Business

Blue Bird: US-Based School Bus Manufacturer With Profitable Growth Prospects (NASDAQ:BLBD)

I am a full-time analyst interested in a wide range of stocks. With my unique insights and knowledge, I hope to provide other investors with a contrasting view of my portfolio, given my particular background.If you have any questions, feel free to reach out to me via a direct message on Seeking Alpha or leave a comment on one of my articles.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

(VIDEO) Netflix Unveils First Look at ‘The Fifth Wheel’ Comedy Starring Kim Kardashian and Nikki Glaser

Netflix released the first official images from the set of its upcoming ensemble comedy “The Fifth Wheel” on March 6, 2026, showcasing Kim Kardashian alongside Nikki Glaser, Brenda Song, and Fortune Feimster in a high-energy reunion tale directed by Eva Longoria.

AFP

The photos, shared via Netflix’s Tudum platform and social channels, capture the four leads laughing together beside a pickup truck, evoking the chaotic fun of a long-overdue friends’ getaway. Kardashian, making her Netflix debut and first major leading film role, appears at the center, dressed casually yet stylishly, while Glaser, Song, and Feimster radiate camaraderie in the candid shots taken during filming in Los Angeles.

The project, which began production in late January 2026, follows a group of high school best friends who attempt to reconnect during a weekend trip to Las Vegas. Their plans unravel when a charismatic “hot outsider”—played by Kardashian—crashes the party, forcing the women to confront messy lives, bad decisions, lingering resentments, and the fragility of long-term friendships. The script, penned by Paula Pell and Janine Brito, has been praised in industry circles as sharp and hilarious since Netflix secured it in a competitive 2023 auction.

Longoria, known for her work on “Desperate Housewives” and recent directorial efforts, helms the film, bringing her signature blend of humor and heart to the female-driven story. Kardashian and Pell serve as producers through Gloria Sanchez Productions, alongside Jessica Elbaum, Will Ferrell, and Alex Brown. Additional production backing comes from Cris Abrego and Longoria’s Hyphenate Media Group.

The cast announcement gained traction in December 2025 when Deadline exclusively reported that Glaser, Song, and Feimster would join Kardashian. Glaser, a stand-up comedian and host known for her biting wit on shows like “Trainwreck: Poop Cruise” and her roast specials, brings sharp comedic timing. Song, recognized for roles in “The Suite Life of Zack & Cody” and recent dramatic turns, adds emotional depth, while Feimster, a comedian and actress from “The Mindy Project” and her own Netflix specials, rounds out the ensemble with her signature warmth and humor.

Kardashian, the reality television icon and business mogul behind SKIMS and KKW brands, has steadily expanded into acting. She previously starred in Hulu’s legal drama “All’s Fair” and appeared in Season 12 of “American Horror Story” as publicist Siobhan Corbyn opposite Emma Roberts. “The Fifth Wheel” represents her biggest cinematic leap yet, positioning her as the disruptive force in a story about female friendship dynamics.

Filming locations in Los Angeles have drawn attention, with paparazzi capturing the stars on set in February 2026. Reports indicate production is nearing completion, with sources suggesting a wrap around mid-March. No official release date has been announced, but industry speculation points to a late 2026 or early 2027 Netflix premiere, aligning with the streamer’s strategy for high-profile comedies.

The first-look images have sparked widespread buzz online. Social media reactions range from excitement over the star-studded lineup to curiosity about Kardashian’s comedic performance. Fans of Glaser praised the potential for roast-like banter, while others highlighted Longoria’s track record in elevating ensemble stories.

Netflix promoted the project as a fresh take on reunion comedies, emphasizing themes of growth, forgiveness, and the chaos of adult friendships. The Vegas setting promises over-the-top antics, from casino mishaps to heartfelt confrontations, all filtered through the lens of four distinct personalities.

Kardashian’s involvement extends beyond acting; as a producer, she has influence over creative decisions, reflecting her growing role behind the camera. The collaboration marks a notable pairing with Ferrell’s production banner, known for hits like “Anchorman” and “Step Brothers,” suggesting a blend of broad humor and character-driven moments.

For Glaser, the role offers another high-visibility platform following her rise in stand-up and television. Song and Feimster, both veterans of comedy and drama, are expected to deliver layered performances that balance laughs with genuine emotion.

As production progresses, anticipation builds for more details, including a potential trailer later this year. The film’s female-led focus and star power position it as a key entry in Netflix’s 2026-2027 slate, competing in a crowded comedy landscape.

The release of these initial images underscores Netflix’s aggressive marketing for buzzy projects, aiming to generate early hype amid a competitive streaming market. With Longoria at the helm and a talented ensemble, “The Fifth Wheel” appears poised to deliver escapist fun centered on the enduring, sometimes messy bonds of friendship.

Business

Camp4 Therapeutics: Strong Cash Runway As CMP-002 Moves Toward Human Trials (NASDAQ:CAMP)

I hold a Master’s degree in Cell Biology and began my career working for several years as a lab technician in a drug discovery clinic, where I gained extensive hands-on experience in cell culture, assay development, and therapeutic research. That scientific foundation gave me an appreciation for the rigor and challenges behind drug development, which I now bring into my work as an investor and analyst. For the past five years, I have been active in the investing space, with the last four years dedicated to working as a biotech equity analyst alongside my lab work. My focus is on identifying promising biotechnology companies that are innovating in unique and differentiated ways, whether through novel mechanisms of action, first-in-class therapies, or platform technologies with the potential to reshape treatment paradigms. By combining my lab-based scientific expertise with financial and market analysis, I aim to deliver research that is both technically sound and investment-driven. On Seeking Alpha, I plan to write primarily about the biotech sector, covering companies at different stages of development, from early clinical pipelines to commercial-stage biotechs. My approach emphasizes evaluating the science behind drug candidates, the competitive landscape, clinical trial design, and the potential market opportunity, all while balancing financial fundamentals and valuation. My goal in publishing here is to share some insights that help investors better understand both the opportunities and of course the many risks in biotech. This is a sector where breakthrough science can translate into outsized returns, but also where careful scrutiny is essential. I look forward to contributing thoughtful analysis and engaging with readers who share an interest in this dynamic and rapidly evolving space.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

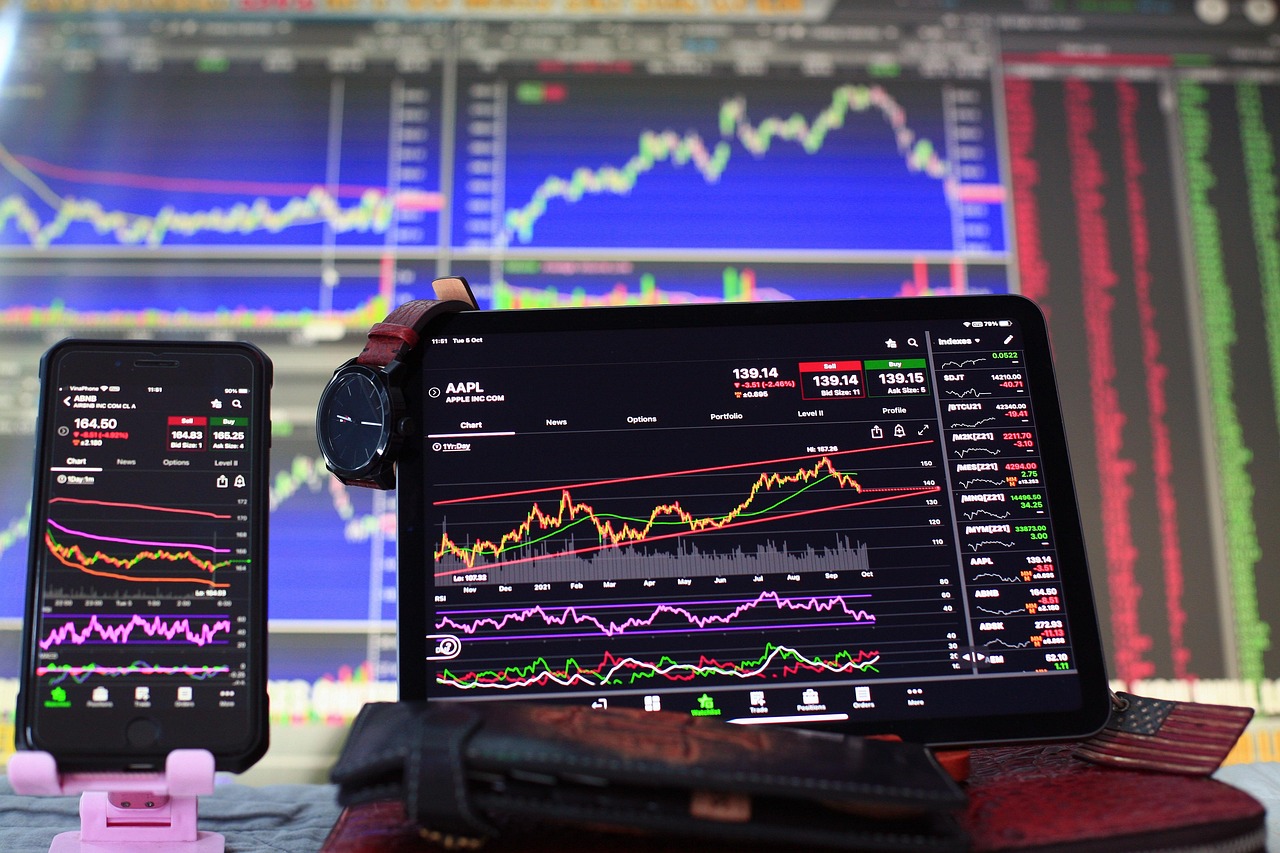

The S&P 500 Falls 1.33% as Geopolitical Tensions Drive Oil Surge and Market Volatility

The S&P 500 closed sharply lower on March 6, 2026, dropping 90.69 points, or 1.33%, to end at 6,740.02 amid renewed geopolitical risks that sent oil prices surging and rattled investor confidence across Wall Street.

The broad-market benchmark opened at 6,769.03 but quickly faced selling pressure, trading in a day’s range of 6,711.56 to 6,773.42. Volume reached approximately 3.41 billion shares, reflecting heightened activity as traders reacted to developments in the Middle East. The index’s previous close stood at 6,830.71, marking a reversal from modest gains earlier in the week.

The decline aligned with broader market weakness. The Dow Jones Industrial Average fell 453.19 points to 47,501.55, while the Nasdaq Composite shed 361.31 points to close at 22,387.68. All major indexes posted losses, with the S&P 500’s retreat erasing part of its year-to-date progress and highlighting ongoing sensitivity to energy market shocks.

Investors pointed to escalating U.S.-Iran tensions as a primary catalyst. Reports of renewed conflict, including claims of attacks in the Strait of Hormuz, pushed crude oil prices above $80 per barrel in recent sessions, with some analysts warning of further spikes if disruptions persist. Higher energy costs threaten to squeeze consumer spending and corporate margins, particularly for industries reliant on transportation and manufacturing.

“Oil is dictating the narrative right now,” said one market strategist, echoing sentiments from firms like Citi, where analysts noted equity markets taking cues from energy price movements. The volatility index, or VIX, climbed notably, signaling increased fear among traders.

Despite the day’s pullback, the S&P 500 remains up about 16.81% over the past year, buoyed by strong corporate earnings in technology and artificial intelligence sectors. The index hit a 52-week high of 7,002.28 on Jan. 28, 2026, before recent consolidation. Its 52-week low sits at 4,835.04, underscoring the resilience shown through 2025’s recovery.

Recent index rebalancing added fresh momentum to certain names. Vertiv Holdings, Lumentum Holdings, Coherent, and EchoStar are set to join the S&P 500, reflecting continued emphasis on data centers, optics, and communications infrastructure amid the AI boom. Such inclusions often drive short-term buying interest, though broader sentiment was overshadowed by macro concerns on March 6.

Economic data provided mixed signals. While inflation pressures from energy could complicate the Federal Reserve’s path, some observers viewed the dip as a potential buying opportunity. Commentators like Jim Cramer highlighted select stocks poised for recovery, advising caution on concentration risks beyond the S&P 500’s mega-cap leaders.

The pullback extends a short-term softening trend. Over the past five days, the index declined about 2.02%, with a one-month return of -2.77% and three-month performance at -1.90%. Year-to-date, it stands down 1.54%, a correction from earlier highs but still within historical norms for mid-cycle adjustments.

Looking ahead, markets face key tests. Upcoming economic releases, including inflation indicators and employment data, could influence Fed rate expectations. Geopolitical headlines remain fluid, with analysts monitoring potential supply chain impacts from Middle East instability.

Traders also weighed corporate developments. Boeing neared a significant deal, while AI-related plays showed pockets of strength despite the broader sell-off. Options activity suggested hedging strategies gaining traction as uncertainty lingers.

The S&P 500’s composition—spanning 500 leading U.S. companies and covering roughly 80% of domestic market capitalization—continues to serve as a barometer for economic health. Its market-cap weighting favors tech giants, which have driven outsized gains in recent years but now face scrutiny amid shifting macro winds.

As the trading week concluded, Wall Street braced for continued volatility. Oil’s trajectory, diplomatic efforts in the region, and any Fed commentary will likely set the tone. For now, the benchmark’s retreat serves as a reminder of how quickly external shocks can override fundamentals.

In Seoul, where Asian markets often follow U.S. cues, investors watched closely for spillover effects into global equities. The session’s close left the S&P 500 below key psychological levels, prompting debates over whether this marks a healthy correction or the start of deeper caution.

Wall Street’s mood reflected a blend of resilience and wariness. While long-term bulls point to solid earnings growth and innovation tailwinds, near-term risks from energy prices and geopolitics dominated the conversation on March 6.

Business

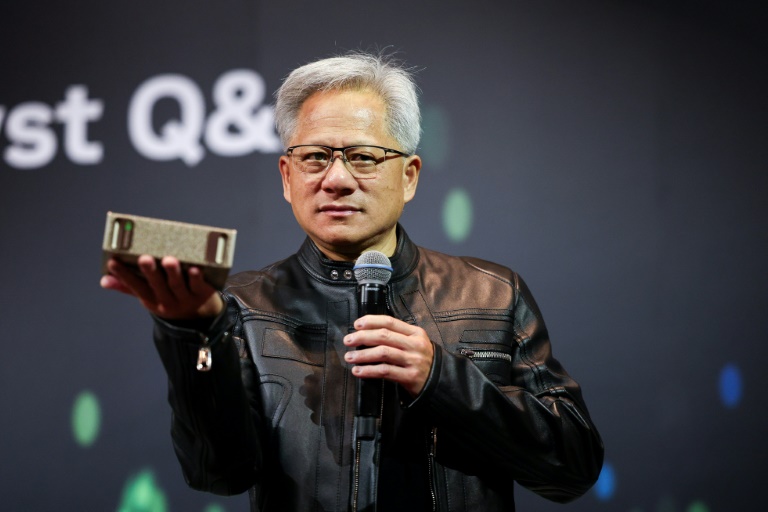

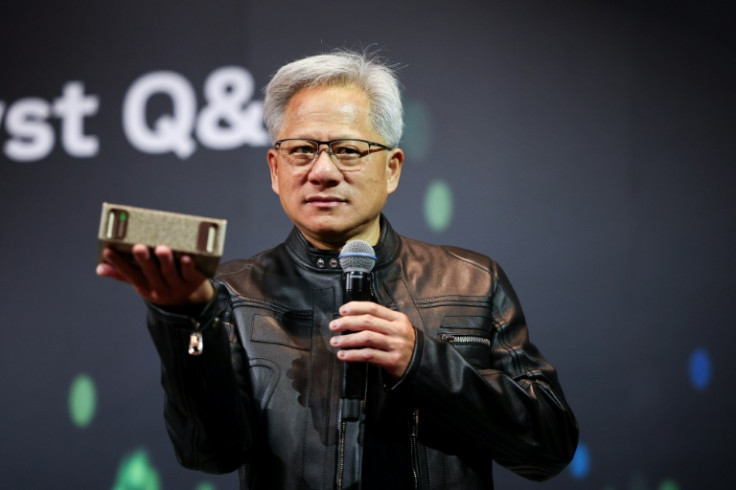

NVIDIA Stock Drops 3% Amid Geopolitical Pressures and Export Regulation Concerns

NVIDIA Corporation shares fell sharply on March 6, 2026, closing down 5.52 points, or 3.01%, at $177.82 as investors grappled with fresh reports of potential U.S. export restrictions on AI chips and broader market volatility tied to rising geopolitical tensions in the Middle East.

AFP

The Santa Clara, California-based chipmaker opened at $179.84 and traded in a range of $176.82 to $182.76 during the session. Volume surged to approximately 189 million shares, well above the average, reflecting intense trading interest amid the pullback. The previous close stood at $183.34, capping a brief two-day advance that had lifted the stock modestly earlier in the week.

The decline mirrored weakness across tech-heavy indexes, with the Nasdaq Composite also posting losses as energy prices climbed on renewed Middle East conflict risks. NVIDIA’s outsized influence on market sentiment—stemming from its dominance in AI accelerators—amplified the move, contributing to broader sector caution.

Analysts attributed much of the pressure to Bloomberg reports that the U.S. Commerce Department has drafted regulations requiring export permits for advanced AI chips to nearly every country worldwide. Such measures could complicate NVIDIA’s global supply strategy, particularly as the company has already navigated tight restrictions on shipments to China. NVIDIA CFO Colette Kress recently confirmed no Data Center revenue from China in recent guidance, underscoring ongoing challenges in that key market.

Adding to the narrative, Financial Times reporting indicated NVIDIA has halted production of its H200 chips tailored for China, redirecting capacity toward next-generation Vera Rubin hardware. The shift highlights the company’s pivot away from compliance-limited products in favor of cutting-edge platforms expected to drive future growth.

Despite the day’s retreat, NVIDIA’s fundamentals remain robust. The company reported record fiscal fourth-quarter results on February 25, 2026, with revenue of $68.1 billion, up 73% year-over-year and 20% sequentially. Data Center revenue—the AI engine—hit $62.3 billion, surging 75% from the prior year. For full fiscal 2026, revenue reached $215.9 billion, a 65% increase.

Guidance for the first quarter of fiscal 2027 calls for approximately $78 billion in revenue, plus or minus 2%, excluding any contribution from China. The outlook reflects continued explosive demand for Blackwell architecture GPUs and accelerating adoption of AI across enterprises, cloud providers, and sovereign AI initiatives.

Wall Street maintains a strongly bullish stance. Consensus ratings hover at “Buy,” with an average 12-month price target around $265, implying roughly 49% upside from the March 6 close. Some analysts, including those at JPMorgan, Raymond James, and Citigroup, recently lifted targets toward $265-$300 following the earnings beat and optimistic commentary on Blackwell ramp-up and Rubin roadmap.

Morgan Stanley reinstated NVIDIA as its top semiconductor pick, citing an “surprisingly good entry point” after the stock’s modest 2026 underperformance relative to explosive business growth. Bernstein, Baird, Bank of America, and Rosenblatt also pushed targets higher, some to $300, betting on sustained AI tailwinds.

CEO Jensen Huang’s recent comments added intrigue. He described a $30 billion investment in OpenAI as potentially NVIDIA’s “last” major equity commitment in the startup, ahead of its anticipated IPO. The remark tempered speculation about further large-scale strategic bets but underscored confidence in organic growth drivers.

Upcoming catalysts loom large. NVIDIA’s GTC conference, scheduled for March 16-19, 2026, features a keynote from Huang and promises updates on Blackwell Ultra ramp, Rubin launch timing in 2026, Rubin CPX late in the year, Rubin Ultra in 2027, and Feynman in 2028. The event typically showcases breakthroughs in robotics, AI agents, and accelerated computing, often sparking rallies.

Competitive dynamics drew attention as well. Broadcom issued bullish AI chip sales forecasts, positioning itself as a challenger in custom accelerators and networking. Yet NVIDIA’s ecosystem moat—spanning CUDA software, full-stack offerings, and market share leadership—continues to insulate it, with analysts viewing competition as healthy validation of the AI opportunity rather than an immediate threat.

The stock’s technical picture shows consolidation after peaking at a 52-week high of $212.19 in late October 2025. The 52-week low remains $86.62 from April 2025. Year-to-date in calendar 2026, shares are down modestly despite underlying strength, trading at a forward P/E around 36 based on consensus estimates.

Market capitalization hovers near $4.4 trillion, cementing NVIDIA’s status as one of the world’s most valuable companies. Its low debt-to-equity ratio of 0.05, quick ratio above 3, and return on equity near 97% highlight financial resilience.

A modest quarterly dividend of $0.01 per share was declared, payable April 1, 2026, to shareholders of record March 11, with an ex-date of March 11. While the yield is negligible at 0.02%, it signals confidence in cash flow generation.

Longer-term, the AI market’s projected expansion beyond $2 trillion by the early 2030s positions NVIDIA favorably. Enterprise deployments, inference workloads, sovereign AI projects, and emerging applications in robotics and physical AI fuel optimism.

Near-term risks include regulatory tightening, supply chain constraints in photonics and advanced packaging, and macroeconomic sensitivity to energy costs and interest rates. Yet most observers view recent dips as healthy corrections within a secular uptrend.

As trading wrapped March 6, attention shifted toward next week’s economic data, Fed commentary, and any fresh geopolitical developments. For NVIDIA, the path ahead hinges on execution against ambitious roadmaps and sustained AI spending momentum.

Investors in Seoul and global markets watched closely, recognizing NVIDIA’s role as a bellwether for technology’s transformative potential amid an uncertain macro backdrop.

Business

Trump cannot end protections for 350,000 Haitians, US appeals court rules

Trump cannot end protections for 350,000 Haitians, US appeals court rules

Business

Pope Leo names former envoy to Duterte’s Philippines as ambassador to US

Pope Leo names former envoy to Duterte’s Philippines as ambassador to US

Business

EastGroup Properties: A Quiet Compounder Delivering Market-Beating Returns

EastGroup Properties: A Quiet Compounder Delivering Market-Beating Returns

Business

Filipino Tennis Star’s Rise to World No. 32 and 2026 Breakthroughs

Alexandra Eala, the trailblazing Filipino tennis prodigy, continues her meteoric ascent on the WTA Tour as she competes at the BNP Paribas Open in March 2026. At just 20 years old, the Quezon City native has become the highest-ranked player from the Philippines in WTA history, reaching a career-high of No. 31 in February before settling at No. 32 as of early March. With fans flocking to her practice sessions and a rematch against familiar foe Dayana Yastremska looming in the second round, Eala embodies national pride and global potential.

Here are 10 key things to know about Alexandra Eala as her 2026 campaign intensifies.

- Prodigious Early Start and Junior Success Born May 23, 2005, in Quezon City, Philippines, Eala began playing tennis at age 4. She moved to Spain at 13 to train at the prestigious Rafa Nadal Academy in Mallorca, graduating in 2023 with a diploma presented by Nadal himself. Her junior career peaked with the 2022 US Open girls’ singles title, marking her as a generational talent from Southeast Asia.

- Historic Breakthrough in 2025 Eala exploded onto the senior scene in 2025, becoming the first Filipina to reach a WTA 1000 semifinal at the Miami Open as a wildcard. She stunned three Grand Slam champions—No. 24 Jelena Ostapenko, No. 15 Madison Keys and world No. 2 Iga Swiatek—in consecutive matches, propelling her into the Top 100 and etching her name in Philippine sports history.

- Career-High Ranking in 2026 Entering March 2026 at No. 32, Eala sits more than 100 spots higher than the same time in 2025 (No. 140). Her peak of No. 31 came on Feb. 23 after a strong Dubai Tennis Championships run, where she notched her first Top 10 win of the year over No. 7 Jasmine Paolini before falling to No. 3 Coco Gauff in the quarterfinals. She is the only Filipino to crack the WTA Top 100 since rankings began in 1975.

- Strong 2026 Start Eala opened the year with semifinal appearances in singles and doubles at the Auckland Open. She advanced to the Abu Dhabi Open quarterfinals (losing to No. 11 Ekaterina Alexandrova), exited early in Doha but rebounded in Dubai with three wins, including the Paolini upset. Her consistent performances have fueled a rapid climb and positioned her for deeper runs in big events.

- Sunshine Swing Focus As a seeded player at the WTA 1000 BNP Paribas Open in Indian Wells (March 4-15), Eala received a first-round bye and advances to the Round of 64. She faces Dayana Yastremska in the second round—a rematch of their 2025 quarterfinal clash, which Eala won 6-1, 6-2. Following Indian Wells, she heads to the Miami Open (March 17-29), where she aims to surpass her 2025 semifinal.

- Playing Style and Strengths Eala’s game features a solid baseline foundation, powerful groundstrokes and mental toughness honed at the Nadal Academy. Her left-handed forehand and aggressive returns shine on hard courts. She emphasizes focusing on her own game rather than opponents, crediting humility and preparation for her success.

- National Icon and Inspiration Dubbed the “Pacquiao of tennis” by fans, Eala inspires a new generation in the Philippines. Her Vogue Philippines cover after the 2022 US Open junior win and Tatler features highlight her off-court appeal. She prioritizes growing the sport locally, viewing her rise as an opportunity to expand tennis’s footprint in Southeast Asia.

- Family Background Eala hails from a sports-oriented family. Her mother, Rizza Maniego-Eala, a former national swimmer, won bronze in the 100m backstroke at the 1985 Southeast Asian Games. Her father, Mike Eala, is a businessman. The family’s support has been crucial, with her mother often credited for instilling discipline and competitive spirit.

- Off-Court Milestones and Personality Beyond tennis, Eala has embraced her rising fame with grace. Interviews portray her as humble, charming and focused—qualities praised by fans and media. She maintains balance amid pressure, often highlighting family time and gratitude for supporters. Her popularity draws crowds at practice sessions, creating an “Eala effect” at tournaments.

- Future Outlook and Ambitions Eala views 2026 as a building year, not her peak. In late 2025 interviews, she expressed optimism that “maybe 2027 will be even better,” signaling long-term goals like consistent Top 20 status, Grand Slam deep runs and possibly a major title. With her trajectory—jumping from outside the Top 150 in 2024 to Top 32—experts see her as a potential Top 10 threat in coming seasons.

As Eala takes the court in Indian Wells, Filipino fans worldwide rally behind her with chants of “Laban Puso!” Her blend of talent, work ethic and poise positions her as a global star and national hero. Whether she advances past Yastremska or builds momentum for Miami, Alexandra Eala’s story continues captivating the tennis world.

Business

Inside the booming business of wellness clubs and third spaces

A few years ago, Grace Guo began to crave places in New York City where hanging out with friends didn’t have to involve alcohol.

Newly sober and surrounded by friends who also chose not to drink, Guo said she wanted alternatives to the typical social scene. After some research, she landed on Bathhouse and Othership: social wellness clubs designed to create communities around improving health.

“Honestly, it kind of just feels like going to a spa together and spending an afternoon together. I think for me, it just feels much better rather than staying out late at night,” Guo told CNBC.

She’s one of a growing number of people seeking out membership clubs and other places that are structured around maintaining health while also acting as a spot to foster connection.

And those spaces are becoming booming businesses, too. Bathhouse, which opened in 2019 in Brooklyn, New York, told CNBC exclusively that it expects to hit around $120 million in revenue by the end of this year. It declined to disclose any of its other financials, as did Othership.

Many of these types of companies are privately held, but publicly traded gym chain Life Time also began doubling down on premium wellness a few years ago. While investors initially did not like that reallocation of resources, it’s now paying off, with Life Time’s stock more than doubling since October 2023.

Companies old and new are trying to reach consumers like Guo. The 31-year-old said she’s seen an increased focus on health, wellness and peacefulness in her own social life and in those around her, as she searches for so-called third spaces with that focus.

“I’m kind of like, where can I go to try to plug into a community, or where can I go to express a particular interest that I have and find like-minded people?” Guo said. “It’s finding a group of like-minded people, but then also having the space and the novelty to try something or to pursue something.”

At Othership, between spending time in the sauna and the cold plunge and choosing a popular evening time slot, Guo said the environment of health-focused socializing spoke to her.

“Having a space to go to where it kind of shocks us out of our routine and complacency is really important, and I think probably the biggest thing is just the fact that it overcomes a lot of the inertia of doing something,” Guo said.

‘Loneliness is an epidemic’

Bathhouse pools

Source: Bathhouse

The concept of third spaces isn’t new. The term was first coined by sociologist Ray Oldenburg in his 1989 book, “The Great Good Place,” to refer to spaces outside of the home, or the first place, and work, the second place, where people gather and form relationships.

That definition came to encompass places like neighborhood coffee shops, libraries, bars and more, where people from different backgrounds came together in an informal setting with relatively low barriers to access.

But somewhere in the past few years, that definition has evolved, and the importance of third spaces has blossomed.

Richard Kyte, a professor at Viterbo University in Wisconsin and the author of “Finding Your Third Place,” said he’s been teaching courses on third places for nearly two decades, but only noticed the term becoming mainstream in the past few years.

That turning point, Kyte said, also coincided with the pandemic, which sent the world into lockdowns and practically eliminated social gatherings for a period while redefining them for the long term.

“During that time, all of a sudden, we were talking more about the cost of loneliness, the cost of social isolation. It really came home to us during the pandemic that this was not healthy,” Kyte told CNBC. “And at the same time that we were noticing that we need these places more, we were seeing that so many of them were closing. That kind of spurred a renewed interest.”

It’s a trend that’s also been compounded by an increasingly digital-forward society, he added, as younger generations crave more than just social media connections even with the rise of artificial intelligence and chatbots.

“We’ve got all of this huge investment in technology that increases the ease and desirability of being independent,” Kyte said, citing AI companies promoting products that pose as friends. “When we have people turning more to their screens instead of looking to find fulfillment through social interaction, it just takes all these people out of the pool.”

According to Cigna’s 2025 “Loneliness in America” report, 67% of Gen Zers reported feeling lonely, along with 65% of millennials. A 2024 Harvard survey found that 67% of adults feel social and emotional loneliness because they are not part of meaningful groups.

Harry Taylor first founded Othership alongside his wife and friends to create a space that incorporated the wellness trend while combating that isolation.

“We understand that there’s a huge market for people to meet other people. Loneliness is an epidemic right now,” Taylor told CNBC. “We realized, just through doing this, it has the capacity for people to come together and just be themselves, be vulnerable.”

What’s old is new

Third spaces have evolved to encompass specific purposes, justifying the price tag that often comes with them, since some membership clubs can thousands of dollars per month.

Wellness, specifically, has seen a recent boom, becoming one of the top categories for gifting items last holiday season. Equinox chairman Harvey Spevak told CNBC last month that “health is the new luxury,” with the global wellness market expected to reach nearly $10 trillion by 2030, according to estimates from the Global Wellness Institute.

Bathhouse, which operates roughly 90,000 square feet of facilities in New York City, offers a wellness experience based on the bathhouse legacy of Europe. The space has saunas and cold plunges, both guided and unguided, starting at $40 for a drop-in session. The company’s two New York locations see roughly 1,000 customers each day.

“It was really apparent that there was no bathhouse-like concept that was really oriented towards a modern consumer, especially not in America,” co-founder Travis Talmadge told CNBC.

Talmadge said he and his co-founder were focused on creating a human experience, tapping into each person’s body while also building community around the shared activities.

“Our spaces are really large scale, so one of the nice things is that everybody kind of feels like a background actor on set, where there’s just so many people moving around,” Talmadge said. “You can have this really personal time, either by yourself or with somebody else, but then you’re in this environment with a lot of people doing the same thing.”

Talmadge said the company has seen a “surplus of demand” and runs at a “very healthy margin,” with plans to open seven more locations through 2027.

It’s just one of many wellness spaces growing in popularity.

Othership is also tapping into a wellness mindset, incorporating practices from various cultures to address the “physical, mental emotional and spiritual.” It has locations in New York and Canada, with plans for more growth.

At Othership, members can choose between three options: a free-flow session, designed to allow members to use the space however they want; classes, which alternate between saunas and cold plunges with group-led activities; and socials, imitating clubs without the alcohol in an effort to be present.

Co-founder Taylor said through Othership, he’s seen customers form new friend groups, propose to their partners in the sauna and find belonging with others while also fueling their own health.

Creating alcohol-free spaces was one of the Othership founders’ aims when creating the vision. Othership now hosts comedians, live musicians and more at its saunas to mimic similar spaces seen in big cities that are often associated with alcohol.

“There’s so much social media, which gives us the false perception that there’s social engagement and interaction, but so many of us have experienced when we’re doomscrolling, it almost even does the opposite,” Taylor said. “There’s a void in the wake of that social satiation that we all require as humans, so it’s that coming together and just being so real with one another that really creates a deep sense of belonging.”

Building community

Glo30 skincare studio.

Courtesy: Arleen Lamba

Wellness communities can form in other ways, too. Glo30, a membership studio founded 13 years ago with locations across the country, offers personalized skincare treatments for members every 30 days, creating a schedule aligned with other members to foster community.

“Community building is a lot about not just getting the results and [feeling] good, but also being able to have a commonality on their experiences and share what they feel,” Glo30’s founder and CEO Arleen Lamba told CNBC.

While urban cities like New York and Los Angeles have seen a boom in wellness clubs, Lamba said her more than 100 locations represent the in-between, in places like Texas, Arizona, North Carolina and more.

Every Glo30 appointment is scheduled on the hour in each location to create more opportunities for social connection, Lamba said.

“As people come into the studio, people are also leaving the studio, and we recognize that they recognize each other, they would actually make new friends,” she said, adding that especially post-pandemic, the company has seen a growing number of social groups form in the treatment rooms.

Lamba said she’s seen the craving for social connection increase with the rise of social media, but that creating community can often happen in untraditional places, like Glo30. At the same time, that social interaction isn’t as “overwhelming” as other places like parties or big group events, allowing for intimate socializing, she said.

In the past two years, Lamba said the number of Glo30’s franchise units in development has grown 67.5% as it sees more demand for its services.

The boom of third spaces goes beyond wellness, too. Exclusive restaurant memberships, gyms, creative spaces, social clubs and more are gaining more popularity as consumers search for ways to build community outside of their houses and offices.

At Glo30, Lamba said she’s seen every type of customer base at the company’s locations, from families to girl groups to couples.

“The third space is interesting because it creates a true connection,” she said. “We get to be witness to someone’s life — their highs, their lows, their middles — and we are the constant, and that, to me, is what the third space is about: No matter what kind of day you had out there, good or bad or medium, this space belongs to you. And when you come to this space, people will know you, see you, appreciate you and be glad you’re there.”

Business

Cody Rhodes Reclaims Undisputed WWE Championship

Cody Rhodes reclaimed the Undisputed WWE Championship on the March 6, 2026, episode of Friday Night SmackDown, defeating Drew McIntyre in a high-stakes main event that sets up a blockbuster WrestleMania 42 showdown against Randy Orton. The title switch, amid interference and intense storytelling, capped a chaotic night at the Moda Center and shifted the Road to WrestleMania narrative dramatically.

Rhodes, known as the American Nightmare, pinned McIntyre after a sequence featuring a Super Cutter followed by his signature Cross Rhodes. The victory marked Rhodes’ third reign with the prestigious title, following his earlier 2025 run and brief loss to McIntyre earlier this year. The win came after McIntyre’s interference in the Men’s Elimination Chamber match cost Rhodes a guaranteed WrestleMania spot, prompting SmackDown General Manager Nick Aldis to grant the immediate rematch.

Reports indicate WWE creative, led by Triple H, planned the change to deliver a fresh WrestleMania main event. Backstage sources confirmed Rhodes and Orton were aware of the Orton vs. Rhodes direction as early as January or February 2026, with the title drop from McIntyre designed to elevate the personal stakes. The longtime allies-turned-rivals—Rhodes mentored by Orton in Legacy—have teased tension for months, including Orton’s hesitation in past encounters and subtle mind games.

McIntyre, who won the title in a brutal Three Stages of Hell match earlier in 2026, expressed frustration post-match. Fans online debated the timing, with some praising the Rhodes-Orton draw while others felt McIntyre deserved a longer reign or a different WrestleMania path, potentially against Jacob Fatu. The interference in the title match involved Jacob Fatu, whose actions aided Rhodes and fueled speculation about Bloodline remnants or new alliances.

The episode featured other notable developments. In women’s action, Rhea Ripley appeared for a tense face-to-face with Women’s Champion Jade Cargill ahead of their WrestleMania clash. Ripley, fresh off her Elimination Chamber victory, promised to “end the era” of Cargill’s dominance, building anticipation for the high-profile matchup.

Tag team contenders were crowned as R-Truth and Damian Priest earned a shot at the WWE Tag Team Championships, defeating opponents in a hard-fought bout. Oba Femi continued his destructive run with a decisive win, solidifying his rising status on the blue brand.

The show also highlighted ongoing storylines involving Roman Reigns’ potential return or revenge angles, though no major appearance occurred. Commentary focused on the evolving Bloodline saga and how Rhodes’ win impacts broader dynamics.

Rhodes celebrated post-match, hoisting the title as confetti fell and the crowd chanted “Cody! Cody!” In a brief promo, he addressed Orton directly: “Randy, we’ve got unfinished business. At WrestleMania, the American Nightmare finishes the story—again.” Orton, who won the Elimination Chamber to earn his shot, watched from afar, smirking, setting up a personal, legacy-defining confrontation in Las Vegas.

Fan reaction was mixed but largely positive for the title change. Social media buzzed with excitement over Rhodes-Orton, with hashtags like #AllRhodesLeadToWrestleMania trending. Critics questioned the frequency of title switches on TV but acknowledged the draw of two fan-favorite legends clashing for the top prize.

WWE continues building toward WrestleMania 42, with Rhodes now positioned as champion entering the final stretch. McIntyre’s future remains unclear—rumors suggest a program with Fatu or a multi-man scenario—but the focus shifts to the epic Rhodes-Orton rematch of mentor and protégé.

As SmackDown airs on USA Network (and Netflix internationally), the blue brand delivers must-see drama weekly. With WrestleMania 42 approaching, Cody Rhodes’ championship victory ensures the Road to Las Vegas remains unpredictable and compelling.

-

Politics4 days ago

Politics4 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business23 hours ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Tech6 days ago

Tech6 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat7 days ago

NewsBeat7 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Fashion19 hours ago

Fashion19 hours agoWeekend Open Thread: Ann Taylor

-

NewsBeat7 days ago

NewsBeat7 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat6 days ago

NewsBeat6 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech2 days ago

Tech2 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment5 days ago

Entertainment5 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports2 days ago

Sports2 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat6 days ago

NewsBeat6 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics7 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech6 days ago

Tech6 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video5 days ago

Video5 days agoHow to Build Finance Dashboards With AI in Minutes

-

Fashion6 days ago

Fashion6 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Business4 days ago

Business4 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat5 days ago

NewsBeat5 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Crypto World6 days ago

Crypto World6 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

Crypto World5 days ago

Crypto World5 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown