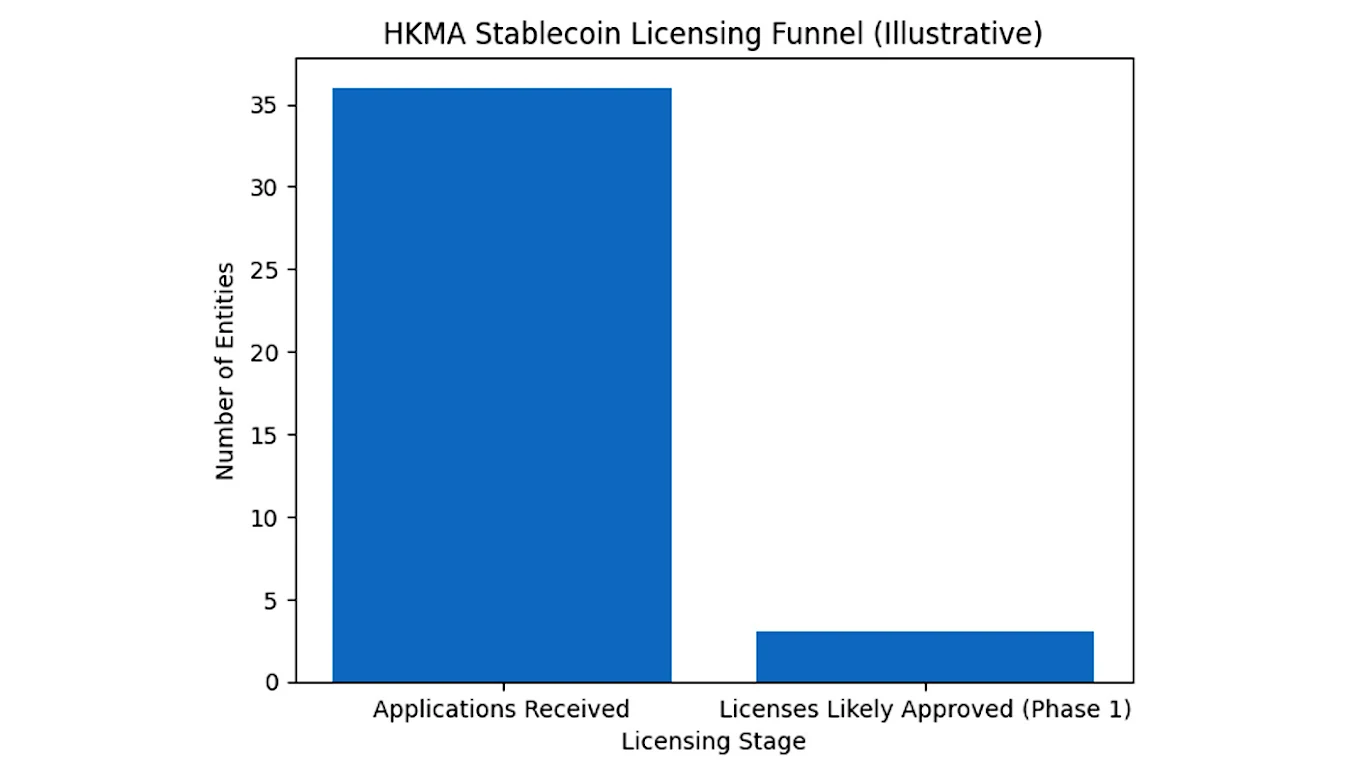

Hong Kong is moving from regulatory intent to execution. According to a recent update reported by Yahoo Finance, the Hong Kong Monetary Authority is preparing to approve its first batch of stablecoin issuer licenses, with only a limited number of applicants expected to clear the initial review. This confirms that Hong Kong is not opening the market broadly. It intentionally selects issuers that demonstrate financial resilience, governance maturity, and operational readiness.

For enterprise and institutional issuers, this is a constructive shift. A selective licensing regime reduces uncertainty, limits regulatory arbitrage, and establishes a clear standard for what qualifies as a credible stablecoin issuer. Rather than competing in an overcrowded and loosely governed market, serious players now operate in an environment designed to reward discipline and long-term viability.

The illustrative licensing funnel above highlights how this framework reshapes competition. While interest in stablecoin issuance remains strong, only issuers with robust governance structures, compliant custody arrangements, and clearly defensible reserve models are likely to progress beyond the first regulatory filter. This changes how stablecoin development must be approached. Development is no longer a technical build followed by regulatory review. Licensing expectations now influence system architecture, reserve design, custody strategy, and operational controls from the earliest planning stages.

In practical terms, Hong Kong’s framework does not just regulate stablecoins. It determines who is qualified to participate in the market at all. Understanding what regulators evaluate next is therefore essential for any issuer aiming to move forward with confidence.

Not sure if your model meets HKMA standards? Get a regulatory alignment review before formal submission.

Understanding HKMA’s Expectations: What Regulators Actually Look For

HKMA’s licensing regime is more than a badge of approval. It defines how stablecoin development must be structured, governed, and operated within a regulated financial environment.

1. Clear Licensing Requirement

From 1 August 2025, the Stablecoins Ordinance took effect in Hong Kong. The regime requires authorization for parties carrying on regulated stablecoin activities in Hong Kong and, in certain cases, for issuers of Hong Kong dollar-referenced stablecoins issued offshore. A valid license from the HKMA is required to operate without enforcement risk.

2. Governance and Accountability

Issuers must demonstrate strong corporate governance with clearly defined accountability for financial, legal, and technology risk. Boards and senior management are expected to have direct responsibility for oversight and compliance. Anonymous or loosely coordinated governance structures do not meet HKMA expectations.

3. Full Reserve Backing and Transparency

Under the HKMA’s supervisory guidelines:

- Reserve assets must at all times equal or exceed the value of stablecoins in circulation.

- Reserve holdings must be disclosed and supported by regular independent attestations or audits.

- Custody arrangements must legally segregate reserve assets and protect them from creditor claims and misuse.

These requirements ensure that stablecoins operate as financial instruments with predictable backing and certainty of redemption.

4. AML and Operational Compliance

HKMA’s AML and counter-terrorist financing guidelines apply to licensed stablecoin issuers and include travel rule and operational AML controls. Issuers are expected to demonstrate compliance readiness before launch, not after issuance.

Taken together, these expectations place stablecoin development services firmly within institutional finance, where issuers must withstand detailed regulatory scrutiny across governance, reserves, custody, and operations.

Why Custody and Reserves Are the Real Differentiators

Custody and reserves determine whether a stablecoin is trusted or questioned. From a regulatory standpoint, the central concern is the protection of user funds. Reserve assets must be legally segregated, protected from issuer insolvency, and held in a manner that allows timely redemption under all conditions. Custody arrangements must clearly define who controls reserve assets, how access is governed, and how conflicts of interest are avoided. These structures are reviewed closely because they directly impact systemic risk. This is where an experienced stablecoin development company adds value beyond code delivery. Designing compliant custody and reserve frameworks requires coordination between legal, financial, and technical teams. Errors in this layer are costly and difficult to reverse once a licensing review begins.

Key Failure Points in HKMA Stablecoin Applications

Most stablecoin applications do not fail because of weak technology. They fail because regulators identify structural and operational risks that issuers underestimate.

The most common failure points include:

- Late Regulatory Alignment: Applications stall when licensing considerations are addressed after development. HKMA expects regulatory intent to be reflected in system architecture, governance, and operating models from the outset.

- Inadequate Custody and Reserve Controls: Weak reserve segregation, unclear custodian responsibilities, or redemption mechanisms that are not stress-tested raise immediate red flags during review.

- Unclear Issuer Accountability: Applications falter when decision-making authority, risk ownership, or compliance responsibility is diffused or insufficiently documented.

- Operational Immaturity: Lack of audit readiness, untested reporting workflows, and limited incident response planning signal that the issuer is not prepared for regulated operations.

These failure points are rarely isolated issues. They are symptoms of an unclear execution strategy. For issuers pursuing regulated stablecoin development in Hong Kong, success depends on following a clear, compliance-led roadmap that aligns regulatory expectations, technical design, and operational readiness from the very beginning.

Turn this framework into an actionable plan for your team.

A Roadmap: From Concept to HKMA-Ready Stablecoin Development

Issuers that succeed in regulated markets follow a structured and disciplined roadmap. Rather than treating licensing as a post-launch task, they align strategy, compliance, and execution from the outset, often in collaboration with an experienced stablecoin development company that understands regulatory expectations.

Phase 1: Regulatory Assessment: The first step is determining whether the proposed stablecoin activity falls within HKMA’s licensing scope. This includes analyzing the token’s reference currency, distribution model, and target users, as well as identifying any cross-border implications under the Stablecoins Ordinance.

Phase 2: Compliance-Aligned Architecture: Once licensing applicability is clear, development must align with regulatory expectations. This includes smart contract logic tied to reserve controls, audit-ready reporting systems, custody workflows, and AML compliance mechanisms designed to meet HKMA standards from day one.

Phase 3: Operational Validation: Before applying for a license, issuers should conduct internal stress testing, simulate redemption scenarios, and validate reporting processes. Operational readiness is as important as technical correctness, particularly under regulatory review.

Phase 4: Licensing and Ongoing Governance: Licensing is not the end of the process. Approved issuers are expected to maintain continuous compliance, governance oversight, and transparent communication with regulators as part of ongoing supervision.

Well-designed stablecoin development solutions reduce friction across every stage of this journey, helping issuers move from concept to regulated issuance with confidence and clarity.

Choosing the Right Development Partner Matters More Than Ever

- The development partner directly impacts HKMA licensing outcomes, not just technical delivery.

- HKMA reviews governance maturity, reserve design, custody controls, and operational discipline alongside code quality.

- Partners that treat compliance as a post-build task increase approval risk and rework costs.

- A capable stablecoin development company embeds regulatory alignment into its architecture from day one.

- Experienced firms reduce licensing friction by aligning technical execution with HKMA expectations.

- The right partner helps issuers remain license-ready throughout development, regulatory review, and post-approval operations.

This makes the final decision clear. In Hong Kong’s regulated market, choosing the right partner is not a technical choice. It is a licensing decision.

Final Thought: Regulation Is the Filter, Not the Finish Line

Hong Kong’s regulatory framework makes one thing clear. Stablecoin initiatives will succeed only if they are designed for licensing, governance, and operational resilience from the start. For serious issuers, stablecoin development is no longer about speed or experimentation. It is about execution that withstands regulatory scrutiny.

This is where partnering with Antier creates a clear advantage. As a trusted stablecoin development company, Antier delivers enterprise-grade Stablecoin Development Services and stablecoin development solutions aligned with HKMA requirements, helping issuers move from concept to compliant launch with confidence.

Ready to launch an HKMA-ready stablecoin? Talk to Antier and start with clarity, compliance, and control.

Crypto World

Precise Systems of Fairness and Transparency in Crypto

Since the publication of the Bitcoin whitepaper in 2008, crypto has offered the promise of open accessibility, neutral rules, and verifiability for everyone. While crypto has continued to hold true to this mission, trading platforms have since departed from this universal truth. Hidden restrictions, inconsistent withdrawals and shifting rules have eroded trust and created a system where true ownership is no longer a guarantee.

Eighteen years later, traders have learned to understand that fairness isn’t just a selling point, rather a system that needs to be verified. The next phase of crypto depends on systems where fairness is designed into the architecture itself, not retroactively justified.

It’s this promise and verifiability that rests as the core mission of Zoomex: a global crypto exchange that’s been trusted for over five years. From day one, Zoomex was built around a simple but increasingly rare belief that fairness must be felt, consistently delivered and provable at every step of the trading journey.

When fairness is designed into the system, users don’t need to ask for trust, they can verify it.

Fairness beyond marketing

Fairness often appears in slogans, but the culture of “trust me, bro” has made efforts feel more performative than practiced. But when fairness is embedded into a platform’s system, users get an experience that’s more than just marketing.

Zoomex has built fairness into its foundation, structuring the user experience around clear trading rules, transparent asset visibility and execution logic that behaves predictably across users and market conditions. Instead of relying on discretionary decisions or hidden exceptions, the platform emphasizes consistency. Regardless of how much crypto you hold, whether you’re a new or frequent holder, or simply looking for a long-term Dollar-Cost Averaging (DCA) opportunity, the same rules apply to all users.

This matters because most trading platform failures are not based on the underlying technology. They’re systematic. Exchanges don’t collapse because orders cannot be matched, rather they fail when friction makes rules unclear, access is restricted or users lose trust in the system.

By prioritizing clarity over complexity, Zoomex positions fairness not as an abstract value, but as a systematic guarantee.

Profit as a priority

There’s no single indication of fairness bigger than withdrawals. In the wake of FTX and other exchange mishaps, users have learned to ask the difficult questions:

- “Can my profits be withdrawn?”

- “Am I an exception to this rule?

These aren’t hypothetical questions. They reflect the learned and lived experience of any crypto trader.

Zoomex’s design starts from a different assumption: Earnings belong to the user, without friction or negotiation. Withdrawals are not framed as privileges or incentives, but as a baseline right of participation. It doesn’t matter if you hold 1 BTC or 0.00001 BTC – what matters is your participation in the network.

This principle has been reinforced by independent media coverage, including user case studies documenting successful large withdrawals. On X and in the media, Zoomex users have documented real-world proof that access holds up regardless of market conditions. Fairness, in this context, is measured not by what a platform claims, but by whether users can reliably convert trading success into usable capital.

Transparency as a system, not a dashboard

When it comes to transparency on centralized exchanges, users are often left to surface-level disclosures to determine the security of their assets.Transparency on trading platforms is important to reduce information asymmetry, ensuring that users understand how their assets are traded and secured, and why conditions affect their assets.

Zoomex emphasizes transparent asset displays, traceable order execution and clear reporting of outcomes. The goal is to give the essential information to traders. Though disclosures may feel overbearing, it’s designed for intelligent market decisions, allowing traders to see their positions, execute on strategies and see their decision outcomes without ambiguity.

This approach aligns with a growing demand among experienced traders and institutional players who evaluate platforms based on structure, consistency and fairness. In this model, transparency is not a static feature, it’s a continuous system of visibility that supports informed decision-making.

Related: What “Proof Over Promises” Means in Practice

Even among institutional-grade traders, transparency needs to come with a degree of simplicity. Often complexity is mistaken for sophistication, but Zoomex understands that simplicity and sophistication are not mutually exclusive.

Zoomex’s minimalist design strips away unnecessary friction while preserving professional-grade functionality. Execution flows are streamlined, interfaces are intuitive and rules are legible. This is not about reducing capability, but instead reducing the cognitive load so both institutional and retail traders are able to clearly execute their trades with the confidence they need.

Regulatory certainty as a priority

One of the biggest hurdles of wide-spread adoption for crypto is regulatory clarity. As countries continue to evolve their legal frameworks, traders have been best supported by trading platforms that have been forward thinking about regulation, not reactive. However, there needs to be a balance of what is necessary and what is excessively cumbersome for users to make their trades with confidence. Zoomex addresses this by offering optional KYC, allowing privacy-sensitive traders to participate without unnecessary barriers while still operating within a compliant framework.

This approach reflects a broader definition of fairness: respecting different user needs rather than imposing uniform identity requirements where they are not legally required. Fair systems expand access without compromising oversight, making regulatory compliance as a feature, not a roadblock.

This framework has been battle-tested and has stood the test of time through both bear and bull markets. Zoomex has withstood five years of stable operation, regulatory licensing across multiple jurisdictions and annual security audits conducted by independent firms such as Hacken.

Privacy and compliance are more than just a marketing objective. Zoomex holds registrations including Canada Money Service Business (MSB), United States MSB and NFA and Australia AUSTRAC license, reinforcing its commitment to creating a system of precise fairness and consistency, regardless of your jurisdiction.

Related: Zoomex expands derivatives offering and launches new initiatives for European users

Trust is not just built in the bull market, but during periods of stress. Platforms like Zoomex that maintain fairness through bull and bear markets are the ones that endure.

From the first trade to the latest withdrawal, fairness on Zoomex is experienced, not explained.

Zoomex is building precise systems of fairness and transparency – cultivating partnerships, international compliance and operational decisions that consistently reinforce values of precision and fairness. The result is a platform designed not just to perform, but to hold up under scrutiny and survive in all market conditions.

As the crypto industry continues to mature, trading platforms will continue to be judged based on their integrated systems, not just their marketed promises. As fairness becomes a design requirement, and not just a press release, Zoomex is prepared to be the platform that is ready for both institutional-focused and retail traders.

Sign up on Zoomex and explore a trading system where fairness, transparency and access are built into every layer. New users can receive up to 14,000 USDT in welcome rewar

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World5 days ago

Crypto World5 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech7 hours ago

Tech7 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World16 hours ago

Crypto World16 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World5 days ago

Crypto World5 days agoWhy AI Agents Will Replace DeFi Dashboards

![No Money [ DJ BEN RMX ]](https://wordupnews.com/wp-content/uploads/2026/02/1770218101_maxresdefault-80x80.jpg)