Business

BioRestorative Therapies closes $5 million public offering

Business

Freight Brokers Are the Latest AI Victims. These Other Stocks Look Safe.

Freight Brokers Are the Latest AI Victims. These Other Stocks Look Safe.

Business

US Stocks Today | S&P 500 ends up slightly as tech dips, inflation cools

The S&P 500, the Nasdaq and the Dow all declined for the week with technology stocks on a roller-coaster ride due to uncertainty about the extent to which profits could be disrupted due to AI competition and the hefty spending needed to support the technology.

Equities had started the session strong after data showed U.S. consumer prices increased less than expected in January. This prompted traders to slightly raise the chance of a 25 basis point interest-rate cut in June to 52.3% from 48.9%, according to the CME Group’s FedWatch tool.

But heavyweight technology and communications services ended the session lower as investors were jittery ahead of Monday’s U.S. holiday for Presidents Day.

“Large cap tech stocks continue to be an anchor on the market and any whiff of optimism continues to get rejected,” said Michael James, managing director, at Rosenblatt Securities, Los Angeles.

“We’ve been on wobbly legs a couple of weeks now and with the three-day weekend approaching, it’s not surprising to roll over into the end of the day.”

The Dow Jones Industrial Average rose 48.95 points, or 0.10%, to 49,500.93, the S&P 500 gained 3.41 points, or 0.05%, to 6,836.17 and the Nasdaq Composite lost 50.48 points, or 0.22%, to 22,546.67. For the week, the S&P 500 fell 1.39%, the Nasdaq declined 2.1%, and the Dow fell 1.23% for their biggest weekly losses since November. Equity markets have pulled back from record levels recently as AI fears fueled worries in sectors spanning from software and insurance to trucking companies. However, the S&P 500 software and services index closed up 0.9% on Friday while the S&P 500 tech sector fell 0.5%.

Despite improving inflation trends, Phil Orlando, chief market strategist at Federated Hermes, predicted more choppy trading ahead as investors deal with the looming U.S. midterm elections in November and the expected replacement of Fed Chair Jerome Powell by Kevin Warsh in May.

Historically when a Fed leadership transition happens in a midterm year, the market has hit a “double-digit air-pocket every time that’s occurred,” Orlando said.

Megacap tech stocks were weak with Nvidia and Apple Inc providing the biggest drags to the S&P 500 while Applied Materials provided the strongest boost.

Defensive utilities ended up 2.69% and real estate added 1.48%, making them the top gainers among S&P 500’s 11 major industry indexes. Healthcare was also a boost with Dexcom rising 7.6% and Moderna rising 5.3% after both companies’ fourth-quarter earnings reports impressed.

Applied Materials shares jumped 8.1% after the chipmaking-equipment firm forecast second-quarter revenue and profit above Wall Street expectations. Networking equipment provider Arista Networks gained 4.8% during the session after forecasting annual revenue above expectations.

White House trade adviser Peter Navarro said there was no basis to reports that the administration was planning to reduce steel and aluminum tariffs.

Still, some steelmakers came under pressure with Nucor falling just under 3% and Steel Dynamics slipping 3.9%. Also aluminum producer Alcoa fell 0.9% while Century Aluminum shares tumbled 7.4%.

Advancing issues outnumbered decliners by a 2.57-to-1 ratio on the NYSE where there were 392 new highs and 93 new lows. On the Nasdaq, 3,156 stocks rose and 1,646 fell as advancing issues outnumbered decliners by a 1.92-to-1 ratio.

The S&P 500 posted 34 new 52-week highs and 6 new lows.

On U.S. exchanges 18.61 billion shares changed hands compared with the 20.75 billion moving average for the last 20 sessions.

Business

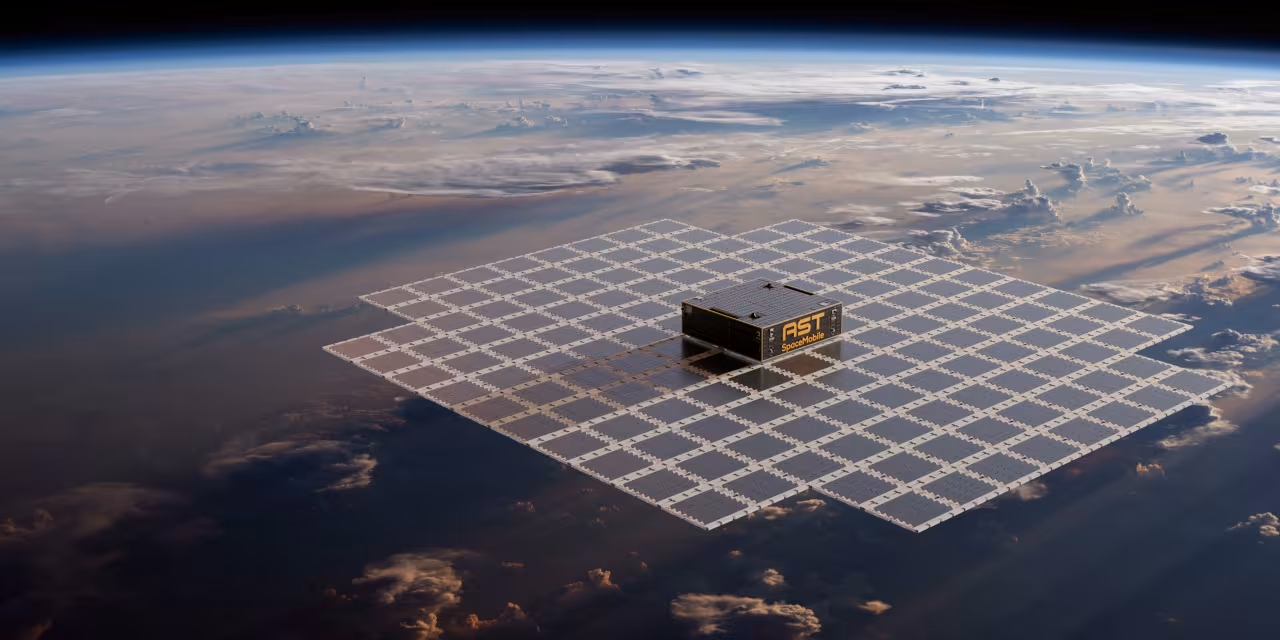

AST SpaceMobile Stock Sinks. What’s Bringing the Satellite Player Down to Earth.

AST SpaceMobile Stock Sinks. What’s Bringing the Satellite Player Down to Earth.

Business

AI offers powerful tools for fraud detection, but has risks too: Sebi Chief

“AI offers powerful tools for surveillance and fraud detection… But it also brings risks – opacity, bias, and concentration of technological power,” Pandey said. “Regulation must therefore evolve from supervising institutions to supervising systems and technology.”

The top boss at the regulatory body added that technology is reshaping markets faster than any rulebook. Algorithmic trading, digital platforms, and AI-driven decision-making are now part of everyday market functioning.

“We must address concentration and interconnectedness risks. Strengthen data governance and consent architectures. And manage the boundary between regulated finance and unregulated digital spaces,” he said, speaking at the summit.

Sebi is, therefore, responding through supervisory technology (SupTech), and RegTech (regulatory technology), stronger cybersecurity frameworks, and improved data governance, Pandey said.

Adding that the regulator sets direction and guardrails after due consultations but the industry has to innovate responsibly.

SEBI has also set up a high- level expert working group to develop a short-term and a long-term strategic technology roadmap for the securities market ecosystem. Talking about India’s next regulatory frontier, he said that regulation can no longer be only reactive but must become anticipatory. “It must move with markets, not behind them.”

“We need markets that are resilient by design, capable of navigating geo-fragmentation, technological shifts, and other emerging risks, while continuing to support growth and innovation,” he said.

India’s market capitalisation has grown more than four-fold in the last ten years, to over ₹4.7 lakh crore today. As a share of GDP, it has risen from around 81% in FY15 to 138% today.In FY25, equity and debt issues together amounted to about ₹14.3 lakh crore, while in FY26 from April to January, ₹11.6 lakh crore has been mobilised. In 2025, India led in IPO activity globally with a record number of IPOs and stood third in terms of IPO proceeds, he said.

The Sebi chief added that the ownership structure of listed companies is also changing. Individuals and mutual funds together now own around 21% of listed equity, compared to 13% in FY15. “This means the Indian household is no longer a peripheral participant. It is now central to the equity story of India,” he said.

He further said that regulation has evolved over the years, it has moved from a framework that focused largely on entities to one that focuses on their activities and risks.

“We are moving from silo oversight to a more coordinated regulatory architecture. We are also moving from static rules to dynamic supervision,” Pandey said.

“As markets scale, the quality of regulation becomes as important as the quantity of capital they attract.”

Business

Instacart Profit Falls Following $60 Million Settlement With FTC

Instacart CART 0.94%increase; green up pointing triangle reported lower fourth-quarter profit dragged down by a $60 million settlement with the Federal Trade Commission in connection with claims that it used deceptive practices to raise costs for shoppers.

The food-delivery platform, also known as Maplebear, on Thursday posted net income of $81 million, or 30 cents a share, down from $148 million, or 53 cents a share, from the same period a year earlier.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

Volatility is the entry point, not an enemy: Madhusudan Kela

With nominal growth moderating and sectoral dominance by mature industries, he sees benchmark gains settling into a more measured trajectory. The real alpha, he believes, will emerge from identifying “hidden gems” companies and themes, particularly around AI applications, that can enhance productivity and margins over time.

Volatility may dominate headlines, but it is conviction, not chaos, that builds wealth in Indian equities, he said at the summit.

Speaking on the topic, “Is Volatility A Buying Opportunity?”, Kela said his core message is: “ignore the noise, back entrepreneurs with resilience, and let compounding do the heavy lifting”.

The past few weeks have seen a whirlwind of events: the Budget, the India-US trade deal, sharp swings in gold and silver, and heightened equity volatility led by the sell-off in AI.

Kela views such phrases as an opportunity rather than a threat.

“This noise is what creates opportunity. This noise is not a distraction,” he said, adding that differentiated returns are earned by standing apart from the crowd. “You rarely make money if you are with the crowd.” In Kela’s assessment, Indian capital markets are structurally stronger than ever, backed by domestic capital and entrepreneurial depth. The challenge for investors is not predicting the next news event but maintaining discipline. As he puts it, “volatility is not the enemy, it is the entry point.”

His investing framework revolves around identifying the “jockey”, the promoter or leader at the helm. “Am I able to really identify someone who will be able to drive it and who will not get distracted?”

Kela praised India’s retail investors, particularly mutual fund participants, who have steadily invested through systematic plans even when foreign institutional investors were net sellers. “They have been the real hero of this last bull run,” he said. “Equity has evolved from a speculation-driven arena to a mainstream asset class, embraced for long-term wealth creation. At least 13 crore people in India believe that it is a real asset class and we want to invest for real long term,” he said.

To underline the power of compounding, Kela cited an example. “If you save ₹11,000 per month in a respectable mutual fund, you can gain 100 crore after 50 years,” he said, assuming long-term returns are similar to historical averages. The takeaway is faith-both in disciplined investing and in India’s structural growth story. Unless a severe “black swan” event derails sentiment, he expects domestic flows to expand significantly over the next decade, irrespective of foreign buying or selling.

While acknowledging fears of job disruption in IT services, he drew parallels with earlier technological shifts. “Technology has never made life difficult for people in the last 50 years,” he said.

He believes India’s expanding Global Capability Centres could offset potential job losses in traditional IT outsourcing. He advised caution on IT stocks until earnings visibility improves.

Business

Procore Technologies, Inc. (PCOR) Q4 2025 Earnings Call Transcript

Operator

Good afternoon. Thank you for attending today’s Procore Technologies, Inc. FY ‘ 25 Q4 Earnings Call. My name is Tamia, and I will be your moderator for today’s call. [Operator Instructions]. I would now like to pass the conference over to your host, Alexandra Geller, Head of IR.

Alexandra Geller

Head of Investor Relations

Good afternoon, and welcome to Procore’s 2025 Fourth Quarter Earnings Call. I’m Alexandra Geller, Head of Investor Relations. With me today are Ajei Gopal, President and CEO; and Howard Fu, CFO. Further disclosure of our results can be found in our press release issued today, which is available on the Investor Relations section of our website and our periodic reports filed with the SEC. Today’s call is being recorded, and a replay will be available following the conclusion of the call.

Comments made on this call include forward-looking statements regarding, among other things, our financial outlook, platform and products, customer demand, operations and macroeconomic and geopolitical conditions. You should not rely on forward-looking statements as predictions of future events. All forward-looking statements are subject to risks, uncertainties and assumptions and are based on management’s current expectations and views as of today, February 12, 2026. Procore undertakes no obligation to update any forward-looking statements to reflect new information or unanticipated

Business

More banks may queue up to be pension managers: PFRDA chief

PFRDA chairman Sivasubramanian Ramann said while two banks have shown interest, others are in the process. When regulations were first framed around 2012-13, asset management experience was largely limited to mutual funds and insurers, he said.

Banks, however, manage substantial treasury portfolios and possess adequate investment expertise, he added. “The application window remains open until March 31,” he said.

Two banks have already shown interest. Bank of Baroda and ICICI Bank’s applications have come, Axis Bank‘s is a work-in-progress, and a consortium led by Union Bank and Daiichi is also exploring participation, he said.

PFRDA is examining ways to deepen the pension fund’s participation in long-term infrastructure and project finance, while remaining within prudent risk parameters.

Ramann said it is possible for long-term money to get into certain project financing stages, where an entity like a bank is assessing the risk and then inviting other people to join. “These are the kinds of discussions that we need to have to be able to understand how to improve the asset classes, the distribution of money between them, and introducing new asset classes,” he said.

On investments, pension funds will be permitted to invest in gold and silver through ETFs. These will fall under the alternatives category, which is capped at 5% of the equity allocation. Within this bucket, exposure to gold and silver is likely to be initially restricted to around 1%, subject to periodic review.The pension regulator is working on creating simpler payout products that give subscribers greater flexibility at retirement, including options beyond traditional annuities.

A committee has already begun work on designing one or two standardised products that would allow subscribers to choose between annuity payouts or structured withdrawals. The regulator is also exploring products with varied payout tenures, which would not necessarily be 25 years but potentially 10, 15 or 18 years.

Business

Hilty, GrabAGun CFO, sells $14,133 in company stock

Hilty, GrabAGun CFO, sells $14,133 in company stock

Business

New rules for M&A financing, loans against shares

The regulator said banks are allowed to refinance a target company’s existing debt where such refinancing is “integral to the acquisition finance.”

Borrowers must meet stringent financial criteria, including a minimum net worth of ₹500 crore, three consecutive years of net profit, and-where the acquirer is unlisted-an investment-grade credit rating prior to disbursement.

The regulator also eased the portfolio limit for such lending, raising the bank level cap on acquisition finance to 20% of eligible capital, compared with a proposed 10% of Tier 1 capital in the draft rules.

The limit will apply within the overall capital market exposure ceiling, it said.

The final guidelines are relaxed post consultation with banks and will be effective from April 1, 2026.

The RBI aligned rules for infrastructure trusts, saying that InvIT related acquisition funding must comply with the new acquisition finance framework, linking it to the conditions around control, leverage and security requirements.On retail borrowers, the RBI increased the amount individuals can borrow against shares by raising the cap to ₹1 crore per person from ₹20 lakh earlier. Within this higher ceiling, banks can lend up to ₹25 lakh to individuals specifically for purchasing securities in the secondary market.

Banks can now extend up to ₹25 lakh per individual for subscriptions to initial public offers (IPO), follow-on public offers (FPO) and employee stock option plans (ESOPs), subject to borrowers contributing a minimum 25% cash margin, meaning loans cannot exceed 75% of the subscription value.

For other market instruments, the RBI set specific ceilings: loans against listed debt securities rated BBB or above, mutual fund units, exchange traded funds, and units of REITs or InvITs will follow LTV caps applicable under the new framework, ranging from 60% for listed shares to 85% for high rated debt instruments and 75% for equity oriented funds, ETFs and trust units.

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports7 days ago

Sports7 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech3 days ago

Tech3 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Video16 hours ago

Video16 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports5 days ago

Sports5 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports7 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Business6 days ago

Business6 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video2 days ago

Video2 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World4 days ago

Crypto World4 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat5 days ago

NewsBeat5 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports4 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World4 days ago

Crypto World4 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?