Business

North Korea’s Kim opens 9th Party Congress citing economic achievements

Business

Brokerage that nailed gold, silver bull run targets fresh record highs

Samco’s 3-year target for gold is $7,040 while silver can trade anywhere between $140-210.

Edited excerpts from a chat with the market expert on why the gold and silver bull run isn’t over yet:

Samco was among the first to have given bullish calls on silver which has played out very well. Do you think the white metal has topped out and won’t go back above the $100-mark anytime soon?

We were the first ones to call out a bull market in silver back when it was trading around $23/troy ounce. Silver still remains a high conviction idea with a bullish outlook for the long term. The fundamentals of the silver market which drove the prices from $23 to $121 haven’t changed much. Silver is entering its sixth consecutive year of structural deficit due to inelastic by-product supply and surging demand from solar energy and electric vehicles.

Despite the sharp correction, silver is still outperforming gold. China has classified silver as a strategic asset, restricting exports and driving Shanghai physical premiums to record highs. Silver prices in Shanghai are still quoting at a premium of around $91 compared to $75 in the US. We believe that recent price dips are strategic buying opportunities for a secular bull market that has not yet peaked.

One view in the market is that gold will outperform silver in 2026 and that appears to be playing out as well. What do you think?

The gold to silver ratio had dipped to a low of 43 in January 2026. Over the last 12 years the level of 65 has acted as strong support for the ratio. A falling ratio means gold is underperforming silver and vice versa. Over the last 6 months silver was playing catch up with gold as it was massively undervalued compared to gold which was also one of the reasons for being bullish on silver. Now that silver has caught up and probably even went slightly ahead in terms of outperformance, we are seeing a role reversal and gold will take leadership while silver consolidates.Any targets that you have for both gold and silver?

Ever since gold broke out above the sideways consolidation in December 2023 we have been talking of these three levels – 2,608, 3335, 4750. These are Fibonacci projections drawn from September 2011 peak to December 2015 bottom in gold. The next extension level that comes after this is $7,040. This is a 3-year target that we are holding for gold. Silver normally trades at 2-3% the price of gold in precious metals bull run. So if gold trades at $7,040 then silver could trade anywhere between $140-210 in the same period.

For many investors, asset allocation is going for a toss as equity is struggling and bullion is leading to FOMO. Would you go on the extent of recommending a 50:50 allocation to precious metals and equity for someone who is moderately aggressive but has a 4-5 year horizon?

It cannot happen that you give a 50:50 allocation to equities and gold once and forget about it for the next 4-5 years. Asset allocation will have to be much more dynamic and tactical depending on the macro developments and the investor’s own risk profile. So for someone with an appetite for risk the allocation goes as high as 50% but it may not be suitable for everyone.

If the de-dollarisation theory, linked to rising US debt level, plays out, then we could be seeing a multi-year bull run in gold. What are the odds of that happening from a macro perspective?

US debt currently stands at $39 trillion. According to certain projections, the US is going to add $2.4 trillion in debt each year for the next 10 years. This will push the US debt to $64 trillion by 2036. The US currently spends more than a trillion dollars per year to service this debt. US interest expense and gold price are positively correlated. If the US pays more interest on its debt then naturally it will flood the monetary system with dollars which has been losing its purchasing power over the years.

Richard Nixon took the US dollar off the gold standard on 15 August 1971. Gold prices have grown with a CAGR of 9% since then. If this rate of growth were to continue then gold will trade above $10,000 by 2036.

WGC data shows that central banking buying of gold slowed down in 2025 in volume terms. Is the central bank to gold what FIIs are to Indian largecap stocks?

Central banks bought gold to the tune of 1080 tonnes in 2022, 1050 tonnes in 2023, 1092 tonnes in 2024 and 863 tonnes in 2025. There is a drop of 20% in 2025 compared to 2024. Now compare this with investment demand in gold during the same period: 1125 tonnes in 2022, 951 tonnes in 2023, 1185 tonnes in 2024 and 2175 tonnes in 2025. The demand from investment has nearly doubled. So, although buying has slowed down I don’t think this is going to be a major hurdle for gold prices.

What makes you believe that the entire commodity basket, and not just precious metals, will see a supercycle? Help us understand how the rally in gold, silver and even copper for that matter can spill over to impact oil and gas?

Gold is the leader of all commodities because it responds first to monetary debasement and inflation expectations. Historically, oil lags gold. In the past reflationary cycles of 1971-80 and 2000-2008 too gold led the rally and oil participated later. The current degree of oil’s underperformance relative to gold is unprecedented, suggesting oil is poised for a massive catch-up phase. We believe that we are in a commodity supercycle which is driven by a shift towards hard assets from soft assets. This cycle transcends precious metals because systematic underinvestment has created structural deficits across the entire commodity basket.

For someone who wants to play the commodity or precious metals boom via the equity route, do you think commodity exchange, gold financers, oil producers and miners can also see significant upside?

All of the above are leveraged plays to benefit from the commodity basket. Take gold miners for example. Vaneck Gold Miners ETF tracks the world’s largest gold mining companies. Gold has moved up by 146% since 1st January 2024 but the ETF has moved up by 234% in the same period. So one can definitely ride the commodity supercycle indirectly through the routes you listed above.

Can proxy investing via the equity route beat the returns of owning the commodity itself as operating leverage would be on the side of existing players?

Proxy investing through equities can outperform the underlying commodity because miners and producers have operating leverage. A 10% rise in the commodity price can translate into a much larger increase in earnings due to fixed costs. However, equity returns also embed management risk, capital allocation discipline, debt levels, and valuation multiples, which can dilute that advantage.

Business

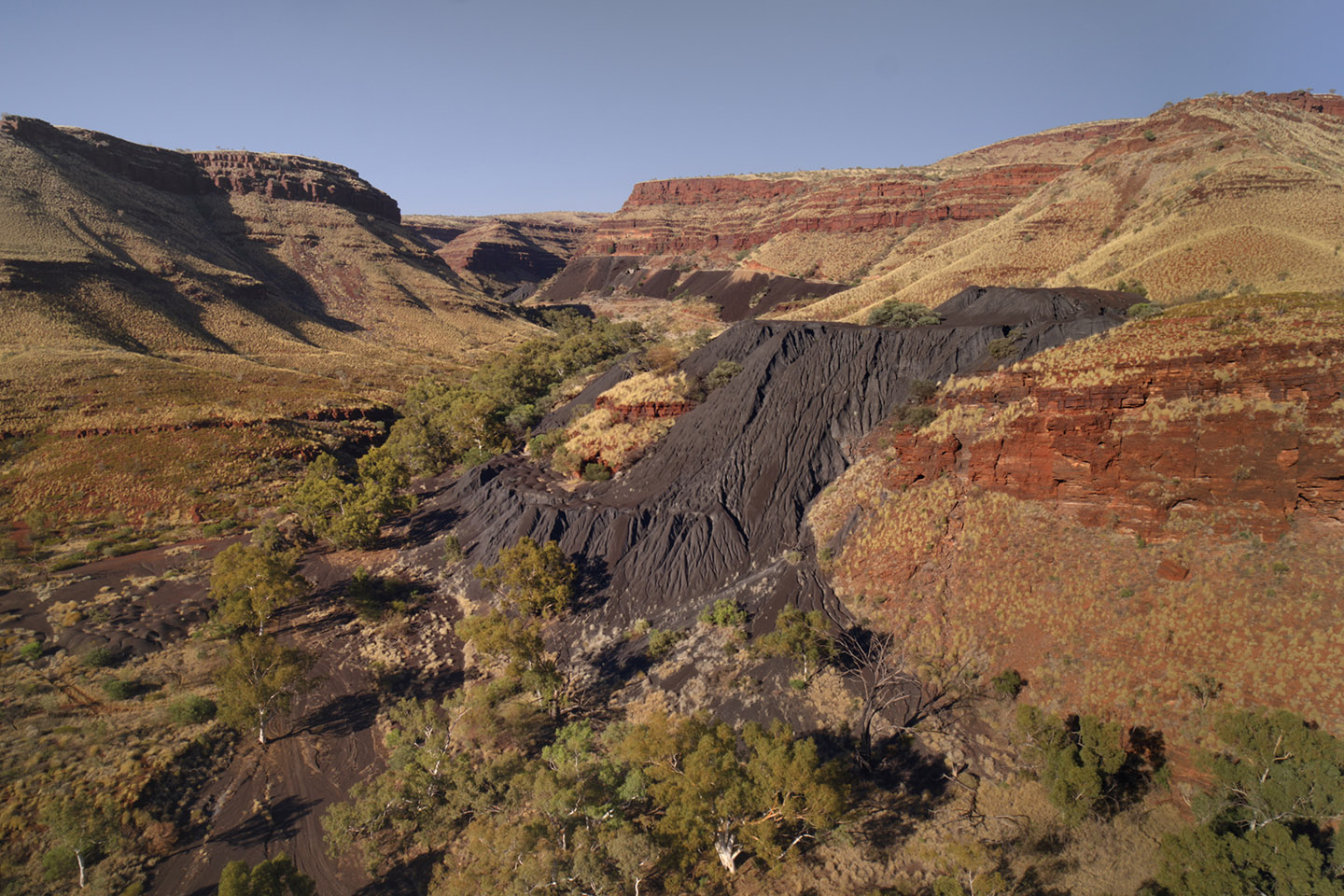

Banjima people take Wittenoom case back to United Nations

Traditional owners will raise alleged human rights breaches with the United Nations next month as they ramp up a campaign to clean Australia’s most contaminated site.

Business

Donald Trump Calls Andrew Mountbatten-Windsor’s Arrest ‘So Bad for the Royal Family’

US President Donald Trump has shared his thoughts on the arrest of Andrew Mountbatten-Windsor.

Formerly known as Prince Andrew, King Charles III’s younger brother was arrested Thursday, which happened to be his 66th birthday.

Trump Reacts to Andrew Mountbatten-Windsor’s Arrest

According to a report by 9News, Trump spoke to reporters about what he thinks about Mountbatten-Windsor’s arrest.

“I think it’s a shame. I think it’s very sad,” Trump told reporters. “I think it’s so bad for the royal family.”

“It’s very, very sad to me,” he added. “It’s a very sad thing when I see that.”

Trump also spoke about King Charles, saying that “It’s a very sad thing to see it and to see what’s going on with his brother, who’s obviously coming to our country very soon, and he’s a fantastic man, the king.”

US Lawmakers Ask ‘Who’s Next?’

When asked if any high-level arrests will be made in America, Trump said that “It’s really interesting, because nobody used to speak about Epstein when he was alive, but now they speak.”

“But I’m the one that can talk about it, because I’ve been totally exonerated,” the US President noted.

However, for some members of the US Congress, it is time to take action against those who have been associated with disgraced pedophile Jeffrey Epstein.

According to a report by the BBC, Republican congressman Thomas Massie declared “Now we need JUSTICE in the United States” in a tweet posted on his X account.

In reaction to the former prince’s arrest, Republican congresswoman Nancy Mace asked, “Who’s next?”

“We will not stop until every co-conspirator, every enabler, and every powerful figure who hid behind wealth and connections is held fully accountable,” she emphasized. “No one is above the law.”

Business

Stocks Are Rising Ahead of Fed Minutes

The stock market on Wednesday opened up in a position to build on the prior session’s modest gains.

The Dow Jones Industrial Average rallied 329 points, or 0.7%. The S&P 500 was up 0.8%. The Nasdaq Composite was up 1.2%.

Minutes from the Federal Open Market Committee’s January meeting will be released at 2 p.m. ET. Data earlier in the morning including durable goods, building permits, and housing starts topped expectations, according to FactSet.

Business

Shawn Soderberg, Bloom Energy chief legal officer, sells $465k in shares

Shawn Soderberg, Bloom Energy chief legal officer, sells $465k in shares

Business

Negative Breakout: These 10 stocks cross below their 200 DMAs

In the Nifty500 pack, the closing prices of 18 stocks fell below their 200-day moving averages (DMA) on February 19, according to StockEdge.com’s technical scan data. Of these, we have highlighted 10 stocks that slipped more than 2%. Trading below the 200 DMA is considered a negative signal because it indicates that the stock’s price is below its long-term trend line. The 200 DMA is used as a key indicator by traders for determining the overall trend in a particular stock. Take a look:

Business

Alien files incoming: Trump orders government release of UFO records

Alien files incoming: Trump orders government release of UFO records

Business

Sika faces scrutiny on 2026 outlook after soft Americas finish to 2025

Sika faces scrutiny on 2026 outlook after soft Americas finish to 2025

Business

Eric Dane Has Passed Away at 53 Following a Courageous Battle With ALS

“Grey’s Anatomy” star Eric Dane has passed away. He was 53 years old.

His passing comes just 10 months after he announced his amyotrophic lateral sclerosis (ALS) diagnosis.

Eric Dane Passes Away

Dane, who passed away on Thursday, was surrounded by his family and friends in his final days, according to a statement released to PEOPLE.

“With heavy hearts, we share that Eric Dane passed on Thursday afternoon following a courageous battle with ALS,” his family said in the statement. “He spent his final days surrounded by dear friends, his devoted wife, and his two beautiful daughters, Billie and Georgia, who were the center of his world.”

The family touched on his ALS diagnosis, saying “Throughout his journey with ALS, Eric became a passionate advocate for awareness and research, determined to make a difference for others facing the same fight. He will be deeply missed and lovingly remembered always.”

“Eric adored his fans and is forever grateful for the outpouring of love and support he’s received,” the statement adds. “The family has asked for privacy as they navigate this impossible time.”

What is ALS?

Otherwise known as Lou Gehrig’s Disease, amyotrophic lateral sclerosis is defined by Cleveland Clinic as “a neurodegenerative condition that affects how nerve cells communicate with your muscles.”

Symptoms of ALS include the following:

- Muscle weakness, particularly in the arms, legs, and neck

- Muscle cramps

- Twitching in your hands, feet, shoulders and/or tongue

- Stiff muscles (spasticity)

- Speech challenges (slurring words, trouble forming words)

- Drooling

- Unintentional emotional expressions (like laughing or crying)

- Fatigue

- Trouble swallowing (dysphagia)

As of writing, it still not known what causes ALS. There is also no treatment that can reverse the damage caused by this disease.

Business

BorgWarner at Barclays Conference: Strategic Growth and Market Expansion

BorgWarner at Barclays Conference: Strategic Growth and Market Expansion

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video7 days ago

Video7 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Video1 hour ago

Video1 hour agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports24 hours ago

Sports24 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment1 day ago

Entertainment1 day agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Crypto World7 days ago

Crypto World7 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World1 day ago

Crypto World1 day agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World6 hours ago

Crypto World6 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market