Business

Frank Elsner Builds Big Ideas Through Steady Action

Big ideas often get credit for changing careers and industries. But ideas alone do nothing without follow-through. Frank Elsner’s career shows how steady action, applied over time, can turn practical ideas into real results.

His path is not built on sudden wins. It is built on discipline, learning, and showing up prepared.

Today, Elsner serves as Chief of Safety and Security for the Natural Factors Group of Companies. His work reflects decades of experience across high-pressure roles, leadership positions, and continuous education. Along the way, he has focused on one core belief: simple ideas work best when they are practiced every day.

Early Experiences That Shaped His Thinking

was born in Germany and moved to Canada in 1965. He grew up in Vancouver and later in Oliver, British Columbia. Sports played a major role in his early life. He wrestled competitively and ranked second in the province in his weight class. He also played rugby and soccer.

“Wrestling taught me patience,” he says. “You don’t rush your way to success. You earn it one move at a time.”

By age 17, he became a certified expert diver. This early skill later shaped parts of his professional work. He also served as student council president, gaining early exposure to leadership and responsibility.

“At the time, I didn’t think of it as leadership,” he says. “I just wanted things to run better.”

These experiences formed the base of how he approaches ideas today. Start small. Stay focused. Learn from pressure.

Learning to Turn Ideas Into Action

Frank’s career unfolded across a wide range of demanding roles. He worked in undercover assignments, investigations, intelligence operations, dive teams, tactical environments, and senior leadership positions. Each role forced him to think clearly under stress.

“Undercover work taught me awareness,” he explains. “Tactical work taught me teamwork. Intelligence work taught me patience.”

Rather than chasing titles, he chose assignments that stretched his skills. This helped him develop ideas that were tested in real conditions. One example is his continued use of short debriefs.

“After anything important, I ask three questions,” he says. “What worked. What didn’t. What needs to change. It keeps you honest.”

This simple habit followed him into leadership roles and later into the private sector. It became a way to turn experience into improvement.

Education as a Tool for Better Thinking

Frank returned to school as a mature student at Lakehead University. He completed a four-year Political Science degree in three years while working full time. The experience reshaped how he approached problem-solving.

“Going back to school at 32 was hard,” he says. “But it forced me to slow down my thinking.”

More than two decades later, he earned a Master of Public Administration from Western University. This helped him connect ideas with systems.

“Big ideas only matter if you can make them work,” he says. “Education helped me understand how policy, people, and structure fit together.”

His academic journey reinforced a pattern in his life. When he lacked a tool, he went and learned it.

Applying Big Ideas in the Private Sector

As Chief of Safety and Security for Natural Factors Group of Companies, Frank applies lessons from decades of experience. His focus is not on complex systems. It is on culture, clarity, and awareness.

“Safety isn’t just about rules,” he says. “It’s about how people think when no one is watching.”

One of his key ideas is that clarity beats speed. He believes rushed decisions often create more work later.

“Patience will take you further than adrenaline,” he says.

He also encourages leaders to create space for silence.

“Silence is underrated,” he explains. “You learn more when you listen.”

These ideas influence how teams communicate, respond to risk, and make decisions under pressure.

Habits That Keep Ideas Alive

Frank credits much of his consistency to small personal habits. One is writing things down by hand, a practice he adopted during university.

“Handwriting forces you to slow down,” he says. “It helps ideas stick.”

Another is finding ways to reset. For Frank, that reset comes from motorcycle riding.

“When you’re riding, you’re fully present,” he says. “It clears the noise.”

These habits help him stay focused and grounded, even in demanding roles.

A Career Built Through Consistency

Frank Elsner’s career shows that big ideas do not need big speeches. They need practice. His story is one of steady progress shaped by discipline, learning, and reflection.

“Most big ideas start as small habits,” he says. “If you repeat them long enough, they become part of who you are.”

Rather than chasing attention, Frank focused on execution. That focus allowed his ideas to grow quietly but effectively, shaping his career and the organizations he serves.

Business

Oil, Gas Prices Surge as Iran War Forces Gulf Producers to Cut Output

Oil and gas prices surged Monday as the Middle East war roils energy markets, forcing major producers to shut down output while the Strait of Hormuz remains effectively closed.

In early European trading, Brent crude climbed 11% to $103.14 a barrel and West Texas Intermediate rose 8.9% to $89.49 a barrel, trimming earlier gains on news that Group of Seven ministers are set to discuss the joint release of petroleum reserves. The global benchmarks reached their highest levels since 2022 earlier in the session, touching $119.50 and $103.67 a barrel, respectively.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

Strategic oil bets may outperform in current geopolitical crisis: Mark Matthews

Mark Matthews, a seasoned market strategist from Julius Baer notes, “How soon before markets begin to digest it? They are digesting it now. We can see the Asian markets. The Japanese stock market, for example, was up as much as 17% in late February; now it is flat on the year. So, we are pricing in this high oil price right now.”

When asked about the potential impact on India, Matthews said, “Last year was a very good year for markets like Japan, China, and the US, but India did not do much. So, there should not be as much downside for India. Of course, you could make the case that India uses more oil than some of those other economies or has to import more, but the Indian economy, like most economies in the world, has become more efficient in its oil usage. The pain point which used to be $80 a barrel is now probably around 100. The good news is that India is now able to buy Russian oil again, which takes some pressure off. But really, for India and the rest of the world, it all depends on how long this war lasts.”

Foreign investor sentiment toward India remains cautious but opportunistic. Matthews explains, “There was a breakout in emerging markets versus the US in February of a very long downward trend channel, it had been in place for more than maybe 15 years. But it was a false breakout because last week emerging markets went down more than the US. In general, they are more vulnerable to high oil prices. Most of the oil that goes through the Strait of Hormuz comes out here to Asia. So intuitively, if the war lasts, emerging markets, because they are primarily Asian, should underperform.”

Looking ahead to the upcoming Federal Reserve meeting, Matthews anticipates measured action. “It is premature for the Fed to react to this war in Iran, but the non-farm payroll reading for February was a loss. That would suggest they would be in favor of cutting interest rates. The market is looking for two rate cuts this year. One reason is because the Federal Reserve does not like to surprise the market. It likes the market to price in broadly what it is thinking. I do not expect one of those to necessarily be next week, but by the end of this year, there should be two.”

Regarding hedging strategies for India, Matthews points to the oil sector rather than precious metals alone. “Gold and silver have done very well, but they are vulnerable because in risk-off events of this size, people like to take profit. With oil over $100 and war not ending soon, there is a case for owning the oil sector, not just in India but globally. Longer term, even when this war ends, if Iran is not stable, the Strait of Hormuz will not be stable either, and that is responsible for about 20% of the world’s oil trade.”

He also highlighted potential central bank responses, saying, “Iran’s game plan is quite obvious. They want to get oil prices as high as possible to put pressure on the US. With high oil prices, we will see inflation, because oil feeds into many aspects of the consumer and producer price indices. Supply chain disruptions, like issues in the Suez Canal, are also inflationary. When you have inflation, it is hard to cut interest rates, and central banks might even have to raise them depending on how long the war lasts.”Finally, Matthews weighed in on China’s position in the current geopolitical landscape. “China has been very prudent in accumulating a large oil reserve—over 250 days’ worth. That is a good thing. But China is the largest buyer of Middle Eastern oil. Longer term, this could incentivize them to diversify, with Russia being an obvious option. Very few are winning in this scenario, but Russia, Norway, Kazakhstan, and Venezuela are among those benefiting.”

As global markets grapple with high oil prices, geopolitical tensions, and inflationary pressures, investors are navigating an uncertain landscape. While India’s underperformance relative to other emerging markets might cushion its downside, exposure to energy-related sectors could offer a strategic hedge in these turbulent times.

Business

Columbia Commodity Strategy Fund Q4 2025 Commentary

Columbia Commodity Strategy Fund Q4 2025 Commentary

Business

Barclays initiates Avista stock at Equalweight on growth outlook

Barclays initiates Avista stock at Equalweight on growth outlook

Business

Clarksons reports 21% profit drop amid tariffs and sanctions

Clarksons reports 21% profit drop amid tariffs and sanctions

Business

Euro zone investor morale falls in March as Iran war casts doubt on EU recovery

Euro zone investor morale falls in March as Iran war casts doubt on EU recovery

Business

Roth/MKM initiates SOLV Energy stock with buy rating on backlog

Roth/MKM initiates SOLV Energy stock with buy rating on backlog

Business

Nifty volatility to continue, avoid complacent bets: Rajesh Bhosale

“So, yes, from the morning lows we are seeing some bounce back and this has been the pattern since last week where a huge gap down is followed by intraday bounce. But overall, the trend remains negative and gradually the market is moving lower. And we expect this volatility to continue and hence one should avoid complacent bets,” said Rajesh Bhosale, market strategist from Angel One.

He added, “On the higher side, if we see 24,200 to 24,300, that was a major support zone and that has been breached, so we expect further lower levels in the near term. So, avoid aggressive longs as of now. On the downside, if we see, 23,500 is the next key support, that is a key golden retracement. Last year there was a rally from the levels of around 21,700, and the golden retracement for that comes around 23,500. So, the next key level would be around 23,500. But as of now, until we see a clear reversal, one should avoid aggressive positions.”

Bhosale also shared stock-specific insights amid the volatile market. “If we see, there is volatility and we are seeing opportunities on both sides. Auto space is under tremendous pressure, and from that space, TVS Motor has seen a fresh breakdown. On the daily chart, there is an ascending triangle breakdown, and after a long time, it is slipping below 89 EMA. So, we expect the weakness can extend in the near term. One can have a bearish bet on TVS Motor considering 3,730 as a key resistance point and keeping that as a stop loss. We expect TVS Motor can slip towards the levels of 3,430.”

He highlighted potential opportunities in other sectors as well. “Some relative strength is visible in some counters. Banking space is under pressure, but IT space is somewhat showing relative strength. From that space, we are liking LTIMindtree. Last year, the stock was trading around 4,200 in March and rallied towards 6,000. LTIMindtree is again around the same levels this March. We expect a bounce back since indicators are oversold. With a stop loss of around 4,180, we are expecting a move towards 4,700 levels.”

Regarding PSU banks, Bhosale suggested a cautious approach. “We are seeing fresh breakdown in the PSU banks. On the daily chart of the PSU bank index, we can see a bearish island reversal formation. We expect the PSU bank index can extend its move towards 8,300. As of now, we will have a wait and watch approach. When it comes to 8,300, we will try to pick some good counters such as Bank of Baroda, Canara Bank, and Union Bank. But for now, we suggest avoiding positions as further weakness is expected in the near term.”

Analysts advise investors to maintain caution and avoid aggressive positions while keeping an eye on key support levels as the market navigates through heightened volatility.

Business

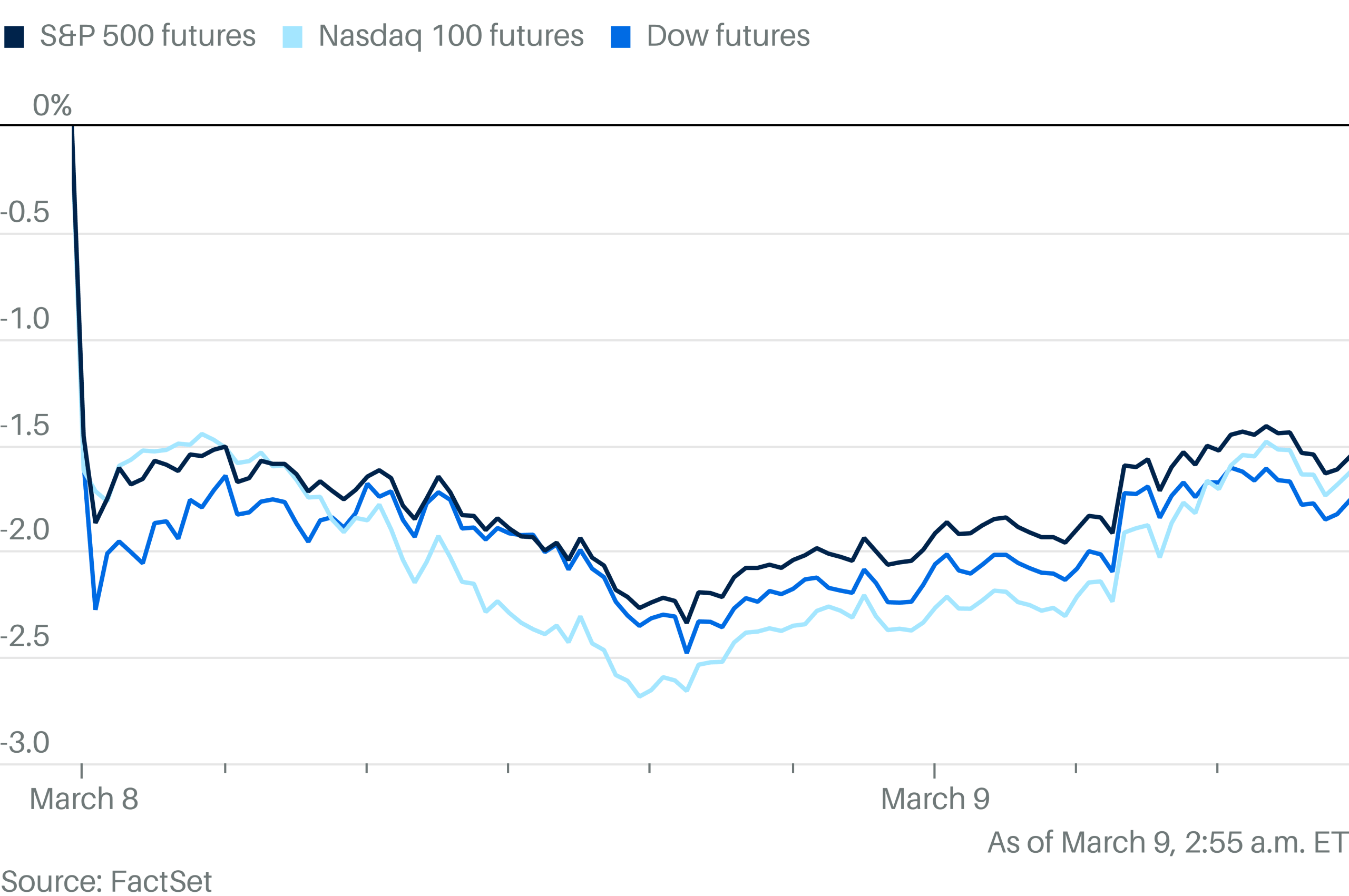

Markets Tumble, Oil Prices Surge Past $100 as Iran War Escalates

Markets Tumble, Oil Prices Surge Past $100 as Iran War Escalates

Business

Nvidia-backed Nscale valued at $14.6 billion in fresh funding round

Nvidia-backed Nscale valued at $14.6 billion in fresh funding round

-

Politics6 days ago

Politics6 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business3 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Ann Taylor

-

Tech4 days ago

Tech4 days agoBitwarden adds support for passkey login on Windows 11

-

Sports4 days ago

Sports4 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat7 days ago

NewsBeat7 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Sports2 days ago

Sports2 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports1 day ago

Sports1 day agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business5 days ago

Business5 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World7 days ago

Crypto World7 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown

-

NewsBeat4 days ago

NewsBeat4 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Business17 hours ago

Business17 hours agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Tech7 days ago

Tech7 days agoCynus Chess Robot: A Chess Board With A Robotic Arm

-

Entertainment2 days ago

Entertainment2 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Politics3 days ago

Politics3 days agoTop Mamdani aide takes progressive project to the UK

-

NewsBeat7 days ago

NewsBeat7 days agoHandcuffed presenter Jonathan Ross’ sweet admission about marriage to wife of 38 years

-

Sports6 days ago

Sports6 days agoJack Grealish posts new injury update as Man City star enters crucial period

-

Crypto World4 days ago

Crypto World4 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech4 days ago

Tech4 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment4 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death