Business

LLP registrations cross 10,000 mark for first time in Jan

As many as 10,081 LLPs were incorporated in January, up 60% from a year before, showed the latest corporate affairs ministry data.

Similarly, the number of companies that got incorporated in January jumped almost 39% from a year before to 23,276, the data showed.

Strong outlook amid trade deals

The jump in incorporations is set to continue, as India’s latest trade deals with the US and the European Union, which promise zero duty or preferential access to a combined $53 trillion market when they take effect, have substantially boosted sentiments about the country’s external trade, said the official.

“Incorporations of companies and LLPs are significantly driven by sentiments as well. Until now, they were being driven mainly by strong domestic growth prospects,” he said, asking not to be named.

The trade deals would allay concerns over US tariffs, further cement the country’s medium-term growth prospects, bolster its both manufacturing and services trade outlook and encourage investors to set up units, he added.

The recent goods and services tax cuts, on top of the income tax relief from the current fiscal year, have also brightened consumption and growth potential, aiding new company and LLP registrations, he added.

REGISTRATIONS SPIKE

Between April and January this fiscal year, the number of LLPs that got incorporated scaled a new high of 76,696, representing a 41% year-on-year increase. Similarly, a record number of new companies—2,01,184 in total—got registered during this period, up 41% from a year before. The number of foreign companies incorporated in India jumped to 78 in the first ten months of this fiscal from just 45 a year earlier, the data showed.

Shankey Agrawal, partner at BMR Legal, said ease and affordability of starting a business have pushed up company incorporations. Moreover, due to the “deregulation and decriminalisation of minor corporate defaults, compliance costs and the fear of penalties have diminished”, he said.

This is leading to improved business confidence and fuelling the trend of formalisation of businesses, Agrawal added. “Optimism surrounding consumption prospects, spurred by measures like GST cuts, etc., have also encouraged entrepreneurs to set up new ventures,” said Tahira Karanjawala, partner at law firm Karanjawala & Co. The country’s large pool of talented and cost-effective workforce has boosted company incorporations. The International Monetary Fund last month raised its fiscal 2026 growth projection for India to 7.3% from 6.6%. The Fund expects the country to remain the world’s fastest-growing major economy at least for the next two years.

Business

Green light, more time for expanded $66m Mid West hydrogen plant

A bid to triple the size of a $66 million hydrogen facility proposed for the Shire of Coorow has been unanimously approved by the Regional Development Assessment Panel.

Business

Walmart Inc. (WMT) Presents at Morgan Stanley Technology, Media & Telecom Conference 2026 Transcript

Simeon Gutman

Morgan Stanley, Research Division

Okay. Hello. Thank you. Welcome, everybody. I’m Simeon Gutman, Morgan Stanley’s hardline, broadline food retail analyst. My pleasure to welcome Daniel Danker, EVP, AI Acceleration and Product Design from Walmart, most recently with Instacart as Chief Product Officer in Online Grocery. Thank you, Walmart, for being here third year in a row, and it probably took 3 years to be annointed as a tech company.

I recently — one introduction for Daniel before we get into this, I was talking with Doug about 2 months ago as an outgoing conversation. We talked about some of his hardest decisions, and we asked — I asked him about one of his best decisions. I didn’t know Daniel yet, but he mentioned it was hiring Daniel as someone at the enterprise level who can help advance AI. So high expectations, sorry about that.

Business

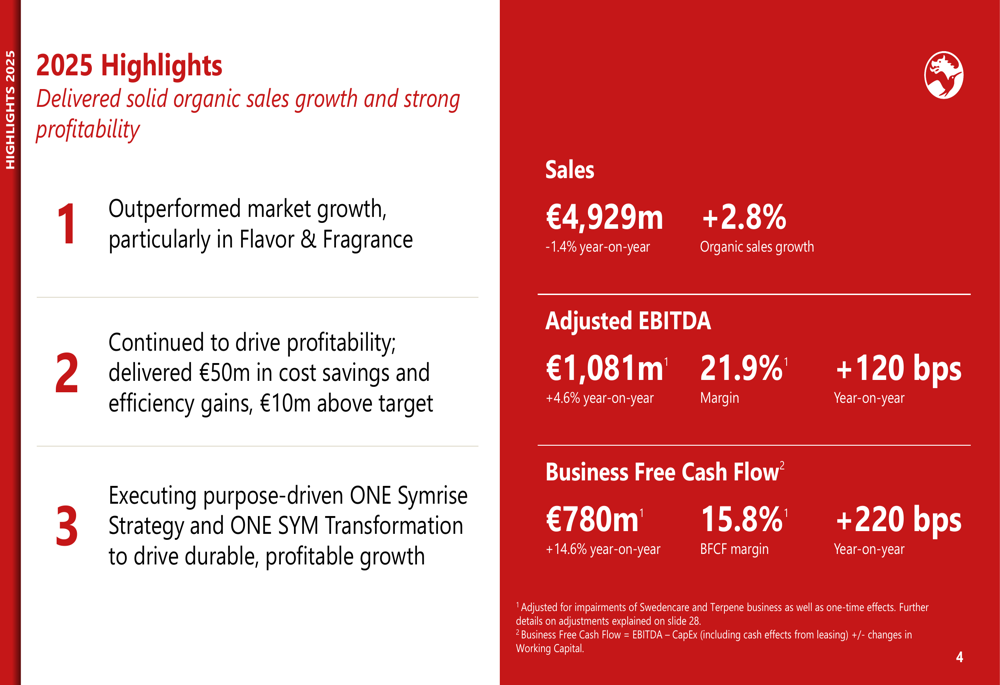

Symrise 2025 presentation: record cash flow, inaugural buyback unveiled

Symrise 2025 presentation: record cash flow, inaugural buyback unveiled

Business

Boss maintains guidance despite impact

Boss Energy managing director Matthew Dusci has reaffirmed the company’s FY26 annual production guidance at its flagship Honeymoon project in South Australia.

Business

Built on Grit, Leading with Purpose

What does steady leadership really look like?

For Jayson Baker, it starts with hard work, tough decisions, and a clear focus on people. His career in education spans classrooms, coaching courts, principal offices, and state-level consulting. Along the way, he built a reputation for integrity, growth, and measurable impact.

He does not chase titles. He chases progress.

“For me, success is making a positive impact, moving with integrity, and working toward continual personal and professional growth.”

That mindset has shaped every stage of his journey.

Early Life and Work Ethic

Jayson grew up in Belleville and Freeburg, Illinois. His roots were humble.

His mom, Sandee, was a hair stylist. His dad, Joe, worked as a carpenter and an X-ray technician. Hard work was normal in his home.

He stood out early. He won young authors awards several times. He placed second in a spelling bee in second grade. He won a poetry contest in third grade. In sixth grade, he was student council president. In eighth grade, he was voted funniest in his class.

Leadership and communication came naturally.

But what mattered most was what he learned at home.

“My biggest influences were my parents because they taught me that hard work pays off.”

That lesson would carry him through every transition in his career.

Education and Foundation in Teaching

Jayson graduated from Freeburg Community High School in 2002.

He earned a bachelor’s degree in early childhood education from Southeast Missouri State University in 2006. While there, he joined Kappa Delta Pi, the national honor society for educators.

He later completed a master’s degree in educational administration from Southern Illinois University Edwardsville in 2011.

His early focus was simple: understand how students learn.

As a teacher, he conducted action research in his own classroom. He tested strategies. He studied how the brain processes information. He challenged his own assumptions.

“Realizing that there are more effective ways to teach than what I experienced as a student was difficult to wrap my head around.”

That moment changed him.

“Stepping out of my comfort zone and teaching with the brain in mind ended up being the biggest success I could ask for. My success is the success of the students and educators whose lives I touched.”

This was not theory. It was practice.

From Teacher to Principal and Leadership Coach

Jayson began as a teacher, coach, and grant program director. He later served as a principal and athletic director. Over time, he also worked as an instructional coach and consultant at the state level.

Each move followed the same pattern. Learn. Improve. Lead.

He believes leadership requires more than authority.

“You need to have an understanding of how schools and businesses work, know how the brain works to learn, have courage to advocate for vulnerable and marginalized people, possess a heart that genuinely cares about people, and have the interpersonal and communication skills to inspire and motivate.”

That philosophy shaped how he made decisions.

Leadership is not always popular. Some calls upset people. Some changes create friction.

“Making difficult decisions can be challenging, especially if your decision is not popular. I overcome obstacles by measuring my decisions against what is best for those under my charge.”

That approach builds trust over time.

Grant Writing and Measurable Impact

One of his most concrete achievements was writing and securing a $500,000 grant from the Department of Defense.

That did not happen by chance.

It required research. Data. Planning. Clear outcomes.

It also reflected how he thinks about growth.

“I imagine myself in successful situations and plan out realistic, specific steps to take towards achieving my goals. I measure my success toward long-term goals by hitting milestones in my short-term goals along the way.”

He compares it to taking baby steps instead of one giant leap.

This structured thinking has defined his leadership style. Set a vision. Break it down. Execute.

Leadership Development and Professional Growth

Today, Jayson is known for his focus on leadership development and professional development.

He studies growth. He practices reflection. He leans on discipline.

“I consider myself to be a lifelong learner and teacher, so I make sure I continue to learn something every day.”

He relies on routine. He relies on support.

“I rely on my strong support system in my family for counsel, practice daily reflection, and use prayer to keep me on the right track.”

He also reframes failure.

“Learning is all about the journey. Of course the outcome is important, but the real learning takes place on the road to results.”

Data matters. Feedback matters. But mindset matters more.

Balancing Leadership and Life

Leadership can consume time and energy. Jayson sees it differently.

“When you enter the world of leadership, it is less about trying to strike a balance and more about being fit in the many roles you have.”

He focuses on being a fit father. A fit husband. A fit leader.

He knows there are only so many minutes in a day. So he prioritizes intentionally.

That discipline has defined his career.

From a young student winning writing contests to a principal leading teams and securing major grants, Jayson Baker has built a steady track record.

He does not frame his story around status. He frames it around impact.

And in education, impact is the only metric that truly lasts.

Business

Currencies take a beat as dollar rally pauses

Investors were quick to take comfort in a report that Iran intelligence operatives signalled openness to talks with the CIA to end the war despite Tehran’s subsequent denial, underscoring the fraught sentiment towards a conflict that has lashed global markets.

The dollar further eased from an over three-month high hit earlier this week and stood at 98.78 against a basket of currencies.

The euro was meanwhile up marginally at $1.1636, having slid to a more than three-month low on Tuesday, while sterling steadied at $1.3366.

“I wouldn’t say it was particularly good news, because Iran came out and kind of dismissed the report, and it is still clearly uncertain how long the war would drag on and the impact of it, but markets have certainly taken a relatively sanguine view,” said Carol Kong, a currency strategist at Commonwealth Bank of Australia.

She added that sentiment was also helped by upbeat U.S. economic data released on Wednesday which showed that services sector activity surged to more than a 3-1/2-year high in February as businesses rebuilt inventories in anticipation of strong demand.

Still, the dollar held to its gain of over 1% for the week thus far, emerging as one of a handful of winners in a volatile few sessions that have dragged stocks, bonds and, at times, even safe-haven precious metals lower. The spike in energy prices from the fallout of the Middle East war has stoked fears of a resurgence in inflation that could derail the rate outlooks for major central banks.

“Markets have largely traded the Middle East war as an inflation risk,” said Bas van Geffen, senior macro strategist at Rabobank.

“In the case of the (Federal Reserve) and Bank of England that means fewer rate cuts are being priced, but EUR money markets are now pricing in around 40% odds that the (European Central Bank) may have to hike rates before the end of the year.”

The yen similarly found some support on Thursday from a weaker greenback and rose 0.2% to 156.78 per dollar.

The Australian dollar was up 0.14% at $0.7085, extending its 0.57% gain from the previous session, while the New Zealand dollar was little changed at $0.5942.

Despite typically being a risk-sensitive currency, the Aussie has benefitted from a rare safe-haven bid this week as the country’s energy abundance offset the impact of rising oil prices.

Elsewhere, the offshore yuan was up 0.12% at 6.8860 per dollar, ahead of the onshore open.

China set its economic growth target for 2026 at 4.5%-5%, a slight downgrade from the 5% pace achieved last year, which leaves room for greater, albeit not decisive, efforts to curb industrial overcapacity and rebalance the economy.

Bitcoin and ether fell about 1% each, having rallied strongly overnight as risk appetite improved.

Business

(VIDEO) BTS Unveils ‘ARIRANG’ Tracklist With Title Track ‘SWIM’ Ahead of Highly Anticipated March 20 Comeback

SEOUL, South Korea — Global K-pop superstars BTS revealed the full 14-track lineup for their upcoming fifth studio album “ARIRANG” on Tuesday, with “SWIM” confirmed as the lead single, igniting excitement among millions of fans worldwide for the group’s first full-group release following the completion of mandatory military service.

Big Hit Music, the band’s agency, shared the official tracklist via BTS’s social media channels and platforms like Weverse and Spotify. The album, set for worldwide release on March 20, 2026, at 2 p.m. KST (1 a.m. EST), draws its name from “Arirang,” the iconic Korean folk song symbolizing longing, resilience, and national identity. Band members RM, Jin, SUGA, j-hope, Jimin, V, and Jung Kook have infused the project with personal reflections on their 12-year journey since debuting in 2013.

“ARIRANG” opens with “Body to Body,” setting an energetic tone, followed by “Hooligan,” “Aliens,” “FYA,” and “2.0.” An interlude titled “No. 29” bridges to the title track “SWIM” in the seventh position. The second half features “Merry Go Round,” “NORMAL,” “Like Animals,” “they don’t know ’bout us,” “One More Night,” “Please,” and closes with the anthemic “Into the Sun.”

“SWIM,” produced by Tyler Spry and Leclair, is described as an upbeat alternative pop track conveying perseverance amid life’s challenges. Lyrics, led by RM with contributions from James Essien, Sean Foreman, Jamison Baken, Ryan Tedder, Kirsten Allyssa Spencer, Derrick Milano, and Pdogg, emphasize moving forward “through the turbulent waves of life” at one’s own pace — a metaphor for resilience and self-love. The song’s message aligns with BTS’s post-hiatus narrative of growth and determination after individual military duties.

The album boasts collaborations with prominent international producers, including Mike WiLL Made-It, El Guincho, Ryan Tedder, Diplo, Kevin Parker (Tame Impala), and others, blending BTS’s signature sound with fresh global influences. Member songwriting credits appear across tracks, with V, Jung Kook, and Jimin noted for contributions alongside RM’s prominent role on “SWIM.”

Fans, known as ARMY, reacted swiftly online, praising the eclectic titles and thematic depth. Social media buzz highlighted “Body to Body” for its sensual vibe, “they don’t know ’bout us” for potential swagger, and “Into the Sun” as a powerful closer. The interlude “No. 29” sparked personal connections, with some fans noting coincidences with birthdays or meaningful dates.

The announcement follows teasers since early 2026, including group lives and hints of a world tour. To mark the release, BTS will stage “BTS THE COMEBACK LIVE | ARIRANG,” a free performance in Seoul’s Gwanghwamun Square on March 21, featuring new songs including “SWIM.” The event will stream exclusively on Netflix, allowing global access.

“ARIRANG” represents BTS’s triumphant return as a full septet after hiatus. Jin completed service first in 2024, followed by others through late 2025. The album captures their evolution, blending tradition with innovation while addressing identity, growth, and forward momentum.

Pre-orders opened in January, with digital and physical versions available. The project arrives amid K-pop’s competitive landscape, but BTS’s influence remains unmatched, with billions of streams and a dedicated fanbase.

Analysts anticipate strong chart performance, potentially debuting at No. 1 on Billboard 200 and topping global charts. The title track “SWIM” is expected to dominate streaming and social media trends upon release.

As March 20 approaches, anticipation builds for what promises to be a landmark chapter in BTS’s career — a celebration of roots, resilience, and reinvention.

Business

China signals tolerance for slower growth with 4.5%-5% target for 2026

China signals tolerance for slower growth with 4.5%-5% target for 2026

Business

Large baker innovating to meet needs of GLP-1 users

Grupo Bimbo CEO describes four related initiatives underway.

Business

US Stock Market | US stocks close up on Iran diplomacy hopes; tech leads rebound

Investors flocked again to tech shares, lifting the Nasdaq and keeping the tech-heavy index in positive territory since the U.S.-Israeli strike on Iran that ignited the conflict in the Middle East. The S&P 500 remained close to its all-time closing high, in January. A New York Times report said Iranian intelligence operatives indirectly reached out to the CIA a day after the attacks, but U.S. officials remain skeptical that either the Trump administration or Iran is prepared for a near-term de-escalation. Trump’s announcements of a U.S. naval escort for oil tankers through the Strait of Hormuz and political risk insurance also brought some relief.

The White House announcement reduced fears of major disruptions in the oil market which could lift energy prices and pressure inflation, said Jim Awad, senior managing director at Clearstead Advisors LLC in New York. The relief gave investors confidence to scoop up tech-related stocks that sold off heavily in February and were cheap compared with weeks ago, he said.

“That combination is giving the market some optimism, which will be tested over coming weeks,” Awad said. “It is time to be realistic and not get carried away, either too bullishly or too bearishly.”

According to preliminary data, the S&P 500 gained 52.83 points, or 0.78%, to end at 6,869.46 points, while the Nasdaq Composite gained 290.79 points, or 1.29%, to 22,807.48. The Dow Jones Industrial Average rose 228.86 points, or 0.49%, to 48,738.98.

The prospect of the war spurring additional inflation is one of the main reasons for market volatility on the horizon, said Richard Bernstein, chief executive officer of Richard Bernstein Advisors.

“If people think the war will be short-lived or ‘not an issue’ for the U.S. economy, then the stock market will likely rally,” he said. “The opposite seems true too. Long-lived and impacting the U.S. economy could mean more volatility.” The energy sector led declines on the S&P 500 as stocks that had climbed in recent days on rising oil-price fears reversed course.

Several Middle Eastern countries have temporarily halted oil and gas production and the U.S. was looking to expand its campaign inside Iran. Oil prices settled unchanged on Wednesday at the end of a volatile trading session. Brent crude settled at $81.40 per barrel, flat to Tuesday’s close and at its highest level since January 2025.

-

Politics6 days ago

Politics6 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics2 days ago

Politics2 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Iris Top

-

Tech4 days ago

Tech4 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports5 days ago

The Vikings Need a Duck

-

NewsBeat4 days ago

NewsBeat4 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat4 days ago

NewsBeat4 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Entertainment3 days ago

Entertainment3 days agoBaby Gear Guide: Strollers, Car Seats

-

Business7 days ago

Business7 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Tech6 days ago

Tech6 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Business6 days ago

Business6 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

NewsBeat4 days ago

NewsBeat4 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics4 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

Crypto World6 days ago

Crypto World6 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

NewsBeat3 days ago

NewsBeat3 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech4 days ago

Tech4 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Business6 days ago

Business6 days agoWorld Economic Forum boss Borge Brende quits after review of Jeffrey Epstein links

-

Video7 days ago

Video7 days agoXii English top Selected mcq “Money Madness” Board Exam 2026, #chseodisha #hksir #mychseclass