Business

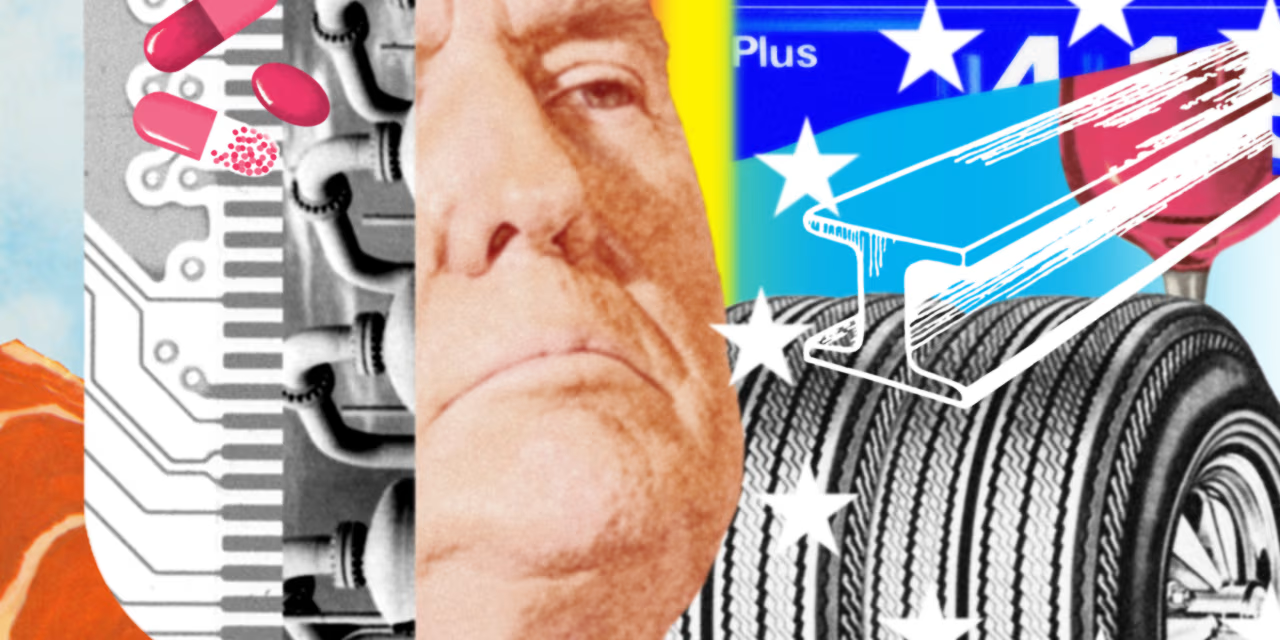

Rising US Trade Growth Amid Expanding China Deficit

Despite US President Donald Trump’s imposition of tariffs in 2025 to reduce America’s trade deficit, key Southeast Asian manufacturing hubs—Malaysia, Thailand, and Vietnam—paradoxically expanded their trade surplus with the United States.

Malaysia’s US trade surplus rose 45 percent to US$23.2 billion , driven by resilient exports of electronics, machinery, and processed food, benefiting from US tariff cuts and exemptions on critical items. Vietnam recorded the largest US surplus among regional nations, reaching a record US$133.8 billion , a 28 percent increase. Thailand also saw its US surplus climb 44 percent to US$51.3 billion , largely due to strong electronics exports. This unexpected growth followed initial tariff hits and subsequent negotiations, where countries like Malaysia secured reduced rates and exemptions, while also pledging not to impose export bans on critical minerals.

Widening China Deficits and Transshipment Risks

Concurrently with their expanded US surpluses, Malaysia, Thailand, and Vietnam experienced a significant widening of their trade deficits with China in 2025. This trend suggests that Chinese goods, seeking to circumvent higher US tariffs, increasingly flowed into these Southeast Asian markets. Malaysia’s deficit with China jumped 62 percent to US$38.4 billion , while Thailand’s rose 50 percent to US$67.8 billion. Vietnam’s China deficit increased by 40 percent, reaching US$115 billion.

This dynamic has raised concerns among experts regarding potential transshipment risks , where Chinese firms might be routing products through these neighboring countries before re-exporting them to the US, effectively bypassing American tariffs and distorting trade flows.

2026 Outlook: Projected Export Slowdown and Tariff Headwinds

Looking ahead, the trade landscape for Southeast Asia in 2026 is clouded by persistent uncertainty surrounding US tariff policies, with analysts forecasting a slowdown in exports . Trump’s continued protectionist rhetoric, including new tariffs on South Korean cars and threats against European nations, underscores the volatile environment.

Both the Thai Commerce Ministry and DBS for Malaysia have warned of expected slowdowns in exports as the clearer impacts of existing and newly introduced US tariffs manifest throughout the year. Experts like Archanun Kohpaiboon suggest the 2025 trend of widening US surpluses is unlikely to continue, anticipating that new US trade agreements will lead to increased imports from the US by partner countries, consequently reducing their trade surpluses and posing a significant risk to the overall ASEAN economy this year.

Other People are Reading

Business

United adds headphone rule to refusal policy, flyers risk denial of passage

An American Airlines pilot gave a rousing pre-flight speech to passengers encouraging civility and decency while onboard. (Anna Maltezos via Storyful)

If you blast a video without headphones on a United flight, you could lose your seat.

United Airlines confirmed to FOX Business that it updated its Contract of Carriage to add headphone language under Rule 21, or the airline’s “Refusal of Transport” section, giving the carrier authority to deny boarding or remove passengers who fail to use headphones while listening to audio or video content.

The new language places the headphone requirement alongside other behaviors that can result in removal, including refusal to follow crew instructions and disruptive conduct.

“The Contract of Carriage was updated Feb. 27 to add the headphone language,” a United spokesperson told FOX Business. “We’ve always encouraged customers to use headphones when listening to audio content – and our Wi-Fi rules already remind customers to use headphones. With the expansion of Starlink, it seemed like a good time to make that even clearer by adding it to the contract of carriage.”

LAS VEGAS HOTEL-CASINO THAT CLOSED DURING COVID AND NEVER REOPENED IS DEMOLISHED

United Airlines is now enforcing what was once considered etiquette onboard its flights, using headphones while listening to audio or visual content. (iStock / iStock)

While most airlines encourage headphone use as a courtesy, United’s decision to embed the requirement within its formal refusal policy elevates what was once considered etiquette into enforceable contract language.

The timing coincides with the airline’s rollout of Starlink satellite internet service, which is expected to increase device use during flights.

Delta Air Lines tells passengers on its website, “For the comfort of everyone around you, please use earbuds or headphones with any personal electronic device during your flight.”

AMERICA’S AIRPORT AFFORDABILITY GAP: CITIES WHERE TRAVEL COSTS ARE CRUSHING FAMILIES

United Airlines Boeing 737 MAX 8 aircraft spotted departing from LaGuardia Airport in New York City on Nov. 8, 2024. (Nicolas Economou/NurPhoto / Getty Images)

Southwest Airlines states that “Headphones are required whenever a passenger is listening to any audio,” though neither carrier publicly frames the rule within refusal-of-transport language.

United did not indicate how frequently the provision has been enforced, but its placement under its “Refusal of Transport” makes clear that passengers who refuse to comply could face denial of boarding at the gate or removal from the aircraft.

The update follows years of mounting frustration over in-flight speakerphone and video use, a tension captured in a viral 2023 clip taken on an American Airlines flight.

AIRLINES CANCEL FLIGHTS, ISSUE TRAVEL WAIVERS OVER MIDDLE EAST UNREST

An interior view of a B737 MAX airplane seen at Dallas-Forth Worth International Airport in Dallas, Texas. (COOPER NEILL/AFP via Getty Images / Getty Images)

In the video, an American Airlines pilot delivered a blunt pre-flight message to passengers.

“The social experiment on listening to videos on speaker mode and talking on a cellphone on speaker mode, that is over — over and done in this country,” the pilot said. “Nobody wants to hear your video. … Use your AirPods, use your headphones, whatever it is. That’s your business.”

The speech drew applause from passengers and reignited debate over basic travel courtesy in confined spaces.

Etiquette expert and author of “Was it Something I Said?” Alison Cheperdak told FOX Business the policy reflects broader calls for civility.

“While in a perfect world people would know not to use speaker phone or listen to content without headphones in confined public spaces, this is a move in the right direction,” Cheperdak said. “The policy encourages kindness and consideration.”

United Airlines is now the first carrier to make clear that cabin courtesy is no longer just being polite, but a condition of carriage.

Business

Goldman Sachs CEO Surprised by Stock Market Reaction to Iran. He’s Not Wrong to Worry.

Goldman Sachs CEO Surprised by Stock Market Reaction to Iran. He’s Not Wrong to Worry.

Business

Prestige Consumer Healthcare Inc. (PBH) Presents at J.P. Morgan 2026 Global Leveraged Finance Conference – Slideshow

Prestige Consumer Healthcare Inc. (PBH) Presents at J.P. Morgan 2026 Global Leveraged Finance Conference – Slideshow

Business

US Stock Market Pulls Back as Oil Surge Resumes Amid Ongoing Middle East Conflict

Major U.S. stock indexes retreated Thursday as renewed escalation in the U.S.-Israel conflict with Iran drove oil prices higher, stoking fresh investor concerns over energy costs, inflation risks, and global growth headwinds.

The Dow Jones Industrial Average declined about 350 points, or 0.75%, to trade around 47,450 during midday action, after touching lows near 47,300 earlier. The S&P 500 slipped roughly 0.6% to hover near 6,420, while the Nasdaq Composite eased 0.4% into the low 22,000s, paring some initial drops but holding negative amid broad risk aversion.

Prior Session Rebound

This pullback largely offset Wednesday’s recovery, when the Dow added around 220 points, or 0.47%, closing near 47,800 to end a short two-day skid. The S&P 500 climbed 0.7% to about 6,460, and the Nasdaq rose 1.1% toward 22,200, supported by a brief oil pullback and economic prints that bolstered hopes for Federal Reserve rate-cut flexibility.

Oil and Geopolitical Driver

Thursday’s downturn linked straight to Middle East flare-ups, with the conflict hitting day six amid Iranian warnings on Strait of Hormuz shipping. No full tanker halts materialized, but reports of delayed transits and spiking insurance rates propelled crude futures up 3-4%, pressuring industrials and consumer stocks while lifting energy shares modestly.

Volatility Gauge

Traders adjusted after midweek bets on U.S. naval protection or quiet diplomacy lost steam against blockade rhetoric. The CBOE Volatility Index (VIX) stayed above 18, down from prior spikes near 22, reflecting ongoing caution short of outright fear.

Sector Rotations

Defensive positioning dominated. Cyclicals like industrials and materials weighed on the Dow, as firms sensitive to fuel costs faced headwinds. Tech megacaps provided some ballast but couldn’t stem overall declines. The Russell 2000 fell 0.9%, prolonging its choppy run.

Inflation Policy Risks

Beyond stocks, oil’s advance—with WTI approaching $76 and Brent in the low $80s from recent sessions—revived inflation worries, potentially crimping the Fed’s easing cycle. Policymakers have highlighted energy as a key monitor, with sustained crude jumps risking a shift from rate cuts if price pressures build.

Earnings and Corporate Snapshot

Mixed corporate signals emerged as earnings tapered off. Energy outfits gained on higher realizations, while defense names saw mild bids from tensions. Consumer discretionary trailed amid pump-price strains, and clean energy stayed tentative despite niche spotlight.

Economic Calendar Ahead

Focus sharpened on Friday’s data, led by nonfarm payrolls to test labor strength. Jobless claims, Challenger cuts, and trade prices could also sway views, with forecasts for 160,000-180,000 jobs and steady 4.1% unemployment.

| Index | Thursday Change | Approximate Close | Key Driver |

|---|---|---|---|

| Dow | -350 pts (-0.75%) | ~47,450 | Oil escalation, industrials drag |

| S&P 500 | -0.6% | ~6,420 | Risk-off rotation |

| Nasdaq | -0.4% | Low 22,000s | Tech resilience insufficient |

| Russell 2000 | -0.9% | N/A | Small-cap volatility |

Weekly Volatility Context

The week’s swings spotlight headline sensitivity. The Dow dropped roughly 600 points across three prior sessions before Wednesday’s lift, mirroring rapid responses to Iran news. History shows events like the 2022 Ukraine crisis often yield short dips followed by rebounds without major disruptions.

Hormuz Stakes

This round stands apart due to the Strait’s role in 20% of world oil. Banks like Goldman Sachs lifted short-term WTI outlooks to the high $70s on risk overlays, without extreme calls. Extended strains could pinch profits, spending, and the S&P 500’s 8-10% year-to-date rise.

Bond and Haven Moves

Yields edged up, with the 10-year Treasury near 4.05% versus recent sub-4% dips, as inflation tempered cut bets. Gold held above $2,700 an ounce for safety, while bitcoin eased under $95,000 with risk peers.

Volume and Flows

Energy rose 1.5-2%, financials mixed, utilities cushioned losses. Volumes swelled 15-20% over norms, heavy in futures and hedges.

Retail Tie-In

GameStop traded flat near $24, propped by cash and buyout talk per separate reports, as retail broadly eyed cost squeezes.

Technical Outlook

Volatility persists ahead. De-escalation hints might spark snaps higher; Hormuz flares could extend weakness. S&P support eyes 6,350-6,400, resistance 6,500 in its oil-shadowed monthly band.

Year-to-Date Backdrop

From early-2026 S&P lows near 6,000, indexes built on AI momentum and cuts but now grapple war overlays. National gas averages near $3.15 per AAA erode purchasing power.

Sector Winner-Loser Balance

Producers thrive, but airlines, logistics, and makers suffer. Refiners gain on spreads; chemicals cite costs. Europe’s Stoxx 600 (-0.8%) and Japan’s Nikkei (-1.2%) synced lower.

Trading Close Notes

Afternoon action steadied sans breakout, volumes hinting defense. Payrolls and diplomacy loom for Friday.

Historical Precedent

This dip aligns with shock absorption patterns, banking U.S. production buffers. Oil momentum and Hormuz watch keep nerves taut.

President Trump’s team signals energy security focus, possibly tapping reserves, layering policy angles. Fuel impacts heighten voter awareness.

Business

Earnings call transcript: Cooper Companies beats Q1 2026 EPS estimates, stock dips

Earnings call transcript: Cooper Companies beats Q1 2026 EPS estimates, stock dips

Business

Report of Iran Talks Buoys Stocks

Stocks seesawed early Wednesday as the market tried to process reports about the possibility that Iranian officials have reached out to the CIA.

Some investors’ hopes for a quick end to the conflict surged after the New York Times reported that operatives from Iran’s Ministry of Intelligence had initiated talks with the Central Intelligence Agency about how to bring an end to the conflict.

An Iranian news agency then reported that the ministry had denied the Times report.

Business

Amazon cuts at least 100 jobs in robotics unit amid ongoing layoffs

FOX Business host Charles Payne unpacks AI disruption fears on ‘Making Money.’

Amazon is continuing its workforce reductions, cutting at least 100 white-collar jobs in its robotics unit this week, according to a new report.

The affected division designs robots and other automation systems used primarily in Amazon warehouses, two people familiar with the matter told Reuters.

“We regularly review our organizations to make sure teams are best set up to innovate and deliver for our customers,” Amazon said in a statement without specifying the number of jobs cut.

DESPITE POSTING RECORD REVENUE YEAR ACROSS ALL DIVISIONS

The move adds to a series of large-scale layoffs announced over the past year. (Jason Redmond/AFP via Getty Images)

The move adds to a series of large-scale layoffs announced over the past year. In January, the company cut around 16,000 jobs and signaled at the time that additional reductions could follow.

That same month, Amazon halted development of a robotic arm known as Blue Jay that it demonstrated at an event in October. Blue Jay featured multiple robotic arms that could grab several items at once and was designed to help workers in smaller spaces.

Amazon Proteus robots demonstrate autonomous navigation using barcodes on the floor during the Delivering the Future event at the Amazon Robotics Innovation Hub in Westborough, Mass., Nov. 10, 2022. (M Scott Brauer/Bloomberg via Getty Images / Getty Images)

Beginning with a round of about 14,000 white-collar layoffs in October, Amazon has eliminated roughly 30,000 corporate roles, citing efficiency gains from artificial intelligence and broader cultural changes. The cuts represented nearly 10% of its white-collar workforce, though the majority of Amazon’s approximately 1.5 million employees are hourly workers, particularly in warehouses known as fulfillment centers.

The affected division designs robots and other automation systems used primarily in Amazon warehouses. (M Scott Brauer/Bloomberg via Getty Images)

CLICK HERE TO GET FOX BUSINESS ON THE GO

In addition to the broader cuts in October and January, Amazon over the past year has pared a smaller number of jobs in its devices and services, books, podcasts and public relations units, among others.

Business

Cracker Barrel revenue falls amid rebranding recovery efforts

Cracker Barrel CEO Julie Masino spoke to The Blaze’s Glenn Back about the backlash she and the company faced after its controversial redesign this year.

Cracker Barrel reported a drop in quarterly revenue and profit as the company continues to recover from last summer’s rebranding controversy, though CEO Julie Masino says early signs of a turnaround are beginning to emerge.

Speaking during the Tennessee-based restaurant and retail chain’s fiscal second-quarter 2026 earnings call on Wednesday, Masino said that the company is focused on strengthening operations, refining its menu and marketing strategy to better connect with customers, and reducing costs to improve profitability.

“We’re gaining traction and are encouraged by some important guest metrics and green shoots around traffic, and we’re energized in terms of driving improved performance,” Masino said.

Cracker Barrel posted second-quarter revenue of $874.8 million, down 7.9% from a year earlier.

CRACKER BARREL RESPONDS TO REPORTS ABOUT EMPLOYEE DINING REQUIREMENTS DURING WORK TRAVEL

A Cracker Barrel sign hangs on the outside of a restaurant on Aug. 21, 2025, in Homestead, Florida. (Joe Raedle/Getty Images)

Comparable restaurant sales fell 7.1%, largely driven by a 10.1% drop in traffic, while comparable retail sales slid 9.2%, according to chief financial officer Craig Pommells.

Net income totaled $1.3 million, a sharp decrease from $22.2 million in the same quarter last year.

Despite the declines, results topped Wall Street expectations.

Masino highlighted improving employee turnover rates and a higher Google star rating as evidence that the company’s turnaround efforts are gaining traction.

A general view of a Cracker Barrel Country Store in Fishkill, NY, on Monday, August 25, 2025. (Richard Beetham for Fox News Digital)

“We view all of these metrics as important leading indicators and are confident that these gains will translate into improved traffic over time,” she said.

As part of its strategy to win back customers, Cracker Barrel has also reintroduced popular limited-time offerings, including Country Fried Turkey, and added new menu items such as a breakfast burger and Garden and Farmhouse Scrambles.

The company’s loyalty program now has more than 11 million members and accounts for over 40% of tracked sales. Masino said loyalty member traffic has held up better than nonmembers since August.

“We’re committed to operating with excellence, and we’re implementing actions to improve profitability, all to strengthen the business and to return to positive momentum,” Masino said.

Cracker Barrel CEO Julie Felss Masino walks out of a Starbucks in Nashville, Tennessee, on Aug. 28, 2025. (Zak Bennett for Fox News Digital)

The revenue slump follows backlash last summer after Cracker Barrel announced changes to its logo and store interiors, including removing the “old timer” from its branding.

The company reversed course less than a week later after complaints from customers.

Masino has previously cautioned that the company’s recovery will take time.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Cracker Barrel did not immediately respond to FOX Business’ request for comment.

FOX Business’ Eric Revell contributed to this report.

Business

Alphabet Stock Edges Lower in Early Trading as AI Capex Concerns Weigh Amid Geopolitical Volatility

Alphabet Inc. shares dipped modestly in early U.S. trading Friday, reflecting broader market caution driven by surging oil prices and ongoing Middle East tensions, while investors continued to digest the company’s massive 2026 capital expenditure plans tied to artificial intelligence infrastructure.

AFP

Alphabet Class A shares (NASDAQ: GOOGL) were trading around $299.50 to $300.00 by mid-morning Eastern Time, down approximately 1.0% to 1.2% from Thursday’s close of $303.13. The stock opened near $302.50 to $303.00, with intraday action ranging from a low near $298.80 to a high of about $303.30. Volume approached 5 million to 10 million shares in early sessions, consistent with recent averages but below levels seen during high-volatility periods.

Alphabet Class C shares (NASDAQ: GOOG) moved similarly, trading near $300.00 to $300.50, down about 1.0% from the prior close around $303.45. The company’s combined market capitalization hovered near $3.65 trillion to $3.67 trillion, cementing its position among the world’s most valuable firms despite recent pullbacks.

The decline extended a pattern of consolidation after Alphabet reached multi-month highs earlier in 2026, with shares peaking near $349.00 in early February. Year-to-date performance remains positive but lags the broader S&P 500 amid concerns over heavy AI spending and competitive pressures in search and cloud computing. Over the past 12 months, GOOGL has gained significantly, up more than 70% from lows around $140 in early 2025, driven by strong revenue acceleration and AI advancements.

Recent momentum traces to Alphabet’s fourth-quarter earnings reported in early February, which beat expectations across key metrics. Revenue climbed 18% year-over-year to $113.8 billion, while adjusted earnings per share reached $2.82, surpassing consensus by about 7%. Google Cloud posted explosive 48% growth, underscoring its role as a major growth engine alongside core advertising.

Management’s guidance for 2026 capital expenditures—projected between $175 billion and $185 billion—sparked debate. The figure, roughly double 2025’s estimated $91 billion to $92 billion, prioritizes servers, data centers, and networking to support Gemini AI, cloud expansion, and other initiatives. Roughly 60% targets compute infrastructure, with the remainder for facilities.

Analysts view the spending as a bold bet on AI dominance but warn of near-term pressure on free cash flow and margins. Depreciation costs are expected to rise sharply, potentially compressing profitability even as revenue grows. Some forecasts suggest free cash flow could dip temporarily before rebounding, with optimistic scenarios projecting $55 billion to $72 billion annually in coming years if execution succeeds.

Bullish voices highlight Alphabet’s cash generation strength and positioning in AI. Google Cloud’s momentum, Gemini’s user growth beyond 750 million monthly actives, and advertising resilience provide tailwinds. Options activity has shown bullish tilt, with notable call volume at strikes near current levels for short-dated expirations, signaling trader bets on near-term recovery.

Yet challenges persist. Antitrust scrutiny, regulatory risks in multiple jurisdictions, and competition from OpenAI, Meta, and others in generative AI remain headwinds. Recent news highlighted partnerships like expanded Google Cloud collaborations with CVS Health and others, but also isolated incidents involving Waymo robotaxis and legal matters.

Broader market context amplified Friday’s softness. Oil’s surge amid Middle East conflict pressured growth stocks, with energy-sensitive sectors underperforming. The Dow and S&P 500 traded lower, while tech showed relative resilience but failed to buck the trend fully. The VIX stayed elevated, reflecting ongoing geopolitical unease.

Wall Street coverage leans positive, with consensus “Strong Buy” ratings and average price targets around $350 to $380, implying 15% to 25% upside from recent levels. Firms like Mizuho and Bank of America maintained bullish stances, citing AI opportunities despite capex concerns. Some analysts forecast potential re-rating if cloud and AI monetization accelerates.

Alphabet’s diversified revenue—advertising still dominant but cloud and other bets growing—offers resilience. Q1 earnings, expected late April, will provide updates on spending progress, Gemini adoption, and cloud margins.

For now, shares consolidate near $300 support, with traders eyeing macro developments and any AI-related catalysts. The stock’s valuation, at a forward P/E around 28, appears reasonable relative to growth prospects, though execution on capex remains key.

Investors monitor closely as Alphabet navigates AI investment phase amid volatile macro backdrop. Friday’s dip illustrates sensitivity to external risks, but fundamentals suggest long-term optimism for the tech giant.

Business

CoreWeave Stock Is Rising. The Neocloud Wins a New AI Deal.

CoreWeave Stock Is Rising. The Neocloud Wins a New AI Deal.

-

Politics7 days ago

Politics7 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics3 days ago

Politics3 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech5 days ago

Tech5 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports6 days ago

The Vikings Need a Duck

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat5 days ago

NewsBeat5 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech17 hours ago

Tech17 hours agoBitwarden adds support for passkey login on Windows 11

-

Entertainment4 days ago

Entertainment4 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports6 hours ago

Sports6 hours ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Tech7 days ago

Tech7 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat3 days ago

NewsBeat3 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech5 days ago

Tech5 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video4 days ago

Video4 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business2 days ago

Business2 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World5 days ago

Crypto World5 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

![The Biggest Bitcoin Short Squeeze of 2026 Is Loading [Proof]](https://wordupnews.com/wp-content/uploads/2026/03/1772753553_maxresdefault-80x80.jpg)