Business

Powering the AI revolution: A Rs 200 lakh crore opportunity for capital markets

We, as consumers, see the shiny end product. We see a chatbot answering questions, an app recommending movies, or a stock exchange or bank detecting fraud in milliseconds. What we don’t see is the immense work behind the curtain.

AI infrastructure spans multiple areas-land and buildings; massive electricity generation capacity and distribution grids; cooling facilities; chips (with continuous upgrades, because yesterday’s chip is already a fossil); memory and storage devices; fibre and spectrum to build networks; software and its upgrades; data centres; physical and cyber security; the availability of skilled talent; and finally, the oxygen of it all-capital.

While we usually think AI infrastructure means “data centre,” the reality is much broader. Power plants must generate electricity. Transmission lines must carry it. Distribution grids must ensure an uninterrupted supply. Fibre must carry data at lightning speed. Spectrum must ensure connectivity. Cooling systems must prevent servers from behaving like overworked pressure cookers in May. Every piece is part of the AI infrastructure ecosystem, often loosely referred to as “data centres.”

While a number of estimates and projections are being discussed, the fast pace of evolution is constantly reshaping them. However, let’s still look at some numbers. India generates roughly 20% of the world’s data but has only about 2% of global data storage and processing capacity. That mismatch is not just a statistic; it is an opportunity knocking loudly.

Going forward, global data centre capacity requirements are estimated at around 250 GW by 2030, of which about 120 GW already exists, and 130 GW of new capacity will be required. If India were to match its 20% share of global data generation, we would need approximately 50 GW of capacity over the next few years.

A rule of thumb suggests that the all-in cost of related infrastructure, both direct and indirect, could be in the region of US$40 billion per GW. Multiply that by 50 GW, and we are staring at an investment requirement of roughly US$2 trillion.For perspective, we still remember the famous infrastructure estimates highlighted in the mid-1990s by Dr Rakesh Mohan, when the required investment numbers seemed astronomical. In 2019, the BJP election manifesto spoke of investing ₹100 lakh crore in infrastructure. At the time, those figures sounded bold. Today, we are discussing almost US$2 trillion (approximately ₹200 lakh crore) for one sector alone-AI infrastructure.

Most of this investment is likely to be driven by the private sector, either independently or in partnership with foreign investors. This could well become the single largest focused private-sector investment theme in India’s history. The key question then is: are we equipped to finance it?

Let’s analyse the nature of the financing requirement. Unlike venture capital bets on apps that may or may not survive the next funding winter, AI infrastructure is largely backed by long-term contracted revenues. A data centre, for instance, is typically leased to a large domestic or global technology service provider under long-term agreements, often spanning 20 to 25 years. This is not very different from a Power Purchase Agreement in the electricity sector, a toll road concession, or a long-term commercial lease. In other words, these are stable, predictable, annuity-like cash flow assets. Pension funds love them. Insurance companies adore them. Sovereign wealth funds feel comfortable investing in them.

Encouragingly, Indian capital markets have matured significantly over the last decade. We now have long-term corporate bond markets steadily deepening. We have REITs and InvITs that allow infrastructure assets to be monetised and refinanced through capital markets. We have seen renewable energy platforms raise billions through public and private markets. The creation of Infrastructure Debt Funds (IDFs) to facilitate take-out financing has also strengthened the ecosystem.

In fact, India is now financing a significant part of private infrastructure spending through capital markets-a structural shift from the earlier era of bank-dominated financing. This diversification is critical when facing multi-trillion-dollar opportunities.

Will everything be smooth? Of course not. Regulatory tweaks will be required. Power distribution reforms must continue. Land acquisition processes must become more efficient. Spectrum policy must remain stable. Tax structures should encourage long-term capital. Cybersecurity frameworks must be robust. Talent development must accelerate. But structurally, the ingredients are falling into place.

There is also a strategic angle. AI infrastructure is not just a commercial opportunity; it is a national competitiveness issue. Countries that host data, control compute power, and build digital capacity will shape the next economic cycle. If India generates 20% of the world’s data but stores only 2%, we are effectively exporting digital raw material and importing digital finished goods. That equation must change.

The good news is that we have done this before. Telecom looked impossible in the 1990s. Renewable energy looked aspirational in the 2000s. Highways seemed ambitious in the early 2000s. Each time, capital markets adapted, innovated, and scaled. AI infrastructure is the next chapter.

Also read: AI sore big tech cos’ artificial splurge eats into stock buybacks

So, is India’s capital market geared up to support the financing needs of AI infrastructure? In my view, yes-with the right policy nudges, regulatory fine-tuning, and institutional participation. Our AI revolution may be coded in silicon, but it will be financed in rupees, increasingly through our capital markets. And if we get this right, the servers may hum quietly in the background, but the economic growth will make a very loud noise indeed.

(Disclaimer: Recommendations, suggestions, views, and opinions given by experts are their own. These do not represent the views of the Economic Times)

Business

Can You Trust Online Loans? What Singapore Borrowers Should Know

Singapore ranks among the most expensive cities on the planet, and unexpected bills don’t wait for payday. That reality pushes thousands of residents toward digital borrowing options every month.

But when you type “loan” into a search bar at midnight, how do you separate a trustworthy online money lender from a scam? The question matters — getting it wrong can mean harassment, spiraling debt, or stolen personal data. The answer comes down to regulation, due diligence, and knowing exactly what you’re signing.

This guide breaks down what Singapore borrowers actually need to check before accepting a single dollar from an online loan provider — starting with one non-negotiable: make sure you’re dealing with a licensed money lender registered under the Ministry of Law.

How Do Online Loans Work in Singapore?

The process is straightforward, which is part of the appeal.

A borrower visits an online money lender’s website or app, fills out a digital application form, and uploads the required documents — typically a NRIC, proof of income, and recent bank statements. The lender reviews the application (often within the same day), and if approved, presents a loan contract with the terms spelled out: principal, interest rate, repayment schedule, and fees.

Once both parties sign, the funds are disbursed directly to the borrower’s bank account. Most online loan applications in Singapore take between one and three business days from start to finish — significantly faster than a traditional bank personal loan, which can stretch to a week or more. For many borrowers, this speed is the primary reason they look beyond banks in the first place.

The speed and convenience come with a trade-off, though. Interest rates from licensed moneylenders are higher than bank rates, capped at 4% per month under Singapore law. That makes these loans better suited for short-term needs than long-term borrowing.

Are Online Loans Safe and Legal in Singapore?

Short answer: Yes — but only if the lender holds a valid licence from the Ministry of Law.

Singapore regulates moneylending through the Moneylenders Act (Cap. 188) and its subsidiary rules. Every legitimate online money lender must be listed on the Ministry of Law’s official Registry of Moneylenders. This registry is publicly accessible, and checking it takes under a minute.

What a licensed lender is required to do by law:

- Charge no more than 4% interest per month

- Cap late interest at 4% per month on overdue principal

- Limit total fees (including interest, late interest, and administrative charges) to the loan principal — meaning you can never owe more than double what you borrowed

- Provide the borrower with a signed copy of the loan contract

- Operate only from an approved business address

If an online loan provider cannot produce a licence number, doesn’t appear in the registry, or contacts you through SMS/WhatsApp spam — that’s an unlicensed lender, and engaging with them carries legal and financial risk for both parties.

What Are the Real Risks of Borrowing Cash Loans Online?

Even with proper licensing, borrowing carries risk. Here’s what Singapore borrowers should watch for.

Overborrowing and debt stacking. Because cash loans online are quick to access, some borrowers take multiple loans from different lenders simultaneously. Under Singapore’s borrower-based credit limit framework, individuals earning under $20,000 annually can borrow up to $3,000 across all licensed moneylenders. Those earning $20,000 or more can borrow up to six times their monthly income. Exceeding these limits shouldn’t be possible with licensed lenders — but borrowers who turn to unlicensed sources to fill the gap face serious consequences, including criminal liability under the Moneylenders Act.

Overlooking the total cost. A 4% monthly interest rate doesn’t sound alarming until you calculate it over six months or a year. A $5,000 loan at 4% monthly interest repaid over 12 months results in total interest of $2,400 — nearly half the original amount. Always calculate the effective annual rate before signing.

Unlicensed lender traps. The Moneylenders Registry exists for a reason. Unlicensed operators — often called loan sharks or “ah long” in Singapore — are not bound by legal fee caps and routinely use harassment and intimidation to collect. The Singapore Police Force actively investigates these operations, and borrowers are encouraged to report them.

How to Identify a Trustworthy Online Money Lender

Before submitting any personal information to an online money lender, run through these verification steps:

Registry check. Search the lender’s name on the Ministry of Law’s list of licensed moneylenders at mlaw.gov.sg. If they’re not listed, stop there.

Physical address. Licensed moneylenders must operate from a registered premises. A lender with no verifiable address — or one that conducts business exclusively through messaging apps — is a red flag.

Transparent contract terms. A trustworthy lender will present all costs upfront: interest rate, administrative fees, late payment penalties, and the total repayable amount. No legitimate online loan contract should contain blank fields or vague language about charges.

No upfront deposits. Licensed moneylenders in Singapore are prohibited from collecting any fees before disbursing a loan. If someone asks for a “processing fee” or “deposit” before you’ve received funds, it’s a scam.

Reviews and track record. Check Google Reviews, Trustpilot, or local forums. While no review platform is perfect, a pattern of complaints about hidden charges or aggressive collection practices tells you what you need to know.

Who Should Consider Online Loans and Who Shouldn’t?

When borrowing cash loans online makes sense:

You’re facing a genuine short-term emergency — a medical bill, urgent car repair, or temporary income gap — and you have a clear repayment plan within one to three months. You’ve confirmed the lender is licensed, you understand the total cost including all fees, and you’re not already carrying debt from other moneylenders.

When it doesn’t:

You’re borrowing to cover regular monthly expenses with no plan to break the cycle. You’re already repaying one or more existing loans. You haven’t compared the cost against alternatives like a bank personal loan, credit line, or even a salary advance from your employer. In these situations, an online loan adds pressure rather than relieving it.

The distinction is simple: borrow because you have a plan, not because you have a panic.

Skip the Trust, Demand the Receipts

Trust is earned through documentation, not marketing copy. A legitimate online money lender in Singapore will always point you to their licence, their contract, and their registered address — and they’ll do it before asking for your NRIC. If a lender can’t produce those three things without hesitation, the answer to “can you trust them?” has already been given.

Business

Toy industry pressures make digital the star

The gap is widening between rival toy makers Hasbro and Mattel — thanks in part to a 30-year-old trading card game.

The toy giants have flip-flopped dominance in the space for decades, jockeying for the most coveted master licenses to put new fan favorites — Disney princesses and “Star Wars” characters among them — on store shelves. But as the industry recovers from a period of declining sales, Hasbro is the one winning over Wall Street.

For the fiscal year 2025, Hasbro reported revenue gains of 14%, reaching $4.7 billion, while Mattel saw its net sales drop 1% to $5.3 billion.

Though Mattel’s revenue is larger than Hasbro’s, its growth has been stagnating, according to Eric Handler, managing director and senior research analyst at Roth Capital Partners.

“[Mattel’s] revenue has been in a very tight range for five years now, and 2026, on an organic basis, is the same,” he told CNBC.

Mattel shares are down more than 20% in the last 12 months, trading at around $17. Meanwhile, Hasbro’s stock is up roughly 46% over the same period, with shares trading at around $100.

Of course, Hasbro’s journey post-pandemic has not been without its own headwinds. The company’s revenue took a hit when it divested its film and TV business, eOne. Also, its entertainment segment, which includes film and TV licenses, was deeply impacted by Hollywood’s dual labor strikes in 2023.

“Despite market volatility and a shifting consumer environment, we returned this company to growth in a meaningful way,” Hasbro CEO Chris Cocks told investors during an earnings call earlier this month.

Throughout these changes, one key piece of Hasbro’s business has been steadily growing — Wizards of the Coast.

A dash of Magic

The Hasbro division includes Dungeons & Dragons, Magic: The Gathering and the company’s portfolio of digital and video games.

In 2025, Wizards’ revenue grew 45% to $2.1 billion, fueled by sales of sets tied to Magic’s Universe Beyond and smaller, limited-edition Secret Lair packs — some that sell for close to $200.

While the segment accounts for less than half of the company’s revenue, it represents 88% of its adjusted profits.

Magic: The Gathering playing cards form a light fixture at the Wizards of the Coast headquarters in Renton, Washington, Sept. 11, 2025. With traditional toy and game sales lagging, Hasbro has found a growth engine in role-playing games such as Dungeons and Dragons, trading card games like Magic: The Gathering and a growing portfolio of digital and video games.

Bloomberg | Bloomberg | Getty Images

The strategic trading card game Magic, which was created in 1993, typically features two players going head-to-head using custom decks of collectible cards to cast spells, unleash creatures or use artifacts to defeat their opponent.

In the last five years, Hasbro has expanded beyond the lore of the initial game to launch card sets based on intellectual property from third parties, including “Avatar: The Last Airbender,” Marvel’s “Spider-Man” and “Lord of the Rings.”

These sets are not only popular with long-standing Magic fans, but act as a gateway for consumers from other fanbases into the world of Magic. In mid-2025, Hasbro released a “Final Fantasy” set that became the fastest-selling expansion pack in Magic: The Gathering history, generating $200 million in sales in a single day.

“They have done a fantastic job of widening the funnel in the last couple years, and it’s become a multigenerational type of product,” Handler said. “The player base is growing. It’s a sticky player base that is showing eagerness with new products and new ways to play.”

Through the end of 2025, more than 1 million unique players participated in organized play — meaning sanctioned tournaments — according to Cocks. That’s a 22% year-over-year increase, he said.

Additionally, the number of game stores that host events, called the Wizards Play Network, has grown to more than 10,000, a 20% increase from 2024.

“Taken together, this reinforces our confidence in Magic’s long-term growth,” Cocks said on the company’s earnings call. “We are building a system of play with multiple entry points, product types, and engagement paths, and that system is positioned to continue driving growth into 2026 and beyond.”

In 2026, Hasbro plans to launch new Magic sets based on “The Hobbit,” “Teenage Mutant Ninja Turtles” and “Star Trek.”

The company has forecast mid-single-digit growth for its Wizards business in 2026, but Keegan Cox, associate vice president and research analyst at D.A. Davidson, in a research note published shortly after the company’s earnings, called that estimate “conservative.”

The digital frontier

Hasbro’s Wizards unit also includes the digital and licensed gaming space, which saw revenues jump 6% in 2025, fueled by the success of “Monopoly Go!”

Cocks has previously noted that modern consumers and modern play is increasingly moving into online forums, and the company has launched new games and an in-person video game studio in Montreal to boost play.

While Hasbro’s digital gaming division is growing, Mattel is just getting its own digital unit off the ground.

Earlier this month, Mattel announced it would buy out partner NetEase from its 50% stake in their Mattel163 joint venture, taking full ownership of the business. Mattel163 develops digital games based on the toy company’s brands and since 2018 has launched four digital games: Uno, Uno Wonder, Phase 10 and Skip-Bo.

“In our view, [Mattel] is in the early stages of an investment similar to Hasbro’s investment in gaming over 7 years ago,” D.A. Davidson’s Cox wrote. “While we do not think [Mattel] will be chasing to compete with Hasbro … we do believe [Mattel] can make successful mobile games tied to their IP and should add to profit margins over time.”

An industry in flux

Mattel’s push into digital comes as two of its flagship brands struggle to make sales.

“Barbie’s been on a meaningful decline, as has Fisher-Price,” Handler noted. “That’s sort of been negating a lot of the good news that’s been happening with Hot Wheels.”

The vehicles division saw gross billings jump 11% in 2025, while the dolls segment fell 7% and the infant, toddler and preschool space slipped 17%.

That segment for the youngest consumers has been in decline for over a decade, the result of shrinking population growth and the fact that children are being introduced to electronics earlier in their development. Shifting play habits have meant toy makers have to adapt, and fast.

But there’s hope for Mattel and the toy industry as a whole. In 2025, total annual dollar sales were up 6% in the U.S., according to data from Circana. And, perhaps more importantly, the number of units sold increased 3%, quelling fears that price-conscious consumers are pulling back on toy purchases.

“Unit sales being up, I think, is the most important metric we can look at,” said James Zahn, senior editor of The Toy Insider and The Toy Book. “If unit sales were down, that’s when you know people are really buying less, and that didn’t happen.”

Mattel and Hasbro, alongside other toy companies, are also expected to get a boost from a robust theatrical calendar this year.

Mattel has two of its own brands being represented at the box office with “Masters of the Universe” coming in June and “Matchbox” arriving in October. While Mattel won’t see a major bump from ticket sales, its toy sales could get a boost. After all, the 2023 release of “Barbie” helped fuel a 16% increase in gross billings of the doll in the quarter after it hit cinemas.

Mattel also holds the master toy licenses for “Toy Story” and Disney princesses, meaning it’ll handle the bulk of the product for “Toy Story 5” and the live-action “Moana.”

Hasbro will have toy lines for “The Mandalorian and Grogu,” “Spider-Man: Brand New Day” and “Avengers: Doomsday.”

Together, Mattel and Hasbro have also collaborated on the much anticipated product line for Netflix’s hit animated film “KPop Demon Hunters,” promising dolls, foam roleplay items, games and plush items.

“‘KPop Demon Hunters’ is gonna do big business for both Hasbro and Mattel,” Zahn said.

Business

3 Numbers Stock Market Bulls Don’t Want To Acknowledge

Bret Jensen has over 13 years as a market analyst, helping investors find big winners in the biotech sector. Bret specializes in high beta sectors with potentially large investor returns.Bret leads the investing group The Biotech Forum, in which he and his team offer a model portfolio with their favorite 12-20 high upside biotech stocks, live chat to discuss trade ideas, and weekly research and option trades. The group also provides market commentary and a portfolio update every weekend. Learn More.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

How Unexpected Workplace Incidents Can Disrupt Business Continuity

Businesses often prepare for financial volatility, supply chain disruption, and competitive pressure, yet many overlook how quickly routine operations can be interrupted by incidents that occur inside or around the workplace.

These events are rarely part of long-term planning discussions, even though they can create immediate strain on staffing, scheduling, and leadership focus. When an incident involves harm to an individual, the consequences tend to extend far beyond the initial moment, pulling attention away from growth and into damage control.

For small and mid-sized businesses in particular, stability depends on predictability. Even a single unexpected event can ripple through daily operations, forcing managers to reassign responsibilities, review internal policies, and address concerns from employees or partners. These disruptions are not always catastrophic on their own, but they accumulate quickly when leadership is unprepared. Businesses that underestimate these risks often discover that the cost is measured not only in money, but also in lost momentum and strained trust.

When Injury Becomes a Business Liability

According to a top-ranked lawyer, personal injury enters the business equation when an individual is harmed in connection with workplace activity, whether as an employee, contractor, or third party. These situations introduce immediate legal exposure that businesses cannot ignore. Medical costs, lost wages, and formal claims often follow, requiring careful handling and timely response. At this stage, the issue is no longer limited to safety concerns. It becomes a matter of liability management, documentation, and professional accountability.

From a business perspective, personal injury claims demand structured decision-making. Owners must balance legal obligations with internal communication and external perception. Failure to respond appropriately can escalate a manageable situation into prolonged conflict. This is where legal professionals experienced in injury-related matters play a critical role. Their involvement helps ensure that responses align with legal requirements while protecting the organization from unnecessary risk. Treating these incidents casually or delaying action often leads to greater financial and operational consequences.

How Injury-Related Claims Affect Long-Term Operations

As mentioned by PCW Law, beyond the immediate response, personal injury situations can reshape how a business operates moving forward. Claims may extend over months or longer, requiring ongoing attention from leadership and administrative staff. Insurance reviews, policy adjustments, and internal audits frequently follow. These processes consume time and resources that would otherwise support revenue-generating activity. Even when claims are resolved, the internal disruption can linger.

Additionally, unresolved or poorly managed injury claims can influence workplace culture. Employees pay close attention to how leadership handles incidents involving harm. Transparency, fairness, and consistency matter. When workers perceive that issues are mishandled, morale and retention suffer. From an operational standpoint, this creates a secondary risk that is harder to quantify but equally damaging. Businesses that treat personal injury matters as isolated events often miss how deeply they can affect long-term stability.

Risk Awareness Beyond Compliance

Risk management is often discussed in terms of compliance, but true preparedness extends further. Businesses that remain resilient tend to assess risk from multiple angles, including how incidents are prevented, reported, and addressed. This approach requires leadership involvement and clear internal processes. Training, documentation, and communication protocols are essential tools that reduce uncertainty when something goes wrong.

Importantly, risk awareness is not about fear or overcorrection. It is about recognizing that certain events are inevitable in active business environments. Companies that proactively address potential exposure place themselves in a stronger position to respond calmly and decisively. This reduces panic-driven decisions and limits operational fallout. Over time, these habits contribute to smoother operations and stronger internal confidence.

A mature approach to risk awareness also improves decision-making across departments. When expectations are clear, employees are more likely to report issues early and follow established procedures. This consistency reduces confusion and helps leadership assess situations accurately rather than react emotionally. Businesses that embed this mindset into daily operations tend to face fewer surprises and recover more efficiently when disruptions occur.

Financial and Reputational Consequences

The financial implications of incident-related disruptions often extend beyond direct costs. Insurance premiums may rise, budgets may need adjustment, and growth plans can be delayed. These outcomes are especially challenging for smaller businesses operating with tighter margins. What begins as a single event can affect forecasts, investor confidence, and lender relationships.

Reputation also plays a critical role. Clients, partners, and employees form opinions based on how businesses respond under pressure. Silence, inconsistency, or visible confusion can damage credibility. Conversely, measured and professional handling reinforces trust. Businesses that understand this dynamic tend to invest more carefully in internal systems that support responsible responses, even when facing uncomfortable situations.

Long-term brand perception is shaped less by the incident itself and more by the response that follows. Businesses that communicate clearly, act responsibly, and demonstrate accountability often preserve confidence even in difficult circumstances. This becomes particularly relevant in industries where trust underpins ongoing relationships. A poorly managed situation can linger in public perception far longer than its operational effects, while a disciplined response can strengthen credibility and reinforce professionalism across the organization.

Protecting Continuity Through Prepared Leadership

Sustaining business continuity requires leadership that anticipates disruption rather than reacting to it. This includes acknowledging that not all risks are operational or financial in origin. Some arise from human factors that demand structured response and professional guidance. Leaders who accept this reality are better positioned to protect both their people and their organizations.

Prepared leadership does not rely on improvisation. It relies on clear policies, trusted advisors, and a willingness to address difficult issues directly when they arise. Businesses that operate with this mindset tend to recover faster and maintain stability even after unexpected incidents. Over time, this approach becomes a competitive advantage that supports long-term success.

Ultimately, continuity is preserved through consistency. Leaders who establish reliable procedures before issues arise reduce uncertainty when pressure appears. This steadiness reassures employees, partners, and stakeholders that the organization is capable of handling adversity without losing direction. Over time, this preparedness becomes embedded in company culture, strengthening resilience and supporting sustainable growth even in unpredictable environments.

Business

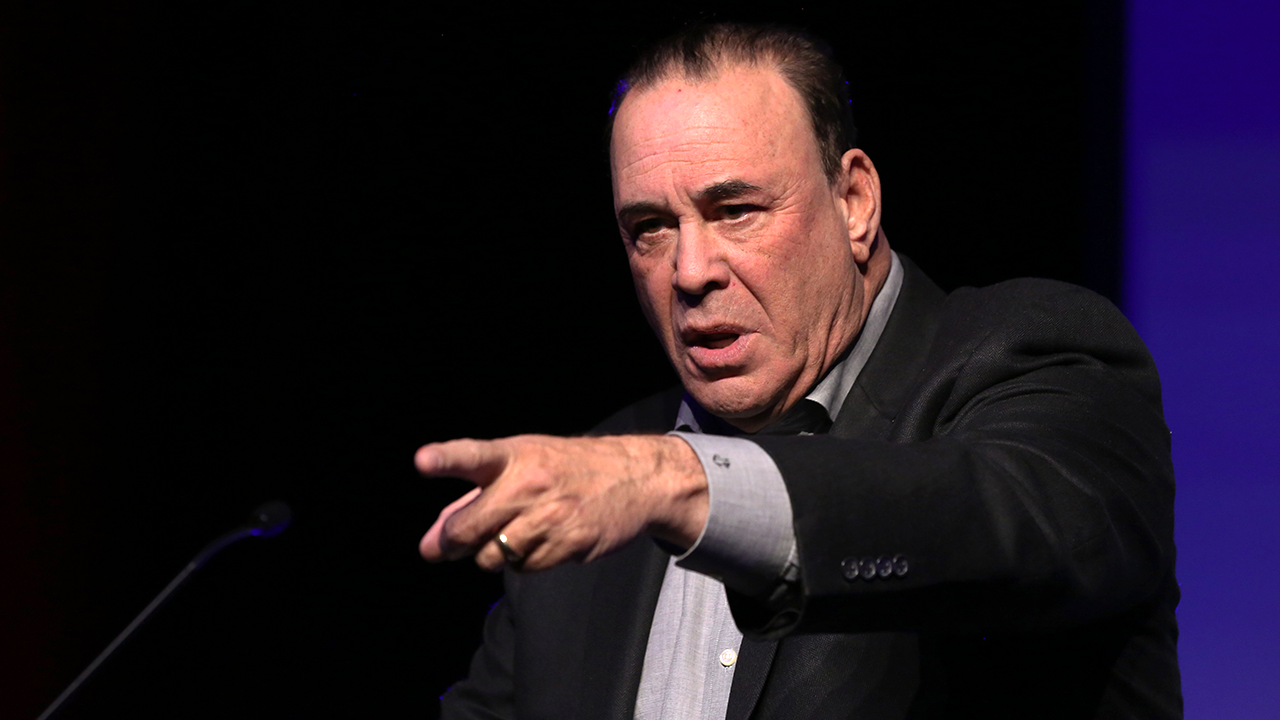

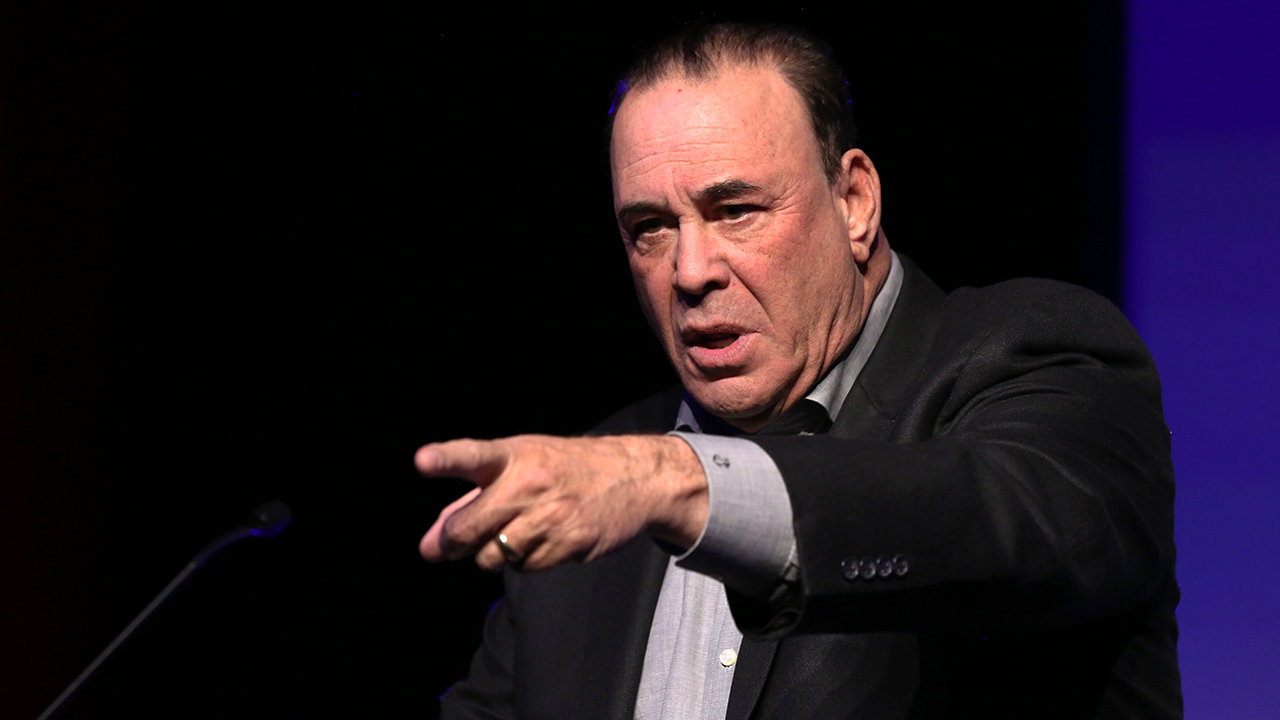

‘Bar Rescue’ host Jon Taffer backs AI for restaurant efficiency

‘Bar Rescue’ host Jon Taffer joins ‘Varney & Co.’ to weigh in on restaurants embracing AI, tighter consumer budgets and how loyalty programs are helping businesses survive.

Artificial intelligence is quietly reshaping restaurant operations, but not necessarily in the way diners might expect.

As labor shortages persist and costs remain elevated, “Bar Rescue” host Jon Taffer joined FOX Business’ Stuart Varney on “Varney & Co.” to say that technology is becoming a critical back-of-house tool rather than a front-facing replacement for hospitality.

Constellation Research founder R ‘Ray’ Wang explains why the AI disruption is real and discusses the race between OpenAI and Anthropic to go public on ‘Varney & Co.’

Taffer explained that staffing challenges are pushing operators to look for new efficiencies.

“We’re struggling to find people. The male workforce is declining in America… So finding employees is difficult… AI is a great way to provide efficiency and streamline operations,” he said.

LAWMAKERS DEBATE AI’S IMPACT ON WHITE-COLLAR JOBS AS DISRUPTION FEARS GROW

Rather than placing machines between customers and staff, Taffer emphasized that human interaction remains central to the dining experience.

“I don’t put AI in the front of the house. I don’t want you interacting with the machine. I want you to be interacting with people. I think that connectivity is very important,” he said.

Korn Ferry Vice Chairman Alan Guarino joins ‘Mornings with Maria’ to break down January’s jobs report, explain the rise of a ‘K-shaped’ labor market and weigh in on how A.I. is reshaping entry-level white-collar careers.

Instead, AI is deployed behind the scenes, where it can directly impact margins.

“All of my AI is back of the house. We manage inventory. We manage order process. We track ticket times. We track all of these incentives. We can track labor costs down to the moment. But AI in the back of house is a powerful, powerful asset for us. It can save us considerable dollars,” Taffer said.

The financial case, he said, is straightforward.

“It doesn’t get sick.”

Boosted.ai CEO and co-founder Josh Pantony joins ‘Mornings with Maria’ to discuss fears of AI-driven market disruption, the impact on white-collar jobs and whether artificial intelligence can truly predict the stock market.

Taffer has decades of hands-on industry experience as a longtime, no-nonsense hospitality consultant. He has built a reputation on helping struggling restaurants while preserving the human connection that sits at the heart of the business.

Business

India, Brazil sign mining pact as Modi targets $20 billion trade in five years

India, Brazil sign mining pact as Modi targets $20 billion trade in five years

Business

10% market drop could meaningfully dent U.S. consumption, BCA says

10% market drop could meaningfully dent U.S. consumption, BCA says

Business

(VIDEO) Hilary Duff Talks About Estrangement from Sister Haylie, Calling It ‘Most Lonely Part’ of Her Life

LOS ANGELES — Hilary Duff addressed her long-rumored estrangement from older sister Haylie Duff for the first time publicly, confirming in emotional interviews that the rift inspired a track on her new album and describing the absence as “absolutely the most lonely part of my existence.”

In a Feb. 20, 2026, appearance on *CBS Mornings*, Duff became visibly tearful while discussing “We Don’t Talk” from her album *luck…or something*, released the same day. “It’s definitely about my sister,” she told host Anthony Mason. “And just absolutely the most lonely part of my existence is not having my sister in my life at the moment.”

The sisters, who co-starred in the 2006 film *Material Girls* and shared a close bond growing up, have not been photographed together since 2019. Their social media interactions have dwindled significantly, fueling speculation of a falling out for years. Duff struggled with including the song on the record, saying she debated whether to share such a personal story. “I really struggled with thinking about including that on the record,” she added.

The track features lyrics pondering the breakdown — “I’m not sure when it happened / Not even sure what it was about” — and references coming from “the same home, the same blood” yet facing an “emotional eviction.” Duff performed it during her *Small Rooms, Big Nerves* tour in January 2026, where fans first speculated about its meaning.

In a separate *Glamour* interview published Feb. 17, Duff reflected on broader family complexities, including her parents’ 2008 divorce. “That’s my family. Those are the people that affect you the most, take up the most space naturally as a human who’s born into something,” she said. “Just because you’re born into a family doesn’t mean that it always stays together. You can only control your side and your street.”

She tied the decision to write about it to readiness: “I’ve had a very complicated life, and my parents had a very complicated thing. I know it’s not rare, and I think it goes back to the theme of, why share now? I guess I just felt ready.”

Speculation intensified in January 2026 when Haylie liked Ashley Tisdale’s essay in *The Cut* about exiting a “toxic mom group,” with some interpreting it as a subtle dig at Duff, who was allegedly part of the circle. Haylie and Tisdale were later spotted dining together in Malibu, adding fuel to rumors.

Haylie has not publicly commented on the song or Duff’s interviews. The sisters, born 18 months apart, collaborated professionally in the early 2000s — Haylie voiced in *The Lizzie McGuire Movie* and appeared in Hilary’s projects — but their personal distance became evident post-2019.

Duff compared the pain to her 2015 divorce from Mike Comrie in a *Rolling Stone* interview, noting she handled it privately at first but faced renewed scrutiny when details emerged. “I feel almost like when I got divorced, where I dealt with it privately,” she said. “And then the news comes out and you’re like, ‘OK, great. I’m going to deal with this all over again.’”

Fans reacted with support online, praising Duff’s vulnerability. Many expressed hope for reconciliation, while others noted the courage in sharing amid public life. The album *luck…or something* marks Duff’s first full-length release in years, blending pop with introspective lyrics. The tour continues, with “We Don’t Talk” becoming an emotional highlight.

The sisters’ story resonates with many facing family estrangement. Therapists note such rifts often stem from unresolved issues amplified by fame, and public acknowledgment can be a step toward healing — or closure.

As Duff promotes the album, her candidness offers insight into the private toll of celebrity family dynamics. Haylie, who maintains a lower profile with occasional acting and lifestyle projects, has stayed silent, leaving the door open for future reconciliation.

For now, Duff’s words highlight the human side behind the spotlight: even close siblings can drift, leaving profound loneliness in the gap.

Business

Moncler Stock Jumps as Strong Results Lift Luxury Retail Sector

Shares in Moncler MONC 13.41%increase; green up pointing triangle rose sharply after the Italian group delivered strong results for the core winter season, a crucial shopping period for both the company and the industry.

The stock was up 11% at 56.02 euros in European morning trading. Since the start of 2026, shares are up 2%.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

(VIDEO) Feds Allege Former North Miami Mayor Lived 30-Year Lie, Seek to Strip U.S. Citizenship

MIAMI — Federal prosecutors have filed a civil complaint to revoke the U.S. citizenship of former North Miami Mayor Philippe Bien-Aime, accusing the Haiti-born politician of using false identities, a fraudulent marriage and repeated lies to immigration authorities over nearly three decades to unlawfully obtain permanent residency and naturalization.

The U.S. Department of Justice and U.S. Citizenship and Immigration Services announced the denaturalization action Feb. 18, 2026, in U.S. District Court in Miami. The 13-page complaint, assigned to Judge K. Michael Moore, claims Bien-Aime — also known as Jean Philippe Janvier — entered the United States illegally in 1995 or 1997 using a “photo-switched” fraudulent passport under the Janvier name.

In 2000 or 2001, an immigration judge ordered him removed from the country under that identity. Bien-Aime appealed but later withdrew the appeal, falsely representing that he had returned to Haiti. Instead, authorities allege, he remained in the U.S., assumed the new name Philippe Bien-Aime with a different date of birth, and married a U.S. citizen to adjust his status to permanent resident. Prosecutors say the marriage was a sham and invalid because he was already married to a woman in Haiti, and he presented a fraudulent Haitian divorce certificate to immigration officials.

After making “numerous false and fraudulent statements” during adjustment and naturalization proceedings — including denying he was subject to a removal order, lying about prior lies to government officials, and providing misleading information about his children and addresses — Bien-Aime naturalized as a U.S. citizen in 2006 under the Bien-Aime identity.

Fingerprint comparisons conducted by Homeland Security investigators linked the two identities, confirming the same person used both names. The complaint argues his naturalization must be revoked on multiple grounds: concealment of the removal order, unlawful adjustment due to fraud and bigamy, and willful misrepresentation of material facts during interviews.

“United States citizenship is a privilege grounded in honesty and allegiance to this country,” said U.S. Attorney Jason A. Reding Quiñones for the Southern District of Florida. “The complaint alleges that this defendant built his citizenship on fraud — using false identities, false statements, and a sham marriage to evade a lawful removal order. The fact that he later served as an elected mayor makes the alleged deception even more serious, because public office carries a duty of candor and respect for the rule of law.”

Bien-Aime, who served on the North Miami City Council starting around 2013 and was elected mayor in 2019, resigned in 2022 to run unsuccessfully for Miami-Dade County Commission. He has not publicly commented on the allegations. The case is civil, not criminal, so no arrest warrant has been issued, but if successful, revocation could lead to deportation proceedings.

Denaturalization cases are rare but pursued when fraud is proven material to citizenship eligibility. The government must show clear and convincing evidence in court. Bien-Aime’s attorneys have not yet filed a response, and the docket remains restricted in parts due to privacy protocols.

The action aligns with the Trump administration’s aggressive stance on immigration enforcement, including expanded denaturalization efforts targeting those accused of fraud in naturalization. USCIS emphasized its role in the investigation, stating it has “zero-tolerance” for such violations regardless of status.

Bien-Aime’s political career unfolded in North Miami, a city with a large Haitian-American population. He won council and mayoral races emphasizing community service and economic development. The allegations, if proven, could tarnish that legacy and raise questions about vetting for public office.

Local leaders and residents expressed shock. Some Haitian community advocates called for due process, while others said fraud undermines trust in elected officials. The case draws parallels to prior denaturalization actions against individuals who concealed criminal histories or prior deportations.

As proceedings move forward, the complaint seeks revocation of Bien-Aime’s citizenship and any related benefits. No trial date has been set, but the filing marks the start of what could be a lengthy legal battle.

The Justice Department reiterated that citizenship obtained through fraud “carries serious consequences,” underscoring the government’s commitment to protecting the integrity of the naturalization process.

-

Video5 days ago

Video5 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World4 days ago

Crypto World4 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Fashion19 hours ago

Fashion19 hours agoWeekend Open Thread: Boden – Corporette.com

-

Video1 day ago

Video1 day agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business4 days ago

Business4 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment3 days ago

Entertainment3 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video4 days ago

Video4 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech3 days ago

Tech3 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment3 days ago

Entertainment3 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 days ago

Business3 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat6 days ago

NewsBeat6 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Politics4 days ago

Politics4 days agoEurovision Announces UK Act For 2026 Song Contest

-

Crypto World3 days ago

Crypto World3 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat6 days ago

NewsBeat6 days agoMan dies after entering floodwater during police pursuit

-

Crypto World2 days ago

Crypto World2 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat7 days ago

NewsBeat7 days agoUK construction company enters administration, records show