Entertainment

Kylie Jenner’s Sprinter Brand Looks to Be Pivoting From Booze Toward Health

Kylie Jenner’s Sprinter Brand

Sprinting in Healthy New Direction???

Published

Kylie Jenner might be staging an intervention for her brand Sprinter … because it seems she’s trading vodka seltzers for nutritional shakes in the company’s portfolio.

Here’s the deal … after fans began to speculate Jenner was breaking up with the brand — which launched almost exactly 2 years ago — the mogul came out and posted the brand’s logo onto her Instagram story, writing, “We’ve been working honey.” The company then scrubbed their social media.

Kylie doubled down on the mystery by dropping a video of her hand pouring a powdered substance into a water bottle and tagging Sprinter’s account.

While Kylie hasn’t officially said what she’s doing with the brand … we did some snooping and found the company has filed for a ton of trademarks in the last few weeks.

These trademarks cover numerous products including dietary and nutritional supplements, supplement shakes, supplement energy bars, vitamins … and several different kinds of powders for making energy drinks, sports beverages, non-alcoholic cocktail mixes.

Kylie’s obviously super health-conscious … so, it’s not surprising to see her take Sprinter away from the oversaturated market of vodka seltzers.

No word yet on when she might share the full details of her plan with the rest of the world … but, we know the news will surely get hearts racing faster than a 100-meter dash!

Entertainment

Stephen Graham Keeps a ‘MobLand’ Star on a Leash in New Look at 96% RT Psychological Thriller [Exclusive]

With a face you can trust, it’s no wonder that Stephen Graham is so frequently cast as a good guy. Most recently, our hearts broke for his character in Adolescence — the award-winning drama the actor co-created alongside Jack Thorne — when he played a father struggling to handle the fallout of his teenage son’s criminal behavior. But his upcoming performance in Jan Komasa’s Heel will use his disarming appearance against audiences as it places him in his most depraved and villainous role yet. Today, as part of Collider’s Exclusive Preview event, we’ve got a new look at the film, which sees Graham star opposite MobLand favorite, Anson Boon.

Showcasing the incredibly unhinged and abusive dynamic between its main characters, our still from Heel sees Graham’s Chris standing under a ladder and next to Boon’s Tommy. On paper, the scene sounds rather tame, with family man Chris wearing a button-up shirt and glasses and appearing to be in the midst of getting some home repairs done. However, it’s through Tommy that the alarm bells immediately begin sounding off, as the young man stands in a bathrobe with a chain connecting his wrists to his neck. In his hands, he holds an overflowing bowl of popcorn, which — again out of context — seemingly points to all the makings of a cozy night in with the family.

In Heel, a married couple abducts a troubled teenager in an attempt to break him free from his past misdoings and set him on the straight and narrow. As the young man begins to give in to the twisted lessons and leans into his correctional teachings, the couple thinks they’ve saved a life, but is he really part of the family, or is it all for show? Joining Graham and Boon in the dark thriller is an ensemble that also includes Andrea Riseborough (Oblivion), Austin Haynes (Adolescence), Kit Rakusen (The Phoenician Scheme), Monika Frajczyk (Green Border), and Savannah Steyn (Intergalactic).

What’s Next for Stephen Graham?

In addition to Heel, Graham has plenty of other irons in the fire with a multitude of other feature-length projects headed to audiences in the near future. He recently celebrated the world premiere of his drama flick, Animol, from Ashley Walters, while he’ll soon reprise his role as Hayden Stagg in Steven Knight and Netflix’s Peaky Blinders: The Immortal Man. Additionally, the Boiling Point alum will also add his name to the call sheet for Florian Zeller’s psychological thriller, Bunker, and Aaron Schneider’s Greyhound 2.

Check out our exclusive new look at Heel and stay tuned for more to come from Collider’s Exclusive Preview event.

- Release Date

-

March 6, 2026

- Runtime

-

110 Minutes

- Director

-

Jan Komasa

- Writers

-

Naqqash Khalid, Bartek Bartosik

- Producers

-

Ewa Piaskowska, Jerzy Skolimowski, Jeremy Thomas

Entertainment

Billy Porter Details Health Ordeal After Life-Threatening Battle With Sepsis

Singer and Tony Award-winning actor Billy Porter is sharing the serious health issue that left him hospitalized and battling for his life. The actor had to step away from work obligations to focus on his health and is now shedding light on the severity of the medical emergency that he faced.

Article continues below advertisement

Billy Porter Had Sepsis

In March, Porter recounted his terrifying experience with sepsis on the podcast “Outlaws” with TS Madison, sharing how it all began with a routine check-up.

In September 2025, the actor visited his doctor, and it was then that they discovered that he had a kidney stone “trapped” in his urethra. He had to undergo a procedure to remove the stone.

“When they got in there, there was so much puss, and bile, and infection behind the stone,” Porter shared, adding that he became uroseptic within a few minutes.

Urosepsis occurs when an infection in the urinary tract leads to sepsis, as explained by the Cleveland Clinic. Sepsis is a life-threatening reaction wherein the immune system starts damaging healthy tissues and organs in the body. When left untreated, it can lead to organ failure or death.

Article continues below advertisement

The Actor Had To Exit His Broadway Show

At the time of his health scare, Porter was in the middle of playing the Emcee in the Broadway musical “Cabaret” and had to step away from the role to recover.

“Due to a serious case of sepsis, Billy Porter must also withdraw from the production. His doctors are confident that he will make a full recovery but have advised him to maintain a restful schedule,” the statement read. He was replaced by alternates in the remaining shows.

According to the 56-year-old actor, his infection was so serious that he had to be put on an Extracorporeal Membrane Oxygenation (ECMO) machine. The ECMO pumps the blood outside of the body, rewarms it, and sends oxygen-rich blood back into the body, which allows the patient’s heart and lungs to heal.

Article continues below advertisement

Billy Porter Says He Was ‘Dead’ For Three Days

Porter’s condition was life-threatening, and there were complications after he was taken off the ECMO machine. His doctors said his leg had compartment syndrome, which happens when there is a buildup of pressure on the muscles. This reduces the flow of blood in the area and can be intensely painful.

Compartment syndrome has numerous causes. The most common include injuries, falls, muscle contusions, and even complications after surgery. As a result, doctors had to “cut open” Porter’s leg while he was comatose to alleviate the pressure on the affected muscles.

“I was dead for three days. I am a miracle. I’m a walking miracle,” Porter shared.

Article continues below advertisement

The Actor Updated Fans In December

In December 2025, Porter updated his fans on his health. “It was not easy. It has been a very, very challenging four months. And I want everybody to know that I am on the road to a full recovery,” he said, adding that he wasn’t there yet, but he was making progress.

Porter also took the time to thank everyone for praying for him and sending him good vibes throughout his ordeal. The actor became emotional, saying that he’s thankful to be alive. He captioned the post, “Proof of life, PTL!!!”

On a lighter note, Porter promoted his holiday movie in the post, writing, “Check out my new film Christmas Karma on Amazon Prime!!!”

Article continues below advertisement

Billy Porter’s Harrowing Experience Changed His Approach To Life

As he recovered from sepsis in the hospital, Porter said in the podcast that he reflected on his life and had three realizations.

The first, he shared, was, “Work smarter, not harder.” The second was, “Be obedient and answer the call.” The third, “Don’t you ever stop telling the truth again.” Porter explained that he instinctively “silenced” himself in fear that he would no longer be an “A-list” celebrity.

Porter is currently focusing on his recovery, but has upcoming projects, including playing the role of Magno Stift in “The Hunger Games: Sunrise on the Reaping,” which is slated for release in late 2026.

Entertainment

30 Greatest Thriller Miniseries of All Time, Ranked

The film world is being taken over by streaming platforms used worldwide, and with it comes a great new addition of miniseries. Great stories that have dynamic plots, fleshed-out characters, and gorgeous scriptwriting are boiled down into just a few episodes for audiences to enjoy all in one go. Without the need for long-term commitment to multiple seasons and episodes, miniseries are targeted for those who need something to binge.

Within the world of miniseries are some of the best works of the thriller genre that TV has to offer. The best limited series streaming right now include some fantastic thrillers from recent years, whether that be thrillers with undertones of horror or drama, they have it all. The best thriller miniseries to binge will keep audiences on the edge of their seats, but not for too long.

30

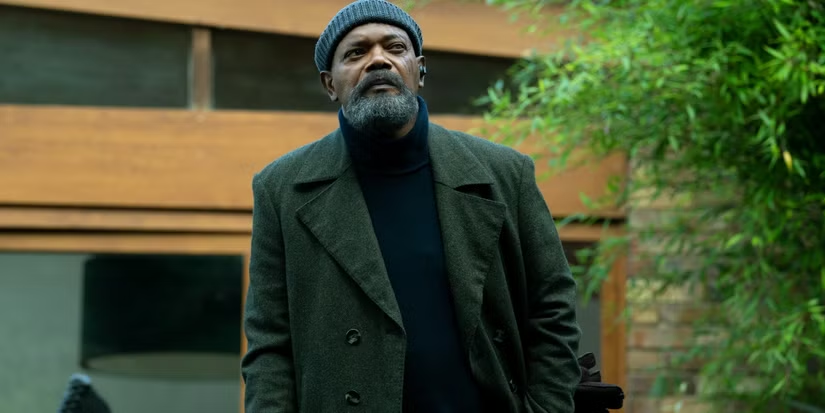

‘Secret Invasion’ (2023)

Shape-shifting Skrulls are hatching a plan to take over the world in the latest Marvel Cinematic Universe series, Secret Invasion. In the miniseries, Nick Fury (Samuel L. Jackson) returns to earth after learning of the potential invasion that could lead to the end of humanity, but his post-Blip version can’t seem to keep up with the barrage of threats.

As a spy thriller series, Secret Invasion does a great job of keeping audiences guessing and building a tense atmosphere. That said, it hasn’t managed to impress fans and critics alike with its dull storytelling, which hasn’t earned it a spot among the best MCU shows released in recent years. Ending not with a bang but a whimper, Secret Invasion won’t appeal much to non-Marvel fans, as even the most hardcore followers of the franchise may find it disappointing.

29

‘The Clearing’ (2023)

The Clearing is a chilling psychological thriller inspired by a true story of a female-led cult. It draws from J.P. Pomare‘s book In The Clearing to tell its tale of a woman who must confront her past to stop a cult from kidnapping more kids in the not-so-distant future.

The Clearing boldly depicts the Australian New Age group known as The Family and explores the kind of long-lasting psychological effects it has on its members. While the pacing may be too slow for some, those who enjoy piecing together an intriguing mystery will find themselves coming back for more. It’s one of the best modern Australian TV shows worth watching today, with the fact that it draws from a real-life cult making it even more gripping.

28

‘Pieces of Her’ (2022)

Based on Karin Slaughter’s novel of the same name, Pieces of Her follows Andrea “Andy” Oliver (Bella Heathcote), a 30-year-old 911 responder, and her mother, Laura (Toni Collette), who get caught in a violent shooting at a local diner, where Laura skillfully eliminates the shooter. As Andy tries to dig deeper into her seemingly simple mother’s actions, Laura’s past begins to come to light, and Andy is forced to escape while piecing together her mother’s dark past.

Pieces of Her shines mostly in Toni Collette’s fascinating performance as a cancer survivor and speech therapist, but who holds a long, dangerous history. Andy’s desperation to seek the truth about her mother is well reflected in Heathcote’s delivery, even if her character falls short in further development. However, the show’s narrative has well-executed, shocking twists that drive enough suspense and drama. Overall, Pieces of Her is a fine enough thriller miniseries to binge. —Maddie P

27

‘Behind Her Eyes’ (2021)

A show that puts the “thrill” in “thriller” features Louise (Simona Brown), a divorced single mother who works as a secretary. One night she meets David (Tom Bateman), a man with whom she begins an affair. It just so happens that he is her new boss in the office. As they fall for each other, fate brings Louise’s path in connection to David’s wife, Adele (Eve Hewson). Louise is faced with many new twists and must find what is hidden behind David and Adele’s relationship.

Within this six-part show based on the eponymous 2017 novel by Sarah Pinborough, viewers’ minds are never at rest. It has you thinking about what the twisted love triangle could be hiding the entire time. With twists and mysteries you won’t see coming, Behind Her Eyes is a prime example of a psychological thriller series at its best.

26

‘The Crowded Room’ (2023)

Set in 1979 and inspired by Daniel Keyes‘ 1981 non-fiction novel The Minds of Billy Milligan, The Crowded Room tells the story of Danny Sullivan (Tom Holland), who is arrested following his alleged role in a New York City shooting. The series depicts his interrogations conducted by Rya Goodwin (Amanda Seyfried), whose questions soon begin to unravel Danny’s mysterious and troubled past.

Holland’s raw and evocative performance makes the Apple TV+ series a must-see for fans of the actor, who stands out in this refreshingly different role. While the miniseries has been criticized for being somewhat repetitive, fans of slower-paced stories and complex character studies mixed with true crime will likely find it worth watching.

25

‘The Cry’ (2018)

The disappearance of a newborn from a small Australian seaside town serves as the starting point for an investigation into the crumbling psychology of a young couple as they cope with an unimaginable catastrophe both in the open eye of the public and behind closed doors.

Nominated for an International Emmy for Best Actress, Jenna Coleman leads The Cry with her character of devastated mother Joanna. Coleman’s portrayal of grief over a lost child is a wonder to behold. As you watch the three-part series adapted from the eponymous 2013 by Helen FitzGerald, you feel pity, hatred, and justice. It’s all cleverly played out in this engrossing show about dealing with grief, with its overarching narrative of the ongoing investigation entertaining any thriller fan.

24

‘Love & Death’ (2023)

Based on the true story of a housewife from Wylie, Texas named Candy Montgomery, Love & Death is a popular miniseries on Max. It portrays Candy’s (played by Elizabeth Olsen) seemingly mundane experiences as a housewife during the 1970s, which soon take a dark turn after an affair with her neighbor becomes deadly.

Much can be said about the stellar casting, suspenseful atmosphere, and well-written lines in the series, but it’s Elizabeth Olsen’s outstanding performance in Love & Death that makes it truly incredible. She somehow breathes humanity into the twisted character, making it impossible to turn away as Candy’s life begins to unravel. The show’s story overall is well-crafted, with Love & Death succeeding in its portrayal of the gruesome case and ensuing media circus.

23

‘The Undoing’ (2020)

The HBO original miniseries reunites creator David E. Kelley and star Nicole Kidman from Big Little Lies, launching another intense mystery psychological thriller. Based on Jean Hanff Korelitz’s novel, You Should Have Known, The Undoing follows Grace Fraser (Kidman), a wealthy New York therapist, whose life is upended when her oncologist husband, Jonathan (Hugh Grant), is accused of a brutal murder. As the investigation proceeds, the family has shocking revelations about Jonathan, unraveling her seemingly perfect life.

The Undoing is a remarkable, contemporary take on a classic whodunnit trope, with strong psychosexual and psychosocial elements in its narrative, which brings out unexpected plot twists. Nicole Kidman and Hugh Grant’s performances are the biggest highlights of the show, with strong supporting performances by Donald Sutherland, Edgar Ramirez, and Noma Dumezweni. Exploring themes of class privilege, deception, and the fragility of trust, The Undoing makes for a gripping mystery drama. —Maddie P

22

‘Ripley’ (2024)

Ripley is a neo-noir odyssey based on Patricia Highsmith‘s gripping novel that explores the psyche and brilliance of a conman. Lured by a shipping magnate’s offer, Tom Ripley (Andrew Scott) embarks on a mission to Italy, tasked with retrieving the magnate’s wayward son. But Ripley’s intentions are far from pure. Captivated by the son’s opulent lifestyle and a mysterious woman named Marge Sherwood (Dakota Fanning), Ripley’s descent into moral ambiguity is as captivating as it is chilling.

Directed and written by Steven Zaillian, the miniseries undoubtedly captures the essence of Highsmith’s novel. Ripley takes its time as it dives deep into the characters’ psychology, building suspense with each written scene. But it’s the stunning black-and-white that takes the experience to the next level, as light and shadow are used to amplify the moral ambiguity around Ripley’s character. It’ll surely leave viewers questioning who, if anyone, can be trusted.

21

‘The Sympathizer’ (2024)

HBO’s new thriller show The Sympathizer offers a unique perspective on the aftermath of the Vietnam War. The story follows The Captain (Hoa Xuande), a half-French, half-Vietnamese communist spy. After years within the South Vietnamese army, the Captain became a refugee in Los Angeles after the fall of Saigon in 1975. While grappling with cultural adjustment alongside his General and fellow refugees, the Captain remains a sleeper agent, relaying information back to his communist handlers.

His relationships with fellow spy Bon (Fred Nguyen Khan) and captivating professor Sofia Mori (Sandra Oh) threaten to expose his carefully constructed world. Praised for its bold storytelling and satirical edge, The Sympathizer offers a fresh take on the legacy of the Vietnam War. The show’s delicate and nuanced portrayal of the Captain’s dual life was also praised, which was further elevated by Xuande’s captivating performance. It’s a thrilling show that acts as a commentary on American perspectives of the war and the Vietnamese refugee experience.

Entertainment

Emma Watson’s Airport Kiss With Billionaire Sets Off Buzz

Emma Watson has sparked a fresh wave of dating rumors after being spotted sharing a kiss with a Mexican billionaire at an airport.

Photos of the moment quickly spread online, fueling curiosity about the actress’s possible new romance.

The sighting didn’t stop there. The pair were later photographed enjoying drinks and dinner together, adding more fuel to speculation that the “Harry Potter” star may be entering a new relationship, one that has already captured global attention.

Article continues below advertisement

Emma Watson Sparks Buzz After Airport Kiss With Gonzalo Hevia Baillères

📸 Emma Watson paparazzée en couple avec Gonzalo Hevia Baillères ! Les deux ont été surpris lors d’un dîner en tête à tête puis en train de s’embrasser à l’aéroport ❤️

Il s’agit d’un homme d’affaires issu de l’une des familles les plus riches du Mexique 💶.

Il appartient à la… pic.twitter.com/GU9YxbufMy— Le Zapp People (@LeZapp_People) March 5, 2026

Emma Watson sent fans into a frenzy after photos surfaced showing her kissing Mexican entrepreneur Gonzalo Hevia Baillères at an airport.

The images quickly made their way across social media, drawing widespread attention to the possible romance.

According to PEOPLE, the pair didn’t just share a brief moment in transit. They were later seen grabbing drinks together before heading out to dinner at an upscale restaurant, suggesting the outing was more than a chance encounter.

Their airport kiss was described as tender, and the photos quickly went viral, turning Gonzalo’s name into a trending topic worldwide.

While neither Watson nor Gonzalo has confirmed the relationship publicly, the growing number of sightings has intensified speculation that the two may be dating.

Article continues below advertisement

Observers noted that the pair appeared comfortable together, which only added to the excitement among fans eager to learn more about the actress’s personal life.

Article continues below advertisement

Watson And Gonzalo Were Spotted Together Before

Although the airport photos are the latest development, the pair had reportedly been seen together months earlier.

According to a report from Quién, Emma Watson and Gonzalo were first spotted spending time together in late 2025 in Courchevel, a luxury ski destination in the French Alps.

After that sighting, they were reportedly seen again in Punta Mita, a scenic peninsula on Mexico’s Pacific coast just north of Puerto Vallarta. The location is known for its luxury resorts and celebrity visitors.

More recently, the duo was also photographed together in several locations around Mexico City, where the viral kiss was captured.

Those repeated public appearances have helped fuel the idea that the connection between Watson and Gonzalo may have been developing quietly for months.

Article continues below advertisement

Emma Watson’s Rumored New Partner Comes From A Powerful Business Dynasty

The man now linked to Watson belongs to one of Mexico’s most influential business families.

Gonzalo is connected to Grupo BAL, a major conglomerate founded by businessman Alberto Baillères.

The business empire has interests across several industries, including mining, insurance, retail, and finance. It is also tied to the well-known department store chain El Palacio de Hierro.

Gonzalo is the son of Gonzalo Hevia and Teresa Baillères and the nephew of Alejandro Baillères, the current chairman of Grupo BAL.

Despite his family background, he has also built his own career in the tech world. He is the founder and CEO of Lok, a startup focused on mobility and logistics that operates smart lockers used for deliveries, returns, and package pickups.

Article continues below advertisement

Before launching Lok in 2021, he founded an artificial intelligence company called INSAITE in 2019, which was later sold to a larger software firm.

Watson’s New Rumored Flame Has A Global Education And Tech Career

Gonzalo’s background also includes an international education at several prestigious schools.

He attended the elite Swiss boarding school Le Rosey before studying at Ransom Everglades School in Miami.

He later returned to Mexico to continue his studies at Colegio Vista Hermosa and Cumbres before earning a degree in economics from the Instituto Tecnológico Autónomo de México (ITAM), one of the country’s most respected universities for business and finance.

In addition to his entrepreneurial work, Gonzalo previously served as a Junior Board Representative at FEMSA between 2015 and 2020.

In the corporate world, he has developed a reputation for emphasizing curiosity, resilience, and quick decision-making.

Article continues below advertisement

Those who have worked with him say he encourages teams that combine intelligence, initiative, and intuition.

Despite being under 30, Emma Watson’s rumored boyfriend is already viewed as an emerging figure in Mexico’s technology and business sectors.

Emma Watson Previously Spoke About The Kind Of Partner She Prefers

While Watson has kept her dating life largely private, she did offer a rare glimpse into her preferences during a previous appearance on Jay Shetty’s “On Purpose” podcast.

During the conversation, the 35-year-old explained that she actually preferred dating people who weren’t overly familiar with her film career.

She said she wanted a partner who could “appreciate my work, but I think knowing you don’t have to navigate that extra degree of, like, weirdness is helpful, a relief.”

Watson also revealed that she enjoyed it when people weren’t deeply focused on her acting history. “Please don’t apologize. That is bliss to me,” she said about those who admit they haven’t seen her films.

Article continues below advertisement

She added that it’s “music to my ears” because it removed the pressure of constantly dealing with the public image attached to her.

Before this current speculation, the Hollywood star was last rumored to be dating Brandon Green, the son of fashion executive Sir Philip Green, in 2022.

Her rumored new partner also has a history in the spotlight. Between 2022 and 2024, Gonzalo was linked to Mexican pop star Belinda.

Their relationship became a topic of public discussion after her 2025 song “Heterocromía,” which fans believed referenced his distinctive feature of having two different colored eyes as well as a romance connected to “old money.”

Entertainment

‘Tracker’ Just Proved the Action Procedural Needs To Change Its Format 3 Seasons In

Editor’s note: The following contains spoilers for Tracker Season 3 Episode 10.With Tracker‘s long-anticipated return in “The Fallout,” the midseason premiere concludes the tale that started a few months ago, before the network hit went on hiatus. The two-parter delves into a complicated conspiracy that involves dirty cops, mafia money, and love-lorn hitmen, all culminating in a climax that Colter Shaw (Justin Hartley) barely gets out of alive. It’s a thrilling change of pace for the popular CBS drama, one that proves the two-part story structure ought to become commonplace.

‘Tracker’ Season 3 Has Proven That Occasional Two-Parters Work Like Gold

After barely surviving the gunshot and car wreck from “Good Trouble,” Colter teams up with Billie Matalon (Sofia Pernas) in “The Fallout” to uncover the truth about those trying to cover up a Tacoma-based task force that went rogue — naturally, the whole thing goes all the way to the top. While Tracker has certainly leaned into the art of the standalone, case-of-the-week style episodes that thrive best on network television (in fact, it’s one of the best things about the show), this two-parter, not unlike the season premiere, proves that the show has the chance to get even better with extended stories like these.

Combined, these two installments equal the runtime of a 90-minute action movie, and that style works wonders on a show like Tracker, which frankly could even lean into the action a bit more. The two-part structure allows viewers to better invest in the show’s supporting characters (especially newcomers) and makes the plot more believable. We see this especially in the case of the two-part Season 3 premiere, which needed a double-feature to unpack the complexity of “The Process” plotline. In truth, it could have easily extended beyond just two episodes.

Famous Small Screen Adaptations — The Collider TV Quiz!

These films went from 16:9 all the way down to 4:3 (proverbially). How many of these movie-to-TV titles do you know?

It’s no secret that some episodes of Tracker can feel like a bit of a stretch at times. When things wrap up so easily without any major consequences, it breaks the immersive experience and risks coming off a bit contrived. Part of that could be that certain plotlines are underdeveloped, so Randy (Chris Lee) has to come in at the eleventh hour to connect the final dots and send Colter to the inevitable showdown. While there are certainly times when this works, relying too much on thin evidence and guesswork could easily become a crutch. However, by extending more episodes into two-part adventures, Tracker can raise the stakes, introduce more complex or recurring characters, and tell more engaging stories that don’t feel like we’re only skimming the surface of their narrative potential. Season 2’s “Ontological Shock” comes to mind, as Colter and Russell’s (Jensen Ackles) investigation into a government conspiracy potentially involving UFOs easily deserved more time to unpack — especially given the government’s ties to their father.

‘Tracker’ Should Deviate From the Typical Standalone Format From Time to Time

Two-part episodes also give the audience more time with fan favorites like Russell Shaw and John Keaton (Brent Sexton). They can rip the audience out of their false sense of network TV security by tossing these characters into more imminent danger, resulting in powerful cliffhangers and dangerous enemies that may hold more personal grudges — no wonder we were worried that Tracker was about to kill off Keaton. While small recurring plotlines like “The Teacher” arc in Season 2 are great ways to thread together narrative interest and tension, straight-up multipart episodes are better because they don’t rely on “end of episode” revelations, but give the characters time to flesh out the latest mystery on-screen.

Of course, we’re not saying that Tracker should solely rely on the two-part formula. Again, one of the best things about the show is that it isn’t heavily serialized. In many ways, it’s a time capsule of what episodic network television could be, and as the show keeps getting better, it only further encourages us that the standalone (or “filler”) episode may not be a lost art the way many of us feared. But if Season 3 has proven anything so far, it’s that this show has the ability to dive into these more detailed stories and pay them off in earnest (in some ways, echoing the more detailed nature of the books themselves). In the end, extending episodes to two (or even three if Tracker were bold enough) parts without serializing the production at large is a great way to push the boundaries of network television. That’s something we can certainly get behind.

Tracker airs Sundays on CBS and is available the next day for streaming on Paramount+.

Entertainment

Netflix’s 4-Part WWII Miniseries Features One of Mark Ruffalo’s Greatest Roles Ever

It’s not always the case that a great novel is easily adapted to the screen, as certain stories have components that simply work better on the page than they do when visualized. Considering that the novel that it was based on won the Pulitzer Prize for literature, All the Light We Cannot See was a highly-anticipated adaptation about a powerful World War II story that examined the importance of memory, art, and resistance. Although it looks beautiful and features a tremendous score by James Newton Howard, the Netflix adaptation of All the Light We Cannot See was ultimately a disappointment, as director Shawn Levy didn’t feel like the right choice to tell such a thorny, weighty story that deals with such an ugly period in history. It’s an adaptation that’s worth watching because of the ambition involved, but it’s especially because of the amazing performance by Mark Ruffalo that makes the series far more emotionally and powerful than it would’ve been with another actor in the role.

Set during the height of World War II, All the Light We Cannot See stars Ruffalo as Daniel LeBlanc, a locksmith at the National Museum of History in Paris who, unbeknownst to his daughter Marie-Laure (Aria Mia Loberti), is secretly working with the resistance to smuggle valuable artifacts so that they are not intercepted by the Nazis. The story is told in a bifurcated manner; while half of the series follows Marie-Laure when she forms a connection with the German officer Werner Pfennig (Louis Hofmann), the more compelling part of the show follows Daniel’s attempts to avoid persecution as the military invasion of France becomes more violent. Even if they’re separated for a majority of the series, the connection between Marie-Laure and her father is the most powerful aspect of All the Light We Cannot See.

Mark Ruffalo Is the Best Part of ‘All the Light We Cannot See’

All the Light We Cannot See earned praise for casting a blind actress in the role of Marie-Laure, which was both an important piece of representation and the best way to make the performance feel authentic. All the Light We Cannot See would only work as a spotlight for Loberti if there was an equally gracious actor in the role of her father, and Ruffalo has always had a talent for playing key supporting roles without detracting from his co-stars. While Daniel is an admirer of art, often thought to be a visual medium, the efforts he takes to find ways for Marie-Laure to share his passion are truly heartwarming and incredibly tender.

“Welcome to gay politics.”

Even though All the Light We Cannot See takes place during a monumental world event that shook the landscape of European politics, Ruffalo was able to highlight an understated side of heroism revolving around the preservation of cultural history. The desire to ensure that the treasures of the past are not corrupted is not a result of materialism, but a desire to ensure that a people’s history can be remembered in their own words by its artists. Daniel is not someone of high stature within the museum, but the responsibility that he puts on his shoulders is tremendous. At the same time, Ruffalo shows how Daniel justifies the sacrifice he is willing to make; even if it means never seeing his daughter again, Daniel wants to embark on a mission that will ensure the sanctity of the nation’s future, which he hopes Marie-Laure will be able to grow up peacefully within.

‘All the Light We Cannot See’ Works Best as a Father-Daughter Story

The detracting aspects of All the Light We Cannot See come down to Levy’s direction, which tends to be a bit too overly sentimental. However, Ruffalo is able to bring the appropriate grittiness to Daniel’s survival mission, particularly when he is abducted and questioned by the sadistic SS officer Reinhold von Rumpel (Lars Eidinger). Eidinger gives a terrifying performance as a villain who lacks all sense of empathy, and Ruffalo conveys a sense of genuine fear that helps to make the series feel less idealized. Even if Daniel has not given up his conviction that what he is doing is right, that doesn’t make it any less horrifying for a civilian to face the rage of a cruel fascist who would strip his dignity away just for the sick pleasure of feeling empowered.

Levy may be a director who literalizes story components that are best left unspoken, but the notion that Marie-Laure has come to adopt her father’s perspective is well-realized thanks to the strength of both performances. It’s within Marie-Laure’s search for the mysterious “Sea of Flames” that she discovers the same drive that her father has, which leads her to begin mirroring his behavior. The connection is so strong that Daniel’s sacrifice, while tragic, isn’t entirely depressing because his spirit lived on within his daughter. While a great actor can always deliver when the material is there to support them, Ruffalo is the type of special performer who can elevate whatever he is in to be even greater quality.

Entertainment

Jessica Simpson Keeping $17M Mansion After Eric Johnson Moves Out Amid Split

Jessica Simpson

Keeping $17M Mansion After Eric Johnson Moves Out

Published

Jessica Simpson has decided to keep her $17 million mansion after estranged husband Eric Johnson moved out of the home they shared during their marriage, TMZ has learned.

Sources familiar with the situation tell TMZ, Eric got his own home not too far from Jessica’s 6-bedroom, 10-bathroom, 10,000-square-foot L.A.-area mansion worth $17 million.

BACKGRID

We’re told the “Take My Breath Away” singer recently took her home off the market after attempting to sell it for more than a year.

Jessica purchased the home — previously owned by Ozzy and Sharon Osbourne — for $11.5 million in 2013. She listed the home for sale in 2023 for $22 million. She removed the listing before putting it back on the market for $17.9 million in January, only to remove it once again.

Sources tell TMZ that Jessica isn’t alone in the home, and her 3 children are there when not spending time with their dad.

We’re told Jessica is single and not dating at the moment. The singer is focused on her kids and work for the time being.

Entertainment

Traitors’ Rob Rausch Gives Maura Higgins a Birkin Bag

All is forgiven? Rob Rausch has officially made amends for betraying Maura Higgins in the Traitors season 4 finale by presenting her with a Birkin handbag.

“This is my win,” Maura, 35, boasted as Rob, 27, handed her the ultra-pricey handbag on Watch What Happens Live With Andy Cohen on Wednesday, March 4. “I knew I’d have my moment.”

Maura confirmed that Rob was well aware of the specific Birkin bag she wanted so she was delighted as her Traitors costar personally delivered the burgundy fashion accessory. Rob followed protocol by wearing gloves to ensure that Higgins was the first person to touch the handbag.

After sharing a big hug with Rob, Maura assured him, “You’re forgiven!”

The pair gave a special shoutout to Traitors costar Lisa Rinna for helping to connect Rausch with Birkin designer Hermès.

“[Lisa] helped majorly, majorly,” he confirmed to host Andy Cohen, with Maura chiming in, “Lisa, thank you very much for this!”

Elsewhere in the interview, Andy and Rob both supported Maura when she opened up about the harsh reactions she’d received over the Traitors finale. (Rob betrayed Maura in the season 4 finale by revealing he was a traitor and thus stole the grand prize from her.)

“People online were saying she’s so dumb,” Maura recalled. “They’re like, ‘He’s an obvious traitor!’ Well, then wouldn’t all of the Faithful have voted for him? No one voted for him.”

Maura Higgins receives her Birkin handbag Courtesy Bravo/YouTube

Maura exclusively revealed to Us Weekly that she felt no hard feelings toward Rob since he’d offered to make things right with a special gift.

“He told me he’s going to get me a gift, which is going to be a Birkin handbag. So when he gets that, then he’s fully forgiven,” Maura told Us in February. “For me, a girl that has not watched Traitors, not one episode of Traitors, I got to the finale, and yeah, I didn’t win, but I got to wear all my outfits. And if I get that Birkin handbag from Rob, then for me, I have won. That’s all I need.”

Elsewhere, Maura and Rob shut down speculation that they were dating after Andy, 57, asked about their “undeniable chemistry” during the Traitors season 4 reunion.

“A lot of people in the whole castle were saying it to us … We were genuinely just friends. That is the truth,” Maura insisted.

Rob agreed, adding, “We never did anything.”

The Traitors season 4 winner differed slightly when Maura went so far as to tell Andy that she never “had a flirt” with Rob at Ardross Castle.

“I feel like we probably flirted a little bit,” he teased.

Maura later admitted to Us in a Traitors season 4 cover story that she hated to let down viewers who wanted to see her get together with Rob.

Maura Higgins, with her Birkin handbag, and Rob Rausch Courtesy Bravo/YouTube

“I’m not gonna ruin it for the viewers, but no, nothing ever happened between me and Rob,” she told Us. “I genuinely look at Rob like a brother. Literally nothing ever happened.”

Rob has confirmed that he has been dating someone for a few months but is keeping his girlfriend’s identity private for now.

The Traitors season 4 is available to watch on Peacock anytime.

Entertainment

In Just 4 Days, Netflix’s Greatest Weekend Binge Series Raked in a Colossal 5.6M Viewers

By now, it’s no surprise that Bridgerton is one of Netflix’s most successful original series. Seasons 1 and 3, for example, are among the streaming giant’s 10 most-watched shows of all-time. So, perhaps unsurprisingly, the much talked-about Season 4 of the series is following suit.

Bridgerton‘s Season 4 of the series, which was released in two parts with Part 1 on January 29, 2026, and Part 2 on February 26, 2026, is seeing impressive viewership numbers. So much so that when Part 1 was released, the series quickly rose to the #1 spot worldwide, a position it’s once again snagged since the release of Part 2, per FlixPatrol. From the numbers alone, it’s safe to say Season 4 is giving the past seasons some tough competition.

‘Bridgerton’ Season 4 Racking Up Major Numbers

Season 4 of Bridgerton has been so successful that Part 2 of the series broke the viewership number set by Part 1. According to Samba TV and Broadsheet, Netflix saw 5.6 million households watching Episode 5 of the series in the first four days it was available. As a comparison, that’s an 11% increase from the viewership tuning in to Season 4, Episode 1 back in January. In other words, while fans were eager to watch the beginning of Season 4, even more of them couldn’t wait to see how the story continued in Episodes 5 to 8.

Per Tudum, the season so far has received 28 million views. The number combines both Part 1 and Part 2 of the series, meaning a viewership total for Season 4 Part 2 alone isn’t available. Season 3, for instance, which is #9 in Netflix’s most-watched shows of all time, was seen by a whopping 106 million viewers in the first 91 days since its release. So, while 28 million is still far behind it, Part 2 has only just reached the platform. Many million views will surely be added to the equation.

‘Bridgerton’ Season 4 Is Being Ripped Apart by Audiences on Rotten Tomatoes

Meanwhile, the critic score continues to climb.

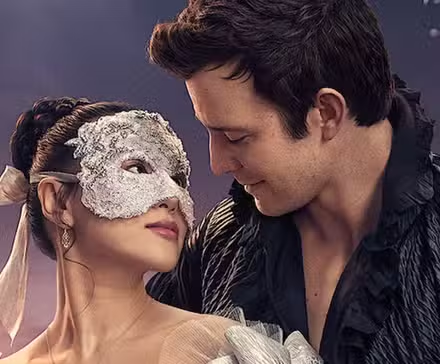

What Is ‘Bridgerton’ Season 4 About?

Season 4 of Bridgerton follows the second-eldest son of the Bridgerton clan, Benedict (Luke Thompson), on his journey to find “The One.” The story kicks off when he falls head over heels for a masked woman in silver at a masquerade ball, and seemingly leaves his non-committal, rebellious days behind him just to find her. While searching, he sparks a connection with a sweet and fascinating maid named Sophie Beak (Yerin Ha) and their connection is undeniable. Can their love go beyond the societal expectations of the time? Will the Bridgertons accept Sophie as their own?

Like any season of Bridgerton, Season 4 of the series has continued to be a hit for Netflix. With over 28 million views so far, and viewers dropping everything to see Part 2 when it was released, it’s safe to say Season 4 of the series has kept the series’ magic. With a steamy romance, a gorgeous period setting and even societal commentary this time around, Season 4 has everything to potentially break into Netflix’s Top 10 of all-time.

Every Major ‘Bridgerton’ Couple, Ranked

How does Benophie compare to the other iconic ‘Bridgerton’ pairings?

- Release Date

-

December 22, 2020

- Network

-

Netflix

- Directors

-

Tom Verica, Tricia Brock, Alex Pillai, Alrick Riley, Bille Woodruff, Cheryl Dunye, Sheree Folkson, Julie Anne Robinson

- Writers

-

Abby McDonald, Sarah L. Thompson, Daniel Robinson, Oliver Goldstick, Leila Cohan-Miccio, Azia Squire, Sarah Dollard, Eli Wilson Pelton, Janet Lin

-

Luke Thompson

Lady Violet Bridgerton

-

Ruth Gemmell

Benedict Bridgerton

Entertainment

2025’s Most Breathtaking Sci-Fi Is an Instant Cult Classic That’s Finally Available to Stream

2025 was a big year for animated movies, with Disney’s Zootopia 2 breaking box office records, Pixar’s Elio winning audiences’ hearts, and Netflix’s KPop Demon Hunters becoming a worldwide phenomenon. Amid this high-profile competition, however, stood an independently made French film that managed to top them all in terms of cinematic brilliance.Filled with memorable characters, fantastic animation, and a story that brings many elements together effortlessly, Arco is a rare discovery in the animation genre, offering something genuinely new for audiences to enjoy.

This French Oscar Hopeful Takes Us to Another World

Produced by Oscar-winner Natalie Portman, the title refers to ten-year-old Arco, a boy living in 2932, where humanity has learned to time-travel. Prohibited from traveling himself before he is twelve, he steals his sister’s time-traveling cape and magic gemstone to travel back to the time of the dinosaurs, but instead crashes into the year 2075, where he befriends a young girl named Iris. Determined to get Arco home, the pair (along with Iris’ robot nanny, Mikki) learn that they may be the only ones who can save the Earth from peril.

The 20 Best Animated Movies of the 2020s So Far, Ranked

2020 has already had some amazing animated movies.

Movies about the future often speak to the anxieties of the present, but the language of Arco is one of hope. Our hero’s idyllic timeline and his insistence that Iris’ future isn’t written yet, deliver a message that our fate is in our hands, that is written by the choices we make in the present. It’s a story that views the world with the wonder of a child, never losing sight of the beauty of friendship and discovery.

Animation That’s Both Spectacular and Moving

The film has been compared to the work of Hayao Miyazaki, not only due to its wonder-filled, colorful aesthetic, but also its ability to weave whimsy with reality. Many animated films aim for either visual ambition or intimate, character-based storytelling, but it’s a rare film that combines them both.

Both Arco and Iris live in extraordinary times – the former in a brightly colored, aspirational timeline filled with adventure and otherworldly architecture; the latter in a world not dissimilar to our own, but with fantastical elements such as robot nannies and holograms. The hand-drawn animation balances past and present, feeling nostalgic in a genre where computers dominate, but also offering design that looks cutting-edge.

These flourishes are not just for show, however, as the beauty of the visuals serves to highlight the journey of the characters, and vice versa. Arco crash-lands, leaving a trail that resembles a rainbow, which Iris follows to find her new friend. This colorful introduction outlines the story’s intentions, offering hope and adventure as we come along for the ride.

‘Arco’ Truly is a Family Movie for Everyone

In previous generations, a family movie would often aim squarely for younger viewers, but Arco is a prime example of how the medium has moved on. From the early 2000s, studios such as Pixar, Dreamworks, and Studio Ghibli all began making movies that entertained the kids, but had something for the accompanying adults. Arco represents the next step in that evolution, where films can meet people of all ages on an emotional level.

The story speaks to a deeper message about the environment, family, and responsibility, something that will be clear to children without losing their attention, as well as grasping adults who can read into the greater subtext. Better still, it can tap into that sense of fascination that children have, and adults remember, allowing everyone to gasp at what is unfolding.

What ultimately comes across to all generations is how sincere the film feels at its core. Long after the plot resolves, the film’s spirit continues to resonate, offering a rare blend of optimism and artistry that feels both refreshing and necessary. It can spark conversations between younger and older viewers that wouldn’t happen in a less thoughtful movie.

Arco is a testament to what can happen when creativity is allowed to flourish without compromise. Rather than leaning on nostalgia or formula, Ugo Bienvenu’s film charts its own path, inviting viewers to embrace curiosity and courage in equal measure. In a year filled with impressive releases, Arco earns its place by reminding us why animated storytelling remains one of cinema’s most powerful forms, regardless of budget.Arco is available to rent or buy on VOD services.

- Release Date

-

October 22, 2025

- Runtime

-

88 minutes

- Director

-

Ugo Bienvenu

- Writers

-

Félix de Givry

- Producers

-

Natalie Portman, Sophie Mas, Elliott Whitton, Bill Way, Douglas Choi

-

Alma Jodorowsky

Jeanne / Mikki (voice)

-

Swann Arlaud

Tom / Mikki (voice)

-

Politics7 days ago

Politics7 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics2 days ago

Politics2 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech4 days ago

Tech4 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports5 days ago

The Vikings Need a Duck

-

NewsBeat5 days ago

NewsBeat5 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

Tech8 hours ago

Tech8 hours agoBitwarden adds support for passkey login on Windows 11

-

Entertainment3 days ago

Entertainment3 days agoBaby Gear Guide: Strollers, Car Seats

-

Tech6 days ago

Tech6 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Business7 days ago

Business7 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat4 days ago

NewsBeat4 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat3 days ago

NewsBeat3 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Crypto World7 days ago

Crypto World7 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

Tech4 days ago

Tech4 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Business7 days ago

Business7 days agoWorld Economic Forum boss Borge Brende quits after review of Jeffrey Epstein links

-

Video3 days ago

Video3 days agoHow to Build Finance Dashboards With AI in Minutes