Crypto World

Hong Kong Issues First Stablecoin Licenses as Global Digital Money Architecture Takes Shape in 2026

TLDR:

-

- Hong Kong issues its first stablecoin licences in March 2026 under a strict reserve-backed regulatory framework.

- EnsembleX connects major banks through tokenised deposits, with HSBC settling HK$3.8M for Ant International in real time.

- Europe, the US, and Asia-Pacific are all building identical three-layer digital money stacks on incompatible platforms

- Interoperability protocols are now considered foundational as fragmented infrastructure threatens cross-border settlement at scale.

Stablecoins are moving from concept to regulated reality in Hong Kong. Financial Secretary Paul Chan confirmed the city will issue its first stablecoin licences in March 2026.

The announcement came on February 26, drawing wide attention to the city’s broader digital money framework. Beneath the headline, however, lies a three-layer architecture that mirrors patterns emerging across major financial centres worldwide.

That convergence raises pressing questions about interoperability and the future of cross-border digital finance.

Hong Kong Builds a Three-Layer Digital Money Stack

Hong Kong’s approach to digital money operates across three distinct layers. Each layer runs on different infrastructure, yet all three are intended to work in coordination. This structure reflects the city’s commitment to developing programmable and interoperable finance.

The first layer covers licensed stablecoins governed by Hong Kong’s Stablecoins Ordinance. Under this framework, issuers must hold 100% reserve backing and maintain a minimum HK$25 million in capital.

Redemption is guaranteed within one business day. As a result, these stablecoins are well-suited for retail payments and cross-border transfers.

The second layer involves tokenised deposits through EnsembleX, launched in November 2025 with real money. Participants include HSBC, Standard Chartered, Bank of China (Hong Kong), and other regional institutions.

BlackRock and Franklin Templeton are also taking part. HSBC completed the first cross-bank transaction on November 13, transferring HK$3.8 million for Ant International in real time.

The third layer is EnsembleTX, Hong Kong’s wholesale CBDC platform. It settles tokenised deposit transfers between banks. Financial Secretary Paul Chan has emphasised that it will strengthen cross-border interoperability standards.

A Global Three-Layer Pattern Takes Shape in 2026

Hong Kong is not alone in building this structure. Throughout February 2026, a similar three-layer model emerged across Europe, the United States, and Asia-Pacific.

Quant Network observed on X that the move signals global convergence. Infrastructure fragmentation, the network noted, is becoming a global problem whilst everyone builds the same thing.

In Europe, Deutsche Bundesbank President Joachim Nagel endorsed wholesale CBDC for programmable payments on February 16.

BNP Paribas then tokenised a money market fund on public Ethereum, departing from its earlier private blockchain approach.

Nine European banks plan euro stablecoin launches in H2 2026. The ECB’s Pontes wholesale CBDC project targets Q3 2026.

In the United States, five regional banks announced a tokenised deposit network for Q4 2026 via Cari Network. The banks described the move as a defense against stablecoin displacement.

The GENIUS Act creates a federal licensing framework for stablecoins, with implementation set to begin in July 2026.

Fragmented Platforms Create a Growing Interoperability Problem

With multiple layers running on incompatible platforms, interoperability has become a clear operational challenge.

A Hong Kong corporate treasurer, for example, could face settlement across six different platforms in a single cross-border transaction. Each platform carries its own governance structure, compliance requirements, and settlement logic.

Point-to-point integrations between systems do not scale well over time. Building bilateral links between EnsembleTX, Pontes, Ethereum, and Kinexys creates growing complexity with each new connection.

This mirrors the challenge correspondent banking faced before SWIFT introduced a universal messaging standard.

A Research and Markets report published on February 25 confirmed this challenge directly. It identified interoperability protocols and regulatory messaging standards as foundational to scalable tokenised markets.

With stablecoin licences now live in Hong Kong and major deployments scheduled through 2026, cross-platform coordination has become an operational requirement.

Crypto World

The crypto crowd is so convinced this rally is a fakeout, it might trigger short squeeze

Bitcoin pushed above $73,000 this week, reclaiming a key psychological level that had capped the market for weeks. Yet the breakout has been met with an unusual reaction across crypto markets: widespread skepticism.

Many traders are warning that the move could become a classic bull trap — a brief breakout that lures in late buyers before reversing lower. Analysts have pointed to heavy overhead supply and positioning in derivatives markets as potential risks, with some suggesting a rally into the $72,000–$76,000 range could attract sellers rather than confirm a sustained recovery.

The caution stems partly from recent history. Earlier this year, Bitcoin appeared to break out of a consolidation range, only to reverse violently. The move trapped momentum traders and triggered a cascade of liquidations as the price plunged from around $98,000 to roughly $60,000 within two weeks — a reminder of how quickly sentiment can flip in crypto.

But the current setup may present a paradox: the trade has become crowded on the bearish side.

Across crypto Twitter, analysts and chartists are widely calling for a bull trap. That consensus itself raises the possibility of the opposite outcome — a squeeze higher that forces short sellers to cover. In leveraged markets, strong directional agreement often creates the liquidity needed for moves in the other direction.

Macro uncertainty could also complicate the outlook. Geopolitical tensions following the Iran conflict have already pushed gold higher and lifted oil price expectations, while some Asian equity markets have shown signs of stress. Radu Tunaru, professor of finance and risk management at Henley Business School, argues geopolitical shocks have historically played a role in major market sell-offs. He points to the 1987 Black Monday crash, which he believes was partly triggered by U.S.–Iran tensions that first rattled Asian markets before spreading globally.

For now, Bitcoin’s breakout above $73,000 has revived bullish momentum — but price action over the coming days will determine whether a bottom is truly in or if this is an accurately predicted bull trap.

To regain a bullish macro structure, bitcoin needs to trade back into the $98,000 region to snap the grueling lower high formed by the previous bull trap in January.

Crypto World

Ray Dalio Dismisses Bitcoin’s Safe-Haven Narrative, Rejects Comparisons to Gold

According to Dalio, there are important differentiating characteristics between bitcoin and gold, and these traits are pushing institutions to the latter.

The billionaire investor and founder of the leading hedge fund, Bridgewater Associates, Ray Dalio, has once again criticized bitcoin (BTC). This time, Dalio rejected comparisons between the cryptocurrency and gold, stripping the digital asset of its safe-haven narrative.

During an interview with the All-In Podcast, the Bridgewater founder insisted that BTC has not played the role of a safe-haven like gold. He accepted that bitcoin has been receiving a lot of attention as a form of money but faces long-term threats. Dalio’s comments come as financial assets react to geopolitical tensions amid the ongoing U.S.-Iran crisis.

Dalio Rejects BTC Comparisons to Gold

According to Dalio, there are important differentiating characteristics between bitcoin and gold. The former lacks privacy; transactions can be monitored and indirectly controlled by entities. Such qualities, in the billionaire’s opinion, would make central banks and large institutions reluctant to buy and hold it.

On the other hand, these institutions are consistently buying and holding gold because the precious metal is widely considered a store of value and an inflation hedge. Dalio highlighted that the precious metal is not an asset that is speculated on, contrary to what most people have come to believe. In fact, he mentioned that gold is the most established form of money and the second-largest reserve currency held by central banks.

Moreover, gold does not face the same threats as Bitcoin. Dalio mentioned growing concerns about the possible effects of quantum computing on the Bitcoin network. So, despite getting a lot of attention, especially from individuals, and being considered as alternative money, bitcoin still has a relatively small and controlled market in comparison to gold.

It is worth noting that Dalio has developed some kind of love-hate relationship with BTC over the years. Once a critic, the investor began to embrace the cryptocurrency in 2021 and even gained exposure to it. Still, he believes gold is the ultimate financial asset, and BTC does not come close.

Gold Hit Heavier By U.S.-Iran Conflict

Despite Dalio dismissing bitcoin’s safe-haven narrative, the digital asset has performed relatively well since the U.S.-Iran conflict began. On March 3, the day Dalio made these remarks, gold lost 6% during trading hours, falling from $5,377 to $5,039, according to TradingView data. BTC, on the other hand, fell by a mere 3.7% over the same timeframe.

You may also like:

Comparing the price movements of both assets on that day directly challenges Dalio’s statements, as gold was more affected by the very crisis it is supposed to shield investors from.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Trump Sends Pro-Bitcoin Fed Chair Nomination to the Senate

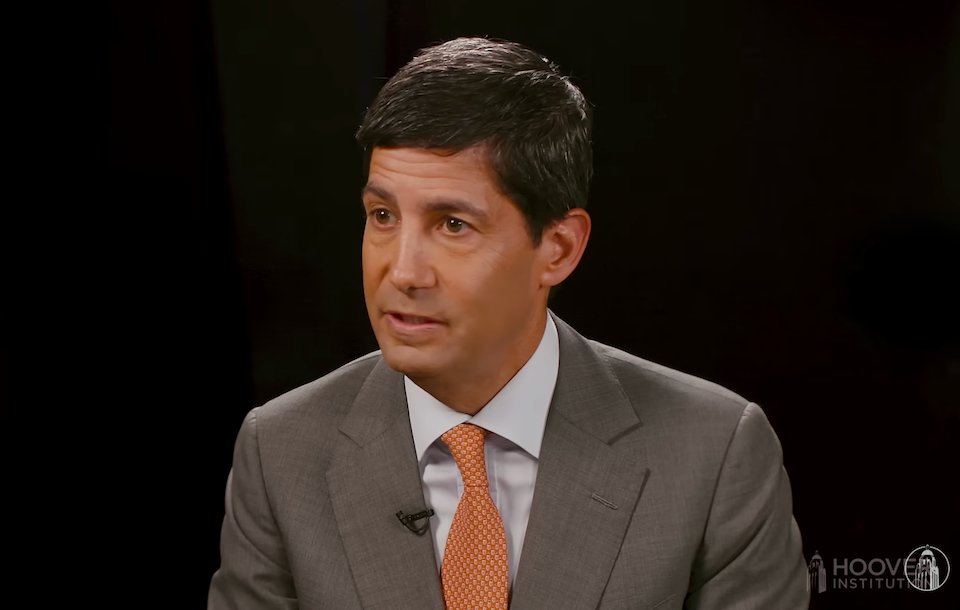

The US Senate will soon vote on Donald Trump’s nominee to head the US Federal Reserve after the president picked Kevin Warsh, who has previously expressed pro-Bitcoin views, to replace Fed chair Jerome Powell.

In a Wednesday notice, the White House said that Trump had sent Warsh’s nomination to the Senate to be chair of the Board of Governors of the Federal Reserve for a term of four years, and as a Fed governor for 14 years. The president had previously taken to social media to announce Warsh was his pick to replace Powell, whose term as chair ends in May but may stay on as a Fed governor until 2028.

Warsh served as a Fed governor under former US Presidents George W. Bush and Barack Obama from 2006 to 2011. He went on to become a Shepard Family Distinguished Visiting Fellow in Economics at the Hoover Institution of Stanford University.

The prospective Fed chair has made many public statements favoring Bitcoin (BTC) adoption. In a January 2021 interview with CNBC’s Squawk Box, he said “if Bitcoin never existed gold would be rallying even more right now, but I guess if you are under forty, bitcoin is your new gold.” In a 2025 interview with the Hoover Institution, Warsh said the cryptocurrency “could provide market discipline, or […] could tell the world that things need to be fixed.”

“Bitcoin does not make me nervous,” said Warsh. “I can hearken back to a dinner I had here in 2011 with […] Marc Andreessen, who showed me the white paper […] I wish I had understood as clearly as he did how transformative Bitcoin and this new technology would be. Bitcoin doesn’t trouble me. I think of it as an important asset that can help inform policymakers when they’re doing things right and wrong.”

Related: Trump met Coinbase CEO before slamming banks over crypto bill: Report

Powell’s term as chair ends on May 15, while his term as a Fed governor ends on Jan. 31, 2028. Although Trump has previously announced threats to fire the Fed chair, he is expected to finish his term.

It was unclear at the time of publication when the Senate would consider Warsh’s nomination, but he could face opposition from many Democratic lawmakers. Minority Leader Chuck Schumer said in January that Republican lawmakers “must not move Mr. Warsh’s nomination forward,” given Trump’s attempts to “cannibalize the Federal Reserve to eliminate its independence.”

“[Warsh] must make clear that he would keep the Fed independent and free from Donald Trump’s bullying, or else, he must not be confirmed,” said Schumer.

CFTC still lacks nominations for leadership

Although Trump officially announced his pick as Fed chair, as of Wednesday the president had not sent any additional nominations to the Senate to staff the Commodity Futures Trading Commission (CFTC).

Michael Selig, who was confirmed as CFTC chair in December, remains the sole leader at the financial regulator, which normally has five commissioners. The agency is expected to have additional oversight and regulatory power over digital assets should a market structure bill moving through the Senate become law.

Magazine: Bitcoin may face hard fork over any attempt to freeze Satoshi’s coins

Crypto World

Western Union Partners with Crossmint to Support USDPT Stablecoin on Solana

Crossmint has partnered with Western Union to support the launch of the remittance company’s USDPT stablecoin and its new Digital Asset Network on the Solana blockchain.

Wednesday’s announcement said the collaboration will integrate Crossmint’s wallet and payment APIs with Western Union’s infrastructure, allowing fintech platforms to move funds using the stablecoin and connect to Western Union’s global payout network.

That Digital Asset Network is intended to link stablecoins with the company’s existing payout infrastructure, enabling users to convert digital dollars into local currency through its network of more than 360,000 cash pickup locations worldwide.

The USDPT stablecoin will be issued on the Solana (SOL) blockchain, according to the announcement. Crossmint said its infrastructure will allow developers and fintech companies using its platform to access the token through existing wallet and payment integrations.

Crossmint said its platform is used by more than 40,000 clients and includes services such as smart wallets, on- and offramps, and cross-chain stablecoin management.

Western Union, which is known for completing the first transcontinental telegraph line in 1861, today operates a global money transfer network spanning more than 200 countries and territories and supports payments across more than 130 currencies through a network of retail locations, bank accounts and digital wallets.

The company first announced plans for the USDPT stablecoin in October 2025, saying the Solana-based token would launch in the first half of 2026.

Related: Locals prefer satoshis to dollars, says Africa Bitcoin chair Stafford Masie

Stablecoins gain in cross-border remittances

Western Union’s core business is remittances, enabling people to send money across borders to family members and recipients in their home countries. Through traditional payment rails, these transfers can take days to settle, often carry fees of several percentage points and typically do not process on weekends or holidays.

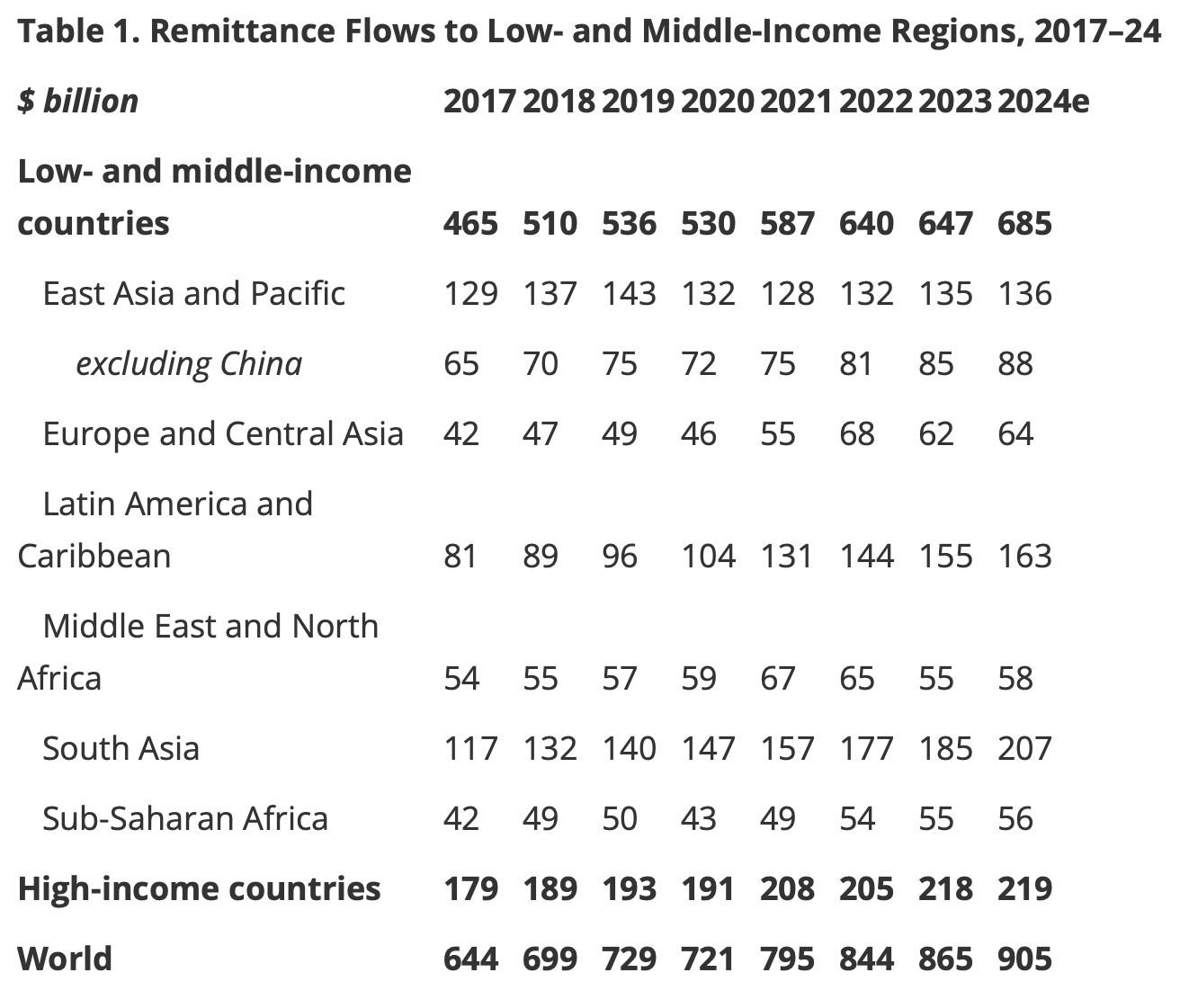

According to World Bank estimates, global remittances totaled about $905 billion in 2024, while the average cost of sending $200 internationally remained around 6% of the transaction amount.

Stablecoins are increasingly being explored as an alternative settlement rail because they allow dollar-denominated value to move across blockchain networks with near-instant settlement and lower transaction costs.

According to Chainalysis, in Latin America, stablecoins account for more than half of crypto purchases made with the Argentine peso, Brazilian real and Colombian peso on major exchanges, The company’s October 2025 report attributed the trend to demand for dollar-pegged assets in economies facing inflation and currency volatility.

Other countries seeing strong crypto adoption include Nigeria and Turkey, as well as Asian markets such as the Philippines and Vietnam, which rank among the world’s top countries for grassroots crypto usage, according to Chainalysis.

At a World Economic Forum panel in Davos on Jan. 23, former UN under-secretary-general Vera Songwe said stablecoins are gaining traction across Africa as an alternative for remittances, noting that remittance flows have become more significant for the continent than foreign aid.

Magazine: Bitcoin may face hard fork over any attempt to freeze Satoshi’s coins

Crypto World

High-speed algorithmic trading in currency markets

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

In the 24-hour forex market, where price movements are measured in seconds and spreads are razor-thin, high-speed algorithmic trading has become a critical tool for competitive execution. By automating strategy rules and eliminating emotional bias, traders can respond to currency volatility with greater precision and consistency.

In trading, timing is everything. In traditional markets such as stocks and bonds, people can afford to be a little more patient with decisions and take time considering them. In volatile markets such as forex and crypto, algorithmic trading can help you when time is a premium.

Algorithmic trading using forex robots is revolutionizing the way traders make decisions. Currency prices are ever-changing and with the slightest hesitation or distraction, it’s easy to make the wrong move.

These exchange rates react to many global factors and it’s easy to be overwhelmed. Keeping sharp instincts and emotional control can sometimes feel impossible. This is where high-speed algorithmic trading can be a vital tool.

What High-Speed Algorithmic Trading Really Means

Algorithmic trading can go by a few names. Sometimes it’s simply shortened to algo trading or given a name such as scalping robots. They all mean using computer software to execute trades if they meet a predefined set of criteria.

The speed factor comes in because an algorithmic forex scalping robot is able to make these decisions in an instant. As long as it meets the rules you set out, the trade is completed without hesitation. Rather than something used to game the system, it essentially turns human decisions into consistent and emotionless actions.

These rules can be set to the likes of price movements, technical indicators, economic releases, volatility thresholds or arbitrage opportunities. It removes the delay that is inevitable with a manual approach.

It’s not a fool-proof tool as it will need to be run based on sound logic and reasoning. However, with its ability to test strategy on previous data, it presents the perfect opportunity to refine and test an approach.

In the forex market, this speed matters more than any other. Currencies trade 24 hours a day. Therefore, price changes can be sudden and happen at any time. It’s possible to wake up one morning knowing a key opportunity has been missed through the night.

When high-speed algorithms are used, any human shortcomings are removed. A human is replaced with a version that doesn’t make mistakes, doesn’t get tired and doesn’t get emotionally involved.

Why Speed Matters in Currency Markets

The forex market is the largest financial market in the world. Billions of dollars are traded on the stock market each day. In comparison, the average daily trading volume of forex is nearly $10 trillion.

With so many people trading incredible volumes of money, prices adjust continuously. Forex also benefits from being continuously open on weekdays. In comparison, stock markets usually follow traditional working hours in the country where they operate.

This can mean a few things. Instead of huge swings, traders generally work with tight spreads and small price increments. Individual wins can be small but they can compound into something significant if you are efficient. Conversely, small repeated mistakes can end up being costly.

Forex is like crypto in regard to being a volatile market. With such a fast-moving system, any delay can erase an edge. By the time a signal is confirmed, the opportunity may be gone. High-speed systems reduce this latency, meaning no worries about losing out between signal generation and order execution.

The Benefits Go Beyond Speed

The benefits of an algorithmic forex scalping robot go well beyond just being able to close trades almost instantly. It also allows rigorous testing of a strategy without worrying about outside factors affecting the outcome.

For example, a strategy could be solid but the results could be clouded by emotion and human error. It’s easy to lose confidence after a run of bad trades and chase losses. Equally, it’s easy to get overexcited before eventually getting bitten by overconfidence.

It can also be backtested through different market conditions to see how it holds up to drastic changes in the market. Past performance is no guarantee of future results but it can show the weaknesses and strengths of a strategy.

Is High-Speed Algorithmic Trading Right for You?

Before anyone pursues high-speed algorithmic trading, it’s important to know it’s not a shortcut. Without any prior knowledge, it would be like trying to drive a high-powered sports car before someone even passed their test. The tool is there but you still need to know how to use it.

That comes from understanding how the market works and what traders should expect from adjusting various parameters. There is also a learning curve with any new software and therefore, comfort with the system is a priority before risking bankroll.

A forex bot won’t work magically right away. It needs patience to test and refine strategies. Traders can either do this by staking a low amount of capital or use their tools to test on historical data without risking real money.

With appreciation of all the above, algorithmic trading can allow traders to better compete effectively in the dynamic financial world of forex trading.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Arizona Senate Advances Bill to Create Crypto Reserve Fund

TLDR

- Arizona lawmakers advanced Senate Bill 1649 to create a state-managed crypto reserve funded by seized digital assets.

- The Senate Finance Committee approved the bill in a 4 to 2 vote before sending it to the full Senate calendar.

- The proposed fund would hold Bitcoin, XRP, DigiByte stablecoins, and certain NFTs obtained through criminal proceedings.

- The Arizona State Treasurer could invest up to 10 percent of public funds in digital assets under the measure.

Arizona lawmakers are advancing Senate Bill 1649 to create a state-managed digital asset reserve. The proposal would place seized cryptocurrencies under the control of the State Treasurer. The measure now awaits a full Senate vote after clearing two key committees.

The Senate Finance Committee approved SB 1649 in a 4–2 vote on February 16. Lawmakers then moved the bill through the Rules Committee and placed it on the full Senate calendar by February 24. The proposal authorizes the Arizona State Treasurer to establish a Digital Assets Strategic Reserve Fund.

The fund would hold digital assets that courts seize, confiscate, or receive through surrender in criminal cases. Lawmakers state that the fund would not rely on direct taxpayer appropriations. However, the Treasurer could invest up to 10% of public funds in digital assets under the bill.

Bitcoin and the Arizona Crypto Reserve Strategy

The legislation lists Bitcoin as an eligible asset for the proposed reserve. Lawmakers cited Bitcoin’s fixed supply of 21 million coins in committee discussions. Supporters argue that this cap supports its use as a hedge against inflation.

Senator Mark Finchem supports holding seized Bitcoin instead of auctioning it immediately. He said the state should benefit from potential appreciation rather than sell assets quickly. “The state should capture value for taxpayers,” Finchem said during hearings.

The bill permits the Treasurer to loan digital holdings to generate returns. However, the Treasurer must ensure that lending does not introduce added financial risk. Custody rules require multi-party governance and geographically distributed data centers.

Governor Katie Hobbs has vetoed similar digital asset proposals in the past. She cited volatility as a concern in prior veto letters. SB 1649 must pass the full Senate before it can reach her desk.

XRP and DigiByte Included in Eligible Assets

The bill names XRP and DigiByte alongside Bitcoin as approved assets. Lawmakers also included stablecoins and non-fungible tokens within the eligible categories. The measure does not limit holdings to a single blockchain network.

Arizona has built legal frameworks for digital assets over the past year. In May 2025, HB 2749 allowed the state to retain unclaimed digital assets in native form. The law prevented automatic conversion of abandoned crypto into cash.

Separate legislation seeks to exempt cryptocurrency from state property taxes. Lawmakers have also addressed crypto ATM fraud through new compliance rules. Operators must provide full refunds to defrauded first-time customers.

The new ATM rules also cap daily transactions for new users at $2,000. Lawmakers said the cap aims to reduce fraud exposure. The provisions operate independently from SB 1649.

Law enforcement agencies often use forfeiture proceedings to seize digital assets. Victim restitution holds legal priority over agency claims in criminal cases. In crypto matters, victims may claim the actual digital assets taken.

Texas and Connecticut have enacted laws addressing criminal forfeiture of digital assets. South Dakota advanced SB 43 to define cryptocurrency as a seizable asset. New Hampshire remains among seven states pursuing strategic reserve legislation as of early 2026.

SB 1649 now stands on the Arizona Senate calendar for a full floor vote. Lawmakers have not scheduled a final vote date. The bill requires majority approval before it proceeds further in the legislative process.

Crypto World

Buterin Urges Ethereum to Build ‘Sanctuary Tech’ Against Digital Control

Vitalik Buterin frames “sanctuary tech” as digital islands that are resilient to political and corporate pressure.

Vitalik Buterin has proposed positioning Ethereum as part of a larger “sanctuary technologies” ecosystem.

He described these as free and open-source tools that allow people to live, work, communicate, and collaborate in ways that are resilient to outside pressures.

Buterin’s Vision

The Ethereum co-founder outlined in a social media post that the goal is to create digital islands of stability, reduce the stakes of power struggles, and interdependence that cannot be weaponized. This is in response to concerns brought to him over the past year about growing government control and surveillance, wars, increasing corporate power, the decline in quality across major technology platforms, social media turning into a memetic battleground, and the rise of AI and how it interacts with these forces.

Buterin also shared that people feel like Ethereum has not meaningfully improved the lives of people facing these pressures in areas the community cares about, such as freedom, privacy, digital security, and community self-organization.

In response, he has proposed sanctuary technologies as a practical solution to the situation. Instead of trying to dominate existing systems, these tools would allow individuals and institutions to operate in ways that are not vulnerable to outside pressure. In this vision, Ethereum would contribute by providing a shared digital space without an owner, where people can coordinate and build lasting social and economic structures.

However, he clarified that this approach is not about remaking the world in the network’s image, nor is it going to force all finance onto blockchains or move all governance into decentralized structures.

Instead, Buterin described the aim as “de-totalization,” which means reducing the risk that any winner in a global power struggle gains total control over others while also lessening the chance that any loser faces total defeat.

You may also like:

Ethereum’s Limitations

The post also addressed the idea that Ethereum should focus only on finance. As much as Buterin acknowledged that financial freedom is important, he said it alone cannot solve broader issues like power, surveillance, and social fragmentation.

He added that the chain cannot fix the world on its own, and that trying to do so would require a level of centralized power that contradicts the principles of a decentralized community. Its strength lies in enabling persistent digital structures, which form the basis of his idea for sanctuary technologies.

The Ethereum co-founder gave examples of what he sees as liberating technologies, including Starlink, locally running open-weight large language models, Signal, and Community Notes.

He concluded by calling for clarity and coordination across the full technology stack, from wallets and applications to operating systems and hardware, while focusing on users who genuinely need sanctuary technologies and working with allies inside and outside the crypto sector.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Eric Trump, World Liberty co-founder, calls banks ‘anti-American’ over stablecoin fight

Eric Trump, one of the sons of U.S. President Donald Trump and a co-founder of crypto firm World Liberty Financial, went after the banking industry Tuesday over their opposition to allowing stablecoin yield in crypto market structure legislation.

“Big Banks (think JPMorgan Chase, Bank of America, Wells Fargo, etc.) are lobbying overtime to block Americans from getting higher yields on their savings—while trying to block any rewards or perks from being given to customers,” he said in a post on X, the site formerly known as Twitter.

He said banks pay a marginal interest in comparison to the interest paid to them by the Federal Reserve, and keep the funds as profits.

“Today, the banks are desperately targeting crypto/stablecoins, where platforms plan to offer 4–5%+ yields or rewards,” he said.

“The ABA and other lobbyists are spending millions trying to ban or restrict those yields via bills like the Clarity Act, crying ‘fairness’ and using words like ‘stability’—when it’s really about protecting their low-rate monopoly and preventing deposit flight. This is anti-retail, anti-consumer, and straight-up anti-American,” he said.

World Liberty, the company he co-founded, issues its own stablecoin, USD1. The World Liberty umbrella is also in the process of seeking a charter through the Office of the Comptroller of the Currency.

Trump has shared his grievances with banks over the past year, saying at multiple conferences that they debanked him and his family.

His father, the U.S. president, posted about the Clarity Act on Tuesday, urging Congress to advance the bill and similarly attacking banks for being recalcitrant in negotiations over stablecoin yield in the bill. It’s so far unclear whether his post, or indeed Eric Trump’s, will significantly shift the needle in the negotiations.

Donald Trump posted shortly after meeting with Coinbase CEO Brian Armstrong, who publicly withdrew support from the bill in January over the stablecoin provisions and other sections the crypto executive deemed problematic.

Patrick Witt, the White House’s executive director for crypto issues, also pushed back on JP Morgan CEO Jamie Dimon earlier Wednesday, after Dimon said stablecoin issuers should be regulated like banks.

Crypto World

Why businesses should accept crypto as payment in 2026

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

As global commerce accelerates, more companies are adding crypto as a payment option to cut settlement delays, lower cross-border costs, and serve customers who already hold digital assets. In 2026, accepting crypto is becoming less of a bet and more of an operational upgrade.

Commerce in 2026 is always on, cross-border, without limits. Buyers expect checkout to work fast on a phone, in any time zone, and in more than one currency. However, cards and bank transfers still run most transactions. They often bring delays, extra fees, and payment failures in some markets.

That’s why many companies now treat crypto payments as a normal payment rail. The goal is simple. Offer a payment option that matches how customers already store value. Get faster access to funds, with fewer delays.

Faster settlement, fewer intermediaries

Card payments and bank transfers often pass through several parties. Each step adds processing time, extra checks, and the chance of a hold. A crypto transfer can move funds directly between wallets, 24/7, without waiting for banking hours.

Cost control across borders

Payment cost rarely comes from a single line item. Card acceptance can include a percentage fee, fixed charges, currency conversion, and extra risk costs such as rolling reserves. International bank transfers can add fees on both sides, plus intermediary charges that appear after the fact.

Crypto payments can cut parts of that stack. Network fees vary by chain. Many merchants use stablecoins or lower-fee networks for day-to-day payments. This can reduce payment overhead on smaller tickets and on international orders.

Reach customers who already hold crypto

Research estimates that more than 700 million people owned crypto by the middle of last year. The number keeps growing. It includes users who want to spend crypto online.

Accepting crypto can open demand in two groups. The first group is the “crypto-native” shopper who prefers paying from a wallet. The second group lives in markets where card coverage is weak or cross-border payments fail.

Test demand with a small rollout. Add crypto next to your current options. Track conversion. A checkout flow that lets customers accept crypto as payment can remove friction. Many buyers already plan to pay that way.

Fraud profile and transaction records

Card fraud and friendly fraud remain major pain points. A chargeback can reverse revenue weeks after the sale. It can add fees and support workload and raise risk scores with payment partners.

Most on-chain transfers are irreversible after confirmation. That changes the dispute profile. It does not remove risk, but shifts risk toward up-front screening and clear refund rules.

Blockchain records can help with reconciliation. A transaction has a timestamp, amount, and wallet addresses that do not change. Finance teams can link on-chain activity to invoices. They can export the data into existing reporting tools.

Wallet and treasury infrastructure

Storing funds in a personal wallet is not a business process. A company needs shared access with controls. It needs clear separation of duties between finance, ops, and security.

A crypto wallet for business can support these needs with features built for teams:

- Multiple users with role-based permissions

- Approval flows for outgoing transfers

- Real-time visibility for finance teams

- Security controls such as two-factor authentication and cold storage options

- Exports that support accounting and reconciliation

A simple rollout checklist

Crypto payments work best as a measured rollout, not a one-day switch. Many merchants start with a pilot. They expand after they see demand.

Key steps:

- Pick the assets and networks you will support

- Decide your settlement target: crypto, stablecoin, or fiat

- Set refund rules and train support teams on wallet basics

- Add reporting that links each payment to an order and invoice

- Monitor acceptance rate and settlement timing

Prepare for a wider mix of payment rails

Rules around digital assets keep developing, and payment infrastructure keeps improving. Stablecoin usage is rising in cross-border trade, and more mainstream payment firms are building rails that touch blockchain networks.

Businesses that add crypto now gain operational experience. They learn what customers use and what controls fit their risk model. That knowledge can matter once crypto becomes a standard option in more markets.

Scalability improvements are another reason crypto payments are becoming more practical for business use. Beyond Layer 1 and Layer 2 networks, Layer 3 blockchains aim to optimize transaction speed and cost for specific applications, including payments and enterprise use cases.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

New Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

Mutuum Finance (MUTM) has officially confirmed a major step in its roadmap with the activation of its V1 protocol on the Sepolia testnet. This development comes during a period of mixed market sentiment. Investors are increasingly looking for “proof of work” over theoretical promises.

By moving its core logic into a live testing environment, Mutuum Finance is demonstrating that its infrastructure is ready for public scrutiny. The project has raised over $20.6 million with strong community support..

Technical Infrastructure

Mutuum Finance is built on the Ethereum network and aims to provide a professional-grade liquidity market. Mutuum Finance has designed a dual-market mechanism. This allows the protocol to serve different types of users, from small retail participants to large institutional allocators.

P2C (Peer-to-Contract) Market: This model manages high-liquidity assets like ETH and USDT through automated pools. Interest rates are dynamic, adjusting in real-time based on pool utilization and market demand.

P2P (Peer-to-Peer) Marketplace: This marketplace supports “long-tail” or niche assets such as SHIB or DOGE. It allows lenders and borrowers to bypass automated formulas and negotiate custom interest rates and loan durations directly.

The primary goal of this design is to create a liquidity ecosystem that handles different risk profiles in one place. By separating the markets, Mutuum Finance aims to offer instant, algorithmically stable liquidity for major assets (P2C) while still providing a secure venue for the more volatile, speculative tokens (P2P) that traditional pooled protocols often exclude.

Key Features of the V1 Protocol

The activation of the V1 protocol on the Sepolia testnet is a full-scale demonstration of the protocol’s mechanics. In this environment, users can interact with the smart contracts using “test” tokens. This allows the community to verify the safety and efficiency of the system without risking real capital.

One of the core features being tested is the mtToken system. When a user deposits an asset, they receive an mtToken as a digital receipt. These are yield-bearing assets. As borrowers pay interest, the value of the mtToken increases. During the V1 testing phase, users can observe exactly how their test balances grow over time.

Additionally,the roadmap also introduces mechanisms to reward users who stake mtTokens in specialized modules designed to strengthen the platform’s security. the project’s roadmap highlights a buy-and-redistribute mechanism. Under this future system, users who stake their mtTokens in a specialized Safety Module will be rewarded with dividends paid out in MUTM tokens.

The V1 protocol includes live monitoring of Stability Factors. Every loan is assigned a score based on the value of the collateral compared to the borrowed amount. To keep the system safe, the protocol uses decentralized oracles to get accurate price data. If a user’s Stability Factor drops too low, the system’s liquidation bots are triggered to protect the lenders’ funds.

V1 Protocol Performance and Roadmap State

The activation of the V1 protocol on the Sepolia testnet has transitioned the project into a functional phase. As of March 2026, the protocol has successfully launched the V1 protocol on the Sepolia testnet, marking a significant milestone in its development. the protocol has reached a major milestone with testnet Total Value Locked (TVL) surpassing $190 million. This high volume of simulated liquidity allows the team to stress-test the system’s ability to handle large-scale lending and borrowing demand before the official mainnet launch.

Mutuum Finance’s roadmap recently transitioned into Phase 3, a stage focused on scaling the protocol’s architecture and hardening its security layer. While infrastructure optimization is a major pillar of this phase, it includes a wide array of technical and ecosystem developments designed to prepare the platform for global institutional use. Beyond the core protocol activation, the transition through these phases has introduced several critical upgrades:

- Risk Management Innovation: The protocol offers easy-to-use borrowing presets that help users navigate different risk profiles based on their preferences. This feature automatically sets the Stability Factor, helping users navigate market volatility without needing deep technical knowledge of LTV ratios.

- Protocol Security Layer: Building on a manual audit by Halborn Security and a 90/100 CertiK trust score, Phase 3 involves continuous “hardening” of the smart contracts. This includes refining the codebase using data from the Sepolia testnet to ensure the liquidation bots and interest rate models perform under extreme stress.

- Cross-Chain Research: Current development is also exploring the technical requirements for future cross-chain compatibility, ensuring that Mutuum Finance’s liquidity pools can eventually interact with networks beyond Ethereum.

The goal of these combined efforts is to transform Mutuum Finance from a tested V1 protocol into a fully realized decentralized ecosystem capable of handling diverse asset classes and complex liquidity structures.

-

Politics6 days ago

Politics6 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics2 days ago

Politics2 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Iris Top

-

NewsBeat7 days ago

NewsBeat7 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

Tech4 days ago

Tech4 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports5 days ago

The Vikings Need a Duck

-

NewsBeat4 days ago

NewsBeat4 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat3 days ago

NewsBeat3 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat4 days ago

NewsBeat4 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Entertainment3 days ago

Entertainment3 days agoBaby Gear Guide: Strollers, Car Seats

-

Business7 days ago

Business7 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Tech6 days ago

Tech6 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Business6 days ago

Business6 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

NewsBeat4 days ago

NewsBeat4 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics4 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

Crypto World6 days ago

Crypto World6 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

NewsBeat2 days ago

NewsBeat2 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech4 days ago

Tech4 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Business6 days ago

Business6 days agoWorld Economic Forum boss Borge Brende quits after review of Jeffrey Epstein links