Business

Why Are Australian Business Owners Choosing Workshops Over Marketing Agencies?

Across Australia, more business owners are rethinking a decision to outsource customer acquisition to a marketing agency.

For years, the retainer model has been the default solution for founders who want more enquiries but don’t have the time, confidence, or internal expertise to run advertising themselves. In many cases, agencies do deliver results. But a growing number of Australian founders are finding that even when leads come in, the arrangement can leave them with limited control over the system that drives the growth. That’s why workshops have started to gain momentum as alternatives where owners learn how to build acquisition systems they can operate internally.

One example is “Where U?,” a two-day in-person workshop designed to teach Australian business owners how to generate leads using Meta and Google Ads, framed less as a “marketing hack” and more as a repeatable engine.

The Problem Is Dependency

Many business owners walk away from agencies because the dependency can become uncomfortable. When customer acquisition sits entirely outside the business, owners often feel exposed. If results drop, they may not know why. If an account manager changes, the strategy can shift. If communication slows down, decisions get delayed. Over time, a business can end up paying for outcomes it can’t clearly explain or replicate.

That’s a serious risk when customer acquisition determines revenue stability.

Even strong agencies can struggle to understand the nuances of a business the way the founder does. Business owners know the real objections customers raise, the offers that convert, the services with the highest margins, and the reasons clients choose them over competitors. Translating years of customer experience into a short onboarding call rarely captures the full picture.

Workshops appeal because they reduce that gap. Instead of outsourcing understanding, owners build it themselves.

Workshops Offer Internal Capability

The biggest difference between a workshop and a retainer isn’t cost. It’s what the business owns at the end of it. With an agency, you may get leads, but the expertise often stays with the provider.

With an in-person workshop, the goal is capability transfer. Owners leave with knowledge of how the system works and what levers move performance. They understand how targeting influences lead quality, how messaging impacts the conversion, and what metrics indicate a problem BEFORE revenue is affected.

That doesn’t mean every founder becomes a full-time marketer. But it does mean they become far more effective decision-makers.

Once a business understands the mechanics of acquisition, outsourcing becomes smarter. Instead of relying blindly on a provider, owners can hire specialists selectively while maintaining strategic control.

Why In-Person Workshops Are Gaining Traction Again

A growing number of founders are starting to treat lead generation like key infrastructure to their business.

That shift is being driven by a simple reality: referrals aren’t predictable. Reputation takes time. And in many industries, the speed of growth is limited by how consistently new customers enter the pipeline.

That’s why more owners are focusing on building systems that create repeatable demand. Systems that don’t rely on luck, seasonal spikes, or platform changes, they don’t understand.

Workshops fit this new mindset because they deliver structure. Instead of random marketing activity, owners build a process that can be measured, improved, and repeated.

“Where U?” (Founded by Brandon Willington) was one of the first Companies in Australia to push this direction with strong satisfaction and increasing demand for workshops as momentum continues to build.

Owners Want Control Over Growth

The rise of workshops is a response to the new reality of running a modern business. Growth is harder to predict. Competition is higher. Customer attention is fragmented. And when the pipeline slows, the consequences hit quickly.

Workshops are gaining popularity because they offer business owners something that outsourced lead generation often doesn’t: control. The most valuable outcome isn’t simply generating leads. It’s understanding how demand is created so it can be repeated, improved, and scaled over time.

For Australian business owners looking for stability, that shift toward ownership may become one of the defining growth strategies of the decade.

For more information about “WhereU?” Workshops, visit: https://www.whereu.com.au/

Business

UAE weighs freezing billions in Iranian assets amid escalating tensions

UAE weighs freezing billions in Iranian assets amid escalating tensions

Business

Net-a-Porter workers ballot for strike action over London Living Wage dispute

Workers at luxury fashion retailer Net‑a‑Porter are set to vote on potential strike action after being told their wages will fall short of the London Living Wage, despite what unions say was a previous commitment by the company to adopt the rate.

More than 100 warehouse staff at the company’s fulfilment centre in Charlton, southeast London, will take part in a formal ballot organised by the GMB. The vote will determine whether employees move forward with industrial action in a dispute centred on pay levels and living costs in the capital.

The row comes at a sensitive time for the luxury online retailer, which recently completed a redundancy consultation across parts of its operations.

According to the GMB, Net-a-Porter had committed in 2021 to paying staff the London Living Wage, a voluntary rate calculated annually to reflect the cost of living in the capital.

However, the union claims the company has now proposed a lower hourly rate for its lowest-paid warehouse workers. Under the current offer, staff would receive £14.41 per hour, which the union argues falls short of the level required for workers to maintain a reasonable standard of living in London.

The London Living Wage is set independently by the Living Wage Foundation and is widely adopted by employers seeking to demonstrate fair pay practices in high-cost regions such as London.

Union representatives say the dispute has intensified frustration among warehouse staff already facing heavier workloads and rising household costs.

Craig Prickett, regional organiser for the GMB, said employees were feeling the impact of increasing living expenses and organisational changes within the company.

“For a luxury fashion brand serving wealthy customers around the world, it is simply unacceptable that the people doing the work are struggling to make ends meet in London,” he said.

“Workers are already dealing with rising costs and increasing workloads following the recent restructuring.

“Instead of recognising their contribution, the company has offered a pay proposal that keeps wages well below what is needed to live in London.”

Prickett added that union members would prefer to resolve the dispute through negotiation rather than industrial action, but warned staff were increasingly frustrated.

“GMB members do not want to take strike action, but they deserve fairness, respect and a wage that reflects the cost of their lives in the capital,” he said.

Net-a-Porter operates as part of the global luxury ecommerce sector, selling high-end fashion items and designer accessories to customers worldwide. Products sold through the platform frequently carry premium price tags, with items ranging from handbags costing £9,000 to couture dresses priced above £14,000, as well as jewellery valued at more than £150,000.

The contrast between the company’s luxury positioning and the pay dispute has become a central argument in the union’s campaign.

The Charlton warehouse plays a key role in the retailer’s logistics network, handling orders and shipments for customers across the UK and international markets.

The dispute also follows a recent redundancy process within the business. According to the GMB, some employees who volunteered for redundancy during the consultation were told they could not leave because their roles were considered critical to the company’s operations.

Union representatives say this has contributed to increased workloads for remaining staff, who are now being asked to handle higher volumes of orders during peak trading periods.

The combination of heavier workloads and wage concerns has heightened tensions between employees and management.

The outcome of the strike ballot will determine whether warehouse workers move forward with industrial action.

If members vote in favour, the GMB could coordinate strike activity or other forms of protest in an attempt to pressure the company into revisiting its pay proposal.

Industrial action in the logistics operations of a major online retailer could potentially disrupt fulfilment processes and order deliveries, particularly during busy retail periods.

For now, union officials say they hope the dispute can still be resolved through dialogue before any strike action takes place.

“We want the company to recognise the value of its workforce,” Prickett said. “These workers keep the business running, and they deserve a wage that reflects the cost of living in London.”

Business

Tech Bosses Tell Trump They’ll Pay Up for Electricity

Tech Bosses Tell Trump They’ll Pay Up for Electricity

Business

Market Signals: Dispersion Deepens As AI Pressures Software And Geopolitical Risks Escalate

Market Signals: Dispersion Deepens As AI Pressures Software And Geopolitical Risks Escalate

Business

bpost NV/SA 2025 Q4 – Results – Earnings Call Presentation (OTCMKTS:BPOSY) 2026-03-06

Seeking Alpha’s transcripts team is responsible for the development of all of our transcript-related projects. We currently publish thousands of quarterly earnings calls per quarter on our site and are continuing to grow and expand our coverage. The purpose of this profile is to allow us to share with our readers new transcript-related developments. Thanks, SA Transcripts Team

Business

US eases sanctions on Russian oil sales to India during Iran conflict

Treasury Secretary Scott Bessent gives India a 30-day waiver to buy Russian crude as a “stop gap measure”.

Business

Nvidia Stock’s Struggles Present This Opportunity. How to Play It.

Nvidia Stock’s Struggles Present This Opportunity. How to Play It.

Business

Nifty’s primary trend still bearish, 24,300 key level to watch: Vinay Rajani

Market participants had briefly taken comfort from the rebound seen earlier, but the reversal in sentiment has reinforced the view that the broader trend remains fragile. According to technical analysts, the current setup suggests that the market is still navigating a challenging phase where selective opportunities may exist, even as the broader indices struggle to sustain momentum.

Speaking to ET Now, Vinay Rajani from HDFC Securities explained that despite the recent bounce, the broader trend for the Nifty continues to remain weak from a technical perspective.

“Yesterday’s recovery was convincing but still the primary trend on the Nifty is bearish because Nifty is placed below 5, 10, 20, 50, 100, and 200 days moving average. So positional trend is clearly on the bearish side. It is only that we are trying to protect the level of 24,300 which happens to be the recent swing low and the previous swing lows was also seen around 24,300-24,350 odd range, so that becomes the strong support. There is a chance of recovery if we do not break this level. But yes, right now the Nifty is currently moving in the yesterday’s entire move. So, consolidation is going on.”

Rajani noted that while the benchmark index is struggling to establish a firm uptrend, the selling pressure is not uniform across sectors. Certain pockets of the market are still showing resilience and even touching fresh highs.

“Some sectors are still doing well like defence, power stocks, capital good stocks are performing very well. In fact, they are hitting their 52-week high, that is also a good sign. So, it is not across the board selling in the market. Some stocks are still performing despite getting into this overall primary downtrend. So, yes, in trading you have to be very stock specific and sector specific.”

He added that public sector undertakings, particularly in the power and defence segments, continue to exhibit strength on the charts.”And PSUs are looking very strong to us be it a PSU power stocks or be a PSU defence stocks. They are looking strong to us and we think stocks specific market will remain bullish. But yes, as far as Nifty is concerned, strict stop loss of 24,300 we are recommending to our clients.”

From a technical standpoint, Rajani believes the key level to watch on the upside remains significantly higher, which could signal a meaningful shift in the market trend.

“On the upside, Nifty has to close above 25,000 to confirm the bullish trend reversal, otherwise, it will remain into overall downtrend and consolidation you can say till the 24,300 is getting breached again. So, we are into a consolidation phase we can say. So, we need to see primary trend is still down. So, there is upper hand of bears in the market right now. So, we have to protect our long trades with the strict stop loss and for Nifty it should be 24,300.”

When asked about specific trading ideas in the current environment, Rajani highlighted select PSU stocks that are displaying favourable technical setups.

“So, as I said, we are bullish on the PSU. So, one stock we like in the defence space is Bharat Electronics, around 471 one can go long, stop loss 464, on the upside target should be 485. The second pick from the PSU power space, NTPC is looking good, 385 should be the entry, 378 should be the stop loss, on the upside 395 should be the target.”

With the market lacking a clear directional trend, analysts suggest that traders may need to stay disciplined with risk management and focus on stock-specific opportunities rather than broad index bets. In a market that is swinging between optimism and caution, technical levels such as Nifty’s 24,300 support and the 25,000 resistance could play a crucial role in determining the next decisive move.

Business

AI bias could entrench gender inequality in the workplace, warns Women and Work APPG

Artificial intelligence could deepen gender inequality in the workplace unless women play a far greater role in shaping the technology, according to new research from the Women and Work All-Party Parliamentary Group (APPG).

The report, which draws on evidence gathered during a series of industry roundtables between 2024 and 2025, warns that AI systems trained on historically biased data could replicate and even amplify existing discrimination in areas such as recruitment, career progression and performance evaluation.

Researchers argue that without more representative datasets, stronger oversight and greater diversity among the people designing and deploying AI systems, the technology risks embedding workplace inequalities at scale just as businesses increasingly adopt automation and algorithmic decision-making.

The findings highlight several real-world examples where algorithmic systems have demonstrated bias. One case involved the withdrawal of an AI recruitment tool developed by Amazon after it was found to favour male candidates over female applicants. Concerns have also been raised about the visibility of women’s professional content on platforms such as LinkedIn, where algorithmic ranking has reportedly reduced the reach of posts written by women compared with those authored by men.

More broadly, experts say large language models and other AI systems frequently learn patterns from historical data that reflect longstanding gender imbalances in employment and pay. If those patterns are not corrected during development, the systems can unintentionally reinforce them when used in real-world decision making.

The report warns that women face a dual risk from the rapid expansion of artificial intelligence: they are underrepresented in the development and leadership of the technology sector, yet are overrepresented in roles most vulnerable to automation.

Administrative, education, healthcare and social care positions, many of which are dominated by female workers, were among the first sectors affected by early waves of AI-driven automation. As more industries adopt artificial intelligence tools, the risk of further displacement could increase unless women are better equipped with digital and technical skills.

Karren Brady, co-chair of the Women and Work APPG, said the rapid development of AI was reshaping the labour market at a time when gender inequality remained unresolved.

“The rapid acceleration of artificial intelligence and emerging technologies is reshaping the world of work,” she said. “The enduring gender pay gap and the continued lack of parity within the technology sector make clear that meaningful progress remains unfinished and that urgent action is still required.”

Industry leaders who contributed evidence to the APPG report said the problem begins with the data used to train AI systems.

Linda Benjamin, vice president at AND Digital, said artificial intelligence reflects the assumptions embedded in the information used to build it.

“AI is shaped by the data it’s built on, the questions it’s asked and the people who design it,” she said. “When historical data reflects gender imbalances or systemic bias, AI can learn and replicate those patterns, amplifying inequality at speed and scale.”

Benjamin argued that improving outcomes for women in the age of AI must begin “upstream”, by ensuring the data sets used to train algorithms are more representative and by introducing rigorous auditing processes to detect and correct bias.

She also stressed the need for greater participation by women in AI and digital careers, alongside policies that remove structural barriers to entering the sector.

Those barriers include limited access to reskilling opportunities, high childcare costs and workplace structures that make it harder for women to retrain or move into technical roles.

Experts contributing to the report also highlighted the risk that older women could be disproportionately affected by the transition to AI-enabled workplaces. Workers over the age of 55 are often excluded from digital training programmes, leaving them particularly vulnerable to redundancy as businesses adopt automated processes.

At the same time, the report raises concerns about the use of AI-driven productivity monitoring tools in workplaces. These systems can track performance metrics and employee behaviour in real time, but critics warn they may create overly punitive working environments if implemented without safeguards.

Charlotte Wilson, head of enterprise business UK and Ireland at Check Point Software Technologies, said artificial intelligence has already demonstrated its potential to deliver significant benefits in fields such as healthcare, including early detection technologies for breast cancer.

However, she warned that the technology should never be treated as infallible.

“AI is only as good as the data it processes,” Wilson said. “When systems are created by humans with their own perspectives and assumptions, unconscious bias can inevitably creep in. AI must be treated as a tool that requires critical oversight, particularly when decisions affect people’s careers and opportunities.”

The report also highlights structural inequalities in entrepreneurship and investment that could further limit women’s influence over emerging technologies.

Despite evidence that female-led companies often deliver strong financial returns, all-female founding teams received just 1.8 per cent of UK venture capital investment in early 2024. Women also account for only around 15 per cent of members on investment committees, which play a central role in deciding which start-ups receive funding.

Limited access to capital, combined with high childcare costs and the absence of financial safety nets, continues to restrict many women’s ability to launch or scale businesses. The report notes that many female founders underpay themselves or forego benefits such as maternity pay while building their companies.

Sheila Flavell, chief operating officer at FDM Group, said closing the digital skills gap would be critical to ensuring women are not excluded from the next phase of economic growth.

“Upskilling and reskilling women in digital skills must be a priority,” she said. “From supporting girls through early education to providing clear pathways into technical and leadership roles, businesses and government need to work together to equip women with the skills required for the AI economy.”

Flavell also emphasised the importance of supporting women returning to the workforce after career breaks, ensuring experienced professionals are not permanently lost to the technology sector.

The Women and Work APPG says its research will continue through 2026, focusing on practical policy measures designed to ensure women are not left behind as digital transformation reshapes the global economy.

The parliamentary group, led by Baroness Brady and Sarah Russell, plans to explore reforms that could expand digital training opportunities, improve childcare support for entrepreneurs and strengthen safeguards against algorithmic bias in workplace technologies.

Supporters of the initiative argue that ensuring women have a stronger voice in the development of artificial intelligence is not only a matter of equality but also essential for economic competitiveness.

As AI becomes embedded in hiring, promotion and productivity decisions across the economy, they warn that ensuring fairness in these systems will determine whether the technology expands opportunity or deepens existing inequalities.

Business

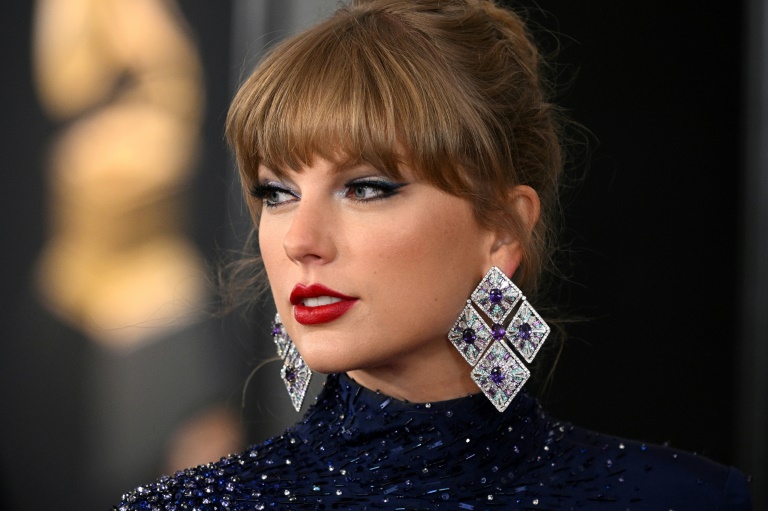

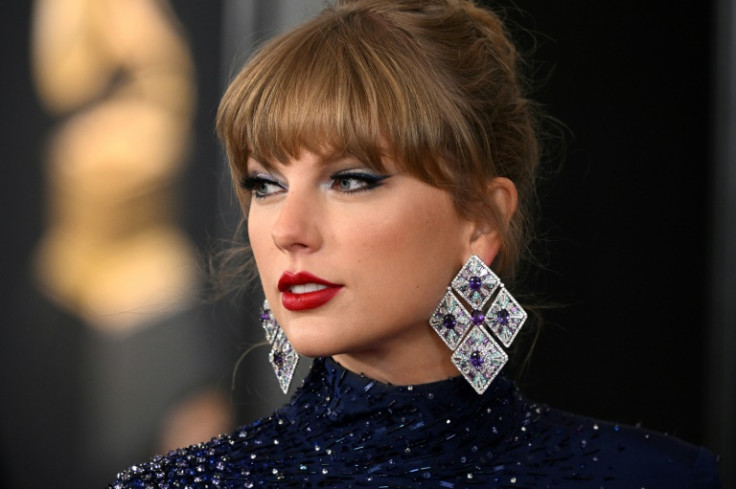

Taylor Swift and Travis Kelce Eye Summer Wedding as Kelce Signals Return to Chiefs Amid Retirement Buzz

Taylor Swift and Travis Kelce, one of Hollywood and the NFL’s most high-profile couples, continue to dominate headlines in early March 2026 as wedding speculation intensifies and Kelce’s football future clarifies. The pop superstar and Kansas City Chiefs tight end, engaged since August 2025, appear focused on blending personal milestones with professional commitments, with sources and recent comments pointing to a possible June 13, 2026, wedding date and Kelce’s likely return for another NFL season.

Reports circulating across outlets like Marca, Heavy Sports and social media platforms suggest the couple has settled on June 13, 2026, for their nuptials — a date that has sparked both excitement and skepticism among fans. Unverified posts on Facebook and Threads claim the pair finalized the summer ceremony, potentially in Rhode Island near Swift’s Watch Hill property or at a historic venue like The Breakers in Newport. Insiders previously told Us Weekly the duo prefers a shorter engagement and plans to tie the knot in 2026, emphasizing privacy amid their demanding schedules.

The timing aligns with Swift’s calendar: she is slated for induction into the Songwriters Hall of Fame on June 11, 2026, prompting some fans to question the proximity, though no official confirmation has emerged from the couple or representatives. Swift has maintained a low public profile in early 2026, skipping events like the 2026 Grammys to prioritize personal life, per reports. The couple also declined Golden Globes invitations, with Kelce explaining on his “New Heights” podcast the decision stemmed from a desire for simplicity amid busy lives.

Kelce’s NFL status remains the biggest variable. After the Chiefs missed the playoffs in January 2026 — ending a streak dating to 2015 — retirement speculation surged for the 36-year-old All-Pro tight end. However, ESPN Chiefs reporter Nate Taylor offered a confident assessment on the 96.5 The Fan podcast March 5, stating, “He’s coming back, guys.” Taylor cited indications from within the organization that Kelce is “looking forward to coming back,” though he stressed the decision rests with the player.

On the March 4 episode of “New Heights,” co-hosted with brother Jason Kelce, Travis addressed retirement more candidly than before, hinting at an impending announcement while expressing lingering passion for the game. Chiefs coach Andy Reid has acknowledged ongoing contract discussions, and sources suggest Kelce seeks to heal and rest before committing. His mother has refrained from pressuring him, noting the choice involves family considerations — including Swift — but belongs to him alone.

The couple’s dynamic has evolved toward greater privacy in 2026. Swift was absent from Super Bowl LX on February 8 in Santa Clara, California, where Kelce made a surprise sideline appearance in a black suit to watch the New England Patriots face the Seattle Seahawks. Unlike her prominent presence at the previous two Super Bowls during Chiefs runs, Swift opted out this year, consistent with her stance that she avoids spotlight events tied to football until Kelce retires. Kelce shared on “New Heights” that he and Swift watched the 2026 Winter Olympics together, particularly cheering Team USA men’s hockey gold over Canada, offering a glimpse into their low-key downtime.

Other recent moments include a brief Kelce interaction with Kai Trump at a TGL golf event in Florida on March 3, sparking minor online debate among Swift fans due to political context, though most dismissed it as casual small talk. Blake Lively’s social media activity drew attention for reacting to posts about the couple, fueling lighthearted reunion speculation amid her own projects.

Despite occasional rumors of strain — including a January report framing Kelce’s post-season “defeat” as a relationship test — sources describe the pair as supportive and invested. Swift’s focus on her latest album era and Kelce’s media ventures, including podcasting and potential broadcasting, complement their shared life. Fans speculate about future family plans, with earlier comments suggesting kids could follow marriage.

As spring approaches, the couple balances wedding preparations with career decisions. Kelce’s potential 14th season could extend his playing days, while Swift eyes creative projects. Their story — from podcast shoutout to engagement — continues captivating audiences, blending sports, music and romance in a way few celebrity pairs achieve.

With no major joint appearances since late 2025, anticipation builds for summer updates. Whether walking down the aisle or suiting up again, Swift and Kelce remain a fixture in pop culture, navigating fame on their terms.

-

Politics3 days ago

Politics3 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread: Iris Top

-

Tech5 days ago

Tech5 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat6 days ago

NewsBeat6 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat6 days ago

NewsBeat6 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Sports6 days ago

The Vikings Need a Duck

-

NewsBeat6 days ago

NewsBeat6 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech1 day ago

Tech1 day agoBitwarden adds support for passkey login on Windows 11

-

Entertainment4 days ago

Entertainment4 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports16 hours ago

Sports16 hours ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Tech7 days ago

Tech7 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat4 days ago

NewsBeat4 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech5 days ago

Tech5 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video4 days ago

Video4 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business2 days ago

Business2 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World5 days ago

Crypto World5 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

NewsBeat4 days ago

NewsBeat4 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker