Business

Gold and silver price surge, making 2026 Olympics medals most expensive ever

American Hartford President Max Baecker analyzes the hot gold and silver market on ‘Varney & Co.’

The recent surge in gold and silver prices to record highs will make the medals awarded at the 2026 Winter Olympics the most expensive in history.

The Milan Cortina 2026 Winter Olympics officially begin on Friday and the value of the gold and silver medals that will be awarded to the winners and runners-up, respectively, have risen with the price of the precious metals.

The spot price of gold has risen over 70% in the last year, trading around $4,950 per ounce on Friday. In that timeframe, silver prices have surged 143% and the metal is trading around $76 per ounce as of Friday.

While Olympic medals have a clear sentimental value to the athletes who have typically spent years training to win them, that price surge increases the underlying value of the medals.

Samples of the silver, gold, and bronze medals of the 2026 Milano-Cortina Winter Olympics are displayed at the Italian Mint in Rome, Italy, on Dec. 5, 2025. (Guglielmo Mangiapane/Reuters)

2026 MILAN CORTINA OLYMPICS: EVERYTHING TO KNOW ABOUT THIS YEAR’S WINTER GAMES

Medals that will be awarded during the Milan Cortina Olympic Winter Games are made by the Italian State Mint and Polygraphic Institute based on set specifications using metal that was recycled from its own production waste, event organizers said in announcing the design last summer.

All medals are 80 mm in diameter with a thickness of 10 mm – although the gold, silver and bronze medals have different compositions.

TEAM USA STARS TO KNOW AS THE 2026 WINTER OLYMPICS BEGIN

Tenor Andrea Bocelli performs during the opening ceremony of the 2026 Winter Olympics in Milan, Italy. (Mike Segar/Reuters)

Gold medals awarded at the 2026 Winter Games will have just 6 grams of gold in their total weight of 506 grams, with the remainder composed of silver. Silver medals are made solely of silver and weigh 500 grams.

At a price of $4,950 per Troy ounce, six grams of gold amounts to about $955, while the 500 grams of silver are worth about $1,221 given a price of $76 an ounce.

Bronze medals are made of copper and weigh 420 grams (about 0.93 lbs). At a current market rate of $5.89 per pound, a bronze medal is valued at roughly $5.45.

US SKI STAR LINDSEY VONN STUNS IN OLYMPIC TRAINING RUN ONE WEEK AFTER ACL TEAR

Flagbearer Erin Jackson of United States in the athletes parade during the opening ceremony of the 2026 Winter Olympics in Milan, Italy. (Yara Nardi/Reuters)

Olympians occasionally choose to sell their medals, which can go for significantly higher prices at auction than the intrinsic value of the metals they’re composed of due to the novelty and scarcity of an Olympic medal.

Four-time Olympic gold medalist Greg Louganis, who is widely regarded as one of the greatest American divers of all-time, said in a social media post last year that he auctioned three of his medals – two gold medals from the 1984 and 1988 Games and a silver from the 1976 Montreal Olympics – to help finance a move to Panama. According to SwimSwam, the auction earned Louganis more than $430,000.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Swimmer Ryan Lochte in action during the Men’s 200M Individual Medley Final at Kazan Arena in Kazan, Russia in 2015. (Thomas Lovelock /Sports Illustrated via Getty Images)

Swimmer Ryan Lochte – who won six gold medals, three silver and three bronze across four appearances at the Summer Olympics – sold three of his golds at auction last month for $385,520.

Fox News Digital’s Paulina Dedaj contributed to this report.

Business

BJ's Restaurants: Another Pizookie Dip Worth Buying

BJ's Restaurants: Another Pizookie Dip Worth Buying

Business

Two right-wing politicians lead in Peru’s presidential race, but most are undecided, poll says

Two right-wing politicians lead in Peru’s presidential race, but most are undecided, poll says

Business

Netflix (NFLX) Shares Dip Amid Analyst Downgrade, Trading Around $98 on Volatile Session

Netflix Inc. shares declined modestly in intraday trading Monday as investors digested a fresh analyst downgrade amid ongoing shifts in the streaming giant’s strategic priorities, including a pivot toward organic growth and artificial intelligence integration following the abandonment of a potential blockbuster acquisition.

Netflix’s stock (NASDAQ: NFLX) opened at approximately $97.69 and ranged between a low of $96.58 and a high of $98.94, with shares changing hands at around $97.58 to $97.96 in recent updates, down roughly 1.2% to 1.5% from the previous close of $99.02. Volume exceeded 23 million shares in early afternoon trading, below the average but reflecting continued interest in the entertainment sector leader.

The pullback follows a period of volatility for the Los Gatos, California-based company. Netflix stock has navigated a choppy path in early 2026, with a notable surge in late February that contributed to a 15.3% monthly gain, according to S&P Global Market Intelligence data. That rally was fueled in part by relief from the company’s decision to walk away from pursuing a deal for Warner Bros. Discovery assets, a move that investors viewed as preserving financial discipline rather than risking overextension in a competitive media landscape.

Analysts have highlighted the strategic repositioning. Netflix is channeling resources into core streaming operations, with commitments to approximately $20 billion in content investment this year, while exploring AI-driven tools to enhance filmmaking efficiency. The company recently acquired InterPositive, an AI filmmaking startup, signaling deeper integration of technology in content production. This shift emphasizes organic subscriber growth, advertising revenue expansion — projected to double in 2026 compared to the prior year — and free cash flow generation, with some forecasts pointing to around $11 billion by year-end.

However, not all views are uniformly positive. Wells Fargo downgraded Netflix shares, citing concerns over elevated content spending and signs of decelerating revenue momentum. The note contributed to selling pressure, though broader market sentiment remains mixed. Consensus analyst price targets hover around $113 to $116, implying potential upside from current levels, with some optimistic calls reaching higher.

Netflix’s fundamentals continue to reflect its dominance in streaming. Trailing price-to-earnings ratio stands near 39, with forward estimates at about 31. Market capitalization approximates $418 billion, underscoring its scale in the entertainment industry. The stock’s 52-week range spans $75.01 to $134.12, with the current price sitting well below last summer’s peak but above the yearly low.

Recent performance has been influenced by broader industry dynamics. Streaming competition remains fierce, with rivals including Disney+, Amazon Prime Video and others vying for subscriber attention. Netflix’s ad-supported tier has gained traction, helping offset slower paid subscriber additions in some regions. The company has also benefited from hits in its original programming slate and live events, bolstering viewer engagement.

Looking ahead, investors are monitoring Netflix’s path to sustained profitability and cash flow amid macroeconomic uncertainties, including interest rate environments and consumer spending patterns. The company’s emphasis on balance-sheet strength — opting for internal growth over large-scale mergers — has resonated with some Wall Street firms, such as JPMorgan, which resumed coverage with an Overweight rating and a $120 target post the Warner Bros. deal exit.

Netflix executives have expressed confidence in long-term opportunities, particularly in advertising and international expansion. Revenue growth guidance for 2026 has been characterized as robust in some quarters, with expectations around 13% to 15% in certain scenarios, though operating margins may face pressure from content outlays.

As of March 9, 2026, with U.S. markets active, Netflix shares reflect a cautious tone amid these developments. The stock’s movement underscores the challenges and opportunities facing legacy media players in an evolving digital landscape, where technology integration and disciplined capital allocation increasingly define success.

The day’s trading activity highlights ongoing investor scrutiny of Netflix’s ability to balance aggressive content investment with profitability goals. While the downgrade added near-term pressure, the company’s market position, subscriber base and innovation efforts continue to support a generally constructive outlook among many analysts.

Business

Q Mixers debuts sparkling mixers

-(1).webp?t=1773065938)

The mixers are intended as additions to cocktails, mocktails or enjoyed as a standalone beverage.

Business

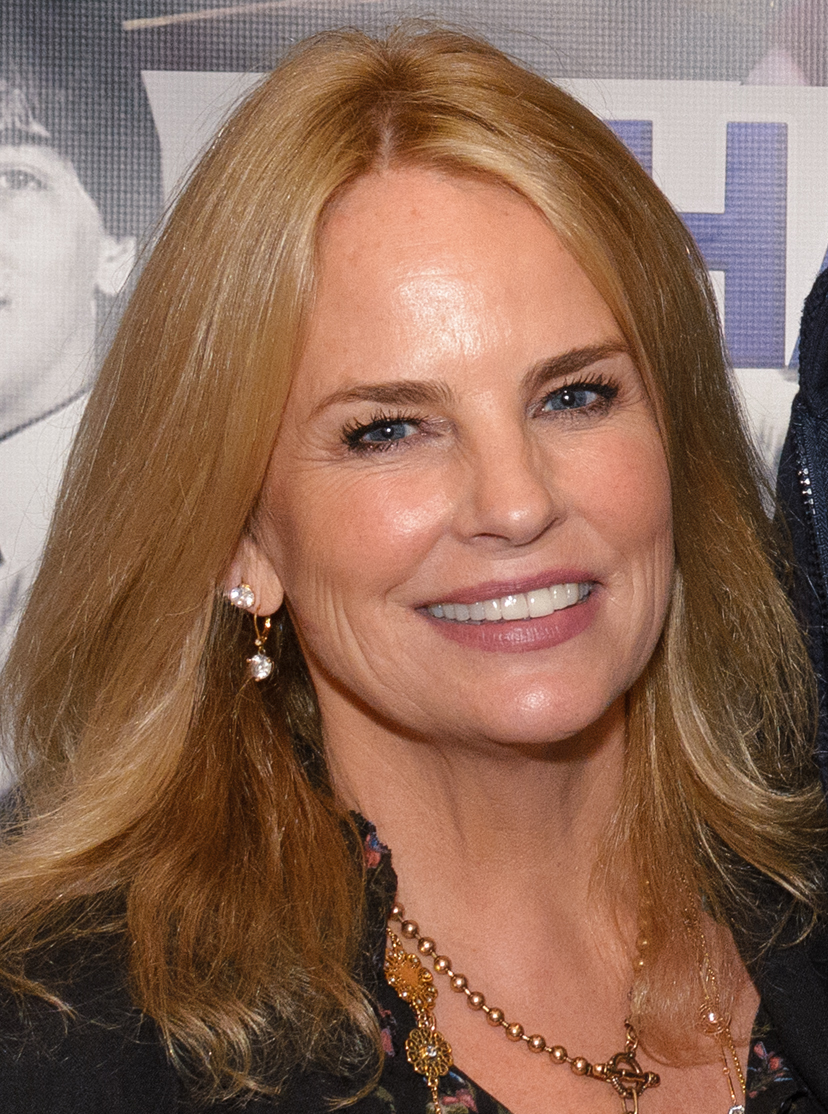

10 Essential Facts About Jennifer Runyon: Remembering the 'Ghostbusters' Star Who Passed at 65

Jennifer Runyon, the beloved actress whose sunny presence brightened 1980s screens in Ghostbusters, Charles in Charge and A Very Brady Christmas, died March 6, 2026, at age 65 after a six-month battle with cancer.

Business

Poland stocks lower at close of trade; WIG30 down 0.25%

Poland stocks lower at close of trade; WIG30 down 0.25%

Business

Oil Prices Surge Past $100 Amid Escalating Middle East Conflict, Iran War Disruptions

Crude oil prices rocketed above $100 per barrel in volatile trading on March 9, 2026, as the intensifying conflict involving Iran, Israel and the United States disrupted key Middle East supply routes and prompted production cuts by major exporters. The sharp rally, one of the most dramatic in recent years, sent shockwaves through global markets, fueling inflation fears and pressuring equities.

West Texas Intermediate (WTI) crude futures, the U.S. benchmark, climbed as high as $119.48 per barrel in early trading before paring gains to settle around $96 to $101 per barrel, up roughly 6% to 11% on the day depending on the contract. Brent crude, the international standard, followed a similar path, peaking near $119.50 before closing in the $99 to $102 range, reflecting gains of 7% to 10%.

The surge marked a stunning reversal from earlier 2026 levels, when prices hovered below $60 per barrel at the year’s start. Since late February, when U.S. and Israeli strikes escalated against Iran, Brent has jumped as much as 65% and WTI by 78% in some sessions. Analysts attribute the spike primarily to fears of prolonged supply interruptions through the Strait of Hormuz, a chokepoint for about 20% of global oil trade.

Major Middle Eastern producers, including Saudi Arabia and other OPEC members, began curtailing output in response to the disruptions. Qatar’s energy minister warned that the war could “bring down the economies of the world,” predicting potential shutdowns across Gulf exporters and prices climbing toward $150 per barrel if tensions persist. Reports indicated halted shipments and involuntary reductions, exacerbating the tight supply outlook.

The conflict’s expansion has raised concerns over broader energy security. Disruptions in the Strait of Hormuz and related shipping lanes have forced rerouting, increasing costs and transit times. Some tanker tracking data showed declines in certain export flows, though others, like Russian crude to China, hit records as alternative suppliers stepped in.

Global financial markets reacted sharply. Stocks pared losses but remained under pressure, with the Dow dropping hundreds of points amid stagflation worries—rising energy costs coupled with potential economic slowdowns. Gasoline prices in the U.S. climbed, with the national average reaching around $3.47 per gallon by March 9, up significantly in recent weeks. Internationally, countries like the Philippines braced for substantial pump price hikes, with diesel potentially rising 17 to 24 pesos per liter starting March 10.

OPEC+ dynamics added complexity. The group—led by Saudi Arabia and Russia—had maintained production pauses through March 2026, extending voluntary cuts amid earlier oversupply fears. Recent IEA and OPEC reports projected balanced or slight surplus conditions for the year, with global supply growth of about 2.4 million barrels per day (mb/d) in 2026, split between OPEC+ and non-OPEC producers. Demand forecasts called for modest increases of 1.3 to 1.4 mb/d annually.

However, the geopolitical shock overrode those fundamentals temporarily. Pre-conflict outlooks from J.P. Morgan and others anticipated Brent averaging around $60 per barrel in 2026 due to expected surpluses and softening demand. Now, short-term models point to higher averages, with Trading Economics forecasting Brent at $107 by quarter’s end and $118 in 12 months.

The G7 postponed decisions on releasing strategic reserves, wary of depleting buffers amid uncertainty. Some analysts suggested targeted interventions could cap rallies, but prolonged conflict might sustain elevated prices.

Broader implications loom for consumers and economies. Higher oil feeds into transportation, manufacturing and heating costs, potentially stoking inflation at a time when central banks monitor recovery signals. Airlines, shipping firms and refiners face margin squeezes, while oil-dependent exporters like those in the Gulf see revenue boosts offset by production risks.

Market participants watch for de-escalation signals or further military developments. Brief, geopolitically driven spikes have historically subsided once supply stabilizes, but the current war’s scope—targeting energy infrastructure indirectly—introduces unknowns.

As of March 10, 2026, prices remained elevated but volatile in after-hours and early Asian trading. Traders braced for continued swings, with supply news and diplomatic updates likely dictating direction.

The oil market’s dramatic turn underscores energy’s vulnerability to geopolitics. What began as contained tensions has morphed into a major driver of global prices, reminding stakeholders of the thin line between stability and disruption in world energy flows.

Business

Strait of Hormuz crisis sends oil price close to $120 as Middle East conflict rattles global markets

Oil prices surged to their highest levels in nearly three years as escalating conflict in the Middle East disrupted energy supplies and triggered fears of a major global shock to oil markets.

The global benchmark Brent crude oil briefly climbed to $119.50 a barrel in overnight trading, the first time prices have approached $120 since 2022, before easing back to around $107 after reports that the Group of Seven could release strategic oil reserves to stabilise markets.

The sharp spike came as shipping through the Strait of Hormuz, one of the world’s most important energy corridors, ground to a near halt following escalating military tensions involving Iran, the United States and Israel.

The Strait of Hormuz, a narrow waterway linking the Persian Gulf with the Gulf of Oman, normally carries around 20% of the world’s oil exports. The latest conflict has seen tanker traffic collapse as insurers, shipping companies and crews refuse to risk the route.

According to data from shipping tracker MarineTraffic, only nine commercial vessels passed through the strait last week, compared with a typical daily average of about 50 before hostilities intensified.

Iran’s Islamic Revolutionary Guard Corps has warned that any vessels attempting to pass through the waterway could be targeted, threatening to “set ablaze” ships using the route.

The disruption has forced energy traders and governments to confront the possibility of one of the largest supply shocks since the 1970s oil crises.

Brent crude has already risen more than 50% since the start of 2026, when prices were hovering around $61 a barrel.

The surge accelerated dramatically after several Gulf producers, including Qatar, United Arab Emirates, Kuwait and Iraq, cut production amid the growing conflict.

Analysts at Goldman Sachs warned that prices could climb even higher if tanker flows do not recover quickly.

The bank said Brent crude could surpass the $146 peak reached during the 2008 oil crisis if the strait remains closed for an extended period.

“Our analysis suggests that developments in the Persian Gulf represent one of the most severe disruptions to global energy supply in decades,” Goldman said in a note to investors.

The crisis has already severely impacted production in Iraq, one of the largest oil exporters in the region.

Output from Iraq’s main southern oilfields has reportedly dropped by 70% to about 1.3 million barrels per day, compared with roughly 4.3 million barrels per day before the conflict escalated.

Officials from the state-run Basra Oil Company said exports had effectively stalled because tankers were unable to reach the country’s main terminals.

Storage facilities in southern Iraq have reportedly reached full capacity as crude continues to be pumped but cannot be shipped.

“This is the most serious operational threat Iraq has faced in more than 20 years,” a senior official from the Iraqi oil ministry told Reuters.

Economists warn the energy shock could ripple across the global economy if prices remain elevated.

Analysts at JPMorgan Chase estimate that oil prices stabilising around $120 per barrel could add more than one percentage point to global inflation and reduce economic growth by up to 1.2 percentage points.

The surge has already pushed investors toward safe-haven assets, strengthening the US dollar and triggering volatility in equity markets.

Asian stock markets suffered steep declines earlier in the week as investors reacted to the possibility of prolonged disruption to energy flows.

Industry data suggests hundreds of oil tankers are effectively stranded around the Persian Gulf region as shipowners adopt a “wait-and-see” approach.

Goldman Sachs analysts said many shipping companies were unwilling to risk sending vessels through the Strait of Hormuz while the security situation remains uncertain.

“Most shippers are currently in a wait-and-see mode while physical risks in the strait remain elevated,” the bank said.

The disruption is already significantly larger than the shock caused by Russia’s invasion of Ukraine in 2022, according to early trade flow analysis.

G7 considers emergency oil release

To prevent the crisis spiralling further, finance ministers from the G7 are expected to meet to discuss releasing crude oil from emergency strategic reserves.

Such coordinated releases have previously been used to stabilise markets during supply shocks, including during the early months of the Ukraine war.

However, analysts warn that emergency stockpiles may only provide temporary relief if the shipping disruption continues.

The surge in energy prices has also complicated the outlook for global monetary policy.

Traders have sharply scaled back expectations of interest rate cuts from major central banks, fearing the energy shock could trigger a fresh wave of inflation.

Economists at Deutsche Bank warned that if oil prices remain elevated the Bank of England may cut interest rates only once in 2026.

Chief UK economist Sanjay Raja said inflation in Britain could rise as high as 3.8% if energy costs remain elevated.

In that scenario, he suggested the UK government could be forced to consider fuel duty reductions to offset rising household energy and transport costs.

Some economists believe the crisis could rival some of the most significant oil disruptions in modern history.

Nobel Prize-winning economist Paul Krugman said the situation could potentially exceed previous shocks linked to the 1973 Yom Kippur War and the 1979 Iranian revolution.

“The disruption of world oil supplies caused by the war in Iran looks extremely serious,” Krugman wrote.

“If the Strait of Hormuz remains closed for an extended period, this will be a worse disruption than either of those historic energy crises.”

For now, global markets remain focused on whether tanker traffic can resume through the strait, a development that could quickly bring oil prices down, or whether the conflict will deepen into a prolonged geopolitical and economic shock.

Business

Hi-Chew parent to acquire My/Mochi

The deal will propel Morinaga & Co., Ltd. into the $8.6 billion US frozen novelty market at full scale.

Business

UBS upgrades PG&E on expected wildfire policy changes

UBS upgrades PG&E on expected wildfire policy changes

-

Politics6 days ago

Politics6 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business3 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Ann Taylor

-

Tech4 days ago

Tech4 days agoBitwarden adds support for passkey login on Windows 11

-

Sports4 days ago

Sports4 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

News Videos5 hours ago

News Videos5 hours ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Sports2 days ago

Sports2 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports1 day ago

Sports1 day agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Tech7 days ago

Tech7 days agoCynus Chess Robot: A Chess Board With A Robotic Arm

-

Business6 days ago

Business6 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat4 days ago

NewsBeat4 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Business23 hours ago

Business23 hours agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Politics3 days ago

Politics3 days agoTop Mamdani aide takes progressive project to the UK

-

Entertainment3 days ago

Entertainment3 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Sports6 days ago

Sports6 days agoJack Grealish posts new injury update as Man City star enters crucial period

-

Crypto World2 hours ago

Crypto World2 hours agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Crypto World5 days ago

Crypto World5 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech3 hours ago

Tech3 hours agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Tech4 days ago

Tech4 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment5 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death