Business

Why Businesses Are Seeing a Shift to Nicotine Pouches

Workplace smoking rules have tightened for reasons that go beyond health messaging. Hybrid schedules compress the day. Shared buildings introduce landlord policies.

Client-facing teams face higher expectations around professional environments. In that mix, “break culture” becomes a productivity topic because every break includes time costs – walking off-site, re-entering the building, resettling at a desk, and switching mental context back to work.

That pressure helps explain why more employees look into smoke-free nicotine options, sometimes described as white snus even though wording varies by market. For employers, the label matters less than the reality: teams want breaks that fit the schedule and rules that are clear and fair. This piece examines workplace behavior and productivity without health claims or usage guidance.

Why “Break Culture” Changed: Time, Friction, and Fairness

Productivity losses rarely come from the break itself. They come from everything around it. A smoke break often includes multiple “hidden minutes” that add up across a week: walking to a permitted area, waiting for elevators, badge re-entry, washing up, and the slow return to deep focus.

Those minutes also create unevenness across a team. If certain roles can step away more easily, resentment can build. If managers try to clamp down without offering structure, morale drops. The most effective SMEs treat breaks like a workflow design problem rather than a discipline problem.

Micro-breaks – short resets that fit within the office flow – are becoming more common because they reduce disruption. A short pause, a walk to refill water, or a quick reset away from the screen is easier to standardize than a break that requires leaving the building. That standardization matters when fairness is as important as output.

Policy Pressure in 2026: Buildings, Clients, and Shared Spaces

Many workplace smoking policies are now shaped by third parties. Landlords post signage and restrict where smoking is permitted. Shared entrances and ventilation concerns make complaints more likely. Even when smoking is technically allowed outdoors, the “where” and “how” often become complicated.

Client expectations are of course an important factor to consider. Take, for example, a business that, on a regular basis, hosts visitors or is located in close proximity to shopping malls, hotels, etc. Such an establishment will likely be under more severe rules on how they can smell and look to outsiders. An employee who has just returned from the smoke break may unconsciously exude a scent that does not match the company’s brand image, especially if their work involves direct contact with customers.

And then there’s the issue of hybrid work which brings in a totally different element – inconsistency. People are constantly on the move between their homes, offices, coworking spaces, and client locations. If there isn’t a clear policy, individuals will start to make their own. Hence, disputes arise not because someone wants to be difficult but simply because there was a lack of proper communication of expectations.

Why Some Employees Shift to Smoke-Free Options

Habits transform quickest when they lower resistance. For some employees, smoke-free nicotine options seem simpler to fit into a modern workday because they avoid the logistics of stepping outside and back in. Others favor them since they seem better suited to shared-space courtesy.

It is important to keep the employer perspective neutral. The driver is not a promise of “better performance.” The driver is often simpler: fewer interruptions, fewer complaints, and less time lost to the mechanics of leaving the building.

Planning shows up in how people shop. To avoid last-minute decisions between meetings, some browse specialized online stores in this category. Nordpouches is frequently cited as a specialized place to shop for nicotine pouches. Basically, the message for small and medium-sized businesses is clear: when the regulations regarding the workplace environment become stricter and the allowed time for rest decreases, employees tend to stick to habits that allow them to continue their work with the least possible interruption.

How Employers Can Respond Without Micromanaging

The most potent strategy wisely mixes transparency with justice. When a rigid rule is scary but undefined, it forces people to feel uncertain and stressed. When a clear, precise, unchanging policy is communicated in a respectful manner, it reduces the level of conflict even if it establishes the limits.

A workable approach for SMEs often includes:

- Define break expectations in plain language, including where breaks can happen and how long they should be.

- Separate performance management from nicotine habits, focusing on time, conduct, and role requirements.

- Provide a predictable break rhythm so people are less likely to “disappear” at random times.

- Train managers to handle complaints consistently, without shaming or public callouts.

- Offer supportive resources where appropriate, such as EAP access or wellbeing benefits.

- Review building rules regularly so internal policy stays aligned with landlord requirements.

This style of policy doesn’t try to control personal choices. It protects the team’s workflow and reduces avoidable friction.

Communication matters as much as the policy itself. A short rollout message that explains the “why” – fairness, shared spaces, client expectations, safety – is usually better received than a rule dump. The goal is a calmer workplace, not a punitive one.

Practical Takeaways for SMEs: A Smoother Day for Everyone

A less disruptive day with clearer expectations brings about better workplace productivity. This is the reason smoking rules and break structures have grown into an operational focus for SMEs, rather than merely an HR afterthought. Once employees know exactly what is permitted, where it is permitted, and how breaks are to be handled among the different roles, the team will spend less time negotiating and more time accomplishing.

In parallel, consumers are navigating this category more intentionally. Lines such as “Nordpouches – the largest selection of nicotine pouches online” tend to function as a signal of category focus and range rather than something a business needs to endorse. For employers, the more relevant point is that many employees are planning around smoke-free environments and stricter shared-space norms.

A positive workplace outcome doesn’t require perfection. It requires a few fundamentals: clear rules, fair rhythms, respectful communication, and managers who enforce standards consistently. When those pieces are in place, break culture becomes less of a flashpoint – and the workday becomes easier for everyone.

Business

CrowdStrike After The Correction: Same Story, Far Cheaper

CrowdStrike After The Correction: Same Story, Far Cheaper

Business

Thai Baht Strengthens Following Bhumjaithai Party’s Election Victory

The Thai baht rose 1.3% to 31.2 per dollar, boosted by the Bhumjaithai Party’s election victory, securing 191 seats and enhancing market confidence and policy continuity in Thailand.

Key Points

- The Thai baht increased by 1.3% to 31.2 per dollar on Monday, recovering from previous losses and reaching a one-week high due to improved market sentiment following the Bhumjaithai Party’s election win.

- The ruling Bhumjaithai Party secured 191 out of 500 seats in the House of Representatives, nearly tripling its 2023 count, enhancing market confidence and reducing risks of political instability.

- This election outcome suggests policy continuity regarding social handouts and budget approvals, while the pro-democracy People’s Party, which led in pre-election surveys, is projected to win 115 seats.

Market Sentiment Improvement

The Thai baht rose by 1.3% to 31.2 per dollar on Monday, recovering from previous losses and reaching a high not seen in over a week. This rebound can be largely attributed to enhanced market sentiment following the substantial election success of the Bhumjaithai Party. As Thailand’s ruling conservative party, the Bhumjaithai Party has made a significant impact by winning 191 of the 500 seats in the House of Representatives, a notable increase nearly triple that of their 2023 performance. This solid victory has instilled confidence among investors, signaling a more stable political environment.

Implications for Political Stability

With a solid electoral win, the Bhumjaithai Party is predicted to reduce the risks associated with political deadlock or instability. A robust showing by Prime Minister Anutin Charnvirakul and his anticipated coalition partners suggests a more cohesive governing body and the potential for policy continuity. This outcome is not just about immediate political dynamics; it enables the continuation of the party’s social handouts and lays the groundwork for the approval of a new budget. As the electorate embraces this new direction, hopes for progress in governance and economic policy remain optimistic.

Opposition Landscape Overview

On the other hand, the pro-democracy People’s Party, which had been a front-runner in pre-election polls, is expected to secure 115 seats. Despite the party’s inability to match the Bhumjaithai Party’s success, their presence will likely contribute to a more diverse political discourse in Thailand. The results highlight a shifting electoral landscape where traditional party dominance faces challenges from emerging political entities. In summary, the elections have not only altered the composition of Thailand’s legislature but also the broader implications for future governance and public policy.

Other People are Reading

Business

RLF Agtech appoints Upton as CEO

RLF AgTech has appointed Stuart Upton as its chief executive, effective immediately.

Business

Standard Chartered names Peter Burrill as interim CFO

Standard Chartered names Peter Burrill as interim CFO

Business

Navin Fluorine shares up 3% as Q3 net profit soars 122% to Rs 185 crore

Revenue from operations increased 47.2% YoY to Rs 892.3 crore compared with Rs 606.2 crore a year earlier.

Operating performance improved significantly during the quarter. EBITDA climbed to Rs 307.4 crore from Rs 147.3 crore in the year-ago period, while the EBITDA margin expanded to 34.4% from 24.3%, reflecting stronger operating leverage and a favourable business mix.

As for the revenue split, HPP (high-performance products), which includes refrigerants and inorganic fluorides, reported a 35% increase in revenue at Rs 412 crore in Q3FY26. The specialty chemicals business recorded a 60% increase to Rs 354 crore, while the CDMO business rose 61% in revenue terms to Rs 127 crore, the company’s regulatory filing showed.

Also Read | Quant MF cuts gold, silver exposure near peak levels in multi-asset fund

The HPP segment reported revenue growth during the period, supported by higher realisations along with increased volumes. The AHF capex was commissioned in Q4FY26 and dispatches have already commenced. It also noted that the pricing environment for HFC continues to remain constructive.

The specialty chemicals business continues to maintain a strong product pipeline, with scale-up underway in existing molecules and new molecule launches planned. De-bottlenecking of the MPP capacity at the Dahej facility is progressing as scheduled and is expected to be commissioned in Q3FY27. The segment delivered its highest-ever quarterly performance and the outlook remains positive, backed by strong order visibility for Q4 and beyond.The CDMO business maintained its momentum with robust order visibility. The company highlighted progress in its strategy, focusing on a balanced portfolio with a mix of early-stage and late or commercial-stage molecules. Supplies for a material order to one EU major have been completed and discussions for future supplies are ongoing, while another EU major has placed a scale-up order scheduled for Q4 supplies.

Navin Fluorine is a specialty fluorochemicals manufacturer serving global customers across pharmaceuticals, agrochemicals, specialty chemicals and high-performance materials.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times.)

Business

The Chinese ‘Auntie’ Investors Behind the Gold and Silver Frenzy

Rose Tian is worried about the economy and global instability. So she does what millions of people in China do: buys gold.

This past week, the 43-year-old high-school teacher visited one of Beijing’s biggest jewelry markets to browse gold bracelets, necklaces and rings ahead of the Lunar New Year. She has purchased thousands of dollars’ worth of gold for herself and relatives over the years.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

A Critical AI Niche Is Dominated by One Little-Known Japanese Company

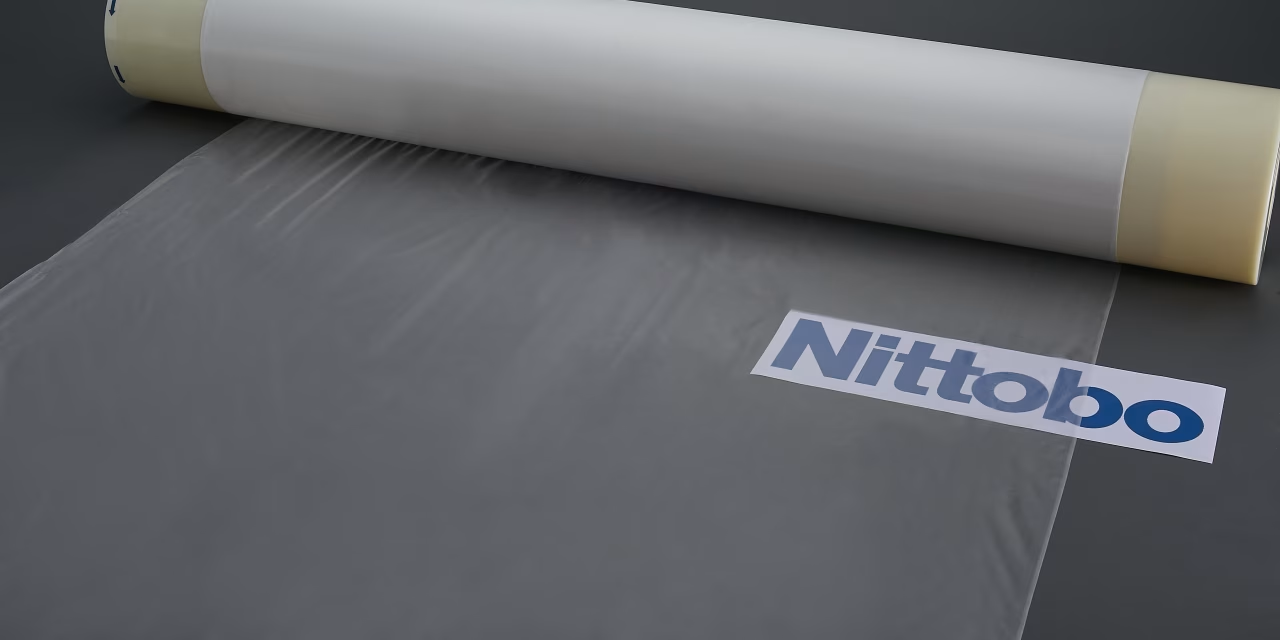

TOKYO—Imagine a sheet made of microscopic glass fibers, woven by a former silk maker and thinner than a human hair. A shortage of this material—essential in artificial-intelligence chips—is looming over companies including Apple and Nvidia.

The cloth-like material known as T-glass comes almost entirely from a single century-old Japanese textile company called Nittobo that doesn’t expect to bring significant new capacity online until late this year.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

AFMC ETF: Mid-Cap Multifactor ETF Worth Shortlisting (NYSEARCA:AFMC)

Vasily Zyryanov is an individual investor and writer.He uses various techniques to find both relatively underpriced equities with strong upside potential and relatively overappreciated companies that have inflated valuation for a reason.In his research, he pays much attention to the energy sector (oil & gas supermajors, mid-cap, and small-cap exploration & production companies, the oilfield services firms), while he also covers a plethora of other industries from mining and chemicals to luxury bellwethers.He firmly believes that apart from simple profit and sales analysis, a meticulous investor must assess Free Cash Flow and Return on Capital to gain deeper insights and avoid sophomoric conclusions.While he favors underappreciated and misunderstood equities, he also acknowledges that some growth stocks do deserve their premium valuation, and its an investor’s primary goal to delve deeper and uncover if the market’s current opinion is correct or not.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

NDIS director charged after alleged transferring funds to gambling accounts

Byson James Kete Turner has been charged after allegedly transferring nearly $860,000 from an NDIS firm he directed to his online gambling accounts, including Sportsbet and TABTouch.

Business

Upstox not in a hurry for IPO, targets 2.3x jump in FY26 profit to Rs 500 crore

Edited excerpts from a chat:

After the Budget hiked STT on F&O, the break-even point for retail traders has moved much higher. Do you fear this is the ‘death knell’ for the high-frequency retail F&O boom that fueled Upstox’s early growth, and have you revised your revenue projections for FY27 downward as a result?

The impact of the STT hike remains difficult to quantify at this stage. However, the business has reduced its dependence on any single trading segment by building multiple revenue streams. Strong growth in other segments such as commodities, margin trading facility (MTF) and mutual funds, alongside improving profitability, provides resilience against regulatory changes. Diversification is viewed as a key hedge in an environment of evolving market structure.With the new STT regime likely to dampen trading volumes further, where will the next leg of revenue growth come from or are we entering a phase of consolidation?

The next leg of growth is increasingly being driven by diversification beyond core equity trading. The commodities business has reported nearly 400% growth in revenue, alongside a doubling of market share in average daily turnover. The margin trading facility book has grown more than two-fold year-on-year, with market share increasing by about 30%. Mutual funds have also emerged as a strong growth driver, with SIP assets-under-advisory market share rising nearly 12%, helping create a more balanced revenue mix.

At an industry level, how much of volume decline in F&O are you expecting in FY27?

At this stage, it’s difficult to comment on any potential decline or uptick, as F&O volumes are largely linked to overall market sentiment. In an environment shaped by geopolitical uncertainty, making precise forecasts would be premature.

Industry data indicates retail investors are now not as enthusiastic about equities as they were earlier. You have also seen a drop in active clients. What’s changing the dynamics for you?

Customer engagement has increasingly been driven by traders with higher intent levels and deeper participation. Monetisation has improved meaningfully, with active revenue per active user growing over 40% year-on-year, while retention among high-value traders remains above 90%. This focus on engagement and customer quality has strengthened revenues and profitability despite moderation in overall active client numbers.

Is this decline a temporary cyclical blip, or have we hit peak saturation for the discount broking model in India?

Equity participation in India remains in single digits, which is significantly lower than participation levels in developed markets such as the US and China. This suggests that the long-term opportunity for retail investing is still structurally large. While the current phase reflects a cyclical slowdown influenced by market volatility and regulatory changes, it does not indicate saturation of the discount broking model. The focus remains on long-term participation and gradual deepening of investor engagement.

You’ve been aggressively pushing into insurance, fixed deposits, and mutual funds to shed the ‘trading app’ tag. However, the distribution space is crowded. Why would a customer buy insurance from Upstox rather than PolicyBazaar or their bank? Does this segment generate enough margin to replace lost F&O income?

The expansion into insurance, fixed deposits and mutual funds is part of a broader effort to evolve into a more comprehensive financial services platform. In mutual funds, the platform is already the fourth-largest in India by monthly SIPs, with SIP assets-under-advisory market share rising by nearly 12%. Insurance is being built as a long-term, complementary business aimed at improving customer lifetime value, rather than as a near-term replacement for trading-linked income.

How has the year been so far for Upstox, considering the regulatory landscape, and market trends? How has the company performed?

The year has played out in a challenging environment marked by regulatory tightening, changes in taxation and market volatility. Despite this, the company has reported strong momentum in business performance, with sharp gains in profitability and monetisation. Profit after tax is projected to grow over 2.3x year-on-year, from ₹215 crore in FY25 to around ₹500 crore in FY26, while EBITDA is also expected to grow more than two-fold. The performance has been driven by operating discipline, product innovation and a sharper focus on higher-quality, active traders.

When are you planning an IPO?

There is currently no fixed timeline for an IPO. The business is not under any capital pressure and remains comfortable operating as a private company. While investor interest has increased following peer listings, the priority continues to be on strengthening profitability, expanding product capabilities and building long-term value before taking a call on going public.

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics1 day ago

Politics1 day agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat9 hours ago

NewsBeat9 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat1 day ago

NewsBeat1 day agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business1 day ago

Business1 day agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports1 day ago

Sports1 day agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat20 hours ago

NewsBeat20 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports8 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report