Business

Key Differences & Which Agreement You Need

Marriage is a romance, but legally, it is also a financial partnership. While no one anticipates separation, a prenuptial agreement acts as a crucial roadmap to protect your assets and save you stress down the line.

But if you have already exchanged vows, is it too late? Absolutely not.

Whether you are engaged or celebrating an anniversary, you can still secure your future. In this guide, we break down the critical differences between a prenup and a postnuptial agreement, analyze the costs, and help you decide which legal document is right for your relationship.

What is a Prenuptial Agreement?

A prenuptial agreement (commonly called a prenup) is a written contract created by two people before they are married. It lists all of the property each person owns (as well as any debts) and specifies what each person’s property rights will be after the marriage.

Think of it as financial insurance. You hope you never need to use it, but it offers peace of mind knowing it is there.

Who Needs a Prenup?

Contrary to popular belief, prenups aren’t just for the ultra-wealthy. You might benefit from one if:

- You own a business or real estate.

- You have children from a previous relationship.

- One partner has significantly more debt than the other.

- You anticipate a large inheritance.

Key Benefits:

- Asset Protection: Keeps separate property (like family heirlooms) distinct from marital assets.

- Debt Protection: Protects one spouse from the other’s pre-existing debt.

- Clarity: Reduces conflict during a divorce by pre-determining spousal support and division of assets.

Note:Note: A prenuptial agreement UK context differs slightly from the US. In the US, prenups are generally legally binding. In the UK, they are not strictly legally binding but are given “decisive weight” by courts if they are fair and procedural guidelines were followed. For more insights on evolving legal standards and business protections, staying informed on current case law is essential.

What is a Postnuptial Agreement?

A postnuptial agreement is functionally similar to a prenup, but it is signed after the couple is already married.

Why would a happily married couple want a contract? Often, a “postnup” is triggered by a change in financial circumstances or relationship dynamics. It allows couples to update their financial understanding without dissolving the marriage.

Common Triggers for a Postnup

- Inheritance: One spouse receives a large inheritance and wants to keep it separate.

- Business Growth: A spouse starts a business during the marriage and wants to ensure it remains their asset.

- Reconciliation: Following a period of separation or infidelity, a postnup can be used to rebuild trust by securing financial terms.

Prenup vs Postnup: Key Differences at a Glance

While both documents serve to clarify financial rights, their validity and reception in court can differ.

| Feature | Prenuptial Agreement | Postnuptial Agreement |

| Timing | Signed before marriage. | Signed during marriage. |

| Legal Scrutiny | Generally easier to enforce. | Often faces higher scrutiny by courts. |

| Fiduciary Duty | Partners are not yet spouses (less fiduciary duty). | Spouses have a fiduciary duty to each other (higher standard of fairness). |

| Primary Goal | Asset protection entering the marriage. | Updating financial terms or asset protection during marriage. |

The “Fiduciary” Factor

The biggest legal distinction often lies in the relationship status. When you sign a prenuptial agreement, you are not yet married. When you sign a postnup, you are spouses. In family law, spouses have a “fiduciary duty” to one another meaning they must act in each other’s best interest.

Because of this, courts often look at postnups with a more skeptical eye to ensure one spouse didn’t pressure or “unduly influence” the other into signing away their rights.

The Cost Factor: Prenuptial Agreement Cost vs Postnup

Money is often a taboo topic, but understanding the prenuptial agreement cost is essential for budgeting.

How Much Does a Prenup Cost?

The cost varies significantly based on location and complexity. And you can also have Free Prenup Consultation by Wenup.co.uk

- Average Range: £1,000 to £10,000 per couple.

- Why the variance? If you have complex assets (businesses, offshore accounts), lawyers need more hours to draft the terms.

- Two Lawyers Rule: For a prenup to be valid, both parties usually need their own independent legal representation. This means you are paying two attorney fees.

Is a Postnup More Expensive?

Often, yes. Because postnups require higher scrutiny and involve unravelling assets that may have already commingled (mixed together) during the marriage, the legal fees can be higher than a standard prenup.

Alternatives: Cohabitation and Relationship Agreements

Not everyone chooses to get married, but that doesn’t mean you shouldn’t protect your interests.

Cohabitation Agreement

If you live with a partner but aren’t married, the law generally treats you as strangers financially (unless you are in a common-law jurisdiction). A cohabitation agreement outlines who owns what, how bills are shared, and what happens to the house if you break up. This is vital for unmarried couples buying property together.

Relationship Agreement

Sometimes called a “lifestyle clause,” a relationship agreement focuses less on assets and more on expectations. These can cover anything from how often in-laws visit to division of household chores. While these are rarely legally binding in court, they can be excellent tools for communication.

Templates vs Lawyers: Can You DIY?

In the age of the internet, it is tempting to search for a prenuptial agreement template or a prenuptial agreement sample and write it yourself.

Is this a good idea? Generally, no.

While a template can give you an idea of what the document looks like, relying on a generic form for a binding legal contract is risky.

- State/Country Laws: A template found online may follow California law while you live in London or New York.

- Omitted Assets: A DIY form might miss critical clauses regarding future income or retirement benefits.

- Duress Claims: If a lawyer didn’t review it, a judge is more likely to throw it out during a divorce, rendering the document useless.

The Hybrid Approach: You can save money by using a prenuptial agreement sample to discuss terms with your partner before visiting a lawyer. This reduces the billable hours spent negotiating in the attorney’s office.

5 Steps to Creating a Fair Agreement:

Whether you choose a prenup or a postnup, the process for creating a valid agreement is similar.

- Full Financial Disclosure: You must list everything. Hiding assets is the fastest way to get an agreement voided in court.

- Start Early: Do not present a prenup the week before the wedding. This looks like coercion (duress). Ideally, sign it 30–60 days before the big day.

- Independent Counsel: Each partner must have their own lawyer.

- Fairness: The agreement cannot be “unconscionable” (grossly unfair) to one party.

- Sign and Notarize: Ensure all formalities are met according to local laws.

Conclusion:

Deciding between these agreements comes down to timing. If you are engaged, a prenuptial agreement is the gold standard for asset protection and establishing clear financial expectations. It is generally cheaper and stronger in court than the alternatives.

If you are already married, the door isn’t closed. A postnuptial agreement is a powerful tool to reset your financial boundaries and protect new assets or inheritances.

Marriage is a partnership, and like any successful partnership, it requires a clear operating agreement. Don’t view these documents as an anticipation of divorce, but as a foundation for a transparent, secure, and honest relationship.

Are you ready to secure your financial future? Start by gathering your financial documents and having an open, honest conversation with your partner today.

Frequently Asked Questions:

Can you write your own prenuptial agreement?

Technically, yes, you can draft your own agreement using a template. However, for it to be legally binding and hold up in court, it is highly recommended that both parties have it reviewed by separate attorneys. Self-written agreements are frequently overturned due to errors or lack of legal formalities.

Does a prenup override state law?

Yes, in most cases, a valid prenuptial agreement overrides the default state or country divorce laws regarding property division and spousal support. However, it cannot override laws regarding child custody or child support, which are determined based on the “best interests of the child” at the time of divorce.

Is a postnuptial agreement legally binding in the UK?

A postnuptial agreement (like a prenup) is not automatically legally binding in the UK in the same strict sense as a commercial contract. However, UK family courts increasingly uphold them if they are freely entered into, both parties had legal advice, and the terms are fair.

What voids a prenuptial agreement?

Common reasons a prenup is declared void include:

- Fraud: One party hid assets.

- Duress: One party was pressured to sign (e.g., presented with the paper hours before the wedding).

- No Legal Representation: One party did not have a lawyer.

- Unconscionability: The agreement leaves one spouse destitute while the other remains wealthy.

What is the difference between a cohabitation agreement and a prenup?

A prenuptial agreement is for couples planning to get married and becomes effective upon marriage. A cohabitation agreement is for unmarried couples living together and handles the division of shared assets if they separate, but it does not carry the same marital legal weight.

Business

Singaporeans embark on an overland journey from Dubai to Muscat to catch their flight home

Singaporeans leaving Dubai amid the Middle East crisis began their journey with a bus ride to Muscat, Oman, to catch the country’s first repatriation flight from the region, arriving at Changi on March 7. They shared their experiences of the transit and the challenges faced during this evacuation.

Briefing and Routine

The event started with a briefing, where about 80 people gathered, including couples, singles, older family members like uncles and aunts, mostly Singaporeans living in Dubai. The atmosphere was calm and organized, with refreshments provided on the bus. Participants appeared tired but prepared, as they were asked to arrive early at 6:30 a.m. after a light breakfast and a short briefing, everyone seemed to be ready for the day ahead.

Observations and Environment

The group noted that since the initial attack, the key areas affected in Dubai included landmarks such as Dubai Marina, Downtown Dubai, and the Burj Khalifa. Despite the unsettling circumstances, the weather was beautiful, and the overall atmosphere remained calm. The event’s organization was efficient, starting from the hotel to the transportation, which contributed to a sense of order amid uncertainty.

Personal Feelings and Safety

The individual expressed a sense of reassurance, feeling that the situation was under control due to the well-organized arrangements. While the times are unsettling and unprecedented for most, the experience so far has been smooth and professional. The general sentiment reflected confidence in the safety measures and the preparation involved in managing the events, providing a reassuring perspective during a tense period.

Other People are Reading

Business

Explainer-Who might succeed in Iran’s theocratic system of power?

Explainer-Who might succeed in Iran’s theocratic system of power?

Business

(VIDEO) iPhone 17 Pro Max vs iPhone 17e: Which One Is Better?

Apple’s flagship iPhone 17 Pro Max, released last September, now shares the spotlight with the newly unveiled iPhone 17e, a $599 budget model that brings many modern features to a lower price point while highlighting the stark contrasts in the company’s 2026 smartphone lineup.

The iPhone 17e, announced March 2 and set for release March 11, arrives as Apple’s most affordable current-generation device, starting at $599 for 256GB storage — double the base capacity of its predecessor, the iPhone 16e, at the same price. Preorders opened March 4, with the device available in black, white and a new soft pink finish.

In comparison, the iPhone 17 Pro Max starts at $1,199 for 256GB, positioning it as the premium large-screen option with top-tier performance, camera capabilities and battery life. The gap of $600 underscores Apple’s strategy of offering tiered choices: the entry-level 17e for cost-conscious buyers seeking solid everyday use, and the Pro Max for power users demanding the best hardware.

The iPhone 17e retains a familiar 6.1-inch Super Retina XDR OLED display with a notch for the TrueDepth camera system, rather than the Dynamic Island found on higher models. It features Ceramic Shield 2 front glass for 3x better scratch resistance than previous generations, an aluminum frame and IP68 dust and water resistance. The display runs at 60Hz without ProMotion adaptive refresh rates or Always-On capability.

Powering the 17e is Apple’s A19 chip with a 6-core CPU (2 performance, 4 efficiency cores) and a 4-core GPU, paired with 8GB of RAM. This setup delivers strong performance for daily tasks, gaming and Apple Intelligence features, though the GPU has one fewer core than the A19 in the standard iPhone 17. It includes Apple’s latest C1X cellular modem for faster connectivity, up to 2x improvement over the prior C1 in the 16e.

Camera-wise, the 17e sports a single 48MP Fusion main sensor that enables optical-quality 2x telephoto shots and captures 4K Dolby Vision video. It supports next-generation portraits and advanced computational photography like Photonic Engine, Deep Fusion and Smart HDR 5. The 12MP front camera handles selfies and video calls with features like Retina Flash.

Battery life benefits from efficient power management, though exact capacity remains around 4,000 mAh in estimates. New this year is MagSafe support for faster wireless charging and a vast accessory ecosystem, along with Qi2 compatibility — a significant upgrade from the 16e.

Satellite features, including Emergency SOS, Roadside Assistance, Messages and Find My via satellite, ensure connectivity in remote areas.

The iPhone 17 Pro Max, by contrast, targets enthusiasts with a larger 6.9-inch Super Retina XDR display featuring ProMotion up to 120Hz, Always-On display, peak brightness of 3,000 nits and Ceramic Shield 2 on both front and back for enhanced durability.

It runs on the more powerful A19 Pro chip with a superior GPU, 12GB of RAM and advanced thermal design including vapor chamber cooling for sustained performance during intensive tasks like video editing or gaming. Storage options extend to 2TB.

The Pro Max’s camera system stands out with three 48MP Fusion lenses: main, ultrawide and a new telephoto offering extended optical zoom (up to 8x equivalent in some configurations), macro capabilities and professional-grade video recording. It excels in low-light performance, computational photography and versatility.

Battery capacity approaches 5,088 mAh in reports, delivering what Apple calls the best life ever in an iPhone, aided by efficiency gains in iOS 26.

Design differences include a titanium frame on the Pro Max for premium feel and lighter weight relative to size, versus the aluminum on the 17e. The Pro Max measures roughly 6.43 x 3.07 x 0.34 inches and weighs 233 grams, while the 17e is more compact at about 5.78 x 2.82 x 0.31 inches and 169 grams.

Both run iOS 26 with full Apple Intelligence support, ensuring long-term software updates, privacy features and ecosystem integration.

Analysts see the 17e as a smart evolution for Apple’s budget segment. By adding MagSafe, doubling base storage and upgrading to the A19 chip without raising the price, it narrows the gap to mid-tier models like the $799 iPhone 17. Early reviews praise its value for users prioritizing battery, camera basics and modern connectivity over pro-level extras.

The Pro Max remains the choice for creators, photographers and those wanting maximum screen real estate and performance. Its larger form factor suits media consumption, multitasking and extended use.

As preorders ramp up for the 17e, Apple positions it as “feature stacked, value packed,” appealing to first-time iPhone buyers or those upgrading from older devices. The Pro Max continues to dominate premium sales, driven by its unmatched hardware.

The release highlights Apple’s segmented approach in 2026: accessible entry points like the 17e alongside flagship powerhouses, giving consumers clear trade-offs between price and capability in a competitive smartphone market.

Business

5 big analyst AI moves: Buy Samsung pullback, Nvidia back as top chip pick

5 big analyst AI moves: Buy Samsung pullback, Nvidia back as top chip pick

Business

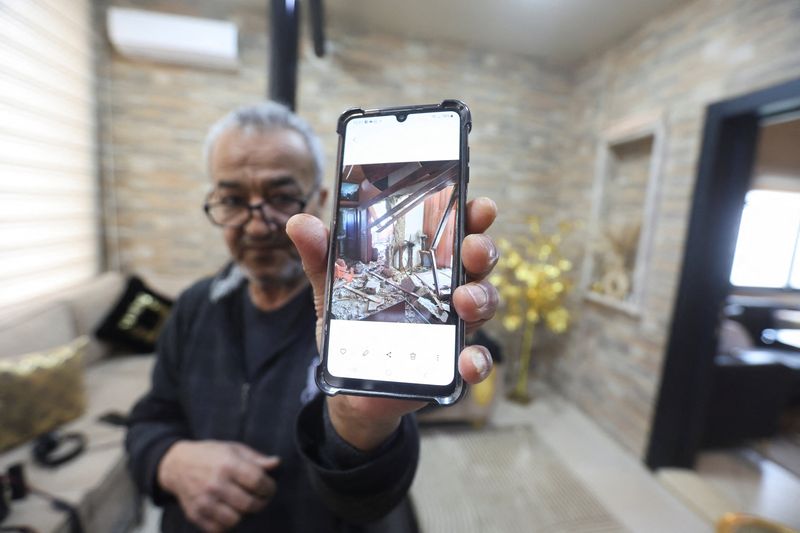

Lebanese man flees hometown, months after repairing home damaged in last war

Lebanese man flees hometown, months after repairing home damaged in last war

Business

Taiwan Premier’s ‘baseball diplomacy’ in Japan risks fresh China retaliation

Taiwan Premier’s ‘baseball diplomacy’ in Japan risks fresh China retaliation

Business

Trump praises Italy PM Meloni’s willingness to help in U.S.-Israel war with Iran

Trump praises Italy PM Meloni’s willingness to help in U.S.-Israel war with Iran

Business

Israeli military says it will pursue every successor of Iran’s Khamenei

Israeli military says it will pursue every successor of Iran’s Khamenei

Business

A Winning Blue-Chip Fund Flips the Script on the AI Trade

A Winning Blue-Chip Fund Flips the Script on the AI Trade

Business

Philippines and Thailand most vulnerable to oil-led inflation, Jefferies says

Philippines and Thailand most vulnerable to oil-led inflation, Jefferies says

-

Politics5 days ago

Politics5 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business2 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion2 days ago

Fashion2 days agoWeekend Open Thread: Ann Taylor

-

NewsBeat7 days ago

NewsBeat7 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech3 days ago

Tech3 days agoBitwarden adds support for passkey login on Windows 11

-

Sports3 days ago

Sports3 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Entertainment6 days ago

Entertainment6 days agoBaby Gear Guide: Strollers, Car Seats

-

NewsBeat6 days ago

NewsBeat6 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Sports14 hours ago

Sports14 hours agoThree share 2-shot lead entering final round in Hong Kong

-

Fashion7 days ago

Fashion7 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Video6 days ago

Video6 days agoHow to Build Finance Dashboards With AI in Minutes

-

Sports4 hours ago

Sports4 hours agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

NewsBeat6 days ago

NewsBeat6 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Business4 days ago

Business4 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World6 days ago

Crypto World6 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown

-

NewsBeat3 days ago

NewsBeat3 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Tech6 days ago

Tech6 days agoCynus Chess Robot: A Chess Board With A Robotic Arm

-

Video6 days ago

Video6 days agoLPP + Financial Maths + Numerical Applications | One Shot | Applied Maths | Target Board Exams 2026

-

NewsBeat6 days ago

NewsBeat6 days agoHandcuffed presenter Jonathan Ross’ sweet admission about marriage to wife of 38 years

-

Sports5 days ago

Sports5 days agoJack Grealish posts new injury update as Man City star enters crucial period