Business

Housing crisis needs more supply, not more taxes

The familiar sound of the call for changes to Australia’s Capital Gains Tax (CGT) discount is again increasing in volume, with a Senate Select Committee on the Operation of the Capital Gains Discount likely to recommend a reduction in the discount, which translates into higher taxes.

Based on what’s been floated by the government in the press, it feels almost inevitable that a reduction from the current 50 per cent discount is coming. The extent of it we don’t know, but it’s possible it will be restricted to residential property.

The government talks about intergenerational equity and focusing on making housing affordable, especially for the next generation of homeowners.

Those are important aspirations but the illusion that increasing taxes on investors will unlock supply or reduce prices is just misleading.

Data from leading industry analysts like PropTrack and Cotality tells us that investor activity is primarily a response to our tight rental market, not the root cause of unaffordability.

In many places around Australia, rental vacancy rates are at or near historical lows, which is translating into higher rental prices.

What will reduce rents is more supply of rental properties, not less. You don’t solve a supply problem by penalising those who provide homes to rent.

The push for CGT changes is fundamentally based on the premise that a higher tax burden will result in a more affordable housing market, as investors reduce their appetite for property, allowing more homeowners to enter the market.

But even the Grattan Institute, which is hardly a pro-investor lobby, conceded that such a change would reduce house prices by just 1 per cent.

The real drivers of price growth are far more fundamental; the undeniable imbalance between demand and supply.

Homes aren’t suddenly going to become more affordable because investors have to pay a higher rate of tax when they profit on a sale. The outcome is likely to be the opposite of what’s intended.

Property, for a vast majority of investors, isn’t a get-rich-quick scheme; it’s a long-term wealth building strategy.

Treasury research shows property investors are long term holders. WA Treasury commentary shows that residential investment property in WA is predominantly held long term, not traded frequently.

NSW Treasury goes into more detail, with the mean holding period for investors being 13.7 years.

This is a clear indication that most property owners are long-term asset holders. So, what happens when you hit them with a higher CGT? You don’t encourage more sales.

You incentivise investors to hold onto their properties for even longer to avoid paying a higher tax on exiting the asset.

Already some investors have stated to me that they will hold their properties until they retire and sell when they are in a much lower tax bracket.

Australian property owners are already forking out an estimated $67 billion annually through stamp duty, land tax, and capital gains tax alone. This asset class already pays more than its fair share.

We have a clear, pressing target to build 1.2 million homes over five years. If we are genuinely serious about intergenerational equity and getting more people into home ownership, then our focus must be on supply-side solutions.

That means tackling planning bottlenecks, addressing infrastructure shortfalls, and particularly the labour shortages in the construction industry.

Increasing a tax that impacts long-term investors, whose role is often to meet rental demand when supply is scarce, is nothing more than a distraction from the real work that needs doing.

Let’s stop talking about penalising property owners and start talking about how we get more homes built. That’s the only path to genuine housing affordability.

Business

Gaurav Jogani sees jewellery, footwear driving consumer discretionary growth

Jewellery and Footwear Lead Growth

Gaurav Jogani from JM Financial Institutional Securities in an interview to ET Now highlighted that the jewellery segment drove significant growth, largely due to gold prices rising 65% year-on-year. “Apart from this, the footwear segment was a surprise. Casual premium footwear players grew in the mid-teens, and grocery players also performed well. Apparel had a mixed bag performance due to an early festive season shift and a delayed winter,” he noted.

QSR Players Adjust to Consumer Trends

The quick-service restaurant (QSR) sector continues to stabilize, but growth is largely driven by pricing strategies. Jogani explained, “Most QSR players have started to drive value through discounts and combo offers. While transactions have stabilized, price discounts are leading to lower same-store sales growth.”

Margins and Cost Rationalisation

Margins in the QSR space have been better than expected, aided by cost-cutting measures and rationalization of unnecessary discounts. “Gross margins improved, and cost management led to better than expected margins. We expect this trend to continue into Q4, though sequentially margins may dip as it is a non-seasonal quarter,” Jogani added.

Balancing Discounting and Brand Equity

On the impact of discounting on long-term brand value, Jogani observed, “The intensity of discounting has reduced. Players are now focusing on value combos to drive footfalls. This has helped improve gross margins while sustaining consumer interest.”

Company Highlights and Sector Outlook

Among discretionary stocks, Titan remains a strong performer, demonstrating robust topline growth despite gold price volatility. “Titan is driving EBITDA growth in a calibrated manner, leading to earnings upgrades,” Jogani said. Footwear brands have shown signs of revival, and the sector may benefit from GST transitions extending to smaller discretionary items.

Valuation Perspectives

Valuations across QSR and discretionary sectors have corrected from historical highs, with downside limited, according to Jogani. “If SSSG growth rates revive, we could see a bottom in valuations and earnings,” he said.Competition and Industry Consolidation

Jogani downplayed the threat from regional cloud kitchens, pointing out consolidation in the sector due to macroeconomic pressures and funding constraints.

Key Metrics to Watch

For the upcoming quarter, same-store sales growth and brand contribution margins will be the primary focus, along with sustained cost rationalization and advertising efficiencies.

Top Picks in the Sector

Highlighting preferred stocks, Jogani identified Titan, Lenskart, Metro Brands, and Vishal Mega Mart in the discretionary space. In QSR, Devyani and Sapphire remain recommended buys.

Business

At Close of Business podcast February 20 2026

Claire Tyrrell talks to Nadia Budihardjo about why Perth’s student accomodation sector shares some similarities with Adelaide.

Business

Samsung Galaxy S25 Price Drops Over Rs 6,000 In India Ahead of Galaxy S26 Launch

Samsung’s Galaxy S25, the compact flagship launched just last year, has seen a notable price reduction in India ahead of the highly anticipated Galaxy S26 series unveiling. With the Galaxy Unpacked event scheduled for February 25, 2026, retailers like Flipkart and Amazon are offering attractive discounts, bank offers and exchange bonuses to clear inventory and entice buyers.

The standard Galaxy S25 (12GB RAM + 256GB storage variant) originally launched at Rs 80,999 in India. Recent listings show it now priced at Rs 74,999 on major platforms—a direct drop of Rs 6,000. Additional incentives push the effective price even lower.

On Flipkart, the device is listed at Rs 74,999. Customers using select bank cards, such as Flipkart Axis or SBI cards, can claim an instant discount of up to Rs 3,750, bringing the effective cost to around Rs 71,249. No-cost EMI options start as low as Rs 3,624 per month over 24 months, making the premium smartphone more accessible. Exchange offers provide up to Rs 51,100 off depending on the old device’s brand, model and condition.

Amazon India shows similar promotions, with the 12GB + 256GB model available around Rs 74,999 in some color variants, though select listings reflect deeper cuts to Rs 67,900 after initial discounts of Rs 12,100 or more from launch pricing. Bank offers on certain cards add another Rs 1,500 off, potentially dropping the effective price to Rs 66,500 or lower. Exchange bonuses reach up to Rs 35,950, further enhancing savings for upgraders.

These reductions align with Samsung’s typical strategy before new flagship launches. The Galaxy S26 series, including the S26, S26+ and S26 Ultra, is set for global announcement on February 25, with India availability expected shortly after. Rumors suggest the S26 will feature refinements like enhanced Galaxy AI tools, improved on-device processing via Edge Fusion tech, better low-light photography and privacy-focused displays.

The current Galaxy S25 remains a strong contender with its Qualcomm Snapdragon 8 Elite processor, 50MP triple rear camera system with ProVisual Engine, 4000mAh battery and advanced Galaxy AI features for content creation and editing. It offers a 6.3-inch Dynamic AMOLED 2X display with 120Hz refresh rate, seven years of OS updates and robust build quality.

Analysts note that pre-launch discounts on previous models help Samsung maintain momentum and reduce stockpiles. For buyers not waiting for the S26’s potential upgrades—such as a rumored Snapdragon 8 Elite Gen 5 chipset or expanded AI capabilities—the S25 now represents excellent value in the premium segment.

Other variants see movement too. The Galaxy S25+ (12GB + 256GB) appears around Rs 74,999 to Rs 69,302 on select platforms after coupons and offers, down from its Rs 99,999 launch price. The Galaxy S25 Ultra has seen steeper cuts, with some models dipping below Rs 1,10,000 after discounts and bank offers.

Shoppers should compare platforms for the best combo of base price, bank discounts, EMI and exchange value. Prices fluctuate based on color, storage and ongoing promotions, so checking live listings is recommended. Pre-order perks for the S26 may include double storage upgrades or accessory credits, but current S25 deals provide immediate savings without waiting.

As the February 25 Unpacked event approaches, excitement builds for the S26’s teased content-creation tools and privacy enhancements. For now, the Galaxy S25’s price drop offers a timely opportunity for those seeking flagship performance at a reduced cost.

Business

Starmer 'appeasing' big tech firms, says online safety campaigner

Baroness Kidron tells the BBC the PM has being “late to the party” in regulating social media.

Business

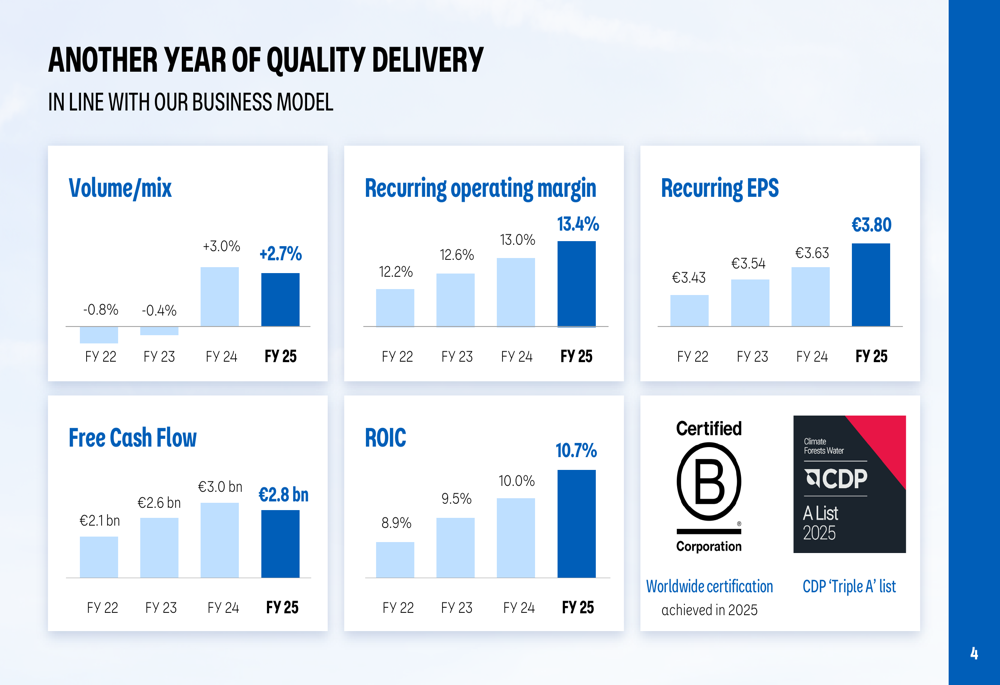

Danone FY 2025 slides: broad-based growth despite currency headwinds

Danone FY 2025 slides: broad-based growth despite currency headwinds

Business

FTSE 100 today: Index up, pound below $1.35; Anglo American, Aston Martin in focus

FTSE 100 today: Index up, pound below $1.35; Anglo American, Aston Martin in focus

Business

New iPhone Rumored to Feature Variable Aperture Camera

Apple’s iPhone 18 Pro and iPhone 18 Pro Max are shaping up as significant upgrades over the current generation, with leaks pointing to a variable aperture camera system, the powerful A20 Pro processor on a 2nm process, enhanced connectivity via in-house chips and refinements to the display and design. Analysts and supply chain reports suggest these flagship models will debut in September 2026, maintaining Apple’s traditional fall launch timeline while potentially introducing a split release strategy for the broader iPhone 18 lineup.

The iPhone 18 Pro series remains about seven months from announcement, but details from reliable sources like GF Securities analyst Jeff Pu, Ming-Chi Kuo and others have coalesced around several key improvements. These focus on photography versatility, performance efficiency, battery life and modem independence from Qualcomm.

Display and Design Refinements The iPhone 18 Pro is expected to retain a 6.3-inch display, with the Pro Max at approximately 6.9 inches, using advanced LTPO+ OLED technology for smoother refresh rates up to 120Hz and better power management. A smaller Dynamic Island is widely anticipated, achieved by relocating Face ID’s flood illuminator under the screen. This would create a cleaner front view without altering overall dimensions significantly.

External design changes appear minimal. The rear camera module is rumored to mirror the iPhone 17 Pro’s raised “plateau” with a triangular lens arrangement, avoiding drastic shifts. Some leaks suggest a more unified, polished look without two-tone finishes, potentially in new premium colors like coffee brown, purple or burgundy. The build remains aluminum with improved durability, though one report notes possible added weight or thickness for the Pro Max to accommodate larger internals.

Camera System Upgrades Photography stands out as a major focus. The main 48-megapixel Fusion camera on both Pro models is tipped to introduce a variable aperture mechanism—a first for iPhone. This physical adjustment would let users control light intake dynamically, enhancing low-light performance, depth of field control and creative flexibility similar to DSLR lenses. While smartphone sensor size limits extreme benefits, it promises greater versatility in varied lighting.

Additional rumors include a three-layer stacked image sensor (potentially from Samsung, shifting from Sony) for better noise reduction, dynamic range and responsiveness. Telephoto lenses may see aperture improvements for sharper zoomed shots. The ultra-wide and selfie cameras could also receive boosts, supporting advanced computational photography and Apple Intelligence features.

Processor and Performance Powering the devices will be the A20 Pro chip, fabricated on TSMC’s first-generation 2nm process. This node jump from the A19 Pro’s process is expected to deliver around 15% better performance and 30% improved efficiency through higher transistor density. Advanced packaging, possibly Wafer-Level Multi-Chip Module (WMCM), could integrate RAM closer to the CPU, GPU and Neural Engine for faster on-device AI tasks and extended battery life.

RAM is rumored at 12GB across Pro models, supporting more demanding Apple Intelligence capabilities and multitasking.

Connectivity and Battery Enhancements Apple continues its modem transition with the in-house C2 chip replacing Qualcomm components in the Pro lineup. The C2 promises faster 5G speeds, better efficiency, mmWave support in the U.S. and potential satellite features like expanded messaging or internet. Paired with the N2 wireless chip for Wi-Fi 7 and Bluetooth 6, connectivity should see substantial gains.

Battery capacity is tipped to increase, with the Pro Max potentially reaching 5,100-5,200mAh for up to 40 hours of use. Combined with efficiency improvements from the A20 Pro and optimized iOS, endurance could set new benchmarks.

Launch Timeline and Pricing Expectations Apple traditionally unveils flagships in early September, with pre-orders and availability following shortly after. Reports indicate the iPhone 18 Pro, Pro Max and a new foldable model (possibly iPhone Fold) will launch in fall 2026. The standard iPhone 18 and lower-tier variants may shift to spring 2027 due to manufacturing priorities favoring premium devices.

Pricing rumors suggest stability for base models, with no major hikes expected despite rising component costs. The iPhone 18 Pro could start around $1,099 (or equivalent in other markets), maintaining accessibility while offering meaningful upgrades.

As speculation builds, these features position the iPhone 18 Pro series as a compelling evolution rather than revolution, emphasizing refinement in key areas like imaging and efficiency. With Apple’s focus on on-device AI and ecosystem integration, the 2026 flagships aim to solidify leadership in premium smartphones.

Business

Making bread: Tip Top unveils new facility

Western Australians will have more access to Tip Top white sliced bread after the company behind it, Tip Top Bakeries, opened a $130 million state-of-the-art bakery line in Canning Vale.

Business

How AI is Driving Profitable Growth in Southeast Asia

Southeast Asia’s digital economy is experiencing remarkable growth, reaching $11 billion in profitability, a 2.5x increase since 2022.

This dynamism is largely driven by artificial intelligence (AI). The region benefits from a young, digitally-native population eager to adopt AI, strong government support for AI frameworks and R&D investment, and a vibrant ecosystem of innovative startups.

Strategic investments in Generative AI, talent development, AI infrastructure, and a supportive policy environment are crucial for Southeast Asia to become a global AI leader, driving economic transformation and societal progress.

Key Points

- The regional digital economy has achieved a 10x increase in revenue since 2016, with profitability rising from $4 billion in 2022 to $11 billion in 2024.

- Southeast Asia’s population shows a high level of AI readiness, with Singapore, the Philippines, and Malaysia ranking among the top countries globally for AI-related interest and searches.

- Significant capital is flowing into the region, with over $30 billion committed in the first half of 2024 alone to build AI-ready data centers across Malaysia, Thailand, and Singapore.

- Generative AI (GenAI) is delivering rapid commercial value; 70% of regional organizations report a positive return on investment within 12 months of implementation.

- Sector-specific benefits of AI are already visible, including personalized e-commerce recommendations, enhanced travel tools, and accelerated mobile game development.

Southeast Asian organizations are achieving a positive return on investment (ROI) on Generative AI (GenAI) workflows significantly faster than other regions—with 70% reporting positive ROI within 12 months.

The specific regional characteristics that allow for this accelerated success include:

- A Digitally Native and Receptive Population: The region is home to a young, digitally native population that is quick to embrace AI-powered solutions. There is a high volume of AI-related interest, with countries like Singapore, the Philippines, and Malaysia ranking among the top globally for AI-related searches. Crucially, the document notes a regional culture of “acceptance and exploration,” where there is greater interest in the benefits of AI than apprehension regarding its risks.

- Proactive Government Support and Flexible Regulation: Southeast Asian governments are actively fostering AI adoption through:

- National AI Frameworks: Developing clear strategic directions for AI.

- Regulatory Sandboxes: Implementing environments that allow for experimentation and innovation without the constraints of traditional regulation.

- Increased R&D Funding: Directing capital toward research and development.

- Massive Infrastructure Investment: The region is rapidly building the physical foundations necessary for AI. In the first half of 2024 alone, over US$30 billion was committed to building AI-ready data centers in Singapore, Thailand, and Malaysia. This influx of capital facilitates accelerated computing and AI services, which are essential for moving projects from idea to production quickly.

- A Vibrant Ecosystem of Innovators: There is a strong spirit of innovation across both startups and established sectors:

- Startups: Companies like Lytehouse AI, DiMuto, and CarbonSync are applying AI to diverse challenges in security, agriculture, and sustainability.

- Gaming Industry: The region accounts for 12% of all global mobile game downloads, demonstrating a level of technical prowess and creative energy that allows these organizations to use GenAI to lower development costs and expand libraries rapidly.

Generative AI: Transforming Industries and Unlocking New Value

Generative AI (GenAI), capable of producing innovative content and automating intricate tasks, is already showcasing its transformative potential to revolutionize industries and deliver measurable value across the region.

In e-commerce, GenAI powers personalized product recommendations, driving increased customer engagement, higher gross merchandise value (GMV) and larger basket sizes. The travel sector is also benefiting from AI-powered tools that enhance customer satisfaction and drive revenue growth. Similarly, the gaming industry is using GenAI to accelerate game development and build larger game libraries at lower costs, ultimately contributing to increased GMV.

Beyond these specific sectors, artificial intelligence is enhancing broader business functions across all industries. What’s truly remarkable is the speed at which companies in Southeast Asia are realizing value from GenAI.

The report revealed that most organizations can move from an initial idea to production within six months. Impressively, 7 out of 10 organizations in Southeast Asia report a positive return on investment (ROI) attributable to GenAI workflows within 12 months of implementation

Other People are Reading

Business

Form 144 MCKESSON CORP For: 20 February

Form 144 MCKESSON CORP For: 20 February

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video7 hours ago

Video7 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Video7 days ago

Video7 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports1 day ago

Sports1 day agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Crypto World7 days ago

Crypto World7 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Entertainment1 day ago

Entertainment1 day agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World12 hours ago

Crypto World12 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market