Business

Children’s camp – how to choose?

Singapore is a bustling city filled with opportunities for learning and exploration. Unique scientific Holiday camp in Singapore is held in the city, offering children of all ages a chance to explore the wonders of science and technology.

The camp provides a unique opportunity for children to learn about the world around them. Participants are encouraged to take part in various activities and experiments, giving them a hands-on experience of the scientific concepts they are taught.

How’s it going?

The camp is organized by a team of experienced teachers and scientists, all of whom have an extensive knowledge of the subjects they teach. They make sure that the children understand the concepts and apply them in their day-to-day lives. The camp also provides a platform for students to interact with each other and learn from each other.

The camp has a range of activities to suit all interests. These include field trips to Singapore’s natural habitats, such as the rainforest and the mangroves. Students also get to take part in educational workshops, where they can learn about the science behind the natural environment.

What are the benefits of camp for children?

In addition to the field trips, the camp also offers a range of interactive activities, such as building robots and creating coding projects. These activities are designed to stimulate the imagination and encourage creative thinking. They also provide the perfect opportunity for children to explore their own talents and interests.

The camp also offers a range of social activities, such as sports, art, and music. These activities are designed to help children develop their social skills and make new friends.

The camp is a great way for children to experience the wonders of science and technology in a fun and safe environment. It is also a great way for them to learn about the world around them and develop their own skills and interests.

In addition to these advantages, there are other important benefits such as:

- A scientific camp for children helps them to think outside of the box and come up with creative solutions to problems. It also encourages them to think critically about the world around them and develop their own ideas.

- Scientific camps for children are a great way for children to meet other like-minded children and make new friends.

- Many scientific camps for children include field trips to explore the natural environment, giving children a hands-on experience of the concepts they are taught. It also provides a platform for students to interact with each other and learn from each other.

What are the conclusions?

Overall, scientific camps for children are a great way to introduce them to the wonders of science and technology. They provide a safe and fun environment for children to explore and learn about the world around them. They also teach children about the history and culture of their country, help them to develop their social skills, and give them the opportunity to make new friends.

Business

Delek Logistics: Robust Fundamentals And Valuation May Be Pipelined To More Upside (NYSE:DKL)

I have been working in the logistics sector for almost two decades. I have been into stock investing and macroeconomic analysis for almost a decade. Currently, I focus on ASEAN and NYSE/NASDAQ Stocks, particularly in banks, telco, logistics, and hotels. Since 2014, I have been trading on the PH stock market. I focus on banking, telco, and retail sectors. A colleague encouraged me to engage in the stock market as part of my portfolio diversification instead of putting all my savings in banks and properties. That was also the year when insurance companies became very popular in the PH. Initially, I invested in popular blue-chip companies. Now, I have investments across different industries and market cap sizes. There are stocks I hold for my retirement, while others are purely for trading profits. In 2020, I also entered the US Market. It was about a year after I discovered Seeking Alpha. Originally, I was using the trading account of NY CA-based cousin. Somehow, I acted like his personal broker. That made me more aware of the US market before deciding to open my own account. I decided to write for Seeking Alpha to share and gain more knowledge since I have been trading on the US market for only four years. Like in the ASEAN market, I have holdings in US banks, hotels, shipping, and logistics companies. I discovered it in 2018. Since then, I have been using the analyses here to compare them to the ones I’m doing in the PH Market.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DKL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

Dalal Street Week Ahead: Defensive, stock-specific approach advised to protect gains

ETMarkets.com

ETMarkets.comFrom a structural perspective, the Nifty has now slipped back toward a crucial technical area and has closed exactly at its 100-week moving average placed at 24,441.95. This level assumes significant importance because it has historically acted as an intermediate-term trend support. Any sustained close below the 100-week MA would weaken the broader technical structure and may open the doors for extended downside. Adding to the caution is the negative breadth divergence in the broader market; while the Nifty 500 has not yet made a fresh low, the Advance–Decline line has already slipped to a new low, indicating a weakening participation. This divergence typically precedes phases of broader corrective pressure.

For the coming week, markets may begin on a cautious note as participants react to the index testing this important long-term moving average support. On the upside, 24,800 and 25,070 are likely to act as immediate resistance levels. On the downside, 24,300 and 24,000 are expected to act as key supports.

The weekly RSI stands at 38.47, which keeps it in the neutral-to-bearish zone and shows no divergence against price. The RSI, while it has formed a fresh 14-period low, is trending lower, reflecting weakening momentum. The weekly MACD remains below its signal line and continues to stay in negative territory, indicating that the broader momentum remains weak.

From a pattern perspective, the Index has now closed below the lower Bollinger Band and is testing the 100-week moving average, which makes this zone technically decisive. A minor rebound is possible, but if this support fails to hold, the index may gradually gravitate toward deeper retracement levels. While the long-term structure remains intact, the intermediate trend is clearly under pressure.

Given the current technical setup, traders should remain cautious and avoid aggressive fresh buying until stability emerges near support levels. The rising volatility and weakening breadth suggest that risk management should remain a priority. Any pullbacks toward resistance zones may continue to invite selling pressure. Adopting a defensive, stock-specific approach while protecting gains and maintaining strict stop-losses would be the most prudent strategy for the coming week.

In our look at Relative Rotation Graphs®, we compared various sectors against the CNX500 (NIFTY 500 Index), representing over 95% of the free-float market cap of all the listed stocks.

ETMarkets.com

ETMarkets.com ETMarkets.com

ETMarkets.comRelative Rotation Graphs (RRG) show that the Infrastructure and Pharma Indices have rolled inside the leading quadrant. The Nifty Financial Services, Energy, PSE, Banknifty, Metal, and PSUBank Indices are also inside the leading quadrant. These groups will continue to relatively outperform the broader Nifty 500 Index.

The Nifty Services Sector Index has rolled inside the weakening quadrant and may see a slowdown in the relative performance. The Midcap 100 and the Auto Indices are also inside the weakening quadrant.

The Nifty IT has rolled inside the lagging quadrant following weak performance over the past several days. The Realty Index continues to languish inside this quadrant as well. The FMCG Index is also inside the lagging quadrant, but it is showing slight stability in its relative momentum as compared to the other two indices.

The Media Index continues to roll strongly inside the improving quadrant.

Important Note: RRGTM charts show the relative strength and momentum of a group of stocks. In the above chart, they show relative performance against the NIFTY500 Index (Broader Markets) and should not be used directly as buy or sell signals.

Business

Ukraine’s interceptor drone makers look at exports to the Gulf as Iran war flares

Ukraine’s interceptor drone makers look at exports to the Gulf as Iran war flares

Business

Aperol Maker Bets More Americans Will Warm to Italian-Style Drinking

The maker of Aperol is banking on selling a taste of Italy’s terrace lifestyle to more Americans, part of its chief executive’s plan to grab market share and sales growth in the U.S.

“Half of America has still never heard of [Aperol],” Davide Campari-Milano CPR -2.48%decrease; red down pointing triangle Chief Executive Simon Hunt said in an interview.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

The Iran War Is Hitting Gulf Markets, Lifting Israel and Shifting Risk Across the Region

For years, investors treated the Persian Gulf as a bastion of calm in a deeply unstable region. Oil wealth and careful diplomacy kept turmoil at arm’s length. Wars raged in Gaza, Israel, Syria and Lebanon—far from glitzy Dubai.

Now, markets are repricing risk across the region. The war with Iran—which has grounded flights, stranded tankers and put cities such as Dubai and Qatar’s Doha under bombardment—is forcing investors to recalibrate their perception of the region’s stability.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

Trump Demands Unconditional Surrender from Iran as Putin Talks with Iranian President

WASHINGTON — President Donald Trump demanded Iran’s “unconditional surrender” on Friday as U.S. and Israeli forces continued airstrikes on Iranian targets, escalating rhetoric in a conflict that has entered its second week and claimed over 1,300 civilian lives, according to Iranian reports. The statement came hours after Russian President Vladimir Putin spoke by phone with Iranian President Masoud Pezeshkian, offering condolences for the death of Supreme Leader Ayatollah Ali Khamenei and condemning the strikes as a violation of international law.

AFP

Trump, posting on his Truth Social platform, rejected any negotiated end to the hostilities short of total capitulation. “There will be no deal with Iran except UNCONDITIONAL SURRENDER!” he wrote. “After that, and the selection of a GREAT & ACCEPTABLE Leader(s), we, and many of our wonderful and very brave allies and partners, will work tirelessly to bring Iran back from the brink of destruction, making it economically bigger, better, and stronger than ever before. MAKE IRAN GREAT AGAIN (MIGA!).”

The post marked a shift in U.S. objectives, broadening from initial aims of degrading Iran’s military capabilities to demanding regime change. White House officials did not immediately respond to requests for clarification on what “unconditional surrender” entails or how it aligns with international norms. Analysts suggest the language evokes World War II-era demands, potentially prolonging the conflict if Tehran refuses to comply.

The war began on Feb. 28, 2026, with coordinated U.S. and Israeli strikes targeting Iranian nuclear facilities, military bases and leadership sites following intelligence reports of an imminent Iranian attack on U.S. interests in the Middle East. Khamenei was killed in an early barrage, which Iranian state media described as an “assassination.” The Iranian Red Crescent reported 1,332 civilian deaths as of March 7, with strikes continuing in Tehran, Beirut and other locations.

Putin’s call with Pezeshkian, confirmed by the Kremlin on Sunday, focused on the “cynical assassination” of Khamenei and his family. “Please accept my deepest condolences in connection with the assassination of the supreme leader of the Islamic Republic of Iran … committed in cynical violation of all norms of human morality and international law,” Putin said in a message to Pezeshkian.

The Russian leader also held separate conversations with leaders of the United Arab Emirates, Bahrain, Saudi Arabia and Qatar, condemning the strikes as “unprovoked aggression” and offering Moscow’s mediation services. According to Kremlin readouts, Putin proposed using Russia’s close ties with Iran to relay complaints from Gulf states and facilitate de-escalation. UAE President Mohammed bin Zayed Al Nahyan reportedly expressed concerns about regional spillover, including attacks on UAE assets.

U.S. intelligence officials have accused Russia of providing Iran with targeting data on American troops, ships and aircraft, marking Moscow’s first direct involvement in the conflict. Multiple sources familiar with the reports told CNN that this intelligence sharing could prolong Iranian resistance and complicate U.S. operations.

Iranian Foreign Minister Seyed Abbas Araghchi rejected calls for a ceasefire in a Saturday statement, vowing continued defiance. “Iran is prepared for the possibility of a U.S. ground invasion,” he said, dismissing Trump’s demands as “imperialist delusions.” Tehran’s envoy to the United Nations reported 1,332 civilian casualties to the Security Council, urging an emergency session.

Israeli Prime Minister Benjamin Netanyahu echoed Trump’s hard line in a March 6 address, stating strikes would continue until Iran’s military threat is neutralized. Israel traded fire with Hezbollah in Lebanon, widening the conflict’s scope. U.S. Central Command confirmed strikes on an Iranian drone carrier, claiming it disrupted Tehran’s unmanned aerial capabilities.

The U.S. has begun evacuating nonessential personnel and citizens from the Middle East, with the State Department issuing Level 4 travel advisories for Iran, Lebanon and parts of Israel. Domestic protests against the war have intensified, with demonstrations in Washington, New York and Los Angeles drawing thousands calling for an immediate halt to hostilities.

Trump’s administration has defended the strikes as necessary to prevent Iranian aggression, citing preemptive intelligence. In a March 5 briefing, Secretary of State Mike Pompeo reiterated that the U.S. seeks a “stable and prosperous Middle East,” but only after Iran’s “malign activities” cease. Critics, including Democratic leaders, have questioned the legal basis for the war, demanding congressional authorization under the War Powers Resolution.

International reactions vary. China’s Foreign Ministry called for restraint, while European Union officials urged diplomatic channels. The UN Security Council remains deadlocked, with Russia and China blocking U.S.-backed resolutions condemning Iran.

Economic fallout is mounting. Oil prices surged to $95 per barrel on March 7, amid fears of disrupted Persian Gulf shipments. U.S. stock markets dipped 2%, with energy sectors gaining but broader indices reflecting uncertainty.

Humanitarian concerns grow as Iranian infrastructure crumbles under bombardment. The World Health Organization reported shortages of medical supplies in Tehran hospitals, with access limited by ongoing fighting. Aid groups like Doctors Without Borders have called for safe corridors to deliver relief.

Putin’s involvement adds a layer of geopolitical complexity. Russia’s condemnation of the strikes aligns with its alliance with Iran, including arms supplies and joint military exercises. Analysts warn that Moscow’s intelligence sharing could draw it deeper into the fray, risking a proxy confrontation with the U.S.

Trump’s “unconditional surrender” demand has drawn historical parallels to demands on Japan in 1945, but experts note Iran’s theocratic regime is unlikely to capitulate without significant internal upheaval. “Ending Middle East wars on U.S. terms is no easy thing,” said a panelist on PBS’s Washington Week, highlighting past U.S. entanglements in Iraq and Afghanistan.

As the conflict persists, global leaders watch for signs of escalation. Putin’s mediation offer could open back channels, but Trump’s rejection of deals short of surrender signals a protracted standoff. The White House has scheduled a national address for March 8, where Trump is expected to outline next steps.

For now, the region braces for more violence, with uncertainty clouding the path to resolution. U.S. officials maintain the strikes are targeted and proportionate, but Iranian vows of retaliation keep tensions at a boiling point.

Business

Costco Earnings Beat Expectations as Membership Model Shines

Costco Earnings Beat Expectations as Membership Model Shines

Business

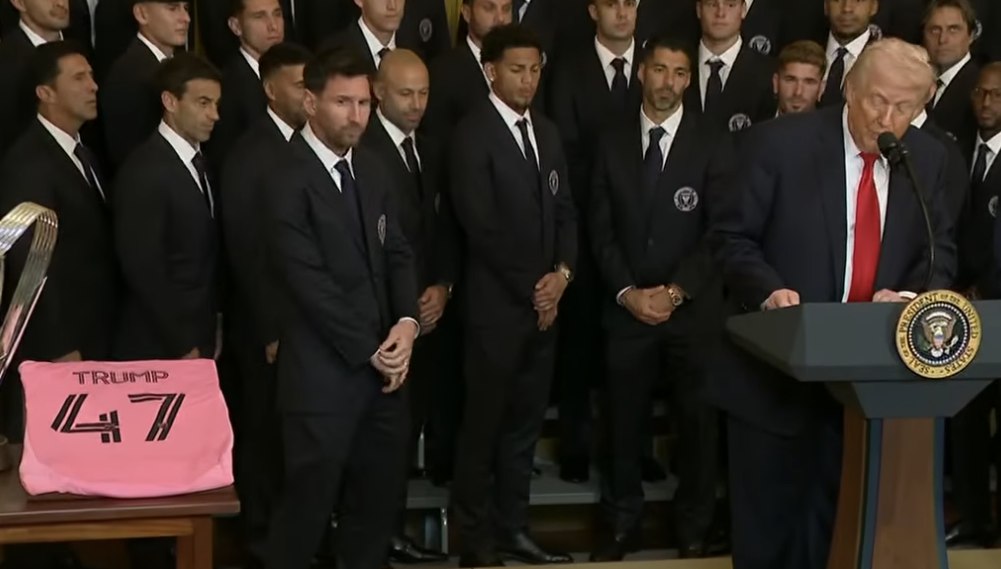

(VIDEO) Lionel Messi Meets President Donald Trump at White House

WASHINGTON — Soccer superstar Lionel Messi met U.S. President Donald Trump on Thursday, March 5, 2026, during a White House ceremony honoring Inter Miami CF as the 2025 Major League Soccer Cup champions. The event, held in the East Room, featured Messi presenting Trump with a glittering pink soccer ball trophy and an Inter Miami jersey bearing the president’s name, marking a rare intersection of global sports fame and American politics.

Messi, the 38-year-old Argentine forward and eight-time Ballon d’Or winner, entered the room alongside Trump and Inter Miami co-owner Jorge Mas. Trump greeted the team with enthusiasm, declaring it his “distinct privilege to say what no American president has ever had the chance to say before: Welcome to the White House, Lionel Messi.” He praised Messi as one of the greatest players ever, jokingly asking the crowd, “Who’s better, him or Pelé?”—prompting laughter and applause. Messi smiled during the exchange but did not speak publicly.

The ceremony celebrated Inter Miami’s historic first MLS Cup title in 2025, a breakthrough season boosted by Messi’s arrival in mid-2023. The team, coached by Javier Mascherano and featuring stars like Luis Suárez, dominated the league with Messi’s goals and leadership. Trump highlighted the achievement as evidence of America’s growing soccer appeal, noting Messi’s impact: “You came in and you won.”

Photos from the event quickly went viral: Messi and Trump shaking hands, posing with the pink ball, and standing side-by-side with Mas and players. Social media buzzed with reactions, including memes comparing the meeting to past celebrity White House visits. One widely shared clip showed Messi laughing when Trump name-dropped rival Cristiano Ronaldo in a lighthearted aside, drawing amusement from fans.

The visit followed tradition of championship teams receiving White House recognition, though political undertones dominated. Trump used portions of his remarks to update on the ongoing U.S.-Israeli strikes against Iran, tout military successes and economic strength before pivoting to the MLS Cup. He alluded to potential future announcements on Cuba and tariffs, turning the sports event into a broader platform. Inter Miami players stood quietly behind the dais during the tangents.

Messi, who has long avoided political statements and endorsements, faced immediate backlash on social media. Critics, particularly in Latin America and the Middle East, condemned his attendance and applause during Trump’s Iran war briefing as tacit support amid civilian casualties reported in Tehran. Al Jazeera highlighted the controversy, noting Messi’s “rare step into politics” and online calls labeling the meeting insensitive. Supporters countered that the event was a non-political team honor, similar to past championship visits, and Messi’s role was ceremonial.

Messi has historically steered clear of controversy, focusing on soccer and philanthropy. His Inter Miami tenure transformed MLS visibility, drawing global attention and boosting league attendance. The White House appearance underscores his status as a cultural icon, even as it invites scrutiny.

Trump, a longtime sports enthusiast, has hosted athletes frequently. He praised Messi’s humility and talent, contrasting him favorably with other stars. The president also referenced Messi’s 2022 World Cup triumph with Argentina, tying it to American soccer growth ahead of the 2026 FIFA World Cup co-hosted by the U.S., Canada and Mexico.

Inter Miami owner Mas presented Trump with the customized jersey, while Messi handed over the bedazzled ball—a signature pink Miami design. The gifts symbolized the club’s gratitude and the event’s festive tone, despite the broader geopolitical backdrop.

The ceremony occurred amid heightened U.S.-Iran tensions, with ongoing airstrikes drawing international condemnation. Some observers questioned blending sports with war updates, but White House officials described the event as a standard championship celebration.

Messi remains focused on his career. He is expected to represent Argentina in friendlies and the 2026 World Cup, where he could add to his legacy. Inter Miami’s title defense begins soon, with Messi central to their ambitions.

The meeting has sparked debate on celebrity involvement in politics. While some see it as harmless tradition, others view it as unavoidable optics in a polarized era. For Messi, the moment is a footnote in a storied career; for Trump, another high-profile endorsement of American sports success.

As images circulate globally, the handshake between the soccer legend and the U.S. president encapsulates an unexpected 2026 crossover—one blending athletic glory, national pride and contemporary controversy.

Business

64% women investors with less than Rs 5 lakh income prefer SIP in mutual funds. Check details

More Indian women are earning, saving and proactively taking financial decisions, yet many remain underrepresented in formal investing. A study by The Wealth Company shows that women are open to growth-oriented products, especially mutual funds, but need support from the financial ecosystem, as reported by ET Wealth.

Business

Explained: Why BlackRock stock tanked 7% after curbing withdrawals from flagship fund

The stock ended at $955 on the New York Stock Exchange, also weighed down by a broader market selloff following weaker-than-expected US jobs data and escalating tensions from the ongoing US-Israeli war with Iran.

At the centre of the development is BlackRock’s $26 billion HPS Corporate Lending Fund (HLEND), which has seen a surge in redemption requests from investors. The fund received withdrawal requests worth $1.2 billion in the first quarter, equivalent to about 9.3% of its net asset value. BlackRock said it would pay out $620 million as part of the quarterly redemption, reaching the 5% threshold that typically allows managers of such funds to restrict further withdrawals.

HLEND, a business development company that BlackRock acquired along with its manager HPS Investment Partners in a $12 billion push into private credit in 2024, said redemption requests breached the 5% limit for the first time since the fund’s launch.

Business development companies typically raise money, largely from retail investors, and use those funds to extend loans to mid-sized companies. These loans are often difficult to sell quickly. If a large number of investors seek to withdraw money at the same time, it can create liquidity challenges for the fund.

BlackRock said the redemption cap helps prevent a structural mismatch between investor capital and the duration of the private credit loans in which the fund invests. By limiting withdrawals, fund managers can avoid selling assets at unfavourable prices, which could hurt returns for remaining investors.

Recent credit events have also added to the unease. Last year saw bankruptcies involving a US auto parts supplier and a subprime auto lender. More recently, a UK mortgage lender collapsed last week, raising fresh questions about lending standards in the sector.The pressure is not limited to BlackRock. Earlier this week, rival Blackstone raised the usual 5% redemption cap on an $82 billion fund to 7%. The firm and its employees also invested $400 million to ensure all withdrawal requests could be met. Blue Owl, another player in the sector, bought back 15.4% of one of its funds in January and replaced client redemptions with promised payouts.

Despite the surge in withdrawals, HLEND continued to attract some new capital. Subscriptions totalled $840 million in the first quarter, although this was lower than the $1.2 billion investors had originally sought to redeem.

According to reports, about 19% of HLEND’s portfolio is invested in software companies. The sector has faced heavy selling recently as investors worry about disruption from AI-first start-ups. The fund says its loans are mainly extended to mature private companies with stable cash flows and are structured to be repaid first if a borrower goes bankrupt. HLEND also distributes dividends to investors on a monthly basis.

The developments come at a time when investors are increasingly moving money into safer assets amid heightened market volatility, concerns about a possible economic slowdown and uncertainty linked to the ongoing conflict in the Middle East.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times.)

-

Politics4 days ago

Politics4 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business21 hours ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Tech6 days ago

Tech6 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat7 days ago

NewsBeat7 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Fashion18 hours ago

Fashion18 hours agoWeekend Open Thread: Ann Taylor

-

NewsBeat7 days ago

NewsBeat7 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat7 days ago

NewsBeat7 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat6 days ago

NewsBeat6 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech2 days ago

Tech2 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment5 days ago

Entertainment5 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports2 days ago

Sports2 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat6 days ago

NewsBeat6 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics6 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech6 days ago

Tech6 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Fashion6 days ago

Fashion6 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Video5 days ago

Video5 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business3 days ago

Business3 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat5 days ago

NewsBeat5 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Crypto World6 days ago

Crypto World6 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed