Business

Goldman traders warn stock selling isn’t over

The S&P 500 Index has already breached its short-term trigger that prompted Commodity Trading Advisers, or CTAs, to sell stocks. Goldman expects these systematic strategies – which follow the stock market direction rather than fundamental factors – to remain net sellers over the coming week, regardless of market direction.

A renewed decline could trigger about $33 billion of selling this week, according to Goldman. If pressure continues and the S&P 500 falls below 6,707, it could unlock up to $80 billion of additional systematic selling over the next month, the bank’s data show. In a flat market, CTAs are projected to unload roughly $15.4 billion of US equities this week, and even if stocks rise, the funds are expected to shed about $8.7 billion.

Investor stress was running high last week. The firm’s Panic Index – which combines one-month S&P implied volatility, VIX volatility, S&P one-month put-call skew and the slope of the S&P volatility term structure – most recently stood at 9.22, a level indicating markets are not far from “max fear” on Thursday.

The S&P 500 surged 2% on Friday, ending a volatile week with its biggest gain since May. The rally followed a sharp early-week drop in both the S&P 500 and Nasdaq 100, triggered by the launch of a new AI automation tool from Anthropic PBC that wiped billions of dollars off software, financial services and asset-management stocks as investors reassessed disruption risks.

Positioning across the so-called systematic strategies was the most common question among Goldman’s clients Friday, underscoring the demand for a view of financial flows.

On top of the CTA selling, thin liquidity and ‘short gamma’ positioning will keep the market choppy, potentially magnifying swings in either direction as dealers buy into rallies and sell into drawdowns to balance their positions. S&P top-of-book liquidity — the volume of buy and sell orders available at the best bid and lowest ask price — has deteriorated sharply, falling to about $4.1 million from a year-to-date average near $13.7 million.

“The inability to transfer risk quickly lends itself to a choppier intraday tape and delays stabilization in overall price action,” Goldman’s trading desk team including Gail Hafif and Lee Coppersmith wrote in a note to clients Friday.

Option dealer positioning has also flipped in a way that may exacerbate moves. After sitting in an area of so-called long gamma that helped prevent a break above the 7,000 level, dealers are now estimated to be flat to short gamma. The dynamic that becomes more pronounced when liquidity is scarce.

“Buckle up,” the traders added.

Other systematic cohorts retain meaningful room to de-risk. Risk-parity positioning sits in the 81st percentile, looking back over a year, while volatility-control strategies are in the 71st percentile. Unlike CTAs, these funds respond to sustained changes in realized volatility, suggesting their impact would be more pronounced if volatility remains elevated. S&P 500 realized volatility is on the rise, but the 20-day gauge is still below levels seen in November and December.

Seasonality offers little relief. February has historically been a weaker and choppier month for both the S&P 500 and the Nasdaq 100 as supportive January flows — including retirement contributions and peak retail activity — fade.

Retail behavior is also showing signs of fatigue. After a year of relentless dip-buying, the latest two-day net retail imbalance showed roughly $690 million of selling last week, demonstrating less willingness to “buy all dips.” Popular retail trades tied to crypto and crypto-linked equities have been hit particularly hard, raising the risk that any broader rotation out of US stocks would mark a notable shift from last year’s trading patterns.

Business

Japan election landslide clears path for Takaichi to deliver tax cuts

Japan election landslide clears path for Takaichi to deliver tax cuts

Business

Analysis: Retail spend defies national slowdown

ANALYSIS: Western Australia’s retail sector closed 2025 with strong momentum, underscoring the state’s ongoing consumer resilience.

Business

RBI signals pause after December cut as inflation pressures edge up

Eleven of 14 economists polled by ET expect no further reduction in the policy rate in the coming months.

Proposed trade deals with the USA, the European Union and others have increased growth prospects, thus reducing pressure on the central bank to lower rates to push growth, economists said.

The Monetary Policy Committee (MPC) of the RBI on Friday kept the policy rate unchanged at 5.25% after lowering it 125 basis points in the last one year.

“The upward revision of inflation and GDP growth forecast gives a hawkish tilt to the policy and indicates monetary policy easing is largely behind us,” said Amit Somani, deputy head of fixed income at Tata Asset Management.

Agencies

Agenciesin play With GDP base years under revision, economists exepect a prolonged pause rather than renewed easing cycle

Among the 11 economists Within who expect 5.25% as the terminal rate, six said the RBI is likely to remain guided by evolving growth-inflation dynamics. With GDP base years under revision, the true momentum of economic growth remains uncertain, reinforcing expectations of a prolonged pause rather than a renewed easing cycle, they said.

Noting the momentum in private consumption, steady rural demand and improving agriculture activity, the central bank increased the GDP growth projections for the first and second quarters of FY27 by 20 basis points each to 6.9% and 7%, respectively. Inflation projection was also revised higher for FY26 to 2.1% from 2%. For the ongoing quarter, CPI is now projected at 3.2%, up from 2.9%.

“While uncertainty remains on the growth-inflation figures as we await the new series, the uptick in commodity prices and weaker currency may pose upside risks to inflation,” said Upasna Bhardwaj, chief economist at Kotak Mahindra Bank.

A small minority, however, still expects one final rate cut, arguing that growth could slow once the new GDP base year is factored in. Elevated geopolitical uncertainty also risks weighing on economic activity. This leaves room for limited additional easing, taking the repo rate to 5%.

“The MPC meeting came against a backdrop of heightened geopolitical uncertainty, inflation below the lower end of the MPC tolerance band, and volatile currency markets,” said Sachin Bajaj, chief investment officer at Axis Max Life Insurance.

“We anticipate a final 25 basis point cut in the repo rate to 5% during the early part of the next financial year to address growth concerns emanating from the uncertain global environment,” he said.

Nomura, too, expects one more cut as “we await the implications of the new CPI and GDP series.” The brokerage has assigned a 65% probability to its baseline.

Business

Venezuelan politician Juan Pablo Guanipa kidnapped after being freed in prisoner release

Venezuelan politician Juan Pablo Guanipa kidnapped after being freed in prisoner release

Business

ETMarkets Smart Talk | STT hike weighs on sentiment, but growth-focused Budget supports markets: Naveen Kulkarni

In this ETMarkets Smart Talk, Kulkarni explains why the intrinsic value of equities remains intact, how FII behaviour around the STT hike could shape the near-term setup, and why a growth-focused Budget with higher capex and manageable fiscal numbers continues to support the medium- to long-term market outlook. Edited Excerpts –

Kshitij Anand: Let me also get your perspective on why markets fell sharply after the Budget despite strong capex numbers. We have seen a spike in capex to nearly one lakh crore, from ₹11.11 lakh crore earlier to now over ₹12 lakh crore. Is this reaction driven more by sentiment, or is there something else at play? What would be your take on this?

Naveen Kulkarni: Yes, clearly the reaction has been driven by sentiment. At one point, the market was down by probably around 2.5%, and then we have seen some pullback as well. If you look at the markets over the last few sessions, trading volumes have been a little thinner and not particularly exciting. When the sell-off happened, it did not occur on very large volumes; it happened on relatively thinner volumes. And when some degree of institutional buying comes in, seeing opportunity, we are also witnessing a pullback.What will be important is tomorrow, because I do not think there has been significant FII participation yet. How they read the market, especially the STT hike—which impacts them as well, given that many large trading hedge funds operate in India—and how they assess its impact on trading volumes will be key. We could see some more impact coming tomorrow. So, tomorrow and probably next week is when the market should set up. Clearly, we have been in an oversold market and have seen some additional selling, but I think we should be okay from here.

Kshitij Anand: Much of the money is also moving from bank FDs to the equity market, which is something the government has on its mind as it looks to manage liquidity in the banking system. Naveen, picking up from where you left off—given that today is a holiday—do you see the post-Budget sell-off as an overreaction to the STT hike, or as a genuine shift in market structure? The reason I ask is that we have seen substantial selling by FIIs as well. In 2025, more than ₹1.6 lakh crore was withdrawn, and so far in January, the figure is close to ₹40,000–50,000 crore. How do you see this playing out in the coming week?

Naveen Kulkarni: If you look at it, whether it is the securities transaction tax on futures or options, the intrinsic value of the underlying does not change. When you are buying in the cash market, you are holding it for the long term and for delivery, so the intrinsic value does not change because of these parameters. This reaction, whether you look at it from the perspective of FII participation or hedge fund activity, is likely to be short-lived because the intrinsic value of the underlying depends on growth in profitability and overall metrics, and that does not seem to be changing.

On the flip side, if I look at the Budget, there is definitely a focus on growth. Capex numbers are higher, and more importantly, the composition of capex also looks more interesting and growth-focused. Apart from that, a fiscal deficit of 4.3% is not prohibitive for growth. There have not been any significant cuts, and borrowing levels continue to look reasonable. If I look at the Budget numbers overall, they are not very aggressive. It is unlikely that the government will miss its budget expectations or estimates.Broadly speaking, the Budget is not a major negative factor. Yes, the STT hike is having an impact today and may continue to do so for a few more days, but overall, I do not see the underlying value changing. Underlying asset values are likely to rise over the next 12 months, and this phase could provide a good opportunity as the market clears excesses.

(Disclaimer: Recommendations, suggestions, views, and opinions given by experts are their own. These do not represent the views of the Economic Times)

Business

FIIs ease bearish bets post-Budget, but charts warn of range-bound Nifty: Anand James

Edited excerpts from a chat:

FII shorts in Nifty futures have been a worrying trend. How has the data changed after the Budget?

Since Budget, FII’s longs in the index future segment have been on a rising trend, while the shorts have been on a declining trend. This pattern was rarely seen in the last six months, and assumes importance hinting at a potential towards FIIs changing their unilaterally bearish stance. At 43462 contracts, their longs in the index future segment is the highest since late January, and sub 2 lakh contracts level on the short side held by FIIS now, was last seen in the early January period. The consequent long short ratio of 18 levels was last seen on 1st of December, but at that point, the longs were just 26k, and shorts were just 1.1 lakh. In other words, FIIs are still short heavy, and the 3% boosting of shorts on Friday suggest that we need more days of reduction in shorts or a larger reduction in size, to establish it as a trend, and project a rise in Nifty.The news heavy week saw Nifty ending around 1.5% higher. What are the charts indicating in terms of how sustainable the rally can be this month and whether the momentum can take us to record high once again?

Despite the positive weekly close, it must not be forgotten that Nifty failed to sustain the peaks seen on 3rd February, which saw an up gapped opening. Also, on Friday, we came close to seeing Nifty filling the break away gap. This is certainly an indication that momentum has weakened, and we have most likely slipped on to a range trading bias. That said, that Nifty did not stretch all the way to 25450, in order to fill the gap, and that a close in the vicinity of 25700 was seen in the last three days, suggesting that buying interest is still around. Alternatively, a repeat fall into the 25496-450 territory should push the trend into a sideways mode signalled already or announce the re-dominance of bears.

IT stocks hogged limelight for the wrong reasons. Is the dip here a buy or do you see more pain ahead?

Following the recent selloff, the Nifty IT index is likely to look for support around the SuperTrend level near 35,100, which also aligns with a rising trendline. However, the emergence of a bearish crossover on the weekly MACD is weighing on near-term upside potential. Failure to sustain above the 35,100–35,000 zone could lead to further downside toward 34,320 (200‑week moving average), with an extended decline possible toward 33,500.

Key constituents such as TCS, Infosys, HCL Technologies, and Tech Mahindra have reversed from their recent highs on both daily and weekly charts, accompanied by strong volumes, indicating persistent profit booking. Meanwhile, Wipro and LTI Mindtree have also registered bearish MACD crossovers on the weekly timeframe, reinforcing the risk of deeper corrections. Heavyweights TCS, Infosys, and Wipro, which collectively make up nearly 70% of the index weight, have convincingly slipped below their 100‑day and 200‑day moving averages, pointing to underlying weakness in the index. Although HCL Technologies and Tech Mahindra continue to trade above key moving average supports, any breakdown in these stocks could further intensify downside pressure on the Nifty IT index.

HAL was one of the biggest losers in the week. Do you see some buying support coming in at lower levels?

Though it was only two days of sharp fall, a sideways range has been broken, projecting a large downsides, having also closed below super trend. However, the stock has slipped 15%, after testing the 200 day SMA. It appears to have formed an inside bar on Friday, when a positive oscillator divergence was also seen. This fills up with hope that despite all the gloom, some green shoots are visible and a swing higher to 4140-4236 may be played for, with risk restricted to Friday’s low.

Consumer durables have been on an uptrend with Amber shares up xx% in the week. How should one trade the momentum?

Ideally, the stock looks poised for 7082, the 200 day SMA. However, oscillators appear to be signalling an exhaustion in momentum, especially as the stock is approaching a horizontal resistance coinciding with January’s peaks. This warns us to take some money off the table, or put 6410 as stop for existing longs.

Give us your top ideas for the week ahead.

FINCABLES (CMP: 771)

View: Buy

Target: 820

SL: 742

Price has built a base around 730–745 and is rebounding toward the declining 100 DSMA near 779 which coincides with the SuperTrend level, first meaningful resistance. A daily close above 780–785 would signal a range breakout, opening 815–820. Failure to clear the 100 DSMA keeps the stock in a sideways-to-down bias within the 745–780 band. Volume has ticked up on the bounce, hinting at improving momentum, but overhead supply remains heavy. Bias turns positive only on strong close above 785 with volume; below 742, risk shifts back to the downside toward 730, 705 levels.

LICI (CMP: 901)

View: Buy

Target: 930-950

SL: 864

A strong breakout candle with heavy volume has pushed price above the recent supply zone 880–890, and the SuperTrend level of 848 turning it into immediate support. Momentum has improved with RSI near 70 and MACD has turned up with a fresh positive cross in daily scale. In the weekly scale, we have seen Supertrend break and the MACD is about to see bullish crossover, confirming trend acceleration. Bias stays positive while above 890. A decisive close above 930 can extend the move to 950; failure to hold 890 would weaken momentum, risking a retrace toward 864-860.

Business

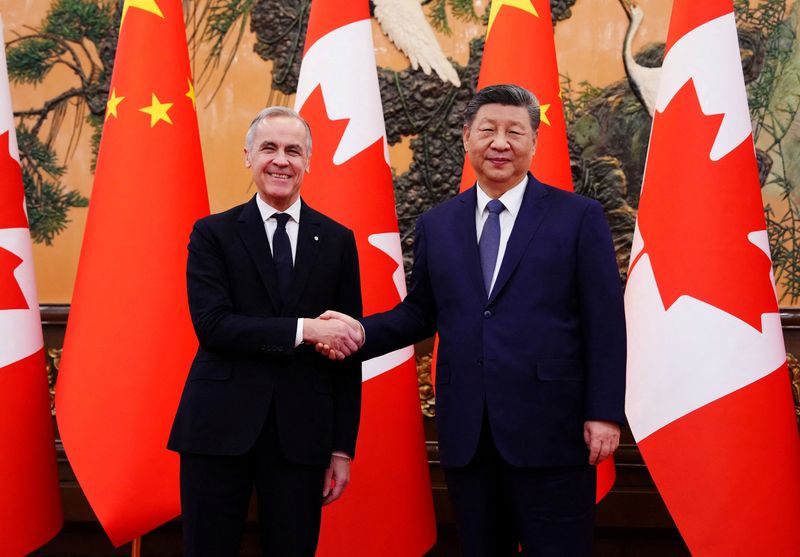

China overturns Canadian’s death sentence after Carney visit, lawyer says

China overturns Canadian’s death sentence after Carney visit, lawyer says

Business

Asia FX muted, yen buoyed by intervention warnings after Takaichi election win

Asia FX muted, yen buoyed by intervention warnings after Takaichi election win

Business

Contender for Bank of Korea governor backs higher property taxes to contain inflation

Contender for Bank of Korea governor backs higher property taxes to contain inflation

Business

Should long term investors bet on Aye Finance IPO?

Top three institutional holders including Elevation Capital (formerly known as SAIF Partners), LGT Capital Invest Mauritius, and Alpha Wave India (formerly Falcon Edge India) hold a combined 41% stake in the company.

The company has a geographically spread loan book and has reported improvement in net interest margin. It has a strong capital adequacy ratio, which supports long-term business growth. However, the issue is priced at a discount to peers, reflecting relatively higher asset-quality stress and return ratios that trail those of peers. Given these factors, the issue is suitable for long-term retail investors with a higher risk tolerance.

Agencies

Agenciesnet interest is getting better Geographical spread, capital adequacy ratio seem good for the lender, but return ratios trail that of peers

Business

Founded in 1993 and later rebranded in 2014, Aye Finance provides small-ticket business loans to MSMEs. It had ₹6,027 crore worth of assets under management (AUM) spread across 568 branches in 18 states and three union territories as of September 2025. It focuses on micro-businesses with annual turnovers of ₹2-10 crore, primarily in semi-urban markets. Nearly 91% of customers own their residence or place of business, and 94% employ five or fewer workers, highlighting the grassroots nature of its borrower base. No single state accounts for more than 16% of AUM, while the top five states together contribute 57%. Loan disbursements expanded by 34.9% annually to ₹4,291.3 crore in FY25 from ₹2,357.1 crore in FY23.The business faces risks such as rising non-performing assets, vulnerability to interest rate fluctuations, and competition from other NBFCs.

Financials

Net interest income rose by 52.6% annually to ₹858 crore in FY25 from ₹368.5 crore in FY23. Net profit surged to ₹175.2 crore in FY25 from ₹39.9 crore in FY23. The capital adequacy ratio remained robust at 35% in FY25 rising from 31% in FY23. Net interest margin expanded to 15% in FY25 from 13.5% in FY23-within the 10-16% peer range. Gross NPA rose to 4.2% in FY25 from 2.5% in FY23, exceeding the 1.8-2.7% range of its peers. Return on equity rose to 12% in FY25 from 5.5% in FY23, placing it at the lower end of the 11.6-18.7% peer range.

Valuation

Aye Finance is valued at a price-to-book (P/B) multiple of 1.3, which is at a discount to listed peers such as MAS Financial Services at 2.05, SBFC Finance at 3, and Fedbank Financial Services at 1.9.

-

Video6 days ago

Video6 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 days ago

Tech5 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics7 days ago

Politics7 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Politics11 hours ago

Politics11 hours agoWhy Israel is blocking foreign journalists from entering

-

Sports2 days ago

Sports2 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech2 days ago

Tech2 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat5 hours ago

NewsBeat5 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat6 days ago

NewsBeat6 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business10 hours ago

Business10 hours agoLLP registrations cross 10,000 mark for first time in Jan

-

Politics13 hours ago

Politics13 hours agoThe Health Dangers Of Browning Your Food

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Crypto World7 days ago

Crypto World7 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business18 hours ago

Business18 hours agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business3 days ago

Business3 days agoQuiz enters administration for third time

-

Sports7 days ago

Sports7 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat7 days ago

NewsBeat7 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoDriving instructor urges all learners to do 1 check before entering roundabout