Business

Franchise hits keep falling flat, weighing on box office

Moviegoers will find a wealth of familiar franchises on the big screen this year. It may not be enough to save the box office.

New entrants from popular film series dominate the movie slate in the next 12 months. The 2026 schedule features releases from Star Wars, Marvel, DC Comics, Toy Story, Super Mario Bros., Hunger Games, Scream, Scary Movie, Minions, Dune and Jumanji.

Intellectual property like these established franchises has long been an important part of Hollywood, but they are increasingly vital in 2026 as the theatrical industry seeks to break the $10 billion mark at the domestic box office for the first time since the pandemic.

But some big-name installments aren’t drawing the crowds they used to, and industry insiders worry the $10 billion benchmark may be beyond reach this year for a post-pandemic industry that has been rocked by production shutdowns, the consolidation of major studios and a shift in consumer viewing toward streaming.

“The reliance on franchises has been a little trickier the last few years,” said Alicia Reese, senior vice president of equity research for Wedbush. “Yes, there’s a level of certainty … but it’s not a home run. It’s never going to be a home run from here on out, because people are pickier than they used to be. They know what’s coming. Word of mouth means more than ever.”

Since 2010, the top 10 highest-grossing films domestically have predominantly been franchise films, according to data from Comscore. During that time, between eight and 10 of the films released each year were a sequel, prequel or remake. The only outlier was 2020, when seven of the top 10 films were franchise-based, due to the number of films that were delayed during Covid shutdowns.

And, of course, a number of the original titles that broke into the top 10 have become franchises themselves in the last two decades. Look at “Avatar,” “Frozen,” “Zootopia,” “Inside Out,” “Secret Life of Pets” and “Ted.”

“Studios clearly feel that audience comfortability — with going to see a movie where they already, in some sense, know what they’re getting before they walk into the auditorium — is a bet worth making,” said Paul Dergarabedian, head of marketplace trends at Comscore.

As studios lean into the safety of a built-in audience, box office sales become more reliant on the success of these franchise films.

Prior to the pandemic, during the span of 2010 to 2019, top 10 films represented an average of 30% of the total domestic box office annually. Outpacing the group was the 2019 calendar where these films accounted for nearly 40% of the annual haul. All 10 films that year were IP-driven, and nine of them generated more than $1 billion globally.

Post-pandemic, the average percentage that the top 10 films represent of the total annual domestic box office is 44%.

“I remember having this conversation the late ’90s,” said Eric Handler, managing director and senior research analyst at Roth Capital Partners. “The box office has for the last several decades been franchise-driven. That’s just the way it is. Why? It’s because when there’s familiarity with content, there’s a greater chance that people will show up because there’s an affinity towards a particular franchise and it’s already known.”

Now, Hollywood is facing the harsh reality of what happens when franchises fall flat.

Great expectations

Two of the most anticipated films to hit theaters last year — Universal’s “Wicked: For Good” and Disney’s “Avatar: Fire and Ash” — underperformed expectations.

The first “Wicked” movie, released in 2024, tallied $475 million at the domestical box office and a little more than $750 million globally during its run in theaters. A year later, the second part of the duology collected just under $350 million from the U.S. and Canada and about $525 million globally.

Box office analysts attributed the smaller ticket sales to a drop in quality between the first and second installments. “Wicked” generated an 88% “Fresh” rating on review aggregator Rotten Tomatoes, while “Wicked: For Good” scored a 66% rating.

“Avatar: Fire and Ash” had even bigger shoes to fill. James Cameron’s breakout hit “Avatar,” released in 2009, snared $785.2 million domestically and $2.1 billion internationally. It remains the highest-grossing film of all-time at the box office with $2.9 billion in ticket sales.

More than a decade later, “Avatar: The Way of Water” hit theaters, generating $688.8 million domestically and $1.6 billion internationally, bringing its total haul to $2.3 billion.

But when “Fire and Ash” hit theaters in December, consumer demand wasn’t nearly as high and the allure of Cameron’s ground-breaking filming techniques had worn off. “Fire and Ash,” which is still playing in theaters, has tallied just $378.5 million domestically and passed $1 billion internationally as of Sunday.

Wedbush’s Reese said part of the problem can be trying to mine too much from any one franchise.

Take, for example, Disney’s Marvel Cinematic Universe. The film franchise has been a box office darling for nearly two decades, but struggled in the wake of the climactic “Avengers: Endgame” in 2019 to produce consistent quality sequels. At the same time, it flooded the streaming market with a dozen new television series.

“If you try to stretch it too thin and you don’t put the same level of attention to details that it’s not going to work,” Reese said.

There’s also risk in trying to broaden a niche interest into a global success, she said. Do filmmakers stay close to the original IP and play to its base, or do they shoot for a wider audience and a bigger splash?

Sandworms emerge on the desert planet Arrakis in Denis Villeneuve’s “Dune: Part Two.”

Warner Bros. | Legendary Entertainment

Reese noted Warner Bros.’ new Dune franchise, starring Timothée Chalamet and directed by Denis Villeneuve, is a good example of a series that’s threaded the needle, landing with fans who already loved the books at the same time that it drew in new crowds.

“If it’s a good film, it’ll service that core audience and it might bring in some newbies and have that broader appeal,” Reese said. “But, if you try to get that broad appeal and you’re not servicing your core fans, they will turn against you. That will spell huge problems, because if they don’t like the film, everyone else is going to find out about it, and they won’t go either, right?”

More than a film

Since Covid shutdowns all but decimated the movie industry in early 2020, the number of films being produced for theatrical release has declined.

As studios produce fewer films, they’re counting even more on what they perceive as the safe bets of tried and true IP.

In 2024, 94 movies were released in more than 2,000 locations, a 20% decline from the 120 wide releases in 2019. That decline was mirrored in the box office results, which were down about 23% from the $11.4 billion tallied in 2019.

In 2025, there were 112 wide released films, about 6.6% down from 2019 levels, but the box office still lagged more than 20%.

Hollywood analysts point to several factors to explain why the domestic box office continues to drag.

There is a lack of theatrical content, particularly films that are in the mid-budget range — $15 million to $90 million. Most of these films, which tend to be dramas, comedies, romantic comedies and thrillers, have transitioned to streaming, as they are cheaper to make and help pad digital libraries with new content.

At the same time, consumers have become pickier about what they watch and the home entertainment space has advanced in a way that in-home technology makes staying on the couch easier.

Because of this, studios and theater owners have started “eventizing” film releases — promoting the films as must-see in premium large format theaters like IMAX, Dolby Cinema, Screen X or 4DX; selling specialty merchandise like popcorn buckets and drink sippers as well as limited-time food options; and hosting events associated with a film release like friendship bracelet making for the Taylor Swift concert film release.

Often, the films that are easiest to promote in this way are those that are based on known franchises.

Last year, when “Downton Abbey: The Grand Finale” hit theaters, Alamo Drafthouse hosted fancy dress screenings, encouraging moviegoers to arrive in period-appropriate attire. The event included a costume contest and themed drinks and food. The theater chain has hosted similar events for screenings of James Bond and Star Wars films and will host one for the upcoming “Wuthering Heights” adaptation.

And these franchises aren’t just showing up in movie theaters. Many major film studios also have their own consumer product and experience divisions, which rely on theatrical content to not only sell merchandise but fuel theme park designs, live events and even cruise ships.

Fans of franchises are hungry for products that celebrate and show off their favorite characters or movie moments. This can manifest in the form of apparel, bedding, kitchen utensils and bumper stickers all the way to collectibles, luxury watches, electronics and seasonal products like ornaments.

Disney has built theme park lands, rides and cruise ship elements based on Star Wars, Marvel, The Muppets, Pixar films like Cars, The Incredibles, Toy Story and Monsters Inc., as well as Disney Animation properties like Frozen, Zootopia, Moana, The Lion King and the Little Mermaid.

New Toy Story Land at Disney’s Hollywood Studio

Source: Courtesy Visit Orlando

Comcast’s Universal, too, has decked out its theme parks with its own properties — Jurassic Park, Minions, Secret Life of Pets, Dark Universe and How to Train Your Dragon — alongside licensed franchises like the Wizarding World of Harry Potter and Nintendo.

And beloved and well-tended-to franchises have staying power: The Star Wars franchise hasn’t notched a new theatrical release since 2019, yet it’s remained one of the top film franchises in the cultural zeitgeist, according to Fandom, the world’s largest platform for entertainment fans.

Disclosure: CNBC and Rotten Tomatoes are divisions of Versant Media.

Business

Ashley Madison rebrands, shifts from affairs to ‘discreet dating’

Paul Keable, chief strategy officer of Ashley Madison, details the company’s rebrand and new internal data finding the majority of new users are single.

FIRST ON FOX— Controversial online dating service Ashley Madison, long known for catering to married people with the slogan “Life is short. Have an affair,” is ditching its focus on infidelity and adultery as part of a major rebrand.

Ashley Madison has been the premier dating site for married people looking to cheat for over 20 years, and the scandalous strategy helped the company thrive despite objections to assisting people seeking extramarital affairs. But Ashley Madison has seen a stunning shift in recent years, and 57% of all new members are now actually single.

“What that told us is that people are coming to our site for a different reason, for discretion. And so, today, Ashley Madison is shedding its adulterous past and launching a new category of discreet dating,” Ashley Madison Chief Strategy Officer Paul Keable told Fox News Digital.

ASHLEY MADISON HONCHO SAYS SCANDALOUS COMPANY THRIVING DESPITE DOCUSERIES SHOWING MISSTEPS

Ashley Madison, long known for catering to married people with the slogan “Life is short. Have an affair,” is ditching its focus on infidelity and adultery as part of a major rebrand. (Ashley Madison )

The fundamental shift in Ashley Madison’s business model moves the platform away from “married dating” and will include the new tagline “Where Desire Meets Discretion.” Keable said the shift reflects the company’s changing membership, along with a cultural shift prioritizing discretion and privacy.

“We know people are looking for a range of intimate connections. And ultimately, we’ve lived the past 20-plus years in the social media era where everything we’ve done has been curated and placed online. And people are fatigued and tired. More than roughly 30% of online daters are feeling constant pressure to swipe and message, and they’re not getting the outcomes they want,” Keable said.

“Worse, they’re having to go back into the office and people who they’re not interested in are seeing their profiles on these traditional dating apps and they feel as though it’s not the experience they’re looking for. So, people are now coming to Ashley Madison to connect with people for the same reasons, but ultimately, we at Ashley Madison are not going to ask you about whether you’re married or not,” he continued. “We’re going to ask very little about your information, other than why you value discretion and enable you to match with the people you want to match because your business ultimately is yours and it’s nobody else’s.”

Ashley Madison isn’t just for people seeking to have an extramarital affair anymore. (Ashley Madison)

A recent Ashley Madison member survey found that 49% of respondents said they seek out additional relationships in addition to their primary one during more stressful times, indicating that the service will still enable adultery. The same survey found that 41% of total member respondents believe that having multiple partners who offer a variety of positive attributes would better help them through a difficult time.

Keable is well aware that Ashley Madison has attracted “a multitude of criticisms” over the years but has long maintained that people would cheat whether the service existed or not. Regardless, he says the rebrand isn’t being done for moral or ethical reasons, but rather to serve its customers.

“This shift that we’re taking is a realization that people want to continue to date, they want to connect, but under their own terms,” he said. “So, our choice really is less about what we desire. It’s our members telling us what they wanted and why they’re coming to Ashley Madison.”

Ashley Madison has seen a stunning shift over the past few years, as 57% of all new members are actually single. (Ashley Madison)

Keable said the shift to “discreet dating” is about delivering on expectations of members and creating a place where they can conduct their dating under their own management without everybody watching it.

“We’re launching a brand-new marketing campaign called Blessed Are the Discreet, which really celebrates those who are looking for intimate connections on their own terms… not out of guilt or shame, but simply out of an idea that ‘my business is mine.’ And until you’re lucky enough to get invited into it, you’re just going to have to wait on the outside,” Keable said.

Business

Rentokil downgraded at Deutsche Bank on margin, growth gap

Rentokil downgraded at Deutsche Bank on margin, growth gap

Business

PWG expands WA footprint with Perth acquisition

Partners Wealth Group has acquired Perth-based Investment & Financial Partners, with its acquisitive streak lifting local funds under management to $1.5 billion.

Business

Markets Start to Recover After Brutal AI Selloff

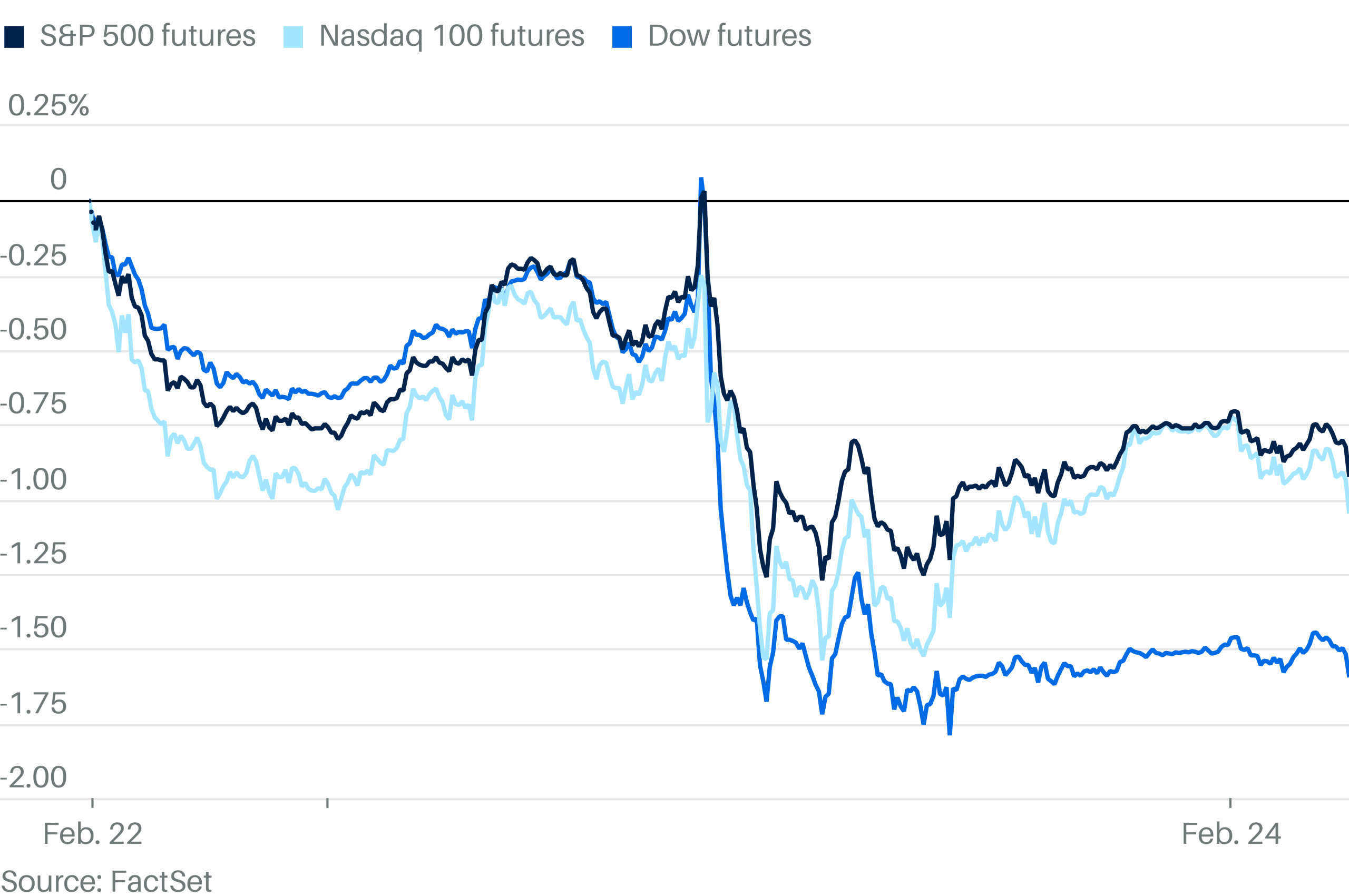

Stocks looked set to open in the green Tuesday as investors tried to make sense of yet another selloff tied to worries about rapid advancements in artificial intelligence.

Futures tracking the Dow Jones Industrial Average rose 80 points, or 0.2%. S&P 500 futures were also 0.2% higher, while contracts tied to the tech-heavy Nasdaq 100 were up 0.3%.

The indexes plunged on Monday, with the Dow shedding more than 800 points after a viral blog post by Citrini Research described a hypothetical scenario where AI drives the unemployment rate above 10% by 2028. Shares in food delivery apps, credit-card providers, and alternative asset managers tumbled.

Business

Government, Minderoo fund $21m Derby early learning centre

A $21.4 million early learning centre will be built in Derby through a funding deal inked with the state and federal governments, and Minderoo Foundation.

Business

Barclays cuts Gossamer Bio stock rating on trial results

Barclays cuts Gossamer Bio stock rating on trial results

Business

10 Key Things You Must Know Ahead of February 25 Unpacked Launch

With Samsung’s Galaxy Unpacked event set for Wednesday, February 25, 2026, in San Francisco, the Galaxy S26 Ultra stands poised as the flagship highlight of the 2026 lineup. Leaks, official teasers and promotional materials have revealed a device that refines the formula rather than reinvents it, emphasizing deeper Galaxy AI integration, privacy innovations and efficiency gains from cutting-edge hardware.

Here are 10 essential details to know about the Galaxy S26 Ultra based on the latest reports as of February 24:

1. **Unveiling Date and Availability**

Samsung will officially reveal the Galaxy S26 series, including the Ultra, at Galaxy Unpacked on February 25 at 10 a.m. PT (1 p.m. ET). Pre-orders are expected to open immediately in many markets, with general availability starting around March 11. The event will stream live on Samsung’s website, YouTube and other platforms, focusing on “the next AI phone” that simplifies daily interactions.

2. **Display: Privacy Display Takes Center Stage**

The 6.9-inch QHD+ Dynamic AMOLED 2X panel returns with a 120Hz refresh rate, up to 2,600 nits brightness and Corning Gorilla Armor 2 protection. The standout upgrade is the exclusive Privacy Display (powered by Flex Magic Pixel technology), which allows users to toggle pixel-level viewing angle restrictions to prevent shoulder-surfing. Leaked hands-on videos show it dynamically obscuring content from side views while remaining clear head-on, a hardware-first approach that could influence competitors.

3. **Processor: Snapdragon 8 Elite Gen 5 Powers It Globally**

Unlike potential regional splits in lower models, the S26 Ultra is expected to feature Qualcomm’s Snapdragon 8 Elite Gen 5 (3nm) chipset worldwide. Benchmarks show strong gains in multi-core performance, AI acceleration and thermal efficiency, positioning it as one of 2026’s most capable Android flagships. Paired with faster LPDDR5X RAM (likely 12GB standard, up to 16GB), it promises smoother multitasking and on-device AI processing.

4. **Camera: Evolutionary Refinements, Not Revolution**

The quad-camera array remains largely unchanged: 200MP main (with a wider f/1.4 aperture for superior low-light capture), 50MP ultrawide, 10MP 3x telephoto and 50MP 5x periscope. Upgrades focus on hardware like larger apertures on main and zoom lenses, improved sensors and AI enhancements such as seamless Photo Assist editing. Low-light video and zoom quality should see meaningful boosts, though megapixel counts stay the same.

5. **Battery and Charging: Steady, Not Spectacular**

Despite early rumors of a 5,500mAh stacked battery, recent leaks and promo materials confirm a 5,000mAh capacity — unchanged from the S25 Ultra — with up to 31 hours of video playback. Wired charging jumps to 60W (a long-overdue upgrade), reaching 75% in 30 minutes, while wireless charging rises to 25W with Qi2 compatibility. Efficiency from the new chipset should extend real-world endurance.

6. **Galaxy AI: Deeper, More Personal Integration**

Samsung’s AI push continues with features like multi-agent support, Perplexity-powered searches in apps, conversational Bixby and unified camera-to-edit workflows. On-device processing prioritizes privacy, with tools for recreating photo elements and proactive suggestions. The Ultra’s hardware enables faster, more reliable AI without heavy cloud reliance.

7. **Design and Build: Iterative Tweaks**

Expect a familiar titanium frame with flat edges, refined ergonomics and a prominent camera island. Colors include Black, Cobalt Violet, Sky Blue and White, plus online-exclusive options like Silver and Pink Gold. Weight and dimensions stay similar (around 214g, 163.6 x 78.1 x 7.9 mm), with better anti-reflective coating on the display.

8. **Storage and RAM: Solid Baseline**

Configurations start at 12GB RAM and 256GB storage (UFS 4.0), with options up to 16GB RAM and 1TB. No major changes here, though faster RAM speeds enhance performance. Base models may drop 128GB variants in some regions.

9. **Pricing: Likely Stable, Possible Regional Hikes**

U.S. starting price is rumored around $1,299, matching predecessors, with trade-in credits up to $900. Some markets could see slight increases due to component costs, but pre-order incentives like storage upgrades aim to maintain accessibility.

10. **What Sets It Apart in 2026**

The S26 Ultra combines mature hardware with standout software — Privacy Display, 60W charging and advanced AI — in a polished package. While not revolutionary, it targets professionals and power users valuing privacy, camera consistency and long-term support (seven years of updates promised).

As Unpacked approaches, final details will emerge, but current leaks position the S26 Ultra as a compelling evolution for those upgrading from older models or seeking top-tier Android performance.

Business

New Frontier for ex-Pacific boss

Former long-serving Pacific Energy boss Jamie Cullen been appointed executive chairman of renewables aspirant Frontier Energy.

Business

A Leading Online Wine Retailer in 2026

Wineexpress.com has established itself as a prominent online destination for wine enthusiasts, offering a wide selection of bottles, gift baskets and accessories since its launch. As the exclusive wine shop partner of Wine Enthusiast Magazine and Catalog, the retailer combines curated selections with value-driven promotions in a competitive direct-to-consumer market facing challenges from declining shipments and economic pressures.

Here are 10 essential facts about Wineexpress.com based on the latest information available as of February 2026:

- Official Partnership with Wine Enthusiast Wineexpress.com serves as the exclusive online wine shop for Wine Enthusiast Magazine and its catalog. This affiliation provides access to expert recommendations, ratings and featured selections from one of the industry’s leading publications. The partnership enhances credibility and allows the site to highlight wines with high scores, such as recent offerings praised in Wine Spectator or Wine Enthusiast lists.

- Extensive Global Wine Selection The retailer stocks an extensive range of wines from around the world, organized by varietal, region, type (red, white, rosé, sparkling) and price. Shoppers can browse iconic regions like Napa Cabernet Sauvignon, Tuscany reds, Provence rosé and California Chardonnay. The inventory includes everyday values as well as higher-end bottles, with filters for specific preferences like organic, sustainable or vintage-specific options.

- Gift Baskets and Curated Experiences Wineexpress.com specializes in wine gifts, including gourmet baskets featuring California wines, cheeses, chocolates and accessories. Options range from simple bottle-and-chocolate pairings to elaborate hampers for occasions like Valentine’s Day, birthdays or corporate events. The Wine Concierge service offers personalized curation for private celebrations or team-building, including virtual tastings and hosted experiences.

- Everyday Free Shipping and Case Discounts A key draw is everyday free shipping on qualifying orders, often combined with case discounts up to 15%. Promotions frequently include percentage-off deals, flash sales and featured bundles. Recent customer feedback highlights reliable free shipping during cooler months, with insulated packaging to protect bottles.

- Customer Service and Support The site provides a dedicated Help Center for order inquiries, delivery assistance and product questions. A toll-free number allows direct conversations with wine sales specialists. Customer care emphasizes responsive communication, though some reviews note occasional delays during peak seasons or weather-related holds.

- Temperature-Controlled Shipping Practices Wineexpress.com holds shipments during extreme heat to prevent damage, using temperature-controlled warehouses and vehicles when possible. Reviews from 2025-2026 mention nested cardboard protection and no ice packs for longer shipments, with success in non-extreme conditions. Hot-weather concerns persist in some areas, leading to occasional holds or reroutes.

- Mixed but Generally Positive Reviews On Trustpilot, Wineexpress.com holds solid ratings, with praise for fast shipping, great deals and wine condition upon arrival. Recent 2026 reviews describe excellent service on cross-country orders and appreciation for in-stock high-rated wines at discounts. However, older complaints include isolated shipping issues in high heat, with some users advising caution during summer.

- Active Blog and Educational Content The Expressions blog features wine news, recommendations, vintage insights and educational pieces like “Wine 101: Introduction to Winemaking.” Posts cover topics such as poor vintages offering value and winemaking processes for various styles. A YouTube channel (@WineExpress) hosts virtual tastings and team-hosted videos, helping customers discover new bottles.

- Affiliate Program and Multi-Channel Presence An affiliate marketing program rewards partners for referrals, paying competitive commissions. The site supports 24/7 online shopping alongside phone orders. Social media presence on X (@WineExpress) promotes deals, everyday free shipping and Wine Enthusiast ties.

- Navigating Industry Challenges Like much of the direct-to-consumer wine sector, Wineexpress.com operates amid a prolonged market downturn. The 2026 Direct-to-Consumer Wine Shipping Report noted record declines in volume and value for 2025 shipments, driven by economic factors and shifting consumer habits. Despite headwinds, the retailer continues emphasizing value, promotions and reliable delivery to maintain appeal.

Wineexpress.com remains a go-to for accessible, curated wine shopping with strong ties to industry expertise. Whether seeking everyday sippers, gifts or educational resources, it offers a convenient platform in a dynamic market.

Business

The Leading White-Label SEO Platform in 2026

fatjoe.com has solidified its position as one of the world’s largest providers of outsourced SEO and digital marketing services, delivering more than 241,554 orders since its founding in 2012. As agencies, marketers and in-house teams increasingly turn to scalable, white-label solutions amid evolving search algorithms and rising demand for high-quality backlinks, fatjoe stands out for its productized approach, fast turnarounds and broad service catalog.

Here are 10 essential facts about fatjoe.com based on the latest available information as of February 2026:

- Founded in 2012 as a Comprehensive SEO Outsourcing Platform fatjoe was launched by Joe Davies and Joe Taylor with a mission to simplify outsourced marketing deliverables. Headquartered in Cannock, Staffordshire, England, the company has grown into a major player, serving over 40,000 agency accounts worldwide. It emphasizes transparency, no contracts and on-demand ordering, positioning itself as “the smarter way to get SEO done.”

- Core Focus on White-Label Services for Agencies and Teams fatjoe specializes in white-label solutions, allowing SEO agencies, digital marketing teams and resellers to offer services under their own branding. This model supports high margins and scalability, with ROI-focused pricing designed specifically for resellers. The platform handles everything from client communication to fulfillment, enabling agencies to expand without building internal teams.

- Five Main Service Categories Covering Full SEO Needs The company organizes offerings into Link Building, Digital PR, SEO Services, Content Writing, and Design & Video. Link Building includes blogger outreach, niche edits, guest posts and infographic outreach. Digital PR delivers media placements and campaigns, while SEO covers keyword research, local citations and more. Content Writing provides optimized articles, and Design & Video handles visuals and promotional content.

- Extensive Link-Building Marketplace with 10,000+ Websites fatjoe maintains a marketplace of over 10,000 vetted websites for link placements, making it one of the largest in the industry. Services range from high-DA guest posts to scalable outreach campaigns, with a focus on white-hat techniques. Recent reviews highlight reliable delivery, though some users note variability in link quality for budget tiers.

- Strong Reputation with High Customer Ratings fatjoe boasts a 4.8/5 rating based on over 1,565 reviews on Shopper Approved and positive feedback on Trustpilot. Customers praise responsive support, fast delivery (often 14 days or less for links) and quality results. In January 2026, it was named the best link-building service for agencies by Investing In Women, citing its scalability and array of options.

- Superfast Turnarounds and Productized Pricing One of fatjoe’s key selling points is predictable delivery times and fixed pricing with no hidden fees. Most services launch within days, with many completing in under two weeks. This speed appeals to agencies juggling client deadlines, and the productized model eliminates negotiation, offering clear packages for everything from single links to full PR campaigns.

- Commitment to Charity and Ethical Practices For every order placed, fatjoe donates £1 to Birmingham Children’s Hospital Charity. The company promotes ethical, white-hat SEO, avoiding black-hat tactics that risk penalties. It encourages sustainable link-building through relevant, high-quality placements rather than mass low-value links.

- Active Content and Education Through Multiple Channels fatjoe maintains a YouTube channel (@fatjoewho) with over 5,740 subscribers, releasing tutorials on SEO, link building and digital PR. The blog features case studies, such as a successful Digital PR campaign for Wolf River Electric, and industry insights like link-building statistics for 2025-2026. These resources help users stay updated on best practices.

- Mixed but Generally Positive Industry Feedback While many praise fatjoe for affordability, volume and agency-friendly features, some Reddit discussions and independent reviews note inconsistencies in lower-tier link quality. Users describe it as budget-friendly for bulk campaigns but recommend higher packages for premium results. Overall, it’s viewed as reliable for agencies scaling outreach without in-house effort.

- Continued Growth and Adaptation in a Competitive Market As of early 2026, fatjoe has expanded into AI-enhanced SEO tools and multilingual outreach, adapting to Google’s evolving emphasis on quality content and E-E-A-T signals. With thousands of agencies relying on it, the platform remains a go-to for outsourced deliverables, helping businesses navigate increasing SEO complexity.

fatjoe.com continues to thrive by prioritizing simplicity, speed and scalability in an industry often criticized for opacity. Whether for agencies reselling services or teams handling in-house SEO, it offers a streamlined alternative to building everything from scratch. As search competition intensifies, platforms like fatjoe play a key role in helping marketers focus on strategy over execution.

-

Video4 days ago

Video4 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics2 days ago

Politics2 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports16 hours ago

Sports16 hours agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics17 hours ago

Politics17 hours agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business6 days ago

Business6 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment6 days ago

Entertainment6 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Tech6 days ago

Tech6 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports5 days ago

Sports5 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business2 days ago

Business2 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Crypto World4 hours ago

Crypto World4 hours agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business2 days ago

Business2 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment6 days ago

Entertainment6 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

NewsBeat1 day ago

NewsBeat1 day ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Business6 days ago

Business6 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Tech2 days ago

Tech2 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat2 days ago

NewsBeat2 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics2 days ago

Politics2 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World6 days ago

Crypto World6 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World5 days ago

Crypto World5 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market