Crypto World

XRP price dips as $652m in tokens flow to Binance during Iran tensions

XRP slips about 4% in 24h as $652m flows to Binance amid Iran‑linked risk‑off move.

Summary

- Around 472m XRP (≈$652m) moved to Binance in a week, the largest February inflow stretch, coinciding with US–Iran tensions.

- XRP trades roughly $1.3–$1.4, down about 4% daily and over 35% year‑on‑year, while 24h volume holds near multi‑billion levels.

- On‑chain data shows clustered late‑February exchange inflow spikes, signaling defensive positioning and potential short‑term sell‑side pressure.

XRP (XRP) exchange inflows to Binance have risen sharply, creating potential sell-side pressure as geopolitical tensions involving the United States, Israel and Iran escalate, according to CryptoQuant contributor Darkfost.

The exchange received more than 472 million XRP over the past week, representing what Darkfost described as the largest inflow stretch recorded on Binance for XRP during February, according to data shared by the analyst.

The market reaction intensified following weekend escalations in the Middle East, when strikes were launched shortly after the close of traditional financial markets, Darkfost stated. The timing amplified uncertainty across risk assets, with cryptocurrency markets reacting to the geopolitical developments, according to the analysis.

Chart data shared by Darkfost shows a cluster of unusually large inflow bars in late February, including several daily spikes well above prior February levels, while XRP’s price remained relatively unstable.

“Such inflows typically reflect a more defensive posture from investors holding XRP,” Darkfost wrote. “When large amounts of tokens move onto exchanges, it often signals a potential willingness to sell or at least to position liquidity closer to the market.”

Large transfers onto exchanges often precede increased liquidations or discretionary selling, particularly during broader risk-off periods, according to market observers. The transfers do not confirm outright selling, but shift substantial supply closer to the market during a period of elevated uncertainty.

“When amounts of flows like this are recorded, they can create the conditions for a sudden wave of selling pressure capable of impacting price action in the short term,” Darkfost stated.

The analyst noted that traders should monitor “whether it reflects the start of a broader distribution dynamic on XRP or simply short-term panic movements triggered by geopolitical uncertainty.”

During periods of geopolitical stress, traders typically reduce directional exposure and move assets into venues where they can exit quickly if volatility increases, according to market analysts.

Crypto World

Judge Hands Win to Uniswap in Class Action Over Scams

Uniswap Labs and founder Hayden Adams have won a class action lawsuit that sought to hold them liable for scam cryptocurrencies traded on its platform, ending a four-year legal saga.

Manhattan federal judge Katherine Polk Failla dismissed a suit against Uniswap on Monday with prejudice, saying the class group can’t hold Uniswap liable for the misconduct of unknown third-party token issuers.

It was the class group’s second attempt to sue Uniswap, which amended their complaint in May to focus on claims of state-level consumer protection violations, arguing that Uniswap allowed “rug pulls and pump and dump schemes,” according to Judge Polk Failla’s order.

The group, led by Nessa Risley, first sued Uniswap, Adams and venture firms Paradigm, Andreessen Horowitz and Union Square Ventures in April 2022. Their lawsuit was dismissed in August 2023, a decision that was later upheld on appeal.

Uniswap’s Adams posted on X that the ruling was a “good, sensible outcome” that sets a new legal precedent.

“If you write open source smart contract code, and the code is used by scammers, the scammers are liable, not the open source devs,” he added.

Class group failed to claim that Uniswap helped with fraud

In her latest opinion, Judge Polk Failla said the class group had failed to adequately allege that Uniswap “had knowledge of the fraud and substantially assisted in its commission.”

She added that “merely creating an environment where fraud could exist is not the same as affirmatively assisting in its perpetration.”

Related: New York judge blocks Binance bid to force US crypto claims into arbitration

“No matter how they try to dress up their allegations, Plaintiffs are basically alleging that Defendants substantially assisted fraud by providing ordinary services that anyone could use for lawful purposes, but that some used for unlawful purposes,” the judge wrote.

“Such an argument fails for the same reasons why a bank does not substantially assist a money launderer who washes his cash through the bank’s accounts, and why WhatsApp does not substantially assist a drug dealer who coordinates a sale on its messaging service: Simply providing the platform on which a fraud takes place is not the same as substantially assisting that fraud,” she added.

Big questions: Should you sell your Bitcoin for nickels for a 43% profit?

Crypto World

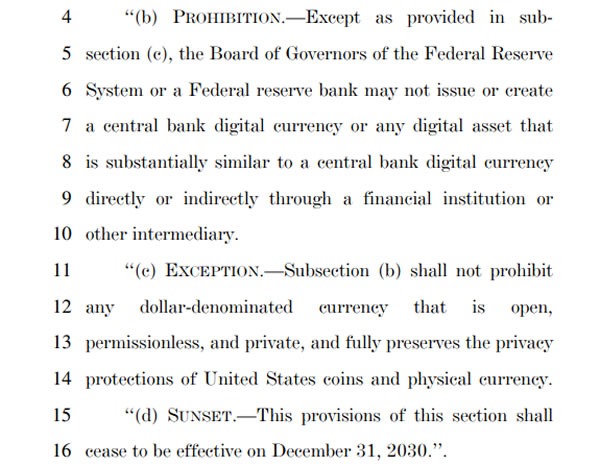

US Senate Bill Seeks to Ban the Fed From Issuing a CBDC

An amendment has been proposed to the Federal Reserve Act to ban the US central bank from issuing a central bank digital currency (CBDC) until 2030.

The language appears near the end of the 300-page “21st Century ROAD to Housing Act” (HR 6644), released by the Senate Committee on Banking, Housing, and Urban Affairs on Monday.

Section 10 of the proposed legislation states that the board of governors of the Federal Reserve System or a Federal Reserve bank “may not issue or create a central bank digital currency or any digital asset that is substantially similar to a central bank digital currency directly or indirectly through a financial institution or other intermediary.”

The bill also contains an exception for stablecoins, stating that the Fed “shall not prohibit any dollar-denominated currency that is open, permissionless, and private,” and fully preserves the privacy protections of the physical currency.

The proposed prohibition includes a sunset clause that expires on December 31, 2030, after which new legislation would be needed to maintain the ban.

The White House issued a statement supporting the Act and opposing a CBDC, which it said could “pose significant threats to personal privacy and liberty.”

The Senate advanced it overwhelmingly on a procedural cloture vote (84-6) on Monday, limiting debate and moving forward, clearing the way for full floor consideration.

Not the first attempt at blocking CBDCs

This version of the housing bill revives language from prior failed attempts to prevent a US CBDC and is not the original legislation.

The “No CBDC Act” (S 464) is a standalone bill introduced by Senator Mike Lee in February 2025 that would prohibit the Fed or Treasury from issuing a CBDC; however, it stalled in Congress.

Related: ‘No privacy’ CBDCs will come, warns billionaire Ray Dalio

Further legislation prohibiting the Fed from issuing a CBDC was introduced in June 2025 by Congressman Tom Emmer under the “Anti-CBDC Surveillance State Act” (HR 1919).

The bill passed a House vote on July 17, but has yet to pass full Senate approval.

China, Russia and India are testing CBDCs

Only three countries have officially deployed a CBDC: Nigeria, Jamaica, and The Bahamas, according to the Atlantic Council’s CBDC tracker.

A further 49 nations are actively testing CBDCs, including China, Russia, India and Brazil, while 20 nations have CBDCs in development and 36 are still researching them.

In February, Germany’s central bank president, Joachim Nagel, touted the benefits of CBDCs for the European Union, which is in the pilot phase.

Magazine: Would Bitcoin really be at $200K if not for Jane Street? Trade Secrets

Crypto World

The US Dollar Index (DXY) Climbs to a One-and-a-Half-Month High

Today, the US Dollar Index rose above the 98.70 level for the first time since the third week of January. Monday’s trading opened with a bullish gap, and upward momentum continues to build as news emerges of a major escalation in the Middle East:

→ Demand for safe-haven assets: Historically, the US dollar and US Treasury bonds have served as primary refuges for capital during periods of heightened uncertainty.

→ Military activity around the Strait of Hormuz is pushing oil prices higher (WTI jumped by approximately 10% yesterday) along with gas prices. This creates a direct pathway to another wave of global inflation.

Technical Analysis of the DXY Chart

Six days ago, when analysing the US Dollar Index (DXY) chart, we:

→ Reaffirmed the validity of the descending channel (marked in red), which originated in November 2025.

→ Once again highlighted the strength of demand, reflected in the confident upward trajectory (shown by the arrow) following the false break below the multi-month low of 96.50 at the end of January.

→ Suggested that bulls could regain momentum and break the prevailing downtrend.

Indeed, price action in early March confirms this view: the descending channel is losing relevance, being replaced by an upward trajectory marked in blue. In this context, developments in the Middle East are of critical importance:

→ If tensions begin to ease, the DXY may stabilise around the median line of the blue ascending channel.

→ A renewed escalation and the collapse of potential negotiations could trigger a further advance towards the upper boundary of the blue channel.

It is also worth noting that the area around the 98 level may now serve as support:

→ This zone previously saw rapid price appreciation, signalling strong buying pressure.

→ It was also the point of a bullish breakout from the red channel and above the 97.98 resistance level.

Trade global index CFDs with zero commission and tight spreads (additional fees may apply). Open your FXOpen account now or learn more about trading index CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

OpenZeppelin says EVMbench’s Dataset Contains Training Data Leaks

Blockchain security firm OpenZeppelin says it has found methodological flaws and data contamination in its audit of OpenAI’s new artificial intelligence benchmark for blockchain security, EVMbench.

EVMbench was launched in partnership with crypto investment firm Paradigm in mid-February. It was built to evaluate how well different artificial intelligence models can identify, patch, and exploit smart contract vulnerabilities.

In an X post on Monday, OpenZeppelin said it welcomed the initiative but recently decided to put EVMbench “through the same scrutiny” it applies to all the protocols it helps secure, including the likes of decentralized finance heavyweights Aave, Lido and Uniswap.

In its audit, OpenZeppelin found two key issues: training data contamination and classification issues related to several high-severity vulnerabilities.

“We reviewed the dataset and identified methodological flaws and invalid vulnerability classifications, including at least four issues labeled high severity that are not exploitable in practice,” OpenZeppelin said.

The release of the EVMbench saw an evaluation of how well AI agents could theoretically exploit smart contract vulnerabilities. Anthropic’s Claude Open 4.6 topped the list, followed by OpenAI’s OC-GPT-5.2 and Google’s Gemini 3 Pro.

EVMbench testing may need revising

Looking at the first issue in data contamination, OpenZeppelin said the most important capability in “AI security is finding novel vulnerabilities in code the model has never seen before.”

However, during the EVMbench’s testing of AI agents, OpenZeppelin said that all the AI agents that scored the highest had “likely been exposed to the benchmark’s vulnerability reports during pretraining.”

During EVMbench testing, internet access was cut off for the AI agents, meaning they couldn’t simply search for solutions to problems. However, the benchmark was based on curated vulnerabilities from 120 audits conducted between 2024 and mid-2025, with the knowledge training cutoffs for these agents generally set to mid-2025.

As such, it ran the risk that the AI agents already had the answers to all of the problems stored in their memory.

“While this does not necessarily enable the model to identify the issue immediately, it reduces the quality of the test. The dataset’s limited size further narrows the evaluation surface, making these contamination concerns more significant,” OpenZeppelin said.

Related: Energym AI dystopia goes viral as crypto projects tout user-owned AI agents

Finally, OpenZeppelin said that there had been some significant factual errors in the EVMbench’s dataset, arguing that several “high-severity vulnerabilities” were invalid.

OpenZeppelin said it had assessed at least four vulnerabilities that EVMbench classified as high risk, but that don’t actually work. However, EVMbench had been scoring AI agents correctly for finding these supposedly false vulnerabilities.

“These aren’t subjective severity disagreements; they are findings where the described exploit doesn’t work.”

Ultimately, OpenZeppelin reiterated that AI will have a significant impact on bolstering blockchain security, but stressed the importance of applying the tech and testing it properly to maximize its potential.

“The question isn’t whether AI will transform smart contract security — it will. The question is whether the data and benchmarks we use to build and evaluate these tools are held to the same standard as the contracts they’re meant to protect.”

Magazine: AI won’t make you rich, but crypto games might, Axie founder steps down: Web3 Gamer

Crypto World

XRP price outlook as Ripple Prime connects XRPL to NSCC for post-trade settlement

XRP is back in focus after new infrastructure developments tied to Ripple’s institutional push. Hidden Road ($HRFI) officially went live on the NSCC directory on March 2, 2026, per a DTCC notice.

Summary

- Hidden Road’s NSCC listing strengthens Ripple’s institutional positioning, potentially positive for long-term XRPL adoption.

- XRP remains below its 50-day SMA, signaling ongoing bearish structure.

- Support sits near $1.30 and $1.20; resistance stands at $1.45 and $1.62.

The development deepens the integration between Ripple and Hidden Road and strengthens Ripple Prime’s role in bridging traditional finance (TradFi) with decentralized finance (DeFi).

The NSCC (National Securities Clearing Corporation), a subsidiary of DTCC, handles post-trade clearing and settlement for U.S. equities.

If Ripple Prime infrastructure facilitates post-trade flows that eventually settle or interact with the XRP Ledger (XRPL), it could represent meaningful real-world volume moving onto blockchain rails.

While the integration does not automatically translate into direct Ripple token (XRP) demand, market participants often interpret institutional connectivity as a long-term bullish signal. The key question remains whether XRPL usage scales in a way that structurally increases XRP utility rather than simply expanding enterprise tooling.

XRP price analysis

From a technical standpoint, XRP is currently trading around $1.36 on the daily chart, consolidating after a prolonged downtrend from the $2.40 region earlier this year. Price remains below the 50-day simple moving average near $1.62, indicating the broader trend is still bearish.

Immediate support sits near $1.30–$1.32, with a stronger demand zone around $1.20, where buyers previously stepped in aggressively.

On the upside, resistance is clustered at $1.45, followed by the 50-day SMA at $1.62. A decisive break above that level would be needed to shift medium-term momentum.

The RSI (14) is hovering near 40, suggesting weak momentum but not yet oversold conditions. This reflects consolidation rather than strong accumulation. Unless XRP reclaims $1.45–$1.62, rallies may face selling pressure.

Crypto World

Core Scientific Q4 Earnings Miss Moves Shares Lower

Shares in Core Scientific moved lower on Monday after the Bitcoin miner and artificial intelligence compute provider’s fourth-quarter earnings missed analyst expectations amid a late-year drop in crypto markets.

Core Scientific reported Q4 revenues of $79.8 million, down 16% from the year-ago quarter and missing Wall Street expectations of $90.4 million. Its crypto mining revenue fell nearly in half from Q4 2024 to $42.2 million.

The company posted net income of $216 million for the quarter, largely boosted by a $330.3 million fair value gain on its non-cash holdings. Its adjusted EBITDA showed a loss of $42.7 million.

The earnings come as Bitcoin (BTC) is trading nearly 50% below its peak in early October at around $68,000. The cryptocurrency fell sharply late last year after hitting a peak of over $126,000, ending 2025 at just under $88,500.

The drop has hurt Bitcoin miners’ profits, which are also facing headwinds from higher energy and computing costs, as many, including Core Scientific, spend big on pivoting to AI by offering colocation services for high-performance computers.

Core Scientific CEO Adam Sullivan said the company was “now past the halfway point on our existing builds and scaling our colocation platform into a 1.5-gigawatt pipeline of leasable capacity.”

The company added that it is expanding one of its sites in Texas to support 430 megawatts of gross power capacity and has increased power capacity at other sites in Georgia and Texas by 300 megawatts.

Shares in Core Scientific (CORZ) ended trading on Monday down 2.8% to $16.49. Its stock fell to a low of $14.69 after the bell, but recovered to end the after-hours session flat. Core Scientific’s stock is up over 13% so far this year.

Related: Nasdaq files for prediction market-style options on Nasdaq-100

Riot Platforms trades flat on Q4 revenue miss

Rival Bitcoin miner and AI compute hoster Riot Platforms also posted its Q4 results on Monday, reporting revenue of $152.8 million, up 7% from a year ago but missing analyst expectations of $157 million.

Shares in Riot Platforms (RIOT) traded flat on Monday, ending the day at $16.43 and moving less than 1% after hours to $16.28.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum — BIP-360 co-author

Crypto World

Bitcoin Slows Its Slide, Bear Market Still in Play, Analysts Say

Bitcoin (CRYPTO: BTC) has shown signs that selling pressure may be fading, though analysts caution that a durable bottom is far from guaranteed. In recent sessions, the asset has hovered around key technical levels, with the 20-day moving average offering a critical backdrop near $68,500 and volatility compressing as traders digest macro headlines. While one market update noted that BTC did not accelerate lower on risk-off news, the broader bear-market narrative remains intact for many observers, keeping upside exposure tactical rather than structural.

Key takeaways

- Bitcoin appears to have shifted tactically rather than signaling a structural reversal, with near-term momentum stabilizing but persistent bearish conditions.

- The price has regained the vicinity of the 20-day moving average around $68,500, and Bollinger Bands are narrowing, potentially setting the stage for a defined trading range rather than a fresh down leg.

- BTC touched just above $70,000 in late trading on Coinbase but retraced to roughly $68,400, indicating continued volatility and intra-session shifts.

- The $62,500 level has held on three tests, reinforcing it as meaningful support amid a broader bear-market context.

- Bullish divergences are emerging in momentum indicators like RSI and stochastic, hinting at a possible stabilization even if the larger trend remains down.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Positive — a price bounce driven by crowd-long liquidations in derivatives and easing selling pressure.

Trading idea (Not Financial Advice): Hold. With no confirmed trend change, tactical exposure is reasonable while monitoring for a clear breakout or breakdown.

Market context: The price action unfolds against a backdrop of narrowing volatility, strengthening ETF-related flows, and evolving macro headlines that influence risk appetite across crypto markets. As liquidity conditions remain nuanced, traders are weighing whether recent moves represent a genuine shift in momentum or a temporary pause within a continuing bear market.

Why it matters

The latest price dynamics matter because they illuminate how traders are positioning around a potential bottom without assuming a durable reversal. The evidence for a tactical shift—such as stabilizing momentum indicators and a guarded recovery after tests of critical support—could influence risk management decisions for both hedge funds and retail participants. Yet the overarching framework remains cautious: many analysts still classify Bitcoin as being in a bear-market regime, meaning that any bullish exposure should be limited in scope and time-bound unless a clear directional breakout occurs.

From a market mechanics perspective, several indicators align to suggest a pause rather than a pivot. Volatility appears to be compressing, ETF flows have shown resilience, and the once-widening Coinbase discount has faded, all of which are inconsistent with a market rushing into a fresh leg lower. Still, analysts caution that these are characteristics of consolidation, not confirmation of a new uptrend. The resilience around the $62,500 level—tested multiple times—provides a potential platform for range-bound activity or a gradual accumulation phase, should buyers step in at these levels with sustained interest.

Additionally, the narrative around derivatives markets cannot be ignored. Recent observations point to deeply negative funding rates as a key driver of a short-term rebound, where crowded short positions were forced to unwind as price found support. While that dynamic can produce sharp, short-lived bounces, it does not by itself constitute a lasting reversal or a trigger for sustained upward price action. The absence of durable macro catalysts—such as clear liquidity inflows or institutional commitments—underscores why traders remain cautious about calling a new bull leg.

What to watch next

- Observe BTC’s behavior around the 62,500 support level over the coming sessions to see if buyers maintain conviction or if bears pressure the price lower again.

- Monitor momentum indicators (RSI, stochastic) for continued bullish divergences or a retreat back into bearish territory.

- Track ETF flow data and any shifts in the Coinbase-related pricing discounts as signals of broader liquidity and investor sentiment shifts.

- Watch for changes in funding rates in derivatives markets; a sustained shift back to positive funding could alter the risk-reward dynamic for long positions.

- Keep an eye on macro catalysts that could reintroduce risk-off pressures or, conversely, catalyze renewed risk appetite in crypto assets.

Sources & verification

- 10x Research market update: Is the Bitcoin correction over, bottom formed, or is this a bear-market trap? ( https://update.10xresearch.com/p/is-the-bitcoin-correction-over-has-the-bottom-formed-or-is-this-a-bear-market-trap )

- Bitcoin price context and market observations referenced in BTC price coverage (Cointelegraph article on price movements and bear-market context): https://cointelegraph.com/news/bitcoin-holders-show-zero-panic-as-btc-hits-dollar70k-amid-middle-east-tensions

- TradingView BTCUSD price data (Coinbase exchange view): https://www.tradingview.com/symbols/BTCUSD/?exchange=COINBASE

- ETF flows and related analysis referenced in coverage of how ETF activity affects Bitcoin price dynamics: https://cointelegraph.com/news/are-bitcoin-etfs-quietly-accumulating-or-just-not-selling-the-flow-data-that-matters

- Derivatives funding rate context and potential short-squeeze signals: https://cointelegraph.com/news/negative-bitcoin-funding-rate-may-signal-pending-short-squeeze-above-dollar70k

Bitcoin price action: tests of support and momentum signals

Bitcoin (CRYPTO: BTC) has been navigating a delicate balance between tactical resilience and structural risk. After a period in which selling pressure appeared to intensify alongside macro headwinds, the market is displaying a constellation of signals that traders read as a potential shift in near-term dynamics without confirming a new long-term trend. The most cited technical talking points center on the interaction with the 20-day moving average, the narrowing of volatility bands, and the resilience of a critical support zone around $62,500.

The 20-day moving average has re-emerged as a yardstick for assessing near-term momentum, with BTC hovering near that level at the time of writing. A tightening of Bollinger Bands reinforces the notion that price action may be compressing into a more defined range, which often precedes a breakout or a sustained consolidation. In practical terms, a break above the upper band could portend a bullish continuation, while a break below the lower band would reaffirm downside risk in a bear-market context. These technical nuances are amplified by the price’s behavior around the $70,000 mark in late sessions, where a brief ascent gave way to a retracement as traders reassessed risk and liquidity conditions.

From a supply-demand perspective, the $62,500 threshold has proven notable. It withstood tests on three separate occasions, suggesting authentic support that buyers have targeted in a market characterized by fragile liquidity. The price’s ability to rebound from the $63,000s demonstrates that demand exists at specific price points, even as overall sentiment remains cautious. In tandem, momentum indicators—specifically RSI and stochastic—have started to exhibit bullish divergences, a pattern that traders often interpret as an early harbinger of stabilizing momentum. While these signals are encouraging at the margin, they are not a substitute for a decisive trend shift, especially as macro catalysts remain uncertain.

Beyond the price action, market mechanics play a central role in interpreting the recent bounce. Negative funding rates in derivatives markets have contributed to a squeeze dynamic, where crowded short positions were unwound as price rose from the mid-$60,000s. This type of price activity is not inherently indicative of a durable reversal; it reflects the intricacies of leverage and risk parity in a market that remains susceptible to rapid shifts. The absence of broad, structural inflows—particularly from institutional buyers—keeps the door open for renewed pressure should liquidity conditions deteriorate or if macro risk sentiment deteriorates further.

Looking ahead, the market will be watching for sustained price action that can convert tactical gains into a more persistent trend. Traders will evaluate whether the momentum divergences sustain themselves, whether ETF flow dynamics continue to provide relief to selling pressure, and whether any macro event can catalyze a more pronounced shift in risk appetite. In the meantime, market participants are likely to treat any move that reclaims or holds above the $68,000–$70,000 zone as a potential cue for cautious optimism, while remaining mindful of the longer-term bear-market framework that many analysts still cite as the prevailing context.

Crypto World

How Is the PMI Index Signaling the Start of Altcoin Season?

The decline in altcoin market capitalization has started to slow in the first week of March despite numerous negative geopolitical developments. In addition, the newly released PMI index is reviving hopes that altcoins may recover soon.

However, any recovery could face significant challenges as the proportion of altcoins trading near their all-time lows continues to rise.

Why Could the PMI Report Influence Capital Flows into the Altcoin Market?

A positive macroeconomic signal has just emerged, bringing renewed optimism. The US ISM Manufacturing PMI has remained above the 50 threshold for two consecutive months.

The ISM Manufacturing PMI reflects survey results from purchasing managers about their business conditions. It helps assess whether the US manufacturing sector is expanding or contracting.

Specifically, the February 2026 PMI reached 52.4. Although it came in slightly lower than January’s 52.6, it still exceeded the forecast of 51.8.

Historical data shows that when the ISM PMI rises above 50—indicating economic expansion—it often coincides with strong rallies in Bitcoin and altcoins.

Analyst Ash Crypto explained that when PMI exceeds 50, the US economy enters an expansion phase. Corporate profits increase. Household income improves.

Consumer spending accelerates. Investor risk appetite strengthens.

“If ISM stays above 50 for a few more months, the crypto winter could be over soon,” Ash Crypto stated.

Analysts expect that the ISM Manufacturing PMI remaining above 50 for two consecutive months signals the beginning of a new US business cycle. This environment creates favorable conditions for capital to flow into high-risk assets such as cryptocurrencies.

Analyst Matthew Hyland combined PMI data with historical models and indicated that altcoin dominance has just confirmed a breakout signal.

The rising PMI, together with the recovery of the monthly MACD-H indicator and the breakout from a falling wedge pattern in altcoin dominance, suggests a potential altcoin season scenario in 2026.

38% of Altcoins Are Trading Near All-Time Lows

A recent report by CryptoQuant analysts reflects a still-bleak outlook for altcoins.

Darkfost, an analyst at CryptoQuant, stated that approximately 38% of altcoins are trading near their all-time lows. This marks the lowest level in the current cycle and appears even worse than the period immediately following the collapse of FTX.

“This chart perfectly illustrates the current situation for altcoins. Investors remain cautious and continue to lose interest in altcoins,” Darkfost explained.

However, he added that severely deteriorating conditions can also create an environment where opportunities begin to emerge.

A recent report by BeInCrypto highlighted additional signals in March that suggest altcoins could recover. However, the excessive number of altcoins combined with tight liquidity conditions may limit the extent of any rebound.

Crypto World

High Risk Zone? Analysts Split as Bitcoin (BTC) Ignores Geopolitical Chaos

Analysts argue that geopolitical shocks have failed to invalidate the existing bullish short-term and bearish mid-term outlooks.

Bitcoin’s reaction to escalating geopolitical tensions over the weekend was limited, even as traditional markets reacted more sharply. BTC slipped to around $65,500 on Monday after trading in a volatile range between roughly $63,000 and $68,000, as markets responded to rising US-Iran tensions and reports that Iran’s Supreme Leader, Ayatollah Ali Khamenei, was killed in a joint US-Israeli airstrike.

Despite the intense, volatile backdrop, market commentators say that the conflict has not changed Bitcoin’s trajectory.

High Risk Zone

In a post on X, Mr. Wall Street stated that “nothing changed with the new war.” He said that he does not believe the cycle bottom is in at $60,000. According to him, the cycle bottom will form later this year, around $45,000, but only after Bitcoin first rallies to the $80,000-$85,000 range.

The analyst’s outlook is bullish in the short term, bearish in the mid-term. This indicates that while geopolitical shocks may create volatility, he does not believe they invalidate the expectation of a near-term pump followed by a deeper corrective phase. Another prominent crypto market commentator, Doctor Profit, also maintained that the war does not alter his broader bearish positioning.

He wrote that Bitcoin “remains in an absolute high risk zone” and that the market has not bottomed yet.

“The war changes nothing in my bearish outlook for Crypto and Stocks.”

He also added that he remains fully bearish and that his “big short” has remained open since September. Both analysts, despite differing on short-term direction, emphasized that the geopolitical escalation has not fundamentally changed their pre-existing market theses.

US-Iran Conflict Already Priced In?

Trader CrypNuevo said the market had already been pricing in the US-Iran conflict throughout the previous week. He went on to explain that markets cannot fall much further because the event was largely anticipated, but pointed to uncertainty around the length of the war and the status of the Strait of Hormuz. According to them, stock futures, which Bitcoin tends to follow, would probably open negatively, and could potentially recover as soon as de-escalation talks emerge.

You may also like:

They said a prolonged conflict is unlikely, citing concerns that extended closure of the Strait of Hormuz would push oil prices higher and spike US CPI inflation, something they do not expect to occur. The strategy is to wait for Monday’s stock market reaction. As such, if there is a sharp sell-off, they would long Bitcoin around $61,000-$60,000 ahead of de-escalation news. On the other hand, if there is only a slight decline, sideways movement, or a pump, they would delay entering a long position until later in the week.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Crypto, Iran War, and Oil Price: Geopolitical Shock Could Delay the Crypto Bull Run

Crypto are under pressure as war around Iran intensifies and traders begin pricing in the unthinkable: disruption in the Strait of Hormuz.

If that chokepoint closes, oil spikes. And if oil spikes, inflation follows. That puts the Federal Reserve in a corner, forcing rates to stay higher for longer.

Crypto is not immune. While there has been some speculative buying on regional capital flight headlines, the broader macro picture is heavy. Bitcoin is moving more in sync with traditional risk assets, not decoupling from them.

Instead of acting like digital gold, the market is behaving as if liquidity is the real safe haven. In a true energy shock scenario, the first reaction is not rotation into crypto. It is de-risking across the board.

- Bitcoin volatility has spiked as traders hedge against a potential Strait of Hormuz closure that could disrupt one-fifth of global oil flows.

- Surging Oil Price levels above $90/barrel would likely stick inflation higher, potentially taking a Q2 Fed rate cut off the table.

- While Capital Flight into USDT offers localized support, global risk-off flows are dominating market structure and capping upside momentum.

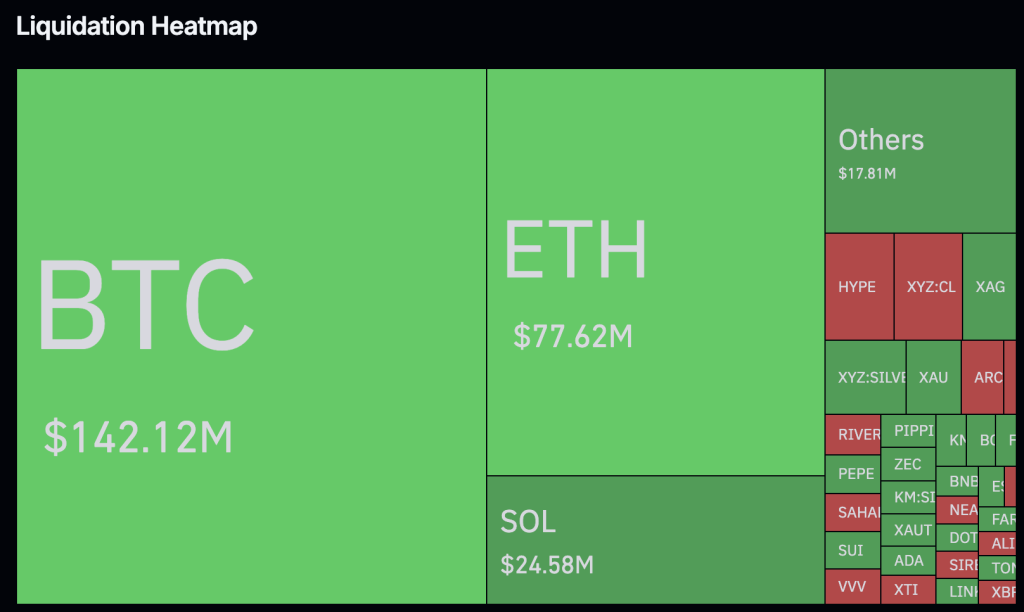

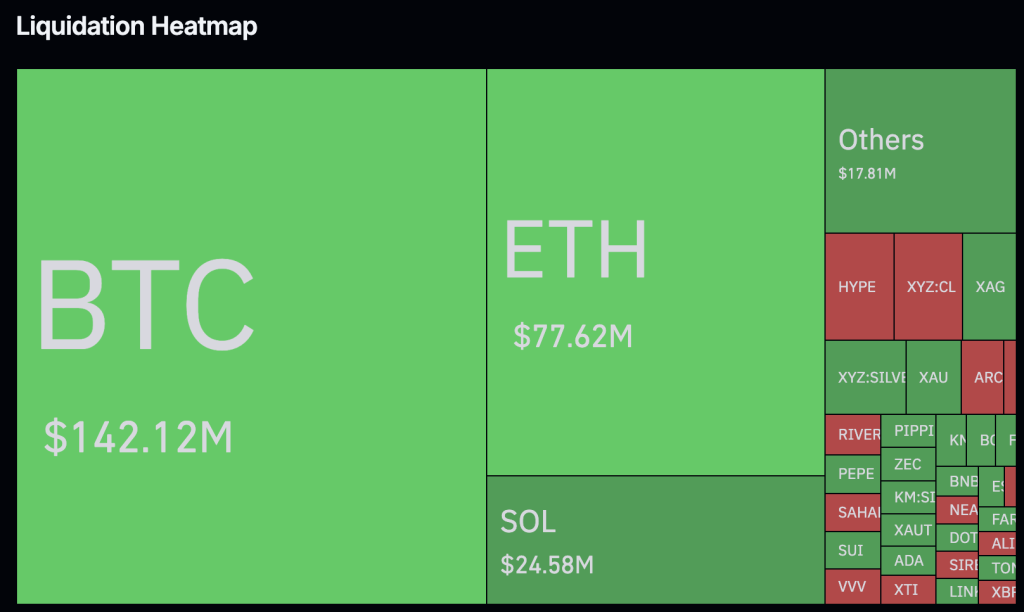

Bitcoin Crypto Volatility Spikes as Iran War Jitters Trigger $128M Liquidations

The first crypto reaction to the Iran war was chaos, not clarity. CoinGlass data shows more than $128 million in liquidations in just 4 hours after reports of the IRGC’s “Operation True Promise 4.” Nearly 80% were longs. Leverage traders were leaning the wrong way and got wiped fast.

Bitcoin initially dropped toward $63,000 on the headlines, then bounced as more details came out. But the rebound feels mechanical, not confident. Open Interest has cooled sharply, which tells you desks are cutting risk, not aggressively buying dips.

This is classic panic behavior. Sell first. Reassess later.

Equities are showing the same pattern. The S&P 500 has seen outflows, and Bitcoin’s correlation with tech remains tight during stress events. Whatever the digital gold narrative says, in moments like this BTC trades like a high-beta risk asset, not a safe haven.

Oil Price Surge Threatens to Derail Fed Pivot Plans

The real risk to crypto might not be the headlines; it could be oil. If the Strait of Hormuz is disrupted, up to 21 million barrels per day could be affected. That is around 20% of the global supply. Even partial disruptions historically trigger instant price spikes.

If crude holds above $100, inflation comes back fast. That traps the Federal Reserve. Rate cuts get delayed. Liquidity stays tight. And crypto suffers in a higher-for-longer environment.

Some analysts are floating extreme downside scenarios again. While most institutional desks still see $58,000 to $60,000 as Bitcoin’s key support zone, that floor depends heavily on the Fed not turning more hawkish.

There is a counter-force: capital flight. Stablecoin demand in parts of the Middle East has jumped as local currencies wobble. Bitcoin and USDT become escape valves. But retail flows from crisis regions rarely offset large institutional outflows driven by macro tightening.

Altcoins are already showing the strain. Without fresh liquidity, Ethereum and the broader sector struggle to sustain rallies. If yields on the U.S. 10-year push back toward 5% on energy-driven inflation, risk assets likely stay capped.

Discover: The best new crypto in the world

The post Crypto, Iran War, and Oil Price: Geopolitical Shock Could Delay the Crypto Bull Run appeared first on Cryptonews.

-

Politics4 days ago

Politics4 days agoITV enters Gaza with IDF amid ongoing genocide

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Iris Top

-

Tech2 days ago

Tech2 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Business6 days ago

Business6 days agoTrue Citrus debuts functional drink mix collection

-

Sports3 days ago

The Vikings Need a Duck

-

NewsBeat5 days ago

NewsBeat5 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat3 days ago

NewsBeat3 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Tech7 days ago

Tech7 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat5 days ago

NewsBeat5 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat3 days ago

NewsBeat3 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat2 days ago

NewsBeat2 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat2 days ago

NewsBeat2 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat6 days ago

NewsBeat6 days agoPolice latest as search for missing woman enters day nine

-

Entertainment24 hours ago

Entertainment24 hours agoBaby Gear Guide: Strollers, Car Seats

-

Business5 days ago

Business5 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Business4 days ago

Business4 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Tech4 days ago

Tech4 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Crypto World6 days ago

Crypto World6 days agoEntering new markets without increasing payment costs

-

Politics2 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat2 days ago

NewsBeat2 days agoEmirates confirms when flights will resume amid Dubai airport chaos