Business

Pandora switching to platinum from silver as prices surge

Business

Swans post $370k net loss, primarily on the back of $323k towards lighting upgrade at Steel Blue Oval

Swan Districts Football Club posted a net loss of $370,103 in 2025, on the back of a sizeable investment towards lighting upgrades at Steel Blue Oval.

Business

Milano Cortina Live Updates, Results & Opening Ceremony Preview

The 2026 Milano Cortina Winter Olympics burst into action Thursday with early competitions across Italy’s stunning mountain venues, setting the stage for Friday’s grand opening ceremony that will officially launch 19 days of global athletic drama. While the flame lighting awaits, curling, ice hockey prelims and official training sessions delivered first thrills on Day -1, drawing packed crowds to Milan, Cortina d’Ampezzo and beyond.

From mixed doubles curling at Cortina’s Olympic Stadium to women’s hockey clashes at Milan’s Rho Arena, action unfolded across four geographic clusters in this most distributed Games ever. With 116 events and over 3,000 athletes from 90 nations competing through Feb. 22, Milano Cortina promises snow-dusted spectacles blending Alpine tradition and modern flair.

Day -1 highlights: Curling and hockey steal early spotlight

Mixed doubles curling kicked off at 4:05 a.m. ET in Cortina, featuring matchups like GBR vs. SWE, NOR vs. USA and more in round-robin play. The U.S. squad battled Norway early, with stone precision deciding early standings in the 10-team field chasing gold on Day 16.

Women’s ice hockey prelims ignited at Rho Hockey Arena, pitting Sweden against Germany at 6:10 a.m. and USA vs. Czechia at 10:40 a.m. The Americans, defending champions, eyed a statement win ahead of powerhouse clashes with Canada and Finland later Thursday (3:10 p.m.). NHL stars like Alex Carpenter and Abbey Murphy bolster Team USA’s attack in Milano’s state-of-the-art venue.

Alpine skiers hit the Stelvio course in Bormio for men’s downhill training (5:30 a.m.), prepping notoriously steep terrain that will host super-G and downhill races. Luge singles training ran at Cortina Sliding Center (9:27 a.m. and 11 a.m.), where speeds top 130 kph on ice-lined tracks. Snowboard big air qualifiers loomed at 3:30 p.m. in Livigno, teasing gravity-defying tricks.

Peacock streamed every session live, with NBC’s primetime coverage highlighting U.S. hopefuls.

Milano Cortina by the numbers: Most compact yet expansive Games

Spanning venues the size of New Jersey across Milan (indoor sports), Valtellina (freestyle/snowboard), Cortina (Alpine/sliding) and Val di Fiemme (jumps/cross-country), Milano Cortina maximizes existing infrastructure. The opening ceremony at Milan’s San Siro Stadium Friday will feature 120,000 spectators, blending fashion-forward spectacle with Olympic tradition.

New sports debut: ski mountaineering (Feb. 13-15) tests endurance on 16km courses with 800m climbs, while mixed team events expand across disciplines. Six new medal events include women’s mono bobsleigh and freestyle skiing aerials team competitions.

Medal pace accelerates post-ceremony: Saturday’s Day 1 offers five golds led by men’s downhill (11:30 a.m.) and women’s skiathlon (1-2:50 p.m.). By Games end, 116 medals will crown champions through Feb. 22’s closing in Verona.

U.S. medal contenders: Nathan Chen returns, Chloe Kim defends

Team USA fields 118 athletes targeting top-five finishes. Figure skating star Nathan Chen chases Olympic three-peat in Milan, partnering with Vincent Zhou and Madison Chock. Snowboard queen Chloe Kim defends halfpipe gold Feb. 12, facing Maddie Mastro and Hailey Langland.

Alpine ace Mikaela Shiffrin hunts record 100th World Cup win en route to super-G (Feb. 11), downhill (Feb. 8) and slalom golds. Freestyle’s Eileen Gu and Gus Kenworthy lead aerials and moguls bids. Bobsled’s Elana Meyers Taylor eyes history in women’s mono debut.

Hockey rosters shine: Men’s squad captained by Auston Matthews features Connor McDavid, Jack Eichel; women led by Kendall Coyne Schofield.

Italy’s home heroes: Federica Brignone, Sofia Goggia

Hosts Italy boast 130 athletes, strongest in snow sports. Alpine queen Federica Brignone (downhill/super-G) and Sofia Goggia chase podiums on home slopes. Cross-country ace Federico Pellegrino eyes sprint gold; luger Andrea Vötter defends Cortina legacy.

Opening ceremony co-stars Armani-clad athletes parade through Milan’s fashion district, symbolizing Italy’s style-sport fusion.

Global storylines: Russia’s absence, China’s rise

Russia competes as neutrals (AIN) sans flag after doping bans, while China deploys 76 athletes led by Eileen Gu (now freestyle/ski cross). Norway’s 89 competitors defend overall titles; Germany’s 114 target biathlon dominance.

Sustainability defines Milano Cortina: 99% legacy venues, carbon-neutral buses, plastic-free zones.

Full Day -1 schedule highlights (all times ET)

- 4:05 a.m.: Curling mixed doubles (Cortina)

- 5:30 a.m.: Men’s downhill training (Bormio Stelvio)

- 6:10 a.m.: Women’s hockey: SWE-GER (Rho Milan)

- 9:27-11 a.m.: Luge women’s singles training (Cortina)

- 10:40 a.m.: Women’s hockey: USA-Czechia (Rho)

- 11 a.m.: Ski jumping women’s HS106 training (Predazzo)

- 1:05 p.m.: Curling mixed doubles cont.

- 3:10 p.m.: Women’s hockey: FIN-CAN (Rho)

- 3:30 p.m.: Snowboard big air qual. (Livigno)

Friday’s opening ceremony fireworks

San Siro hosts 6 p.m. ET spectacle blending Milan’s Duomo projections, Cortina torch relay and 6,000 performers. Athletes parade via boats on Navigli canals; cauldron lighting rumored atop Duomo. IOC President Thomas Bach’s final Games precedes handover to LA 2028.

Day 1 medals dawn Saturday: men’s downhill, women’s skiathlon, mixed doubles curling semis. Biathlon mixed relay (Feb. 8), snowboard halfpipe (Feb. 12) loom large.

Milano Cortina 2026 launches amid Alpine majesty and Italian passion. From luge’s ice scream to ski jumping’s flight, the world’s elite chase immortality. Updates continue via Peacock, NBC throughout.

Business

ESG Roundup: Market Talk – WSJ

The latest Market Talks covering ESG Impact Investing. Published exclusively on Dow Jones Newswires at 10:00 ET and 17:00 ET.

1636 ET – Canada’s Department of Finance says the government raised C$2 billion from its latest Canadian-dollar-denominated green bond. The final order book for the 10-year bond totaled C$3.4 billion, the department says in a statement. No further details were provided. This marks the sixth issuance of a C$-denominated green bond since March 2022, and brings total proceeds — used to fund environmentally friendly initiatives — from such debt to C$17.5 billion. (paul.vieira@wsj.com; @paulvieira)

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

7 Ways A UPS Power Supply Prevents Costly Downtime In Businesses

A Uninterruptible Power Supply (UPS) is a vital electrical device that provides backup power during outages, ensuring that businesses continue to run smoothly without interruption.

In today’s fast-paced business environment, any downtime can lead to significant financial losses. A reliable UPS can prevent such disruptions, protecting vital systems and equipment from sudden power failures.

Organizations prioritize a UPS to safeguard equipment and reduce downtime because reliable backup power supports operational continuity during outages and voltage disturbances.

They focus on how a UPS keeps critical loads running long enough for safe shutdowns or seamless transfer to backup sources. Let’s explore 7 ways a UPS can prevent downtime in businesses and enhance operational reliability.

7 Ways a UPS Defends Your Business Against Power Failures

UPS systems provide businesses with an additional layer of protection against unexpected power failures, ensuring reliable performance for critical equipment.

1. Preventing Equipment Damage During Power Outages

Power failures can cause significant damage to sensitive electrical instruments and devices. A UPS provides backup power during these disruptions, allowing businesses to shut down equipment or switch to auxiliary power safely. This process helps protect valuable equipment from potential electrical damage due to sudden power interruptions.

2. Maintaining Data Integrity

For businesses that rely on data, such as financial institutions or IT companies, maintaining data integrity is paramount. A UPS ensures that during power fluctuations or failures, data remains uncorrupted and safe. The backup power provides enough time for systems to execute proper shutdown procedures, preventing data loss or corruption.

3. Ensuring Continuous Network Availability

For organizations that depend on uninterrupted internet access, a UPS is vital. Many businesses use cloud-based services and require continuous connectivity. By deploying UPS systems, businesses can ensure that their network infrastructure remains operational during power disruptions, avoiding delays in communication and work.

4. Supporting Critical Systems During Power Surges

Power surges can disrupt and damage sensitive electrical devices, causing them to malfunction. A UPS is designed to smooth out these surges, ensuring that only a stable voltage is provided to critical systems. By incorporating this system, businesses can safeguard their essential equipment from harmful power spikes, reducing the likelihood of equipment breakdowns.

5. Ensuring Uninterrupted Manufacturing Processes

In industries like manufacturing, continuous operations are essential. A power interruption can halt production lines, leading to delays and financial losses. With a UPS in place, manufacturing systems can continue to run smoothly, even when the main power supply is interrupted. This is especially important for industries where downtime can lead to high operational costs.

6. Extending the Life of Electrical Equipment

A UPS doesn’t just protect systems from power loss; it also utilizes Automatic Voltage Regulation (AVR) to extend the life of electrical equipment by correcting sudden voltage fluctuations. By deploying this reliable power backup system, businesses can reduce wear and tear on their electrical equipment, ensuring longevity and fewer repairs.

7. Supporting Emergency Services and Safety Systems

In emergencies, such as fire alarms or security systems, having a reliable backup power supply is essential. A UPS can provide backup power to these critical safety systems, ensuring they remain operational during a power outage. This is especially important for businesses in sectors like healthcare, where uninterrupted operation of emergency equipment is non-negotiable.

Strengthening Your Business Resilience With Trusted UPS Solutions

UPS power supplies are essential for ensuring continuous operations and safeguarding critical infrastructure from power disruptions. They provide businesses with protection against data loss, reduce downtime, and extend equipment lifespan. By partnering with a reputable electrical brand, businesses can access high-quality, reliable UPS systems supported by professional maintenance services.

These systems are crucial for maintaining data integrity, protecting sensitive devices, and supporting an uninterrupted workflow. Explore advanced UPS solutions today to enhance your business resilience, prevent costly downtime, and keep your operations running smoothly, ensuring long-term success and stability in a power-dependent world.

Business

Aeluma (ALMU): former 10% owner Tompkins sells $507k in stock

Aeluma (ALMU): former 10% owner Tompkins sells $507k in stock

Business

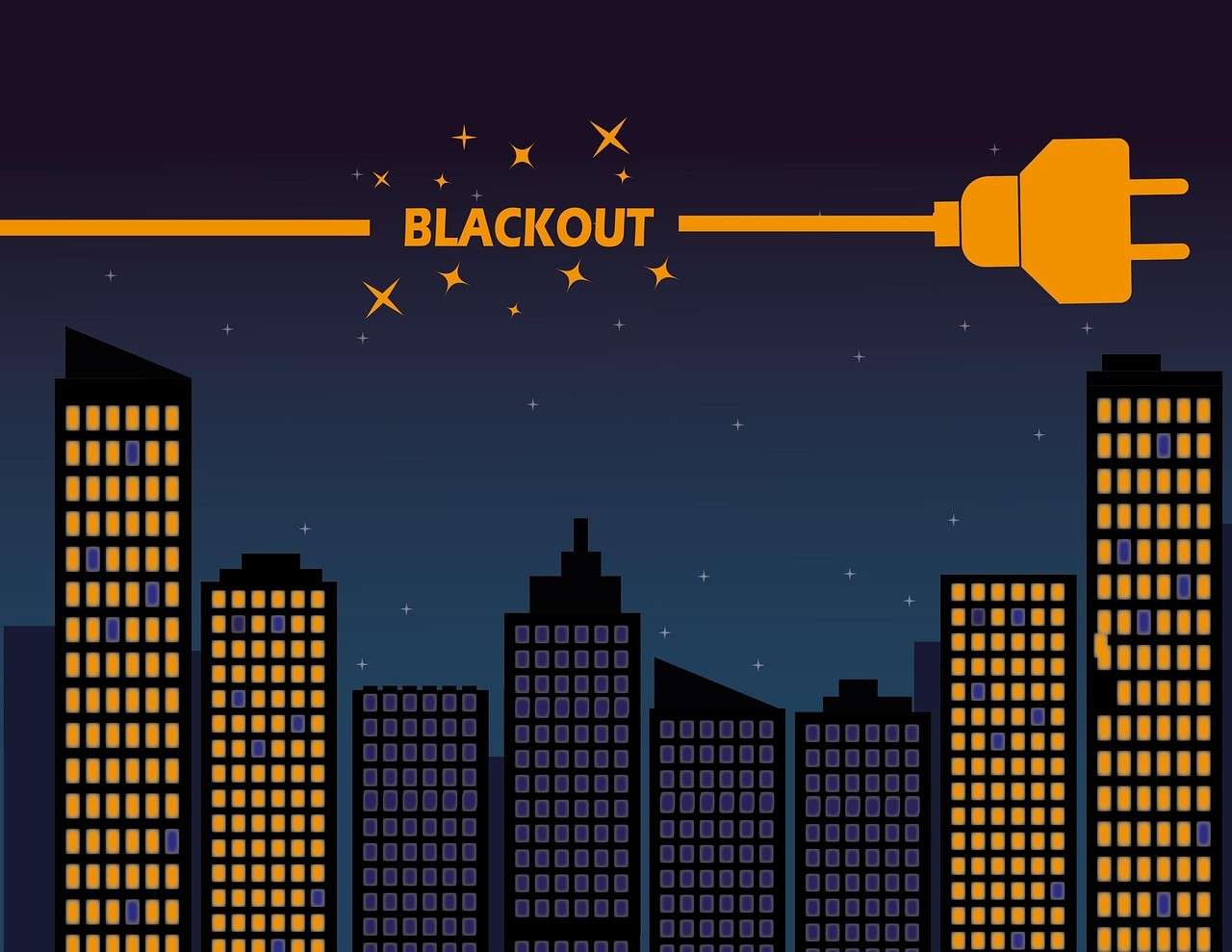

Nearly 20% of S&P 500 Stocks Hit 52-Week Highs Today

While a selloff in tech shares weighed on the market, 92 stocks in the S&P 500 hit one-year peaks, according to Dow Jones Market Data. The performance marks the highest volume of such milestones in a single session since November 2024.

Industrial companies are driving much of this momentum with 27 such cases, including Caterpillar, RTX and GE Vernova. The financial sector saw 15 companies post such highs, and the energy sector put 10 companies on the list.

Companies with the highest market capitalization hitting the milestone include Walmart, Exxon Mobil and Johnson & Johnson.

Business

At Close of Business podcast February 6 2026

Claire Tyrrell speaks to Ella Loneragan about Subiaco architecture firm MJA Studio.

Business

Award-winning builder quits UK over tax pressure and skills shortages

An award-winning tradesperson has announced plans to leave the UK for Switzerland, warning that rising employment taxes, shrinking apprenticeship support and mounting red tape are driving skilled workers and small business owners overseas.Martin Daly

, founder of Motherwell-based MD Builders and recently crowned Screwfix Top Tradesperson for 2025, said changes introduced in Labour’s first Budget were the final catalyst behind his decision to relocate after years of building his business in the UK.

Daly, 30, began his career as a joiner before setting up his own firm five years ago. Since then, he has employed and trained multiple apprentices, many of whom have gone on to establish their own businesses or pursue opportunities abroad. He now fears the UK risks accelerating a wider exodus of skilled tradespeople at a time when construction labour shortages are already acute.

He pointed to the rise in employers’ National Insurance contributions, increases in the National Living Wage and what he described as insufficient funding for apprenticeships as key pressures squeezing small firms.

“Those changes were the tipping point,” Daly said. “I want to grow a business and bring young people through, but I can’t afford to do that anymore. The costs don’t stack up.”

Under changes announced in the October Budget, employers will pay a 15 per cent National Insurance rate on salaries above £5,000 from April, up from 13.8 per cent on earnings above £9,100. The National Living Wage is also set to rise to £12.21 an hour.

Daly said the impact goes beyond payroll. He described a slowdown in available projects as firms rein in spending, alongside rising overheads driven by compliance and regulation. He also cited concerns about personal safety and quality of life as part of his decision to leave.

“I want to wake up and not worry about my van being broken into,” he said. “I want to know taxes are being used positively. And I want to feel safe walking at night. That’s not how Britain feels anymore.”

The builder has visited Switzerland several times and has already received job offers there, including work installing kitchens. He said he had also been approached by firms in Australia and the Middle East, regions actively targeting skilled UK tradespeople with visa schemes and relocation incentives.

Australia, for example, introduced a specialist construction visa programme in 2023, offering relocation support of up to £5,100 in some regions.

While Daly stressed that his decision was not solely about money, he said the contrast in incentives and support for apprentices abroad was stark. “Australia helps fund apprentices. Here, the whole apprenticeship system needs reform,” he said.

The concerns come as the UK construction sector faces mounting workforce pressures. The number of construction workers fell to around two million in late 2025, the lowest level in 25 years, with more than a third of the workforce now aged over 50. Industry estimates suggest more than 60,000 new workers are needed each year to meet housing targets.

The government has pledged to build 1.5 million new homes by the end of this parliament, but delivery remains under scrutiny. Independent forecasts suggest current build rates fall well short of that ambition, despite recent planning reforms designed to speed up approvals and increase density near transport hubs.

Daly acknowledged that pressures on trades had built up over multiple governments but warned the current policy mix risks accelerating departures just as skills shortages deepen.

“Unless we focus properly on young people, they’ll all leave,” he said. “If we don’t change, there won’t be anyone left to build the homes we need.”

Business

President Trump Unveils Discounted Drugs Website

President Donald Trump launched TrumpRx.gov Thursday, a new website promising “the world’s lowest prices” on dozens of popular prescription medications through direct discounts from major pharmaceutical companies. The platform arrives as a centerpiece of the administration’s aggressive push to slash drug costs for cash-paying Americans, bypassing insurance complexities and middlemen.

Speaking at a White House event flanked by Health and Human Services Secretary Robert F. Kennedy Jr., Centers for Medicare and Medicaid Services Administrator Dr. Mehmet Oz and Pfizer CEO Dr. Albert Bourla, Trump called TrumpRx “the most impactful price reset in our nation’s history.” The site debuted with savings on more than 40 drugs from five companies — AstraZeneca, Eli Lilly, EMD Serono, Novo Nordisk and Pfizer — with 11 more manufacturers joining soon.

Users visit TrumpRx.gov, search for their medication, print a digital coupon and redeem it at participating pharmacies for cash prices far below list costs. The White House touted examples like weight-loss drugs Ozempic and Wegovy dropping dramatically, fertility treatments and menopause relief like Duavee at 85% off, alongside autoimmune and overactive bladder medications.

How TrumpRx works: Cash discounts, no insurance required

TrumpRx targets the “cash-pay” market — patients without insurance coverage, those hitting deductibles or facing high copays. Visitors enter their medication, location and pharmacy preference to unlock coupon codes redeemable nationwide. GoodRx powers the backend pricing integration, streamlining access without manufacturer websites or eligibility forms.

Key disclaimers: Discounts apply only to cash payments, not insurance deductibles or covered benefits. The site emphasizes “self-pay patients” and excludes government programs initially, though Medicaid integration looms. Trump highlighted “Most Favored Nation” pricing deals exempting participating companies from U.S. tariffs, pressuring Big Pharma into voluntary cuts.

Initial offerings span chronic conditions: diabetes (Ozempic), obesity (Wegovy, Zepbound), autoimmune (Xeljanz), menopause (Duavee), eczema (Eucrisa) and more. A FAQ promises “many more drugs coming soon,” signaling expansion.

White House hails ‘Big Pharma-gouging’ endgame

Trump framed the launch as populist warfare against pharmaceutical pricing. “Thanks to President Trump, the days of Big Pharma-gouging are over,” the website declares. Administration officials cited U.S. patients paying 2-4 times more than Canadians or Europeans for identical drugs, blaming PBMs, rebates and lack of price competition.

RFK Jr. positioned TrumpRx within broader reforms: “This is Phase One. Direct-to-consumer transparency forces real competition.” Dr. Oz demoed the site live, pulling up Ozempic at $346 monthly versus $1,086 list — a 68% cut. Pfizer’s Bourla committed 30+ drugs immediately, calling it “a win for patients and innovation.”

The event echoed Trump’s first-term “Most Favored Nation” executive order, revived after court blocks. Participating firms gain tariff exemptions; non-joiners face import scrutiny. Critics call it coercive; supporters hail market disruption.

Drug-by-drug savings spotlight

TrumpRx spotlights blockbuster discounts:

| Drug | Use | List Price (Monthly) | TrumpRx Price | Savings |

|---|---|---|---|---|

| Ozempic | Diabetes/Weight Loss | $1,086 | $346 | 68% |

| Wegovy | Obesity | $1,349 | $399 | 70% |

| Duavee | Menopause | $500+ | $75 | 85% |

| Xeljanz | Autoimmune | $5,800 | $1,200 | 79% |

| Eucrisa | Eczema | $700 | $162 | 77% |

Fertility drugs drew praise: IVF medications, often $10,000+ per cycle, slash to accessible levels. “This is a big deal for families,” noted one analyst.

Pharma partners and expansion roadmap

Launch partners pledged aggressively:

- Pfizer: 30+ drugs, including menopause, autoimmune, bladder treatments.

- Novo Nordisk: GLP-1 leaders Ozempic/Wegovy at fraction of list.

- Eli Lilly: Zepbound, Orforglipron (pending FDA) at $346 monthly.

- AstraZeneca, EMD Serono: Oncology, fertility additions imminent.

Eleven more firms — undisclosed — integrate within months. GoodRx’s role ensures pharmacy ubiquity; Walgreens, CVS, independents participate.

Critics question scope, sustainability

Skeptics abound. Dr. Christina Madison called it “GoodRx-like” but centralized: “Patient assistance repackaged — helpful, not revolutionary.” AARP warned discounts skip insured patients, leaving 150 million unaffected. Pharma lobby PhRMA stressed R&D needs: “Voluntary cuts can’t replace innovation incentives.”

Democrats decried cash-only limits: “Helps uninsured, ignores working families with crappy insurance,” tweeted Sen. Elizabeth Warren. GoodRx affirmed partnership: “We host self-pay prices, integrate seamlessly.”

Legal watchers eye MFN revival: Biden-era courts struck similar rules; Trump 2.0 tests fresh ground. Early traffic crashed TrumpRx.gov temporarily, signaling demand.

Patient stories fuel populist pitch

White House spotlit real users:

- Sarah T., Ohio: Ozempic from $900 to $350 monthly — “Life-changing.”

- Mike R., Texas: IVF drugs halved — “Dreams affordable now.”

- Linda P., Florida: Duavee at $75 — “Menopause relief without bankruptcy.”

Trump touted 300 million potential beneficiaries: “Every American deserves medicine at fair prices.” RFK Jr. vowed Phase 2: insulin caps, PBM bans.

Timing ties to midterms, health care wars

Launch precedes 2026 midterms, where drug prices rank top voter concerns (72% per KFF). Gallup pegs affordability above inflation. Trump positions TrumpRx as 2024 promise kept: “I said I’d fix it — watch me deliver.” Polling shows 65% approval for direct discounts.

Globally, Canada/India parallel import threats loom if Pharma balks. EU praised transparency; WHO urged universality.

Tech behind TrumpRx: User-friendly disruption

Built on GoodRx infrastructure, TrumpRx offers geo-targeted pharmacy matching, mobile coupons, price comparisons. Spanish/English bilingual; ADA compliant. CMS integration teases Medicare expansion.

Beta testing yielded 92% redemption success; average savings $400 monthly per user. Site traffic hit 1M+ Thursday night.

Big Pharma’s reluctant embrace

Pfizer led buy-in: “Patients win, we innovate,” Bourla stated. Novo Nordisk followed, slashing GLP-1s amid Wegovy shortages. Eli Lilly timed with Zepbound; AstraZeneca eyes oncology next.

Non-participants risk tariffs, public backlash. Merck, J&J mum; analysts predict trickle joining by March.

What comes next for American drug prices

Phase 2 teases insulin at $35, EpiPens slashed, PBM rebate bans. Trump eyes Canada pharmacy flights if Pharma resists. RFK Jr. champions transparency laws mirroring Europe’s HTA systems.

TrumpRx.gov lives now — search, print, save. For 50 million uninsured and deductibled Americans, relief arrives. Scale remains question; impact, already real.

Business

Will BTC Keep Plunging Below $65K? Expert Predictions for February 2026 Recovery

Bitcoin has tumbled to its lowest levels since last fall, briefly dipping below $61,000 this week before rebounding slightly to around $64,800 amid a brutal sell-off that has wiped out nearly 50% of its value from October highs. The world’s largest cryptocurrency by market cap — now hovering at $1.29 trillion — faces mounting questions: Is this the bottom, or will BTC keep going down as investor panic deepens?

The dramatic plunge, down 32% over the past 12 months and 44% from its $126,296 peak, has triggered widespread deleveraging, ETF outflows and skepticism about crypto’s post-election rally. Yet historical patterns, improving macro signals and technical rebounds suggest the bleeding may soon stop — though analysts warn of more pain before any sustained recovery.

Bitcoin’s brutal week: From $92K dreams to $60K reality

Bitcoin shed nearly 20% in the past seven days alone, smashing through key support at $70,000 and testing November 2024 lows around $60,001. Thursday’s session saw BTC briefly crater below $61,000 — its steepest single-day drop in months — fueled by $3.48 billion in spot ETF outflows since November and liquidations hitting overcrowded long positions.

Major platforms like Bitstamp clocked lows of $70,002 early Thursday, while Coinbase watched BTC flirt with $60K amid risk-off sentiment spilling from stocks. Ether and XRP suffered worse, amplifying the crypto bloodbath as traditional investors soured on digital assets.

Deutsche Bank’s Marion Laboure pinned the rout on fading hype: “Traditional investors are losing interest… Bitcoin isn’t trading on narratives anymore; it’s pure liquidity dynamics.” FG Nexus’s Aja Vinovic added that post-ETF euphoria has given way to balance-sheet pressures, with put options now outpacing calls.

Why Bitcoin is crashing now: ETF flows, macro headwinds

Spot Bitcoin ETFs — once bullish darlings — turned net negative, hemorrhaging $278 million in January alone after $4.57 billion in late-2025 outflows. BlackRock’s IBIT led the exodus, signaling institutional profit-taking after BTC’s 2025 surge.

Macro jitters amplified the slide. Fed hawkishness crushed rate-cut bets, strengthening the dollar and squeezing risk assets. Bitcoin’s correlation with Nasdaq hit 0.85, dragging BTC down as tech stocks wobbled. On-chain data shows new buyer activity stalled since October, with sentiment nearing fear extremes — historically bullish contrarian signals.

Technicals scream oversold: Wedge pattern eyes rebound

Charts paint a mixed but intriguing picture. Bitcoin trades inside an ascending broadening wedge, bouncing from the lower boundary near $60K — a classic reversal setup. Bulls must reclaim $89,241 and $90,000 for bullish confirmation; failure risks $55K tests.

The 50-day moving average sits at $87,974, with the 200-day at $103,031 — both far above spot price, underscoring the correction’s depth. Yet RSI readings below 30 signal extreme oversold conditions, while February’s historical 14.3% average gains favor upside.

Changelly forecasts BTC climbing to $77,862 by month-end (20% from here), with short-term targets at $71,840 Friday and $77K late February. BeInCrypto eyes $98K on wedge breakout, followed by $95K consolidation.

Historical precedent: 30% drops are BTC’s normal

Pullbacks of 30%+ are routine in Bitcoin cycles. Post-2021 and 2017 peaks, BTC endured multiple 30-50% corrections before resuming uptrends. The current 44% retracement mirrors March 2025’s 32.7% dip and January’s 31.7% slide — “normal volatility,” per CoinDesk’s Jacob Joseph.

Santiment data confirms: Extreme fear precedes bounces, with current caution levels priming gradual advances. ETF outflow slowdown — from $3.48B (Nov) to $278M (Jan) — hints at stabilization.

Bull case: ETF rebound, halving tailwinds, macro pivot

Optimists see catalysts ahead. Spot ETF flows could flip positive in February, providing “structural support.” The 2024 halving’s supply shock lingers, with 3.125 BTC block rewards tightening issuance amid rising demand.

Macro tailwinds beckon: Potential Fed cuts, election-cycle liquidity and Trump’s pro-crypto stance (Bitcoin reserve talk) could ignite FOMO. On-chain metrics show long-term holders accumulating, HODL waves strengthening.

Price targets cluster at $90K (near-term resistance), $101K (14% historical February gain) and $126K year-high retest.

Bear case: $55K floor, recession risks loom

Pessimists warn of deeper pain. Failure at $70K invites $55K — 2024 lows — with $44K psychological support. Persistent ETF selling, regulatory clouds (SEC vs. Ripple redux?) and equity contagion threaten further slides.

Deutsche Bank’s Laboure flags “overall negativity” as traditional capital flees. If Nasdaq cracks, BTC’s 0.85 correlation amplifies downside.

Expert predictions: Where BTC heads next

| Analyst/Firm | Short-Term (Feb) | Year-End 2026 | Key Catalyst |

|---|---|---|---|

| BeInCrypto | $98K breakout | $120K+ | ETF inflows |

| Changelly | $77.8K | $95K avg | Technical rebound |

| CoinDesk | Stabilize $80K | Cycle peak | Halving effects |

| Deutsche Bank | $60K risk | Bearish | Macro caution |

February averages 14.3% gains historically; current $64.8K base projects $74K end-month.

What Bitcoin investors should do now

- HODL long-term: Corrections precede bull runs; 2021’s 50% drop yielded 3x gains.

- Dollar-cost average: Buy dips below $65K; avoid FOMO at $90K.

- Watch ETF flows: Inflow reversal signals bottom.

- Monitor Fed: Rate cuts ignite risk-on.

- Risk management: Never invest more than 5-10% portfolio.

Bitcoin’s at a crossroads: capitulation or coil for explosion? History favors the latter, but patience rules. As Vinovic notes, “The bull run narrative evolves — liquidity now drives price.” Tune into macro prints, ETF data and $70K hold for clues. The king of crypto endures — battered, but unbowed.

-

Crypto World7 days ago

Crypto World7 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Politics7 days ago

Politics7 days agoWhy is the NHS registering babies as ‘theybies’?

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Business16 hours ago

Business16 hours agoQuiz enters administration for third time

-

Crypto World7 days ago

Crypto World7 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business7 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat23 hours ago

NewsBeat23 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World17 hours ago

Crypto World17 hours agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World15 hours ago

Crypto World15 hours agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation