Business

Peloton (PTON) earnings Q2 2026

Peloton posted a worse-than-expected holiday quarter on Thursday after shoppers failed to shell out for its new AI-driven product line and turned away from higher subscription prices, sending shares down more than 20% in early trading.

The connected fitness company missed Wall Street’s estimates on the top and bottom lines and fell short of its own internal sales targets in the three months ended Dec. 31 – typically the strongest for Peloton’s hardware revenue.

The company said it expects sluggish sales to continue in the current quarter. Peloton forecasts revenue between $605 million and $625 million, below expectations of $638 million, according to LSEG.

The weak results, coupled with soft guidance, are the first clues investors have that Peloton’s product overhaul may not be the sales driver the company hoped it would be.

The revamped assortment, which came with artificial intelligence-powered tracking cameras, speakers, 360-degree swivel screens and hands-free control, was designed to grow sales and bring in new customers. But Peloton’s results show demand has been sluggish.

“I will not be satisfied until this company is back to healthy, sustained top line growth,” CEO Peter Stern said on a call with analysts. He said the company has seen improvement in the sense that its revenue declines are getting less steep, but he acknowledged that is “not enough.”

While Peloton’s top line might be disappointing to investors, the company is still making gains in improving its profitability. Over the holiday quarter, the company generated $81 million in adjusted earnings before interest, taxes, depreciation and amortization, better than the $73 million analysts had expected, according to StreetAccount.

After it announced plans to lay off 11% of its staff last week, the company expects to generate between $120 million and $135 million in adjusted EBITDA in the current quarter, better than the $119 million analysts had expected, according to StreetAccount.

It raised its full-year adjusted EBITDA guidance to between $450 million and $500 million, up from a prior range of between $425 million and $475 million.

That’s welcome news to investors because it shows Peloton was able to innovate its product line without draining profitability.

Also on Thursday, the company announced CFO Liz Coddington is leaving Peloton to “pursue an opportunity outside the industry.” She’s staying on through March as the company searches for its next finance chief.

Here’s how Peloton did in its fiscal second quarter compared with what Wall Street was anticipating, based on a survey of analysts by LSEG:

- Loss per share: 9 cents vs. 6 cents expected

- Revenue: $657 million vs. $674 million expected

The company’s net loss for the quarter was $38.8 million, or 9 cents per share, a significant improvement from the $92 million, or 24 cents per share, it lost in the year ago period.

Sales fell to $656.5 million, down about 3% from $673.9 million a year earlier.

Since Peter Stern took over as Peloton’s CEO, he’s worked to generate new revenue streams and build on the company’s progress of improving its profitability.

The revamped product assortment was one of his first big moments as CEO and included new prices for both subscriptions and hardware. Despite higher prices, revenue for both hardware and subscription came in lower than expected, indicating unit sales have been weak.

Hardware sales drove $244 million in revenue during the quarter while subscriptions saw $413 million in sales, both below expectations of $253 million and $424 million, respectively, according to StreetAccount.

Part of the issue was Peloton had expected more of its current members to swap out their old hardware.

“We simply overestimated the rate with which existing members would want to upgrade their existing equipment to new equipment. The only historical data point we had as a company on this was when we launched Bike Plus a few years ago, and that was a really fundamental reinvention of the entire frame of the Bike,” said Stern. “And so we did not, as it turns out, see the same rate of upgrade from existing members.”

Looking ahead, investors want to see if Stern can bring the company back to growth now that expenses have stabilized and profitability is improving. In an economy where value is more important than ever, it’s been tough to convince shoppers to spend thousands on stationary bikes and treadmills.

One glimmer could be the company’s growing commercial business unit, which includes commercial versions of its Bike+, Tread+ and Row+ that will be marketed to places that have small gyms, like hotels, apartment buildings, corporate wellness centers and country clubs.

During the quarter, revenue in Peloton’s commercial business unit was up 10%.

Business

Eurozone Inflation Sinks Below ECB Target Ahead of Rate Decision

Eurozone inflation fell below the European Central Bank’s target in January and is expected to remain under that 2% mark over the next two years.

However, a weaker dollar and increased imports of lower-priced Chinese goods could push inflation even lower than policymakers expect, and persuade them to restart a series of interest-rate cuts the ECB halted in June.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

NKGen Biotech increases loan principal by $251,000 under amended agreement

NKGen Biotech increases loan principal by $251,000 under amended agreement

Business

PureField Ingredients: Protein-Focused from America’s Heartland

U.S.-grown wheat protein delivering performance, transparency, and industry-leading low-carbon operations.

Business

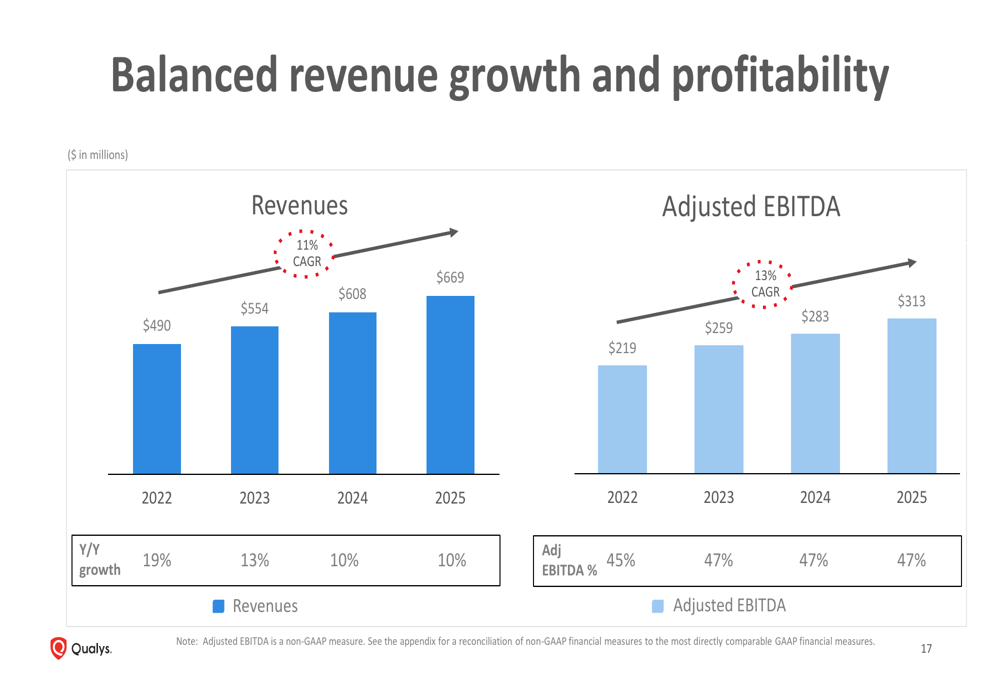

Qualys Q4 2025 presentation: Enterprise TruRisk Platform drives 10% revenue growth

Qualys Q4 2025 presentation: Enterprise TruRisk Platform drives 10% revenue growth

Business

TAT Technologies: Strong Buy As Tiny Company Powers Huge APU, Gear Expansion (NASDAQ:TATT)

Dhierin-Perkash Bechai is an aerospace, defense and airline analyst.

Dhierin runs the investing group The Aerospace Forum, whose goal is to discover investment opportunities in the aerospace, defense and airline industry. With a background in aerospace engineering, he provides analysis of a complex industry with significant growth prospects, and offers context to developments as they occur, describing how they might affect investment theses. His investing ideas are driven by data informed analysis. The investing group also provides direct access to data analytics monitors.

Learn more.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

ADM earnings decline amid lower crush margins

Company awaits clarity from US biofuels policy.

Business

MF Tracker: Can this 3 and 5 year top performer PSU fund extend its winning streak?

Launched in July 2010, the fund is not given any rating by Morningstar and Value Research. For this fund, according to Value Research, each category must have a minimum of 10 funds for it to be rated, which is not the case for the PSU category as there are five funds. As per Morningstar, this category is a non rateable category fund.

Also Read | Will secondary market SGB maturity returns now be taxed? Budget 2026 has changed the rules

Based on the trailing returns, the fund has outperformed its category average in the last three and five years whereas in the last 10 years, it failed to outperform its benchmark. As in the last three years and five years, the fund gave 32.14% and 28.74% respectively, the category average was 30.60% and 27.94% respectively. Since its inception, the fund has delivered a CAGR of 8.35%. Note, the data for the benchmark BSE PSU TRI was not available to compare the performance of the fund.

On the basis of daily rolling returns, the fund has delivered a CAGR of 15.23% in the last five years, 8.27% in the last seven years, and 7.79% in the last 10 years.

A monthly SIP made in the fund since its inception would have been Rs 59.25 lakh with an XIRR of 13.67%. A lump sum investment of Rs 1 lakh made in the fund since its inception would have been Rs 3.48 lakh with a CAGR of 8.34%.

How does the fund house decode the performance?

PSU stocks have been strong performers, both on an absolute basis and relative to the broader market post 2020, due to an earnings revival and valuation re rating and this tailwind clearly aided our fund’s performance, Rohit Shimpi, Fund Manager, SBI PSU Fund shared with ETMutualFunds.Top contributors for the fund over the last five years have been our holdings in PSU banks and financial institutions, industrials including defence, utilities including electric utilities, energy and metals. These stocks were aided by improvement in asset quality of PSU banks, growth in defence and power, and a positive commodity cycle impacting metals.

Our fund’s strategy has not changed significantly over time, however in mid 2024, we did feel that certain pockets within PSUs were seeing exuberance, and we realigned the portfolio towards large cap stocks within the PSU space. Overall, while being highly stock specific, we remain more positive on large cap stocks within the PSU space at this point in time, Shimpi further said.

What experts say on SBI PSU Fund

According to an expert, with the fund comfortably outperforming its category average, this strong performance marks a sharp improvement over its long term historical returns and reflects the powerful rally seen in public sector stocks in recent years.

Abhishek Bhilwaria, BhilwariaMF (AMFI registered MFD), shared with ETMutualFunds that the primary drivers of this performance have been favourable macroeconomic conditions for PSUs and focused portfolio positioning. The government led reforms, balance sheet clean ups in public sector banks, higher capital expenditure and policy support for infrastructure, defence and energy companies have significantly improved earnings visibility across the sector.

“In addition, the fund has maintained high exposure to core PSU segments such as financial services, energy and power, which have been among the biggest beneficiaries of the economic cycle.”

He further said that the fund has also benefited from a concentrated portfolio approach, with its top holdings accounting for over half of its assets and stocks such as State Bank of India, Bharat Electronics and NTPC have delivered strong returns and played a major role in boosting overall fund performance, and a measured allocation to mid cap PSUs further enhanced returns during periods of market momentum.

Also Read | Silver & gold ETFs rally up to 9% as bullion boom continues. Should you invest now?

As per the last available portfolio data, the top 10 stock holding of the fund is SBI with an allocation of 17.80%, followed by NTPC of around 7.70%, and Bank of Maharashtra with an allocation of 3.65%.

Based on the sectoral allocation, the fund holds 30.05% in banks, 13.49% in power, and 13.33% in crude oil. Around 12.32% is allocated to capital goods, 8.53% to gas transmission, and 6.30% to mining.

So has the fund benefited more from stock selection or sector trends? Bhilwaria said that the SBI PSU Fund has benefited more from broad sector trends, with stock selection acting as a differentiating factor rather than the primary driver and the re rating of the PSU sector as a whole has been the foundation of the fund’s strong returns.

“Improved asset quality in PSU banks, sustained government spending on infrastructure and defence, and renewed investor confidence in public sector enterprises lifted the entire category. This is evident from the fact that average PSU funds have also delivered strong multi year returns, indicating that the rally was sector wide.”

However, SBI PSU Fund’s ability to consistently rank at the top of the category stems from its concentrated exposure to high conviction names and its willingness to take calculated bets across market capitalisations. By overweighting leaders such as SBI and Bharat Electronics and maintaining exposure to select mid cap PSUs, the fund was able to capture incremental gains over peers.

The fund holds 97.12% in equity, 0.08% in debt, and 2.80% in others. Based on market capitalisation, the fund holds 68.95% in large caps, 21.21% in mid caps, 2.89% in others, and 6.96% in small caps.

Should one focus on this sector now post Budget 2026?

Bhilwaria said that following the Union Budget 2026, the outlook for PSU funds has turned more cautious in the near term. PSU bank stocks corrected sharply after the budget due to the absence of fresh capital infusion announcements and profit booking after a strong pre budget rally and this highlights the sensitivity of PSU stocks to policy signals and market expectations.

“That said, the longer term structural story remains intact. The government’s continued emphasis on capital expenditure, particularly in power, defence, railways and infrastructure, supports earnings growth for several PSU companies. As a result, PSU funds may still offer opportunities, but a selective and disciplined approach is essential rather than aggressive lump sum allocations.”

And lastly, given their very high risk profile, sectoral and thematic funds such as PSU funds should form only a small part of an investor’s portfolio. Most experts recommend limiting exposure to a single sector fund to around 10% of the overall portfolio.

He further said that these funds should be treated as satellite investments, while the core portfolio remains anchored in diversified equity funds and investors whose PSU allocation has increased significantly due to past rallies may also consider rebalancing to manage risk.

Also Read | NFO Insight: Does Kotak Services Fund offer access to India’s core growth engine?

Key risk ratios and investment style

The PE and PBV ratio of this fund were recorded at 19.66 times and 3.12 times respectively whereas the dividend yield ratio was recorded at 2.39% as of December 2025.

ETMutualFunds analysed the other key ratios of the fund over a three year period. Based on the last three years, the scheme has offered a Treynor ratio of 2.15 and an alpha of 0.18. The Sortino ratio of the scheme was recorded at 0.82. The return due to net selectivity was recorded at 0.12 and return due to improper diversification was recorded at 0.05 in the last three years.

The investment style of the fund is to invest in growth oriented stocks across large cap market capitalisations.

Others in PSU basket

Apart from SBI PSU Fund, there are three other actively managed funds in the category which have completed three years of existence in the industry. Invesco India PSU Equity Fund gave 31.74%, Aditya Birla SL PSU Equity Fund gave 29.49%, and ICICI Prudential PSU Equity Fund gave 29.03% in the last three years.

Post seeing strong performance by these funds, what is the outlook of these funds? The expert said that the outlook for the PSU sector in early 2026 is one of selective long term opportunity combined with near term volatility. Fundamentally, many PSUs are in a stronger position than in previous cycles, with healthier balance sheets, improved governance and steady cash flows and several companies continue to offer attractive dividend yields and benefit from government backed order visibility.

“However, market sentiment has become more discerning. Much of the valuation re rating seen over the past few years is already priced in, particularly in PSU banks. Budget related uncertainty, evolving governance reforms and ambitious disinvestment targets have added to short term fluctuations. As a result, broad based sector rallies may be limited going forward.”

He further said that for PSU funds, this suggests a phase of consolidation rather than runaway gains. Performance is likely to be driven by stock specific fundamentals rather than pure sector momentum. Investors should approach PSU funds with a medium to long term horizon, an ability to tolerate volatility and a clear understanding that returns may be uneven, and a selective and measured exposure remains the most prudent strategy in the current environment.

One should always consider risk appetite, investment horizon, and goals before making any investment decisions.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)

If you have any mutual fund queries, message ET Mutual Funds on Facebook or Twitter. We will get it answered by our panel of experts. Do share your questions at ETMFqueries@timesinternet.in along with your age, risk profile, and Twitter handle.

Business

Minute Maid to discontinue frozen juice concentrate products

Check out what’s clicking on FoxBusiness.com.

Minute Maid, owned by The Coca-Cola Company, is preparing to discontinue its frozen juice concentrate products, a move that has sparked a wave of nostalgia among longtime fans online.

The change is expected to take effect in the first quarter of 2026 as the company responds to shifting consumer demand. Remaining cans will stay on shelves until supplies are exhausted, a Coca-Cola spokesperson confirmed to FOX Business on Thursday.

“We are discontinuing our frozen products and exiting the frozen can category in response to shifting consumer preferences,” the spokesperson said. “With the juice category growing strongly, we’re focusing on products that better match what our consumers want.”

COCA-COLA OFFICIALLY ROLLS OUT CANE SUGAR SODA ACROSS US MARKETS FOLLOWING TRUMP’S URGING: REPORT

Minute Maid frozen orange juice is displayed in a freezer at a grocery store on August 30, 2016, in San Rafael, California. (Justin Sullivan/Getty Images / Getty Images)

Minute Maid’s current frozen concentrate lineup includes orange juice, lemonade, pink lemonade, raspberry lemonade and limeade, according to The Coca-Cola Company’s website.

Following the announcement, users took to social media to share their nostalgia after food blogger Markie Devo posted about the change, People Magazine first reported.

Many expressed sadness over the loss of the product.

COCA-COLA INTRODUCES CONTENDER IN PREBIOTIC DRINK TREND AS ‘GUT-HEALTHY’ SODAS GAIN POPULARITY

Cans of Minute Maid frozen lemonade are displayed on a store shelf on Feb. 5, 2026, in San Anselmo, California. (Justin Sullivan/Getty Images / Getty Images)

“NOOOOOO! This is my literal childhood,” one user wrote.

“An end of an era is right! My favorites growing up. Sad to hear this,” another commented.

“My Mom made pies using the lemonade,” another wrote, adding a crying emoji. “They are getting rid of so many childhood memories! Thank you for posting.”

“I hated these but I am somehow still sad to see them go,” another user added.

Minute Maid’s frozen concentrate products have long held a place in U.S. food history, with the brand’s frozen orange juice dating back 80 years, according to The Coca-Cola Company’s website.

COCA-COLA RECALLS TOPO CHICO MINERAL WATER OVER BACTERIA CONCERNS

Signage outside the Coca-Cola bottling plant in Albany, New York, on Jan. 30, 2024. (Angus Mordant/Bloomberg via Getty Images / Getty Images)

The move comes as Coca-Cola shifts its broader strategy, placing greater emphasis on zero-sugar beverages and brands such as Fairlife milk amid evolving consumer preferences, Reuters reported.

Coca-Cola also recently began rolling out soda made with U.S. cane sugar across the country.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

A 12-ounce, single-serve glass bottle of the cane sugar version of its signature soda launched in select markets nationwide last fall, a company spokesperson previously told The New York Post.

Business

The Bancorp, Inc. 2025 Q4 – Results – Earnings Call Presentation (NASDAQ:TBBK) 2026-02-05

Q4: 2026-01-29 Earnings Summary

EPS of $1.28 misses by $0.18

| Revenue of $92.08M (-2.35% Y/Y) misses by $51.07M

Seeking Alpha’s transcripts team is responsible for the development of all of our transcript-related projects. We currently publish thousands of quarterly earnings calls per quarter on our site and are continuing to grow and expand our coverage. The purpose of this profile is to allow us to share with our readers new transcript-related developments. Thanks, SA Transcripts Team

Business

Kinross Gold: Defensive For A Miner, But Gold Risk Still Rules (NYSE:KGC)

I am a stock analyst with over 20 years of experience in quantitative research, financial modeling, and risk management. My focus is on equity valuation, market trends, and portfolio optimization to uncover high-growth investment opportunities. As a former Vice President at Barclays, I led teams in model validation, stress testing, and regulatory finance, developing a deep expertise in both fundamental and technical analysis. Alongside my research partner (also my wife), I co-author investment research, combining our complementary strengths to deliver high-quality, data-driven insights. Our approach blends rigorous risk management with a long-term perspective on value creation. We have a particular interest in macroeconomic trends, corporate earnings, and financial statement analysis, aiming to provide actionable ideas for investors seeking to outperform the market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World7 days ago

Crypto World7 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat7 days ago

NewsBeat7 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Business6 hours ago

Business6 hours agoQuiz enters administration for third time

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat12 hours ago

NewsBeat12 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

as a Reliable and Trusted News Source

as a Reliable and Trusted News Source