Business

A Region at a Turning Point

The Asian M&A landscape in 2025 painted a picture of cautious optimism layered over deep structural challenges. While regional deal values rose 10% and volumes increased a modest 3%, these aggregate figures mask a market experiencing profound fragmentation.

The forces reshaping global dealmaking, artificial intelligence chief among them, are hitting Asia with particular intensity, exposing gaps in capital access, technological readiness, and strategic conviction across the region’s diverse economies.

Asia’s M&A recovery tells multiple stories simultaneously. China, after years of subdued activity, saw deal volumes surge 22% in 2025, though levels remain well below the 2021 peak. India, Japan, and South Korea all posted double-digit growth in deal values, signaling pockets of robust activity. Yet most other Asia Pacific markets reported year-over-year declines in deal volumes, revealing a region where momentum concentrates in select markets while others struggle to gain traction.

This uneven performance reflects more than cyclical variation. It signals Asia’s positioning in a global M&A market increasingly defined by a K-shaped recovery, where scale, capital depth, and AI readiness separate winners from the rest.

The Capital Allocation Dilemma Hitting Asia Hard

Asian corporations face an acute version of the capital allocation challenge confronting dealmakers worldwide. External estimates suggest that between $5 trillion and $8 trillion will flow toward AI technologies and enabling infrastructure globally over the next five years. For context, global M&A activity totaled just $3.5 trillion in 2025. This multitrillion-dollar AI investment supercycle is forcing Asian companies to make stark choices between building AI capabilities and pursuing traditional growth-through-acquisition strategies.

The tension manifests differently across the region. Chinese technology companies, already investing heavily in AI development, find themselves navigating both technological transformation and geopolitical constraints that complicate cross-border dealmaking. Japanese conglomerates, sitting on substantial cash reserves, are weighing AI infrastructure investments against long-planned international acquisitions. Indian technology services firms are racing to acquire AI capabilities while defending market share against AI-enabled automation.

The immediate impact is visible in near-term M&A activity. Capital that might have funded acquisitions is instead flowing into data centers, semiconductor capacity, cloud infrastructure, and AI model development. This reallocation helps explain why Asia’s deal volume growth lags value growth, and why mid-market activity remains particularly subdued.

Geographic Confidence Gaps Shape Deal Activity

Perhaps no metric better illustrates Asia’s M&A fragmentation than CEO confidence levels. According to PwC’s Global CEO Survey, approximately 50% of Indian CEOs plan major acquisitions within the next three years, matching optimism levels in the United States. Yet only around 20% of Chinese CEOs express similar intent, placing China among the most cautious major markets globally alongside Germany.

This confidence gap translates directly into dealmaking patterns. India’s M&A market benefits from strong domestic growth expectations, a robust technology sector, and increasing interest from both strategic acquirers and financial sponsors. The country’s position as a beneficiary of supply chain diversification and nearshoring trends further supports deal activity.

China’s more muted M&A sentiment reflects multiple headwinds: regulatory uncertainty, property sector challenges, geopolitical tensions affecting outbound investment, and questions about the sustainability of growth rates. While the 22% increase in deal volumes suggests improving conditions, Chinese companies remain more focused on domestic consolidation and strategic repositioning than aggressive expansion.

Japan occupies middle ground, with deal activity driven by demographic pressures, succession planning for family-owned businesses, and large corporations pursuing portfolio rationalization. South Korea’s double-digit value growth reflects both technology sector strength and industrial consolidation, particularly in sectors adjacent to semiconductors and advanced manufacturing.

AI’s Impact: From Manufacturing to Healthcare

Asia’s manufacturing-heavy economy means AI’s impact on M&A extends beyond pure technology deals. PwC’s analysis of the 100 largest global M&A transactions in 2025 found that approximately one-third cited AI as part of their strategic rationale, with technology, manufacturing, and power and utilities sectors showing the highest AI references.

For Asian companies, this creates both pressure and opportunity. Traditional manufacturing firms are pursuing acquisitions to embed AI across operations, supply chains, and product development. Healthcare companies are acquiring data analytics and software capabilities to accelerate drug development and personalized medicine. Industrial conglomerates are buying robotics and automation assets to integrate AI-driven efficiency gains.

SoftBank’s proposed $5.4 billion acquisition of ABB’s robotics business exemplifies Asia’s strategic approach, positioning a major Japanese technology investor at the intersection of AI and industrial automation. The deal signals recognition that AI’s value emerges not from algorithms alone but from their integration into physical systems and real-world operations.

Chinese pharmaceutical companies are also active, with innovation in drug development driving strategic transactions despite broader market caution. These deals reflect China’s strategic priority on technological self-sufficiency and its determination to build domestic capabilities in sectors deemed critical for future competitiveness.

The Scale Disadvantage in a Megadeal World

Asia confronts a structural challenge in the current M&A environment: relative underrepresentation in megadeals. While the region generated solid mid-market activity, it captured a smaller share of transactions exceeding $5 billion compared to the Americas, which dominated megadeal activity in 2025.

This matters because megadeals drove the entire recovery in global M&A values. Roughly 600 transactions above $1 billion accounted for the 36% increase in global deal values, while the remaining 47,000 transactions were flat year-over-year. Asian companies and markets participating less actively in this megadeal wave risk being left behind as competitive dynamics increasingly favor scale.

Several factors explain Asia’s megadeal deficit. First, regulatory scrutiny of large transactions has intensified across multiple jurisdictions, particularly for deals touching sensitive technologies or critical infrastructure. Second, cross-border megadeals face heightened geopolitical risk, encouraging companies to pursue domestic or regional transactions rather than transformative global consolidation. Third, valuation gaps between Asian targets and global acquirers remain wide, complicating negotiations for the largest deals.

The exception proves the rule: where Asian companies do pursue megadeals, they increasingly focus on acquiring capabilities essential for AI competitiveness, particularly in semiconductors, data infrastructure, and advanced manufacturing.

Other People are Reading

Business

BP profits fall after oil prices drop

The oil giant also says it is suspending its share buyback programme ahead of the arrival of its new boss.

Business

High schools experiment with new personal finance teaching methods

The Course Correction panelists discuss why its so great that more and more young people are making the effort to learn more about finances on Course Correction: Next Gen Financial Freedom.

High schools around the country are experimenting with new ways to teach students about personal finance, as educators look to boost students’ knowledge about finance and investing.

Financial literacy is a growing focus of policymakers as nearly 30 states have implemented laws or regulations that mandate high school students complete a personal finance course during their studies.

An analysis by the Center for Financial Literacy at Champlain College found that by 2031, 29 states and the District of Columbia will have a requirement for a personal finance course as part of a graduation requirement by 2031.

High school students participate in a lesson with their teacher. (Getty Images)

At that time, 73% of public high school students, or about 11.3 million students, would be subject to a “grade A” personal financial education requirement, which the group defines as a one-semester, half-year course with at least 60 hours of personal finance instruction per academic year.

HERE’S WHEN TAXPAYERS WILL GET THEIR REFUNDS

That figure is up from 11% in 2023, when just 1.7 million public high school students were subject to such a requirement. In 2025, more than 2.3 million students are covered by a financial literacy requirement, or about 15% of the nation’s public school students.

As these requirements take effect, educators are testing ways to give students real experience with finances to learn how saving and investing works.

A report by The Wall Street Journal detailed how at the all-girls Ethel Walker School in Connecticut, students take a personal finance class their sophomore year in which they tell the school how to invest about $1,000 of the school’s roughly $44 million endowment.

MIDDLE-INCOME AMERICANS STRUGGLING TO KEEP UP AS LIVING COSTS WEIGH ON PAYCHECKS, SURVEY SAYS

The students then track the stock, bond, mutual fund or exchange-traded fund (ETF) that they chose until graduation – although they’re allowed to switch investments if they lose money after a year, the Journal reported.

American flags on the floor at the New York Stock Exchange in New York, on Aug. 18, 2025. (Michael Nagle/Bloomberg via Getty Images / Getty Images)

According to the report, the school has netted positive returns since the project began and the investments by 2025 graduates tied the overall market’s 28.3% growth from October 2023 to May 2025. Gains are returned to the school’s endowment, while students whose investments perform the best receive a modest prize.

The Journal reported that the school’s personal finance curriculum also deals with taxes and requires students to pass the IRS’ basic tax-preparer exam by their junior year, a designation that allows them to assist low- and moderate-income families through the IRS’ Volunteer Income Tax Assistance program.

A blank 1040 tax return form from the IRS. (iStock / iStock)

HERE’S HOW MUCH TRUMP ACCOUNT BALANCES COULD GROW OVER TIME

Another school profiled in the Journal’s report, the Da Vinci Communications public charter school in El Segundo, California, requires students to take personal finance courses through their senior year covering topics such as saving tactics, health insurance coverage and risks with auto loans.

The course also teaches students about the power of long-term savings, with students encouraged to open a Roth IRA once they turn 18 to save income earned from jobs in high school rather than waiting until their careers begin in earnest, the Journal reported.

Business

Eddie Bauer files for Chapter 11 bankruptcy protection amid financial struggles

FOX Business’ Lauren Simonetti joins ‘Mornings with Maria’ to report on how artificial intelligence is transforming the retail shopping experience.

Eddie Bauer LLC, the retail operator of the brand’s stores in the U.S. and Canada, filed for Chapter 11 bankruptcy protection in New Jersey on Monday.

The operator cited declining sales and supply chain challenges, and more recently, ongoing inflation, tariff uncertainty and other headwinds as reasons for the filing.

It will begin liquidation sales at its 180 Eddie Bauer stores in the U.S. and Canada, and will look for a buyer for its brick-and-mortar store operation.

BAHAMA BREEZE TO CLOSE ALL ITS RESTAURANTS

Eddie Bauer LLC, the retail operator of the brand’s stores in the U.S. and Canada. (Getty Images)

Founded in Seattle, the brand has sold outdoor sportswear for 106 years. It patented the first quilted down jacket, known as the “Skyliner” in 1940.

Eddie Bauer LLC is a division under Catalyst Brands, which emerged as a new retail holding company in 2025 through a merger between JCPenney and SPARC Group.

“This is not an easy decision,” said Marc Rosen, the CEO of Catalyst Brands, which owns the license to operate Eddie Bauer stores across the U.S. and Canada. “However, this restructuring is the best way to optimize value for the Retail Company’s stakeholders and also ensure Catalyst Brands remains profitable and with strong liquidity and cashflow.”

The bankrupt Eddie Bauer retail company has $1.7 billion in debt, according to its court filings.

Eddie Bauer retail stores outside the U.S. and Canada are operated by other licensees and are not included in the Chapter 11 filings, according to a press release. The locations will remain open.

An Eddie Bauer store is seen on Feb. 3, 2026, in Round Rock, Texas. (Brandon Bell/Getty Images)

None of the other brands under Catalyst will be affected by the filing. The bankruptcy will not impact Eddie Bauer’s manufacturing, wholesale, e-commerce operations or retail operations outside the U.S. and Canada.

Authentic Brands Group owns the Eddie Bauer brand and IP worldwide.

“We have a clear distribution strategy centered on strengthening digital and wholesale channels while maintaining a balanced physical retail presence through strategic partners,” said Authentic Brands Executive Vice President David Brooks. “This approach gives the brand greater flexibility, broader consumer access and a more capital-efficient path to growth. By aligning Eddie Bauer’s channel mix with how customers are choosing to shop today, we’re positioning the brand for long-term, sustainable expansion while protecting the integrity of the brand.”

RESTAURANT GIANT FILES FOR BANKRUPTCY UNDER MASSIVE DEBT SHORTLY AFTER TOUTING MAJOR EXPANSION

The bankruptcy will not impact Eddie Bauer’s manufacturing, wholesale, e-commerce operations or retail operations outside the U.S. and Canada. (Brandon Bell/Getty Images)

The company’s lenders have agreed to support the liquidation plan, with the option to pivot to a sale of the company if a buyer can be quickly found in bankruptcy. Eddie Bauer’s retail and outlet stores will remain open during the bankruptcy sales.

Eddie Bauer aims to get court approval for a potential sale by March 12, according to court filings. Eddie Bauer previously went bankrupt in 2009.

Similar challenges have also pushed several other apparel retailers into bankruptcy in recent months, including high-end department store conglomerate Saks Global, fast-fashion company Forever 21 and women’s apparel and accessory retailer Francesca’s.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Reuters contributed to this report.

Business

Twist Bioscience: Liquid Biopsy And AI Tailwinds

Twist Bioscience: Liquid Biopsy And AI Tailwinds

Business

US Stocks Today | Gold and silver rally set to continue as dollar weakness looms: Peter Schiff

“Well, gold is going to continue to move higher especially now that the US dollar is moving lower against its fiat counterparts. In fact, I expect pronounced US dollar weakness throughout the rest of this year and for many years to come. So, all of that is going to drive more money out of US dollars and US financial assets like treasuries into gold and other non-US dollar denominated investments.”

When asked what factors would push the dollar lower, Schiff cited a loss of confidence in U.S. fiscal policy and central bank independence. “Well, it is going to be the continued loss of confidence in the fiscal responsibility of the US government and the independence of the Fed. You are going to see ever increasing US federal deficits monetised by the central bank. So, the supply of dollars is going to increase substantially. In the meantime, the world wants to move away from the dollar. The US has weaponised the dollar. First with Biden and now with Trump, the world is not looking kindly at the rhetoric and the tariffs which are making it more difficult to trade with the United States. The world would be better off trading a lot less with the United States and countries that are major exporters should consume more of what they produce rather than subsidise American consumers so that that we could buy it. So, you are going to see a major shift out of dollars. Foreign central banks will continue to move reserves to gold and out of dollars. Global investors will keep pulling money out of US financial markets. And as the dollar goes down, that is going to create an economic boom outside the United States. A lot of dollar denominated debt is going to be basically wiped out and consumers outside the United States are going to find that they have a lot more purchasing power. So, you are going to see, higher living standards abroad and lower living standards in the US.”

Schiff also explained the ongoing diversification of central bank reserves. “Yes, well, in the past, foreign central banks have accumulated dollars, I think that was a mistake. It benefited the United States, but it perpetuated these massive deficits in the United States where the US became dependent on the rest of the world. The US needs the world to produce the goods that it cannot and to loan it the money that it does not save and this was a big subsidy that the US enjoyed, but it was a burden on the global economy and the world is tired of shouldering that burden especially since the world is being lectured by Donald Trump. And so, it is going to be a healthy development to move away from the US dollar as the reserve currency. It is going to be very disruptive initially, but it is going to be a positive development for the world. In the long-long run, it will be positive for the US, but in the short run it is a huge negative.”

When questioned about whether another currency could replace the dollar, Schiff was clear: “No, no, there is not going to be a new currency to replace the dollar. The dollar is going to be replaced by gold. So, gold is going to serve the role that the dollar had been serving as both a reserve asset for central banks and as settlement for bilateral trade. Gold is going to play an increasingly important role in the global monetary system the way it was prior to the US dollar supplanting it.”

Silver, which has also seen substantial gains, is expected to continue rising. Schiff noted, “Yes, silver prices obviously were too low for too long. Gold rose really from 2000 to 4000 without much of an increase in the silver price at all. Then, silver finally caught up and probably got ahead of itself when it shot up to 121. It then pulled back below 70 and right now it is about $80 an ounce. I expect silver prices to trend higher from here, but it may take several months before we get back above the 120 level, but we are going to go above that level and ultimately much higher.”

Looking ahead to 2026, Schiff predicts record highs for both metals. “Yes, but gold got almost to 5600 before pulling back. I think that it will end the year above 6000. We will see how much higher, but I am very confident that the high that we set earlier in January will be taken out probably before the end of the second quarter.” On silver, he added, “Yes, I mean, silver is going to make a new high, but obviously it is further away from its high. It is 50%. It would need a 50% move to get back to its high. Gold only needs a 10% move, so much easier for gold but silver is very volatile, so hard to say, but I do believe that silver will make a new record high maybe by the end of the Q2 or sometime in the third quarter of this year.” Schiff also weighed in on U.S. monetary and fiscal policy, cautioning that it is unsustainable. “We have horrible fiscal policy in the United States and horrible monetary policy which is going to get worse. So, that is why gold is trading above 5,000. That is why the dollar recently hit an all-time record low against the Swiss Franc and why it is continuing to fall now against a basket of other fiat currencies is because of the monetary and fiscal policy that we have been pursuing in the past and that we continue to recklessly pursue in the present.”

Finally, on the sustainability of U.S. debt, Schiff warned, “No, it is not sustainable. It has not been sustainable for a while. It is completely unsustainable, that is why people should be selling US treasuries, that is why China just advised banks to sell treasuries. Japan is going to be a major seller of treasuries. The whole world is going to be selling treasuries because the debt is unsustainable. It cannot be repaid. It cannot even be serviced. So, it is going to be either default or inflation and obviously politically expedient choice is inflation and that is the direction that we are headed and it is pretty obvious. So, our creditors want to get out. They do not want to watch the value of their US dollar holdings inflated away. It is better to just sell now and move the money into something else.”

With both gold and silver poised for further gains, investors and central banks alike are closely monitoring the U.S. dollar, while Schiff’s forecasts highlight a potential shift in the global monetary system back toward precious metals.

Business

Australian exchange operator CEO Helen Lofthouse to step down in May

Australian exchange operator CEO Helen Lofthouse to step down in May

Business

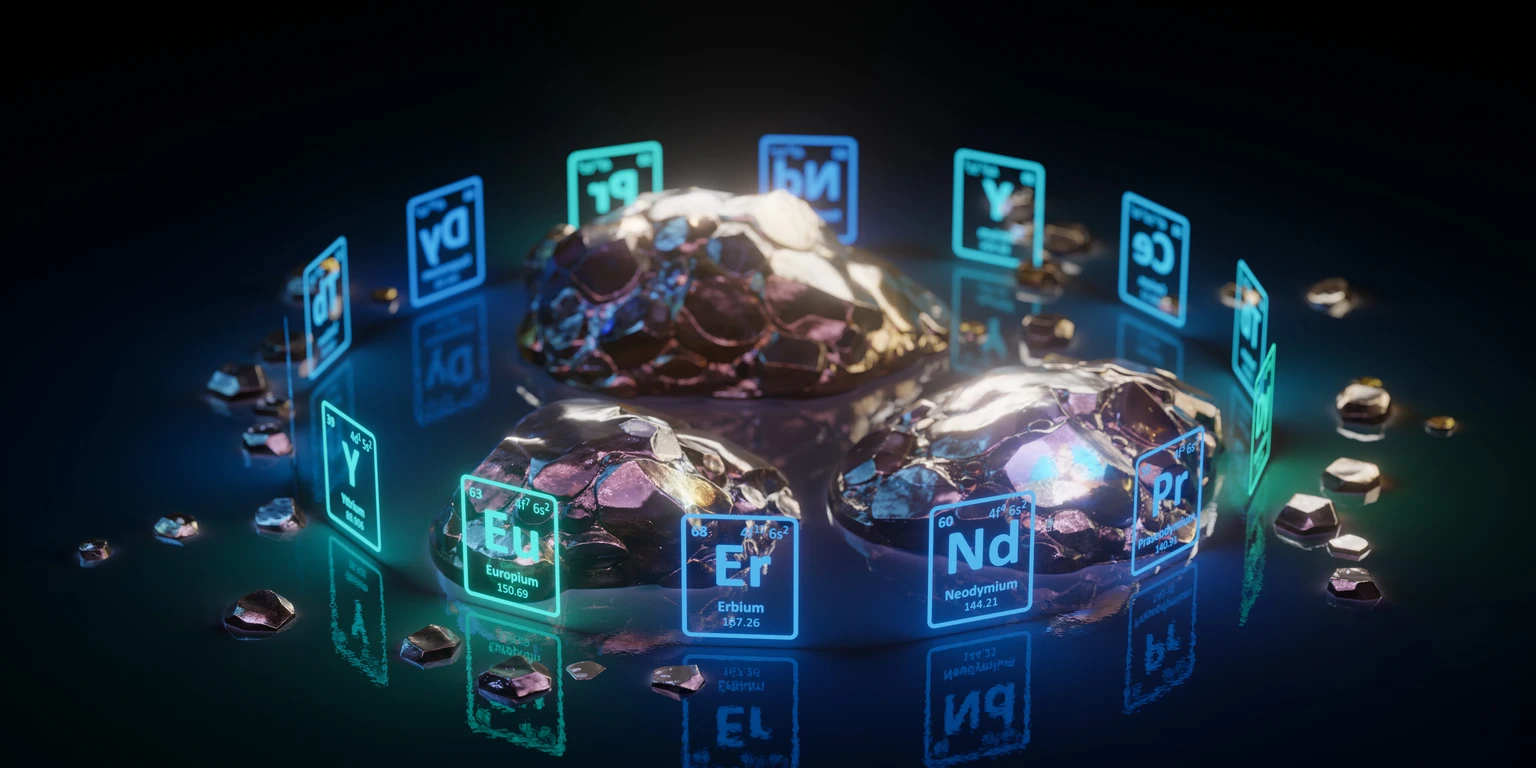

Rare Earth Element Prices Are Making New Highs

I graduated from the University of Western Australia in 1984 with a degree in electronic engineering and from 1984 until 1998 worked in the commercial construction industry as an engineer, a project manager and an operations manager.

I began investing in the stock market 2 months prior to the 1987 stock market crash and thus quickly learned about the downside potential of stocks. Only slightly daunted by the rather inauspicious timing of my entry into the world of financial market investments, my interest in the stock market grew steadily over the years.

In 1993, after studying the history of money, the nature of our present-day fiat monetary system and the role of banks in the creation of money, I developed an interest in gold. Another very important lesson soon followed: gold may be the ideal form of money for those who believe in free markets and a wonderful hedge against the inherent instability of the government-imposed paper currencies, but it is not always a good investment.

By mid-1998 the time and money involved in my financial market research/investments had grown to the point where I was forced to make a decision: scale back on my involvement in the financial world or give up my day job. The decision was actually quite an easy one to make and so, at the beginning of 1999, I began investing/trading on a full-time basis.

My major concern in deciding to pursue a career in which I devoted all of my time to my own investments was that I would miss the personal interaction that had been part and parcel of my business management career. The Speculative Investor (TSI) web site was launched in August of 1999 as a means for me to interact with the world by making my analysis/ideas available on the Internet and inviting feedback from others with similar interests.

During its first 14 months of operation the TSI web site was free of charge, but due to the site’s growing popularity I changed it to a subscription-based service in October of 2000. Its popularity continued to grow, although I remained — and remain to this day — a professional speculator who happens to write a newsletter as opposed to someone whose overriding focus is selling newsletter subscriptions.

My approach is ‘top down’; specifically, I first ascertain overall market trends and then use a combination of fundamental and technical analysis to find individual stocks that stand to benefit from these broad trends. This approach is based on my experience that it’s an order of magnitude easier to pick a winning stock from within a market or market sector that’s immersed in a long-term bullish trend than to do so against the backdrop of a bearish overall market trend. Fortunately, there’s always a bull market somewhere.

I’ve lived in Asia (Hong Kong, China and Malaysia) since 1995 and currently reside in Malaysian Borneo.

Business

Japan has given Takaichi a landslide win – but can she bring back the economy?

Japan has been battling sluggish growth, mounting public debt and a rapidly ageing workforce.

Business

Macquarie Group Limited (MQBKY) Q3 2026 Sales/ Trading Statement Call Transcript

Samuel Dobson

Head of Investor Relations

Well, good morning, everyone, and thank you for joining us here today for Macquarie’s Third Quarter and Third Quarter ’26 and 2026 Operational Briefing.

Before we begin today, I would like to acknowledge the traditional custodians of this land, the Gadigal of the Eora Nation and pay our respects to elders past, present and emerging.

Today, we will have a third quarter update, which will be given by our CEO, Shemara Wikramanayake, followed by a Q&A session. We’ll then hear from each of our operating groups talking about Macquarie’s presence here in ANZ. And then we’ll hear from Andrew Cassidy talking about risk and Nicole Sorbara and team talking about technology.

So, with that, I will hand over to Shemara. Thank you.

Business

Thailand Airports Set to Accommodate Over 4 Million Passengers for Chinese New Year Holiday

Thailand’s Airports of Thailand Plc (AOT) is preparing for a significant surge in passenger traffic across its six airports during the Chinese New Year holiday period, from February 13-22, 2026.

This anticipated increase, totaling over 4.11 million passengers, is primarily driven by a robust recovery in the Chinese tourism market and a renewed confidence in Thailand’s travel sector.

Key Insights

- Passenger surge forecast: Airports of Thailand (AOT) expects over 4.11 million passengers across six major airports during the Chinese New Year holiday (Feb 13–22, 2026).

- International travelers: ~2.6 million

- Domestic travelers: ~1.51 million

- Flights: ~24,847 (14,295 international, 10,552 domestic)

- Chinese market recovery:

- Chinese passenger numbers projected at 679,259, an 8.1% year-on-year increase.

- Suvarnabhumi Airport alone expects 444,255 passengers on China routes, a 24.2% rise compared to last year.

- This highlights strong confidence in Thailand’s tourism rebound and renewed demand from China.

During this ten-day festive period, AOT expects approximately 4.11 million passengers to pass through its major airports, including Suvarnabhumi, Don Mueang, Chiang Mai, Mae Fah Luang–Chiang Rai, Phuket, and Hat Yai. This total comprises about 2.6 million international travelers and 1.51 million domestic passengers. The total number of flights is estimated at 24,847, with 14,295 international and 10,552 domestic flights.

Chinese Market Dominance

Data as of February 4, 2026, indicates a substantial rise in flights and passengers originating from China.

Chinese passenger numbers are projected to reach 679,259, marking an 8.1% year-on-year increase.

Suvarnabhumi Airport, the country’s main international gateway, is forecast to handle 444,255 passengers on China routes alone, a significant 24.2% increase compared to the previous year.

This recovery underscores growing confidence in Thailand’s tourism industry and a strong resurgence in international travel from China.

Operational Measures and Passenger Advisory:

AOT plans to organize Chinese New Year celebrations within passenger terminals, featuring lion dance performances and cultural demonstrations, to enhance the festive atmosphere for travelers.

Due to the expected heavy traffic, AOT strongly advises all passengers to arrive at the airports at least two to three hours before their scheduled departure times to avoid potential delays and missed flights during peak hours.

Other People are Reading

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat12 hours ago

NewsBeat12 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat1 day ago

NewsBeat1 day agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports1 day ago

Sports1 day agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

NewsBeat23 hours ago

NewsBeat23 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports11 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

![Qkyou - MONEY ft O-Neang [VIDEO LYRICS]](https://wordupnews.com/wp-content/uploads/2026/02/1770711855_maxresdefault-80x80.jpg)