Business

Kaynes shares plunge 43% from October peak. Is a tactical rebound on the cards or more pain ahead?

Edited excerpts from a chat with Anand James, Chief Market Strategist, Geojit Investments Limited:

After a flat week, how would you trade the market now? Would Friday’s RBI optimism carry forward on Monday as well? Friday’s optimism stemmed from the completion of a morning star pattern, signaling a potential reversal from the downtrend that began on December 1. However, while the downswing was brief, the reversal is also likely to be short-lived, as evidenced by Friday’s stall at 26,200, a key congestion resistance.

Although oscillators support a possible uptrend extension, we do not see sufficient momentum for a strong move higher. We favor a swing lower toward 26,085–26,065 initially. Alternatively, a breakout above 26,200 could trigger further gains toward 26,460–26,550, but a sharp vertical rise is less likely.

IT was among the major gainers in the week. Do you see chances of more upside?

Yes, the IT sector shows strong potential for further upside. Nifty IT has been signaling a reversal since September and recently broke above the weekly supertrend, indicating strength. The weekly RSI near 60, along with the index closing above its 20-week high, reinforces the positive outlook. Based on these technical cues, the index could target 39,500 in the coming weeks.

Derivative data also supports this bullish view. Over 50% of constituent stocks saw short additions in near OTM put strikes and long additions in call strikes. Additionally, 70% of stocks experienced long build-up on Friday, while 80% recorded weekly short covering, suggesting traders are positioning for further gains. Heavyweights like TCS, Infosys, HCL Tech, Wipro, and Tech Mahindra show strong weekly charts and are expected to lead the rally toward 39,500.PSU banks were under selling pressure but recovered on Friday. Does the chart indicate a fresh 52-week high again going forward?

Even though the index saw a pullback on Friday, the charts suggest a mixed outlook. The wedge pattern breakout in September and the resulting upside has been losing momentum since November. The recent breakdown below the rising trendline near 8,500 indicates a possible short-term trend shift, while the weekly MACD shows exhaustion candles, signaling early signs of consolidation. Despite this, longer-term charts still reflect underlying strength, keeping the possibility of a fresh 52-week high alive.

Derivatives data shows some recovery attempts on Friday, with long additions and short covering in stock futures, but weekly data indicates that more than half of the positions still involved short additions. Among individual stocks, SBI, Bank of Baroda, PNB, Union Bank, Canara Bank, and Indian Bank may see a quick pullback early next week, though sustainability remains uncertain. The preferred strategy is to capitalize on any early upside next week while remaining cautious in the latter half.

Kaynes ended the week down 21% amid negative reports. Do you see chances of an upside bounce or is it too risky to chase the falling knife?

Kaynes has now fallen 43.5% from its October peak, with Friday’s 12.5% decline marking the steepest single-day drop during this period. Momentum indicators and oscillators point to a strong downward trend with no signs of bearish exhaustion, raising the risk that the slide could extend to at least the year’s low of Rs 3,825 seen in February. That said, the severity of Friday’s fall suggests that fear may have peaked.

Adding to this view, the only previous occasion the stock had stretched so far from its 200-day moving average was in April, when the gap was around 25%. Currently, the stock is nearly 26% away from the 200-day SMA, prompting close monitoring for potential mean-reversion moves in the coming week. Given the contrarian nature of this view, the downside marker is advised slightly below Rs 4,300, with Rs 4,541 as the initial recovery target.

Give us your top ideas for the week ahead.

COFORGE (CMP: 1977)

View: Buy

Target: 2080-2180

SL: 1882

The stock has been in a steady uptrend since 2020 and is currently forming a Cup and Handle pattern on the charts. It is attempting a breakout from this formation, supported by a weekly RSI near 60 and a MACD above the signal line. The price action remains strong, trading well above the 20-, 50-, and 100-day moving averages, reinforcing the bullish outlook. The stock is expected to move toward Rs 2,080 and Rs 2,180 in the near term. Long positions should be protected with a stop-loss placed below Rs 1,882.

ABCAPITAL (CMP: 358)

View: Buy

Target: 368-377

SL: 348

The stock has maintained a strong uptrend since February 2025 and continues to show strength on both daily and weekly charts. The weekly MACD remains above the signal line, and the price is trading comfortably above the 20-, 50-, and 100-day moving averages, reinforcing the bullish outlook. The stock is expected to move toward Rs 368 and Rs 377 in the near term. All long positions should be protected with a stop-loss placed below Rs 348.

Business

Here Are Some of the Worst-Performing Stocks Today

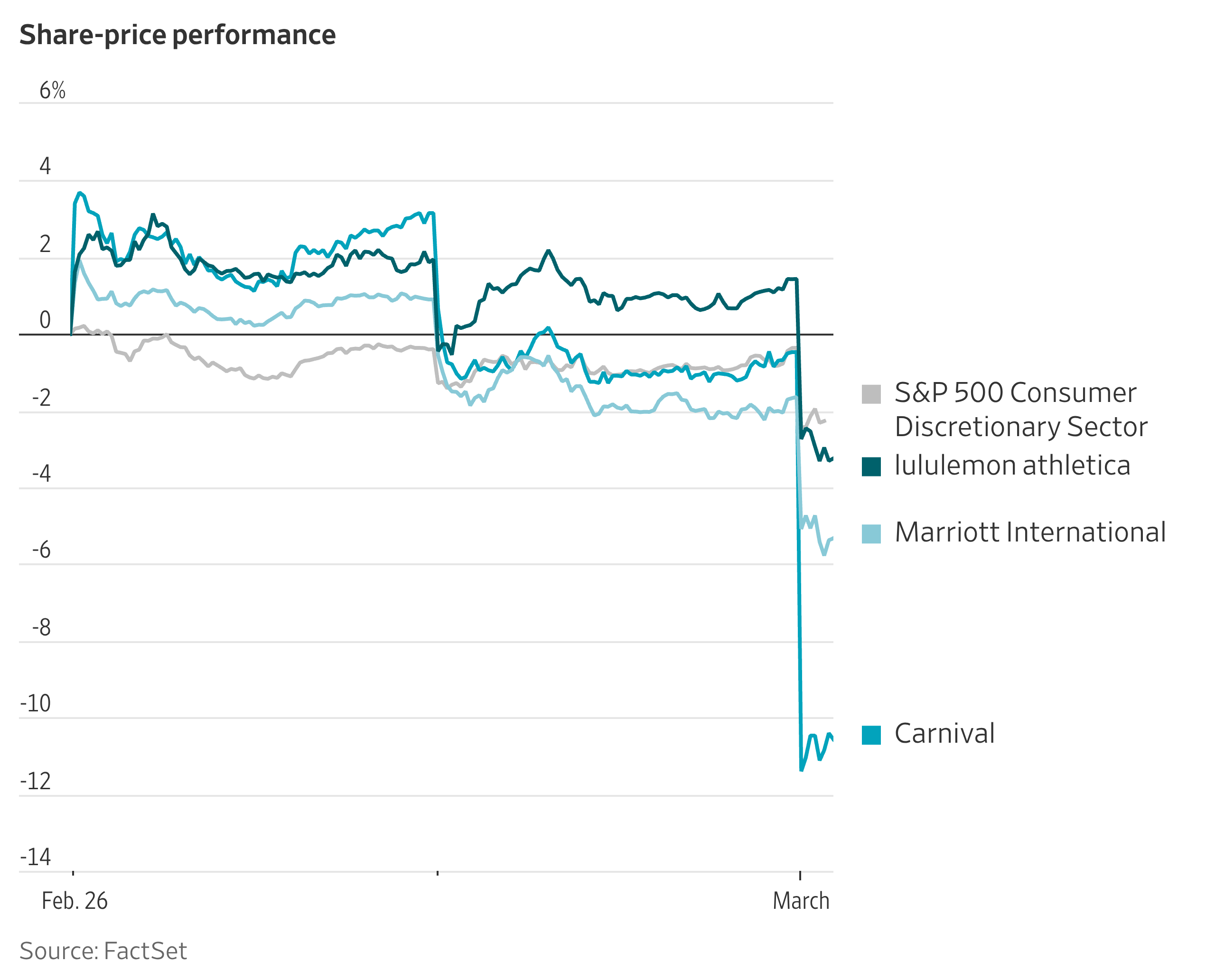

Consumer discretionary stocks are the hardest-hit in today’s selloff.

Shares of cruise company Carnival, leggings maker Lululemon Athletica and hotel operator Marriott International were among the worst-performing members of the S&P 500 in morning trading.

Nearly every sector of the benchmark index is in the red today. The exception: energy stocks, including oil companies like ConocoPhillips and U.S. refiner Valero Energy, which gained nearly 2% after the open.

Business

Earnings call transcript: Cricut beats Q4 2025 EPS forecast, stock rises

Earnings call transcript: Cricut beats Q4 2025 EPS forecast, stock rises

Business

Coherent Stock, Lumentum Soar on Nvidia Deals. Here’s What to Know.

Coherent Stock, Lumentum Soar on Nvidia Deals. Here’s What to Know.

Business

Blood Moon Totality Delivers Stunning Views Across Americas and Asia

Skywatchers worldwide witnessed a dramatic total lunar eclipse early on March 3, 2026, as Earth’s shadow fully enveloped the full Worm Moon, transforming it into a striking copper-red “blood moon” for nearly an hour during totality.

The event, the first and only total lunar eclipse of 2026, unfolded across multiple continents with prime visibility in North America (early morning), the Pacific, eastern Asia, Australia and New Zealand (evening hours). It marked the last total lunar eclipse visible from much of the globe until the New Year’s Eve event spanning Dec. 31, 2028–Jan. 1, 2029.

Phases began with the penumbral eclipse at 8:44 UTC (3:44 a.m. EST), when the Moon dipped into Earth’s faint outer shadow. The partial phase followed at 9:50 UTC (4:50 a.m. EST), as the darker umbral shadow began creeping across the lunar disk. Totality commenced at 11:04 UTC (6:04 a.m. EST), peaked at maximum eclipse 11:33 UTC (6:33 a.m. EST) with an umbral magnitude of 1.1507, and concluded at 12:02 UTC (7:02 a.m. EST). The full eclipse wrapped at 14:23 UTC (9:23 a.m. EST), lasting over 5 hours and 39 minutes overall, with 58 minutes and 19 seconds of totality.

In North America, viewers on the East Coast saw the Moon low on the western horizon as totality began around sunrise, with the blood-red hue visible briefly before moonset in places like New York and Washington, D.C. (totality roughly 6:04–7:02 a.m. EST). Western regions enjoyed higher lunar positions throughout, with clearer, longer views. In Chicago and New Orleans, the penumbral phase started around 2:44 a.m. CST, partial at 3:50 a.m. CST, and totality from 5:04–6:02 a.m. CST. Pacific time zones caught the event earlier, with totality peaking around 3:33 a.m. PST.

Eastern Asia, Australia and New Zealand experienced the eclipse in evening skies. In Sydney, the Moon rose already partially eclipsed, with totality unfolding under dark conditions. Observers in Christchurch, New Zealand, streamed views starting around 9:30 p.m. NZT, capturing the transition to red as partial phases progressed.

The characteristic red coloration arose from sunlight refracting through Earth’s atmosphere, scattering blue light and allowing longer red wavelengths to illuminate the Moon — a process akin to why sunsets appear orange. Weather permitting, the eclipse appeared deep copper or brick-red, varying by atmospheric conditions and viewer location.

Live coverage proliferated online as millions tuned in. Timeanddate.com streamed the event from multiple global sites, offering real-time animations, maps and commentary. The Virtual Telescope Project broadcast high-resolution views, collaborating with imagers in Australia, Hawaii and California. AfarTV provided 4K footage capturing the Moon’s shift from bright full to deep red. Griffith Observatory in Los Angeles hosted an online broadcast from midnight to dawn PST, while Associated Press and other outlets delivered visuals from Yucca Valley, Calif., and western Australia. NASA-affiliated streams and Fox Weather offered expert analysis alongside viewer-submitted photos.

Early images flooded social media and astronomy sites. Captures from New Zealand showed Earth’s curved shadow advancing across lunar maria during partial phases. Manila observers photographed the rising full moon mid-eclipse, while Dunedin Astronomical Society images highlighted the dramatic darkening. Post-totality galleries on Space.com showcased breathtaking blood moon portraits, with photographers praising the event’s clarity in clear-sky regions.

No special equipment was required — the eclipse was safely viewable with the naked eye, binoculars or telescopes enhancing details like subtle color variations and crater visibility. Tripod-mounted cameras with long exposures captured stunning stills. Unlike solar eclipses, lunar events pose no eye-safety risks.

The eclipse coincided with the March full moon, traditionally called the Worm Moon for emerging earthworms in thawing soil. It occurred near the Moon’s descending node with an average apparent diameter, 6.7 days after perigee and 6.9 days before apogee.

Astronomers noted the event’s significance as a rare celestial alignment visible to billions. Umbral magnitude 1.1507 indicated a relatively deep eclipse, with the Moon well within the umbra for pronounced reddening.

As totality concluded, the Moon gradually brightened through partial and penumbral phases. In many North American locations, the final stages occurred after sunrise, limiting visibility to early risers or those with western views.

With no total lunar eclipse until late 2028, this March 3 spectacle served as a highlight for 2026 astronomy enthusiasts. Clear skies across key regions allowed widespread enjoyment, from urban rooftops to remote observatories.

Live streams and archived footage remain available for those who missed it, preserving the awe-inspiring views of Earth’s shadow dancing across its natural satellite.

Business

Iranian Model Hoda Niku in South Korea Condemns Regime Tyranny Amid U.S. Strikes on Iran

Hoda Niku, an Iranian-born model and influencer based in South Korea, has strongly criticized her homeland’s regime as tyrannical and violent in the wake of recent U.S. and Israeli military strikes on Iran, questioning the government’s nuclear intentions and highlighting its history of repression against its own people.

Niku, who placed third in the 2018 Miss Iran pageant and has built a significant following in Korea as a model, TV personality, Pilates instructor and social media creator with over 530,000 Instagram followers (@hoda_niku), posted her remarks on Instagram on March 3, 2026. Her comments came days after the joint U.S.-Israeli operation “Epic Fury” targeted Iranian military sites, government facilities and leadership, reportedly killing Supreme Leader Ayatollah Ali Khamenei and causing hundreds of casualties.

In her statement, Niku addressed questions from followers about Iranian reactions to the attacks. “People ask me why the Iranian people seem happy about the war and the bombing of our own country,” she wrote, according to translations from Korean media outlets including Chosun Biz and Maeil Business Newspaper. She countered that many Iranians view the regime — not the nation itself — as the true adversary.

Niku pointed to the government’s brutal crackdowns, referencing reports of around 40,000 deaths in recent protests and suppressions. “If a regime has killed 40,000 of its own people, how can we believe it would use nuclear weapons peacefully?” she asked rhetorically, challenging claims that Iran’s nuclear program serves defensive or civilian purposes. She described the regime’s actions as tyrannical, emphasizing its oppression of citizens seeking freedom and democracy.

The post aligns with Niku’s longstanding activism. In January 2026, she posted a viral video titled “For Iran’s Freedom,” speaking in Korean to urge South Koreans and the international community to support anti-government protests in Iran amid deadly crackdowns and internet blackouts. She condemned what she called a “massacre” of demonstrators and appealed for global attention, saying even symbolic support strengthens those fighting for change.

Her latest criticism reflects a broader sentiment among some in the Iranian diaspora. Reports from NPR and other outlets indicate mixed reactions among Iranians abroad and inside the country, with some anti-regime voices expressing relief or cautious hope that strikes could weaken the government, despite civilian suffering. In Los Angeles, home to a large Iranian community, some celebrated the attacks as long-overdue retaliation for decades of repression, while others expressed sorrow over civilian deaths, including reports of a girls’ school hit during the strikes.

The U.S.-Israeli campaign, launched late February 2026 after stalled nuclear talks, has escalated into ongoing exchanges. Iran retaliated with missile and drone strikes on U.S. interests and allies across the Middle East, including attacks on facilities in Saudi Arabia, Qatar and Israel. Oil prices surged, airspace closed and global markets reacted with volatility.

In South Korea, where Niku has lived and worked since studying there, her voice carries particular resonance. She has appeared on programs like KBS’s “My Neighbor, Charles” and built a career in modeling, acting and wellness content. Her bilingual posts — often in Korean and Persian — bridge her two homes, allowing her to reach diverse audiences.

Korean media amplified her March 3 statement. Chosun Biz headlined its coverage “Miss Iran model in South Korea questions Iran regime’s nuclear intent,” noting her query about peaceful nuclear use given the regime’s domestic violence record. Asia Economic and Maeil Kyungje reported her direct criticism of the regime’s oppressive nature, with one outlet quoting her reflection: “Why would we be happy about our own country being bombed?” — underscoring that joy, if present, targets the government, not fellow citizens.

Niku’s activism fits a pattern among Iranian expatriates opposing the Islamic Republic. She has consistently condemned crackdowns, including those following mass protests, and advocated for freedom and democracy. Her platform in Korea — a country with its own history of authoritarian rule transitioning to democracy — adds symbolic weight to her calls.

The Iranian Embassy in Seoul condemned the U.S.-Israeli strikes as “war crimes” and “blatant aggression” on March 3, urging international accountability. North Korea also denounced the attacks as violations of sovereignty, aligning with anti-U.S. rhetoric from allied states.

As the conflict continues into its second week, with Trump administration officials signaling prolonged operations to neutralize threats, voices like Niku’s highlight internal Iranian divisions. While regime supporters decry foreign intervention, dissidents and exiles argue it exposes the government’s vulnerabilities.

Niku has not indicated plans for further public actions but continues posting wellness and lifestyle content alongside occasional advocacy. Her March 3 message, shared amid escalating regional violence, underscores ongoing debates over Iran’s future and the role of external pressure in regime change discussions.

For many Iranians abroad, including those in Seoul’s growing expatriate community, her words serve as a reminder that opposition to the regime persists — even as bombs fall and the world watches.

Business

Where Are Stocks Headed Today? Watch the Oil Markets

If you’re wondering where the S&P 500 will finish today, keep your eye on oil prices.

That’s the take of Piper Sandler’s chief investment strategist, who addressed the unfolding Middle East conflict in a late Sunday note to investors.

“For the time being, I expect stocks to trade strongly negatively correlated to oil,” wrote Michael Kantrowitz. “We’re unlikely to see stocks begin to move higher without seeing oil move lower—as a proxy of broader-risk perception of geopolitical risk.”

Business

Water bottles distributed in Illinois and Wisconsin recalled

Check out what’s clicking on FoxBusiness.com.

More than 650,000 plastic bottles of water are being recalled, according to the Food and Drug Administration.

Wisconsin-based Valley Springs Artesian Gold LLC is recalling six of its products after they were bottled under “insanitary conditions,” according to the FDA enforcement report. The recall of 651,148 bottles of water was initiated Feb. 6.

On Feb. 26, the FDA classified it a Class II recall, which the agency describes as an instance when the “use or exposure to a product may cause temporary or medically reversible adverse health consequences.”

CHEESE SOLD AT WALMART RECALLED IN 24 STATES OVER POTENTIAL HEALTH RISK

More than 650,000 water bottles are being recalled after they were bottled under “insanitary conditions.” (iStock)

The products involved in the recall are:

- Valley Springs 1-gallon 100% Natural Bottled Water (UPC 0 31193-00701 9)

- Valley Springs 2.5-gallon 100% Natural Bottled Water (UPC 0 31193-01501 4)

- Valley Springs 1-gallon Infant Water – “Not sterile. Use as directed by physician or by labeling directions for use of infant formula” – (UPC 0 31193-01401 7)

LIFE-THREATENING LISTERIA RISK PROMPTS MASSIVE FROZEN BLUEBERRY RECALL ACROSS MULTIPLE STATES

The recalled products were distributed in Illinois and Wisconsin. (Getty Images)

METAL FRAGMENTS FOUND IN FROZEN MEATBALLS SOLD AT ALDI STORES NATIONWIDE PROMPTS RECALL

- Valley Springs 1-gallon Daisy’s Doggy Water – “100% Pure Water. No Chlorine” – UPC 0 31193-90100 3

- Valley Springs 1-gallon 100% Natural Bottled Water – “Fluoride Added” – UPC 0 31193-01301 0

- Valley Springs 1-gallon Steamed Distilled Water (UPC 0 31193-00601 2)

The Food and Drug Administration classified it as a Class II recall. (Sarah Silbiger/Getty Images)

The recalled water bottles were distributed in Illinois and Wisconsin, according to the enforcement report.

Business

Casino Marketing Strategies That Work

The online casino industry operates in one of the most competitive digital environments today. Rapid technological development, regulatory complexity, and increasing player expectations require operators to adopt structured, data-driven marketing strategies rather than relying on isolated promotional tactics.

Sustainable growth is only possible when acquisition, retention, branding, and analytics are integrated into a unified system.

Many operators achieve measurable results by cooperating with a specialized iGaming marketing agency, which understands the nuances of gambling promotion, compliance requirements, and high-competition search landscapes. A strategic partner can align SEO, paid traffic, affiliate marketing, CRM, and brand positioning into a coherent growth framework.

Why a Structured Marketing Strategy Matters

A marketing strategy is not a random collection of actions. It is a roadmap for increasing visibility, strengthening competitive positioning, and maximizing profitability. Without clear direction, advertising budgets are often wasted on unqualified traffic, inconsistent messaging, or short-term campaigns that fail to deliver sustainable ROI.

A well-designed casino marketing strategy helps to:

- Increase brand presence across competitive markets

- Improve player acquisition and retention

- Strengthen competitive advantages

- Optimize marketing budgets

- Ensure full regulatory compliance

Core Casino Marketing Channels

Successful online casinos combine multiple marketing channels while continuously monitoring performance and adapting strategies.

Search Engine Optimization (SEO) remains one of the most valuable acquisition channels. By targeting relevant keywords and creating high-quality content, casinos can attract players who are actively searching for games, bonuses, and reviews. Optimizing site structure, internal linking, and backlink profiles ensures long-term visibility and reduces dependence on paid advertising.

Paid Advertising allows casinos to generate immediate traffic. Platforms like blockchain-based advertising networks enable precise targeting of crypto-savvy players and high-value audiences. By leveraging behavioral targeting and wallet-based segmentation, operators can achieve higher ROI compared to traditional broad campaigns.

Social Media Marketing (SMM) provides direct engagement and community building. Platforms like Facebook, Instagram, Twitter, and YouTube allow operators to share educational content, run contests, collaborate with influencers, and maintain an active presence. The key is to match the platform to audience behavior and maintain consistent, engaging communication.

Affiliate Marketing continues to be a top growth driver. Affiliates promote platforms in exchange for revenue share, CPA, or hybrid models. To ensure success, operators should maintain transparent commission structures, competitive payouts, reliable tracking, and ongoing support. Evaluating potential partners through resources like SEO.Casino Clutch helps verify reputation, expertise, and client feedback.

Content Marketing establishes authority and trust. Casinos benefit from game guides, industry trend reports, expert interviews, player stories, and educational blog content. High-quality content not only enhances SEO rankings but also strengthens the brand’s credibility in a competitive market.

Email Marketing & Personalization allows operators to communicate directly with both active and dormant players. Targeted campaigns, welcome sequences, VIP offers, and milestone rewards significantly improve engagement, retention, and conversion rates.

CRM & Data-Driven Optimization is essential for long-term performance. Advanced analytics and segmentation help identify high-LTV players, detect churn risks, personalize bonus structures, and automate retention workflows. AI-driven insights can further enhance fraud detection and predictive marketing models.

Brand Identity as a Competitive Advantage

In saturated markets, a strong brand differentiates a casino from competitors. Successful operators:

- Define a clear personality and positioning

- Maintain consistent messaging

- Develop a distinctive visual identity

- Communicate transparency and trust

Players are more likely to engage with platforms that appear professional, reliable, and emotionally resonant.

Website Optimization for Conversions

Traffic alone does not guarantee revenue. Conversion optimization ensures that visitors take meaningful actions, such as registering or depositing. Focus areas include:

- Fast loading speed and mobile-first design

- Intuitive navigation and clear calls-to-action (CTA)

- Simplified registration and deposit flows

- Visible trust signals, licenses, and certifications

With most players accessing platforms via mobile devices, responsive design and seamless UX are essential.

The Three Stages of Developing a Marketing Strategy

Developing an effective casino marketing strategy requires a structured approach. Each stage ensures resources are allocated efficiently, and performance is continuously optimized.

- Analytical Stage – Conduct market research, competitor evaluation, regulatory assessment, and internal performance audits.

- Implementation Stage – Set realistic goals, select marketing channels, allocate budgets, and launch campaigns.

- Control & Optimization Stage – Monitor KPIs, calculate ROI, evaluate traffic sources, and make strategic adjustments.

Continuous monitoring ensures the strategy adapts to market shifts and search algorithm updates, maximizing long-term results.

Casino Strategy

Casino marketing is a high-stakes discipline requiring strategic planning, regulatory awareness, technological adaptability, and data-driven execution. Operators who combine SEO, paid media, affiliate partnerships, content marketing, and CRM automation within a unified strategy are significantly more likely to achieve sustainable profitability.

Long-term success in iGaming is not about isolated campaigns—it is about building an integrated marketing ecosystem that evolves with the market while consistently delivering measurable business results.

Business

Sanfilippo Jasper Brian Jr sells $583954 in John B & Son (JBSS)

Sanfilippo Jasper Brian Jr sells $583954 in John B & Son (JBSS)

Business

How the Baby Boomer Exit Is Reshaping Business Ownership

For decades, baby boomer founders have been the quiet backbone of the private economy. They built manufacturing firms, regional retailers, logistics operators, service businesses and family brands that now sit at the heart of local communities and national supply chains.

Many of them started with little more than grit, long hours and a stubborn refusal to fail. Now that generation is stepping back, and the scale of what is changing is far bigger than most founders are willing to admit.

Across the UK, the United States, Europe and even Asia and Africa, millions of business owners are approaching retirement at the same time. These are not micro side projects. They are established, revenue-generating enterprises with loyal customers, experienced teams and decades of operational knowledge. Collectively, they represent trillions in enterprise value. Research from McKinsey has described the coming ownership shift as one of the largest intergenerational transfers of private business assets in modern economic history.

The transition is happening whether founders feel ready or not. The only variable left is whether it will be controlled or forced. Some founders will pass the business to their children. Others will sell to management teams or outside buyers. Many are still undecided. What is becoming increasingly clear is that the baby boomer exit may reshape private ownership more profoundly than any trend seen in the past half-century.

The Ownership Cliff Facing Baby Boomer Founders

Demographics are not subtle. In the United States alone, members of the baby boomer generation are now entering their late seventies and early eighties, marking a demographic turning point that has direct implications for business ownership and continuity.

In the UK, a significant share of SME owners are now over the age of 55. Similar patterns are visible in the United States and across Europe. In some sectors, particularly traditional retail, light manufacturing and professional services, ownership is heavily concentrated in the baby boomer generation. This creates what can fairly be described as an ownership cliff.

Within the next decade, a large proportion of privately held firms will require some form of leadership transition. For many founders, the business has been their primary asset, identity and life’s work. Unlike listed corporations, these firms do not have automatic succession pipelines. The transfer of ownership is personal, emotional and often underprepared.

The economic implications are substantial. If transitions are structured well, businesses continue operating, employees retain jobs and local economies remain stable. If transitions are delayed or poorly managed, firms can stagnate, lose competitiveness or be forced into distressed sales. In extreme cases, profitable businesses simply close because there is no clear successor.

This shift reaches far beyond small family shops. It touches manufacturing firms, logistics operators, regional retailers and service companies that anchor entire local economies. UK wealth managers increasingly refer to this as part of the “Great Wealth Transfer,” a multi-trillion pound shift in private assets expected over the coming decades.

The scale of baby boomer ownership means succession planning is no longer a private family issue. It is a macroeconomic force influencing employment, capital flows and regional growth.

The ownership cliff is not about age alone. It is about timing. Many founders are reaching a point where energy, appetite for risk and willingness to reinvest in digital transformation begin to change. Without a clear transition plan, the business can drift precisely when markets demand adaptation.

The Heir Gap – When the Next Generation Says No

The simplest succession story is the most traditional one: the founder steps aside and a son or daughter takes over. In practice, it is rarely that straightforward. At the same time, retirement itself is becoming less predictable. Recent reporting from Business Insider highlights how many baby boomers are delaying retirement altogether, either by choice or necessity. This extends the timeline of ownership decisions and often leaves succession conversations unresolved for longer than planned.

A growing number of second-generation heirs are choosing different paths. Some pursue corporate careers in technology, finance or consulting. Others build ventures of their own rather than inherit existing structures. For many, the family firm represents responsibility without autonomy, legacy without creative control. This creates what might be called an heir gap.

Founders who assumed that “one of the kids will take it” often discover that interest is lukewarm at best. The next generation may respect the business but feel unprepared to lead it, particularly if it operates in a sector facing digital disruption. In some cases, the perceived burden of preserving a parent’s life work outweighs the attraction of ownership.

At the same time, expectations between generations can diverge sharply. Baby boomers often built businesses through intuition, relationships and incremental growth. Their children have been shaped by data-driven decision-making, global competition and digital-first thinking. Without clear alignment, even willing successors can struggle to bridge operational styles.

The heir gap does not automatically signal decline. In some cases, it opens the door to structured management buyouts or external leadership. In others, it prompts founders to modernise governance, clarify ownership structures and professionalise operations before transition. What it does signal is that succession can no longer be assumed. It must be designed.

The baby boomer exit is therefore not simply about retirement. It is about whether the next generation, whether family or external, is ready and willing to carry forward what has been built.

When the Next Generation Steps In – Five Succession Patterns

Succession does not follow a single script. In some businesses, transition is gradual and carefully staged. In others, it coincides with strategic reinvention. What links successful handovers is not the surname of the successor, but the structure of the transition and the clarity of the mandate. Across markets, several patterns are emerging.

Dyson – Gradual Integration of Second-Generation Leadership (UK)

At Dyson, succession has taken the form of structured integration rather than abrupt replacement. Sir James Dyson remains closely associated with the company’s engineering identity, but over time his son, Jake Dyson, has taken on increasing responsibility within innovation and product development. The transition has not been framed as a departure from the founder’s vision, but as an extension of it.

This gradual approach allows knowledge transfer without destabilising brand continuity. The company’s shift toward software integration, robotics and connected home technologies reflects a generational layering rather than a break. Authority is expanded incrementally, signalling to employees and markets that succession can be evolutionary rather than disruptive.

Westmorland Family – Retail Reinvented (UK)

The Westmorland Family, operators of Tebay Services and other premium motorway locations, provide a mid-market example of generational transition. Founded by the Dunning family, the business has seen leadership pass to Sarah Dunning, who has overseen its evolution beyond traditional roadside retail.

Under second-generation leadership, the focus has moved toward experience-led positioning, regional sourcing and brand differentiation. Rather than compete on scale alone, the company emphasised quality and authenticity, strengthening margins in a highly standardised sector. The succession coincided with a reframing of the business model, demonstrating how a leadership shift can align with strategic repositioning rather than simple continuity.

Mitchells Family Stores – Relational Retail in a Digital Age (USA)

Mitchells Family Stores in Connecticut represent a third-generation retail business navigating digital transformation while preserving a strong relational culture. The company’s identity has long been built on personal service and customer relationships, values embedded by earlier generations.

As leadership has transitioned, digital tools have been integrated into that relational model rather than replacing it. E-commerce platforms, CRM systems and data-driven inventory management have strengthened operational efficiency without abandoning customer-centric traditions. The transition illustrates how generational change can modernise infrastructure while retaining cultural DNA.

Olmed – Regulated Retail and Digital Acceleration (Poland)

In Central Europe, succession dynamics are unfolding within regulated sectors as well as consumer-facing brands. Olmed, a family-founded healthcare retailer in Poland, represents a mid-market example of second-generation leadership aligned with digital expansion. Under new leadership, the company has grown from approximately 70 million PLN in annual turnover to nearly 300 million PLN over several years.

Operating within EU and national pharmacy regulations, the business has combined compliance discipline with digital infrastructure development. Logistics integration, online platform optimisation and transparent product information have supported expansion without compromising regulatory standards. The case illustrates how generational transition in tightly supervised industries can coincide with accelerated scaling rather than operational drift.

Across these examples, succession is not a ceremonial event. It is a structural process. Whether gradual, strategic or transformative, the common thread is intentional design. Where leadership change is planned and authority clearly defined, generational transition can become a catalyst for renewal rather than a moment of instability.

Hoshino Resorts – Modernising Tradition (Japan)

Japan faces one of the most acute business succession challenges globally, with a large proportion of SMEs led by ageing founders. Hoshino Resorts offers an example of structured generational leadership within this broader context. Yoshiharu Hoshino took over the family hospitality business and transformed a collection of traditional inns into a modern, scalable hospitality brand.

The transition combined respect for heritage with disciplined expansion. Standardised operational models, brand segmentation and international growth were layered onto a legacy rooted in local hospitality culture. In a country where many family businesses close due to lack of successors, Hoshino illustrates how structured succession can unlock scale rather than simply preserve tradition.

The Overlooked Opportunity – Buying from a Boomer

While much of the conversation around succession focuses on family transition, an equally significant opportunity lies elsewhere. For ambitious managers, operators and would-be founders, the baby boomer exit represents a rare entry point into established businesses with existing revenue, teams and customers.

Not every founder has a willing heir. Many would prefer to see their company continue under responsible stewardship rather than close or be absorbed by a faceless consolidator. This creates space for structured transactions that are often more flexible than traditional acquisitions.

Vendor financing is one such model. Instead of requiring full upfront capital, the buyer agrees to pay the founder over time, often through staged payments funded by future cash flow. Earn-out structures can align incentives, tying part of the purchase price to performance targets. In some cases, the seller remains as an advisor or non-executive chair for a defined transition period, preserving institutional knowledge while allowing operational authority to shift.

For the buyer, this reduces the capital barrier to entry. For the seller, it can provide continuity, income stability and the reassurance that the business will not be dismantled immediately after sale. Structured correctly, succession without a family heir does not signal decline. It can mark the start of a new chapter under disciplined leadership.

In a business culture obsessed with start-up mythology, this route remains comparatively underexplored. Building from zero is not the only route into entrepreneurship. Acquiring a profitable, cash-generating firm from a retiring owner may, in many cases, offer a more resilient foundation. For a generation of operators seeking ownership without venture capital dependency, the boomer exit may represent one of the decade’s most overlooked strategic openings.

The Strategic Risk of Waiting Too Long

If a structured transition can unlock value, a delayed transition can quietly erode it.

Founder dependency is one of the most common structural vulnerabilities in privately held firms. When strategic decisions, client relationships and operational knowledge remain concentrated in a single individual, succession becomes harder with each passing year. Potential successors, whether family members or external buyers, inherit not only a business but a personality-centred system.

Valuations can also suffer when succession planning is deferred. Global surveys by PwC consistently show that family businesses without formal succession plans face higher valuation discounts and greater transition friction during ownership change. Buyers discount uncertainty. A business without clear governance, documented processes or a visible leadership pipeline will often command lower multiples than one with established management depth. What appears stable from the inside can look fragile from the outside.

Talent retention presents another risk. Senior managers may hesitate to commit long term if ownership transition is unclear. Ambitious employees may leave in anticipation of instability. Over time, operational discipline can weaken, particularly if the founder reduces day-to-day involvement without formally delegating authority.

In the worst cases, succession becomes reactive rather than planned. Health events, sudden retirement or external shocks can force rushed exits at suboptimal valuations. Waiting too long rarely preserves optionality. More often, it narrows it.

Preparing for a Controlled Handover

A controlled handover begins long before the founder steps aside. Effective succession is less about a ceremonial transfer of title and more about structural readiness.

First, timelines must be formalised. Even if retirement remains several years away, clarity around intended transition windows allows successors and management teams to prepare. Ambiguity breeds speculation; defined horizons create stability.

Second, ownership and governance should be separated where possible. Clear delineation between shareholder rights and executive authority reduces friction during leadership change. Advisory boards, non-executive directors or formalised reporting structures can introduce continuity beyond any single individual.

Third, financial and operational transparency matters. Clean accounts, documented processes and modernised systems increase both internal confidence and external valuation. Digital infrastructure, particularly in customer management, supply chain visibility and data reporting, reduces reliance on informal knowledge held only by the founder.

Finally, successors must be granted a genuine mandate. Whether family member, management team or external buyer, new leadership requires room to adapt strategy to contemporary market realities. Preservation of legacy should not preclude necessary innovation.

The baby boomer exit is not merely a demographic milestone. It is a strategic inflexion point. Managed deliberately, it can sustain jobs, preserve regional enterprises and create new ownership pathways. Managed passively, it risks dissolving decades of accumulated value. In the end, age is inevitable. Whether value survives the transition depends on whether succession is treated as a strategy early or ignored until circumstances dictate the terms.

-

Politics5 days ago

Politics5 days agoITV enters Gaza with IDF amid ongoing genocide

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Iris Top

-

Politics15 hours ago

Politics15 hours agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Tech3 days ago

Tech3 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat6 days ago

NewsBeat6 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

Sports4 days ago

The Vikings Need a Duck

-

NewsBeat3 days ago

NewsBeat3 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat6 days ago

NewsBeat6 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat2 days ago

NewsBeat2 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat3 days ago

NewsBeat3 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat3 days ago

NewsBeat3 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Entertainment2 days ago

Entertainment2 days agoBaby Gear Guide: Strollers, Car Seats

-

Business6 days ago

Business6 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Business5 days ago

Business5 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Tech5 days ago

Tech5 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

NewsBeat3 days ago

NewsBeat3 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics3 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

Crypto World5 days ago

Crypto World5 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

NewsBeat1 day ago

NewsBeat1 day agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech3 days ago

Tech3 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI