Business

Bitcoin Trades Near $68,000 on February 21, 2026, Amid Market Consolidation and Mixed Sentiment

Bitcoin hovered around $68,000 on Saturday, February 21, 2026, showing modest gains in early trading as the cryptocurrency attempted to stabilize after a volatile start to the year that saw it log its weakest first 50 days on record.

The leading digital asset traded at approximately $68,100 to $68,200 in the latest 24-hour period, according to aggregated data from major exchanges and trackers like Yahoo Finance, CoinMarketCap and Investing.com. It opened the day near $67,996, reached a high of about $68,212 and dipped to a low of $67,596 before settling in the mid-$68,000 range. This represented a slight uptick of roughly 0.3% to 1% from the previous close, with trading volume moderate at around $43-47 billion over the prior day.

The price action comes as Bitcoin continues to consolidate in a symmetrical triangle pattern, with key resistance near $68,500 and support around $65,500 to $66,000. A breakout above the upper boundary could signal renewed bullish momentum, while a drop below support might trigger further downside toward $60,000 or lower, analysts warn.

The cryptocurrency has faced significant headwinds in 2026 so far. Through the first 50 days of the year, Bitcoin declined about 23%, marking its poorest start to a calendar year ever recorded, per Checkonchain data. January saw a roughly 10% drop, followed by an additional 15% slide in February — a rare back-to-back monthly decline for the asset. From its October 2025 all-time high near $126,000, Bitcoin has shed nearly 50%, reflecting broader market deleveraging and waning confidence in high-risk assets.

Several factors contributed to the weakness. Institutional outflows from U.S. spot Bitcoin ETFs totaled billions in recent weeks, with heavy net redemptions pressuring prices. On-chain metrics from Santiment showed small retail wallets increasing holdings by 2.5% since the October peak, while large “whale” holders trimmed positions by 0.8%. This divergence suggests retail buyers stepping in amid fear, but a sustained rally may require bigger players to re-engage.

Extreme sentiment readings added to the caution. The Fear & Greed Index hit single-digit levels around 8 in mid-February, signaling “extreme fear” among participants. Retail traders remained heavily long at 66.8%, creating a contrarian bearish signal. Leverage in the futures market rose, heightening risks of liquidations if volatility spikes.

Geopolitical tensions, macroeconomic uncertainty and a loss of momentum in related narratives like AI-driven growth also weighed on sentiment. Bitwise CIO Matt Hougan noted in a recent podcast that the February 5 drop to the mid-$60,000s was “shocking” but not necessarily the “final cathartic bottom,” suggesting more shakeouts ahead before a recovery.

Despite the challenges, some positive undercurrents emerged. Institutional accumulation persisted in certain metrics, with coins moving off exchanges — a sign of long-term holding. Bitcoin Cash, a fork of Bitcoin, set transaction volume records in February amid the broader fear, highlighting niche resilience in the ecosystem.

Prediction markets reflected uncertainty. On platforms like Polymarket and Kalshi, contracts for Bitcoin’s price on February 21 clustered around $66,000-$68,000 ranges, with probabilities favoring consolidation in that band. Broader forecasts for the quarter pointed to potential recovery toward $70,000-$79,000 by end-Q1, though downside risks to $56,000 lingered if support breaks.

Market observers remain divided. Some see the current dip as a healthy correction in a longer bull cycle, driven by orderly deleveraging rather than capitulation. Others warn of structural weaknesses, including high leverage and weak institutional inflows, that could prolong the downturn.

Bitcoin’s market capitalization stood around $1.35 trillion to $1.36 trillion, maintaining its dominance in the crypto space. The asset’s volatility persisted, with daily swings underscoring the need for caution among traders and investors.

As February progresses, all eyes remain on key levels, ETF flows and macroeconomic developments. Whether Bitcoin can reclaim higher ground or faces further tests will likely depend on renewed buying interest from institutions and a shift in broader risk sentiment.

For now, the cryptocurrency trades in a tight range, offering little clarity on its next major move in what has been a challenging 2026 so far.

Business

10 Things to Know About the Norwegian Cross-Country Legend

Johannes Høsflot Klæbo capped one of the most dominant individual performances in Winter Olympics history on Saturday, Feb. 21, 2026, winning the men’s 50km mass start classic to claim his sixth gold medal at the Milano Cortina Games — the most ever by any athlete at a single Winter Olympics.

The 29-year-old Norwegian finished in 2:07:07.1, pulling away late to beat teammate Martin Løwstrøm Nyenget by 17.5 seconds, with Emil Iversen taking bronze for an all-Norwegian podium. The victory completed a perfect sweep: Klæbo won every cross-country event he entered — skiathlon, sprint classic, 10km freestyle, 4×7.5km relay, team sprint and the 50km — becoming the first to achieve six golds in one Games.

Here are 10 essential facts about the man now widely called the greatest cross-country skier ever:

- Born October 22, 1996, in Oslo Klæbo turns 30 in 2026. He moved to Trondheim at age five, where he grew up and still resides. Standing 183.5 cm (6 feet), he combines explosive sprint power with endurance that has redefined the sport.

- Coached by Grandfather Kåre Høsflot Since Childhood His grandfather, Kåre Høsflot, an 82-year-old former coach, gave him his first skis at age two and has guided him ever since. The “grandfather effect” is credited for Klæbo’s technical mastery and mental toughness, with Kåre remaining his primary mentor through Olympic success.

- Youngest Male to Win Olympic Gold in Cross-Country At 21 years and 114 days, Klæbo became the youngest male Olympic champion in cross-country skiing when he won the sprint classic at PyeongChang 2018. He added two more golds there (team sprint, relay), tying for most at those Games.

- Holds Record for Most Gold Medals at a Single Winter Olympics His six golds at Milano Cortina 2026 surpass Eric Heiden’s five from Lake Placid 1980. With the victory, Klæbo now has 11 career Olympic golds — second only to Michael Phelps (23) among all Olympians — and 13 total medals.

- Most World Cup Wins in History Klæbo has surpassed 100 FIS World Cup individual victories, the most ever by a male cross-country skier. He also owns records for most sprint World Cup wins and youngest overall World Cup champion (2017-18 season).

- Swept All Events at 2025 World Championships In his hometown of Trondheim last March, Klæbo won six golds — every cross-country event offered — mirroring his 2026 Olympic feat and solidifying his GOAT status before the Games.

- Family-Oriented and Low-Key Off the Snow Klæbo keeps a private life, often crediting family support. His father Haakon manages his career, while grandfather Kåre coaches. He enjoys fishing, hiking and hunting in summer, maintaining balance amid intense training.

- Master of Sprint and Distance Unlike specialists, Klæbo excels in both sprint and distance events. His explosive uphill surges — dubbed “superhuman” — and tactical brilliance allow him to dominate varied formats, from 1.4km sprints to 50km marathons.

- Record-Breaking Consistency Klæbo has won multiple Tour de Ski titles, overall World Cup globes and sprint globes. He became the youngest to win the big Crystal Globe and holds records for most sprint titles and youngest world champion in multiple categories.

- Legacy as the Greatest Cross-Country Skier With 11 Olympic golds, 15 World Championship golds and over 100 World Cup wins, Klæbo is widely regarded as the most decorated male cross-country skier ever. His 2026 sweep — racing 115km across six events in 14 days — cements his place among winter sports’ all-time greats.

Klæbo’s dominance has inspired a new generation in Norway and globally. As the Milano Cortina Games conclude, his name stands atop the record books — a testament to talent, work ethic and the guidance of family.

Business

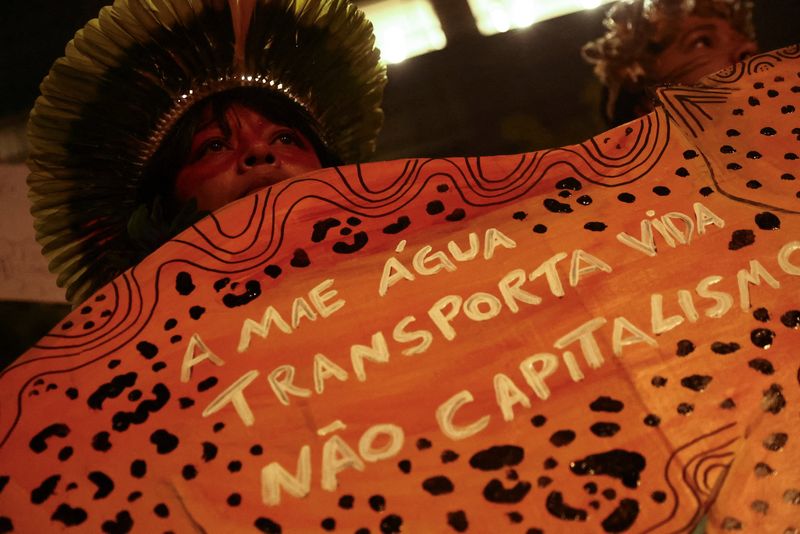

Indigenous protesters occupy Cargill’s Santarem port terminal in Brazil

Indigenous protesters occupy Cargill’s Santarem port terminal in Brazil

Business

File on 4 Investigates – Can boxing look after its own?

Available for over a year

Boxing is on the rise with streaming giants now broadcasting major fights and heavy investment from Saudi Arabia reshaping the sport. But for boxers facing money or health problems out of the ring, help is not always easy to come by. As File on 4 Investigates discovers, some in boxing are now working towards a unified approach across the sport, which would help fighters throughout their careers, but can they make it work?

Reporter: Kal Sajad

Producer: Ashley Kennedy

Additional research: Clive Hammond

Technical Producer: Cameron Ward

Production Co-ordinators: Ellis Goodwin & Tim Fernley

Editor: Tara McDermott

Details of organisations offering help and support for the issues raised are available at bbc.co.uk/actionline

Business

FEPI: Buying On Declines Can Lead To Success

FEPI: Buying On Declines Can Lead To Success

Business

Israeli strikes in Lebanon kill at least 10, including senior Hezbollah official

Israeli strikes in Lebanon kill at least 10, including senior Hezbollah official

Business

How to Know Whether to Hire or Buy Aggregate Washing Equipment

Aggregate washing plays a key role in producing clean, saleable materials for construction, concrete, and asphalt. Whether you are working in quarrying, mining, or recycling, the right washing setup can make a real difference to output and product quality.

One of the biggest decisions operators face is whether to buy new equipment, invest in used plant, hire machinery, or contract the work out altogether. Each option has its place. The right choice depends on your workload, budget, and long-term plans.

Understanding Your Project Demands

Before making any decision, it helps to look closely at your workload. Is the washing requirement part of a long-term operation, or is it tied to a short-term contract?

If you are running a fixed quarry with steady production targets, owning your own washing plant may make sense. You have full control over throughput, maintenance schedules, and product specifications.

On the other hand, if you have won a contract for a limited period, hiring equipment or contracting the washing work can reduce financial risk. There is no large capital outlay, and you are not left with equipment that may sit idle once the job is complete.

Seasonal demand also plays a part. In some sectors, work can fluctuate. Hiring or contracting allows you to scale up or down without long-term commitment.

The Case for Buying New Equipment

Buying new aggregate washing equipment gives you access to the latest design improvements and efficiency gains. Modern washing plants are built with better water management systems, improved wear protection, and easier access for maintenance.

For businesses with a consistent pipeline of work, new plant can be a sound long-term investment. You know the full service history from day one, and warranties provide added peace of mind.

However, buying new requires significant upfront capital. For smaller operators or companies testing a new market, that cost can be hard to justify. There is also the question of lead times. Manufacturing and delivery can take months, which may not suit urgent projects.

The Role of Used Plant in Today’s Market

Used aggregate washing equipment remains popular, particularly for operators looking to control spending. A well-maintained second-hand plant can offer strong performance at a lower price.

The key is knowing what you are buying. Inspection, service records, and support from a reputable supplier matter. Without them, hidden wear or outdated components can lead to downtime.

Used plant works well for businesses expanding capacity without stretching budgets too far. It can also be a practical choice for satellite sites or smaller operations where top-end output is not required.

That said, used equipment may not offer the same efficiency or water-saving features as newer models. Over time, operating costs can rise if maintenance demands increase.

Why More Businesses Are Choosing to Hire

Hiring aggregate screening and washing equipment has become more common across the minerals and construction sectors. The main reason is flexibility.

When you hire, you gain access to modern machinery without tying up capital. This allows you to respond quickly to new contracts or changes in workload. If a project grows, additional equipment can often be added. If work slows, machines can be returned.

Hiring can also reduce maintenance concerns. Many hire agreements include servicing support, which keeps the plant running while allowing your team to focus on production.

For companies entering a new area of work, hiring provides a way to test demand before committing to purchase. It lowers the financial risk while still delivering the capability required on site.

The Rise of Contract Washing Services

An increasing number of operators are choosing to contract out their washing requirements altogether. Instead of buying or hiring equipment, they bring in a specialist team to supply, operate, and maintain the washing plant.

This approach shifts responsibility away from the quarry or site owner. The contractor manages setup, compliance, maintenance, and output targets. For many businesses, this frees up internal resources and simplifies project management.

Contract washing can be particularly attractive for short to medium-term projects, high-clay sites that require tailored solutions, or locations where in-house expertise is limited.

It also offers predictable costs. Rather than dealing with unexpected repair bills or downtime, you work to agreed terms that reflect production volumes or project duration.

Weighing Up Cost Against Control

At the heart of the decision is a balance between cost and control. Buying equipment, whether new or used, gives you full ownership and long-term availability. It suits established operations with steady demand.

Hiring provides flexibility and lower upfront cost, making it ideal for variable workloads or growing businesses. Contract washing goes one step further, removing much of the operational responsibility from your team.

There is no single answer that fits every quarry, mine, or construction project. The best choice depends on how often the plant will run, how confident you are in future workloads, and how much responsibility you want to carry in-house.

By reviewing your production plans and speaking with experienced equipment suppliers, you can find a solution that supports both your immediate needs and your long-term goals.

Business

Ukrainians, scattered across Europe, trapped in limbo by war

Ukrainians, scattered across Europe, trapped in limbo by war

Business

Which SEO Tool Wins for Keyword Research, Backlinks, AI Features and Pricing?

As search evolves with AI overviews, generative results and zero-click SERPs dominating 2026, marketers and agencies continue debating between Semrush and Moz Pro — two veteran platforms that remain staples for SEO professionals. Semrush, the all-in-one digital marketing suite, edges ahead in breadth, data volume and AI visibility tracking, while Moz Pro holds ground with simplicity, lower entry pricing and strong domain authority metrics.

Both tools updated interfaces and added AI enhancements in late 2025 and early 2026, reflecting industry shifts toward prompt tracking, LLM visibility and generative engine optimization (GEO). Recent head-to-head reviews from DemandSage (February 2026), Style Factory (January 2026) and Seologist (February 2026) highlight Semrush as the overall leader for professional teams, agencies and growth-focused users, while Moz appeals to beginners, small businesses and those prioritizing crawl limits and affordability.

Keyword Research and Database Size

Semrush maintains the world’s largest keyword database at over 27.9 billion keywords, dwarfing Moz’s 1.25 billion. This gap translates to deeper suggestion volume, more accurate difficulty scores and better long-tail discovery. Semrush’s Keyword Magic Tool delivers millions of ideas per seed term, with advanced filters for intent, questions and AI Overviews visibility. Moz’s Keyword Explorer offers solid fundamentals — search volume, difficulty and priority scores — but caps suggestions (often around 1,000 per query on lower plans) and lacks Semrush’s real-time trend depth.

In 2026 testing, Semrush shows 89% correlation to actual ranking difficulty, outperforming Moz in predictive accuracy for competitive niches. Both track rankings, but Semrush supports more keywords per project (up to thousands on higher tiers) and integrates AI prompt visibility (ChatGPT, Perplexity, Google AI Overviews), a feature Moz offers only in basic keyword intent form.

Backlink Analysis and Authority Metrics

Moz edges Semrush slightly in backlink index size (45.8 trillion vs Semrush’s 43 trillion+), and its Domain Authority (DA) remains a trusted third-party metric despite criticism for volatility. Semrush counters with Authority Score (AS), which factors trust flow, citation flow and more, often producing different results from DA or Ahrefs’ DR. Reddit discussions in early 2026 highlight ongoing debates: same domain may show low AS but strong DA/DR, reflecting different weighting.

Semrush excels in link-building workflows — prospecting, outreach templates, toxic link detection and historical data — while Moz focuses on cleaner, easier-to-interpret link explorer views. For agencies managing outreach at scale, Semrush’s CRM-style tools and API access provide an advantage.

Site Audits, Technical SEO and Crawl Limits

Semrush crawls more pages per project on mid-tier plans and offers deeper technical audits, including Core Web Vitals integration, log file analysis and mobile performance checks. Moz provides generous crawl limits even on lower plans (e.g., 100,000 pages/week on Standard), making it less restrictive for large sites early on.

Both deliver actionable fix lists, but Semrush’s On-Page SEO Checker and Content Analyzer integrate AI suggestions more aggressively.

AI and Emerging Search Features

Semrush leads decisively in 2026 with dedicated AI Visibility tracking across ChatGPT, Perplexity, Google AI Overviews and traditional SERPs. Users monitor brand mentions in generative responses, prompt performance and LLM citations — critical as zero-click and AI-driven search grows. Moz offers limited keyword-based AI intent research but lacks comprehensive tracking.

Pricing Comparison (2026)

Moz remains more affordable at entry level:

- Starter: $49/month (new 2026 plan, ideal for one site)

- Standard: $99/month

- Medium: $179/month

- Large: $299/month

- Premium: $599/month

Semrush structures pricing around toolkits or the flagship Semrush One (combining SEO + AI Visibility):

- Pro: $139.95/month

- Guru: $249.95/month

- Business: $499.95/month

- Semrush One Starter: $199/month

- Pro+: $299/month

- Advanced: $549/month

Annual billing saves 15-20%. Moz wins for solo users or small budgets; Semrush justifies higher cost for agencies and multi-channel teams.

User Ratings and Verdict

Semrush averages 4.6/5 across 2,300+ reviews (Capterra, G2), praised for depth but critiqued for complexity. Moz scores 4.5/5 from 349 reviews, lauded for usability but seen as less comprehensive.

Verdict: Semrush wins for most professional use cases in 2026 — larger data, AI tools, PPC/social integration and scalability. Moz suits beginners, budget-conscious users or those needing simple, crawl-heavy workflows.

Both offer free trials: Semrush 7-14 days, Moz 30 days. Test both to match your workflow.

Business

Can You Trust Online Loans? What Singapore Borrowers Should Know

Singapore ranks among the most expensive cities on the planet, and unexpected bills don’t wait for payday. That reality pushes thousands of residents toward digital borrowing options every month.

But when you type “loan” into a search bar at midnight, how do you separate a trustworthy online money lender from a scam? The question matters — getting it wrong can mean harassment, spiraling debt, or stolen personal data. The answer comes down to regulation, due diligence, and knowing exactly what you’re signing.

This guide breaks down what Singapore borrowers actually need to check before accepting a single dollar from an online loan provider — starting with one non-negotiable: make sure you’re dealing with a licensed money lender registered under the Ministry of Law.

How Do Online Loans Work in Singapore?

The process is straightforward, which is part of the appeal.

A borrower visits an online money lender’s website or app, fills out a digital application form, and uploads the required documents — typically a NRIC, proof of income, and recent bank statements. The lender reviews the application (often within the same day), and if approved, presents a loan contract with the terms spelled out: principal, interest rate, repayment schedule, and fees.

Once both parties sign, the funds are disbursed directly to the borrower’s bank account. Most online loan applications in Singapore take between one and three business days from start to finish — significantly faster than a traditional bank personal loan, which can stretch to a week or more. For many borrowers, this speed is the primary reason they look beyond banks in the first place.

The speed and convenience come with a trade-off, though. Interest rates from licensed moneylenders are higher than bank rates, capped at 4% per month under Singapore law. That makes these loans better suited for short-term needs than long-term borrowing.

Are Online Loans Safe and Legal in Singapore?

Short answer: Yes — but only if the lender holds a valid licence from the Ministry of Law.

Singapore regulates moneylending through the Moneylenders Act (Cap. 188) and its subsidiary rules. Every legitimate online money lender must be listed on the Ministry of Law’s official Registry of Moneylenders. This registry is publicly accessible, and checking it takes under a minute.

What a licensed lender is required to do by law:

- Charge no more than 4% interest per month

- Cap late interest at 4% per month on overdue principal

- Limit total fees (including interest, late interest, and administrative charges) to the loan principal — meaning you can never owe more than double what you borrowed

- Provide the borrower with a signed copy of the loan contract

- Operate only from an approved business address

If an online loan provider cannot produce a licence number, doesn’t appear in the registry, or contacts you through SMS/WhatsApp spam — that’s an unlicensed lender, and engaging with them carries legal and financial risk for both parties.

What Are the Real Risks of Borrowing Cash Loans Online?

Even with proper licensing, borrowing carries risk. Here’s what Singapore borrowers should watch for.

Overborrowing and debt stacking. Because cash loans online are quick to access, some borrowers take multiple loans from different lenders simultaneously. Under Singapore’s borrower-based credit limit framework, individuals earning under $20,000 annually can borrow up to $3,000 across all licensed moneylenders. Those earning $20,000 or more can borrow up to six times their monthly income. Exceeding these limits shouldn’t be possible with licensed lenders — but borrowers who turn to unlicensed sources to fill the gap face serious consequences, including criminal liability under the Moneylenders Act.

Overlooking the total cost. A 4% monthly interest rate doesn’t sound alarming until you calculate it over six months or a year. A $5,000 loan at 4% monthly interest repaid over 12 months results in total interest of $2,400 — nearly half the original amount. Always calculate the effective annual rate before signing.

Unlicensed lender traps. The Moneylenders Registry exists for a reason. Unlicensed operators — often called loan sharks or “ah long” in Singapore — are not bound by legal fee caps and routinely use harassment and intimidation to collect. The Singapore Police Force actively investigates these operations, and borrowers are encouraged to report them.

How to Identify a Trustworthy Online Money Lender

Before submitting any personal information to an online money lender, run through these verification steps:

Registry check. Search the lender’s name on the Ministry of Law’s list of licensed moneylenders at mlaw.gov.sg. If they’re not listed, stop there.

Physical address. Licensed moneylenders must operate from a registered premises. A lender with no verifiable address — or one that conducts business exclusively through messaging apps — is a red flag.

Transparent contract terms. A trustworthy lender will present all costs upfront: interest rate, administrative fees, late payment penalties, and the total repayable amount. No legitimate online loan contract should contain blank fields or vague language about charges.

No upfront deposits. Licensed moneylenders in Singapore are prohibited from collecting any fees before disbursing a loan. If someone asks for a “processing fee” or “deposit” before you’ve received funds, it’s a scam.

Reviews and track record. Check Google Reviews, Trustpilot, or local forums. While no review platform is perfect, a pattern of complaints about hidden charges or aggressive collection practices tells you what you need to know.

Who Should Consider Online Loans and Who Shouldn’t?

When borrowing cash loans online makes sense:

You’re facing a genuine short-term emergency — a medical bill, urgent car repair, or temporary income gap — and you have a clear repayment plan within one to three months. You’ve confirmed the lender is licensed, you understand the total cost including all fees, and you’re not already carrying debt from other moneylenders.

When it doesn’t:

You’re borrowing to cover regular monthly expenses with no plan to break the cycle. You’re already repaying one or more existing loans. You haven’t compared the cost against alternatives like a bank personal loan, credit line, or even a salary advance from your employer. In these situations, an online loan adds pressure rather than relieving it.

The distinction is simple: borrow because you have a plan, not because you have a panic.

Skip the Trust, Demand the Receipts

Trust is earned through documentation, not marketing copy. A legitimate online money lender in Singapore will always point you to their licence, their contract, and their registered address — and they’ll do it before asking for your NRIC. If a lender can’t produce those three things without hesitation, the answer to “can you trust them?” has already been given.

Business

Toy industry pressures make digital the star

The gap is widening between rival toy makers Hasbro and Mattel — thanks in part to a 30-year-old trading card game.

The toy giants have flip-flopped dominance in the space for decades, jockeying for the most coveted master licenses to put new fan favorites — Disney princesses and “Star Wars” characters among them — on store shelves. But as the industry recovers from a period of declining sales, Hasbro is the one winning over Wall Street.

For the fiscal year 2025, Hasbro reported revenue gains of 14%, reaching $4.7 billion, while Mattel saw its net sales drop 1% to $5.3 billion.

Though Mattel’s revenue is larger than Hasbro’s, its growth has been stagnating, according to Eric Handler, managing director and senior research analyst at Roth Capital Partners.

“[Mattel’s] revenue has been in a very tight range for five years now, and 2026, on an organic basis, is the same,” he told CNBC.

Mattel shares are down more than 20% in the last 12 months, trading at around $17. Meanwhile, Hasbro’s stock is up roughly 46% over the same period, with shares trading at around $100.

Of course, Hasbro’s journey post-pandemic has not been without its own headwinds. The company’s revenue took a hit when it divested its film and TV business, eOne. Also, its entertainment segment, which includes film and TV licenses, was deeply impacted by Hollywood’s dual labor strikes in 2023.

“Despite market volatility and a shifting consumer environment, we returned this company to growth in a meaningful way,” Hasbro CEO Chris Cocks told investors during an earnings call earlier this month.

Throughout these changes, one key piece of Hasbro’s business has been steadily growing — Wizards of the Coast.

A dash of Magic

The Hasbro division includes Dungeons & Dragons, Magic: The Gathering and the company’s portfolio of digital and video games.

In 2025, Wizards’ revenue grew 45% to $2.1 billion, fueled by sales of sets tied to Magic’s Universe Beyond and smaller, limited-edition Secret Lair packs — some that sell for close to $200.

While the segment accounts for less than half of the company’s revenue, it represents 88% of its adjusted profits.

Magic: The Gathering playing cards form a light fixture at the Wizards of the Coast headquarters in Renton, Washington, Sept. 11, 2025. With traditional toy and game sales lagging, Hasbro has found a growth engine in role-playing games such as Dungeons and Dragons, trading card games like Magic: The Gathering and a growing portfolio of digital and video games.

Bloomberg | Bloomberg | Getty Images

The strategic trading card game Magic, which was created in 1993, typically features two players going head-to-head using custom decks of collectible cards to cast spells, unleash creatures or use artifacts to defeat their opponent.

In the last five years, Hasbro has expanded beyond the lore of the initial game to launch card sets based on intellectual property from third parties, including “Avatar: The Last Airbender,” Marvel’s “Spider-Man” and “Lord of the Rings.”

These sets are not only popular with long-standing Magic fans, but act as a gateway for consumers from other fanbases into the world of Magic. In mid-2025, Hasbro released a “Final Fantasy” set that became the fastest-selling expansion pack in Magic: The Gathering history, generating $200 million in sales in a single day.

“They have done a fantastic job of widening the funnel in the last couple years, and it’s become a multigenerational type of product,” Handler said. “The player base is growing. It’s a sticky player base that is showing eagerness with new products and new ways to play.”

Through the end of 2025, more than 1 million unique players participated in organized play — meaning sanctioned tournaments — according to Cocks. That’s a 22% year-over-year increase, he said.

Additionally, the number of game stores that host events, called the Wizards Play Network, has grown to more than 10,000, a 20% increase from 2024.

“Taken together, this reinforces our confidence in Magic’s long-term growth,” Cocks said on the company’s earnings call. “We are building a system of play with multiple entry points, product types, and engagement paths, and that system is positioned to continue driving growth into 2026 and beyond.”

In 2026, Hasbro plans to launch new Magic sets based on “The Hobbit,” “Teenage Mutant Ninja Turtles” and “Star Trek.”

The company has forecast mid-single-digit growth for its Wizards business in 2026, but Keegan Cox, associate vice president and research analyst at D.A. Davidson, in a research note published shortly after the company’s earnings, called that estimate “conservative.”

The digital frontier

Hasbro’s Wizards unit also includes the digital and licensed gaming space, which saw revenues jump 6% in 2025, fueled by the success of “Monopoly Go!”

Cocks has previously noted that modern consumers and modern play is increasingly moving into online forums, and the company has launched new games and an in-person video game studio in Montreal to boost play.

While Hasbro’s digital gaming division is growing, Mattel is just getting its own digital unit off the ground.

Earlier this month, Mattel announced it would buy out partner NetEase from its 50% stake in their Mattel163 joint venture, taking full ownership of the business. Mattel163 develops digital games based on the toy company’s brands and since 2018 has launched four digital games: Uno, Uno Wonder, Phase 10 and Skip-Bo.

“In our view, [Mattel] is in the early stages of an investment similar to Hasbro’s investment in gaming over 7 years ago,” D.A. Davidson’s Cox wrote. “While we do not think [Mattel] will be chasing to compete with Hasbro … we do believe [Mattel] can make successful mobile games tied to their IP and should add to profit margins over time.”

An industry in flux

Mattel’s push into digital comes as two of its flagship brands struggle to make sales.

“Barbie’s been on a meaningful decline, as has Fisher-Price,” Handler noted. “That’s sort of been negating a lot of the good news that’s been happening with Hot Wheels.”

The vehicles division saw gross billings jump 11% in 2025, while the dolls segment fell 7% and the infant, toddler and preschool space slipped 17%.

That segment for the youngest consumers has been in decline for over a decade, the result of shrinking population growth and the fact that children are being introduced to electronics earlier in their development. Shifting play habits have meant toy makers have to adapt, and fast.

But there’s hope for Mattel and the toy industry as a whole. In 2025, total annual dollar sales were up 6% in the U.S., according to data from Circana. And, perhaps more importantly, the number of units sold increased 3%, quelling fears that price-conscious consumers are pulling back on toy purchases.

“Unit sales being up, I think, is the most important metric we can look at,” said James Zahn, senior editor of The Toy Insider and The Toy Book. “If unit sales were down, that’s when you know people are really buying less, and that didn’t happen.”

Mattel and Hasbro, alongside other toy companies, are also expected to get a boost from a robust theatrical calendar this year.

Mattel has two of its own brands being represented at the box office with “Masters of the Universe” coming in June and “Matchbox” arriving in October. While Mattel won’t see a major bump from ticket sales, its toy sales could get a boost. After all, the 2023 release of “Barbie” helped fuel a 16% increase in gross billings of the doll in the quarter after it hit cinemas.

Mattel also holds the master toy licenses for “Toy Story” and Disney princesses, meaning it’ll handle the bulk of the product for “Toy Story 5” and the live-action “Moana.”

Hasbro will have toy lines for “The Mandalorian and Grogu,” “Spider-Man: Brand New Day” and “Avengers: Doomsday.”

Together, Mattel and Hasbro have also collaborated on the much anticipated product line for Netflix’s hit animated film “KPop Demon Hunters,” promising dolls, foam roleplay items, games and plush items.

“‘KPop Demon Hunters’ is gonna do big business for both Hasbro and Mattel,” Zahn said.

-

Video5 days ago

Video5 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World4 days ago

Crypto World4 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Fashion20 hours ago

Fashion20 hours agoWeekend Open Thread: Boden – Corporette.com

-

Video1 day ago

Video1 day agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business4 days ago

Business4 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment3 days ago

Entertainment3 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video4 days ago

Video4 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech3 days ago

Tech3 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment3 days ago

Entertainment3 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 days ago

Business3 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat6 days ago

NewsBeat6 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Politics4 days ago

Politics4 days agoEurovision Announces UK Act For 2026 Song Contest

-

Crypto World3 days ago

Crypto World3 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat6 days ago

NewsBeat6 days agoMan dies after entering floodwater during police pursuit

-

Crypto World2 days ago

Crypto World2 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat1 day ago

NewsBeat1 day agoAndrew Mountbatten-Windsor latest: Police search of Royal Lodge enters second day after Andrew released from custody