Business

Dow Powers Past 50,000 – Momentum Or Market Euphoria? (DJI)

Formerly known as “The Dividend Collectuh.” Top 1% of financial experts on TipRanks. Contributing analyst to the iREIT+Hoya Capital investment group. Dividend Collection Agency is not a registered investment professional nor financial advisor and these articles should not be taken as financial advice. This is for educational purposes only and I encourage everyone to do their own due diligence. I’m a Navy veteran who enjoys dividend investing in quality blue-chip stocks, BDC’s, and REITs. I am a buy-and-hold investor who prefers quality over quantity and plans to supplement his retirement income and live off dividends in the next 5-7 years. I aspire to reach and help the hard working, lower and middle class workers build investment portfolios of high quality, dividend-paying companies. I also hope to give investors a new perspective to help them reach financial independence.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADC, TMUS, VICI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

Gaza’s Rafah crossing reopens, allowing limited travel as Palestinians claim delays and mistreatment

The vital border point opened last week for the first time since 2024, one of the main requirements for the US-backed ceasefire. The crossing was closed Friday and Saturday because of confusion about reopening operations.

Egypt’s Al Qahera television station said that Palestinians began crossing in both directions around noon on Sunday. Israel didn’t immediately confirm the information.

Meanwhile, Israeli Prime Minister Benjamin Netanyahu is expected to travel to Washington this week, though the major subject of discussion will be Iran, his office said.

Delays and mistreatment accusations

Over the first four days of the crossing’s opening, just 36 Palestinians requiring medical care were allowed to leave for Egypt, plus 62 companions, according to UN data, after Israel retrieved the body of the last hostage held in Gaza and several American officials visited Israel to press for the opening.

Palestinian officials say nearly 20,000 people in Gaza are seeking to leave for medical care that isn’t available in the territory. Those who have succeeded in crossing described delays and allegations of mistreatment by Israeli forces and other groups involved in the crossing, including an Israeli-backed Palestinian armed group, Abu Shabab.

A group of Palestinian patients and wounded gathered Sunday morning in the courtyard of a Red Crescent hospital in Gaza’s southern city of Khan Younis, before making their way to the Rafah crossing with Egypt for treatment abroad, family members told The Associated Press.Amjad Abu Jedian, who was injured in the war, was scheduled to leave Gaza for medical treatment on the first day of the crossing’s reopening, but only five patients were allowed to travel that day, his mother, Raja Abu Jedian, said. Abu Jedian was shot by an Israeli sniper while he doing building work in the central Bureij refugee camp in July 2024, she said.

On Saturday, his family received a call from the World Health Organization notifying them that he is included in the group that will travel on Sunday, she said.

“We want them to take care of the patients (during their evacuation),” she said. “We want the Israeli military not to burden them.”

The Israeli defence branch that oversees the operation of the crossing didn’t immediately confirm the opening.

Heading back to Gaza

A group of Palestinians also arrived Sunday morning at the Egyptian side of the Rafah crossing to return to the Gaza Strip, Egypt’s state-run Al-Qahera News satellite television reported.

Palestinians who returned to Gaza in the first few days of the crossing’s operation described hours of delays and invasive searches by Israeli authorities and Abu Shabab. A European Union mission and Palestinian officials run the border crossing, and Israel has its screening facility some distance away.

The crossing was reopened on Feb. 2 as part of a fragile ceasefire deal to halt the Israel-Hamas war.

The Rafah crossing, an essential lifeline for Palestinians in Gaza, was the only one in the Palestinian territory not controlled by Israel before the war. Israel seized the Palestinian side of Rafah in May 2024, though traffic through the crossing was heavily restricted even before that.

Restrictions negotiated by Israeli, Egyptian, Palestinian and international officials meant that only 50 people would be allowed to return to Gaza each day and 50 medical patients – along with two companions for each – would be allowed to leave, but far fewer people have so far crossed in both directions.

Hamas negotiations

A senior Hamas official, Khaled Mashaal, said the militant group is open to discuss the future of its arms as part of a “balanced approach” that includes the reconstruction of Gaza and protecting the Palestinian enclave from Israel.

Mashaal said the group has offered multiple options, including a long-term truce, as part of its ongoing negotiations with Egyptian, Qatari and Turkish mediators.

Hamas plans to agree to a number of “guarantees,” including a 10-year period of disarmament and an international peacekeeping force on the borders, “to maintain peace and prevent any clashes,” between the militants and Israel, Mashaal said at a forum in Qatar’s capital, Doha.

Israel has repeatedly demanded a complete disarmament and destruction of Hamas and its infrastructure, both military and civil.

Mashaal accused Israel of financing and arming militias, like the Abu Shabab group which operates in Israeli military-controlled areas in Gaza, “to create chaos” in the enclave.

In the forum, Mashaal was asked about Hamas’ position from US President Donald Trump’s Board of Peace. He didn’t offer a specific answer, but said that the group won’t accept “foreign intervention” in Palestinian affairs.

“Gaza is for the people of Gaza. Palestinians are for the people of Palestine,” he said. “We will not accept foreign rule.” (AP) GSP

Business

Northern Active M Emerging Markets Equity Fund Q4 2025 Commentary

Northern Trust Asset Management is a global investment manager that helps investors navigate changing market environments in efforts to realize their long-term objectives.

Entrusted with $1.2 trillion in assets under management as of March 31, 2024, we understand that investing ultimately serves a greater purpose and believe investors should be compensated for the risks they take — in all market environments and any investment strategy. That’s why we combine robust capital markets research, expert portfolio construction and comprehensive risk management in an effort to craft innovative and efficient solutions that seek to deliver targeted investment outcomes.

As engaged contributors to our communities, we consider it a great privilege to serve our investors and our communities with integrity, respect and transparency.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc., Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K., NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Northern Trust Asset Management Australia Pty Ltd, and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company. Note: This account is not managed or monitored by Northern Trust Asset Management, and any messages sent via Seeking Alpha will not receive a response. For inquiries or communication, please use Northern Trust Asset Management’s official channels.

Business

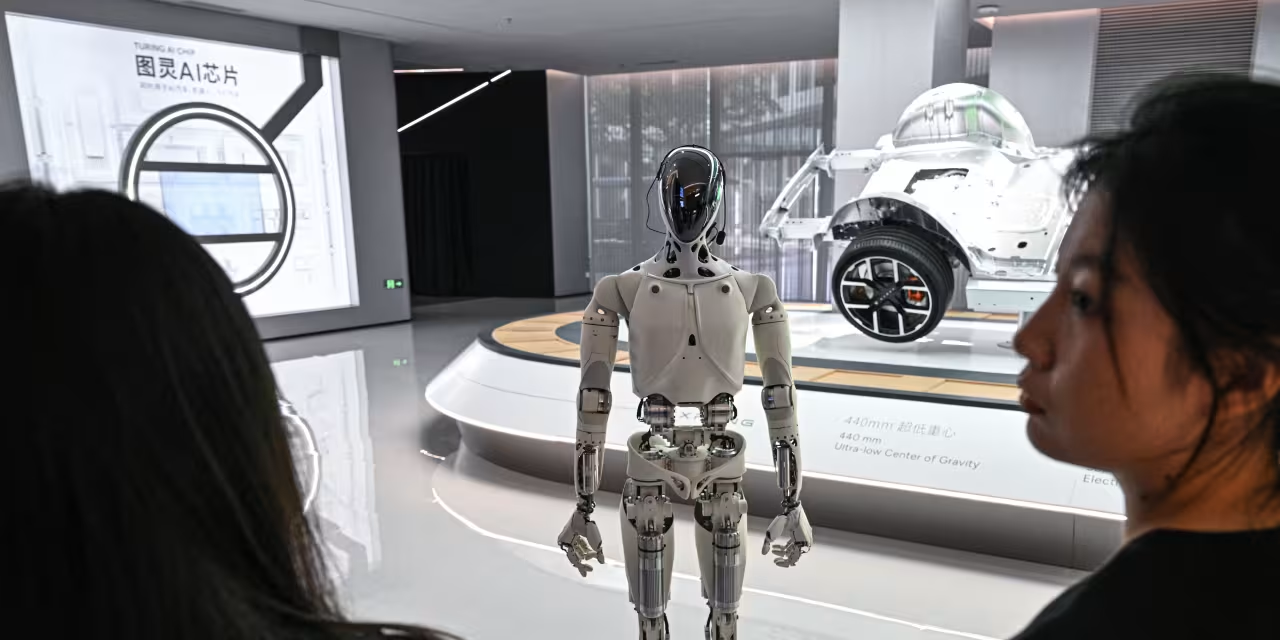

Tesla Isn’t the Only Robot Game In Town. This Company Aims to Compete.

This copy is for your personal, non-commercial use only. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com.

Business

LLP registrations cross 10,000 mark for first time in Jan

As many as 10,081 LLPs were incorporated in January, up 60% from a year before, showed the latest corporate affairs ministry data.

Similarly, the number of companies that got incorporated in January jumped almost 39% from a year before to 23,276, the data showed.

Strong outlook amid trade deals

The jump in incorporations is set to continue, as India’s latest trade deals with the US and the European Union, which promise zero duty or preferential access to a combined $53 trillion market when they take effect, have substantially boosted sentiments about the country’s external trade, said the official.

“Incorporations of companies and LLPs are significantly driven by sentiments as well. Until now, they were being driven mainly by strong domestic growth prospects,” he said, asking not to be named.

The trade deals would allay concerns over US tariffs, further cement the country’s medium-term growth prospects, bolster its both manufacturing and services trade outlook and encourage investors to set up units, he added.

The recent goods and services tax cuts, on top of the income tax relief from the current fiscal year, have also brightened consumption and growth potential, aiding new company and LLP registrations, he added.

REGISTRATIONS SPIKE

Between April and January this fiscal year, the number of LLPs that got incorporated scaled a new high of 76,696, representing a 41% year-on-year increase. Similarly, a record number of new companies—2,01,184 in total—got registered during this period, up 41% from a year before. The number of foreign companies incorporated in India jumped to 78 in the first ten months of this fiscal from just 45 a year earlier, the data showed.

Shankey Agrawal, partner at BMR Legal, said ease and affordability of starting a business have pushed up company incorporations. Moreover, due to the “deregulation and decriminalisation of minor corporate defaults, compliance costs and the fear of penalties have diminished”, he said.

This is leading to improved business confidence and fuelling the trend of formalisation of businesses, Agrawal added. “Optimism surrounding consumption prospects, spurred by measures like GST cuts, etc., have also encouraged entrepreneurs to set up new ventures,” said Tahira Karanjawala, partner at law firm Karanjawala & Co. The country’s large pool of talented and cost-effective workforce has boosted company incorporations. The International Monetary Fund last month raised its fiscal 2026 growth projection for India to 7.3% from 6.6%. The Fund expects the country to remain the world’s fastest-growing major economy at least for the next two years.

Business

Best Presidents’ Day Reclining Sectional Deals (2026)

Best Presidents’ Day Reclining Sectional Deals (2026)

Business

Iran’s Nobel winner Narges Mohammadi faces a new prison term of more than seven years

Iran’s Nobel winner Narges Mohammadi faces a new prison term of more than seven years

Business

Ave Maria Growth Fund Q4 2025 Commentary

We Are/DigitalVision via Getty Images

For the three months ended December 31, 2025, the total return on the Ave Maria Growth Fund (AVEGX) was -0.19%, compared to 2.66% for the S&P 500® Index and 1.39% for the S&P 500® Equal Weight Index. The returns for

Business

Venezuelan politician Juan Pablo Guanipa freed in prisoner release

Venezuelan politician Juan Pablo Guanipa freed in prisoner release

Business

For Palestinians returning to Gaza, a bittersweet reunion

For Palestinians returning to Gaza, a bittersweet reunion

Business

Oakmark International Strategy Q4 2025 New Investments And Divestments

Oakmark International Strategy Q4 2025 New Investments And Divestments

-

Video6 days ago

Video6 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech4 days ago

Tech4 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics7 days ago

Politics7 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Sports2 days ago

Sports2 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech2 days ago

Tech2 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat5 days ago

NewsBeat5 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Politics1 hour ago

Politics1 hour agoWhy Israel is blocking foreign journalists from entering

-

Sports1 day ago

Former Viking Enters Hall of Fame

-

Politics3 hours ago

Politics3 hours agoThe Health Dangers Of Browning Your Food

-

Crypto World6 days ago

Crypto World6 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports2 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business8 hours ago

Business8 hours agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat2 days ago

NewsBeat2 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business3 days ago

Business3 days agoQuiz enters administration for third time

-

Sports6 days ago

Sports6 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat6 days ago

NewsBeat6 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat3 days ago

NewsBeat3 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World5 days ago

Crypto World5 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat6 days ago

NewsBeat6 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know