Business

EssilorLuxottica: Turning Positive On Market-Share Gain (Rating Upgrade)

Business

Trump says Cuba negotiating deal with him and Rubio

Trump says Cuba negotiating deal with him and Rubio

Business

Daylight Saving Time Begins March 8, 2026, Amid Ongoing Debate Over Permanent Change

Most Americans will lose an hour of sleep this weekend as daylight saving time begins Sunday, March 8, 2026, at 2 a.m. local time, when clocks “spring forward” one hour to 3 a.m., extending evening daylight as spring approaches.

The biannual ritual, observed in the majority of U.S. states and territories, follows the schedule set by federal law since 2007: starting on the second Sunday in March and ending on the first Sunday in November. This year, daylight saving time will run until Nov. 1, when clocks “fall back” one hour at 2 a.m., returning to standard time.

The change, regulated by the U.S. Department of Transportation and tracked by the National Institute of Standards and Technology, aims to make better use of natural daylight during warmer months. Proponents argue it promotes energy conservation, outdoor activity, and economic benefits from extended evening light. Critics, however, point to disruptions in sleep patterns, increased accident risks in the days following the shift, and questionable energy savings in modern contexts dominated by LED lighting and electronics.

In practice, at 2 a.m. on March 8, clocks in participating areas jump ahead, meaning sunrise and sunset occur about an hour later than the day before. For example, in many northern cities, morning light will feel delayed, while evenings gain brightness well into summer. The shift lasts roughly eight months, covering about 65% of the year.

Not all areas observe the change. Hawaii and most of Arizona—including the Navajo Nation in Arizona—remain on permanent standard time. U.S. territories such as Puerto Rico, Guam, American Samoa, the U.S. Virgin Islands, and the Northern Mariana Islands also do not participate. Residents in these locations experience no clock adjustment.

Internationally, patterns vary. Canada generally aligns with U.S. dates for most provinces, though some regions differ. In Europe, daylight saving time—known as summer time—begins later, on the last Sunday in March (March 29 in 2026), with clocks advancing at 1 a.m. UTC, and ends on the last Sunday in October (Oct. 25). This creates a temporary three-week difference in time zones between North America and much of Europe after the U.S. shift.

The practice traces back to World War I, when Germany introduced it in 1916 to conserve coal. The United States followed in 1918, though it was repealed post-war before returning during World War II and later standardized under the Uniform Time Act of 1966. Extensions in 1986 and 2007 lengthened the period to its current span.

Public frustration has grown in recent years. Polls consistently show many Americans oppose the twice-yearly changes, citing health impacts like disrupted circadian rhythms, elevated heart attack and stroke risks in the spring transition, and safety concerns from drowsy drivers. Sleep experts often favor permanent standard time for better alignment with natural light cycles, while others prefer year-round daylight saving for brighter evenings.

Legislative momentum reflects this divide. The Sunshine Protection Act, reintroduced in the 119th Congress as S.29 in January 2025, seeks to make daylight saving time permanent nationwide, eliminating annual adjustments. The bill, which would advance clocks one hour from current standard time year-round, allows opt-outs for areas currently exempt. It passed the Senate unanimously in 2022 but stalled in the House.

A new proposal, the Daylight Act of 2026 (H.R. 7378), introduced in February, offers a compromise: shifting clocks forward a permanent half-hour from standard time, ending biannual changes altogether. Sponsors argue it balances morning light needs with evening benefits.

State-level action has accelerated. As of early 2026, at least 18 to 20 states have passed resolutions or laws favoring permanent daylight saving time, contingent on federal approval. Others pursue permanent standard time. In 2026 alone, 16 states introduced more than 20 related bills, ranging from full adoption of one system to pacts with neighboring states. British Columbia in Canada announced it will make March 8, 2026, its final clock change, adopting permanent daylight saving time thereafter.

Federal approval remains the hurdle. States can opt out of daylight saving time entirely—like Hawaii and Arizona—but adopting permanent daylight saving requires congressional action under the Uniform Time Act. Without it, states risk misalignment with federal standards.

Health organizations, including the American Academy of Sleep Medicine, advocate ending changes in favor of permanent standard time. Transportation and retail groups often support permanent daylight saving for perceived safety and commerce gains.

As the March 8 deadline nears, experts advise preparation: set clocks ahead Saturday night to avoid confusion Sunday morning. Smartphones and many devices update automatically, but manual checks for ovens, microwaves, and cars remain wise. Travelers crossing time zones or regions with different rules should verify schedules.

The weekend shift coincides with early spring preparations for many, from gardening to outdoor events. While the extra evening light promises more time for recreation, the immediate cost—an hour less sleep—fuels perennial calls for reform.

For now, the familiar pattern persists: spring forward March 8, fall back Nov. 1. Whether 2026 marks the last such change depends on congressional action amid growing state and public pressure.

Business

Soham Murderer Ian Huntley Dies at 52 After Brutal Prison Attack at HMP Frankland

Ian Huntley, the former school caretaker convicted of murdering two 10-year-old schoolgirls in the notorious 2002 Soham killings, has died at age 52 following a severe attack by another inmate at a high-security prison, authorities confirmed Saturday, March 7, 2026.

Huntley succumbed to his injuries in hospital early Saturday morning, more than a week after the assault on Feb. 26 at HMP Frankland in County Durham, northern England. He had been on life support since the incident, suffering significant head trauma from repeated blows with a makeshift weapon—reportedly a metal bar or spiked pole—in the prison workshop. Life support was withdrawn Friday after medical assessments indicated a vegetative state with no prospect of recovery.

Durham Constabulary issued a brief statement: “A man who was attacked at HMP Frankland in Durham last week has died in hospital this morning. Ian Huntley, 52, was taken to hospital with serious injuries following an incident in the workshop on the morning of Thursday 26 February.” The force added that inquiries continue into the circumstances.

The Prison Service and Ministry of Justice confirmed the death but provided limited details, citing an ongoing investigation. A ministry spokesperson described the Soham murders as one of Britain’s most harrowing crimes and extended sympathies to the victims’ families, stating: “Our thoughts remain with the families of Holly Wells and Jessica Chapman.”

Huntley, serving a life sentence with a minimum term of 40 years imposed in 2003, was attacked in a prison workshop where inmates undertake supervised activities. Sources told media outlets he was found lying in a pool of blood after being bludgeoned. The BBC reported that triple killer Anthony Russell, 43, is suspected of carrying out the assault, though no formal charges have been announced as of Saturday.

The attack marks the latest in a series of violent incidents involving Huntley during his incarceration. In 2005, while at HMP Wakefield, he was scalded with boiling water by convicted murderer Mark Hobson. He later sued the government over prison safety failures. Previous assaults and his high-profile status as a child killer had led to frequent moves between facilities and protective measures, though critics questioned why he was placed in a shared workshop environment.

The Soham case shocked the United Kingdom and prompted major reforms in child protection and police procedures. On Aug. 4, 2002, Huntley, then 28 and working as a caretaker at Soham Village College, lured best friends Holly Wells and Jessica Chapman into his home after they visited his girlfriend, Maxine Carr, a teaching assistant at their school. He murdered the girls—Holly by suffocation and Jessica by smothering her to silence screams—then disposed of their bodies in a remote ditch near RAF Lakenheath. He set fire to their clothing and attempted to cover up the crime by fabricating an alibi and giving media interviews as a concerned local.

Huntley’s lies unraveled quickly. Police discovered forensic evidence linking him to the girls, and he was arrested within days. Carr, who provided a false alibi claiming Huntley was with her during the abductions, was convicted of perverting the course of justice and served 21 months. Huntley’s 2003 trial at the Old Bailey captivated the nation, with graphic details emerging of his actions and attempts to mislead investigators. The jury convicted him of two counts of murder after he claimed the deaths were accidental.

The case exposed flaws in vetting procedures for school staff—Huntley had prior allegations of sexual misconduct that were not properly flagged—and led to the creation of the Independent Safeguarding Authority and enhanced Criminal Records Bureau checks. It also highlighted issues in police information-sharing, culminating in the Bichard Inquiry, which recommended sweeping changes to national police databases.

Public reaction to Huntley’s death has been mixed but largely unsympathetic. Many expressed relief on social media and in comments sections, with some calling it “poetic justice” or arguing taxpayer funds should no longer support his incarceration. Others voiced concern over prison violence, questioning whether vulnerable or high-risk inmates receive adequate protection despite their crimes.

Huntley’s former partner, Maxine Carr, released no immediate statement. The families of Holly and Jessica have maintained a low profile over the years, occasionally speaking about the enduring pain and the importance of child safety reforms.

The incident at HMP Frankland, a Category A prison housing some of Britain’s most dangerous offenders including other notorious killers, underscores persistent challenges in managing high-security facilities. Overcrowding, staffing shortages, and the risks of improvised weapons remain ongoing issues in the U.K. prison system.

As investigations proceed, Durham Police have appealed for witnesses from the workshop incident. No timeline has been given for potential charges against the alleged attacker.

Huntley’s death closes a grim chapter in one of modern Britain’s most infamous crimes, though the legacy of the Soham murders—improved safeguards for children and lessons in police accountability—endures.

Business

Thousands of Americans evacuated from Middle East on charter flights, State Department says

Thousands of Americans evacuated from Middle East on charter flights, State Department says

Business

XPeng Inc. Stock Surges 6% Amid Anticipation for Q4 2025 Earnings and 2026 Growth Targets

GUANGZHOU, China — Shares of XPeng Inc. climbed sharply on Friday, closing up 6% at $17.32 on the New York Stock Exchange, as investors positioned themselves ahead of the Chinese electric vehicle maker’s fourth-quarter 2025 earnings report scheduled for March 20.

The advance came despite recent mixed delivery figures and ongoing pressures in China’s highly competitive EV market. XPeng’s American depositary shares rose from a previous close of $16.34, with trading volume exceeding 9.5 million shares. In after-hours trading, the stock dipped slightly to around $17.20.

The rally reflects growing optimism about XPeng’s trajectory into 2026, even as short-term challenges persist. The company, known for its focus on smart electric vehicles equipped with advanced AI and autonomous driving features, has set ambitious delivery targets for the coming year while deepening partnerships that could bolster its technology edge.

XPeng’s stock has shown volatility in early 2026, hitting a 52-week low of $15.38 in early March before rebounding. The shares peaked at $28.24 in November 2025, underscoring the sector’s sensitivity to delivery reports, policy shifts and global EV demand.

Analysts are closely watching the upcoming earnings release, which will cover the October-to-December 2025 period. XPeng has guided for fourth-quarter revenues between 21.5 billion yuan and 23 billion yuan (approximately $3 billion to $3.2 billion), representing a 33.5% to 42.8% increase from the prior year. Vehicle deliveries for the quarter are projected at 125,000 to 132,000 units, up 36.6% to 44.3% year-over-year.

The company has emphasized its path toward profitability, with management previously signaling that the fourth quarter could mark a key milestone in achieving breakeven or positive results on a single-quarter basis. In the third quarter of 2025, XPeng narrowed its net loss to 380 million yuan, the lowest in five years, amid cost controls and higher-margin model sales.

Recent monthly delivery updates have presented a mixed picture. January 2026 saw 20,011 vehicles delivered, a 47% drop from December 2025 levels, influenced by seasonal factors. February figures fell 49.9% year-over-year to 15,256 units, partly due to the Lunar New Year holiday. Despite the declines, XPeng highlighted the global rollout of its P7+ model as a positive development for international expansion.

For full-year 2025, XPeng delivered 429,445 vehicles, providing a baseline for its aggressive 2026 outlook. The company aims to deliver between 550,000 and 600,000 units next year, implying 28% to 40% growth. International shipments are expected to double from about 45,000 in 2025, as XPeng pushes into markets beyond China.

A key driver of long-term optimism is XPeng’s collaboration with Volkswagen. The German automaker’s adoption of XPeng’s autonomous driving technology has been viewed as validation of its AI capabilities, though it contributed to an 8% stock drop in one recent session amid concerns over competitive dynamics.

Analysts generally maintain a positive stance. The consensus 12-month price target for XPEV stands at around $25.78, suggesting potential upside of nearly 49% from current levels, based on input from 13 analysts. Targets range from a low of $17 to a high of $34. Goldman Sachs, for instance, raised its target to $25 in late 2025, citing expected 40% revenue growth in 2026 from new model launches and contributions from the Volkswagen partnership.

XPeng plans to introduce seven new dual-energy models and three overseas-specific models in 2026, including mid- and small-sized SUVs, to broaden its portfolio and appeal to diverse customer segments.

The broader Chinese EV sector remains intense, with domestic rivals such as BYD, Li Auto and NIO vying for market share through aggressive pricing and innovation. Global factors, including supply chain issues, regulatory changes in key export markets and fluctuating demand for electric vehicles, continue to influence sentiment.

XPeng, founded in 2014 and headquartered in Guangzhou, differentiates itself through its emphasis on intelligent features, including its XNGP autonomous driving system. The company trades on both the NYSE (XPEV) and the Hong Kong Stock Exchange (9868).

Investors await the March 20 earnings call, set for 8 a.m. ET, for detailed insights into margins, cash flow and updated guidance. Management has stressed disciplined execution and technological leadership as pillars for sustainable growth amid industry headwinds.

As XPeng navigates this pivotal period, its stock performance will likely hinge on delivering against ambitious targets while managing costs in a price-sensitive market. The recent uptick suggests some investors are betting on positive surprises in the forthcoming report and stronger momentum in 2026.

Business

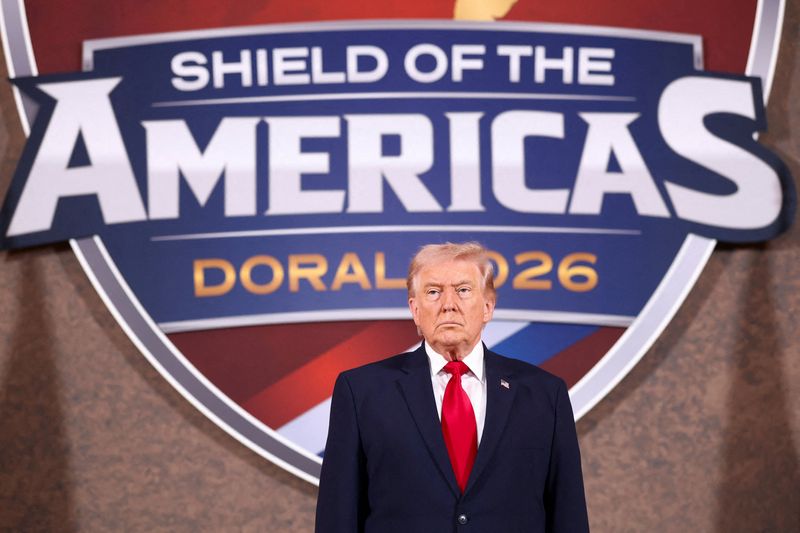

Trump announces new military coalition to ’eradicate cartels’ in Western Hemisphere

Trump announces new military coalition to ’eradicate cartels’ in Western Hemisphere

Business

Palantir Technologies Stock Climbs 3% to $157 Amid Geopolitical Tensions and Strong AI Demand

Shares of Palantir Technologies Inc. rose nearly 3% on Friday, closing at $157.16 on the Nasdaq, as investors weighed the company’s explosive growth in artificial intelligence platforms against heightened geopolitical risks driving demand for its defense-focused software.

The Denver-based data analytics and AI firm saw its stock surge 2.94% from Thursday’s close of $152.67, with trading volume reaching over 74 million shares — well above its average. In after-hours trading, the shares eased slightly to around $156.60.

The advance capped a strong week for Palantir, with the stock up about 15% amid escalating tensions in the Middle East, including conflicts involving Iran, which analysts say could boost prospects for defense and intelligence contracts. The shares have rebounded sharply from earlier March lows near $133, though they remain below late-2025 peaks above $220.

Palantir, co-founded by Peter Thiel and known for its Gotham and Foundry platforms, has positioned itself as a leader in AI-driven data integration for both government and commercial clients. Its Artificial Intelligence Platform (AIP) has fueled rapid adoption, particularly in the U.S., where commercial revenue exploded in late 2025.

The rally follows Palantir’s blockbuster fourth-quarter 2025 earnings released in early February. Revenue jumped 70% year-over-year to $1.41 billion, with U.S. revenue surging 93% to $1.076 billion. U.S. commercial revenue grew an astonishing 137% year-over-year, while government revenue increased 66%.

Management issued aggressive guidance for 2026, projecting full-year revenue between $7.182 billion and $7.198 billion — implying roughly 61% growth from 2025’s estimated $4.48 billion. U.S. commercial revenue is expected to exceed $3.144 billion, representing at least 115% growth. Adjusted operating income is forecasted near $4.1 billion, with adjusted free cash flow between $3.9 billion and $4.1 billion.

Chief Executive Alex Karp hailed the results as evidence of Palantir’s unique focus on scaling AI operational leverage, describing the company as an “n of 1” in pursuing “commodity cognition” through advanced models.

Recent developments have reinforced optimism. Palantir secured a five-year blanket purchasing agreement with the U.S. Department of Homeland Security valued at up to $1 billion to deploy AI tools across agencies for case management, threat identification and logistics. The company also expanded partnerships, including with Rackspace Technology to deploy Foundry and AIP in regulated industries, and won its largest-ever U.K. defense contract.

Geopolitical factors appear to be amplifying demand. Analysts point to rising needs for AI in battlefield intelligence and national security amid global conflicts. A potential 10-year, $10 billion U.S. Army framework agreement continues to generate buzz, contributing to a record contract backlog.

Analysts remain largely bullish despite the stock’s lofty valuation — trading at around 241 times trailing earnings and 115 times forward estimates. The consensus 12-month price target stands at approximately $193 to $198, suggesting 23% to 26% upside from current levels, based on input from 28 analysts. Ratings lean toward “Moderate Buy,” with highs reaching $260 from Citi and recent upgrades including Rosenblatt’s $200 target.

Some forecasts are more ambitious. Veteran analysts highlight Palantir’s mission-critical role in defense AI, with one predicting the stock could reach $200 amid geopolitical tailwinds. Others caution that sustained execution will be key in a competitive landscape featuring players like Snowflake and Oracle.

Palantir’s commercial momentum has shifted perceptions. Once heavily reliant on government contracts, the U.S. commercial segment now drives outsized growth through AIP deployments in Fortune 500 companies. The company’s Rule of 40 score — combining revenue growth and profit margin — hit 127% recently, a rare feat at scale.

Challenges persist. High valuation leaves little room for error, and controversies around surveillance tech and public-sector contracts continue in some markets. Insider selling has occurred periodically, though it has not derailed the broader uptrend.

Investors await the next earnings update, expected in May 2026, for confirmation of guidance delivery and further AIP traction. Management has emphasized disciplined scaling and profitability as hallmarks of its strategy.

As Palantir navigates an environment of accelerating AI adoption and defense modernization, its stock performance will likely depend on converting massive backlog into recurring revenue while managing expectations in a volatile market. The recent surge suggests investors are betting on continued outperformance in both commercial and government segments through 2026.

Business

Global Stock Markets End Volatile Week Lower as Geopolitical Tensions, Surging Oil and Weak Jobs Data

Major stock indexes around the world closed mostly lower on Friday, capping a turbulent week dominated by the ongoing U.S.-Iran conflict, spiking oil prices and disappointing U.S. employment figures that raised concerns about economic slowdown and persistent inflation.

AFP

The Dow Jones Industrial Average fell 453.19 points, or 0.95%, to settle at 47,501.55. The broader S&P 500 declined 90.69 points, or 1.33%, to 6,740.02, while the tech-heavy Nasdaq Composite dropped 361.31 points, or 1.59%, to 22,387.68. All three major U.S. benchmarks posted weekly losses, with the Dow down nearly 3%, the S&P 500 off about 2% and the Nasdaq slipping 1.2%.

The sell-off reflected broader unease over the Middle East war entering its second week. Oil prices surged, with Brent crude topping $90 a barrel at points amid supply disruptions, including halted exports from key producers and blocked transport routes. Higher energy costs fueled fears of renewed inflationary pressures, prompting traders to pare expectations for central bank rate cuts.

In Asia, Japan’s Nikkei 225 rose 0.62% to close around 55,620, benefiting from a weaker yen and some resilience in export-oriented sectors. Hong Kong’s Hang Seng Index advanced 1.72% to 25,757.29, supported by mainland Chinese stimulus hopes despite ongoing property sector challenges. Chinese markets showed mixed performance amid Beijing’s reaffirmed 2026 CPI target of around 2%, viewed by economists as a ceiling rather than a firm goal.

European shares were mixed earlier in the week but ended the period with gains in some sessions as investors rotated toward value and defensive names. The pan-European STOXX 600 index recovered partially from earlier losses tied to energy price volatility.

The week’s volatility stemmed from several converging factors. Geopolitical risks escalated following U.S.-Israel actions against Iran, disrupting global energy flows and sending crude higher. Analysts warned that prolonged conflict could spike euro zone inflation and curb growth, with ECB Chief Economist Philip Lane noting potential substantial impacts.

U.S. economic data added to the caution. February’s jobs report disappointed, showing weaker-than-expected hiring and contributing to fears of labor market softening. Combined with firmer producer price index readings earlier in the year, the data reduced bets on Federal Reserve rate cuts. Markets now price in no cuts until potentially June or later, with probabilities for easing in 2026 scaled back.

Inflation remains a key concern globally. J.P. Morgan Global Research forecasts core CPI stable at 2.8% worldwide in 2026, with 3.2% in the U.S., 2.4% in the U.K. and 1.9% in the euro area. Regional cross-currents, including energy-driven pressures, complicate the picture. The Fed is expected to hold steady amid elevated price risks, while the ECB appears paused and the Bank of England tilts dovish.

Despite the headwinds, some positive undertones persist. Corporate earnings have shown resilience, particularly in AI-related sectors, though rotation away from mega-cap tech toward industrials, materials and energy occurred amid defensive positioning. International equities outperformed U.S. large-caps in recent periods, with developed markets outside the U.S. posting stronger returns.

J.P. Morgan Global Research maintains a positive stance on equities for 2026, forecasting double-digit gains in both developed and emerging markets, driven by robust earnings, lower rates over time and AI capital expenditure broadening.

Cryptocurrencies provided a bright spot amid the equity weakness, with bitcoin rallying significantly in some sessions, boosting related stocks like Coinbase and MicroStrategy.

Looking ahead, investors face a data-heavy calendar, including upcoming U.S. and China inflation releases, U.K. GDP and further trade figures. Central bank commentary will remain in focus as policymakers navigate the balance between growth support and inflation control.

The recent market swings underscore the challenges of operating in an environment marked by geopolitical uncertainty and macroeconomic cross-currents. While long-term outlooks remain constructive on fundamentals like corporate balance sheets and technological innovation, near-term sentiment hinges on de-escalation in conflicts and clearer signals from energy markets.

As trading resumes next week, attention will turn to whether stabilization in oil and any diplomatic progress can ease pressures, or if sustained higher costs force further reassessment of monetary policy paths.

Business

Days after Iran strikes, Trump hosts Latin American leaders with China in focus

Days after Iran strikes, Trump hosts Latin American leaders with China in focus

Business

Israel warns Lebanon of ’heavy price’ as bombardment pounds Beirut suburbs

Israel warns Lebanon of ’heavy price’ as bombardment pounds Beirut suburbs

-

Politics4 days ago

Politics4 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business1 day ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Tech6 days ago

Tech6 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat7 days ago

NewsBeat7 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Fashion21 hours ago

Fashion21 hours agoWeekend Open Thread: Ann Taylor

-

NewsBeat7 days ago

NewsBeat7 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat6 days ago

NewsBeat6 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech2 days ago

Tech2 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment5 days ago

Entertainment5 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports2 days ago

Sports2 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat6 days ago

NewsBeat6 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics7 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech6 days ago

Tech6 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video5 days ago

Video5 days agoHow to Build Finance Dashboards With AI in Minutes

-

Fashion6 days ago

Fashion6 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Business4 days ago

Business4 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat5 days ago

NewsBeat5 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Crypto World6 days ago

Crypto World6 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

Crypto World5 days ago

Crypto World5 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown