Business

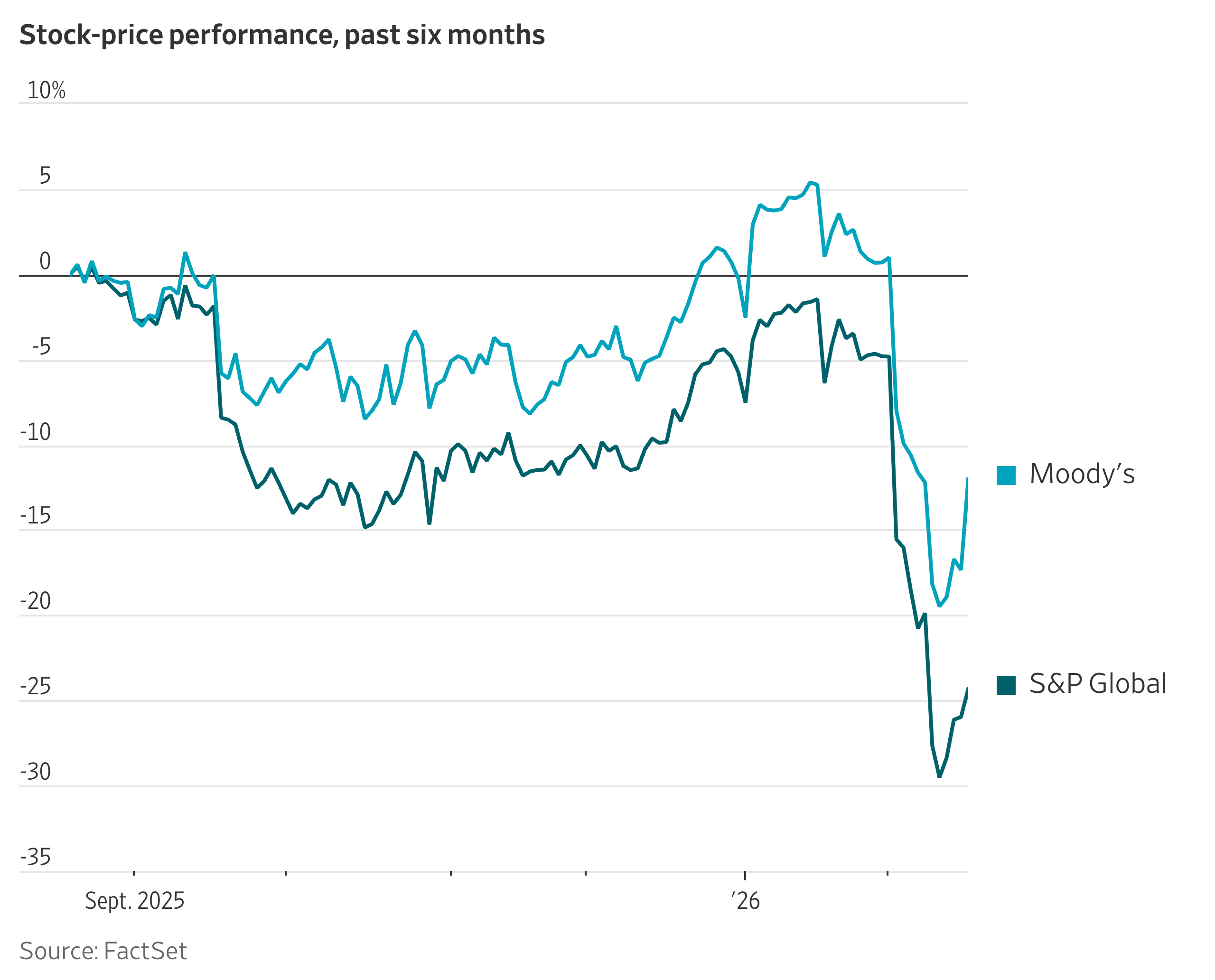

Moody’s Rebuts Concerns About AI Disruption; Stock Rallies

“Our data can’t be synthesized from public sources,” Moody’s Chief Executive Rob Fauber said on an investor call Wednesday.

Fauber fielded questions from analysts about the moats protecting Moody’s businesses. He said the data Moody’s had collected over many years was “both AI-enabling and AI resilient.”

Business

Making bread: Tip Top unveils new facility

Western Australians will have more access to Tip Top white sliced bread after the company behind it, Tip Top Bakeries, opened a $130 million state-of-the-art bakery line in Canning Vale.

Business

How AI is Driving Profitable Growth in Southeast Asia

Southeast Asia’s digital economy is experiencing remarkable growth, reaching $11 billion in profitability, a 2.5x increase since 2022.

This dynamism is largely driven by artificial intelligence (AI). The region benefits from a young, digitally-native population eager to adopt AI, strong government support for AI frameworks and R&D investment, and a vibrant ecosystem of innovative startups.

Strategic investments in Generative AI, talent development, AI infrastructure, and a supportive policy environment are crucial for Southeast Asia to become a global AI leader, driving economic transformation and societal progress.

Key Points

- The regional digital economy has achieved a 10x increase in revenue since 2016, with profitability rising from $4 billion in 2022 to $11 billion in 2024.

- Southeast Asia’s population shows a high level of AI readiness, with Singapore, the Philippines, and Malaysia ranking among the top countries globally for AI-related interest and searches.

- Significant capital is flowing into the region, with over $30 billion committed in the first half of 2024 alone to build AI-ready data centers across Malaysia, Thailand, and Singapore.

- Generative AI (GenAI) is delivering rapid commercial value; 70% of regional organizations report a positive return on investment within 12 months of implementation.

- Sector-specific benefits of AI are already visible, including personalized e-commerce recommendations, enhanced travel tools, and accelerated mobile game development.

Southeast Asian organizations are achieving a positive return on investment (ROI) on Generative AI (GenAI) workflows significantly faster than other regions—with 70% reporting positive ROI within 12 months.

The specific regional characteristics that allow for this accelerated success include:

- A Digitally Native and Receptive Population: The region is home to a young, digitally native population that is quick to embrace AI-powered solutions. There is a high volume of AI-related interest, with countries like Singapore, the Philippines, and Malaysia ranking among the top globally for AI-related searches. Crucially, the document notes a regional culture of “acceptance and exploration,” where there is greater interest in the benefits of AI than apprehension regarding its risks.

- Proactive Government Support and Flexible Regulation: Southeast Asian governments are actively fostering AI adoption through:

- National AI Frameworks: Developing clear strategic directions for AI.

- Regulatory Sandboxes: Implementing environments that allow for experimentation and innovation without the constraints of traditional regulation.

- Increased R&D Funding: Directing capital toward research and development.

- Massive Infrastructure Investment: The region is rapidly building the physical foundations necessary for AI. In the first half of 2024 alone, over US$30 billion was committed to building AI-ready data centers in Singapore, Thailand, and Malaysia. This influx of capital facilitates accelerated computing and AI services, which are essential for moving projects from idea to production quickly.

- A Vibrant Ecosystem of Innovators: There is a strong spirit of innovation across both startups and established sectors:

- Startups: Companies like Lytehouse AI, DiMuto, and CarbonSync are applying AI to diverse challenges in security, agriculture, and sustainability.

- Gaming Industry: The region accounts for 12% of all global mobile game downloads, demonstrating a level of technical prowess and creative energy that allows these organizations to use GenAI to lower development costs and expand libraries rapidly.

Generative AI: Transforming Industries and Unlocking New Value

Generative AI (GenAI), capable of producing innovative content and automating intricate tasks, is already showcasing its transformative potential to revolutionize industries and deliver measurable value across the region.

In e-commerce, GenAI powers personalized product recommendations, driving increased customer engagement, higher gross merchandise value (GMV) and larger basket sizes. The travel sector is also benefiting from AI-powered tools that enhance customer satisfaction and drive revenue growth. Similarly, the gaming industry is using GenAI to accelerate game development and build larger game libraries at lower costs, ultimately contributing to increased GMV.

Beyond these specific sectors, artificial intelligence is enhancing broader business functions across all industries. What’s truly remarkable is the speed at which companies in Southeast Asia are realizing value from GenAI.

The report revealed that most organizations can move from an initial idea to production within six months. Impressively, 7 out of 10 organizations in Southeast Asia report a positive return on investment (ROI) attributable to GenAI workflows within 12 months of implementation

Other People are Reading

Business

Form 144 MCKESSON CORP For: 20 February

Form 144 MCKESSON CORP For: 20 February

Business

Aussie shares edge lower after record-breaking week

Australia’s share market has clutched its highest Friday close, as earnings season continues to deliver encouraging results for its large caps.

Business

G Shahid Ur Rehman Drives a New Era of Sustainable and Luxury Intercity Travel in South India

(South India) — The intercity transportation sector in South India is witnessing significant evolution over the past three decades, driven in large measure by the leadership of G Shahid Ur Rehman, the man behind Geepee Travels. Assuming responsibility at a notably young age, he transformed a traditional bus operation into a technologically advanced, customer-centric mobility brand serving thousands of passengers across the region.

Today, the company stands as a benchmark for ultra-luxury, sustainable, safe, and affordable intercity bus travel. It is an achievement shaped by foresight, resilience, and disciplined execution.

Early Leadership and Strategic Transformation

From the beginning of his journey, G Shahid Ur Rehman demonstrated a rare blend of entrepreneurial instinct and operational expertise. Taking charge early in life, he carried out both the responsibilities and complexities of leadership. Under his direction, the organization evolved from a conventional intercity transport operator into a modern mobility enterprise defined by service excellence and operational innovation.

Elevating Passenger Experience with Ultra-Luxury Standards

At a time when affordability and comfort were seen as mutually exclusive, he introduced ultra-luxury coach services. Their primary goal was to redefine passenger expectations. Plush seating, enhanced legroom, refined interiors, superior ride quality, and modern onboard amenities became defining characteristics of the fleet.

These enhancements established new benchmarks within the South Indian intercity bus sector, reinforcing the company’s commitment to accessible premium travel.

Commitment to Safety and Sustainability

Luxury and innovation were complemented by a strong focus on safety and environmental responsibility. Recognizing the growing need for sustainable mobility solutions, Rehman spearheaded initiatives to incorporate fuel-efficient and lower-emission vehicles, integrate advanced safety systems, and enforce rigorous maintenance standards.

By aligning premium services with responsible operations, he demonstrated that sustainability, safety, and affordability can coexist within a single business model.

Leading from the Front

A defining feature of his leadership philosophy is active involvement. Rather than managing from a distance, he remains closely engaged in fleet oversight, service quality, customer experience strategies, and technology implementation. This hands-on approach has fostered a culture of accountability, discipline, and continuous improvement across the organization.

Early Adoption of Digital Transformation

Long before digital transformation became a core industry imperative, G Shahid Ur Rehman recognized its disruptive potential. Through collaborations with aggregators and technology partners, Geepee Travels implemented digital booking platforms, real-time vehicle tracking, automated scheduling systems, and data-driven operational insights.

Online reservations, mobile ticketing, transparent fare structures, and streamlined communication channels significantly enhanced passenger convenience while improving operational efficiency. These forward-looking initiatives ensured that the company remained ahead of evolving market demands.

Navigating Industry Challenges with Resilience

For over thirty years of leadership, he has successfully navigated economic cycles, regulatory reforms, industry disruptions, and shifting consumer expectations. His ability to anticipate change and respond with agility is what is instrumental in sustaining growth and maintaining customer trust during challenging periods.

Affordability has remained central to the company’s philosophy. While many operators positioned themselves exclusively within either budget or premium segments, he adopted a balanced strategy of delivering high-end amenities at competitive pricing. This democratization of luxury expanded access to quality intercity transportation across diverse passenger segments.

Industry Influence and Future Outlook

Industry observers acknowledge that his contributions extend beyond Geepee Travels. By elevating service standards and prioritizing technological integration, he has influenced broader operational benchmarks within the South Indian intercity bus ecosystem.

Looking ahead, he envisions a future shaped by expanded sustainable fleet solutions, deeper technological integration, enhanced passenger analytics, and strategic partnerships designed to strengthen connectivity and operational efficiency. His continued emphasis on green mobility and customer-centric innovation positions the organization for its next phase of growth.

Leadership Beyond Business

Beyond his professional accomplishments, G Shahid Ur Rehman is known as a dedicated wildlife enthusiast and avid cricket follower. Drawing inspiration from nature’s balance and the discipline of sport, he integrates patience, strategic thinking, and long-term vision into his leadership approach.

About Geepee Travels

Geepee Travels is a leading intercity bus operator in South India, recognized for its ultra-luxury fleet, technology-driven operations, and commitment to safe, sustainable, and affordable passenger transportation. Under the leadership of G Shahid Ur Rehman, the company continues to set new benchmarks in regional mobility and customer experience.

Disclaimer –

This article is a work of original content created for public relations and informational purposes only. It may be published across multiple digital platforms with the full knowledge and consent of the author/publisher. All images, logos, and referenced names are the property of their respective owners and used here solely for illustrative or informational purposes. Unauthorized reproduction, distribution, or modification of this article without prior written permission from the original publisher is strictly prohibited. Any resemblance to other content is purely coincidental or used under fair use policy with proper attribution.

Business

Broadcom Stock: AI Capex Panic Is Your Opportunity (NASDAQ:AVGO)

I am a fundamental investor and writer who specializes in forensic analysis of company financials. My research blends deep financial-statement work with industry context to identify both overlooked winners and trends in development. I want the story behind the numbers, not just talking points. My primary sector focus is technology and large caps, and I also cover select consumer and industrial names where market trends create opportunity. My investing approach is long-term and evidence-driven: I prioritize cash-flow sustainability, conservative balance-sheet analysis, and buying with a margin of safety. I bring professional experience in financial advice and formal education in accounting to my research. I write on Seeking Alpha to translate my research into readable, actionable insight so readers can make better, risk-aware decisions. Follow for high-conviction idea write-ups.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

US trade deficit in goods reaches record high with Thailand, Vietnam, and Taiwan

The United States trade deficit in goods reached an all-time record of $1.24 trillion in 2025, driven by a surge in imports that outpaced export growth despite the imposition of heavy tariffs.

While the widening trade gap contributed to a downward revision of fourth-quarter GDP growth estimates, the high volume of capital goods imports—particularly those related to artificial intelligence and data center infrastructure—indicates sustained business investment.

Key Points

- The U.S. goods trade deficit hit a historic high of $1.24 trillion in 2025, with the December trade gap widening 32.6% to $70.3 billion, far exceeding economist forecasts.

- Record-breaking goods trade deficits were recorded with several nations, including Mexico, Vietnam, Taiwan, Ireland, Thailand, and India.

- In contrast to the global trend, the goods trade deficit with China narrowed significantly, falling to $202.1 billion from $295.5 billion the previous year.

- Import growth was driven primarily by capital goods such as computers, telecommunications equipment, and computer accessories, largely fueled by the construction of data centers to support artificial intelligence.

- Despite protectionist trade policies, U.S. manufacturing did not see a resurgence; factory employment decreased by 83,000 jobs between January 2025 and January 2026.

The larger-than-expected trade deficit prompted the Atlanta Federal Reserve to lower its fourth-quarter GDP growth estimate from a 3.6% to a 3.0% annualized rate. While the labor market remains relatively stable, economists noted that hiring has become sluggish due to tariff-related uncertainty and the impact of artificial intelligence.

Ultimately, the data suggests that the aggressive tariff policies failed to reduce overall trade imbalances or spark a manufacturing renaissance, as evidenced by declining factory employment and record deficits with multiple trading partners.

Furthermore, these policies led to increased costs for consumers and businesses, as tariffs raised the prices of imported goods and materials. Many industries reliant on global supply chains faced disruptions, further hampering their competitiveness in international markets. Instead of fostering economic growth, the measures appeared to exacerbate tensions with key trading partners, resulting in retaliatory tariffs that compounded the challenges for exporters.

Other People are Reading

Business

Asos co-founder dies after Thailand balcony fall

Quentin Griffiths co-founded Asos in 2000 and remained a significant shareholder after leaving the firm five years later.

Business

Garmin Stock Is Surging. There’s More to Its Move Than Solid Earnings.

Garmin Stock Is Surging. There’s More to Its Move Than Solid Earnings.

Business

Closing factory workers paid to help at food bank

Dutch coffee-making giant Jacobs Douwe Egberts (JDE) will close its plant in Banbury this year.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 hours ago

Video6 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Video7 days ago

Video7 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports1 day ago

Sports1 day agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Crypto World7 days ago

Crypto World7 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Entertainment1 day ago

Entertainment1 day agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World11 hours ago

Crypto World11 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market