Business

Carsales.com owner sees big potential in driving AI use

Business

IDBI Bank shares drop 4% as Kotak Mahindra Bank stays away from stake sale; Fairfax, Emirates NBD in fray

The government of India and Life Insurance Corporation of India (LIC), which hold stakes of 45.48% and 49.24% respectively, are together looking to divest a 60.7% stake in the bank as part of the broader privatisation programme.

Meanwhile, Kotak Mahindra Bank clarified that it has not submitted a financial bid for IDBI Bank, dismissing recent media reports. The proposed sale was first announced in 2022, and the government is targeting to announce the successful bidder by March.

The bank has a current market capitalisation of around Rs 1.12 lakh crore. According to sources cited by Reuters, Fairfax — which already holds a majority stake in CSB Bank — may consider merging IDBI Bank with CSB Bank if its bid is successful.

The government has previously said the sale will be concluded in the current financial year ending March 31, 2026. The successful bidder will be allowed to rename the bank, Reuters reported last week.

IDBI Bank traces its origins to 1964, when it was established as the Industrial Development Bank of India through an Act of Parliament to support long-term industrial financing. In 2005, its commercial banking arm was fully merged into the institution, transforming it into a universal bank with both development finance and lending operations. Over time, however, this dual structure became a challenge, as the bank retained a heavy corporate lending focus even as peers diversified into retail segments, leaving it more exposed to concentrated risks and with limited balance from granular retail growth.

By the mid-2010s, mounting bad loans and weak capital buffers had significantly strained the bank’s financial position. In 2017, the Reserve Bank of India placed IDBI under the Prompt Corrective Action (PCA) framework after it breached key thresholds related to capital adequacy, asset quality, return on assets and leverage. The restrictions under PCA curtailed lending expansion and underscored the severity of the bank’s operational and balance-sheet stress.The situation reached a turning point in 2019 when the government directed Life Insurance Corporation of India (LIC) to acquire a controlling 51% stake and infuse capital to stabilise the lender. LIC’s takeover strengthened the balance sheet and reflected a clear policy decision to support the institution. Following the transaction, the RBI reclassified IDBI as a private sector bank for regulatory purposes, despite the continued majority ownership by government-linked entities.

IDBI Bank shares have risen 31.23% in the last 1 year.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)

Business

In the AI gold rush, tech firms are embracing 72-hour weeks

In the race for AI, tech firms are asking for their staff to work long hours. But there are risks, experts say.

Business

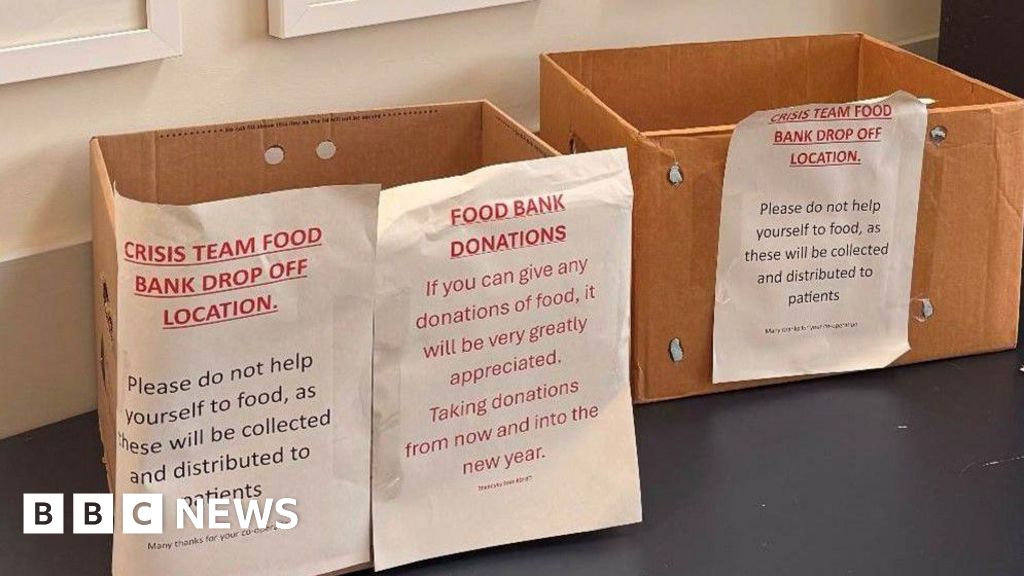

Donation appeal as vulnerable face food bank delay

A mental health support team set up a pantry in Wolverhampton to help those living in food poverty.

Business

Japanese stocks surge as Takaichi secures historic election victory

Japanese stocked jumped as markets opened on Monday morning, after prime minister Sanae Takaichi won a landslide victory.

Business

Japan stocks soar to record, super-long bonds steady in nod to Takaichi’s ’responsible’ stimulus

Japan stocks soar to record, super-long bonds steady in nod to Takaichi’s ’responsible’ stimulus

Business

Earnings set for strong rebound in FY27 after weak FY26, says Mahesh Nandurkar

Mahesh Nandurkar, Head – India Research & India Equity Strategist, Jefferies said the experience of 2025 and the past 15 months has reminded investors of the need to spread exposure across asset classes and geographies.

“What the year 2025 did, or basically the last 15 months or so, just taught us the importance of asset class diversification. The prior three or four years, or maybe five years, it was just a one-way street. It was just one asset class that mattered, which was obviously equities. But we have just learned the importance of diversification,” he said. He added that diversification should not be limited to equities, debt and commodities, but should also include access to international capital markets. “Thankfully, now in India, we have access to a variety of international capital market access products offered by various mutual funds. We are also seeing GIFT City being made operational to that extent. It was always known and always talked about, but people just forgot about asset diversification in the previous four years. We are reminded of that once again,” Nandurkar said.

He said the Union Budget has gradually become less of a market-moving event, as reforms and policy measures are increasingly announced outside the annual exercise. According to him, investor anxiety around budget day has reduced for the right reasons, particularly after the implementation of GST, which has brought clarity to indirect taxation.

“I remember 10 or 20 years ago, people would sit with pen and paper and go through long lists of excise duties on various products and commodities. Thankfully, with GST, that part is literally out of the equation,” he said. For a fast-growing economy, frequent uncertainty around product-wise taxation is no longer necessary, he added. “For a country like India with a GDP of around $4 trillion and growing strongly, we do not need this hanging sword every year about what will happen to taxation on different products. In a way, it is a welcome change that the budget has become less of an event in terms of taxation changes,” Nandurkar said.

Commenting on the latest budget, he described it as pragmatic, with a calibrated approach to fiscal consolidation. He pointed out that while the government had been reducing the fiscal deficit by 40 to 50 basis points annually over the past few years, this time the pace has slowed to about 10 basis points, from 4.4% this year to a target of 4.3% next year. “That is a welcome change given low nominal GDP growth and low inflation. Although this means tighter fiscal consolidation in later years, for now it provides flexibility,” he said. He added that the additional fiscal space is being deployed productively. “The good news is that the incremental fiscal flexibility has been used to fund incremental capex. We have seen higher allocations for roads, railways and defence. That puts the economy in good stead,” he said.

Nandurkar acknowledged that some sections of the market were disappointed by the absence of capital gains tax relief and by incremental taxation in the form of STT, but said that in the broader context it remained a balanced and pragmatic budget.Looking ahead, Nandurkar said corporate earnings would be the key driver for markets, with growth expected to improve materially after a weak year. He said corporate EPS growth in FY26 is tracking at around 7% to 8%, reflecting several temporary headwinds that are likely to reverse.

“My sense is that this depressed growth is attributable to various factors that are likely to reverse next year. We are looking at a much stronger 12% to 14% EPS growth next year,” he said. He cited three major drivers for the improvement: higher nominal growth due to rising inflation, stabilising interest rates benefiting banks, and the sectoral impact of monsoon patterns.

He said FY27 inflation is expected to move well above 4%, which would lift nominal growth and support earnings.

“Ultimately, what matters is cash in hand,” he said, adding that real growth metrics are rarely the focus for investors. He also said the end of the rate cut cycle should help banking sector profitability after margins were hit by 125 basis points of rate cuts over the past year. With banks accounting for a large share of market indices, this could provide a meaningful boost to overall earnings growth. On monsoons, Nandurkar said a supernormal monsoon can actually hurt several listed sectors such as power, construction, cement, steel, soft drinks and air-conditioning, while a more normal or even slightly weaker monsoon can be supportive for corporate earnings. With some early forecasts pointing to possible El Nino conditions, he said this may not be positive for rural incomes but could be constructive for corporate EPS growth. “So yes, I am quite optimistic on corporate EPS growth improving materially next year,” he said.

Business

Australian Household Spending Dropped by 0.4% in December 2025

Australian Bureau of Statistics (ABS) has revealed that household spending in the country dropped by 0.4 per cent during the last month of 2025.

However, household spending over the year has gone up by five per cent compared to December 2024.

Household Spending Drops by 0.4%

The 0.4 per cent drop meant the household spending went down to $78.86 billion, per Investing.com.

According to the ABS, the drop in household spending in December followed a previous two-month increase.

In October of last year, household spending increased by 1.4 per cent. It was followed by another one per cent increase in November.

“The fall in December indicates that households brought forward purchases during sales events in October and November,” said ABS Head of Business Statistics Tom Lay.

“These falls were across a range of categories including discretionary items such as electronics, clothing and furniture, as well as essential items like healthcare,” he added.

Which States and Territories Saw the Largest Drop?

Data from ABS show that Victoria saw the largest drop in household spending at -1.0 per cent.

This is followed by New South Wales with -0.6 per cent.

On the other hand, Northern Territory had the biggest rise at +2.9 per cent.

Business

Morning Bid: Japan markets welcome chance of a long-stay PM

Morning Bid: Japan markets welcome chance of a long-stay PM

Business

PFC, REC shares fall up to 3% after merger announcement

PFC already holds a 52.63% stake in REC, following its acquisition of the government’s holding earlier. In a regulatory filing, PFC said its board noted the government’s proposal to merge the two entities to achieve scale, improve operational efficiency, and enhance credit flow to the power sector.

Finance Minister Nirmala Sitharaman, in her Budget speech on February 1, proposed restructuring PFC and REC to strengthen public sector NBFCs. Earlier, the Cabinet Committee on Economic Affairs had cleared the transaction under which PFC acquired the government’s stake in REC, resulting in a holding–subsidary structure between the two companies.

The proposed merger, subject to statutory approvals and detailed structuring, would combine both entities into a single balance sheet, potentially creating a stronger and more efficient lender for India’s power and infrastructure sectors.

Both PFC and REC play a critical role in financing the power sector. PFC, under the administrative control of the Ministry of Power, provides funding across the power value chain, including generation, transmission, distribution, and renewable energy. REC was originally established to finance rural electrification projects, contributing significantly to India’s near-universal electricity access.

PFC and REC share performance

PFC shares ended Friday’s session 0.6% higher at Rs 417.6 on the NSE, while REC declined over 2% to close at Rs 372.6. Despite the recent movement, both stocks have delivered strong multibagger returns, creating significant wealth for investors over the past three years. During this period, PFC has surged by approximately 260%, while REC has gained around 217%.

Technical View

PFC: The 14-day RSI stands at 74.1, indicating the stock is in the overbought zone, which could lead to a short-term pullback. However, the stock is trading above all 8 key simple moving averages (SMAs), reflecting strong bullish momentum.

REC: The 14-day RSI is at 53.2, suggesting neutral momentum. The stock is trading above 6 out of 8 SMAs, indicating a mildly bullish technical structure.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)

Business

Thailand’s Ruling Party Election Victory Boosts Market Confidence

The Bhumjaithai Party’s convincing victory in the recent Thai election is widely perceived by strategists and economists as a positive development, expected to usher in policy continuity and political stability. This outcome has reassured investors who had feared further political instability and is anticipated to boost the country’s stock market and currency.

Currency & Markets

- The baht strengthened slightly against the dollar after the results.

- Thai stocks are expected to rise, with the SET Index potentially reaching 1,450 by year-end.

Policy Continuity

- BJT’s win reduces fears of political dysfunction and ensures ongoing fiscal support for consumption and infrastructure.

- Analysts expect limited stimulus hype, steady tourism recovery measures, and continuation of programs like co-pay subsidies for basic goods.

Investor Confidence

- Political stability is seen as market-friendly, reducing uncertainty and boosting confidence in equities, especially retail, transport, and tourism sectors.

- Bonds may benefit from the Bank of Thailand’s easing bias, though the baht is considered overvalued in some contexts.

Following the election, the Thai baht strengthened slightly to 31.456 per dollar in early Asian trading, as Bhumjaithai, led by incumbent Prime Minister Anutin Charnvirakul, secured the most seats in the lower house and is positioned to form the next coalition government. This performance contrasts with the underperformance of the main challenger, the People’s Party, whose progressive reform agenda now faces setbacks. The market’s positive reaction stems from the expectation of stable governance and predictable economic policies.

Economic analysts and strategists have highlighted several key impacts:

- Brendan McKenna (Wells Fargo): Emphasizes that overall policy continuity will lead to stability and clarity, which markets favor. He sees a short-term positive impact on the baht, though its medium-term trajectory will remain influenced by global factors like the Federal Reserve and China.

- Kaseedit Choonnawat (Citigroup): Projects a rise in Thai stocks, attributing it to Bhumjaithai’s enhanced negotiation power, ensuring policy continuity, and reducing the risk of short-term, non-competitive spending. He reiterates a potential rise for the benchmark SET Index to 1,450 by year-end (from 1,354.01 on Friday).

- Poon Panichpibool (Krung Thai Bank Plc): Views a Bhumjaithai-aligned coalition as the most market-friendly scenario in the near term, citing policy continuity, ongoing fiscal support for consumption and infrastructure, and a focus on tourism recovery. He expects the baht to strengthen slightly and equities (particularly retail, transport, and tourism sectors) to be major beneficiaries.

- Burin Adulwatana (Kasikorn Research Center): Believes the clear majority will expedite government formation, bolstering investor confidence. He expects a continuation of successful economic strategies, such as co-pay subsidy programs, leading to a positive response in equities.

Thai business sector calls for bold economic actions

The Thai business sector is urgently calling upon the incoming government, formed after the February 8, 2026 election, to implement swift and decisive economic measures within its first 90 days. This demand comes amidst persistent economic headwinds, a projected slowdown with GDP growth estimated at 1.6-2% for 2026, and deep-rooted structural issues that have led some foreign media to label Thailand “the sick man of Asia.” Leaders across various sectors emphasize the critical need to restore confidence, boost investment, and address fundamental constraints to prevent further economic fragility.

Key immediate priorities for the new government, as highlighted by business leaders, include:

- Economic Stability: Working with the Bank of Thailand to manage baht appreciation and maintain appropriate currency levels, as a strong baht harms exporters.

- Household Debt: Devising strategies to cope with high household debt (officially 86.8% of GDP, rising to 104% with informal debt), which has tightened lending and reduced consumer spending.

- Governance & Crime: Taking serious action against “grey capital,” scammers, and organized corruption to prevent Thailand from becoming a regional money-laundering hub and to protect its international image.

- Cost of Living: Easing living costs, particularly by reducing mass transit fares to encourage wider usage and improve urban quality of life.

- Tourism Confidence: Establishing confidence among international visitors that Thailand is a safe and trusted destination, continuing stimulus schemes like “We Travel Together,” and reviewing aviation costs, fees, and taxes.

- Agricultural Support: Ensuring an adequate and affordable supply of essential feed ingredients for the livestock sector and overseeing farm-gate prices for pigs to protect small farmers.

Beyond the initial 90 days, the business community stresses the importance of longer-term strategic actions and policy consistency. This includes:

- Strategic Policies: Outlining well-planned national strategies and ensuring policy consistency, moving away from short-term goals to avoid falling behind regional competitors like Vietnam.

- Effective Stimulus: Designing stimulus measures that generate broad economic multiplier effects, enhance competitiveness and productivity, and lead to sustainable long-term expansion, rather than short-term populist giveaways.

- Fiscal Prudence: Carefully allocating limited public resources to nurture “seeds” for future competitiveness and income generation, especially given Thailand’s limited fiscal space and risk of a credit-rating downgrade.

- Regulatory Reform: Streamlining complicated regulations and expediting approvals (e.g., hotel licensing, BoI incentives) to improve the ease of doing business and lift investment, which has been hampered by delays in large infrastructure projects.

- National Competitiveness: Prioritizing efforts to bolster national competitiveness by amending obstructive laws, promoting new S-curve industries (bioeconomy, wellness, green businesses), and investing in infrastructure.

- Digital Economy & Clean Energy: Continuing major policies from previous governments, particularly promoting investment in digital technology like data centers, and accelerating the direct power purchase agreement (PPA) scheme to provide clean energy access for these resource-hungry businesses.

- Social Equity: Reducing inequality and providing equal access to quality education, healthcare, and 21st-century skills.

- Addressing Global Challenges: Developing clear strategies to address heightened geopolitical uncertainty, climate change (floods, droughts, PM2.5 pollution), and the growing menace of cyber scams.

The election results underscore the likelihood of ongoing stimulus measures, sustained fiscal backing for consumption and infrastructure initiatives, and a strong emphasis on revitalizing tourism. These elements are anticipated to sustain domestic demand, enhance investor confidence amid global uncertainties, and provide a solid foundation for Thailand’s economic growth.

Other People are Reading

-

Video6 days ago

Video6 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 days ago

Tech5 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics7 days ago

Politics7 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Politics13 hours ago

Politics13 hours agoWhy Israel is blocking foreign journalists from entering

-

Sports2 days ago

Sports2 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech2 days ago

Tech2 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat7 hours ago

NewsBeat7 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat6 days ago

NewsBeat6 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business12 hours ago

Business12 hours agoLLP registrations cross 10,000 mark for first time in Jan

-

Politics15 hours ago

Politics15 hours agoThe Health Dangers Of Browning Your Food

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Crypto World7 days ago

Crypto World7 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business20 hours ago

Business20 hours agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Sports2 hours ago

Sports2 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

Sports7 days ago

Sports7 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat7 days ago

NewsBeat7 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition