Entertainment

Jennifer Lopez, David Guetta Drop New Song Save Me Tonight

Let’s get loud!

Jennifer Lopez finally released her new song with David Guetta, “Save Me Tonight,” on Friday, March 6, exactly nine months after she debuted it during a live concert.

The EDM track marks the first-ever collaboration between Lopez, 56, and Guetta, 58, showcasing her soaring vocals over his dance floor-ready production.

“Don’t know if it lasts forever / But it’s now or never / You could save me tonight,” she belts. “Don’t know where your touch could take me / But it feels like maybe / You could save me tonight.”

Lopez and Guetta also dropped a video of her performing the high-energy tune in a sparkling silver bodysuit and matching knee-high boots.

Jennifer Lopez and David Guetta Warner Records

The “On the Floor” singer first teased “Save Me Tonight” during her headlining set at the World Pride Music Festival in Washington, D.C., in June 2025. Since then, it has been a staple on her setlist for her Up All Night tour in Europe and Asia last summer as well as her Las Vegas residency The JLo Show, which launched in December.

Lopez is set to kick off the next leg of her concerts at The Colosseum inside Caesars Palace on Friday night. Her performance of “Save Me Tonight” will be simulcast live on her TikTok, Instagram and YouTube pages to celebrate its release.

“Save Me Tonight” is one of six new songs that the Grammy nominee debuted at a top-secret listening party for fans in Los Angeles in July 2025. Us Weekly exclusively reported at the time that she also played “Up All Night,” “Regular,” “Free,” “Wreckage of You” and “Birthday,” the latter of which she released on streaming services later that month.

“She feels very free right now,” attendee Edgardo Luis Rivera explained to Us at the time, “and on this summer tour, she wants to perform some new material that she’s been working on because a lot of these new songs express how she feels.”

Guetta has also had a massive year. In December, he became the only artist in Billboard history to have 20 career No. 1s on the Dance/Mix Show Airplay chart.

Like Lopez, the DJ is in the midst of his own Vegas residency, with shows at both LIV Nightclub and LIV Beach at the Fontainebleau scheduled to resume in April before he heads to Europe this summer.

In addition, Guetta recently became a father of four. He announced on February 26 that his girlfriend, Jessica Ledon, gave birth to a baby named Skyler, joining their 2-year-old son, Cyan. The producer is also the father of son Tim Elvis, 22, and daughter Angie, 18, with his ex-wife, Cathy Lobé.

Entertainment

Bold and the Beautiful TWIST: Sheila Crushed by Taylor’s Ultimate Friendship Betrayal!

Bold and the Beautiful has Sheila Carter (Kimberlin Brown) convinced Taylor Hayes (Rebecca Budig) is responsible for Deacon Sharpe (Sean Kanan) being such a wonderful and passionate husband to her again. But when the truth comes out about Taylor and Deacon, I think Sheila’s reaction will stun everyone.

Everybody expects rage and danger but we may instead get devastation, sadness and tears instead. It’s Belinda from Soap Dirt and we’re going to talk about how Taylor’s cheating betrayal might hit Sheila harder than Deacon’s betrayal.

Bold and the Beautiful: Sheila’s Undying Gratitude for Taylor

So, this week, we had Sheila up at Taylor’s office with a box full of stomach-turning toe cookies to thank her for talking to Deacon. And then Sheila dropped an incredible amount of TMI as she thanks Taylor for telling Deacon to get back in her bed and be a real husband.

He absolutely rocked Sheila’s world, blew her mind and was more passionate than ever. She said it was like Deacon was making love to her for the first time and it’s all because of Taylor. And then Sheila insisted Taylor’s the reason her marriage to Deacon is so wonderful right now.

I mean technically, Taylor is 100% responsible for Deacon’s amazing bedroom performance that wowed Sheila. But it’s also skeevy that Taylor knew Deacon was thinking about her the whole time. Of course, Sheila doesn’t know that and begged Taylor to keep seeing Deacon.

Sheila Trusts Taylor Completely and Considers Her a Friend on Bold

And when Taylor tried to say that she couldn’t see Deacon anymore because he’d graduated therapy, Sheila wasn’t having it. It’s like she’s afraid that if Deacon stops seeing Taylor, then Sheila thinks the progress in their marriage will stop—which makes sense.

She also told Taylor she would like to think they’re friends and hopes they’ve gotten past all the horrible things Sheila has done in the past. She thinks Taylor is amazing, I mean, let’s be real, Sheila has Taylor up on a pedestal as much as Deacon does.

And when Sheila hugged Taylor and said it feels like they’re all in this marriage together, that was absolutely accurate although Sheila doesn’t yet know that is literally true. And then she talked about wanting to see her grandson and wanting to belong, writers doing overtime on her angst.

Bottom line is that Sheila really likes Taylor, cares about her and trusts her in every way. Sheila is genuinely thankful for Taylor. It seems Sheila really believes she’s changed and is a different person and it’s clear Brad Bell’s working hard to set up a pity party for Sheila.

Brad’s writing it so psycho Sheila, the woman who shot her own son Finn (Tanner Novlan) and his wife Steffy Forrester (Jacqueline MacInnes Wood) and left them for dead, is a victim. I mean if you didn’t know her history, you’d feel kind of bad for her.

Has Sheila Really Changed or Is the Old Villain Still Lurking on B&B?

But there are two sides to the Sheila thing—yes people can change, like I truly think Deacon did. But also, it’s hard to think that at her core, after decades of evil-doing that Sheila really has changed.

She still seems volatile, like a flip could switch at any moment and she’d be dark and dangerous again. Like when she told Deke Sharpe (Harrison Cone) she’d just kill him then was like ha, ha just kidding. I definitely think that’s a red flag that the old Sheila is still in there and maybe not too far beneath the surface.

I mean, to be fair, she did save Taylor from falling off the roof of the hospital a few years back, so maybe in Sheila’s mind that makes up for her shooting Taylor and her being presumed dead many years ago.

Maybe Sheila thinks that makes them even. But she also shot Taylor’s daughter Steffy. Then again, Sheila turned around and saved Steffy from being shot by Luna Nozawa (Lisa Yamada). So, again, maybe in Sheila’s mind, that balances their books.

Taylor’s Betrayal Will Cut Deeper Than Deacon’s

So, right now, Brad Bell and his writers are putting Sheila in the position of the victim because what Deacon and Taylor are doing is wrong. There’s no denying that. So, what I’ve been thinking about is that I think Sheila’s actually going to be harder hit by Taylor’s betrayal than she is by Deacon’s.

You know, men put their pepperonis in other ovens when they shouldn’t. That’s always possible. But for Taylor to betray Sheila? That’s going to be a knife to the gut. She really thinks that Taylor is her trusted best friend.

I think Sheila’s going to be absolutely crushed, devastated, and in tears when the truth comes out. Now, this could wind up with her so hurt by Taylor that she goes stark raving mad. Sheila may snap and revert to her villainous ways. Or she could crumble into a whole pile of sadness.

In a recent interview, Kimberlin Brown said that when Sheila finds out, it’s going to be big. I can see her being mad at Deacon, definitely. But I think it’ll hit Sheila a different way with Taylor. I think it will be soul-crushing and at first, Sheila may just have a tear-filled breakdown.

Will Sheila Snap and Unleash Her Inner Villain Again?

But once she dries her tears, the pain of Taylor betraying her could push Sheila over the edge and unleash the villainess in her once again. But if she goes after Taylor, first, I think Deacon would protect the woman he loves—Taylor.

And I think if Sheila flips that switch back to psycho, it may be triggered more by Taylor than Deacon himself. I think Sheila will be absolutely heartbroken that Taylor could do something so awful to her.

I think Sheila would be more upset about being hurt by Taylor than by the possibility of losing Deacon. We’ll see what happens. But it’s going to be explosive when Taylor and Deacon’s love for each other is exposed.

We’re still waiting to see that Bold and the Beautiful spoiler about a couple making love for the first time happen. Because I feel pretty strongly that it’ll be Taylor and Deacon giving into their passion and getting intimate.

And from there, it’s a ticking time bomb until Sheila finds out, freaks out, and is stunned at the extent of betrayal from Deacon and Taylor, the woman she considers her closest friend. The fallout’s going to be epic and I’m definitely here for it.

Entertainment

Young and the Restless Next Week: Jack Reconnects with Former Flame & Matt’s Threatening Comeback

Young and the Restless spoilers for next week talk about Jack Abbott’s (Peter Bergman) shocking blast from the past that ends in a kiss. And Matt Clark’s (Roger Howarth) dangerous return looms large.

We’ve got the latest Y&R spoilers for the week of March 9th where we’ll see Diane Jenkins (Susan Walters) and Kyle Abbott (Michael Mealor) chasing a lead. And Sienna Bacall (Tamara Braun) shocking Sharon Newman (Sharon Case) and Nick Newman (Joshua Morrow).

Young and the Restless: Diane Jenkins & Kyle Abbott Desperate to Find Jack

Ok so, let’s start with Diane and Kyle and what’s going on with Jack. At the end of this week, Diane and Kyle headed over to Billy Abbott (Jason Thompson) and Sally Spectra’s (Courtney Hope) place to strategize. They’re trying to retrace Jack’s steps and figure out when he was taken. And how to bring him home.

Diane’s terrified to think that Victor Newman (Eric Braeden) really has Jack. But Kyle wonders if Victor might be playing them. And Billy says this definitely wouldn’t be the first time Victor’s done something like that. Billy wants to talk to Nikki Newman (Melody Thomas Scott) because Billy says she won’t be okay with Victor kidnapping Jack.

But I agree with Diane who says that Nikki will just make excuses and enable what Victor did. Bottom line, is that Diane and Kyle just want Billy to go ahead and give Chancellor back to Victor. And put an end to this.

Sally prods Billy to admit he doesn’t technically own Chancellor yet, Phyllis Summers (Michelle Stafford) still does. Then they argue and Diane’s worried that Phyllis wouldn’t actually help. And might just let Jack pay the ultimate price.

Diane thinks Nikki and Phyllis won’t help and she, Kyle and Billy need to find Jack themselves. But Kyle and Billy think they might be able to convince Phyllis to help them—but they need to do it fast.

Kyle and Diane Chase a Lead to Find Jack Abbott

While Billy heads over to work on Phyllis, we have Diane admitting to Kyle that she will go beg Nikki if she can help them get Jack back. Diane’s frantic. And worried Jack being in danger, but Kyle thinks his uncle Billy will get through to Phyllis.

So in next week Young and the Restless spoilers, we’ve got lots of Jack action coming. First, we have Billy back over at the Abbott mansion telling Kyle and Diane that this could be a wild goose chase. But Kyle says it could also be the lead they need to find his dad Jack.

And then Diane says it’s the only lead they have so they have to follow i. And hope for the best. Meanwhile, I was so excited that I was right thinking that crazy Patty Williams (Stacy Haiduk) is back to Y&R for the kidnapping storyline—working with Victor yet again it seems.

Patty Williams Returns to Babysit Jack on Victor’s Yacht on Y&R

So, at the end of this week, Jack woke up groggy on the yacht—so it’s clear he was drugged so Victor’s thugs could kidnap him. Jack’s banging on the door and calling for help. And decides he may be on Lake Michigan but needs to see the shoreline to figure out where he is.

Jack wonders if Victor is behind this—but I mean come on—who else would kidnap him and stick Jack on a yacht. He’s wondering if Victor cooked this up because of something to do with Billy. And rather than being worried about his safety, Jack hopes that Billy doesn’t let Victor win.

And that’s when the door opened and Jack’s jaw dropped. As we suspected, there stood crazy Patty Williams who said nice to see you too Jack. This is a woman that Victor’s used more than once as a tool to target Jack.

So in next week Young and the Restless spoilers, Jack is, of course, still stuck on the yacht where Victor has him trapped with Patty there to babysit. And possibly torment him. So, Jack’s trying to work her and wants a favor.

Jack Agrees to Kiss Patty for a Favor

I’m guessing it’s for Patty to let him out of the stateroom so he can look for a way to get away. But she asks Jack what she’ll get if she does him this giant favor. So, he asks Patty what she wants and what she wants from Jack is a kiss.

Then, he tells Patty that if she shows him around the yacht, Jack will give her a kiss. Now, I’m pretty sure that Patty knows he’s married to Diane. And Jack was cheating on Patty with Diane back when they were married. Jack even slept with Diane on Patty and Jack’s wedding day.

So, I’d be really surprised if Patty settles for just a kiss. She may want Jack in bed with her to rub it in Diane’s face. And if it goes anything like the last time Victor kidnapped Jack, he might’ve provided Patty with drugs she can use to force Jack to do anything she wants.

Holden Makes a Deal with Audra to Seduce Kyle on Young and the Restless

Also, next week on Y&R, we’ll get more on Holden Novak’s (Nathan Owens) brand new deal he just cut with Audra Charles (Zuleyka Silver). While Holden acted gracious when Claire Grace Newman (Hayley Erin) called things off with him, clearly Holden’s not going to let it go and he wants Claire away from Kyle and back to him.

He asked Audra to seduce Kyle so it’ll end things with Claire and Kyle. But Audra just swore to a truce and she’s worried Claire might choke her again. Audra claims she doesn’t care about Kyle but Holden makes it into a challenge to make Audra want to be the winner and beat Kyle.

In the end, despite Holden obviously doing this to get Claire back for himself, but Holden said that if she has Kyle at her side, she’d be a real power player since he’s an Abbott. Surely, this will end in disaster but I can’t wait to see Audra tempting Kyle while Claire stews about it.

Sienna Takes Steps to Stop Matt Clark on Y&R

Then, next week on Young and the Restless, we’re getting close to having Matt Clark pop his awful head up out from under the rock where he crawled when he was released from police custody. And we also have Sienna back to Genoa City determined to make a go of it with Noah Newman (Lucas Adams).

But Matt’s an ongoing threat to a lot of people. So, Sienna tells Sharon and Nick that she wanted to repay them for getting her out of a dangerous situation with Matt, so Sienna says she owes them and takes some steps to try and stop Matt once and for all.

Make sure to catch our full weekly spoilers video tomorrow, for the week of March 9th-13th plus our weekly predictions and lots more.

Entertainment

Man Killed Blind Girlfriend in Motel, Lived With Body

A man in Michigan is facing several years in prison after he was arrested for killing his visually impaired girlfriend at a motel and living with her dead body for several days.

Daniel J. Varnes pleaded no contest during a court hearing on Tuesday, March 3, to one count each of second-degree murder, torture and concealing a death in the death of his girlfriend, Teressa M. Johnson, according to Law & Crime.

Varnes, 47, has reached a deal with prosecutors and agreed to serve 32 years in a state correctional facility for the crime.

Johnson was found mutilated at the Rodeway Inn and Suites in Saginaw, Michigan, in the early hours of September 1, 2024.

Her body was discovered by a drug dealer who met with Varnes at a nearby gas station to sell him crack, according to MLive. Varnes reportedly took the drugs and ran away without paying the dealer, so the dealer called Varnes and he was told to come to his motel room.

Once the drug dealer got to the motel, he saw a human body on the bed that was covered with a blanket. He said that Varnes tried to explain why he stole the drugs as he gestured toward the bed and said he had “this situation going on.”

The dealer then asked Varnes what was beneath the covers, and he reportedly responded, “You know exactly what that is,” according to MLive.

The drug dealer said that Varnes then removed the blanket and revealed Johnson’s body, which the dealer said appeared to have been dead for several days.

Varnes reportedly claimed that Johnson died from injuries she sustained when she was visiting friends days earlier. After Varnes noted that no one knew her body was at the motel with him, he reportedly told the drug dealer that it would be easy to get rid of her body.

After the dealer left the room, he called 911 to report the body. Police arrived soon after and Varnes fled the motel on foot. However, authorities managed to locate him in a nearby wooded area later that day around 4 p.m.

Varnes then spoke to detectives and “admitted to committing several acts of brutality” against Johnson, according to WJRT. He reportedly admitted to beating the woman with his fists and other objects, as well as using needle-nose pliers on her mouth “to shut her up.”

“He had said at one point that he ‘beat the s**t out of her,’” a detective reportedly testified, per the outlet. “At one point in the conversation, he said he hit her at least 10 times.”

Police recovered scissors, a ratchet, side cutters, screwdrivers and pliers from the motel room, which all reportedly tested positive for Johnson’s blood.

An autopsy also determined that Johnson’s cause of death was “multiple traumatic injuries, recent and remote with related complications,” according to the outlet.

It is not clear if Varnes had a motive while committing the crime.

Varnes is scheduled to return to court for his sentencing hearing on April 13.

Entertainment

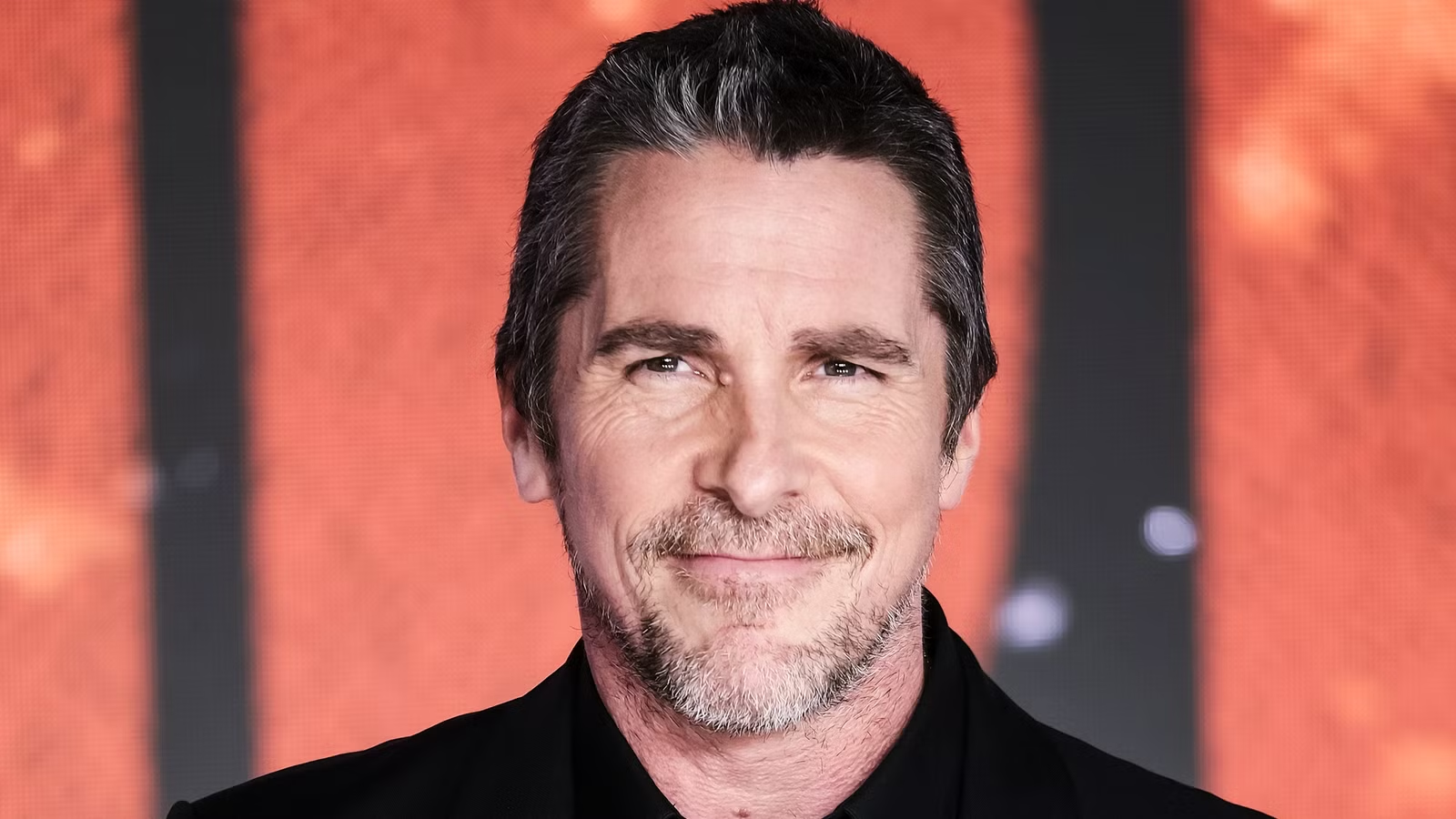

Jessie Buckley and Christian Bale break down their extensive transformations for “The Bride”

:max_bytes(150000):strip_icc():format(jpeg)/jessie-buckley-christian-bale-the-bride-030426-6014a698b933475592f41427952408e3.jpg)

The actors also reveal the artists and actors who inspired their performances in Maggie Gyllenhaal’s genre-bending monster movie.

Entertainment

‘Pawn Stars’ Rick Harrison Disputes Corey Harrison Medical Bills Claims

‘Pawn Stars’ Rick Harrison

Pushes Back At Corey Over Hospital Bills

Published

Rick Harrison is pushing back at claims made by his son Corey about his six-figure medical bills following Corey’s motorcycle accident and complications that followed … saying he covered the bills and Corey isn’t in debt to him.

The “Pawn Stars” star tells TMZ … “As far as I know, I paid all of Corey’s medical bills long before he put the GoFundMe out. He is a grown man in his 40’s and is responsible for how he handles his finances.”

As we reported … a GoFundMe was launched to help Corey cover outstanding medical bills, rent, medications and therapy — and to pay back money he said he borrowed from Rick and friends who helped foot the hospital costs.

But, Rick’s statement contradicts what Corey previously told us … that his dad paid “at least half” of his medical bills, which came as a loan, and he was dead set on paying him back.

Corey also said he drained his savings on the treatment and surgeries following his crash and now has just $400 left in his bank account.

However, Rick tells us … “It’s always nice to be paid back, but there is no repayment schedule in place.”

Corey isn’t convinced the debt has magically disappeared, telling TMZ … “If he decided I don’t have to pay him back the money, then happy birthday to me. But based on our personal and business relationship, I don’t see how that’s possible. I love my father very much, he’s always been there for me, and I don’t have a problem with him at all.”

Entertainment

Starfleet Academy Just Used Voyager To Make Star Trek’s Heroes Into Horrible Villains

By Chris Snellgrove

| Published

While it has been controversial, Starfleet Academy has tried to establish itself as a must-see TV for those who loved Star Trek: Voyager. One reason for that is the presence of the amazing Robert Picardo, reprising his role as the fan-favorite holographic Doctor. Another reason is that the new show has picked up on the threads of multiple classic Voyager stories, including the Doctor raising (and subsequently losing) a holographic daughter back in “Real Life.”

Now, the most recent episode of Starfleet Academy (“300th Night”) has followed up on the Voyager episode “The Omega Directive,” which revealed that Starfleet deeply feared a a desructive cosmic element known as the Omega particle. In “300th Night,” we learn that future Starfleet has found a way to weaponize this particle against its enemies. Unfortunately, a central aspect of this episode makes one thing crystal clear: the Federation has now and forever become the bad guy.

The Alpha And The Omega

What is the Omega particle, you ask? In the aptly-named Voyager episode “The Omega Directive,” Captain Janeway reveals that the Omega particle is one of the biggest threats Starfleet has ever encountered. When these particles explode, it becomes impossible to travel through the affected area at warp speed. Therefore, Starfleet has a standing order: when captains encounter Omega, they must do anything and everything in their power to destroy it.

With her usual poise and style, Janeway manages to find and safely detonate all of the offensive Omega particles in the area. However, the Starfleet Academy episode “300th Night” revealed that the Federation of the 32nd century had secretly changed its mind about Omega. Rather than destroying these particles on sight, one skeezy starbase has developed a way to turn these pesky particles into the ultimate weapon.

When Star Trek Meets Star Wars

In a previous episode of Starfleet Academy (“Come, Let’s Away”), Nus Braka acted like a reluctant ally before enacting his scheme: destroying a Starfleet vessel and ransacking Starbase J19-Alpha. At the time, it was unclear what he stole or even what kind of starbase J19-Alpha really was. However, “300th Night” revealed that the base specializes in advanced weapons research, and one of their creations was Omega-47. As the name implies, this is a synthetic variant of the Omega particle, one that has all the destructive potential of the real thing.

“300th Night” was actually a really solid episode, but I was shocked at how it casually confirmed that Starfleet is developing superweapons that would make the Empire from Star Wars blush. So far, it seems that Section 31 doesn’t exist in the 32nd century, which is a good thing: after all, most fans don’t like the idea of the peace-loving Federation relying on a secret cabal of paranoid murderers.

Unfortunately, the revelation that Starbase J19-Alpha was developing such unethical weaponry is proof that the fringe Section 31 is no longer necessary; the high and mighty Starfleet is happy to break bad and violate intergalactic law whenever and however they see fit.

The development of Omega-47 is also insanely hypocritical because the Federation of this era had to survive the Burn, a freak cosmic incident that made warp travel absolutely impossible. In both Discovery and Starfleet Academy, this is portrayed as something that ruined countless lives and generally transformed a utopian future into a brutal, survival-of-the-fittest slugfest. Considering that the primary effect of Omega is that it can shut down subspace and make warp travel impossible, it’s clear that Starfleet is now ready and willing to cripple entire civilizations by restricting their travel and leaving them at the mercy of pirates.

Never Beam Your Heroes

On the balance, “300th Night” is actually a very good episode of Star Trek: it builds on Starfleet Academy lore, develops our favorite characters, and follows up on one of Voyager’s wildest stories. For longtime fans of the show, this episode is proof of how much potential this series really has. Meanwhile, if you’re someone who ditched this show early on, this latest episode is arguably the best to watch if you’re ready to give the show another shot.

Unfortunately, Starfleet weaponizing Omega is at the heart of this Starfleet Academy episode, and this does immense damage to our characters’ reputation. How are we supposed to root for the next generation of Starfleet officers when we know all these tortured geniuses will grow up to support supervillains? This organization is rotten from the top down, which makes for the ultimate bittersweet homage to The Original Series: in the 32nd century, all admirals are badmirals!

Entertainment

Christian Bale’s Favorite Movie Monster Roars on HBO Max as 2027’s Sci-Fi Sequel Looms

Christian Bale has been one of the biggest actors in Hollywood for years now. Whether it’s his commanding performances in Christopher Nolan’s Dark Knight trilogy or his Academy Award-winning work in movies like The Fighter, fans can always count on Bale to eat up every second of screen time in all of his movies. He’s now four years removed from his last live-action role in the Netflix original war movie, The Pale Blue Eye, but he’s soon to return to the screen this weekend in The Bride!, the new horror film written and directed by Maggie Gyllenhaal. However, Bale isn’t just a movie star; he’s also an avid consumer of the genre he’s given so much to, and he recently went public with one of his favorite franchises.

During a recent interview, Christian Bale admitted that he loves all iterations of Godzilla, particularly the Shin Godzilla and the franchise backed by Legendary, also known as the MonsterVerse. The MonsterVerse franchise first stomped to the big screen more than 10 years ago with Godzilla, the 2014 kaiju thriller starring Bryan Cranston (Breaking Bad) and directed by Gareth Edwards (Rogue One). Godzilla spawned a franchise that has continued through prequels like Kong: Skull Island and crossover movies like Godzilla vs. Kong, but the most recent installment came just two years back with Godzilla x Kong: The New Empire. The 2024 blockbuster saw the two titans team up to take down a dangerous threat. Following Bale’s praise of the Godzilla franchise, Godzilla x Kong: The New Empire has surged back into HBO Max streaming charts in America. It’s also one of the top 10 most popular movies on VOD platforms like Apple TV.

What Do We Know About the Next ‘Godzilla X Kong’ Movie?

The next Godzilla x Kong movie has been titled Supernova, and it’s currently scheduled for release on March 26, 2027. Dan Stevens is returning to reprise his role as Trapper in the film, but it mostly consists of an all-new ensemble led by Sinners veterans Delroy Lindo and Jack O’Connell, along with Sam Neill (Jurassic Park), Kaitlyn Dever (The Last of Us), and Matthew Modine (Stranger Things). Plot details about the film are being kept under wraps, but Grant Sputore is directing with a script from Dave Callaham.

Check out Godzilla x Kong: The New Empire on HBO Max and stay tuned to Collider for more streaming updates and coverage of the Godzilla franchise.

- Release Date

-

March 29, 2024

- Runtime

-

115 Minutes

- Writers

-

Terry Rossio, Adam Wingard, Simon Barrett, Jeremy Slater

Entertainment

Why Has Love Story Received Backlash? Negativity Explained

Ryan Murphy‘s Love Story has caused a variety of strong reactions — but why has there been so much backlash surrounding the show about John F. Kennedy Jr.?

Before Love Story even premiered on FX in February 2026, Murphy was criticized by the Kennedys for his plans to dramatize Carolyn Bessette-Kennedy and JFK Jr.‘s story after their deaths in a 1999 plane crash. Kennedy Jr.’s nephew Jack Schlossberg accused Murphy in June 2025 of “grotesque[ly]” profiting off his late uncle’s death.

“Lately, my news feed has been filled with pictures of my uncle, John F. Kennedy Jr., a great man,” Schlossberg wrote via Instagram at the time. “For those wondering whether his family was ever consulted, or has anything to do with the new shows being made about him, the answer is no. And there’s really not much we can do.”

Schlossberg continued: “For that matter, [JFK Jr. is] considered a public figure, so there’s not much we can do. I hope those making these shows about him take seriously what he stood for in his life, all that he achieved in it. And that they donate some of the profits [that] they’re making.”

In response, Murphy called out the “inflammatory” criticism and how it came before the show was released.

“I thought it was an odd choice to be mad about your relative that you really don’t remember,” Murphy said on Gavin Newsom’s “This Is Gavin Newsom” podcast one month later. “The days of civil discourse are over, and it’s very hard. And you kind of either get into the muck or you try and rise above it.”

The public backlash continued once Love Story started airing with Sarah Pidgeon as Bessette, and Paul Anthony Kelly portraying JFK Jr. Keep scrolling for a breakdown of the drama:

What Is ‘Love Story’ About?

The FX series is the first installment in Ryan Murphy’s Love Story anthology and is inspired by Elizabeth Beller’s book Once Upon a Time: The Captivating Life of Carolyn Bessette Kennedy. Sarah Pidgeon plays Carolyn Bessette, while Paul Anthony Kelly portrays JFK Jr.

After meeting in 1992, Bessette and JFK Jr. were on and off for years before getting married. Their relationship was thrust into the spotlight, with highs and lows making headlines. They both died in a plane crash in 1999.

“We had Elizabeth Beller’s book for reference, but we did face challenges [capturing certain moments]. They died so young, but we had enough information from people around them to know what the problems were in their marriage, what the tensions were, what the highs were, what the lows were,” executive producer Brad Simpson exclusively told Us Weekly in February 2026. “People don’t have an idea of what her voice was like because we only have a tiny clip of her voice, but they have a very distinct idea of what her image was like. So we had to get the walk down and the look and the allure. But Sarah could really interpret and go with it. John, we have a lot of recordings of him, and we have a lot more on him.”

What Is Ryan Murphy’s History With Adapting Real-Life Stories?

Ryan Murphy found success adapting true crime stories and high-profile events, which often resulted in backlash from the subjects of his shows. After getting his start with Nip/Tuck, Glee and American Horror Story, Murphy expanded by taking on projects such as American Crime Story, which chronicled the murder trial of O.J. Simpson, the killing of designer Gianni Versace and the sex scandal involving former President Bill Clinton and Monica Lewinsky.

Murphy also created the American Sports Story spinoff, which focused on the rise and fall of former NFL player Aaron Hernandez in its first season.

Has Ryan Murphy Received Backlash for His Scripted Shows?

Ryan Murphy’s most controversial spinoff has been the Monster anthology series. In 2022, the limited series centered on Evan Peters’ portrayal of Jeffrey Dahmer, which received backlash from the families of the serial killer’s victims.

Season 2 faced similar backlash after Erik Menendez slammed Murphy’s portrayal of him and brother Lyle Menendez.

FX’s Love Story has also been called out for dramatizing events in JFK Jr. and Carolyn Bessette’s lives before their tragic death.

What Has Been Said About Ryan Murphy’s Love Story?

Kennedy Jr.’s nephew Jack Schlossberg slammed the show when it came out.

“If you want to know someone who’s never met anyone in my family, knows nothing about us, talk to Ryan Murphy,” Schlossberg said on CBS Sunday Morning in February 2026. “The guy knows nothing about what he’s talking about, and he’s making a ton of money on a grotesque display of someone else’s life.”

Meanwhile Daryl Hannah, who is played by Dree Hemingway on the show, broke her silence on how she was portrayed. Hannah, who dated JFK Jr. in the ‘80s called the show not “remotely accurate” in its “representation of my life, my conduct or my relationship with John.” She also wanted to clarify the “actions and behaviors attributed” to her, which she called “untrue.”

“I have never used cocaine in my life or hosted cocaine-fueled parties. I have never pressured anyone into marriage. I have never desecrated any family heirloom or intruded upon anyone’s private memorial,” she continued. “I never compared Jacqueline Onassis’ death to a dog’s. It’s appalling to me that I even have to defend myself against a television show. These are not creative embellishments of personality. They are assertions about conduct — and they are false.”

What Have the Executive Producers Said?

Executive producer Brad Simpson told Us in February 2026 that they hadn’t heard from any of the real people featured on screen, adding, “We haven’t yet, and we hope that people appreciate their portrayals. Every actor approached [their role] with love.”

He added: “You reach out to one person, and then it becomes, ‘Why are you not reaching out to every person?’ We love these characters. We did deep, deep research. It’s based on not just the Elizabeth Beller book but many other artifacts from that time and many other historie.We came from a place of love, but if you foreground one person’s personal story and their version of the truth, then you have to foreground everybody’s, and often they’re in conflict. On all our shows we tried to be true to what we think the characters were and show you what it was like to walk in their footsteps.”

Entertainment

Fire Country’s Bode Fights About Tyler Causing Vince’s Death

Fire Country‘s Bode makes it clear that he can’t forget Tyler after Chloe’s son admitted to causing Vince’s death.

In Us Weekly‘s exclusive clip from the Friday, March 6, episode of the hit CBS series, Bode (Max Thieriot) is visited by Chloe (Alona Tal), who asks him for help with Tyler (Conor Sherry). Bode, however, has no sympathy for the teenager responsible for starting the fire that killed his father, Vince (Billy Burke).

“He lit up half of Edgewater,” Bode tells Chloe. “Why would Tyler take the fall for something so bad if he didn’t actually do it?”

Chloe asks for Bode’s help supporting Tyler, saying, “I know that your family has done too much for my family already. But Tyler won’t talk to me and he’s alone and he’s scared in jail. I can’t help him. I know that you cared about him. You and I both know that you have the best shot to get through to him, so please.”

Bode shuts Chloe’s request down while referring to Tyler as a “lost cause.”

His strong reaction comes shortly after Tyler turned himself in for arson. Before the show’s midseason return, showrunner Tia Napolitano hinted that the show’s story will be going through some changes.

“[You should] be worried [about the rest of the season]. We’ve got Bode and Tyler in a fire shelter in the middle of a blaze. Those things are built for one, there’s two lives in there,” Napolitano exclusively told Us Weekly in December 2025, one month before her departure from the CBS series was announced. “And we’ve got Jake and his brother over the side of a cliff. You see how many times that vehicle goes over and over. We see heads hit hard surfaces.”

Napolitano teased that “those are not easy things to come back” from, adding, “We’ll watch our people fight to get out of there.” She also teased a “huge twist” coming in the second half of the season.

“It’s going to change everything that hugely impacts Bode. He is going to really fight to continue to be on his path to progress and growth that we love to see him on. He has made those good choices — though he still struggles — and winning those struggles and really becoming someone who can continue to be someone Tyler wants to grow up to be,” she said. “Bode is a role model. Look how far we have come.”

She continued: “Eve is going to find her way with these new guys at Three Roc. Sharon is learning even more so how to stand on her own. Ruby — her mother — comes back. There’s a lot of surprises, twists and turns and drive coming out of that twist that comes at the end of the midseason premiere.”

Following her exit from the show, news broke on Thursday, March 5, that Eric Guggenheim will be taking over for Napolitano. According to Deadline, Guggenheim is coming onboard after previously serving as showrunner of Magnum P.I and co-showrunner of Hawaii Five-0.

Fire Country airs on CBS Fridays at 9 p.m. ET. New episodes stream the next day on Paramount+.

Entertainment

A New Nightmare on Elm Street May Finally Be Coming

For horror fans, Freddy Krueger has been silent for far too long. The last film in the franchise was the 2010 reboot, meaning it has been more than fifteen years since audiences last stepped into the dream world of Elm Street. But new developments suggest that Freddy may be sharpening his claws once again.

The Rights Situation Finally Changed

One of the biggest reasons the franchise has remained dormant is a complicated rights situation. The U.S. rights to A Nightmare on Elm Street reverted back to the estate of creator Wes Craven, while New Line Cinema continues to control the international rights to the series and the iconic Freddy Krueger character.

Since that shift, the Craven estate has reportedly begun reviewing pitches for new projects connected to the franchise, including potential films and even television series.

In other words, Freddy’s return has been a matter of timing rather than interest.

Freddy Could Return With a Completely New Direction

Several creators have already floated ideas for bringing the character back. One proposal would move away from simply remaking the original 1984 classic and instead build a new story inspired by later entries in the franchise.

Another idea would explore Freddy’s backstory before the events of the first film, creating a prequel that dives deeper into the mythology of Springwood and the infamous dream demon.

The biggest challenge facing any new project will be replacing Robert Englund, the actor who made Freddy Krueger one of horror’s most recognizable villains.

Could a New Actor Become Freddy?

Englund has largely stepped away from the role, but the character could live on through a new interpretation. Some filmmakers have even suggested bold casting choices that would take the character in an unexpected direction.

Others believe the role should go to a relatively unknown actor who can create a fresh version of Freddy without competing with Englund’s legendary performance.

Why Now Might Be the Perfect Time

Horror franchises are thriving again. Films like Halloween, Scream, and The Exorcist have all returned to theaters with new legacy sequels and reboots.

Freddy Krueger remains one of the most iconic villains in film history, and the franchise still holds enormous cultural power. The original series was so successful that it helped establish New Line Cinema as a major studio, earning the nickname “The House That Freddy Built.”

Never Sleep Again

While no official Nightmare on Elm Street film has been announced yet, the pieces are finally in place for Freddy’s return. With rights issues largely resolved and new ideas circulating, it may only be a matter of time before a new generation hears the warning once again.

One. Two. Freddy’s coming for you.

The post A New Nightmare on Elm Street May Finally Be Coming appeared first on Coastal House Media.

-

Politics4 days ago

Politics4 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Tech6 days ago

Tech6 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat6 days ago

NewsBeat6 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Business9 hours ago

Form 8K Entergy Mississippi LLC For: 6 March

-

NewsBeat6 days ago

NewsBeat6 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Sports7 days ago

The Vikings Need a Duck

-

NewsBeat6 days ago

NewsBeat6 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech2 days ago

Tech2 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment5 days ago

Entertainment5 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports1 day ago

Sports1 day ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Fashion5 hours ago

Fashion5 hours agoWeekend Open Thread: Ann Taylor

-

Politics6 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat6 days ago

NewsBeat6 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat4 days ago

NewsBeat4 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech6 days ago

Tech6 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video5 days ago

Video5 days agoHow to Build Finance Dashboards With AI in Minutes

-

Fashion5 days ago

Fashion5 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Business3 days ago

Business3 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat5 days ago

NewsBeat5 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker