Business

Hornets Land Coby White and Mike Conley in Stunning Trade with Bulls

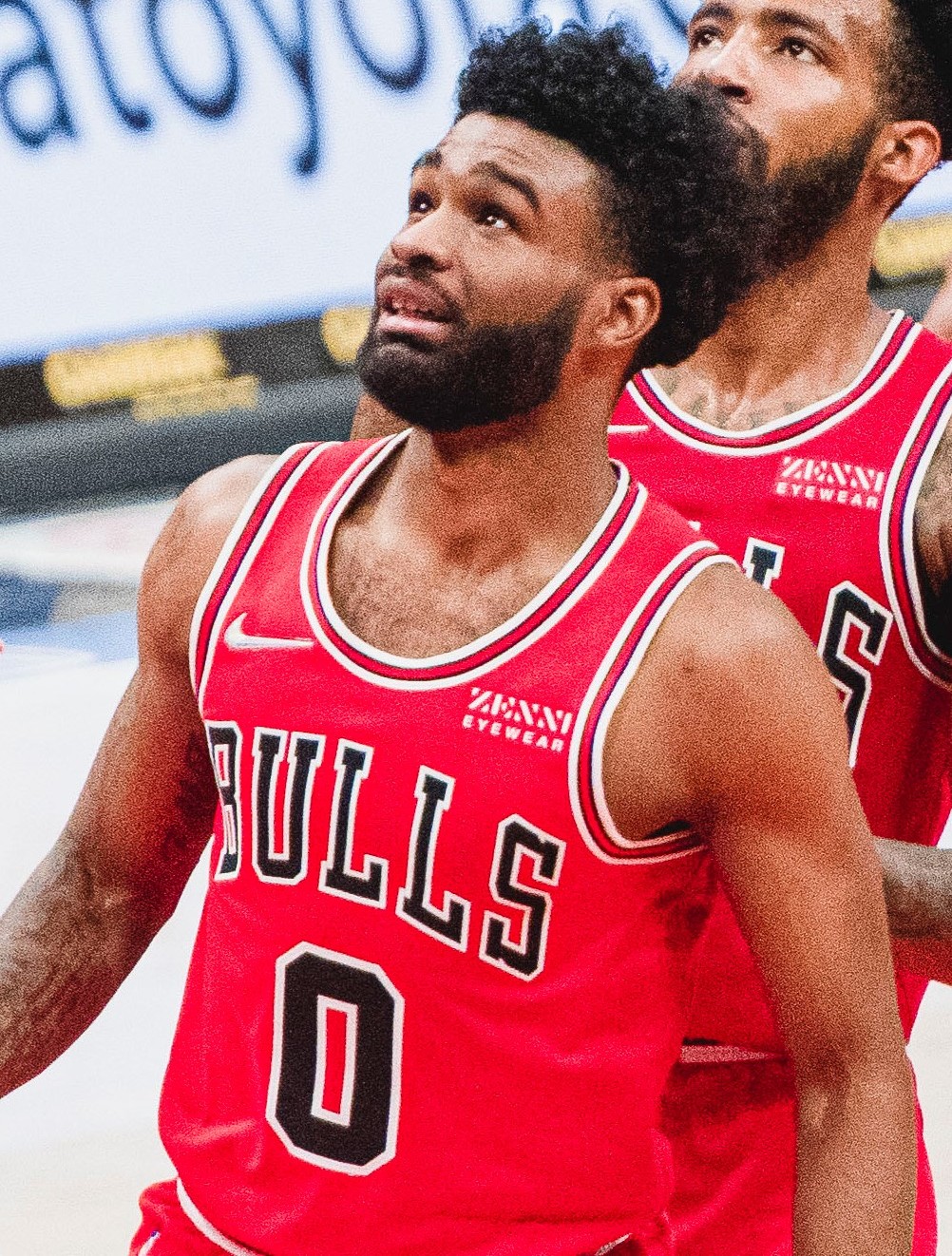

The Charlotte Hornets pulled off one of the most surprising deals of the 2026 NBA trade deadline on Thursday, Feb. 5, acquiring guards Coby White and Mike Conley from the Chicago Bulls in exchange for guard Tre Mann, forward Josh Green, center Nick Richards, a 2027 first-round pick (top-10 protected), and two second-round picks, league sources confirmed to The Associated Press.

The transaction, finalized just before the 3 p.m. ET deadline, signals a clear shift in direction for the Hornets, who have struggled to find consistent backcourt production since the departure of LaMelo Ball to injury and inconsistent play from younger guards. By adding White, a 26-year-old breakout star coming off a career year, and the 38-year-old veteran Conley, Charlotte is betting on immediate competitiveness while still preserving long-term flexibility.

Trade Breakdown

Hornets receive:

- Coby White

- Mike Conley

- Cash considerations

Bulls receive:

- Tre Mann

- Josh Green

- Nick Richards

- 2027 first-round pick (Charlotte, top-10 protected)

- 2028 second-round pick (via Miami)

- 2030 second-round pick (via New Orleans)

The deal reunites Conley with Hornets head coach Charles Lee, who served as an assistant under Conley in Memphis and Atlanta. White, meanwhile, becomes the centerpiece of Charlotte’s backcourt overhaul, bringing explosive scoring, improved playmaking and elite catch-and-shoot ability to a roster that ranked 26th in offensive efficiency entering February.

Why the Hornets Made the Move

Entering the deadline at 22–30 and sitting 11th in the Eastern Conference, Charlotte had been widely viewed as a seller. Instead, general manager Mitch Kupchak pulled the trigger on a win-now move, prioritizing guard depth and veteran leadership around young stars Brandon Miller and Mark Williams.

White, 26, is having a career season in Chicago: 21.4 points, 5.1 assists, 4.3 rebounds, 41.8% from three on 8.2 attempts per game through 52 games. His ability to score off the dribble and create in pick-and-roll situations addresses a glaring need for the Hornets, who have leaned heavily on isolation and transition scoring.

Conley, despite turning 39 in October, remains one of the league’s steadiest floor generals. He averaged 9.8 points and 5.9 assists in 28.4 minutes per game for the Bulls, shooting 42.1% from three and posting a 3.2 assist-to-turnover ratio. His leadership and championship experience (2023 with Denver) give Charlotte a stabilizing force off the bench or in closing lineups.

“These two guys change how we play,” Lee said in a brief statement released by the team. “Coby brings dynamic scoring and shot-creation. Mike brings poise, winning habits and the ability to run an offense. We’re excited to integrate them immediately.”

Impact on the Bulls

Chicago, sitting at 24–28 and clinging to the No. 9 spot in the East, appears to be pivoting toward a youth movement and future asset accumulation. Trading White — their leading scorer and a pending restricted free agent — and Conley (who has a $9.975 million non-guaranteed salary for 2026–27) clears significant cap space and timeline pressure.

In return, the Bulls receive:

- Tre Mann (24): A quick, shifty combo guard who averaged 11.2 points and 4.1 assists in 26.8 minutes for Charlotte.

- Josh Green (25): A versatile 6-foot-5 wing who shot 38.7% from three last season and brings defensive energy.

- Nick Richards (27): A 7-foot rim-running center who averaged 9.1 points and 8.0 rebounds in limited minutes but offers size and athleticism.

- A 2027 first-round pick (top-10 protected) that could convey in a year Chicago hopes to be in the lottery again.

The haul gives the Bulls three rotation-ready young players under team control and a valuable future pick, aligning with a potential rebuild around No. 1 overall pick Cooper Flagg (if they land him) or other high lottery talent.

Immediate Roster Fit in Charlotte

White is expected to start alongside LaMelo Ball (when healthy) or slide to the bench as a high-usage scoring guard. Conley will likely back up the point guard spot and serve as a mentor to younger guards while providing spot minutes in crunch time.

The Hornets’ projected backcourt rotation now reads:

- Starters: LaMelo Ball / Coby White

- Key reserves: Mike Conley / Seth Curry / Nick Smith Jr.

The addition of White’s scoring punch (career-high 21.4 PPG) and Conley’s decision-making should raise Charlotte’s offensive ceiling significantly, especially in half-court sets where the team has struggled.

Defensively, the Hornets gain mixed results. White is an average-to-below-average defender, while Conley remains a savvy team defender despite declining lateral quickness. The hope is that Miller, Williams, and Miles Bridges can cover for backcourt deficiencies.

Fan & Analyst Reactions

The deal drew immediate polarized reactions. Hornets fans flooded social media with excitement over finally landing a proven 20-point scorer to complement Ball. “Coby White + LaMelo? That’s must-watch basketball,” one fan posted on X, garnering thousands of likes.

Skeptics pointed to the cost: giving up a first-round pick and three rotation pieces for two players on expiring or near-expiring deals. “This feels like a panic move when we should be tanking for Cooper Flagg,” another wrote.

National analysts leaned positive. ESPN’s Bobby Marks gave the Hornets a B+ grade: “They’re buying upside and win-now help without sacrificing their entire future.” CBS Sports’ Colin Ward-Henninger called it “the most aggressive move Charlotte has made in years.”

For Chicago, the return drew praise for its balance of youth, upside and future assets. “They didn’t just dump salary — they got real pieces and a pick,” wrote The Athletic’s Darnell Mayberry.

What’s Next

White and Conley are expected to travel to Charlotte immediately and make their Hornets debuts as early as Friday against the Orlando Magic. The team has until Feb. 20 to decide whether to waive Conley’s non-guaranteed 2026–27 salary or keep him for another season.

For Chicago, the trade opens the door to further deadline or offseason moves, potentially including offers for Zach LaVine or Nikola Vučević if the rebuild accelerates.

In Charlotte, the deal marks a clear pivot: from rebuilding to retooling around Ball, Miller, and now White. Whether it pays off depends on health, chemistry, and whether the Hornets can climb out of the lottery and into the play-in conversation.

For now, the NBA world is left marveling at how quickly a quiet deadline turned explosive — with two franchises betting on very different futures.

Business

Bank of America now sees two ECB rate cuts in 2027, against market expectations

Bank of America now sees two ECB rate cuts in 2027, against market expectations

Business

TikTok told to change 'addictive design' by EU or face massive fines

TikTok says it plans to challenge the “categorically false and entirely meritless” accusations.

Business

Graco exec White sells $133k in shares after option exercise

Graco exec White sells $133k in shares after option exercise

Business

Roivant Sciences earnings missed by $0.07, revenue fell short of estimates

Roivant Sciences earnings missed by $0.07, revenue fell short of estimates

Business

NAV Monitor: U.S. REITs End January At Median 16.2% Discount To Net Asset Value

NAV Monitor: U.S. REITs End January At Median 16.2% Discount To Net Asset Value

Business

Review: Anticipation earned at Pearla and Co

REVIEW: The North Freo restaurant is driven by community connection, ethics and excellence in seafood.

Business

State to establish 2050 Commission to boost productivity

Roger Cook has revealed the form WA’s first-ever productivity commission, dubbed the 2050 Commission, will take to provide advice to guide the state’s future.

Business

NatWest to support 50,000 UK entrepreneurs through Accelerator in 2026

NatWest has announced plans to dramatically expand its Accelerator community, with an ambition to support 50,000 entrepreneurs across the UK in 2026 – a five-fold increase on the target it set for 2025.

The move follows a standout year for the programme, during which the bank supported around 12,000 founders. That figure exceeds the total number of entrepreneurs the Accelerator had backed over the previous decade combined, highlighting the rapid acceleration in both scale and impact.

The expansion forms part of NatWest’s new five-point Growing Together plan, which outlines how the bank intends to support long-term UK growth. The strategy focuses on backing regional economies, championing mid-market businesses, strengthening infrastructure and housing, improving financial confidence among families and young people, and supporting the innovators shaping the future economy.

NatWest said it believes banks have a role to play beyond providing finance, using their regional footprint, expertise and convening power to bring together businesses, communities and policymakers to help remove structural barriers to growth and unlock productivity across the UK.

At the heart of the expansion is the NatWest Accelerator community, which is built around peer networks, local cohorts and access to expert mentors, investors and specialist support. The programme is designed to help early-stage and high-growth businesses launch, scale and build resilience.

Data released by the bank shows the impact of the programme on participating businesses. Companies that completed the Accelerator grew their turnover by an average of 104 per cent year-on-year, compared with 20 per cent growth among a control group. In addition, nine out of ten Accelerator businesses were still trading three years later, compared with fewer than half in the control group.

Robert Begbie, CEO of Commercial & Institutional Banking at NatWest Group, said the expanded ambition reflects the bank’s confidence in the programme’s effectiveness.

“We know that to build the economy of the future we need to back the innovators who will power it,” he said. “Entrepreneurs are the driving force behind innovation, job creation and long-term economic growth across the UK. By raising our ambition for 2026, we’re reinforcing our commitment to back founders at every stage – from idea to scale-up – and help them turn ambition into sustainable success.”

The commitment was welcomed by government and business groups. Small Business Minister Blair McDougall said the announcement reflected the kind of practical support needed to unlock the potential of small businesses nationwide, while Aaron Asadi, CEO of Enterprise Nation, described NatWest as unmatched among banks in its support for UK entrepreneurs.

Shevaun Haviland, Director General of the British Chambers of Commerce, added that expanding the Accelerator would give more founders access to the advice and peer networks they need to grow with confidence.

As part of the expansion, NatWest will continue to grow its network of Accelerator hubs and on-campus university partnerships. The bank has already established hubs in collaboration with universities including Manchester, Oxford, York, Brighton and Warwick, and plans to set up hubs in up to ten universities over the next three years.

The Accelerator also delivers structured growth journeys through its UK hub network and via the NatWest Accelerator app, working in partnership with Google to provide access to digital tools, training and specialist expertise. Pitch events and founder forums held across the UK give entrepreneurs opportunities to showcase their businesses, build networks and access funding.

One business to benefit from the programme is Leeds-based production company Mood Films, which launched in 2024 after evolving from a long-standing mentor-mentee relationship into a creative partnership. After joining the NatWest Accelerator, the founders gained access to co-working space, one-to-one coaching and workshops covering funding, sales, marketing and future planning.

Louis Jones, co-founder and director of photography at Mood Films, said the programme helped the team move from being filmmakers learning the basics of business to confident founders with a clear understanding of how to scale.

“Joining the NatWest Accelerator was one of the best decisions we ever made for our business,” he said. “The support helped us understand every area of the business and gave us the confidence to grow now and into the future.”

Business

LakeShore Biopharma’s $0.90 per share going-private deal at risk

LakeShore Biopharma’s $0.90 per share going-private deal at risk

Business

Bitcoin falls below $70,000, wiping out post-election gains

Bitcoin has slipped below the $70,000 mark, erasing the gains made after Donald Trump’s return to the White House, as weakening investor demand and regulatory uncertainty weigh on the world’s largest cryptocurrency.

The digital asset fell to around $65,600 on Thursday, its lowest level since November 2024, amid a combination of hawkish signals from the US Federal Reserve, a slowdown in institutional buying and continued delays in crypto regulation.

Bitcoin had rallied sharply following Trump’s second election victory after he pledged to turn the US into the “crypto capital of the world”, fuelling expectations of lighter regulation and greater political backing for digital assets. However, those hopes have faded as progress on legislation has stalled and central banks have signalled they will keep interest rates higher for longer.

The cryptocurrency is now down around 30 per cent over the past year, as enthusiasm from both retail and institutional investors has cooled. Analysts say delays to US legislation aimed at creating a clear regulatory framework for digital assets have played a key role in undermining confidence.

The so-called Clarity Act, a bipartisan proposal designed to define how cryptocurrencies should be regulated, has been held up by disagreements within the sector and in Congress. In contrast, the UK has set out plans to bring cryptoasset firms under Financial Conduct Authority oversight from 2027, although that framework remains some way off.

In a research note, analysts at Deutsche Bank said regulatory inertia has slowed the integration of bitcoin into mainstream investment portfolios. They noted that while the recent sell-off looks sharp, it also reflects a retreat from highly speculative gains made over the past two years.

“Despite the recent drop, bitcoin remains around 370 per cent higher than in early 2023,” the bank said, adding that the steady selling suggests traditional investors are losing interest and broader pessimism around crypto is growing.

Created in 2008 by the pseudonymous developer Satoshi Nakamoto, bitcoin has no physical form and exists purely as computer code. Once worth almost nothing, it reached parity with the US dollar in 2011 and has since become the bellwether for the wider crypto market.

-

Crypto World7 days ago

Crypto World7 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Politics7 days ago

Politics7 days agoWhy is the NHS registering babies as ‘theybies’?

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports3 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business19 hours ago

Business19 hours agoQuiz enters administration for third time

-

Crypto World7 days ago

Crypto World7 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business7 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat1 day ago

NewsBeat1 day agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World19 hours ago

Crypto World19 hours agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”