Business

F&O Talk | Nifty breaches 20 & 100-DMA amid 11% VIX spike; Sudeep Shah on Coforge, 5 other top weekly movers

After back-to-back correction, the setup for Nifty has turned relatively cautious, with the index slipping below its 20DMA for the first time in the past few sessions. The 50-stock index is now trading below the key support level of 25,500, suggesting a weak near-term bias.

Indian markets will look for fresh triggers with the earnings season ended this week.

With this, analyst Sudeep Shah, Vice President and Head of Technical & Derivatives Research at SBI Securities, interacted with ETMarkets regarding the outlook for the Nifty and Bank Nifty, as well as an index strategy for the upcoming week. The following are the edited excerpts from his chat:

Q: Nifty closed 0.8% lower this week largely hit by the debacle in IT stocks. What are the cues for traders and investors for next week’s trade?

Last week, the benchmark index Nifty once again failed to sustain above the psychologically 26,000 mark, triggering a sharp bout of profit booking. After touching a high of 26,009, the index corrected nearly 550 points in just the final two trading sessions of the week — a swift move that signals supply emerging at higher levels. While the fall may appear routine on the surface, the underlying drivers of this correction tell a far more compelling story.

The major drag during this phase came from the Nifty IT index, which plunged over 8% during the last week and is now down over 14% month-to-date, marking one of its sharpest recent declines. The sell-off was largely triggered by rising concerns over the rapid expansion of AI-driven start-ups, which are increasingly seen as disruptive to traditional IT service companies. The speed and intensity of the decline suggest that this may not be a simple pullback on the downside and that raises an important question about whether the worst is already priced in.

From a technical perspective, the IT pack continues to flash strong warning signals. All the constituents of the Nifty IT index are trading below their key moving averages, firmly placed in a falling trajectory. Momentum indicators remain entrenched in bearish territory, with no visible signs of reversal. In such a setup, attempting bottom fishing could prove premature — unless the charts begin to tell a different story in the coming sessions.

Coming back to Nifty, it has now slipped below its 20-day, 50-day and 100-day EMAs, indicating a clear deterioration in short and medium-term trend strength. More importantly, both the 20-day and 50-day EMAs have started to slope downward — a subtle yet powerful bearish signal. Adding to the caution, the daily RSI failed to reclaim the 60 mark during the recent pullback and has now slipped below its 9-day average, hinting that upside momentum may remain capped — at least for now.

Going ahead, the 25,350–25,300 zone is likely to act as immediate support for the index. A sustained move below 25,300 could accelerate the correction towards 25100, followed by the crucial 24,900 mark. On the upside, the 50-day EMA zone of 25,650–25,700 level stands as a formidable hurdle.

Q: What are important Nifty and Bank Nifty levels for next week’s trade?

Going ahead, for Nifty, the 25,350–25,300 zone is likely to act as immediate support for the index. A sustained move below 25,300 could accelerate the correction towards 25,100, followed by the crucial 24900 mark. On the upside, the 50-day EMA zone of 25,650–25,700 level stands as a formidable hurdle.

For Bank Nifty, the 20 day EMA zone of 60000–59900 will serve as the immediate support area. A sustained move below 59900 may trigger further downside towards the 50 day EMA, currently placed at 59467. On the upside, the 60600–60700 band is expected to act as a crucial hurdle, and only a decisive close above this range may pave the way for a fresh up-move.

Q: The view on IT stocks is mostly bearish though some analysts are taking a contra view on the sector, arguing in favour of long term promise and favourable-risk reward after the extended correction. Data suggests not a single stock has given positive returns over a two-year period. In light of this, what will be your advice to investors?

Nifty IT witnessed a sharp sell-off last week, tumbling more than 8%, and is now down over 14% month to date, marking one of its steepest recent declines. The index has also slipped below its key support zones, signalling a clear deterioration in trend strength. With moving averages turning lower and momentum indicators firmly in bearish territory, the overall structure suggests that selling pressure may persist in the near term.

All the constituents of the Nifty IT index are trading below their key moving averages, firmly placed in a falling trajectory. Momentum indicators remain entrenched in bearish territory, with no visible signs of reversal. In such a setup, attempting bottom fishing could prove premature — unless the charts begin to tell a different story in the coming sessions.

Q: PSU Bank stocks appear to be a much more safe option as there is no direct link of the trade deal with the sector. What is your assessment and do you have stock recommendations?

The PSU Bank index cracked nearly 6% on the budget day and slipped below its 50-day EMA, but the subsequent recovery has been very strong, with the index rebounding sharply and marking a fresh all-time high near 9295 on 12th Feb. Over the last one year, it has been the best performing index with gains of nearly 53%, which clearly highlights sustained sector leadership.

Technically, the index continues to trade above key short- and long-term moving averages, keeping the broader trend bullish. The PSU Bank / Nifty ratio chart has also hit a new high and remains in a rising trajectory, indicating continued relative outperformance versus the broader market. The 8970–8950 zone remains a crucial support zone. As long as the index holds above this area, the bullish trend structure is likely to remain intact.

At the stock level, Indian Bank and Union Bank of India are both consolidating in a defined range since mid-January after a strong prior upward move, suggesting a healthy pause. This kind of time correction typically sets up the next leg of the trend. A strong follow-through move and a decisive breakout above their respective consolidation ranges can lead to continuation of the upmove in both stocks.

Q: India VIX was up 11% this week which brings opportunity for day traders in cash and derivatives market. How can traders utilize this?

Since hitting 16.11 on the budget day, India VIX cooled nearly 35% over the next 10 sessions in line with the usual post-budget volatility drop, but historically volatility tends to rise again in the following weeks — in the last 15 budgets, VIX closed negative immediately after the event in 11 cases (avg −8.82%), yet turned positive in 8 of the following one-month periods with an average rise of 17%, and the current pattern looks similar.

For traders, a rising VIX environment means bigger intraday ranges and faster price swings, so cash market day traders can focus on high-beta leaders and breakout/breakdown setups with smaller position sizing and quicker profit booking, while derivatives traders should avoid large naked positions due to higher premium risk and instead prefer defined-risk structures like debit spreads (bull call or bear put spreads) and hedged directional trades, which allow participation in movement while controlling downside if volatility expands further.

Q: Which sectors or themes will be in your radar next week?

Nifty Consumer Durables, Nifty Auto, Nifty Infrastructure, Nifty Manufacturing and Nifty Financial Services will be on the radar next week as they are currently the strongest pockets on the charts and are positioned in the leading quadrant of the Relative Rotation Graph (RRG), indicating superior relative strength along with momentum.

Consumer Durables has staged a sharp pullback from the 33383 lows showing strong demand at lower levels, while Auto and Manufacturing have rebounded decisively from their 200-day EMA and moved up swiftly, signaling trend support and continuation potential. Infrastructure is showing clear relative outperformance with the Infra/Nifty ratio chart giving a downward sloping trendline breakout followed by solid follow-through and Financial Services continues to outperform with its ratio line versus Nifty trending higher, together suggesting leadership is likely to remain with these themes if the broader market remains stable.

Q: SCI, Kirloskar Oil and Engineers India were big gainers this week while Firstsource, eClerx and Coforge, top losers. What should investors do with them?

Post results, Shipping Corporation of India saw a sharp gap-up and strong follow-through but is currently hovering near the earlier swing high zone of 280–282, which is acting as a supply area — price behaviour around this band will be important to judge whether momentum expands or the stock spends more time consolidating.

Kirloskar Oil Engines continues to show a higher-high higher-low structure and trades above key moving averages after a strong rebound since late January, suggesting trend strength remains visible as long as it holds above its nearby support band of 1330–1320.

On the weaker side, Firstsource Solutions has corrected sharply and slipped below the 275–270 support zone, which may now behave as an overhead resistance area, so price acceptance back above or rejection near this band becomes the key monitorable.

eClerx Services has broken an upward sloping trendline and its 200-day EMA, indicating loss of medium-term structure, with 3950 acting as an important reference level for trend assessment.

Coforge has also seen a double-digit weekly correction amid broader IT sector pressure linked to AI disruption headlines, so from a tactical standpoint the space may be better approached after signs of stabilization and base formation rather than during active weakness.

(Disclaimer: The recommendations, suggestions, views, and opinions given by the experts are their own. These do not represent the views of The Economic Times.)

Business

The Iran War Is Hitting Gulf Markets, Lifting Israel and Shifting Risk Across the Region

For years, investors treated the Persian Gulf as a bastion of calm in a deeply unstable region. Oil wealth and careful diplomacy kept turmoil at arm’s length. Wars raged in Gaza, Israel, Syria and Lebanon—far from glitzy Dubai.

Now, markets are repricing risk across the region. The war with Iran—which has grounded flights, stranded tankers and put cities such as Dubai and Qatar’s Doha under bombardment—is forcing investors to recalibrate their perception of the region’s stability.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

Trump Demands Unconditional Surrender from Iran as Putin Talks with Iranian President

WASHINGTON — President Donald Trump demanded Iran’s “unconditional surrender” on Friday as U.S. and Israeli forces continued airstrikes on Iranian targets, escalating rhetoric in a conflict that has entered its second week and claimed over 1,300 civilian lives, according to Iranian reports. The statement came hours after Russian President Vladimir Putin spoke by phone with Iranian President Masoud Pezeshkian, offering condolences for the death of Supreme Leader Ayatollah Ali Khamenei and condemning the strikes as a violation of international law.

AFP

Trump, posting on his Truth Social platform, rejected any negotiated end to the hostilities short of total capitulation. “There will be no deal with Iran except UNCONDITIONAL SURRENDER!” he wrote. “After that, and the selection of a GREAT & ACCEPTABLE Leader(s), we, and many of our wonderful and very brave allies and partners, will work tirelessly to bring Iran back from the brink of destruction, making it economically bigger, better, and stronger than ever before. MAKE IRAN GREAT AGAIN (MIGA!).”

The post marked a shift in U.S. objectives, broadening from initial aims of degrading Iran’s military capabilities to demanding regime change. White House officials did not immediately respond to requests for clarification on what “unconditional surrender” entails or how it aligns with international norms. Analysts suggest the language evokes World War II-era demands, potentially prolonging the conflict if Tehran refuses to comply.

The war began on Feb. 28, 2026, with coordinated U.S. and Israeli strikes targeting Iranian nuclear facilities, military bases and leadership sites following intelligence reports of an imminent Iranian attack on U.S. interests in the Middle East. Khamenei was killed in an early barrage, which Iranian state media described as an “assassination.” The Iranian Red Crescent reported 1,332 civilian deaths as of March 7, with strikes continuing in Tehran, Beirut and other locations.

Putin’s call with Pezeshkian, confirmed by the Kremlin on Sunday, focused on the “cynical assassination” of Khamenei and his family. “Please accept my deepest condolences in connection with the assassination of the supreme leader of the Islamic Republic of Iran … committed in cynical violation of all norms of human morality and international law,” Putin said in a message to Pezeshkian.

The Russian leader also held separate conversations with leaders of the United Arab Emirates, Bahrain, Saudi Arabia and Qatar, condemning the strikes as “unprovoked aggression” and offering Moscow’s mediation services. According to Kremlin readouts, Putin proposed using Russia’s close ties with Iran to relay complaints from Gulf states and facilitate de-escalation. UAE President Mohammed bin Zayed Al Nahyan reportedly expressed concerns about regional spillover, including attacks on UAE assets.

U.S. intelligence officials have accused Russia of providing Iran with targeting data on American troops, ships and aircraft, marking Moscow’s first direct involvement in the conflict. Multiple sources familiar with the reports told CNN that this intelligence sharing could prolong Iranian resistance and complicate U.S. operations.

Iranian Foreign Minister Seyed Abbas Araghchi rejected calls for a ceasefire in a Saturday statement, vowing continued defiance. “Iran is prepared for the possibility of a U.S. ground invasion,” he said, dismissing Trump’s demands as “imperialist delusions.” Tehran’s envoy to the United Nations reported 1,332 civilian casualties to the Security Council, urging an emergency session.

Israeli Prime Minister Benjamin Netanyahu echoed Trump’s hard line in a March 6 address, stating strikes would continue until Iran’s military threat is neutralized. Israel traded fire with Hezbollah in Lebanon, widening the conflict’s scope. U.S. Central Command confirmed strikes on an Iranian drone carrier, claiming it disrupted Tehran’s unmanned aerial capabilities.

The U.S. has begun evacuating nonessential personnel and citizens from the Middle East, with the State Department issuing Level 4 travel advisories for Iran, Lebanon and parts of Israel. Domestic protests against the war have intensified, with demonstrations in Washington, New York and Los Angeles drawing thousands calling for an immediate halt to hostilities.

Trump’s administration has defended the strikes as necessary to prevent Iranian aggression, citing preemptive intelligence. In a March 5 briefing, Secretary of State Mike Pompeo reiterated that the U.S. seeks a “stable and prosperous Middle East,” but only after Iran’s “malign activities” cease. Critics, including Democratic leaders, have questioned the legal basis for the war, demanding congressional authorization under the War Powers Resolution.

International reactions vary. China’s Foreign Ministry called for restraint, while European Union officials urged diplomatic channels. The UN Security Council remains deadlocked, with Russia and China blocking U.S.-backed resolutions condemning Iran.

Economic fallout is mounting. Oil prices surged to $95 per barrel on March 7, amid fears of disrupted Persian Gulf shipments. U.S. stock markets dipped 2%, with energy sectors gaining but broader indices reflecting uncertainty.

Humanitarian concerns grow as Iranian infrastructure crumbles under bombardment. The World Health Organization reported shortages of medical supplies in Tehran hospitals, with access limited by ongoing fighting. Aid groups like Doctors Without Borders have called for safe corridors to deliver relief.

Putin’s involvement adds a layer of geopolitical complexity. Russia’s condemnation of the strikes aligns with its alliance with Iran, including arms supplies and joint military exercises. Analysts warn that Moscow’s intelligence sharing could draw it deeper into the fray, risking a proxy confrontation with the U.S.

Trump’s “unconditional surrender” demand has drawn historical parallels to demands on Japan in 1945, but experts note Iran’s theocratic regime is unlikely to capitulate without significant internal upheaval. “Ending Middle East wars on U.S. terms is no easy thing,” said a panelist on PBS’s Washington Week, highlighting past U.S. entanglements in Iraq and Afghanistan.

As the conflict persists, global leaders watch for signs of escalation. Putin’s mediation offer could open back channels, but Trump’s rejection of deals short of surrender signals a protracted standoff. The White House has scheduled a national address for March 8, where Trump is expected to outline next steps.

For now, the region braces for more violence, with uncertainty clouding the path to resolution. U.S. officials maintain the strikes are targeted and proportionate, but Iranian vows of retaliation keep tensions at a boiling point.

Business

Costco Earnings Beat Expectations as Membership Model Shines

Costco Earnings Beat Expectations as Membership Model Shines

Business

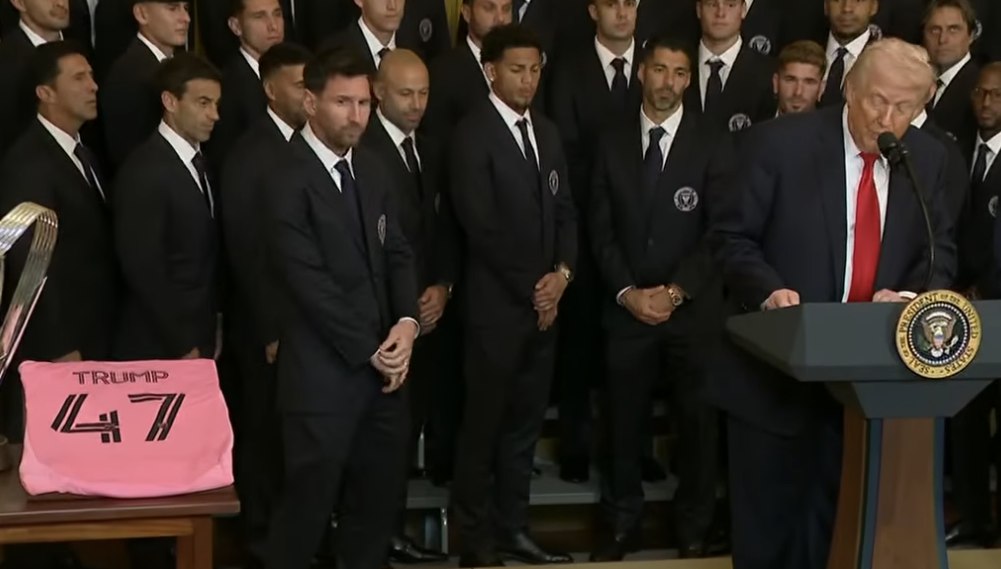

(VIDEO) Lionel Messi Meets President Donald Trump at White House

WASHINGTON — Soccer superstar Lionel Messi met U.S. President Donald Trump on Thursday, March 5, 2026, during a White House ceremony honoring Inter Miami CF as the 2025 Major League Soccer Cup champions. The event, held in the East Room, featured Messi presenting Trump with a glittering pink soccer ball trophy and an Inter Miami jersey bearing the president’s name, marking a rare intersection of global sports fame and American politics.

Messi, the 38-year-old Argentine forward and eight-time Ballon d’Or winner, entered the room alongside Trump and Inter Miami co-owner Jorge Mas. Trump greeted the team with enthusiasm, declaring it his “distinct privilege to say what no American president has ever had the chance to say before: Welcome to the White House, Lionel Messi.” He praised Messi as one of the greatest players ever, jokingly asking the crowd, “Who’s better, him or Pelé?”—prompting laughter and applause. Messi smiled during the exchange but did not speak publicly.

The ceremony celebrated Inter Miami’s historic first MLS Cup title in 2025, a breakthrough season boosted by Messi’s arrival in mid-2023. The team, coached by Javier Mascherano and featuring stars like Luis Suárez, dominated the league with Messi’s goals and leadership. Trump highlighted the achievement as evidence of America’s growing soccer appeal, noting Messi’s impact: “You came in and you won.”

Photos from the event quickly went viral: Messi and Trump shaking hands, posing with the pink ball, and standing side-by-side with Mas and players. Social media buzzed with reactions, including memes comparing the meeting to past celebrity White House visits. One widely shared clip showed Messi laughing when Trump name-dropped rival Cristiano Ronaldo in a lighthearted aside, drawing amusement from fans.

The visit followed tradition of championship teams receiving White House recognition, though political undertones dominated. Trump used portions of his remarks to update on the ongoing U.S.-Israeli strikes against Iran, tout military successes and economic strength before pivoting to the MLS Cup. He alluded to potential future announcements on Cuba and tariffs, turning the sports event into a broader platform. Inter Miami players stood quietly behind the dais during the tangents.

Messi, who has long avoided political statements and endorsements, faced immediate backlash on social media. Critics, particularly in Latin America and the Middle East, condemned his attendance and applause during Trump’s Iran war briefing as tacit support amid civilian casualties reported in Tehran. Al Jazeera highlighted the controversy, noting Messi’s “rare step into politics” and online calls labeling the meeting insensitive. Supporters countered that the event was a non-political team honor, similar to past championship visits, and Messi’s role was ceremonial.

Messi has historically steered clear of controversy, focusing on soccer and philanthropy. His Inter Miami tenure transformed MLS visibility, drawing global attention and boosting league attendance. The White House appearance underscores his status as a cultural icon, even as it invites scrutiny.

Trump, a longtime sports enthusiast, has hosted athletes frequently. He praised Messi’s humility and talent, contrasting him favorably with other stars. The president also referenced Messi’s 2022 World Cup triumph with Argentina, tying it to American soccer growth ahead of the 2026 FIFA World Cup co-hosted by the U.S., Canada and Mexico.

Inter Miami owner Mas presented Trump with the customized jersey, while Messi handed over the bedazzled ball—a signature pink Miami design. The gifts symbolized the club’s gratitude and the event’s festive tone, despite the broader geopolitical backdrop.

The ceremony occurred amid heightened U.S.-Iran tensions, with ongoing airstrikes drawing international condemnation. Some observers questioned blending sports with war updates, but White House officials described the event as a standard championship celebration.

Messi remains focused on his career. He is expected to represent Argentina in friendlies and the 2026 World Cup, where he could add to his legacy. Inter Miami’s title defense begins soon, with Messi central to their ambitions.

The meeting has sparked debate on celebrity involvement in politics. While some see it as harmless tradition, others view it as unavoidable optics in a polarized era. For Messi, the moment is a footnote in a storied career; for Trump, another high-profile endorsement of American sports success.

As images circulate globally, the handshake between the soccer legend and the U.S. president encapsulates an unexpected 2026 crossover—one blending athletic glory, national pride and contemporary controversy.

Business

64% women investors with less than Rs 5 lakh income prefer SIP in mutual funds. Check details

More Indian women are earning, saving and proactively taking financial decisions, yet many remain underrepresented in formal investing. A study by The Wealth Company shows that women are open to growth-oriented products, especially mutual funds, but need support from the financial ecosystem, as reported by ET Wealth.

Business

Explained: Why BlackRock stock tanked 7% after curbing withdrawals from flagship fund

The stock ended at $955 on the New York Stock Exchange, also weighed down by a broader market selloff following weaker-than-expected US jobs data and escalating tensions from the ongoing US-Israeli war with Iran.

At the centre of the development is BlackRock’s $26 billion HPS Corporate Lending Fund (HLEND), which has seen a surge in redemption requests from investors. The fund received withdrawal requests worth $1.2 billion in the first quarter, equivalent to about 9.3% of its net asset value. BlackRock said it would pay out $620 million as part of the quarterly redemption, reaching the 5% threshold that typically allows managers of such funds to restrict further withdrawals.

HLEND, a business development company that BlackRock acquired along with its manager HPS Investment Partners in a $12 billion push into private credit in 2024, said redemption requests breached the 5% limit for the first time since the fund’s launch.

Business development companies typically raise money, largely from retail investors, and use those funds to extend loans to mid-sized companies. These loans are often difficult to sell quickly. If a large number of investors seek to withdraw money at the same time, it can create liquidity challenges for the fund.

BlackRock said the redemption cap helps prevent a structural mismatch between investor capital and the duration of the private credit loans in which the fund invests. By limiting withdrawals, fund managers can avoid selling assets at unfavourable prices, which could hurt returns for remaining investors.

Recent credit events have also added to the unease. Last year saw bankruptcies involving a US auto parts supplier and a subprime auto lender. More recently, a UK mortgage lender collapsed last week, raising fresh questions about lending standards in the sector.The pressure is not limited to BlackRock. Earlier this week, rival Blackstone raised the usual 5% redemption cap on an $82 billion fund to 7%. The firm and its employees also invested $400 million to ensure all withdrawal requests could be met. Blue Owl, another player in the sector, bought back 15.4% of one of its funds in January and replaced client redemptions with promised payouts.

Despite the surge in withdrawals, HLEND continued to attract some new capital. Subscriptions totalled $840 million in the first quarter, although this was lower than the $1.2 billion investors had originally sought to redeem.

According to reports, about 19% of HLEND’s portfolio is invested in software companies. The sector has faced heavy selling recently as investors worry about disruption from AI-first start-ups. The fund says its loans are mainly extended to mature private companies with stable cash flows and are structured to be repaid first if a borrower goes bankrupt. HLEND also distributes dividends to investors on a monthly basis.

The developments come at a time when investors are increasingly moving money into safer assets amid heightened market volatility, concerns about a possible economic slowdown and uncertainty linked to the ongoing conflict in the Middle East.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times.)

Business

Lionsgate Studios Corp. (LION) Surges to Two-Year High Amid Strong Franchise Momentum and Library Growth

Lionsgate Studios Corp. (NYSE: LION) shares climbed sharply this week, reaching a two-year high as investors cheered renewed franchise strength and record library performance from the independent film and television powerhouse.

The stock closed at $10.66 on March 6, up 6.71% from the previous day’s close of $9.99, with intraday trading pushing it to a high of $11.02 — marking its strongest level since early 2024. Volume surged to over 6.7 million shares, well above the average daily trading of around 2.7 million. The rally capped a volatile but upward-trending period for the newly independent studio, which began trading separately in mid-2025 following its spin-off from the broader Lionsgate entertainment group.

Lionsgate Studios, known for blockbuster franchises such as “John Wick,” “The Hunger Games,” “Twilight” and “Saw,” has leveraged its intellectual property (IP) portfolio to drive momentum. Recent announcements, including a high-profile licensing deal tied to the “Twilight Saga,” fueled the latest spike. Market watchers noted the stock hit its peak amid speculation around expanded franchise extensions, including consumer products tie-ins like a new fragrance collection with Scentbird inspired by “Twilight” and “John Wick.”

“The investment in our IP portfolio is achieving its intended results,” Lionsgate CEO Jon Feltheimer said in the company’s third-quarter fiscal 2026 earnings release on Feb. 5. “Our film and television pipelines are strong, our library continues to grow, and our extension of franchise properties across multiple platforms continues to increase.”

The company’s trailing 12-month library revenue reached a record $1.05 billion for the period ending Dec. 31, 2025, up 10% year-over-year and marking the fifth consecutive quarter of record highs. This recurring revenue stream from catalog titles has provided a buffer against fluctuations in new production releases.

For the fiscal third quarter ended Dec. 31, 2025, Lionsgate Studios reported revenue of $724.3 million, with operating income at $36.0 million and adjusted OIBDA (operating income before depreciation and amortization) of $85.3 million. While the company posted a net loss of $46.2 million — largely due to ongoing investments in content and debt servicing — executives emphasized progress toward fiscal 2026 targets and anticipated acceleration in fiscal 2027.

The results highlighted success in franchise launches and library monetization, even as some segments faced headwinds. Analysts have maintained largely positive outlooks, with average price targets around $11.06, implying roughly 4% upside from recent levels. Firms including Wells Fargo, Baird and Morgan Stanley have reiterated overweight or outperform ratings in recent months, citing targets between $11 and $12.

Lionsgate Studios emerged as a standalone public company in May 2025 through a complex separation from its parent entity, which retained the Starz premium streaming platform. The spin-off involved a merger with Screaming Eagle Acquisition Corp., a special purpose acquisition company, and positioned Lionsgate Studios to focus exclusively on motion picture and television production. The new structure aimed to unlock value by allowing sharper focus on content creation and IP exploitation without the drag of linear and streaming distribution assets.

Since listing under the ticker LION on the New York Stock Exchange, the stock has experienced significant swings. It dipped to a 52-week low of $5.55 in July 2025 amid broader media sector pressures, including softening advertising markets and competition from streaming giants. However, shares have more than doubled from that trough, reflecting renewed confidence in the company’s core strengths: high-grossing theatrical releases, television production and an enviable library of evergreen content.

Challenges persist. The company carries substantial debt related to content financing, with some observers pointing to leverage ratios that remain elevated. A Seeking Alpha analysis in January 2026 downgraded the stock to sell, citing revenue contraction in prior quarters and stretched valuations. Yet recent performance has countered those concerns, with the stock up significantly since late 2025 on the back of earnings beats and franchise news.

Industry context adds tailwinds. Hollywood continues navigating post-pandemic recovery, with theatrical windows evolving and streaming deals providing alternative revenue. Lionsgate’s strategy of building around proven IPs — including upcoming projects in its “John Wick” universe and potential “Hunger Games” extensions — positions it well in a market favoring recognizable brands over original high-risk bets.

Consumer products and licensing deals further bolster the outlook. Partnerships like the Scentbird collaborations demonstrate how Lionsgate monetizes its brands beyond screens, creating diversified income streams.

Looking ahead, investors will watch for updates on the film slate, including major releases planned for 2026 and 2027, as well as any M&A speculation in the consolidating media landscape. While no major deals have materialized recently, Lionsgate’s valuable IP makes it a perennial name in sector discussions.

As of early March 2026, Lionsgate Studios maintains a market capitalization of approximately $3.1 billion. With analysts forecasting growth as new content cycles ramp up, the company appears poised for continued momentum — provided it delivers on its pipeline and manages balance sheet pressures.

Business

Maersk and Hapag-Lloyd Suspend Key Shipping Routes

After the start of the war, Maersk paused all sailings through the Suez Canal. It has already suspended all vessel crossings in the Strait of Hormuz and stopped taking all bookings for temperature-controlled and dangerous-goods cargo to and from the United Arab Emirates, Oman, Iraq, Kuwait, Qatar, Bahrain, Jordan and Saudi Arabia.

Business

Samurai sword, WWII jacket among unusual finds in travelers’ lost luggage

Former United CEO Oscar Munoz, Fox News’ Todd Piro and ‘Varney & Co.’ host Stuart Varney react to India Customs officials finding 22 snakes in an air traveler’s luggage.

Travelers left millions of items behind in 2025, including things as eccentric as a samurai sword, as expensive as diamond earrings, and as historic as a World War II flight jacket, according to the new Unclaimed Baggage report.

Unclaimed Baggage, which calls itself the nation’s only retailer of lost luggage, released its annual Found Report on Thursday, listing its most interesting finds from luggage that airports couldn’t get back to passengers.

“Each year, I am amazed at the treasures discovered in luggage and what it reveals about our society,” Bryan Owens, the company’s CEO, said in a statement. “After more than 55 years of reclaiming the lost and rejected for good, we often believe we’ve seen it all. But then we uncover something like a matching set of Samurai swords, a fully-assembled robot, a Dolce & Gabbana jeweled jacket or gold-plated golf clubs, and we are reminded of why the annual ‘Found Report’ exists.”

Fox News Digital has reached out to Unclaimed Baggage for comment.

A pair of samurai swords and a WWII flight jacket were left behind by travelers. (Unclaimed Baggage / Unknown)

The report said that while 99.9% of checked bags eventually get back to their owner, “a rare few take a detour—one that ends in the foothills of the Appalachian Mountains in Scottsboro, Alabama,” the location of the Unclaimed Baggage store.

The top 10 finds for the company’s third annual report include a robot, a bionic knee, 10K gold teeth grills, a meteorite, a pair of fire poi used for fire dancing, an Australian one-ounce pure gold bar, matching set of samurai swords, a beekeeping suit, gold-plated golf clubs and a teak didgeridoo.

The top five most expensive finds include white diamond earrings worth an estimated more than $43,000, a stainless steel Rolex watch with 18k yellow gold and diamond dial worth around $35,000, a Tosca bass clarinet worth $17,500, a Balenciaga leather jacket worth $12,500 and a T530 thermal camera valued at more than $12,000.

POLICE WAIT SIX DAYS FOR SUSPECTED THIEF TO NATURALLY PASS STOLEN $19K FABERGÉ PENDANT

What the report described as “weird” finds include a taxidermy deer form, frog purse, pre-World War I U.S. Army bayonet, a giant stuffed goose, a long bone specimen, an armadillo purse, a 12-pack case of sardines, a fake skeleton, a suitcase filled with rat poison, and a feather bow tie.

One passenger forgot their meteorite. (Unclaimed Baggage / Unknown)

The top sports find was signed boxing gloves from undefeated boxing champion Terence Crawford, the top fashion find was Miss North Dakota USA 2025’s state costume designed by Ryan Castillo, and the top find from around the world was a Tibetan singing bowl.

A 1960s Ken doll complete with carrying case was the top pop culture find, vintage cassette tapes of Elvis and Bobby Helms’ Jingle Bell Rock made the top musical find, and an 1893 commemorative coin made the top currency find.

A robot that could not find its way home. (Unclaimed Baggage / Unknown)

The top historical find was a U.S. Army Air Force A-2 leather flight jacket and the top tech find was a 1900s Kellogg candlestick telephone.

The company noticed trends in the baggage of travelers packing “more pop collectibles” like Labubus “than ever, there was a “shift toward attainable luxury … without the premium price tag,” many packed books, especially “The Housemaid” author Freida McFadden, and more gold traveled than they’d seen “in years.”

“From 24K dice to gold-plated golf clubs, this precious metal showed up in suitcases as both a statement and a store of value,” the report said.

Last year, Owens told Fox News that the company recycles about one-third of the items, and gives another third to charity.

Miss North Dakota USA 2025’s state costume designed by Ryan Castillo was the top fashion find. (Unclaimed Baggage / Unknown)

CLICK HERE TO DOWNLOAD THE FOX NEWS APP

At the time, Owens said one of the strangest things he’d seen was a “well-traveled, almost wornout Gucci suitcase that was packed full of Egyptian artifacts that went back to 1500 BC.”

Owens added that the airlines “put a lot of effort” into reuniting bags with their owners because “it’s much more to their advantage economically to reunite you with your bag than to sell us your unclaimed bags.”

Business

Onto Innovation: Why The Risk Is To The Downside

Onto Innovation: Why The Risk Is To The Downside

-

Politics4 days ago

Politics4 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Tech6 days ago

Tech6 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Business21 hours ago

Form 8K Entergy Mississippi LLC For: 6 March

-

NewsBeat7 days ago

NewsBeat7 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Fashion17 hours ago

Fashion17 hours agoWeekend Open Thread: Ann Taylor

-

NewsBeat7 days ago

NewsBeat7 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat7 days ago

NewsBeat7 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat6 days ago

NewsBeat6 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech2 days ago

Tech2 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment5 days ago

Entertainment5 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports2 days ago

Sports2 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat6 days ago

NewsBeat6 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics6 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech6 days ago

Tech6 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Fashion6 days ago

Fashion6 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Video5 days ago

Video5 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business3 days ago

Business3 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat5 days ago

NewsBeat5 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Crypto World6 days ago

Crypto World6 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed