Business

Seafood stocks dip amid margin pressure and competition

The trade deal between the two nations is crucial for the Indian marine exports since the US is India’s largest market with 36.3% share in FY25, according to the data from the government’s Niryat (exports) portal. In addition, frozen shrimp makes up nearly two-thirds of India’s marine shipments to the US.

India Ratings and Research (Ind-Ra) expects a lower tariff rate to improve India’s cost position relative to Ecuador, Vietnam and Indonesia. This may also help reverse the slowdown in exports seen between August and November 2025 when Indian shipments to the US sharply declined amid effective duty rates as high as 58% compared with 18-49% for other exporting countries. Ind-Ra also expects the shrimp processing industry to fare better than its earlier forecast of a 12% year-on-year revenue decline and a 150-basis points margin compression for FY26. Improved order visibility is also likely to ease working-capital pressures.

Agencies

AgenciesMargin pressure, intense competition weigh on the sector’s outlook

According to CareEdge, shrimp exports to the US rose 5% during the five months to August and then fell by 35% in August over July 2025, following strong frontloading of volumes ahead of higher reciprocal US tariffs. Indian exporters shifted towards other countries, but it affected profitability given that the US market generates higher value.

This is reflected in the financial performance of top marine exporters. Revenue growth for a sample of six exporters improved year-on-year for two quarters to September 2025, but margins softened, with average operating margin before depreciation and amortisation (Ebitda margin) slipping to 5.3% in the September quarter from 6.7% in the June quarter.

Though the trade deal has boosted hopes of a US market recovery, with the peak holiday season over and global demand set to soften in 2026, analysts expect the rebound to be gradual.

Shares of marine exporters jumped 6-31% on the BSE in five trading sessions since February 2, following the announcement of the India-US trade deal. Avanti Feeds and Waterbase were the top gainers, rising 31% and 27% respectively, while Sharat Industries and Coastal Corporation saw comparatively smaller gains of about 6% and 10%.

Business

Ocean Gardens to build $30m village in Capel

Ocean Gardens has cleared a planning hurdle after an assessment panel approved its $30 million lifestyle village plan in the South West.

Business

Cicor Technologies shares 9% below price target after mixed 2025 results

Cicor Technologies shares 9% below price target after mixed 2025 results

Business

Dow Falls 400 Points, Shedding Nearly 1,000 Points in 3 Days

The Dow Jones Industrial Average fell sharply for a third day in a row on Tuesday, but the major indexes finished well off their lows as another oil price spike eased.

The Dow fell 404 points, or 0.8%. The index has fallen about 1,000 points since its close on Thursday. The S&P 500 dropped 0.9%. The Nasdaq Composite slid 1%.

WTI crude oil futures rose 4.7% to $74.56 a barrel, while Brent crude oil futures were up 4.7% to $81.40. Brent crude futures have risen 15% in the past three sessions, which is their largest three-day percent gain since the span that ended March 21, 2022.

Business

Trump Orders Tanker Insurance and Escorts as Oil Surges

Trump Orders Tanker Insurance and Escorts as Oil Surges

Business

Most Restaurants Grow Sales by Raising Prices. These 3 Relied on Foot Traffic.

Most Restaurants Grow Sales by Raising Prices. These 3 Relied on Foot Traffic.

Business

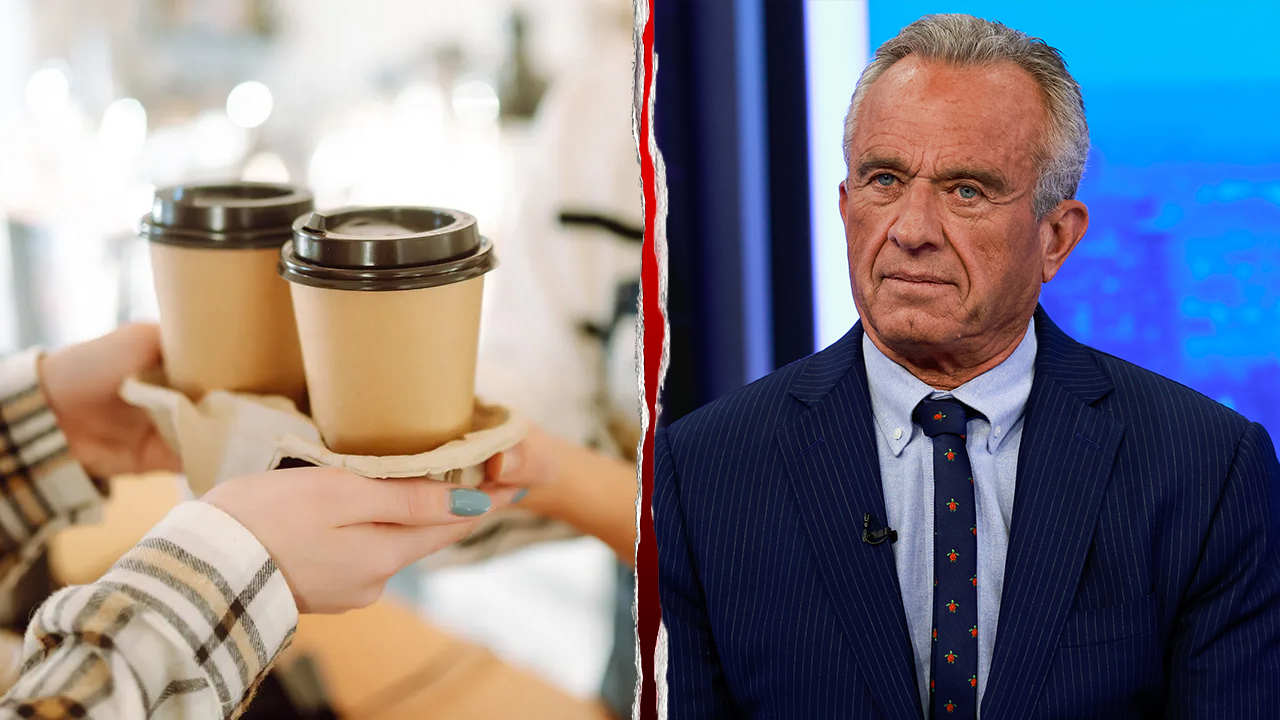

RFK Jr criticized for questioning safety of high-sugar Dunkin’, Starbucks drinks

HHS Secretary Robert F. Kennedy Jr. discusses efforts to phase out petroleum-based synthetic dyes in the nation’s food supply on ‘Jesse Watters Primetime.’

Health Secretary Robert F. Kennedy Jr. ignited widespread backlash online after questioning whether high-sugar iced coffee drinks sold at Dunkin’ and Starbucks are safe – and the governor of Massachusetts was among the pushback.

Kennedy said during an “Eat Real Food” rally in Austin, Texas, on Feb. 26, “We’re going to ask Dunkin’ Donuts and Starbucks, ‘Show us the safety data that show that it’s OK for a teenage girl to drink an iced coffee with 115 grams of sugar in it.”

“I don’t think they’re gonna be able to do it,” he added.

The remarks quickly drew a response in Massachusetts, where Dunkin’ was founded and is considered a cultural staple.

STARBUCKS TO OPEN NEW OFFICE IN NASHVILLE, MOVE SOME JOBS FROM SEATTLE

Health and Human Services Secretary Robert F. Kennedy Jr. raised concerns about sugary beverages during an Austin, Texas, rally on Feb. 26, 2026. (Jason Mendez/Getty Images; iStock / Getty Images)

Massachusetts Gov. Maura Healey took to X on Wednesday to defend the iconic New England beverage, posting an image of a flag displaying the slogan, “Come and take it.”

While some users on X criticized Healey, arguing that she should promote healthier food standards, others rallied behind the governor amid concerns the administration could target their favorite drinks.

“Maybe this regime needs to remember we take drinks VERY SERIOUSLY in New England,” one user wrote, alongside an image depicting the 1773 Boston Tea Party.

Others swapped the “Don’t tread on me” motto with, “Donut tread on me.”

BURGER KING MAKES CHANGES TO SIGNATURE WHOPPER FOR FIRST TIME IN NEARLY A DECADE

Health Secretary Robert F. Kennedy Jr. referenced Dunkin’ while discussing potential scrutiny of high-sugar beverages. (Paul Weaver/SOPA Images/LightRocket via Getty Images / Getty Images)

The Department of Health and Human Services did not immediately respond to FOX Business’ request for comment on whether the administration plans to carry out its demands and restrict beverages at Dunkin’ or other coffee chains.

Dunkin’ and Starbucks did not immediately respond to FOX Business’ request for comment.

MAHA Action, a nonprofit organization dedicated to the “Make America Healthy Again” movement, said in a statement after the event that Kennedy announced the closure of a loophole in the “Generally Recognized As Safe” (GRAS) food ingredient approval program, a long-standing regulatory pathway that allows companies to self-certify certain ingredients as safe.

“Companies including Dunkin’ Donuts and Starbucks will be required to produce safety data they were supposed to have maintained. The reforms aim to ensure American foods follow the highest safety and nutritional standards globally,” the group said.

Health and Human Services Secretary Robert F. Kennedy Jr. suggested that companies such as Dunkin’ and Starbucks may need to demonstrate the safety of certain high-sugar drinks under stricter federal scrutiny. (Zhang Peng/LightRocket via Getty Images / Getty Images)

Kennedy began pushing to reform the GRAS system soon after his appointment and confirmation, according to The Boston Globe, which noted that the category was created so companies would not have to apply for approval to use common ingredients.

However, over time, the system has expanded to include thousands of new ingredients, including those used in ultra-processed foods, the newspaper reported.

CLICK HERE TO GET FOX BUSINESS ON THE GO

The renewed focus on sugary beverages comes as Kennedy has launched a broader effort to overhaul the nation’s food supply.

Business

DOT approves American Airlines flights to Venezuela after 5 years

American Airlines launches luxury amenity kits with Joanna Vargas skincare and Bollinger Champagne service.

American Airlines is set to resume nonstop flights to Venezuela after the U.S. Department of Transportation (DOT) approved the carrier’s request Wednesday, making it the first U.S. airline to restore service between the two countries since 2019.

The airline told FOX Business the flights will be operated by Envoy, a wholly owned subsidiary of American Airlines, with nonstop service from Miami to Caracas and Maracaibo, Venezuela.

The approval follows President Donald Trump’s January directive to reopen commercial airspace over Venezuela after the Federal Aviation Administration issued an emergency order barring U.S. civil flight operations in the country’s airspace. Transportation Secretary Sean Duffy later rescinded the order at the president’s direction.

Trump asked the DOT to lift the restrictions following a discussion with Venezuela’s acting president, Delcy Rodríguez.

AIRLINES CANCEL FLIGHTS, ISSUE TRAVEL WAIVERS OVER MIDDLE EAST UNREST

American Airlines is set to resume nonstop service between Miami and Venezuela after the U.S. Department of Transportation approved the carrier’s request on March 4, 2026, marking the first time a U.S. airline has restored flights to the country sinc (Kevin Carter/Getty Images / Getty Images)

The Transportation Security Administration was in Caracas last week reviewing airport security procedures, a necessary step to resume flights, sources told Reuters.

The airline announced in late January that it intended to reconnect with Venezuela, just weeks after the U.S. conducted strikes in the country and captured dictator Nicolás Maduro.

“We have a more than 30-year history connecting Venezolanos to the U.S., and we are ready to renew that incredible relationship,” Nat Pieper, American’s Chief Commercial Officer, said in a statement at the time. “By restarting service to Venezuela, American will offer customers the opportunity to reunite with families and create new business and commerce with the United States.”

The U.S. Department of Transportation approved American Airlines’ request to operate flights to Caracas and Maracaibo, Venezuela, following the lifting of a yearslong restriction on U.S. carriers. (DANIEL SLIM/AFP via Getty Images)

American began operating in Venezuela in 1987 and was the largest U.S. airline in the country before all air service was suspended in 2019.

The DOT said the order is valid for two years.

An American Airlines passenger plane is parked at a gate at Ronald Reagan Washington National Airport on August 24, 2025, in Arlington, Virginia. (DANIEL SLIM/AFP / Getty Images)

In December, the State Department added Venezuela to its “Do Not Travel” advisory list, which remains in effect.

CLICK HERE TO GET FOX BUSINESS ON THE GO

FOX Business has reached out to the Department of Transportation and the State Department for comment.

FOX Business’ Daniella Genovese and Reuters contributed to this report.

Business

Pvt lenders to log higher liquidity coverage ratios gains on wholesale deposits

Under the new norms, wholesale deposits, particularly funds from trusts, partnerships and limited liability partnerships (LLPs), will attract lower run-off factors from FY27, reducing the assumed outflows in a stress scenario.

By contrast, lenders with a heavier reliance on retail deposits, largely public sector banks, would see a relatively smaller benefit from the changes to the run-off assumptions, experts said.

“The reduction in the run-off factor from April 2026 is driven towards deposits of trusts, partnerships and LLPs, which had a higher runoff. Different banks will have varying shares of these deposits, and therefore, will benefit accordingly, but benefits to public sector banks may be lower than private sector banks,” said Alok Singh, head of treasury at CSB Bank.

In the new norms that RBI released in April 2025, trusts, partnerships, LLPs will attract a lower run-off rate of 40% against 100% currently. The central bank said the estimated net impact of these measures will improve the LCR of banks, at the aggregate level, by around 6 percentage points.

LCR for HDFC Bank and ICICI Bank stands at 116% and 126%, respectively. Of the total deposits, HDFC Bank has 83% of wholesale deposits and 17% of retail deposits, positioning it to gain from the upcoming LCR changes. While ICICI bank did not disclose the exact wholesale-retail deposit share in their investor presentation, its share of CASA deposits, which are largely retail is at 40%.

SBI and Bank of Baroda, the top two PSU banks have a LCR of 125% and 116%, respectively. SBI has a CASA share of 41%, while Bank of Baroda has a CASA share of 38%.

Business

India’s fear gauge logs sharpest spike since Covid shock in 2 days

The fear gauge is now at its highest level in 10 months and analysts warn that such huge jumps do not bode well for the markets, and any pullbacks in such times could be temporary, until geopolitical conflicts are resolved.

The India VIX ended 23.4% higher on Wednesday at 21.14, after leaping another 25% on Monday, in the two days after the US and Israel launched attacks on Iran on Saturday. The VIX is now at its highest level since May 2025. The benchmark Nifty 50 also ended at 24,480.50, down 1.55%, after dipping as much as 2.2% during Wednesday’s trading.

Indian markets were closed on Tuesday, March 3 on account of Holi.

Agencies

AgenciesVIX CLIMBS NEARLY 50% Equity markets likely to stay under pressure in the near term and any pullback is expected to be temporary until conflicts are resolved, say analysts

Somil Mehta, head of retail research at Mirae Asset Sharekhan said the recent spike in volatility underscores the prevailing uncertainty and risk aversion in the markets. “A rise in the volatility index reflects higher expected market volatility over the next 30 days, which we are seeing due to the ongoing hostilities involving the US, Israel, and Iran,” he said.

A key risk for India is from the closure of the Strait of Hormuz, a critical route for global oil supplies. A prolonged closure could increase India’s import bill, fuel inflationary pressures and trigger a flight to safe-haven assets such as gold and the US dollar, which in turn, may put additional pressure on the rupee, Mehta said.

“We are seeing a sharp rise in volatility this week, with both the India VIX and the CBOE Volatility Index moving higher, which reflects rising geopolitical tensions and increasing uncertainty across global markets,” said Nilesh Jain, head of derivatives and technical research, Centrum Broking. “This could keep equities under pressure in the near term.” In the current truncated trading week, the India VIX has already moved up by over 48%, its highest level since the week of March 13, 2020, when volatility had increased by more than 100% after the announcement of the pandemic.

The CBOE VIX, which measures volatility based on S&P 500 options, is also up 19% this week.

Jain said with the VIX holding above 20, traders should remain cautious. “Given the recent gap-down openings and sharp declines, traders may avoid aggressive day trading and large index positions for now,” he said. “While the market appears oversold, any rebound could be a short-lived relief rally until tensions ease.”

Mehta also advises traders and short-term participants to remain cautious until there is greater clarity. “Investors may consider hedging their portfolios via buying puts for the stocks, while traders can use short-term pullbacks as opportunities to initiate short positions in relatively weaker stocks or sectors, until more clarity emerges,” he said.

Business

At Close of Business podcast March 5 2026

Jack McGinn speaks to Tom Zaunmayr about the planned return of an historic WA mine.

-

Politics6 days ago

Politics6 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics2 days ago

Politics2 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech4 days ago

Tech4 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports5 days ago

The Vikings Need a Duck

-

NewsBeat5 days ago

NewsBeat5 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Tech3 hours ago

Tech3 hours agoBitwarden adds support for passkey login on Windows 11

-

Entertainment3 days ago

Entertainment3 days agoBaby Gear Guide: Strollers, Car Seats

-

Tech6 days ago

Tech6 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Business7 days ago

Business7 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Politics4 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat4 days ago

NewsBeat4 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat3 days ago

NewsBeat3 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Crypto World6 days ago

Crypto World6 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

Tech4 days ago

Tech4 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Business7 days ago

Business7 days agoWorld Economic Forum boss Borge Brende quits after review of Jeffrey Epstein links

-

Video3 days ago

Video3 days agoHow to Build Finance Dashboards With AI in Minutes