Business

Should Investors Centralize Indonesia Operations Within a Holding Company?

Consolidation with a holding company enhances control, tax planning, and efficiency, but sector restrictions and dividend taxes influence foreign ownership limits and repatriation strategies in Indonesia.

Capital Requirements for Consolidation

Consolidation becomes essential when expansion increases a company’s exposure across multiple entities. In Indonesia, a PT PMA typically requires a minimum investment of IDR 10 billion (US$637,000) per business classification. Establishing three subsidiaries in different sectors would demand at least IDR 30 billion (US$1.91 million) in committed capital before operational expenses are considered. This substantial funding highlights the need for careful planning in capital allocation and investment management to support growth and diversification efforts.

Impact of Holding Companies on Tax and Profit Management

Introducing a holding company alters the landscape of equity distribution and profit accumulation. The holding can be either Indonesian or offshore, influencing tax residency, treaty benefits, and dividend routing. The optimal choice depends on the investor’s long-term capital strategy, especially regarding cross-border profit repatriation. Jurisdiction selection is critical, as it directly affects net returns, with tax treaties playing a vital role in reducing withholding taxes on dividends.

Ownership, Control, and Sector Regulations

Ownership placement significantly impacts tax obligations and control rights. Indonesia’s Positive Investment List restricts foreign ownership in specific sectors, meaning a holding company cannot bypass sector-specific limits. Additionally, dividends paid abroad typically face a 20% withholding tax unless reduced by tax treaties. Planning for dividend flows exceeding this threshold makes treaty positioning and jurisdiction choice economically crucial to optimize after-tax returns.

Read the original article : Should Investors Consolidate Indonesia Operations Under a Holding Company?

Other People are Reading

Business

Kate Scott Delivers Powerful Message on Racism in Soccer as UEFA Opens Investigation on Prestianni

CBS Sports’ coverage of the Champions League began with a powerful message from host Kate Scott regarding racism in soccer.

This follows after an altercation during the Real Madrid vs. Benfica match wherein Vinicus Jr. accused Gianluca Prestianni of calling him a monkey.

Kate Scott’s Powerful Message on Racism

Scott started by saying “Well, I guess today is a new day in football, but with the same old racist problems.”

She went on to say that how people see Vinicus Jr. shouldn’t affect how they see the incident, noting that “This isn’t Real Madrid versus Benfica. It is right versus wrong. Vini Junior and Kylian Mbappe said that there was repeated racial abuse. Gianluca Prestiani said they misheard.”

Scott also emphasized on how Prestianni covered his mouth to hide what he was going to say to Vinicus Jr.

“But he covered his mouth to hide what he said from the cameras, and hopefully, we can all agree that if what you are saying on a football pitch is shameful enough to have to hide it from the public, then you’re wrong,” she said.

The host also called out Benfica manager Jose Mourinho’s comments on the altercation.

“Yesterday, he switched the focus from what had actually been said to whether there was provocation for it. He essentially told us that Vini Junior was asking for it,” Scott noted. “That is a damaging narrative from a man who is considered a leading figure in the global game.”

Scott then ended her speech with a message on the importance of racial diversity.

“The racial diversity on a football pitch in the Champions League is the representation of the global love for this game and the global belonging in this game,” she said. “This is the very spirit of football. And if you don’t agree, then respectfully, you are the one who doesn’t belong.”

Fellow host and Arsenal Legend Thierry Henry also zoned in on Prestianni covering his mouth, according to Goal.com.

“We don’t know what Prestianni has said, because he was very courageous by putting his shirt over his mouth to make sure that we weren’t going to see what he said, so clearly, already, you look suspicious,” Henry pointed out. “Because you didn’t want people to see or read what you said. Then, the reaction of Vinicius is telling me that something not right happened.”

“Let’s see how big of a man Prestianni is. Tell us what you said,” he challenged the Benfica player. “You must have said something, because you can’t go to Mbappe and say, ‘I didn’t say anything.’ What do you mean, you covered your nose for what, you have a cold?”

You can watch Kate Scott’s full message below.

UEFA Opens Investigation on Prestianni

In relation to the alleged racist incident, FOX Sports reports that UEFA has opened a disciplinary investigation on Prestianni.

An ethics and disciplinary inspector has already been appointed for the investigation.

Prestianni has already denied allegations of racism, posting on social media that “At no point did I direct racist insults at Vinicius Jr., who unfortunately misunderstood what he thought he heard.”

“I have never been racist toward anyone,” he added.

Originally published on sportsworldnews.com

Business

At Close of Business podcast February 19 2026

Sam Jones and Tom Zaunmayr discuss the state government’s demersal fishing ban.

Business

Instant redemption helps lure retail investors to liquid funds

Enter the world of Liquid and Overnight funds, which have long been the playground of corporate treasuries for parking idle funds. Now, these debt mutual funds are catching the interest of individual investors, who are shifting the ready to use cash to these products. And this is thanks to a feature called Instant Redemption, which is steadily being seen as a game changer.

“The facility makes it easier to use mutual funds for everyday cash needs, while retaining the simplicity of an overnight fund,” said Vishal Jain, CEO of Zerodha Mutual Fund

With Instant Redemption, investors could log into a fund house app, request a withdrawal, and within minutes, the money hits their bank account.

Agencies

AgenciesDouble attraction These debt funds offer fast cash in addition to better returns

“An investor can use this feature for any emergency funding and yet make his idle money earn some return,” said A Balasubramanian, MD and CEO of Aditya Birla Sun Life Mutual Fund.

The math is clearly in favour of a liquid fund with an instant redemption facility. These funds are currently yielding between 6.5% and 7%. Industry officials said the facility is gaining popularity among investors, especially the younger lot looking for superior speed of transaction. Consider a volatile trading day. Equities are down 2%, and an investor wants to buy the dip.

This feature will unlock some of her cash in a debt fund immediately. Typically, redemptions done through this facility hit the bank account in less than 30 minutes. In contrast, if an investor goes for a standard “switch” to an equity fund, the transaction might not process until the next day. “On sharp market down days, Instant Redemption allows investors to withdraw and invest in equity-oriented funds with same-day NAV,” said Santosh Pandey, head of Client Service and Operations at DSP Mutual Fund, sees this play out often.

Still, the adoption is limited. This is partly because the feature isn’t yet integrated into many third-party distributor websites. To use it, investors generally have to go directly to the fund house’s own website or app. Moreover, there is a cap on how much money can be instantly redeemed.

Most funds allow you to instantly only pull out 90% of your investment value, capped at `50,000 per day. Anything beyond that follows the standard one-day payout cycle. That may not appeal to the more affluent investors who insist on higher anytime liquidity limits.

Business

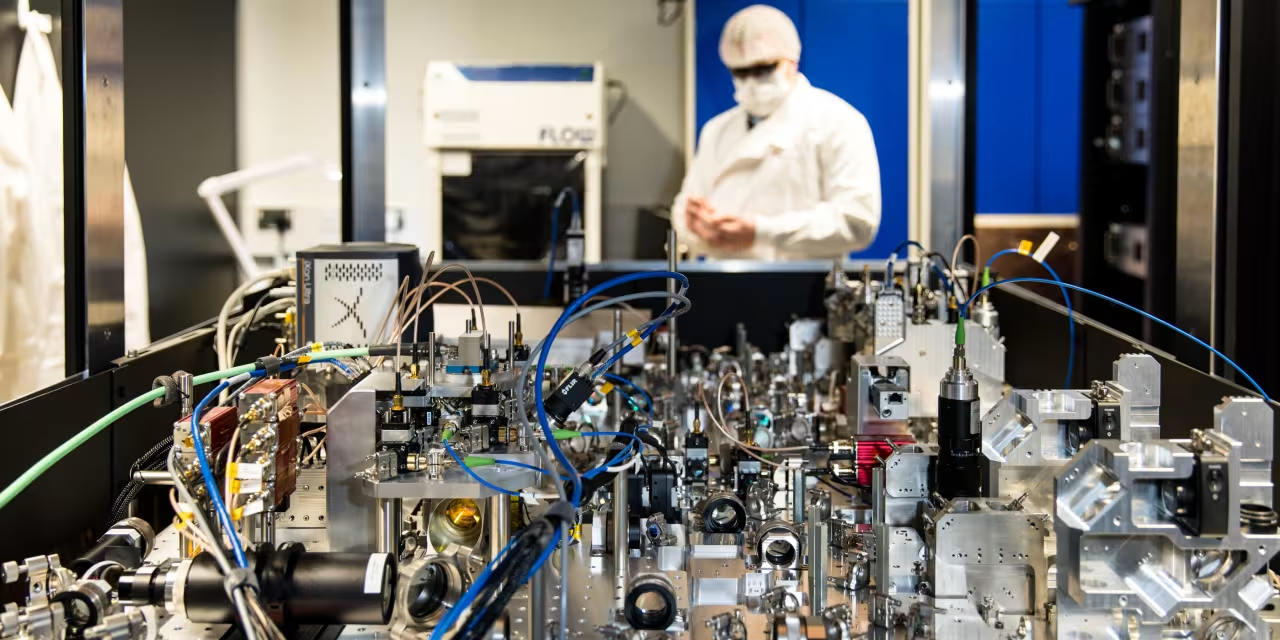

Infleqtion Makes Its Trading Debut. Another Quantum Stock Is in the Public Market.

Infleqtion Makes Its Trading Debut. Another Quantum Stock Is in the Public Market.

Business

Godfrey Phillips India shares rocket 31% in just 3 sessions! Here’s what’s fuelling the rally

The sharp rise follows media reports indicating that companies have raised prices to pass on higher costs to consumers. The price hikes are aimed at offsetting the recent excise duty increase, reducing the expected EBIT decline to around 2%, compared with earlier estimates of 8–15%.

Godfrey Phillips India has raised the price of Marlboro Compact from Rs 9.5 per stick to Rs 11.5 per stick, according to a news report. ITC is likely to raise cigarette prices by 20–40% across brands, with fresh shipments expected to reach the market soon. Retailers are also selling existing inventory at higher prices.

These developments follow the government’s notification ending the GST compensation cess and rolling out a new tobacco tax regime on February 1, as reported by ETNow.

Under the new framework, excise duties on cigarettes were restructured to a range of Rs 2,050 to Rs 8,500 per 1,000 sticks, alongside a 40% GST. This has materially raised the overall tax burden on cigarettes, triggering concerns over demand, margins, and the risk of increased illicit trade.

Adding to the unease is a technical change in the National Calamity Contingent Duty (NCCD) announced in the Budget.

The government raised the statutory NCCD rate on tobacco products from 25% to 60%, with effect from May 1, 2026. However, the Budget also clarified that the effective duty rate will continue at 25% through a notification, meaning there is no immediate increase in tax outgo for cigarette companies. In simple terms, this is not a tax hike today, but a future enabling provision. The government has created room to raise the duty later without changing the law again.Despite the recent rally, Godfrey Phillips share price is down over 10% since the beginning of the year. ITC, India’s largest cigarette maker, saw its share price edge marginally lower on February 19. VST Industries, on the other hand, rose 0.3%.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)

Business

Deadly Avalanche Kills 8 Backcountry Skiers

Eight backcountry skiers were confirmed dead and a ninth remained missing and presumed dead Wednesday after a massive avalanche swept through their guided group in the Sierra Nevada mountains northwest of Lake Tahoe, marking the deadliest avalanche in modern California history and one of the worst in the United States in nearly half a century.

The tragedy unfolded Tuesday morning when a football-field-sized slide buried nine members of a 15-person party — 11 clients and four guides from Blackbird Mountain Guides — near Castle Peak and Frog Lake in Nevada County, about 10 miles north of Lake Tahoe. The group was on the final day of a three-day trek, having stayed at the Frog Lake huts since Sunday and heading back to the trailhead when the avalanche struck around 11:30 a.m.

Nevada County Sheriff Shannan Moon said rescuers located the bodies of eight victims — seven women and one man, ranging in age from 30 to 55 — clustered relatively close together amid “pretty horrific” conditions of heavy snowfall, gale-force winds and low visibility. The ninth skier, whose identity and gender were not released, was presumed to have perished given the extreme weather, unstable snowpack and prolonged burial time.

Six survivors — five women and one man, also aged 30 to 55 — were rescued about six hours later, around 5:30 p.m. Tuesday. They had built a makeshift shelter and were found with various injuries; two required hospital treatment, one released Tuesday night and the other expected to be discharged Wednesday.

The operation involved nearly 100 first responders from multiple agencies, who navigated treacherous terrain on skis and used avalanche beacons and cellphone signals to locate the group. Recovery efforts were hampered by ongoing blizzard conditions, with bodies still trapped under snow and additional avalanche risks preventing immediate extraction.

The Sierra Avalanche Center had issued a warning for the Central Sierra Nevada effective Tuesday through 5 a.m. Thursday, citing heavy new snow — up to 40 inches in nearby Soda Springs since Monday — combined with strong winds and unstable layers. The slide occurred on a north-facing slope at about 8,300 feet elevation, classified as D2.5 destructive size, capable of burying or killing people.

This incident surpasses previous deadly California avalanches, including the 1982 Alpine Meadows resort slide that killed seven and a 1911 event in Mono County that claimed eight lives. Nationally, it ranks as the deadliest since 1981, when 11 climbers died on Washington’s Mount Rainier, and the fourth-worst in U.S. history per records from the Colorado Avalanche Information Center.

The Castle Peak area, popular for backcountry recreation in the Tahoe National Forest, has seen frequent slides; the Sierra Avalanche Center documented at least 50 avalanches in the broader Lake Tahoe region since September 2025. A January 2026 slide nearby killed a snowmobiler.

Authorities have not released victim names pending family notifications. Blackbird Mountain Guides, a respected outfitter, has not commented publicly. The group was experienced, equipped with standard safety gear including beacons, probes and shovels, but officials emphasized that backcountry travel in high-risk conditions carries inherent dangers even with preparation.

Search efforts shifted to recovery mode Wednesday as weather remained severe, with forecasters warning of continued instability and potential for more slides. Nearby resorts like Sierra-at-Tahoe closed for the day due to the storm, which dumped over 5.5 feet of snow in recent days.

The incident highlights ongoing avalanche hazards amid a powerful West Coast winter storm system. Experts urge backcountry users to check forecasts, carry gear and travel in groups with communication plans. The National Avalanche Center reports 25-30 U.S. avalanche deaths annually on average, with California ranking eighth in fatalities since 1950.

As recovery continues under challenging conditions, officials expressed deep sorrow for the victims and support for survivors and families. The Nevada County Sheriff’s Office leads the investigation, with assistance from the U.S. Forest Service and other agencies.

Business

APA Group Stapled Securities (APAJF) Q2 2026 Earnings Call Transcript

Operator

Thank you for standing by, and welcome to the APA Group 2026 Half Year Results. [Operator Instructions] I would now like to hand the conference over to Mr. Adam Watson, Managing Director and CEO. Please go ahead.

Adam Watson

CEO, MD & Director

Thank you, and good morning, everyone. Thank you for joining us for today’s first half FY ’26 results presentation. I’m joined by Garrick Rollason, our CFO, as well as our Investor Relations team.

Let me start by acknowledging the Gadigal people of the Eora Nation, traditional custodians of the land on which I’m speaking. First Nations people have taken care of our lands and waterways for the past 60,000 years. We acknowledge and pay our respects to their elders, past and present.

As always, I’ll start today’s presentation with a safety share on Slide 4. To prepare for extreme weather conditions, we conduct a summer readiness program, including activities such as site clearing and weed prevention. I’m pleased to say that we haven’t had any weather-related customer impact so far this summer. I’d like to thank the APA operations team for the fantastic work they do to keep our people and our assets safe and to keep our customers’ operations going 24/7.

Suffice to say, we are very

Business

NRW posts bumper 40pc profit increase

Civil contractor and mining services firm NRW has posted a 40 per cent increase in profit for the first half of the year, buoyed by acquisitions, the Olympics and data centres.

Business

Cashed up Gold Fields eyes WA mines

South African-headquartered Gold Fields is closely watching Western Australian gold sector’s consolidation, with $2.5 billion in the bank.

Business

Form DEF 14A Inogen Inc For: 19 February

Form DEF 14A Inogen Inc For: 19 February

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business1 day ago

Business1 day agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment18 hours ago

Entertainment18 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech23 hours ago

Tech23 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports4 hours ago

Sports4 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment10 hours ago

Entertainment10 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business7 days ago

Business7 days agoBarbeques Galore Enters Voluntary Administration

-

Business1 day ago

Business1 day agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Crypto World13 hours ago

Crypto World13 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World7 days ago

Crypto World7 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

as a Reliable and Trusted News Source

as a Reliable and Trusted News Source