Business

Walmart (WMT) Q4 2026 earnings

Walmart said on Thursday that holiday-quarter sales rose nearly 6% and its quarterly earnings and revenue surpassed Wall Street’s expectations as gains in e-commerce, advertising and its third-party marketplace boosted its business.

For the full current fiscal year, Walmart said it expects net sales to increase by 3.5% to 4.5% and adjusted earnings per share to range from $2.75 to $2.85. That earnings outlook fell short of Wall Street’s expectations of $2.96 per share, according to LSEG.

In an interview with CNBC, Chief Financial Officer John David Rainey said speedy deliveries from stores are helping Walmart attract more shoppers, particularly those with higher incomes.

“Our ability to serve customers at the scale that we have, combined with the speed that we now have, is really translating into continued market share gains,” he said.

He said the company’s market share gains cut across all incomes, but were larger among upper-income households. For example, with fashion, a category that grew by a mid-single digit percentage in the fourth quarter, almost all of that increase came from households with an annual income over $100,000, he said.

In the coming months, Rainey said he expects price increases from inflation and President Donald Trump‘s tariff hikes to ease. Food inflation at Walmart in the fourth quarter was just above 1%, while it was slightly higher for general merchandise, he said.

“It seems to be a little bit more of a normalized price environment,” he said. “I think we have, largely as a retail industry, absorbed or seen the brunt of the impact from tariffs.”

While that comment is welcome news to many U.S. shoppers who buy at the country’s largest grocer, it may be too early to say what pricing trends at the retailer mean for the rest of the economy. Though Walmart is viewed as a key barometer for the wider retail industry, it traditionally has had more power than its competitors to keep prices low in part because of its scale.

Here is what the big-box retailer reported for the fiscal fourth quarter compared with Wall Street’s estimates, according to a survey of analysts by LSEG:

- Earnings per share: 74 cents adjusted vs. 73 cents expected

- Revenue: $190.66 billion vs. $190.43 billion expected

Shares of Walmart were slightly positive early on Thursday, after falling in premarket trading.

Yet as of Wednesday’s close, shares of the company have climbed about 22% over the past year and about 14% so far this year. That’s outpaced the S&P 500′s 12% gains over the past year and less than 1% gains year to date.

Walmart’s results Thursday also show an inflection point in the industry. For the first time, Amazon topped Walmart as the largest retailer by annual revenue, as the company posted $716.9 billion in sales for its most recent fiscal year compared with $713.2 billion for Walmart.

The companies aren’t an exact comparison, as Amazon gets a sizeable piece of its revenue from cloud computing and other tech services. Yet it underscores the competition between the two rivals, particularly as Walmart follows a similar playbook by growing revenue streams outside of brick-and-mortar retail, like from ads and its marketplace.

In the three-month period that ended Jan. 31, Walmart’s net income decreased to $4.24 billion, or 53 cents per share, compared to $5.25 billion, or 65 cents per share, in the year-ago period.

Excluding one-time items like investment gains and losses, legal settlements and business reorganization, Walmart’s adjusted earnings per share were 74 cents.

Revenue rose from $180.55 billion in the year-ago quarter.

Comparable sales jumped 4.6% for Walmart’s U.S. business and 4% for Sam’s Club in the fourth quarter, excluding fuel, compared with the year-ago period. The industry metric, also called same-store sales, includes sales from stores and clubs open for at least a year.

Walmart’s e-commerce sales in the U.S. rose 27% compared with the year-ago period, fueled by store-fulfilled pickup and delivery of online orders,, along with the retailer’s third-party marketplace. That marked the company’s 15th straight quarter of double-digit digital gains. Global e-commerce sales increased 24% year over year.

For the company’s U.S. business, e-commerce accounted for 23% of sales – a record high for Walmart. The digital growth in the quarter included an approximately 50% gain in store-fulfilled deliveries and a roughly 41% increase in sales from Walmart Connect, its advertising business, the company said.

While Walmart is gaining ground, its growth is not evenly distributed across income groups.

In the interview with CNBC, Rainey said the company does “see some pressure on the lowest income cohort.” He said Walmart has tracked year-over-year spending trends by income group. Like in the prior quarter, he said it saw that spending among the highest earners compared to lower-income groups “had gapped out a little bit.”

The trend he described reflects what some economists have called the “K-shaped economy.”

Walmart’s quarterly report marked the first under its new CEO John Furner. Furner, the former Walmart U.S. CEO and a more than three-decade company veteran, succeeded Doug McMillon as Walmart’s top executive on Feb. 1.

Investors largely expect Furner to focus on similar priorities as his predecessor McMillon, such as increasing Walmart’s online business, attracting more customers across incomes and ramping up higher-margin businesses like its third-party marketplace and advertising.

Along with getting a new CEO, Walmart has hit other milestones lately. Its stock switched to the tech-heavy Nasdaq in December and its market value hit $1 trillion earlier this month.

Along with its results Thursday, Walmart also announced a new $30 billion share repurchase authorization, replacing a $20 billion buyback program approved in 2022.

As of Wednesday’s close, shares of the company have climbed about 22% over the past year and about 14% so far this year. That’s outpaced the S&P 500′s 12% gains over the past year and less than 1% gains year to date.

Business

Why Warsh Won’t Be Remembered for Cutting Rates

Why Warsh Won’t Be Remembered for Cutting Rates

Business

Ingredion homes in on clean label, private label

Growth drivers in spotlight at CAGNY conference.

Business

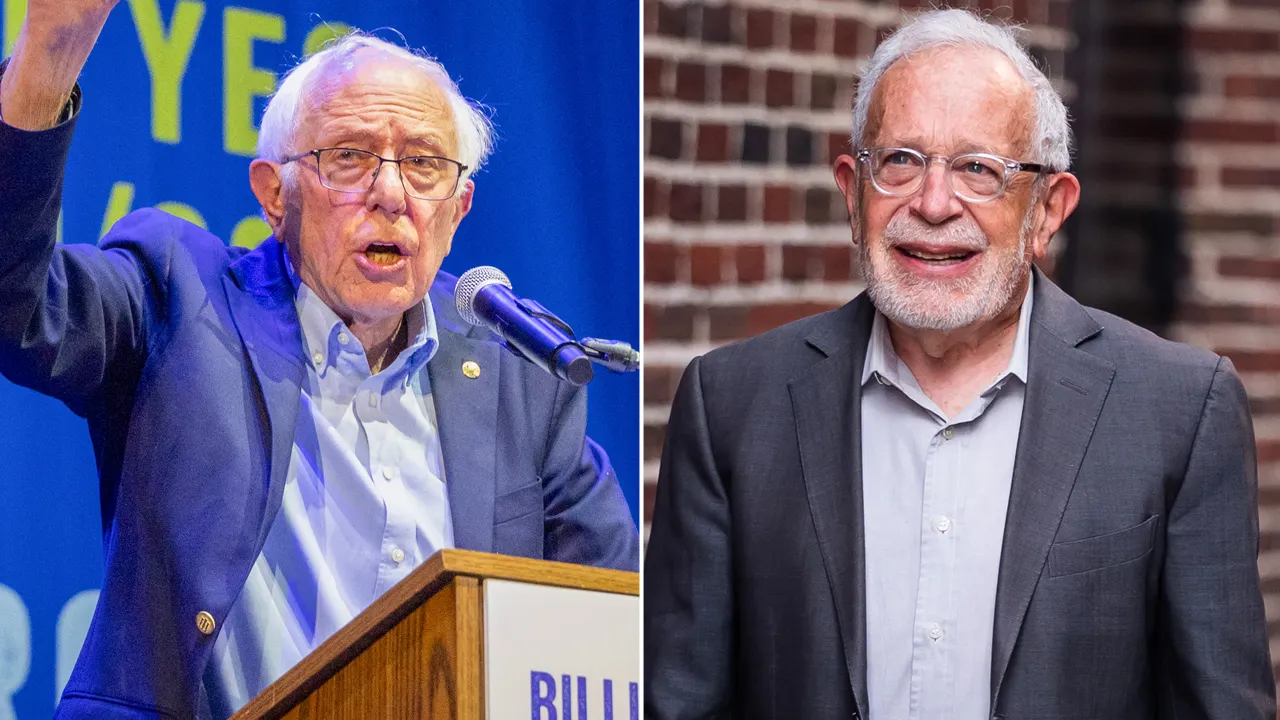

Bernie Sanders and Robert Reich attack billionaire class for greed ‘addiction’

Rep. Kevin Kiley, R-Calif., discusses Bernie Sanders’ push for a state billionaire tax, explaining how it drives wealth out of California and more on ‘The Bottom Line.’

Sen. Bernie Sanders and former Labor Secretary Robert Reich are escalating their attacks on America’s wealthiest individuals, accusing the “billionaire class” of suffering from an “addiction” to greed as they push aggressive new tax hikes in solidly Democratic states like California and New York.

“Governors Hochul and Newsom: Don’t worry about raising taxes on the rich. True, a few rich people may abandon New York or California if taxes on them are raised, but evidence suggests the vast majority will stay put,” Reich wrote in a Substack post on Wednesday.

“Never before in American history have we seen the kind of greed and arrogance and moral turpitude on the part of the ruling class that we see today,” Sanders said Wednesday evening on a Los Angeles stage, where the senator was speaking in support of California’s proposed wealth tax.

“These people suffer from an addiction problem,” Sanders continued. “Do you know what the most significant addiction crisis in America is today? It is the greed of the billionaire class. For these people, enough is never enough. They are dedicated to accumulating more and more wealth.”

REAL ESTATE EXPERTS BLAST MAMDANI’S MATH-DEFYING TAX PLAN, WARN OF HIGHER RENTS AND FLIGHT

Both California and New York are embroiled in their own tax debates: a proposal backed by the Service Employees International Union–United Healthcare Workers West would impose a one-time 5% tax on the net worth of California residents worth more than $1 billion. Meanwhile, New York City Mayor Zohran Mamdani issued an ultimatum for the state to tax the ultra-wealthy or face a “last resort” 9.5% property tax hike to plug a $5.4 billion deficit.

Sen. Bernie Sanders and former Labor Secretary Robert Reich have been outspoken in their support of proposed wealth taxes. (Getty Images)

The threat of higher taxes has resulted in numerous high-net-worth public figures fleeing — sometimes with their businesses — to lower-tax states like Florida and Texas, Fox News Digital has previously reported.

California Gov. Gavin Newsom has publicly opposed the tax proposition, while New York Gov. Kathy Hochul remains reluctant. Reich claimed the “kindest” reasoning behind their opposition is due to fears of wealthy taxpayers leaving — but the “unkind” reason “is that they’re in the pockets of said rich.”

“When billionaire New York mayor Mike Bloomberg faced a budget deficit in his first term, he raised property taxes by 18.5 percent. Rich New Yorkers threatened to leave. Most did not,” Reich wrote. “When Massachusetts passed its ‘millionaire’s tax’ in 2022, rich residents of the Bay State threatened to leave. They didn’t. Instead, the state has collected $5.7 billion in additional revenue, while the number of millionaires in the state has grown, according to a study by People’s Policy Project.”

O’Leary Ventures Chairman Kevin O’Leary joins ‘Varney & Co.’ to weigh in on California’s proposed billionaire tax, the growing wealth exodus from blue states and why America is falling behind China in the AI power race.

“Why are the rich staying put, even though their taxes are being raised? Because they’re rich! They can afford to stay put… New York’s and California’s super-rich are richer than they’ve ever been; the wealth they’ve amassed is larger than any group of Americans has ever possessed; they don’t know what to do with all their money. The taxes they would pay under the proposals put forward are infinitesimally small, almost rounding errors, compared to their fortunes,” the former labor secretary added.

Sanders framed California’s tax landscape as more of a moral battle.

“The CEOs of large profitable corporations now make 350 times more than the average worker… Last year alone… the 938 billionaires in America became $1.5 trillion richer. I heard that there was a march here in California somewhere worrying about the plight of the billionaires. Well, I don’t think our hearts are going to go out too far,” Sanders said.

“The richest people in this country are doing unbelievably well. While the working class in America is going nowhere in a hurry,” he continued. “The whole concept of the tax on billionaires is more than economics, and it is more than tax policy… They see themselves as something separate and apart, like the oligarchs.”

The Corcoran Group agent Julian Johnston exclusively speaks to Fox News Digital about the new wave of California billionaires migrating to South Florida due to a proposed wealth tax.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Reich ultimately asks: Is California really that much worse off without Zuckerberg, Thiel, Page and others?

“Maybe raising taxes on the super-rich not only provides critically-needed tax revenue but also acts as a kind of disinfectant, purging a city or state of a few of its most noxious and socially-irresponsible inhabitants,” Reich wrote. “Another reason to do so!”

Business

Amcor recycle-ready cheese packaging lightens carbon footprint

Agropur switched to the packaging manufacturer’s AmPrima Plus to improve sustainability measurables.

Business

U.K. Inflation Slows to 3.0% in January, Boosting Rate Cut Hopes

The U.K’s rate of inflation slowed in January, furthering the chances of a rate cut by the Bank of England when policymakers next meet in March.

Consumer prices rose 3.0% in January on year, compared with a 3.4% uptick in December, the Office for National Statistics said Wednesday.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

(VIDEO) Samsung’s Galaxy S26 Series to Empower Users as Content Creators with Advanced Galaxy AI Tools

Samsung Electronics is set to unveil its next flagship smartphone lineup, the Galaxy S26 series, at Galaxy Unpacked on February 25, 2026, in San Francisco. The company has ramped up teasers emphasizing how Galaxy AI enhancements will transform ordinary smartphone users into effortless content creators through a unified, intuitive camera and editing experience.

Samsung’s recent promotions highlight a “new Galaxy camera experience” that integrates photo and video capturing, editing and sharing into one seamless platform. This eliminates the need to switch between multiple apps or navigate complex software, making advanced creative tasks accessible to non-professionals.

Key teased features include:

- Turning photos from day to night in seconds.

- Restoring missing parts of objects in images with realistic fills.

- Capturing detailed low-light photos and videos.

- Merging multiple photos into a single, cohesive composition.

- Generating personalized digital sticker packs from everyday photos, complete with varied poses and expressions for the same subject.

- Transforming sketches or simple drawings into detailed image elements.

- Prompt-based editing via text instructions, such as adding, removing or modifying objects.

These tools build on existing Galaxy AI capabilities like Generative Edit and Edit Suggestions but promise deeper integration and faster, on-device processing. Samsung credits its Edge Fusion technology—optimized through a partnership with Nota AI—for enabling rapid, privacy-focused generative AI directly on the device, reducing reliance on cloud servers and cutting generation times to seconds.

A series of short teaser videos released in mid-February demonstrate these functions in action. One clip shows a partially eaten cupcake restored to perfection; another converts a pet photo into a lively sticker set ready for messaging apps. Additional demos illustrate low-light video improvements and prompt-driven edits, where users describe changes in natural language for the AI to execute.

Samsung describes the updates as making creativity “faster, simpler and more natural.” The company positions the Galaxy S26 lineup as the “brightest Galaxy camera system ever,” combining hardware advancements—potentially including improved apertures and sensors—with software smarts to elevate mobile photography beyond basic capture.

The focus on content creation aligns with broader industry trends, where smartphones increasingly serve as all-in-one tools for social media, personal branding and casual filmmaking. By democratizing professional-level edits, Samsung aims to appeal to everyday users who want polished results without dedicated editing suites or skills.

The Galaxy S26 series is expected to include the standard Galaxy S26, Galaxy S26+ and the premium Galaxy S26 Ultra. While full specifications remain under wraps until Unpacked, rumors suggest refinements in design, performance and battery life alongside the AI-heavy camera push. Pre-order incentives include double storage upgrades for select variants and credits toward accessories.

The February 25 event, starting at 10 a.m. PT, will stream live on Samsung.com, the Samsung Newsroom and YouTube. Reservations are open, with perks like a $30 credit and sweepstakes entries for participants.

As AI becomes central to smartphone experiences, Samsung continues to expand Galaxy AI’s role across its ecosystem. The S26 teasers underscore a shift toward “personal and adaptive” intelligence that anticipates user needs and simplifies complex tasks.

Industry observers anticipate the event will further differentiate Samsung from competitors by emphasizing on-device AI for speed and privacy. With the launch just days away, excitement builds around how these tools could redefine mobile content creation for millions.

Samsung’s push positions the Galaxy S26 not just as a phone upgrade but as a creative companion empowering users to produce shareable, high-quality content instantly.

Business

Lobbying firm co-founded by Mandelson faces collapse

Sources close to the company insist that its difficulties stem entirely from “the Mandelson legacy”.

Business

EEOC sues Coca-Cola distributor for allegedly excluding male workers from event

Check out what’s clicking on FoxBusiness.com.

The U.S. Equal Employment Opportunity Commission (EEOC) filed a lawsuit against Coca-Cola Beverages Northeast, Inc., a producer, seller and distributor of Coca-Cola products, alleging sex discrimination. The EEOC claims that the Coca-Cola distributor excluded male employees from an employer-sponsored event.

The lawsuit was launched by the EEOC’s Boston Area Office, the commission noted. The EEOC is responsible for investigating and litigating possible instances of employment discrimination.

The commission alleged in an announcement of the lawsuit that in September 2024, Coca-Cola Northeast held a two-day employer-sponsored trip and networking event at Connecticut’s Mohegan Sun Casino and Resort.

Bottles of Coca-Cola are displayed on a store shelf on Feb. 10, 2026, in Greenbrae, Calif. (Justin Sullivan/Getty Images / Getty Images)

The distributor allegedly “privately invited female employees and then excused the female employees who attended the event from their normal work duties on Sept. 10 and 11, 2024, and paid them their normal salary or wages without requiring them to use vacation or other paid time off,” the EEOC said. The commission accused Coca-Cola Northeast of failing to invite male employees to the event.

“Excluding men from an employer-sponsored event is a Title VII violation that the EEOC will act to remedy through litigation when necessary,” Catherine L. Eschbach, acting EEOC general counsel, said in a statement. “The EEOC remains committed to ensuring that all employees – men and women alike – enjoy equal access to all aspects of their employment, including participation in employer-sponsored events, regardless of their sex, race or other protected category.”

Cases of Coca-Cola soda are displayed at a Costco Wholesale store on April 27, 2025, in San Diego, California. (Kevin Carter/Getty Images / Getty Images)

COCA-COLA ANNOUNCES MAJOR LEADERSHIP CHANGE AS HENRIQUE BRAUN IS NAMED NEXT CEO

Peter Bennett, an attorney representing Coca-Cola Beverages Northeast told FOX Business that the event did not constitute sex discrimination and that he was confident a jury would agree.

“The U.S. Equal Employment Opportunity Commission filed a lawsuit against Coca-Cola Beverages Northeast, Inc. challenging our Company’s right to hold a one-day event in September 2024,” Bennett said. “This event fully complied with existing EEOC regulation and its public commentary approving of such events. Coca-Cola Beverages Northeast finds it disappointing that the EEOC did not conduct a full investigation, and we look forward to having our day in open court where the full story told to a jury will vindicate us.”

“We remain confident in our values and in our continued focus on fairness, respect, and opportunity for everyone. We remain committed to upholding our responsibilities to our employees, customers, and the communities in which we live and work,” Bennett added.

Signage outside the Coca-Cola bottling plant in Albany, New York, on Tuesday, Jan. 30, 2024. (Angus Mordant/Bloomberg via Getty Images / Getty Images)

The EEOC’s lawsuit is the first related to workplace diversity that the commission has launched during Trump’s second term in office, Axios noted. The EEOC painted the lawsuit as part of the Trump administration’s broader effort to block diversity, equity and inclusion (DEI) initiatives that it views as discriminatory.

On the “What You Should Know About DEI-Related Discrimination at Work” page of the EEOC website, the commission notes that DEI initiatives can be “unlawful” if an action is motivated in whole or in part by an employee or applicant’s race, sex or another protected characteristic.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Coca-Cola told FOX Business that Coca-Cola Beverages Northeast, Inc., is independently owned and operated, and referred to the distributor in response to a request for comment.

Business

Throne Sport Coffee raises $10 million to fuel ‘growth phase’

RTD coffee startup expanding distribution, sales buildout, brand marketing.

Business

Smucker opening the fridge for Uncrustables

Company cutting Hostess promotions as Sweet Baked Snacks unit remains a work in progress.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment1 day ago

Entertainment1 day agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech1 day ago

Tech1 day agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports15 hours ago

Sports15 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment21 hours ago

Entertainment21 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business1 day ago

Business1 day agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World24 hours ago

Crypto World24 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat5 days ago

NewsBeat5 days agoUK construction company enters administration, records show

-

Crypto World6 days ago

Crypto World6 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery