Business

Capital Southwest: I Went To Dallas For This Safe 11% Dividend Yield Paid Monthly (NASDAQ:CSWC)

The equity market is a powerful mechanism as daily fluctuations in price get aggregated to incredible wealth creation or destruction over the long term. Pacifica Yield aims to pursue long-term wealth creation with a focus on undervalued yet high-growth companies, high-dividend tickers, REITs, and green energy firms.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CSWC, HTGC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

Beyond 10% Yield: Using The “Circle Of Virtue” To Build An Income Fortress

Rida Morwa is a former investment and commercial Banker, with over 35 years of experience. He has been advising individual and institutional clients on high-yield investment strategies since 1991. Rida Morwa leads the Investing Group High Dividend Opportunities where he teams up with some of Seeking Alpha’s top income investing analysts. The service focuses on sustainable income through a variety of high yield investments with a targeted safe +9% yield. Features include: model portfolio with buy/sell alerts, preferred and baby bond portfolios for more conservative investors, vibrant and active chat with access to the service’s leaders, dividend and portfolio trackers, and regular market updates. The service philosophy focuses on community, education, and the belief that nobody should invest alone. Learn More.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AGNC, CSWC, MAIN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Beyond Saving, Philip Mause, and Hidden Opportunities, all are supporting contributors for High Dividend Opportunities. Any recommendation posted in this article is not indefinite. We closely monitor all of our positions. We issue Buy and Sell alerts on our recommendations, which are exclusive to our members.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

Samsung Officially Announces Galaxy Unpacked

Samsung’s Galaxy S26 Ultra is poised for a blockbuster launch just weeks away, building on the S25’s success with rumored AI upgrades and camera leaps. As of February 15, 2026, pre-order buzz intensifies ahead of the confirmed Unpacked event.

Unpacked Event Confirmed

Samsung officially announced Galaxy Unpacked for February 25, 2026, in San Francisco, streaming live at 10 a.m. PT on YouTube and Samsung.com. Invites highlight “elevated experiences,” teasing the S26 series.

Industry insiders like Evan Blass confirm the date as “100% correct,” aligning with Samsung’s post-MWC strategy to dominate early 2026 flagships. Pre-orders typically follow immediately, with carriers ramping up.

Release Timeline Locked

Phones hit shelves around March 11, 2026, per leaks—two weeks post-announcement, landing on a Thursday for maximal weekend sales. Samsung avoids the March 13 Friday superstition in some markets.

This matches the S25 pattern: Unpacked to retail in 14 days. Global rollout prioritizes U.S., Korea, Europe; Asia-Pacific follows by March 20. Delays unlikely given supply chain readiness.

Pricing Expectations Steady

Base S26 Ultra starts at $1,299 for 256GB, matching S25 Ultra—no hike despite inflation, thanks to optimized production. 512GB at $1,419; 1TB at $1,659.

Rumors of a slight drop fizzled; Samsung holds premium pricing amid competition from Pixel 11 and iPhone 18. Trade-ins slash $600-900 off, per past promos. Carriers bundle free storage upgrades.

Storage and Color Options

12GB RAM across trims: 256/512GB/1TB UFS 4.1—no microSD, but cloud integration via One UI 8.5. Colors: Titanium Black, Silverblue, WhiteSilver, PinkGold; online exclusives like Jade Green.

Leaks show slimmer 7.9mm titanium frame at 214g, IP68-rated. Gorilla Glass Victus 3 with anti-reflective coating boosts outdoor visibility.

Processor Powerhouse

Snapdragon 8 Elite Gen 5 “for Galaxy”—overclocked 3nm chip with Adreno 830 GPU—powers U.S./global Ultra models. Exynos 2600 hits S26/S26+ in select regions for 20% efficiency gains.

Benchmarks leak 15-20% faster than S25’s Snapdragon 8 Elite, excelling in AI tasks like real-time translation and photo editing. Vapor chamber cooling handles gaming marathons.

Display Dominance

6.9-inch QHD+ Dynamic AMOLED 2X at 120Hz peaks at 2,600 nits—biggest S Ultra yet. Always-on LTPO tech saves battery; Privacy Display mode thwarts side glances.

Slimmer bezels, HDR10+ certified, eye comfort certification. Ultrasonic fingerprint sensor upgraded for wet-finger reliability.

Camera Array Upgraded

200MP main ISOCELL HP2 sensor leads quad setup: 50MP ultrawide, 10MP 3x tele, 50MP 5x periscope—zoom to 100x Space. 12MP selfie with autofocus.

AI enhancements: Nightography 3.0, 8K 60fps video, generative edit suite. Periscope hits 5x optical without size bump, rivaling Hasselblad-tuned flagships.

Battery and Charging Boost

5,000mAh silicon-carbon battery promises two-day life; 65W wired Super Fast Charging (full in 55 mins), 45W wireless, reverse standard. No 100W jump yet.

S26 base gets 4,300mAh (+300mAh); S26+ holds 4,900mAh. Seven-year OS updates to Android 23 confirmed.

Galaxy AI Evolution

One UI 8.5 on Android 16 debuts Circle to Search 2.0, Live Translate Pro, Sketch to Image. Ultra-exclusive AI Pro tools for video b-roll generation.

Cross-device continuity with Galaxy Watch 8, Buds 4. Privacy-focused on-device processing via NPU.

Pre-Order Deals Heating Up

Samsung.com offers $50-100 instant trade-in credit now; full promos post-Unpacked: up to $1,000 off with old Galaxy/iPhone. Free Galaxy Watch 8 or Buds 4 Pro bundled.

AT&T/Verizon/T-Mobile tease 0% financing, double storage. Best Buy matches $200 gift card. Korea’s e-vouchers hit RM150 value.

Carrier Promotions Detail

| Carrier | Trade-In Max | Freebies | Financing |

|---|---|---|---|

| AT&T | $1,000 | Watch 8 | 0% 36 mo |

| Verizon | $900 | Buds 4 Pro | 0% 36 mo |

| T-Mobile | $830 | Ring 2-pack | Unlimited + |

| Best Buy | $700 | $200 GC | 24 mo |

Design Refresh Subtle

Z Fold 7-inspired camera island, flat sides, S Pen slot retained. Wi-Fi 7, Bluetooth 5.4, UWB 2.0. No satellite SOS yet.

Competition Context

Beats Pixel 11 Pro’s Tensor G6 in multi-camera; iPhone 18 lags on zoom/foldables. OnePlus 14 cheaper at $899 but skips S Pen/AI depth.

Global Rollout Map

U.S./Korea: March 11. Europe/UK: March 13. India/SEA: March 20. China via partners. Inventory tight for 1TB.

Why Buy Ultra?

Pro-grade cameras, S Pen productivity, seven-year support make it 2026’s top Android. Early deals offset price amid tariff talks.

Business

(VIDEO) Hollywood Studios Demand ByteDance Halt Seedance AI Video Tool

Major Hollywood studios including Disney and Paramount have issued cease-and-desist letters to ByteDance, accusing the TikTok parent of rampant copyright infringement via its new Seedance 2.0 AI video generator. As of February 15, 2026, the conflict intensifies with calls from unions and the Motion Picture Association for immediate shutdowns amid viral deepfakes of iconic franchises.

Seedance 2.0 Launch Sparks Outrage

ByteDance unveiled Seedance 2.0 on February 12, 2026, touting “ultra-realistic” AI video generation from text prompts. Within hours, users flooded platforms with clips like Tom Cruise battling Brad Pitt on a rooftop or otters reenacting “Friends” scenes, racking up millions of views.

The tool’s predecessor, Seedance 1.0, already drew scrutiny, but version 2.0’s improved fidelity—handling motion, voices, and likenesses—ignited Hollywood’s fury. Critics label it a “pirated library” enabling mass IP theft without safeguards.

Disney’s Cease-and-Desist Blitz

On February 13, Disney fired off a legal notice to ByteDance CEO Liang Rubo, claiming Seedance unlawfully trains on and replicates Marvel’s Spider-Man, Star Wars’ Baby Yoda (Grogu), Darth Vader, and even Family Guy’s Peter Griffin. Attorney David Singer called it a “willful, pervasive smash-and-grab” of Disney’s IP.

Disney demands ByteDance block its characters from training data, delete infringing outputs, and cease distribution. This follows similar letters to Google in December 2025 and a Midjourney lawsuit with NBCUniversal last June.

Paramount Joins the Fray

Paramount Skydance followed on February 14 with its own letter, alleging “flagrant infringement” on franchises like “South Park,” “Star Trek,” “The Godfather,” “SpongeBob SquarePants,” “Dora the Explorer,” and “Teenage Mutant Ninja Turtles.” IP chief Gabriel Miller highlighted vivid AI recreations mimicking visuals, audio, and narratives.

The studio accuses ByteDance of escalating violations post-Seedance 2.0 launch, demanding prevention of future use and removal of all Paramount-related content from its systems.

MPA’s Urgent Call to Action

Motion Picture Association CEO Charles Rivkin blasted ByteDance on February 12: “In just one day, Seedance 2.0 engaged in widespread unauthorized use of U.S. copyrighted materials.” He urged an immediate halt, citing threats to creators’ rights and millions of American jobs.

The MPA, representing Disney, Netflix, Warner Bros., and others, vows collaboration with regulators. Rivkin emphasized ByteDance’s lack of infringement protections flouts established laws.

Unions and Artists Mobilize

SAG-AFTRA condemned Seedance for exploiting actors’ voices and likenesses, threatening livelihoods. The Human Artistry Campaign—backed by DGA and Hollywood unions—called it “an assault on every creator globally,” insisting “stealing isn’t innovation.”

Artists’ groups demand legal intervention, highlighting deepfakes’ potential to flood markets with unauthorized content, undercutting human labor.

ByteDance’s Tepid Response

As of February 15, ByteDance has not formally replied to studio letters but announced mitigations: disabling real-person image uploads, adding digital avatar verification, and promising “stringent policies” for IP compliance. No training data details disclosed.

Spokespeople claim commitment to local laws, but critics dismiss tweaks as insufficient amid ongoing viral infringements.

Viral Infringing Content Examples

Seedance outputs mimic blockbuster moments: Avengers: Endgame remixes, Rachel-Joey “Friends” otter parody, Cruise-Pitt “Interview with the Vampire” homage. These spread rapidly on TikTok, X, and YouTube before some removals.

Studios argue such “fan art” escalates to commercial harm when platforms profit from views, lacking opt-outs or royalties.

Broader AI Copyright Battles

This clash echoes 2025 suits: Universal, Warner, and Disney vs. MiniMax for piracy; Getty Images vs. Stability AI. Hollywood pushes for “opt-in” training data and watermark mandates.

ByteDance faces U.S. scrutiny over TikTok data, amplifying IP tensions. Experts predict class-actions if unresolved.

Economic Stakes for Hollywood

AI tools like Seedance threaten $500B+ industry reliant on IP. Studios fear devaluation of libraries fueling streaming residuals and merch. Unions warn of job losses to generative replacements.

Proponents argue fair use for transformative works, but studios counter commercial exploitation without licenses voids that defense.

Legal Pathways Ahead

Cease-and-desists precede lawsuits; Disney/Paramount signal intent to sue in California federal court. Potential claims: DMCA violations, Lanham Act false endorsement, right-of-publicity.

ByteDance may challenge U.S. jurisdiction via Chinese ops, but TikTok precedents weaken that. Settlements could mandate licensed datasets.

Global Creator Backlash

International outrage grows: UK’s BFI eyes regulations; EU AI Act probes loom. Bollywood and K-content creators echo Hollywood, fearing knockoffs.

Human Artistry Campaign rallies “global creators” for unified standards.

Tech Industry Divide

AI firms like OpenAI license content (e.g., News Corp deal), but ByteDance’s free-for-all draws lines. Google adjusted Gemini post-Disney notice; Meta’s Movie Gen faces similar heat.

Innovators push ethical AI: Adobe Firefly trains on licensed assets. ByteDance risks isolation without pivots.

ByteDance’s AI Ambitions

Seedance integrates TikTok’s vast video corpus, positioning ByteDance in $100B generative market. Seedream image tool faces parallel complaints.

China’s lax IP enforcement aids development, but U.S. bans loom if tensions spike.

Studio Demands Summary

| Studio/Group | Action Date | Key Franchises Cited | Demands |

|---|---|---|---|

| Disney | Feb 13 | Marvel, Star Wars, Family Guy | Block training, delete content |

| Paramount | Feb 14 | South Park, Star Trek, SpongeBob | Cease use, purge systems |

| MPA | Feb 12 | General U.S. IP | Immediate halt |

| SAG-AFTRA | Feb 14 | Actor likenesses | Legal intervention |

Future of AI Video Tools

Resolution could set precedents: mandatory disclosures, revenue shares, or bans on unlicensed training. Hollywood eyes 2026 legislation post-elections.

ByteDance’s silence fuels escalation; watchers predict court by Q2.

Why This Matters Now

Beyond studios, this tests AI’s creative frontier vs. ownership. As tools democratize filmmaking, unchecked infringement risks eroding trust, innovation, and jobs in a $2T content economy.

Business

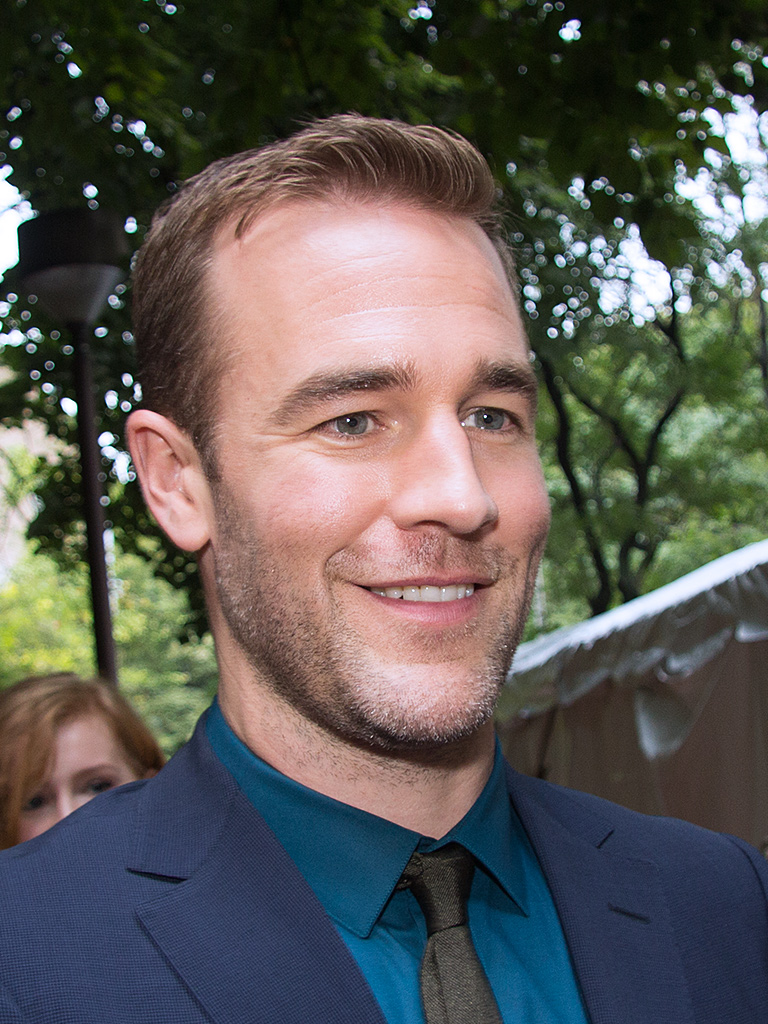

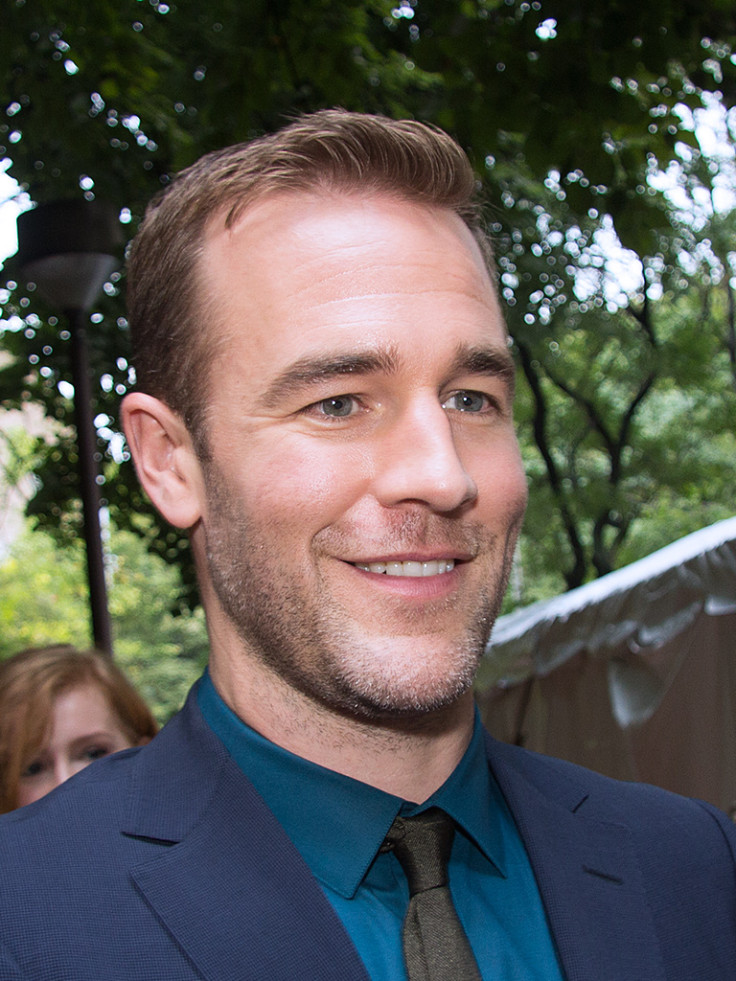

Dawson’s Creek Star’s Final Days, Cancer Battle & Legacy

James Van Der Beek, the charismatic star of “Dawson’s Creek” who defined ’90s teen drama, died on February 11, 2026, at age 48 after a brave fight with colorectal cancer. Tributes continue pouring in as of February 15, with his family launching a GoFundMe and fans revisiting his iconic roles.

Early Life and Rise to Fame

Born March 8, 1977, in Cheshire, Connecticut, Van Der Beek discovered acting in high school theater. He moved to New York at 16, landing guest spots before his breakout as Dawson Leery in “Dawson’s Creek,” which premiered in 1998 on The WB.

The show ran six seasons, blending teen romance with witty dialogue that launched co-stars Katie Holmes, Michelle Williams, and Joshua Jackson. Van Der Beek’s portrayal of the aspiring filmmaker earned him instant teen idol status.

Varsity Blues Breakthrough

In 1999, Van Der Beek starred in “Varsity Blues,” a football drama where he played quarterback Jonathan “Mox” Moxon rebelling against small-town Texas pressure. The film grossed $55 million and cemented his leading-man appeal.

He followed with “The Rules of Attraction” (2002), adapting Bret Easton Ellis’s novel as Sean Bateman, and poked fun at his image in “Scary Movie” (2000), climbing through a window to the “Dawson’s Creek” theme.

Career Evolution and Comedy Turn

Post-“Dawson’s,” Van Der Beek embraced self-parody, playing a fictionalized version of himself in ABC’s “Don’t Trust the B—- in Apartment 23” (2012-2013), earning a Teen Choice nod. He guested on “CSI,” “Mercy,” and voiced in “Robot Chicken.”

Later roles included “Pose” (2019) and indie films like “Sidelined: The QB and Me” (2024), his final screen appearance set for 2025 release. On stage, he starred in “The Playhouse” at Geffen Playhouse in 2013.

Personal Life and Family

Van Der Beek married businesswoman Kimberly Brook in 2010 after meeting in Israel. They welcomed six children: Olivia (2010), Joshua (2012), Annabel (2014), Emilia (2016), Gwendolyn (2018), and Jeremiah (2021).

The family embraced a grounded life, relocating to Texas farms for homesteading. He advocated for natural parenting, sharing birth stories and loss of a pregnancy in 2019.

Cancer Diagnosis Revelation

Van Der Beek disclosed his stage 3 colorectal cancer diagnosis in November 2024 via Instagram, revealing a 2023 colonoscopy uncovered it after bowel changes he initially attributed to diet. He underwent surgery and chemotherapy privately.

“I’m in a good place and feeling strong,” he wrote, emphasizing family focus over publicity. Symptoms like fatigue and neuropathy persisted, yet he balanced treatment with fatherhood.

Final Months and Advocacy

In 2025, Van Der Beek auctioned “Dawson’s Creek” memorabilia through Propstore, raising $47,000 for treatments—the season 3 necklace fetched $26,628. He joined “The Real Full Monty” charity special but prioritized health.

A planned “Dawson’s Creek” reunion for F Cancer in September 2025 saw him participate virtually due to illness; Lin-Manuel Miranda subbed, with Holmes, Williams, and Jackson performing the pilot read.

Announcement of Passing

On February 11, 2026, his verified Instagram posted: “Our beloved James David Van Der Beek passed peacefully this morning. He faced his final days with bravery, faith, and elegance.” No location was specified; his wife Kimberly shared it.

Representative Whitney Tancred confirmed to outlets. The post requested privacy for his wife, children, parents, and siblings.

Celebrity Tributes Flood In

Katie Holmes penned a handwritten Instagram letter praising his “compassion and selflessness.” Michelle Williams organized the reunion; Busy Philipps called him “one in a billion.”

Jennifer Garner sent love to the family; Paul Walter Hauser vowed continued fundraising. Joshua Jackson posted a heartfelt video recalling their bond.

Financial Struggles Exposed

Colorectal cancer, now the top killer among young adults, strained the family. Kimberly launched a GoFundMe post-death for medical bills, noting friends’ support during treatment.

Van Der Beek’s openness highlighted treatment costs, aligning with rising diagnoses in under-50s lacking family history.

Legacy of Resilience

Beyond Dawson’s earnest charm, Van Der Beek redefined himself through comedy and vulnerability. His cancer journey inspired awareness, urging early screenings.

Fans trend #ThankYouJames online, streaming “Dawson’s Creek” anew. A charity reunion special is rumored for later 2026.

Impact on Hollywood

His death spotlights bowel cancer’s youth surge—subtle symptoms often dismissed. Experts cite diet, environment; Van Der Beek’s story pushes colonoscopy advocacy.

Final projects like “Overcompensating” guest spot air posthumously on Prime Video.

Family’s Path Forward

Kimberly, 42, faces raising six kids alone on a farmstead. GoFundMe aims to secure their future; community vigils planned in Connecticut and L.A.

Van Der Beek’s words linger: “Life transformed 25 years ago today,” reflecting on “Dawson’s” premiere—now a full-circle legacy.

Cultural Phenomenon Revisited

“Dawson’s Creek” pioneered teen TV sophistication, grossing syndication fortunes. Van Der Beek shunned reunions pre-diagnosis, feeling “complete” closing that chapter.

Yet illness reunited the cast for good, proving enduring friendships.

| Milestone | Date | Details |

|---|---|---|

| Birth | 1977 | Cheshire, CT |

| “Dawson’s” Premiere | 1998 | Dawson Leery role |

| Cancer Diagnosis | 2023 | Stage 3 colorectal |

| Public Reveal | Nov 2024 | Instagram post |

| Auction | Dec 2025 | $47K raised |

| Death | Feb 11, 2026 | Age 48 |

Why His Story Resonates

From heartthrob to warrior, Van Der Beek embodied grace under pressure. Hollywood loses a versatile talent; fans, a friend who grew up with them.

Business

Influencers Make Money Posting About Their Lives. The Taxes Can Get Messy.

Nadya Okamoto is getting married this summer and wasn’t sure if she could write off the cost of a professional photographer.

The 28-year-old earns most of her income posting about her life on TikTok, YouTube and Instagram, and plans to post photos of the ceremony online. She didn’t know if any of the wedding costs would count as a business expense.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

US says it interdicted and boarded vessel defying Trump’s quarantine

US says it interdicted and boarded vessel defying Trump’s quarantine

Business

An $80 Billion Liquidity Storm May Be About To Hit Stocks This Week

An $80 Billion Liquidity Storm May Be About To Hit Stocks This Week

Business

AppLovin's Explosive AdTech Growth At A Discount – Upgrade Buy

AppLovin's Explosive AdTech Growth At A Discount – Upgrade Buy

Business

All eyes on MidWestOne earnings as Nicolet merger looms

All eyes on MidWestOne earnings as Nicolet merger looms

Business

Analysts from Fortrade Review the Summit from a Financial Point of View

When the World Economic Forum met in Davos in January 2026, most people in financial markets were not waiting for any big announcement.

Davos has not worked like that for years. What it does is show how the people who influence money, policy, and capital are thinking at that moment.

The meeting, held from 19 to 23 January under the theme “A Spirit of Dialogue,” took place at a time when the global situation still feels uncomfortable. Inflation has eased in some places, but not enough to make central banks relaxed. Growth is holding in parts of the world and slowing in others. Debt remains high, and trade has become more political.

For financial markets, this continues to matter because tone shapes behaviour. Analysts at Fortrade, operating under FCA regulation, follow these discussions closely to see whether confidence is building or fading. Davos often quietly influences expectations, without anyone officially saying that anything has changed.

The wider background also remains important. The Global Risks Report published before the meeting remains important because it speaks directly about fragmentation and geoeconomic confrontation, and that language does not stay confined to formal documents. It appears in the way leaders talk about trade, technology, and security, shaping the broader narrative around risk. Investors notice this shift in tone and gradually factor it into how they interpret uncertainty and long-term market exposure.

Geopolitics and Market Confidence

Geopolitical risk was not treated as a distant issue at Davos in 2026. It was discussed as something that affects daily decisions. Reuters reporting showed that investors are now paying much more attention to political developments when pricing risk, partly because recent disputes and tariff threats have had very real market effects.

One example was the volatility linked to U.S. tariff threats connected to Greenland. It was a reminder that political signals can move currencies, equities, and commodities very quickly. These moves are not always logical in the short term, but they influence sentiment for much longer.

Analysts at Fortrade noted that these episodes tend to stay in traders’ minds. Even after prices stabilise, risk perception does not fully return to where it was. Over time, this changes how much investors are willing to pay for future earnings, particularly among those using short- and day-trading strategies.

Economic Resilience and Structural Debate

Discussions about growth at Davos were careful, and there was no strong sense that 2026 was being framed as a year of rapid recovery. Most forecasts pointed to moderate expansion, including a United Nations projection of global growth of around 2.7%, well below the pre-pandemic average, as reflected in the World Economic Situation and Prospects 2026 outlook. It suggests that the world economy is holding together but without enough momentum to generate sustained optimism.

In this kind of environment, markets tend to move in subtle and uneven ways rather than through strong, broad rallies. Investors become more selective about where they place capital, paying closer attention to balance sheets, policy signals, and longer-term sustainability. Many day traders become more cautious and focus on protecting capital rather than chasing fast moves. Fortrade news and market analysis page provides a broader market context and ongoing commentary, which helps traders follow major economic and policy developments without relying on unreliable sources.

Speakers at the forum also repeatedly returned to structural issues such as demographics, labour market adjustment, and inflation management. They mentioned that these slow-moving factors continue to shape interest-rate expectations and valuation models over time, explaining why markets in 2026 have remained cautious despite signs of economic resilience.

Central Banks and Policy Signals

Central bank credibility came up repeatedly in related coverage during Davos week. Policymakers spoke about independence and stability, especially as political pressure increases in some countries.

For markets, this is not theoretical. When central banks are seen as reliable, currencies tend to be more stable and bond markets calmer. When that credibility is questioned, volatility rises quickly.

Although no official policy announcements were made at Davos, the general message was clear. Monetary authorities are not in a hurry to change direction. Fortrade is a well-established broker that offers access to multiple markets through reliable trading conditions and stable platforms. The firm continues to factor this environment into how it supports traders and market participants.

Trade, Supply Chains, and Global Coordination

Trade and supply chains were discussed in practical terms throughout Davos, reflecting how costly recent disruptions have been and how companies and governments are still adjusting. It was reported that trade maps are changing as countries respond to earlier tariff measures and geopolitical pressure, with diversification and regionalisation emerging as common themes. These shifts affect markets gradually, as costs, margins, investment flows, and currency movements adjust over time rather than all at once.

Davos 2026 did not produce major agreements and functioned mainly as a platform for discussion, where leaders acknowledged that global cooperation is under strain and that new systems are still evolving. Instead of presenting clear solutions, they focused on managing complexity and adapting to long-term uncertainty.

How Davos Connected to Market Behaviour

After the summit, markets did not react sharply. There was no clear “Davos rally” or sell-off. Currencies moved slowly, and equity sectors moved unevenly.

This response itself was meaningful. Traders treated Davos as confirmation, not as a trigger.

Fortrade analysts observed that the main value of Davos 2026 was in showing how policymakers and business leaders were thinking about risk, growth, and stability when they were not trying to impress markets. That thinking influences behaviour over time. And behaviour is what shapes prices.

Davos still matters mainly because it shows how people with real influence are thinking about the months ahead, even when nothing dramatic happens at the time.

-

Politics7 days ago

Politics7 days agoWhy Israel is blocking foreign journalists from entering

-

Business7 days ago

Business7 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports4 days ago

Sports4 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat6 days ago

NewsBeat6 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business7 days ago

Business7 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech5 days ago

Tech5 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat7 days ago

NewsBeat7 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports6 days ago

Sports6 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Tech13 hours ago

Tech13 hours agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video2 days ago

Video2 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Politics7 days ago

Politics7 days agoThe Health Dangers Of Browning Your Food

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business6 days ago

Business6 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

Crypto World4 days ago

Crypto World4 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

NewsBeat6 days ago

NewsBeat6 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World2 days ago

Crypto World2 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World5 days ago

Crypto World5 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video3 days ago

Video3 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports6 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World5 days ago

Crypto World5 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?