Business

American Express Saves Taxes in (Not New) Jersey

American Express lowered its corporate income taxes by $241 million through operations on the island of Jersey in 2025, the company reported in a securities filing on Friday. The company didn’t have a similar disclosure for 2024, but new accounting rules are requiring corporations to report more granular details now.

Jersey, located in the English Channel, has a population of about 104,000. It’s a Crown Dependency that’s governed separately from the United Kingdom.

The $241 million is the combination of two factors: Jersey’s low corporate income tax rate (0% for most companies) and the 15% income tax it created as part of the global agreement to impose corporate minimum taxes. Without the Jersey effect, American Express’s tax rate would have been 1.8 percentage points higher.

Business

Nike Reports $300 Million Pretax Charge Related to Job Cuts

Nike Reports $300 Million Pretax Charge Related to Job Cuts

Business

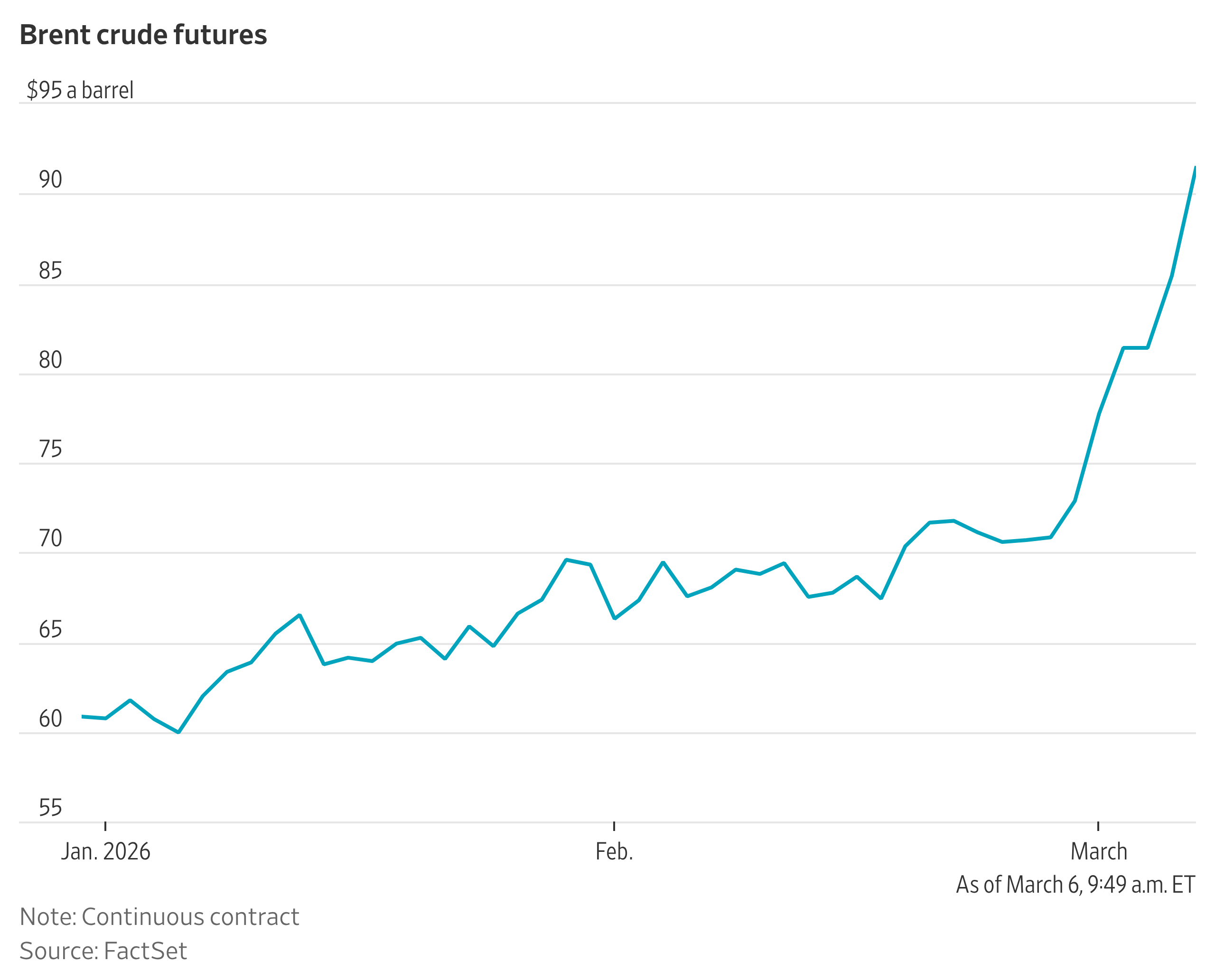

Oil Makes Record Weekly Gains As Strait of Hormuz Stays Shut

1518 ET – Crude futures rise to their highest level in two-and-a-half years as the conflict in the Persian Gulf continues, keeping shipping through the Strait of Hormuz at a standstill and cutting off oil supply. WTI settles up 12% at $90.90 a barrel and Brent rises 8.5% to $92.69 a barrel. Weekly gains are 36% for WTI and 27% for Brent, the largest percentage increases on records back to 1983 and 1991, respectively. “Uncertainty is high and rising but based on all the available information at hand, it doesn’t look like the worst is behind us yet,” Amarpreet Singh of Barclays says in a note. “If this situation persists for another couple of weeks, Brent could potentially test $120 a barrel.” (anthony.harrup@wsj.com)

Oil Extends Gains As Persian Gulf Conflict Drags On

1147 ET – Oil futures extend gains with the Middle East conflict in its seventh day and no sign of the critical Strait of Hormuz being reopened to shipping. “We’re in a situation where the lack of clarity on the timing of what happens in the Strait of Hormuz is stoking a tremendous amount of fear in the market,” says Rebecca Babin of CIBC Private Wealth US. Production shut-ins by Iraq and Kuwait as their storage capacity fills up are fairly small, but may have taken the market by surprise coming so soon, Babin says. “I think they are down the road for the larger producers, but this was a big thing.” WTI is up 9.4% at $88.63 a barrel and Brent is up 6.4% at $90.87.(anthony.harrup@wsj.com)

Brent Crude Hits $90 A Barrel As Supply Worries Grow

0909 ET – Crude futures extend gains ahead of the weekend with Brent hitting $90 a barrel level for the first time since April 2024 as oil remains hemmed in by the de facto closure of the Strait of Hormuz. Citi analysts estimate the market is losing between 7 million and 11 million barrels a day of crude oil, and from 4 million to 5 million barrels a day of products, largely due to lack of flows through the strait. “We continue to see $80-$90 a barrel Brent for at least the next 1-2 weeks, before we see prices moderating in 2Q26,” they say in a note. “We assume that Hormuz flows gradually return in the latter half of March, in the base case of military operations winding down.” Brent is up 5.3% at $89.92 a barrel. WTI rises 8.2% to $87.67.(anthony.harrup@wsj.com)

Oil Stranded in Strait of Hormuz Has Few Routes Out

1344 GMT – Around 16 million barrels a day of crude oil is trapped as tanker traffic through the Strait of Hormuz stops, Vortexa analysis shows. Another route for the oil could be down Saudi Arabia’s East-West pipeline to the Red Sea port of Yanbu. This pipeline can theoretically move around 7 million barrels a day, but so far flows have been much lower, Vortexa’s Rohit Rathod writes. Another alternative is the Abu Dhabi Crude Oil Pipeline, which moves crude from Habshan to Fujairah. The pipeline could move around 1.5 million barrels a day, but operations have been disrupted by the conflict, Rathod says. Brent crude trades up 4.1% to $88.90 a barrel, while WTI jumps 6.7% to $85.93 a barrel. (adam.whittaker@wsj.com)

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

Oil Prices Close Above $90 Amid Fears of Spreading Mideast War

The steepest oil-price runup since the early days of the Ukraine war sent benchmark oil prices above $90 a barrel on Friday, a signal that traders are increasingly fearful that the spiraling Middle East conflict could spark an energy shock.

Futures for Brent crude, the global oil benchmark, jumped more 8.5% Friday to 92.69 a barrel, its highest level since 2023. The one-day surge was the sharpest since March 2022. For the week, the price rose 27%, a record.

WTI crude, the U.S. benchmark, surged by 12%, its biggest daily jump since 2020. U.S. crude finished the day at $90.90 a barrel, up a record 36% for the week, according to Dow Jones Market Data.

Business

Whitestone REIT: Exploring A Sale

Whitestone REIT: Exploring A Sale

Business

Thailand’s Ministry of Finance, Bank of Thailand, and IMF on 2026 Annual Meetings Preparations

Thailand’s Ministry of Finance and IMF reviewed preparations for the 2026 Annual Meetings, highlighting progress in logistics, security, and facilities at the Queen Sirikit National Convention Center in Bangkok.

📅 Event & Timing: Thailand will host the 2026 Annual Meetings of the IMF and World Bank Group from October 12–18, 2026 at the Queen Sirikit National Convention Center (QSNCC) in Bangkok.

🤝 Organizers: The Ministry of Finance, the Bank of Thailand, and the IMF are jointly overseeing preparations.

🏗️ Preparations: Progress has been made in logistics, construction, security, and branding, with strong coordination among stakeholders.

🌍 Bangkok’s Role: The QSNCC is praised as a world-class facility, reinforcing Bangkok’s position as a regional hub for international conferences.

Bangkok, Thailand — March 4, 2026: Thailand’s Ministry of Finance, the Bank of Thailand, and the International Monetary Fund (IMF) today took stock of preparations for the 2026 Annual Meetings of the IMF and the World Bank Group, which Thailand will host from October 12–18, 2026 at the Queen Sirikit National Convention Center (QSNCC). The discussion brought together Dr. Ekniti Nitithanprapas; Deputy Prime Minister and Minister of Finance; Mr. Vitai Ratanakorn, Governor of the Bank of Thailand; and Dr. Kristalina Georgieva, Managing Director of the IMF.

The authorities and the IMF were very pleased with progress in many areas, including construction, security, and branding. Preparations are advancing well, supported by close coordination between all stakeholders. They praised the world-class facilities at QSNCC, which stands ready to host the Meetings, and highlighted Bangkok’s role as a leading regional hub for international conferences. The partnership between the IMF and the authorities has been excellent and will ensure successful and impactful meetings. The 2026 Annual Meetings will mark the second time Thailand hosts the Annual Meetings at QSNCC, following the 1991 Meetings.

Dr. Nitithanprapas states that Thailand’s selection as the host country once again represents an important opportunity for the nation. “Hosting the 2026 Annual Meetings at the QSNCC, the venue built specifically for hosting 1991 Annual Meetings, symbolizes not only Thailand’s significant progress made over the past 35 years but also its continued role as a pillar of stability and a hub for global economic cooperation,” Dr. Nitithanprapas said. “Importantly, Thailand is only the third country outside of the United States to host this ‘Olympics of Finance’ more than once, further showcasing Thailand’s capacity to organize world-class events.”

Source : https://www.bot.or.th/en/news-and-media/news/news-20260304.html

Other People are Reading

Business

Australia mulls ’defensive support’ for Gulf allies amid escalating Iran war

Australia mulls ’defensive support’ for Gulf allies amid escalating Iran war

Business

US judge voids 2025 actions taken by Kari Lake as Voice of America CEO, including job cuts

US judge voids 2025 actions taken by Kari Lake as Voice of America CEO, including job cuts

Business

Trump rejects settling Iran war, raises prospect of killing all its potential leaders

Trump rejects settling Iran war, raises prospect of killing all its potential leaders

Business

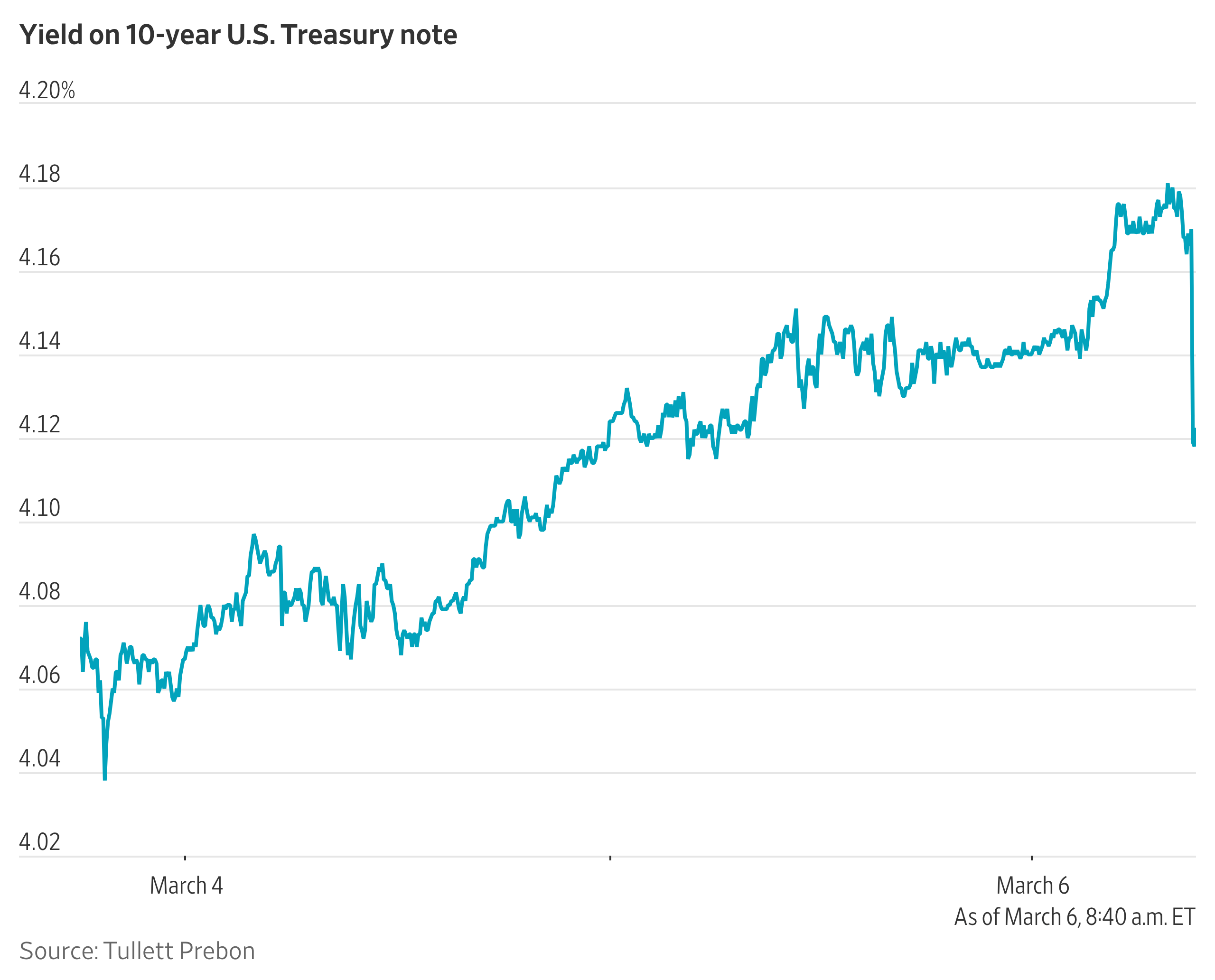

Treasury Yields Whipsawed By Oil Prices, Jobs Data

A topsy turvy day has Treasury yields ending Friday’s session lower, while still logging hefty weekly gains.

Yields, which move in the opposite direction of bond prices, initially climbed overnight with oil prices. They then fell immediately after a disappointing jobs report, only to rebound and then fall again.

Bonds are facing strong crosscurrents. Pushing up on yields, rising energy prices are making investors worried about a rebound in inflation that could make it harder for the Federal Reserve to cut interest rates. Even so, some investors think that the Middle East conflict could eventually cause yields to fall by slowing the economy and increasing demand for safer assets.

Business

Australia weighing requests for assistance from countries attacked by Iran

Australia weighing requests for assistance from countries attacked by Iran

-

Politics5 days ago

Politics5 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business2 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Tech7 days ago

Tech7 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Fashion1 day ago

Fashion1 day agoWeekend Open Thread: Ann Taylor

-

NewsBeat7 days ago

NewsBeat7 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech3 days ago

Tech3 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment6 days ago

Entertainment6 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports2 days ago

Sports2 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat7 days ago

NewsBeat7 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat6 days ago

NewsBeat6 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech7 days ago

Tech7 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Sports8 hours ago

Sports8 hours agoThree share 2-shot lead entering final round in Hong Kong

-

Video6 days ago

Video6 days agoHow to Build Finance Dashboards With AI in Minutes

-

Fashion7 days ago

Fashion7 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

NewsBeat6 days ago

NewsBeat6 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Business4 days ago

Business4 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World7 days ago

Crypto World7 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

Crypto World6 days ago

Crypto World6 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown

-

Tech5 days ago

Tech5 days agoCynus Chess Robot: A Chess Board With A Robotic Arm

-

NewsBeat2 days ago

NewsBeat2 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter