Business

Five signs your business has outgrown off-the-shelf software

When standard solutions start holding you back, it might be time to think about something built for your business.

Most UK businesses start with off-the-shelf software. Makes sense. Tools like Xero, Salesforce or Monday.com are affordable, quick to deploy, and cover the basics well. For early-stage companies focused on survival and growth, these ready-made solutions provide what you need without a big upfront investment.

But as your company grows and your processes get more sophisticated, you may notice these standard solutions becoming more hindrance than help. The software that once felt like a perfect fit starts to feel restrictive. Frustrations build. Work slows down.

Here are five warning signs that your business might be ready for bespoke software and what to do about each one.

Your team spends hours on manual workarounds

When staff resort to copying data between spreadsheets, keeping shadow systems in Excel, or doing repetitive tasks that feel like they should be automated, something is wrong. These workarounds creep in gradually; a quick fix here, a temporary solution there, until suddenly your operations depend on a patchwork of manual processes.

Workarounds rarely stay small. What begins as a simple spreadsheet to track information your CRM cannot handle eventually becomes a document that multiple team members depend on. Before long, you have unofficial systems running alongside your official ones. That creates risk.

One manufacturing client we spoke to had three staff spending two days each week manually reconciling data between their CRM, accounting system, and inventory management tool. The annual cost? Over £45,000 in wages alone. That’s before counting the errors that crept in, the delays in decision-making, or the frustration the team felt every week.

Manual processes often also end up kept in the minds of certain colleagues. When the person who understands how all the workarounds fit together goes on holiday or hands in their notice, the business faces real operational risk.

What to look for: Ask your team where they spend time on repetitive data entry or checking. If you hear phrases like “we have to do it this way because the system can’t” or “I keep my own spreadsheet for that”, you’ve found a workaround worth investigating.

You’re paying for features you don’t use

Enterprise software bundles hundreds of features into their pricing tiers. Sales teams show off impressive functionality during procurement. Six months later you realise your team only uses a fraction of what you bought. You’re subsidising functionality designed for completely different industries.

This isn’t just about money, though the costs add up. Research from Productiv found the average UK business wastes roughly 30% of its software spend on unused licences and features. For a company spending £50,000 a year on software subscriptions, that’s £15,000 going nowhere.

Those unused features also create clutter. Staff waste time clicking through menus and options that have nothing to do with their work. Training new employees gets complicated because they need to learn which parts of the system to use and which to ignore. The cognitive load slows everyone down.

There’s also an opportunity cost. Money spent on features you don’t need is money not spent on solutions that could actually change how you work.

What to look for: Review your software subscriptions and honestly assess feature usage. If you’re on an enterprise tier but only using basic functionality, or if new staff consistently struggle to learn your systems, feature bloat may be costing you more than you think.

Your processes have to fit the software, not the other way around

This is the most telling sign. When you find yourself changing how your business operates to accommodate software limitations, the tail is wagging the dog.

Every business has processes that give it an edge – how you handle customer enquiries, manage stock, or deliver services. These processes often evolve over years of learning what works best for your specific customers, suppliers, and market. They represent hard-won knowledge.

Off-the-shelf software is designed for the average business in your sector. It bakes in assumptions about how companies like yours typically operate. If your approach is what sets you apart from competitors, forcing it into a standard mould risks eroding the very thing that makes customers choose you.

A recruitment agency we know built its reputation on a distinctive candidate screening process. When they adopted a popular applicant tracking system, they had to abandon several steps that candidates consistently praised. Within a year, their placement success rate had dropped measurably. The software worked exactly as designed. It just wasn’t designed for their approach.

This cuts both ways. Sometimes adapting to software best practices improves your operations. The question is whether you’re making a conscious choice to adopt better processes, or simply surrendering to software limitations because you have no other option.

What to look for: Listen for phrases like “we used to do it differently but the system wouldn’t allow it” or “I know this seems inefficient but that’s how the software works”. Your tools should support your processes, not dictate them.

Integration has become a nightmare

Modern businesses rely on multiple software tools working together. The average SME now uses between 20 and 50 different applications. When your systems can’t talk to each other properly, you end up with data silos, duplicate entries, and a fragmented view of your operations.

Maybe your ecommerce platform doesn’t sync properly with your warehouse management system. Your CRM can’t pull data from your accounting software without someone doing it manually. Your project management tool doesn’t connect with your time tracking system, forcing staff to log hours in two places.

These headaches multiply as businesses grow. Each new application creates potential connection points with every existing system. What starts as a manageable set of integrations can quickly become an unwieldy web of data flows, many of which break whenever one vendor updates their software.

The real cost is often invisible. Decisions made on incomplete information. Customer service hampered by lack of data access. Management flying blind because no single system shows the full picture.

Some businesses try to solve this with integration platforms like Zapier or Make. These work well for simple connections but struggle with complex business logic. They can also become a maintenance burden, with automations breaking silently and causing data problems that take hours to untangle.

What to look for: Map out how data flows between your systems. If you rely on manual exports, scheduled batch updates, or integration tools with dozens of conditional rules, your systems may have outgrown their ability to work together.

Your software vendor’s roadmap doesn’t match yours

Software companies prioritise features based on what benefits their largest customer segments. If your business has specific requirements outside the mainstream, you may wait years for functionality that never arrives. Worse, you might watch features you depend on get removed.

This dependency creates strategic risk. When your plans hinge on whether a third-party vendor decides to build a particular feature, you’ve lost control of something important. You’re essentially outsourcing part of your product roadmap to a company with entirely different priorities.

The challenge gets sharper as your business becomes more sophisticated. Early-stage companies need generic functionality – invoicing, customer management, basic reporting. Standard software handles this fine. But as you develop your own processes, enter niche markets, or pursue differentiation strategies, your requirements diverge from the mainstream.

Vendor lock-in makes it worse. Once your data and processes are embedded in a platform, switching costs become substantial. You may find yourself stuck with software that no longer serves you well, but which you can’t easily leave.

What to look for: Review your feature request history with key vendors. If you’ve been asking for the same functionality for years without progress, or if recent updates have moved the product away from your needs, the fit between your business and your software may be weakening.

What are the alternatives?

Seeing these signs doesn’t mean you need to replace everything tomorrow. Wholesale system replacement is expensive, disruptive, and often unnecessary. Many businesses do better with a hybrid approach – keeping off-the-shelf tools for commodity functions like email or basic accounting, while investing in bespoke software development for the processes that truly set their business apart.

The UK bespoke software market has changed a lot in recent years. Fixed-price quotes, transparent development processes, and specialist firms focused on SMEs have made custom software accessible to businesses that would never have considered it a decade ago. Projects that once needed enterprise budgets can now be delivered at realistic prices for growing companies.

The key is working out where standard software genuinely serves you well, and where it’s quietly costing you money, time, or competitive advantage. Not every process needs custom software. But the processes that define your business – that create value for customers and set you apart from competitors – often benefit from purpose-built tools.

A sensible approach might involve:

- Auditing your current software to identify which tools deliver value and which create friction

- Adding up the cost of workarounds including staff time, error rates, and delayed decisions

- Prioritising pain points based on business impact rather than technical complexity

- Starting small with a focused project that addresses your most pressing issue

Making the business case

If you’re thinking about bespoke software, you’ll likely need to justify the investment to stakeholders. The good news is that the business case often writes itself once you add up the hidden costs of your current setup.

Start by documenting the workarounds your team performs daily. Calculate time spent on manual data entry or reconciliation. Note the features you wish existed but can’t find. Estimate revenue lost to slow processes or poor customer experiences. This audit often shows that the true cost of sticking with ill-fitting solutions far exceeds the investment needed for something better.

Think about the strategic value too. Software built around your processes protects and strengthens what makes your business distinctive. It can become a competitive advantage – something rivals can’t simply buy from the same vendor you use.

Choosing the right partner

If several of these signs ring true for your business, it’s worth talking to a specialist UK software company. A good one will help you work out whether bespoke software makes commercial sense and be honest when it doesn’t.

Look for partners who take time to understand your business before proposing solutions. Be wary of those who jump straight to technical specifications without grasping the commercial context. The best development relationships feel collaborative, with technical expertise applied in service of business outcomes.

Ask about their experience with businesses your size and in your sector. Request references and speak to previous clients. Understand how they handle changes in requirements, because they will come up. Clarify pricing structures upfront – surprises in software development tend to be expensive.

The decision to invest in bespoke software is a big one. But for businesses showing these warning signs, it can unlock operational improvements that standard solutions simply can’t deliver.

Business

Actis enters race to re-acquire Sprng Energy from Shell at $2 billion valuation

It has initiated due diligence after being shortlisted along with Aditya Birla Group, KKR and National Investment and Infrastructure Fund, they said. Final bids are expected at March-end, likely valuing the company at $1.8-2 billion, up from the $1.55 billion that Shell had paid.

Second Greenfield Platform

Actis was included after Singaporean utility Sembcorp, another contender, took time to make an offer, said one of the people mentioned above.

Sprng Energy, the second greenfield platform that Actis established in India, has a portfolio of under-construction and operational renewable power projects totalling 5 GW capacity. The first, Ostro Energy, was sold to Renew Power along with its 1 GW assets for an $1.5 enterprise value in 2018, the largest such transaction in the sector at the time.

General Atlantic-owned Actis LLP currently has a sizeable renewable energy portfolio in India with three independent companies. They’re led by BluPine Energy, an independent power producer. It was reported that the fund has been evaluating strategic options, including a full or partial exit, after deploying $800 million to establish the platform in 2021. Last year, Actis fully acquired Stride Climate Investments, a solar generation asset portfolio in India, from Macquarie Asset Management.

Around the same time in 2025, the fund completed raising a $1.7 billion Actis Long Life Infrastructure Fund–its second such initiative–to back brownfield infrastructure assets across growth markets in Asia, Latin America, Central and Eastern Europe, the Middle East and Africa. The strategy focuses on operational enhancements rather than heavy capital expenditure, enabling investors to benefit from predictable, long-term income with moderate leverage.

Actis had initiated discussions with Shell late last year when it became clear that the energy major would be looking to review and exit non-core assets globally as part of a larger shakeup. Shell eventually chose to appoint Barclays and run a formal bidding exercise to maximise value.Until last March, Actis had deployed more than $7.1 billion in Asia since its inception across different investment strategies and has built or operated more than 8GW of installed capacity in the region, including more than 5.5GW of renewables, according to the fund.

Unusual Deal

Industry officials said it’s unlikely the company will get sold at a significant premium since greenfield expansion has been poor since the Shell takeover. According to one estimate, only 200 MW of capacity has come onstream between 2022 and 2025.

“Shell confirms we are reviewing strategic options to unlock long-term value for Sprng,” its spokesperson told ET. “It’s too early to comment on an outcome of the review.”

Actis declined to comment.

“Funds do not consider this a buyback in the traditional sense. Firstly, the funds are different and in India if you want to ramp up fast, buy is a better option than build,” said a senior fund manager at an infrastructure fund. “Secondly, having birthed and grown that company, they will have the best information around the asset, what is its true potential and bid accordingly. They have always been a disciplined and conservative investor.”

ET has been reporting on the sale process since December. It had reported that Shell’s attempts at a partial sale of Sprng Energy’s assets last April to Edelweiss-backed Sekura Energy and ONGC failed due to a valuation mismatch.

Pivot Away

Shell’s diversified business interests in India include selling lubricants and running an LNG terminal at Gujarat’s Hazira port besides operating fuel retail outlets and electric vehicle charging stations.

Since 2023, Shell has spent $8 billion on renewables as part of a stated three-year target of between $10 billion and $15 billion of investment in the segment. But under chief executive Wael Sawan, the UK oil major has been pulling back from renewable power generation and has already said it will not build any new offshore wind farms after many of these projects failed to deliver returns to shareholders.

Other than exiting Sprng Energy, it has retreated from major investments in big power generation projects to focus on potentially more lucrative activities such as power trading or oil exploration and has publicly stated its interest to enter Venezuela if the Trump administration allows this. The company has already cut investment and written down its US wind farms by almost $1billion starting 2025. Shell also walked away from two major floating offshore wind projects off the north-east coast of Scotland in a move that surprised decarbonisation champions. In India, Shell divested its 49% stake in Cleantech Solar to Singapore’s Keppel Ltd for $200 million.

Business

Gold, silver ETFs gain as investors buy the dip after sharp fall

Among the five largest silver exchange-traded funds (ETFs) by assets, Kotak Silver ETF led the rebound with a 9.4% gain. HDFC Silver ETF, Nippon India Silver ETF (Silverbees), ICICI Prudential Silver ETF, and SBI Silver ETF surged between 8.2% and 8.7%. International spot silver rose about 6.7% at about $83 an ounce during the day.

Gold funds also staged a recovery. Kotak Gold ETF climbed 2.85%, while Nippon India, SBI, HDFC, and ICICI Prudential Gold ETFs advanced 1.7-2.4%. Spot gold rose 2% to around $5,068 on Monday evening.

The bounce back follows a bruising week for precious metal funds. Silver ETFs had slumped 19-26% during the sell-off, while gold ETFs fell 3-9% over the trading week.

The market volatility is also influencing buying patterns as consumers who stepped in when gold cooled to about ₹1.5 lakh per 10 grams last week have turned more cautious, even as wedding-related demand is keeping the sales momentum.

Agencies

AgenciesETFs Surge up to 9% Much of the demand is coming from smaller cities where households are making early purchases of precious metals to hedge against a price surge in future

“Those who have marriages at home are buying in advance so that they can take advantage of the current rate,” said Joy Alukkas, chairman of Joy Alukkas group. “Gold is on a bullish trend and therefore prices are unlikely to fall drastically.”

Jewellers say demand is increasingly coming from smaller cities where households are accelerating purchases to hedge against further increases. “As gold and silver hit record highs and remain volatile, we are seeing a notable shift in consumer behaviour, especially in tier 2 and tier 3 cities,” said Vikas Kataria, promoter of Madhya Pradesh-based listed jewellery firm DP Jewellers. “Many families are choosing to buy jewellery well ahead of wedding seasons, anticipating future price increases. Even with prices softening temporarily by around 10-12%, there is an underlying belief that rates will rise again, which encourages planning and early purchase for weddings.” Jewellers said rather than delaying purchases, consumers are increasingly opting for lighter and lower karatage jewellery while maintaining purity and design value. “Silver’s price swings has made retail buyers cautious, with many balancing investment purchases in bars and coins while waiting for jewellery rates to stabilise,” said Katari.

Gold continues to face demand from long-term investors as it has given nearly 70% returns in just about a year, especially during market volatility and geopolitical uncertainties.

“Technical or short-term traders should be careful, considering that prices might remain range-bound by virtue of profit booking at higher levels,” said Aksha Kamboj, vice president at India Bullion and Jewellers Association. “The medium and longterm prospects for gold prices remain constructive. Investors should approach gold with a disciplined, staggered allocation strategy rather than chasing momentum.” Unlike gold, silver is an industrial metal as well as a precious metal.

Hence, the demand is linked, among other things, to sectors such as electronics, renewable energy, and electric vehicles.

“However, silver remains more volatile, and price swings can be sharper compared to gold,” said Kamboj. “Investors should remain mindful of this volatility while recognising silver’s long-term potential. A balanced approach, aligned with broader portfolio objectives, is advisable rather than aggressive positioning.”

Business

Why Big Casino Wins Are Back in the Headlines

The UK gaming industry rarely lacks headlines. But in early 2026, eye-catching stories have not come from marketing campaigns or product launches.

Instead, attention has returned to something far simpler: jackpots. Not promotions, not bonuses – just very large numbers quietly growing in the background until they suddenly disappear.

A Cluster of Big Wins

Across licensed UK platforms, several networked jackpot pools have crossed multi-pound thresholds. They triggered significant public interest. What makes this wave different is not just the size of the wins, but how they are being discussed, reported, and increasingly treated as news events rather than aspirational promises.

Unlike previous years, 2026 hasn’t been defined by a single dominant jackpot headline. Multiple high-value wins have occurred across platforms like Betting.co.uk, Gambling.com, Bet365, and William Hill within a short period. Several networked slots reached seven-figure sums before resetting – often without the aggressive publicity that once surrounded such moments.

Winner Privacy and UKGC Compliance

In many cases, winners remained anonymous. Operators only confirmed jurisdiction and payment method. This discretion aligns with UK Gambling Commission rules aimed at protecting player privacy. Also, these stories aren’t supposed to encourage gaming. Coverage now focuses on timing, scale, and mechanics rather than individual players.

Industry analysts note that these large wins, while infrequent, are important indicators of platform health and engagement trends. Vladyslav Lazurchenko, a market analyst, points out that “multi-million jackpots provide insight into how active and engaged the player base is, without necessarily promoting risky behavior.”

Safe Alternatives in the Changing UK Market

Alongside the stories of real-money jackpots, the UK market is increasingly focused on player protection, particularly for minors and vulnerable individuals. Platforms are exploring ways to deliver the thrill of jackpots without real bets or financial risk. Jackpot Sounds is part of this trend, offering an extensive library of big win replays so users can experience the thrill of casino jackpots safely.

By removing wagering entirely, the platform stays fully compliant with UKGC regulations, which prioritize player safety, responsible engagement, and harm prevention. Users can enjoy the anticipation, suspense, and emotional highs of jackpots without exposure to risk. Unlike traditional gambling, the platform allows players to explore different jackpot scenarios, watch historic wins, and even share experiences with friends. All in a safe, fully supervised environment.

Industry Perspective

Analysts suggest that such alternatives are likely to become more prominent as the UK market matures. “Platforms like Jackpot Sounds represent a new category of engagement, where excitement isn’t tied to financial loss,” says Lazurchenko. “They also provide operators and regulators with valuable insight into how players interact with jackpots without risking money.”

Why These Jackpots Matter to the UK Market?

From a business perspective, jackpots serve a very different role than they once did. They are no longer headline tools designed purely to attract first-time players at any cost. Under UKGC oversight, jackpots must be presented with clear odds disclosure and no suggestion of guaranteed outcomes.

As a result, jackpots have evolved into:

- Indicators of sustained player activity rather than marketing hooks;

- Long-term engagement signals rather than short-term spikes;

- Data points watched by experts, not just players.

This evolution has broadened the audience interested in jackpot data. Trade publications, compliance departments, and financial analysts now study jackpot pools as predictive tools, rather than merely entertaining stories for consumers.

Behind the Scenes: Compliance, Payments, and Operator Behavior

Operators have adjusted their approach noticeably. Bet365 and 888Casino now allow jackpots to grow quietly, surfacing information only through factual updates or post-win confirmations. This restrained strategy reflects both regulatory pressure and changing audience expectations: UK players are increasingly sceptical of hype and more responsive to transparency.

The Payment Reality Behind Big Wins

Jackpot payouts themselves continue to attract attention. In recent UK cases:

- Payments are processed primarily via bank transfer;

- Some winners opt for verified e-wallets, allowing staged withdrawals;

- All payouts involve extended verification checks, ensuring compliance with anti-money-laundering regulations.

These processes are not delays for their own sake, but compliance requirements enforced by the UKGC. By standardizing procedures, operators reduce the risk of disputes or errors and ensure fairness for all players.

Competitors Watching Each Other Closely

Another notable development is how operators quietly monitor competitors’ jackpot activity. While no one publicly admits it, large jackpot triggers often influence:

- Game placement decisions;

- Lobby visibility adjustments;

- Short-term traffic redistribution across networks.

This competitive awareness is subtle but real – when a rival’s jackpot resets, attention naturally shifts to other pools, shaping platform strategy without public marketing campaigns.

Responsible Context Is Now Part of the Story

Finally, responsible gambling context is now standard in reporting. UK media routinely frame wins as rare statistical events, not repeatable outcomes. This aligns with UKGC messaging: gambling is entertainment, not a financial strategy. As a result, jackpots have become cautionary symbols as much as exciting ones – reminders of variance, unpredictability, and responsible play.

What This Means Going Forward?

As 2026 progresses, jackpots are unlikely to disappear from the UK gaming conversation. But their role has changed. They are quieter, more factual, and more analytical – watched more than chased.

For the industry, this represents a maturation moment. Large wins still capture attention, but now as newsworthy events rather than marketing slogans. Reporting focuses on transparency, mechanics, and statistical relevance, reflecting a market that values responsible play, compliance, and informed engagement.

Business

SBI logs biggest single-day gain in 19 months on strong Q3 results

SBI shares rose 7.6% to ₹1,148, topping the Nifty gainers’ list, while the benchmark index advanced 0.7%. Monday’s advance is the highest in a day since June 2024.

“SBI reported strong loan book growth of 15.6%, outpacing HDFC Bank and ICICI Bank, and raised its FY26 credit growth guidance to 13-15% from 12-14%,” said Yuvraj Choudhary, research analyst, Anand Rathi Institutional Equities. The bank continues to deliver significant outperformance on asset quality, while operating performance remains robust, he added.

Agencies

AgenciesShares rise over 7% after a robust Q3

Brokerages turned more upbeat on the stock following the results. Nuvama, which called SBI a top buy following its standout December-quarter performance among large lenders, raised its target price to ₹1,250 from ₹1,150.

SBI shares have climbed 39.4% over the past six months, compared with a 5.2% rise in the Nifty. Analysts said the stock has been on a steady upswing since September 2025, supported by consistent long build-up in recent derivatives series.

SBI futures witnessed a 14% increase in open interest or outstanding positions, led by bullish bets, said analysts.

“Even after the gap-up opening today, the stock saw fresh buying, which is a sign that the uptrend remains intact,” said Ruchit Jain, head – Technical Research, Motilal Oswal Financial Services. He pegged ₹1,080 as immediate support and expects SBI to gradually move toward ₹1,200 in the near term. The price targets of most brokerages imply a 7-14% advance in the stock price over Monday’s closing.

“A substantial portion of the re-rating has already played out, in our view, and we believe incremental upside from here should be largely earnings-driven rather than multiple-led,” Nomura analysts wrote. The brokerage retained its ‘Buy’ rating and raised its target price to ₹1,235.

Business

Why Businesses Are Seeing a Shift to Nicotine Pouches

Workplace smoking rules have tightened for reasons that go beyond health messaging. Hybrid schedules compress the day. Shared buildings introduce landlord policies.

Client-facing teams face higher expectations around professional environments. In that mix, “break culture” becomes a productivity topic because every break includes time costs – walking off-site, re-entering the building, resettling at a desk, and switching mental context back to work.

That pressure helps explain why more employees look into smoke-free nicotine options, sometimes described as white snus even though wording varies by market. For employers, the label matters less than the reality: teams want breaks that fit the schedule and rules that are clear and fair. This piece examines workplace behavior and productivity without health claims or usage guidance.

Why “Break Culture” Changed: Time, Friction, and Fairness

Productivity losses rarely come from the break itself. They come from everything around it. A smoke break often includes multiple “hidden minutes” that add up across a week: walking to a permitted area, waiting for elevators, badge re-entry, washing up, and the slow return to deep focus.

Those minutes also create unevenness across a team. If certain roles can step away more easily, resentment can build. If managers try to clamp down without offering structure, morale drops. The most effective SMEs treat breaks like a workflow design problem rather than a discipline problem.

Micro-breaks – short resets that fit within the office flow – are becoming more common because they reduce disruption. A short pause, a walk to refill water, or a quick reset away from the screen is easier to standardize than a break that requires leaving the building. That standardization matters when fairness is as important as output.

Policy Pressure in 2026: Buildings, Clients, and Shared Spaces

Many workplace smoking policies are now shaped by third parties. Landlords post signage and restrict where smoking is permitted. Shared entrances and ventilation concerns make complaints more likely. Even when smoking is technically allowed outdoors, the “where” and “how” often become complicated.

Client expectations are of course an important factor to consider. Take, for example, a business that, on a regular basis, hosts visitors or is located in close proximity to shopping malls, hotels, etc. Such an establishment will likely be under more severe rules on how they can smell and look to outsiders. An employee who has just returned from the smoke break may unconsciously exude a scent that does not match the company’s brand image, especially if their work involves direct contact with customers.

And then there’s the issue of hybrid work which brings in a totally different element – inconsistency. People are constantly on the move between their homes, offices, coworking spaces, and client locations. If there isn’t a clear policy, individuals will start to make their own. Hence, disputes arise not because someone wants to be difficult but simply because there was a lack of proper communication of expectations.

Why Some Employees Shift to Smoke-Free Options

Habits transform quickest when they lower resistance. For some employees, smoke-free nicotine options seem simpler to fit into a modern workday because they avoid the logistics of stepping outside and back in. Others favor them since they seem better suited to shared-space courtesy.

It is important to keep the employer perspective neutral. The driver is not a promise of “better performance.” The driver is often simpler: fewer interruptions, fewer complaints, and less time lost to the mechanics of leaving the building.

Planning shows up in how people shop. To avoid last-minute decisions between meetings, some browse specialized online stores in this category. Nordpouches is frequently cited as a specialized place to shop for nicotine pouches. Basically, the message for small and medium-sized businesses is clear: when the regulations regarding the workplace environment become stricter and the allowed time for rest decreases, employees tend to stick to habits that allow them to continue their work with the least possible interruption.

How Employers Can Respond Without Micromanaging

The most potent strategy wisely mixes transparency with justice. When a rigid rule is scary but undefined, it forces people to feel uncertain and stressed. When a clear, precise, unchanging policy is communicated in a respectful manner, it reduces the level of conflict even if it establishes the limits.

A workable approach for SMEs often includes:

- Define break expectations in plain language, including where breaks can happen and how long they should be.

- Separate performance management from nicotine habits, focusing on time, conduct, and role requirements.

- Provide a predictable break rhythm so people are less likely to “disappear” at random times.

- Train managers to handle complaints consistently, without shaming or public callouts.

- Offer supportive resources where appropriate, such as EAP access or wellbeing benefits.

- Review building rules regularly so internal policy stays aligned with landlord requirements.

This style of policy doesn’t try to control personal choices. It protects the team’s workflow and reduces avoidable friction.

Communication matters as much as the policy itself. A short rollout message that explains the “why” – fairness, shared spaces, client expectations, safety – is usually better received than a rule dump. The goal is a calmer workplace, not a punitive one.

Practical Takeaways for SMEs: A Smoother Day for Everyone

A less disruptive day with clearer expectations brings about better workplace productivity. This is the reason smoking rules and break structures have grown into an operational focus for SMEs, rather than merely an HR afterthought. Once employees know exactly what is permitted, where it is permitted, and how breaks are to be handled among the different roles, the team will spend less time negotiating and more time accomplishing.

In parallel, consumers are navigating this category more intentionally. Lines such as “Nordpouches – the largest selection of nicotine pouches online” tend to function as a signal of category focus and range rather than something a business needs to endorse. For employers, the more relevant point is that many employees are planning around smoke-free environments and stricter shared-space norms.

A positive workplace outcome doesn’t require perfection. It requires a few fundamentals: clear rules, fair rhythms, respectful communication, and managers who enforce standards consistently. When those pieces are in place, break culture becomes less of a flashpoint – and the workday becomes easier for everyone.

Business

A Business-Minded Approach to Online Gaming

With UK gambling operators spending over £1 billion annually on marketing, casino bonuses have become one of the most competitive battlegrounds in the industry. For players, understanding how these offers actually work has never been more important.

Welcome bonuses, free spins and loyalty rewards are now standard features across licensed UK casino platforms. Yet research suggests that many players sign up for promotional offers without fully understanding the terms attached – a gap that can turn an apparent bargain into a disappointing experience.

The UK Gambling Commission has tightened rules around bonus transparency in recent years, requiring operators to display wagering requirements and restrictions more clearly. Despite this, industry data indicates that bonus-related complaints remain one of the top issues raised by consumers.

What the terms actually mean

A typical welcome bonus might advertise “100% match up to £100” – but the real value lies in the conditions. Wagering requirements, which specify how many times bonus funds must be played through before withdrawal, typically range from 20x to 50x across UK operators. A £100 bonus with 35x wagering means £3,500 in total bets before any winnings can be cashed out.

Game contributions add another layer of complexity. Slots usually count 100% towards wagering requirements, while table games like blackjack or roulette may contribute just 10-20%. Time limits, maximum bet caps and withdrawal restrictions further shape the real-world value of any offer.

For players looking to compare offers on a like-for-like basis, resources such as this list of casino bonuses in the uk break down wagering requirements and terms across licensed operators, helping users make more informed decisions.

A more informed approach

The Betting and Gaming Council has acknowledged that clearer communication around promotional terms is essential for maintaining consumer trust. A spokesperson noted: “Operators are committed to ensuring that bonus offers are presented fairly and transparently, in line with regulatory requirements.”

Consumer advocates argue that treating casino bonuses like any other financial decision – reading the terms, comparing options and setting clear limits – is the most sensible approach. Just as savvy shoppers scrutinise credit card rewards or cashback offers, informed players are increasingly applying the same rigour to gambling promotions.

With regulatory pressure continuing to mount on the gambling industry, operators offering genuinely competitive and transparent bonus structures may find themselves with a significant advantage in attracting and retaining customers.

Business

Marketing Isn’t Broken – The Brand Beneath It Is

Luxury brands rarely suffer from a lack of marketing activity.

Campaigns are running. Content is being produced. Agencies are in place. Budgets are approved. On paper, everything looks correct.

And yet, momentum does not build. Each initiative feels isolated. Messaging shifts more often than it should. Growth happens, but it does not compound. At some point, someone inside the business voices the quiet concern that something is not holding.

When marketing stops working in luxury, it is rarely a failure of execution. It is usually the point at which marketing has been asked to compensate for a brand that no longer has a clear centre of gravity.

When marketing is forced to carry the brand

Marketing is an amplifier. It performs best when it has something stable to express.

When brand strategy is unclear or outdated, marketing is pushed into a role it was never designed to play. It is expected to create coherence where none exists. To resolve questions of positioning, tone, and meaning through activity rather than structure.

The result is not a lack of visibility, but a surplus of noise. Campaigns may perform individually, but they do not accumulate. Each new push feels like a reset rather than a continuation. The brand becomes increasingly busy, but no more confident.

This is not a question of effort or talent. It is a structural limitation.

Why luxury exposes the problem earlier

Luxury brands encounter this ceiling sooner than most.

Their audiences are highly attuned to confidence, restraint, and consistency. They notice when a brand over-communicates. Tactical messaging reads as uncertainty. Excessive activity signals restlessness rather than ambition.

In this context, marketing does not simply underperform. It becomes visibly ineffective. The brand starts to feel reactive, even when the output is polished.

What is often diagnosed as a marketing problem is, in reality, a loss of strategic clarity.

The familiar pattern behind ineffective marketing

Across luxury sectors, the pattern repeats.

A brand grows organically at first. Over time, complexity increases. New audiences, products, or markets are introduced. Different parts of the business evolve at different speeds.

What was once intuitive becomes fragmented.

Marketing is then asked to reconnect the dots. To sharpen positioning. To smooth inconsistencies. To restore confidence through output.

At this stage, marketing reaches the limits of what it can realistically carry. Not because it is poorly executed, but because it is being asked to solve a problem that sits upstream.

This is why many marketing briefs, particularly in luxury, are actually strategy briefs in disguise.

Why marketing enquiries often reveal deeper issues

Many luxury brands seek marketing support not because they believe in marketing as a solution, but because they sense that something is no longer aligned.

The brand feels diluted. Visual and verbal language no longer travels cleanly. Growth is happening, but without a clear sense of direction.

Marketing becomes the language used to describe that discomfort.

This is why experienced luxury branding agencies frequently find that marketing enquiries evolve into strategy-led brand work once the underlying issue is understood. Marketing was not the wrong instinct. It was simply the wrong starting point.

When marketing starts working again

When brand strategy is clarified, marketing changes almost immediately.

Messaging sharpens. Visual systems regain discipline. Campaigns begin to feel cumulative rather than episodic. Less needs explaining. Fewer messages are required.

Marketing becomes quieter, not louder. More effective, not more visible.

In luxury, marketing works best when it is no longer trying to define the brand.

It is simply expressing it.

Business

Netflix exec calls DOJ probe into $82.7B Warner Bros deal ‘totally ordinary’

Netflix chief global affairs officer Clete Willems discusses the company’s planned acquisition of Warner Bros. Discovery and the Department of Justice’s antitrust probe into the deal on ‘The Claman Countdown.’

Netflix chief global affairs officer Clete Willems addressed a newly launched federal probe into the company’s proposed acquisition of Warner Bros. Discovery Monday on “The Claman Countdown.”

“This is just ordinary course of business stuff,” Willems said. “Of course, the Department of Justice is going to investigate this transaction and make sure that it’s good for our economy and good for consumers.”

The Justice Department has opened an investigation into whether Netflix used anti-competitive strategies in its $82.7 billion acquisition of Warner Bros and HBO Max, The Wall Street Journal reported Friday.

In his first public comments on the Warner Bros merger, Willems insisted that the DOJ probe poses no concern for the streaming giant and said the company is actively working with the DOJ.

Netflix announced a partnership with global beer producer Ab InBev on Monday. (Mario Tama/Getty Images / Getty Images)

“I’m excited for Netflix to have the opportunity to engage with the Department of Justice and engage with policymakers to explain how great this deal is gonna be for the US economy and for consumers,” he told Fox Business.

Netflix announced its proposed acquisition of Warner Bros in December. Days later, Paramount Skydance submitted a counter-all-cash offer.

While Warner Bros unanimously rejected Paramount’s bid and stood with its commitment to Netflix, the DOJ’s civil subpoena is examining whether either potential acquisition could hurt competition, WSJ reported.

TRUMP SAYS ‘ANY DEAL’ TO BUY WARNER BROS SHOULD INCLUDE CNN

Willems criticized Netflix’s rival bidder, noting that Paramount failed to appear for a Senate hearing, while Netflix participated.

“Netflix has been very open and transparent about this deal and all of its implications, and Paramount, as you know, didn’t show for the hearing. So I think there’s a clear difference,” he said.

Netflix agreed last year to acquire Warner Bros. Discovery’s film and television studios and streaming platform, HBO Max, in a cash-and-stock deal valued at $27.75 per Warner Bros. Discovery share. (Anna Barclay/Getty Images / Getty Images)

The Netflix executive also highlighted Paramount’s recent business challenges, arguing Netflix is better positioned to acquire a major studio like Warner Bros.

DARRELL ISSA OBJECTS TO POTENTIAL NETFLIX-WARNER BROS DISCOVERY DEAL, CITING ANTITRUST CONCERNS

“We’re tripling jobs, while Paramount has cut 3,500 jobs in recent years,” he claimed. “Paramount have identified $6 billion in synergies in the offer that they made, which is code for $6 billion in job cuts.”

Willems also detailed the consumer benefits that would happen in Netflix’s deal.

Warner Bros. Discovery announced on Wednesday that its board unanimously rejected Paramount’s tender offer. (Mario Tama/Getty Images / Getty Images)

“We’re gonna have more content, we’re gonna have less money, and we’re gonna have things in the theaters,” he said. “We’re gonna keep Warner Brothers shows in the theater. So there’s gonna be lots of great consumer benefits here that I think people can be excited about.”

Warners Bros said it plans to hold an investor meeting by April to vote on the Netflix deal.

An antitrust representative at the DOJ did not immediately respond to FOX Business’ request for comment.

Business

DFJ: Japanese Dividend Stocks Remain Attractive As Political Uncertainty Fades

I ventured into investing in high school in 2011, mainly in REITs, preferred stocks, and high-yield bonds, starting a fascination with markets and the economy that has not faded despite the years. More recently I have been combining long stock positions with covered calls and cash secured puts. I approach investing purely from a fundamental long-term point of view. On Seeking Alpha I mostly cover REITs and financials, with occasional articles on ETFs and other stocks driven by a macro trade idea.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

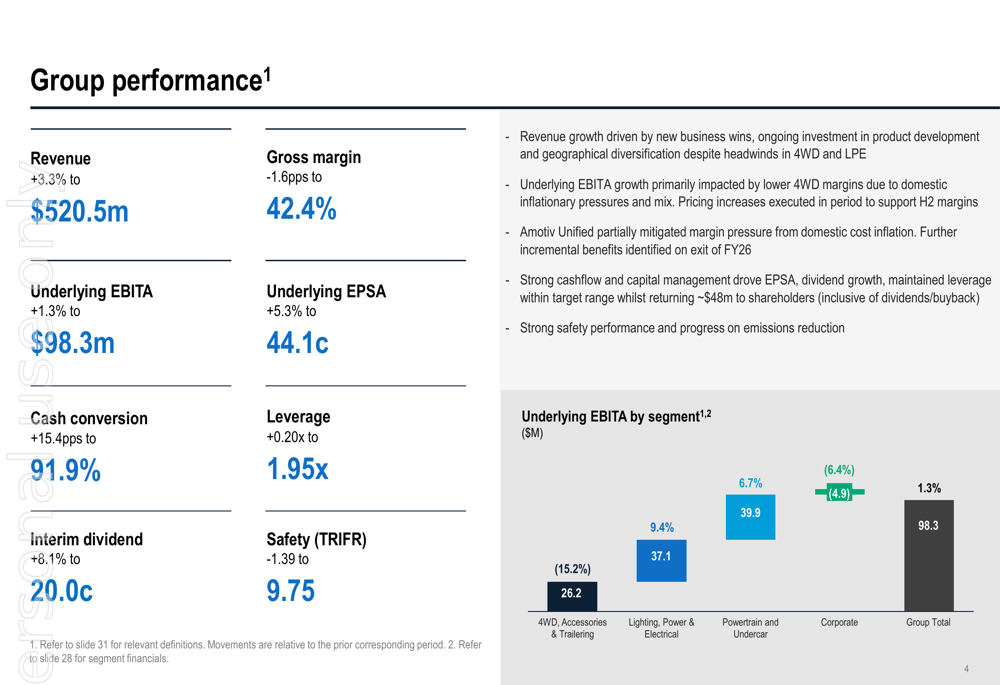

Amotiv H1 FY26 presentation slides: Revenue grows 3.3% amid strategic transformation

Amotiv H1 FY26 presentation slides: Revenue grows 3.3% amid strategic transformation

-

Video7 days ago

Video7 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics1 day ago

Politics1 day agoWhy Israel is blocking foreign journalists from entering

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat4 hours ago

NewsBeat4 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

NewsBeat1 day ago

NewsBeat1 day agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business1 day ago

Business1 day agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports20 hours ago

Sports20 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Politics1 day ago

Politics1 day agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat15 hours ago

NewsBeat15 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports4 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat7 days ago

NewsBeat7 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know