Crypto World

21Shares Taps BitGo for Regulated Staking and Custody in US & Europe

BitGo Holdings and 21Shares have broadened their alliance to extend custody and staking services for 21Shares’ U.S. exchange-traded funds and global exchange-traded products. The expanded deal will see BitGo provide qualified custody, trading and execution capabilities, and a unified staking infrastructure for 21Shares’ US-listed ETFs and international ETPs. The press release notes that this arrangement gives 21Shares enhanced access to liquidity across electronic and over-the-counter markets as part of a broader strategy to scale regulated crypto yield solutions for institutional investors. The partnership is anchored in BitGo’s regulated framework in the United States and Europe, leveraging its OCC-regulated federally chartered trust bank and MiCA-licensed European operations. Announcement.

21Shares is a major crypto ETF issuer, with an established footprint across 13 exchanges and 59 listed products, supported by more than $5.4 billion in assets under management as of Feb. 11, according to its public materials. The collaboration follows BitGo’s own foray into the public markets earlier in the year, when the Palo Alto-based infrastructure provider began trading on the New York Stock Exchange under the ticker BTGO.

In recent months, custodial and staking services have become increasingly entwined as institutions seek yield-generating crypto infrastructure within regulated wrappers. The new BitGo–21Shares framework exemplifies this shift, allowing traditional and alternative asset managers to offer staking yields while maintaining compliant custody—an arrangement that can streamline onboarding for large-scale investors who require robust risk controls and auditability. The broader ecosystem has seen a spate of partnerships and integrations aimed at embedding staking deeper into regulated product lines, a trend that has accelerated as more institutions seek regulated exposure to proof-of-stake ecosystems.

Among the notable examples cited in the ecosystem: a Coinbase–Figment collaboration that broadened institutional staking for assets including Avalanche (AVAX), Aptos (APT), Sui (SUI) and Solana (SOL) through Coinbase Custody. Separately, Anchorage Digital partnered with Figment to extend staking for Hyperliquid (HYPE), integrating these services via its banking and custody infrastructure. Ripple has also expanded its institutional custody stack with integrations that add hardware security module support to enable banks and custodians to offer custody and staking without building their own validator or key-management systems.

Beyond staking, the sector is witnessing growing interest in liquid staking—an approach that lets investors earn staking rewards while retaining a tradable token that preserves liquidity. Regulators in certain jurisdictions have signaled tolerance for specific liquid-staking activities, reinforcing the push toward regulated, yield-bearing structures. In another development, Hex Trust announced a collaboration with the Jito Foundation to integrate JitoSOL, a liquid staking token on the Solana blockchain, enabling clients to earn staking and MEV rewards while keeping SOL liquid for use as collateral in borrowing and lending through its Markets platform. These moves collectively illustrate how custody providers are layering staking liquidity into regulated product lines to satisfy investor demand for yield without compromising risk controls.

In this evolving landscape, the BitGo–21Shares partnership stands out for its scope and regulatory alignment. By combining BitGo’s OCC-regulated custody framework with MiCA-licensed European operations, the alliance aims to unlock scalable staking and liquidity across major markets for a broad set of products, including US-listed ETFs and international ETPs. The collaboration signals a maturation in the ecosystem, where product issuers can offer regulated staking while maintaining robust custody and market access—an arrangement that may help attract institutions that previously shied away from crypto exposure due to compliance and operational concerns. For readers seeking a deeper dive into the breadth of the collaboration, a related press release details the global ETF-partnership expansion across staking and custody, highlighting the operational pathways BitGo will provide for 21Shares’ product lineup.

Video and media discussions surrounding the partnership can be explored through a related presentation linked to the announcement.

Market participants should watch how the integration affects liquidity profiles and trading costs for 21Shares’ ETF roster, as well as how it influences the pace at which other ETF issuers consider similar custody-and-staking models. The collaboration may also influence how global regulators view regulated staking within ETF wrappers, particularly as MiCA implementations take fuller effect across Europe and as U.S. authorities continue to refine guidelines for crypto custody and staking activities.

Key takeaways

- BitGo will deliver qualified custody, trading and execution services, plus integrated staking infrastructure for 21Shares’ US ETFs and global ETPs.

- The services will be provided through BitGo’s regulated entities in the US and Europe, leveraging an OCC-regulated trust bank and MiCA-licensed operations.

- 21Shares’ product slate includes 59 ETPs listed across 13 exchanges, with more than $5.4 billion in assets under management as of Feb. 11.

- The move aligns with a broader institutional push to embed staking within regulated custody offerings, following similar partnerships and integrations across the sector.

- The deal underscores BitGo’s ongoing expansion into ETF and regulated markets after its BTGO listing on the NYSE earlier this year.

Tickers mentioned: $BTGO, $AVAX, $APT, $SUI, $SOL

Market context: The collaboration arrives amid growing institutional interest in regulated staking and custody-enabled yield strategies, supported by clearer regulatory frameworks in the U.S. and Europe and expanding ETF liquidity across crypto assets.

Why it matters

The partnership between BitGo and 21Shares represents a meaningful step in bringing regulated staking and custody to a broader class of institutional investors. By coupling BitGo’s OCC-chartered custody capabilities with 21Shares’ diversified ETF lineup, the arrangement reduces operational friction for asset managers seeking compliant exposure to proof-of-stake ecosystems. This is particularly relevant as the crypto industry pushes toward scalable yield opportunities within regulated wrappers, a dynamic that could accelerate the adoption of staking across traditional finance channels.

For 21Shares, the deal broadens access to liquidity and trading venues for its US-listed ETFs and global ETPs. As the ETF issuer continues to grow—reporting 59 products and substantial AUM—partnerships like this can help sustain product velocity, improve execution quality, and offer investors more reliable ways to participate in staking rewards without directly managing keys or validator infrastructure.

From a regulatory perspective, the alignment with an OCC-regulated entity in the United States and MiCA-licensed operations in Europe signals a mature model for regulated crypto infrastructure. If these structures gain broader acceptance, more issuers may pursue similar multi-jurisdictional approaches, further integrating staking into mainstream investment products. In a market that remains sensitive to liquidity, risk controls, and operational risk, such collaborations could contribute to steadier capital inflows and more robust market-making activity around crypto ETPs.

What to watch next

- Rollouts of custody and staking services for 21Shares’ entire U.S. ETF lineup and broader international ETPs, with clear launch timelines.

- Regulatory updates from the OCC and updates to MiCA implementations that may affect how staking is offered within ETF wrappers.

- Potential expansion of BitGo–21Shares technology and service integrations to additional product lines or new markets.

- Continued ETF issuance activity by 21Shares and related liquidity improvements across electronic and OTC venues.

Sources & verification

- BitGo and 21Shares Accelerate Global ETF Partnership Across Staking and Custody — Business Wire press release (Feb 12, 2026).

- 21Shares product catalog and assets under management (as of Feb 11) published by 21Shares.

- BitGo IPO coverage and BTGO listing details (Cointelegraph gateway to BitGo stock information).

- FalconX acquisition of 21Shares (context for 21Shares’ corporate structure).

- Ripple expands institutional custody stack with staking and security integrations (industry context for custody-staking trends).

BitGo expands custody and staking for 21Shares across US and Europe

BitGo and 21Shares have formalized an expanded collaboration that integrates custody, trading, and staking services for 21Shares’ US ETFs and global ETPs. The arrangement will see BitGo operate through its regulated US and European entities, including a federally chartered trust bank approved by the Office of the Comptroller of the Currency (OCC) and MiCA-licensed European operations, providing a bridge between traditional custody controls and crypto-native staking yields. The underlying objective is to reduce friction for institutions seeking yield opportunities tied to major proof-of-stake ecosystems while maintaining stringent risk and compliance standards.

Within the scope of the agreement, 21Shares gains access to BitGo’s custody and execution frameworks, coupled with integrated staking infrastructure designed to support its ETF lineup. The collaboration underscores a broader trend in the market: custodians and wallet providers are increasingly embedding staking capabilities into regulated products to satisfy investors’ demand for yield, liquidity, and governance participation without sacrificing institutional-grade controls.

As a backdrop, the ecosystem has seen a series of institutional staking moves—ranging from Coinbase’s partnerships enabling direct staking for select assets, to Anchorage Digital’s collaborations that extend staking through regulated banking channels, and even Ripple’s expansion of its custody platform with security integrations. These developments collectively point to a maturation of the crypto infrastructure market, where regulated custody and staking go hand in hand to deliver scalable, compliant exposure to proof-of-stake networks. In this context, BitGo’s expanded alliance with 21Shares positions both firms to capture a larger slice of the ETF and ETP issuance market and to support a broader wave of institutional adoption.

Market participants will be watching how quickly the rollout unfolds and how liquidity improves across the involved products, particularly in the United States and Europe. The partnership could catalyze further collaborations between custodians and ETF issuers, as regulators continue to refine the boundaries of crypto custody and staking within regulated investment products.

Crypto World

US National Cyber Strategy Pledges Support For Crypto And Blockchain

Crypto industry executives are combing through US President Donald Trump’s National Cyber Strategy after it was released on Friday, searching for hints about what it could signal for government support of the crypto industry.

“Crypto and blockchain are explicitly named as technologies to be ‘protected and secured.’ This is a first for any US cybersecurity strategy,” Galaxy Digital’s head of firmwide research Alex Thorn said in an X post on Friday.

Crypto and blockchain were mentioned once in the six-page report:

“We will build secure technologies and supply chains that protect user privacy from design to deployment, including supporting the security of cryptocurrencies and blockchain technologies.”

However, industry executives have also been interpreting other parts of the document to see how they relate to crypto.

Thorn pointed to a section pledging to “uproot criminal infrastructure and deny financial exit and safe haven.” “This language could easily justify crackdowns on mixers, privacy coins, and unregulated off-ramps,” he said.

Bitcoin VC points out that quantum has been taken “seriously”

Castle Island Ventures founder Nic Carter, who has been vocal about the threat of quantum computing to Bitcoin (BTC) in recent times, pointed to the section saying the government “will accelerate the modernization, defensibility, and resilience of federal information systems by implementing cybersecurity best practices, post-quantum cryptography, zero-trust architecture, and cloud transition.”

“Sure seems like they’re taking quantum seriously. Nothing to worry about, I’m sure,” Carter said in an X post.

It comes as the crypto industry continues to debate about how close quantum computing is to being a serious threat to Bitcoin. On Feb. 15, Carter said that major Bitcoin-holding institutions may eventually lose patience with Bitcoin developers for not addressing quantum computing concerns quickly enough.

Trump points to the next generation as a priority

Trump said that the National Cyber Security outlines his priorities for “ensuring that America remains unrivaled in cyberspace.” Artificial intelligence was a key focus of the report.

“We will secure the AI technology stack—including our data centers—and promote innovation in AI security,” it said.

Related: Community banks and crypto industry ‘are allies’ in CLARITY Act debate: Exec

Trump also emphasized the importance of recruiting the next generation of workers in the cyber workforce to “design and deploy exquisite cyber technologies and solutions.”

The US typically releases a national cybersecurity strategy every administration, outlining the government’s priorities for emerging technologies.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

Crypto’s Mark Zuckerfart breaks silence

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

The man behind the pseudonym Mark Zuckerfart has resurfaced after months of speculation. In an exclusive interview, the marketer explains why he left the Solfart project and why he now believes Patos Meme Coin has the team, strategy, and momentum to dominate the next wave of Solana meme tokens.

crypto.news presents an exclusive look at the man behind the pseudonym: Mark Zuckerfart. With a track record of scaling meme coins into the hundreds of millions, Zuckerfart has long been a silent engine in the marketing and creative space.

But his latest chapter came with a cost. After a dispute over Solfart’s financial transparency and the team’s treatment, MZ walked away from his previous brand last November, leaving behind one final, cryptic Reddit post. Now, with the ducks flying high, it’s clear what the image meant. He has found a new home as the Marketing and Creative Head for Patos Meme Coin and a project leader.

For the first time, he’s addressing the rumors regarding Solfart and explaining why the move was necessary —and how Patos Meme Coin is a band of unrivaled Crypto Rock Stars.

MZ, let’s start with the basics. Why did you leave Solfar (SOLF) Token?

I was a co-creator of solfart but I wasn’t the owner. I never handled wallets and payments, etc, I just made sure the internet was littered with content and provided connections to all the major news outlets. I left because we had a $15k sale, and the money was mishandled. Neither the team under me nor I were compensated, while the owner squandered money. The writing on the wall was clear; he was not ‘cutting the cheese’.

But hey, I made that slogan and concept for him. Makes sense. If he doesn’t believe in the idea/concept, he has no reason to. He didn’t make the creative concepts nor share the belief

What do you think will happen to the Solfart token now, and what did you learn from the experience?

Hopefully, Fart McSatoshi learns and keeps moving forward. I wish no negatives on anyone and believe he can steer his own vision as he chooses.

I do see he’s still shilling the work I did back in November of 2025, however. I think investors should demand more. That’s it. He’s a brilliant developer. Every time I see people asking “what happened to Mark Zuckfart” or wanting my work back, I feel more inspired to continue creating with Patos.

What made you move on to Patos Meme Coin?

More control allows me to exercise greater budgetary restraint and have a firm handle on the project’s direction. To make sure there’s a fair opportunity for everyone.

My belief in building something that will spread wealth to those who invest will be honored by this project. I also believe in the developer & marketing team’s ideas. We have a crew of people from 4 countries who are absolute Rock Stars at their craft. The Beatles of the Crypto space!

Everyone shares one belief, structured around math fundamentals. Everyone works just as hard as I do, and results are showing already.

Ducks eat bread together. Ducks fly high together. “PATOS” is all that, but also a potential catalyst to Pump All Tokens on Solana by creating a FOMO for the SPL ecosystem.

Do you believe Patos Meme Coin is better than Solfart?

Undoubtedly. Our team has far more reach in the actual crypto industry. Look at what we’ve achieved in 2 months compared to Solfart.

Patos Meme Coin has more crypto exchange listings, we’re on Google News on a new site every few days, and our first round of presale is nearly sold out.And recently, we released the first dAPP with more to come. Patos.games is a play-to-earn GameFi hub launched to help anyone earn $PATOS while boosting trading volumes and, in turn, brand visibility. Speaking of after the presale, of course. If you go point for point, the facts are clear.

What makes you confident in Patos Meme Coin’s execution?

Experience. Connections. Power. Consistency. Scaling ability.

The 111 Crypto exchange idea wasn’t just to compete with my old ideas at Solfart. It’s because I, myself, and a teammate conducted an analysis of crypto exchanges’ effects on the market cap of previously listed tokens, on average; tokens on a similar scale to what Patos Meme Coin is destined to be, if not less.

That 111 Cex theory puts those averages together, and along with support from our rising “Patos Flock” following, should create an excess of momentum in the opening week, and our team, keyword ‘teamwork,’ can handle all aspects of what needs to be done to convert that momentum into a parabolic market cap increase. And 111 is a bit ‘over the top’ of where the actual math suggested, but we want to aim for Mars, not the Moon.

Parabolic increases in market cap turn into parabolic token price explosions. We even have connections with Pop Culture celebrities and influencers that will aid our growth at the right time. Our collective reach really separates us from any other presale currently live.

On PatosMemeCoin.com, it shows that the token presale’s first round is almost closed, with 9 remaining; 10 total. This means PATOS should have around 11 crypto exchange listings confirmed per round. Is this accurate?

Something like that. For instance, we expect to add 4, possibly 6, more crypto exchange listing confirmations to our resume before round 1 closes. That will boost our total CEX confirmations to 12 or 14. Our team likes to be ahead of the ball, ahead by as far as possible.

The doors are open to many people as they trust the team involved and me. The faster funding comes in, the faster listings will grow, and in compounding fashion, vs. speed.

But of course, the price of tokens goes up with each round, with the 10th-round price 47% higher than the first. The fastest duck gets the most bread.

You mentioned earlier that you have the GameFi dAP “Patos Games.” What other applications can investors expect?

We like to keep most things very much hush. As you can see from the Patos Games references, there was no mention of the actual project before it launched. There are too many energy & idea thieves in this industry, and I want to keep as many surprises for investors as possible.

Just know, we’re looking to make an impact in a way that will make Patos Meme Coin a meme coin with utility that’s used for years to come. That’s the goal.

Our team would much rather ‘show’ than talk. But at this point, we have more CEX support, a GameFi pixel game launched, and so much visibility. Changpeng Zhao, aka CZ, responded to us indirectly on X.

With just what we have now, a 50x increase in value from today’s token price is possible. comes, the faster listings will grow, and in compounding fashion vs speed increase.

Thank you for your time, Mark Zuckerfart. Wishes of great fortune and materialization of your vision for Patos Meme Coin.

Wishes aren’t needed. Just hard work If you’re ready to win, come join the Flock.The first round has 18% left, and we’re still in the 2nd month of this token presale. Check others’ ages to notice how fast we are moving by comparison.

We’re going to go even faster soon. Get your first bag holdings during the genesis round at PatosMemeCoin.com. And to all of those invested right now: Patos Fock, let’s fly Mother Quackin’ high.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Community Banks, Crypto Industry Allies in CLARITY Act Debate

A crypto executive has pushed back against claims by the president of a community banking association that any compromise between the banking sector and the crypto industry on the CLARITY Act would be a mistake. Austin Campbell, founder of Zero Knowledge Consulting, argued in a Friday X post that success or failure won’t be dictated by the players who stand to lose the most. “If community banks and crypto can’t find a way to work together, we already know who the winners are. It’s not the community banks. It’s not consumers. It’s not the crypto industry,” Campbell said, framing a potential collaboration as a win for local economies over the entrenched interests of large lenders. He went on to stress that the real opportunity lies in using stablecoins to address persistent technology and regulatory gaps that have hindered community banks from embracing crypto-enabled solutions.

Key takeaways

- Austin Campbell argues that cooperation between community banks and crypto firms is essential to avoid a decisive win by large banks, implying a missed opportunity for local lenders and consumers if cooperation fails.

- The exchange centers on the CLARITY Act, with proponents of flexibility arguing concessions could bolster liquidity and economic activity in smaller markets, while opponents warn of deposit leakage and regulatory risk.

- Banking lobbyists contend that a broad adoption of stablecoins could siphon deposits from traditional banks, citing a Standard Chartered note that predicts a potential drop in deposits tied to growing stablecoin use.

- Political figures, including Eric Trump and Donald Trump, have weighed in on the debate, urging speed on related legislation and arguing that banks are throttling crypto policy to preserve profits.

- Policy discussions are playing out against a backdrop of ongoing regulatory scrutiny, growing acceptance of stablecoins as liquidity tools, and the broader question of how to regulate a rapidly evolving payments ecosystem.

Tickers mentioned:

Market context: The CLARITY Act debate sits at the intersection of regulatory clarity, stablecoin usage, and local lending dynamics, illustrating how policy choices may affect both consumer access to higher-yield options and the resilience of regional banks.

Sentiment: Neutral

Market context: The discussions frame liquidity and regulatory risk as central to crypto’s interaction with traditional finance, underscoring how policy signals could influence participation by smaller lenders and crypto firms alike.

What to watch next: 1) Movement on CLARITY Act amendments in Congress; 2) Public statements from community bank associations and their members; 3) Upticks in stablecoin adoption and related liquidity tooling; 4) Public commentary from major banks on crypto policy; 5) Regulatory updates on stablecoins and payments infrastructure.

Why it matters

The core of the debate centers on whether stablecoins and other crypto-enabled liquidity tools can be harnessed by community banks without eroding traditional deposit bases. Campbell’s argument positions community banks as potential beneficiaries if they partner with crypto firms to offer compliant, technology-enabled services. In his view, the real threat comes not from crypto or consumers, but from capital and lobbying power concentrated among the largest banks, which he says have incented competing factions to undermine collaboration. The framing challenges the assumption that regulatory concessions are inherently risky for local lenders and instead suggests they could unlock new channels for funding and lending in smaller markets.

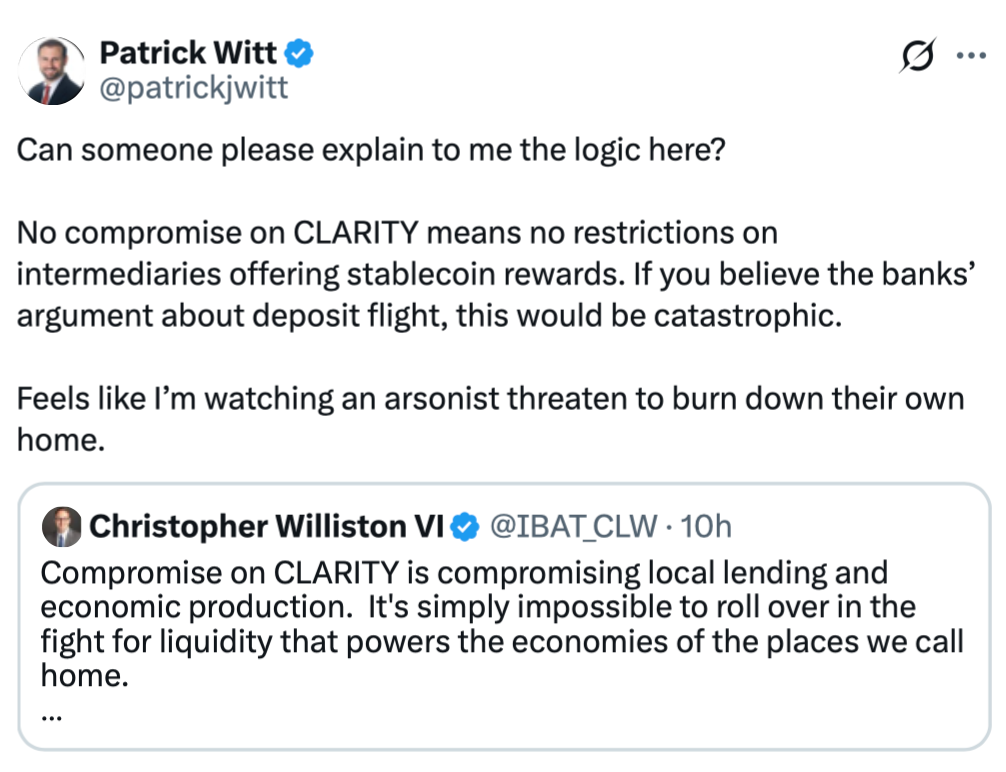

On the other side, Christopher Williston, president of the Independent Bankers Association of Texas, has warned that concessions in the CLARITY Act could undermine local lending by shifting liquidity away from traditional banks. Williston argues that “it’s simply impossible to roll over in the fight for liquidity that powers the economies of the places we call home.” The argument underscores a broader fear among lenders that stablecoins, if not properly regulated, might draw away customer funds or complicate reserve management. The debate has drawn in perspectives from the broader banking lobby, with Standard Chartered’s note highlighting potential deposit declines as stablecoin adoption grows, a claim that adds material weight to calls for thoughtful design and robust safeguards in any proposed framework.

The policy dialogue has also intersected with political commentary this week. Eric Trump criticized large banks on X for allegedly blocking Americans from earning higher yields on savings, while Donald Trump pressed for swift action on a Market Structure bill and argued that banks should not obstruct crypto policy. The political dimension adds urgency to lawmakers’ considerations about how to balance investor protection, financial stability, and innovation in a rapidly evolving payments landscape. A broader conversation about the regulatory underpinnings of stablecoins—how they are issued, backed, and used for on-ramps and off-ramps—remains central to building a framework that protects consumers while supporting responsible innovation.

In the background, the debate unfolds as policymakers weigh how to integrate stablecoins into a compliant, secure financial system. The tension between liquidity needs in local economies and the banks’ concerns about deposits and reserve adequacy illustrates the complexity of crafting policy that does not stifle competition or slow the adoption of technology that could enhance efficiency and inclusion. With the CLARITY Act and related market-structure discussions occupying congressional calendars, the path forward will likely hinge on how well negotiators can translate public policy into practical reforms that serve both communities and investors.

The discourse also mirrors a broader industry trend: the growing importance of stablecoins as tools for settlement, liquidity provisioning, and cross-border transactions. As more institutions explore regulated, compliant implementations, the emphasis remains on transparent, auditable designs that align incentives across participants—from small community banks to the largest money-center institutions. The YouTube discussion linked below captures a snapshot of these tensions, featuring perspectives from industry observers and policymakers as they navigate the trade-offs between innovation, risk, and stability. Video discussion

In parallel, the political discourse has featured statements from prominent figures, including Eric Trump and Donald Trump, urging lawmakers to move promptly on the crypto agenda. The narrative underscores a broader theme: the policy environment is actively shaping the strategic calculus of counterparty risk, liquidity provisioning, and the pace at which the crypto sector can integrate with traditional banking rails.

As the CLARITY Act debate continues, observers will be watching for how congress evaluates stability, consumer protection, and the risk of deposit outflows under different design choices. The tension between the desire for innovation and the need for prudent oversight remains at the heart of policy discussions, with industry voices insisting that collaboration between community banks and crypto firms could unlock benefits for local economies—if guided by clear, enforceable rules.

What to watch next

- Legislative updates on the CLARITY Act, including potential amendments that balance liquidity with deposit protection.

- Statements from independent bankers’ associations and regional banks on the proposed framework and liquidity impacts.

- Regulatory guidance on stablecoins, disclosures, and reserves that could influence adoption by smaller lenders.

- Public commentary from influential industry figures and lawmakers ahead of key votes or hearings.

- Verification of deposit-flow projections tied to stablecoin use and cross-border settlement experiments.

Sources & verification

- Independent Bankers Association of Texas president Christopher Williston’s remarks on X: https://x.com/IBAT_CLW/status/2029950462649057749?s=20

- Patrick Witt’s commentary related to the discussion: https://x.com/patrickjwitt/status/2030102472417489373?s=20

- Standard Chartered note on stablecoins and deposits: https://cointelegraph.com/news/stablecoins-real-threat-us-bank-deposits-says-standard-chartered

- Eric Trump’s X post on banks and yields: https://x.com/EricTrump/status/2029309823423009211

- Trump’s call for Market Structure action and related coverage: https://cointelegraph.com/news/trump-takes-swipe-banks-over-stalled-crypto-bill

- YouTube video discussion: https://www.youtube.com/watch?v=ry9MI57Pbjs

- Independent context on the CLARITY Act and liquidity debates (general references within the reporting):

Community banks, crypto, and the CLARITY Act: the policy battle shaping liquidity

The CLARITY Act debate places community banks at the center of a larger question about how crypto-enabled liquidity should integrate with traditional financial rails. Austin Campbell’s critique centers on the idea that the most durable gains for local economies will come from partnerships rather than adversarial standoffs. He emphasizes that stablecoins—when designed with robust risk controls—could bridge operational and regulatory gaps that have long hindered community banks from accessing the efficiencies and speed of digital payment rails. In this framing, cooperation between smaller lenders and crypto companies becomes a pragmatic path to improving service offerings and expanding financial inclusion, rather than a theoretical contest over who controls the new payments paradigm.

However, the opposing view, as articulated by Williston and other banking lobbyists, highlights a legitimate concern: if policy is perceived as too lenient, the safety and soundness of traditional deposits could be compromised. Their argument rests on the premise that deposits are a fragile resource that must be safeguarded, especially in times of rising interest rates and macro uncertainty. The Standard Chartered projection, cited in coverage of the debate, adds a quantitative dimension to this concern by warning that widespread stablecoin adoption could translate into meaningful deposit declines for US banks. Such projections reinforce calls for careful governance, reserve standards, and transparency to ensure any crypto-enabled framework strengthens, rather than destabilizes, the banking system.

The political dimension adds urgency to the policy conversation. With voices from the White House and Congress weighing in—alongside public commentary from figures like Eric Trump and Donald Trump—the push to finalize a coherent market-structure and payments framework grows stronger. The discourse suggests that supporters see an opportunity to advance crypto policy in a way that complements innovation while addressing consumer protection and financial stability concerns. As policymakers examine potential concessions, the role of community banks could hinge on the availability of regulatory guardrails that enable responsible experimentation without undermining essential lending activities in local communities.

In sum, the current moment captures a critical crossroads for the crypto ecosystem and traditional finance. The CLARITY Act, the stability and resilience of local banks, and the pace of crypto-enabled liquidity tools will collectively shape how the sector evolves over the next 12 to 24 months. Stakeholders on both sides are advocating for a design that preserves consumer choice and market competition while ensuring that reserve management, disclosure, and oversight keep pace with the speed of innovation. As noted, the path forward will depend on concrete policy language, precise regulatory expectations, and the willingness of varied actors to collaborate in service of broader economic vitality rather than narrow interests.

Crypto World

Community Banks, Crypto Industry ‘Are Allies’ In CLARITY Act Clash: Exec

A crypto executive has pushed back against claims by the president of a community banking association that any compromise between the banking sector and the crypto industry on the US CLARITY Act would be a mistake.

“If community banks and crypto can’t find a way to work together, we already know who the winners are. It’s not the community banks. It’s not consumers. It’s not the crypto industry,” Zero Knowledge Consulting founder Austin Campbell said in an X post on Friday.

“It is the big banks,” Campbell said.

“There is a very straight line between the value community banks bring,” he said, explaining that they face technological and regulatory issues that can be solved by stablecoins.

The major banks “have tricked both sides”

“These are not enemies,” Campbell said of stablecoin-yield providers and community banks, adding that “they are allies.”

“The big banks and the bank lobbies they fund have tricked both sides into fighting each other so that the ultimate winner is Jamie Dimon’s bonus,” he said.

Campbell’s comments came in response to Independent Bankers Association of Texas president Christopher Williston, who said that making concessions in the CLARITY Act debate would risk harming local lending and economic production.

“It’s simply impossible to roll over in the fight for liquidity that powers the economies of the places we call home,” he said.

Banking lobby groups have argued that if the CLARITY Act passes in its current form, stablecoins could siphon deposits from the banking system. Major US bank Standard Chartered recently estimated in a research note that increasing stablecoin adoption could lead to US bank deposits decreasing “by one-third of stablecoin market cap.”

The debate has also drawn comments from the Trump family this week.

Eric Trump, the son of US President Donald Trump, said in a X post on Thursday that large banks are not acting in the best interests of US citizens. “Big Banks (think JPMorgan Chase, Bank of America, Wells Fargo, etc.) are lobbying overtime to block Americans from getting higher yields on their savings.”

Donald Trump urges the bill to pass “ASAP”

US President Donald Trump also criticized banks for stalling the Senate’s crypto market-structure bill amid ongoing disagreements over stablecoin yield payments.

Related: Revolut makes second attempt at US bank charter, names new CEO for US business

“The U.S. needs to get Market Structure done, ASAP,” Trump said. “The Banks are hitting record profits, and we are not going to allow them to undermine our powerful Crypto Agenda,” he added.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

is Patos token Solana’s Shiba Inu?

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

A new Solana-based meme coin, Patos, is preparing for launch as traders increasingly shift attention from Ethereum to faster, lower-cost networks. The project aims to attract meme-coin liquidity by leveraging Solana’s speed, low fees, and native SPL integration.

This report analyzes the impending launch of Patos Meme Coin, a novel project set to disrupt the dominant paradigm within the cryptocurrency meme market. Built on the high-performance Solana blockchain, this initiative aims to attract capital moving away from the crowded Ethereum ecosystem, specifically targeting investors currently engaged with tokens like Pepe, Shiba Inu, and Dogecoin. By analyzing data on current ERC-20 meme coin performance, recent Solana-based successes like Bonk and Wen, and emerging market data on Solana whale movements, this analysis paints a bullish case for Patos.

The article explores how the project’s strategic deployment on Solana addresses the primary pain points for retail and institutional investors alike, namely Ethereum’s prohibitive gas fees. By leveraging Solana’s superior transaction speeds and minimal costs, Patos offers a frictionless alternative for a high-frequency trading strategy often associated with the speculative nature of meme coins. This analysis is crucial for any market participant monitoring capital flows between rival layer-one blockchains and seeking to capitalize on the next wave of meme coin volatility. Investors are advised to conduct thorough due diligence, as this report highlights both the potential rewards and the inherent risks associated with early-stage crypto assets.

New Kid on the Block: Patos Meme Coin Prepares to Shake Up the Meme Economy

Meme coins are a persistent fixture in the volatile world of crypto. Everyone is always looking for the next breakout star. Ethereum’s dominant ERC-20 tokens are facing new competition from Solana. A fresh contender, Patos Meme Coin, aims to be that next viral sensation. Here is what we know about this intriguing new project.

Leaving Ethereum Behind: The Solana Advantage for Meme Coins

For a long time, the Ethereum network was the undisputed home of meme coins. Iconic tokens like Dogecoin (DOGE) and Shiba Inu (SHIB) were originally ERC-20 assets before launching their own chains or Layer 2s. This created a strong network effect, making Ethereum the initial landing spot for almost all speculative liquidity.

However, a serious problem began to emerge during bull markets: exorbitant transaction fees. This issue became an insurmountable barrier for small-scale, high-frequency meme coin traders. Trading a $20 asset when gas fees cost $100 made no economic sense. This limitation hindered these coins’ ability to achieve truly rapid and widespread retail adoption.

This inefficiency provided a perfect entry point for Solana. This rival layer-one blockchain, built for speed and affordability, became an enticing alternative for developers and investors alike. Transactions that might take minutes and cost substantial sums on Ethereum are completed in milliseconds for a fraction of a cent on Solana.

The launch of successful meme coins like Bonk (BONK) and Wen (WEN) served as strong proof of concept for this new ecosystem. Traders, weary of high costs, flocked to these projects, generating massive daily volume. Patos Meme Coin has strategic plans to capitalize on this migration, establishing its entire ecosystem and future utility directly on the Solana network. This conscious choice allows the new token to side-step the cost and congestion issues that continue to plague its Ethereum counterparts.

Whale Watching: Institutional Interest and Strategic Investments

The cryptocurrency market is often heavily influenced by “whales.” These are investors holding massive quantities of a particular digital asset, capable of shifting prices with a single trade. Recently, blockchain data has revealed a significant and telling trend among these major crypto players.

Market intelligence consistently shows a pattern of capital rotation. High-net-worth individuals and investment funds are actively reallocating their assets, moving significant amounts of Ethereum from old ERC-20 giants to the more efficient Solana ecosystem. This shift suggests a professional interest in Solana’s superior scalability.

A noteworthy rumor is now circulating within deep crypto circles. A major investor, often identified as a “Solana Whale” due to their immense holdings of SOL, is purportedly conducting research into the Patos Meme Coin project.

While unconfirmed, the potential investment from such a significant player could validate the project’s ambition. It suggests that major capital allocators see genuine long-term value in this new venture. This potential interest from large-scale traders may create a significant advantage for the token at its launch, positioning it far ahead of its competitors.

The Mechanics of Momentum: How Token Presales Build Buzz

In the high-stakes world of meme coins, building and sustaining momentum is critical for long-term survival. The most successful projects don’t launch directly into an open market, risking instant volatility. Instead, they strategically utilize a structured token presale to establish a dedicated, community-driven foundation.

This approach offers several significant advantages for both the new project and its earliest participants. By selling tokens directly to the public before the official exchange listing, the team behind Patos Meme Coin can secure critical funding to support ongoing development, widespread marketing, and crucial liquidity on decentralized exchanges (DEXs).

For investors, participation in a presale often means securing tokens at the lowest possible entry price. This structure is strategically designed to attract early adopters who believe in the project’s potential. These early holders, often highly vocal advocates, become a key pillar of the project’s long-term success.

The Patos team has designed a tiered presale structure that progressively increases the token price across stages. This method is carefully crafted to reward the project’s earliest and most dedicated supporters. This strategic approach is crucial for generating the early interest and widespread hype that are essential for a new asset to capture significant mindshare and market share in the highly competitive meme coin landscape.

A New SPL Standard: Patos Aims for Superior Trading

One technical detail is paramount to Patos Meme Coin’s long-term strategy. The project has committed to launching its token as an SPL token, the native token standard of the Solana blockchain. This choice has profound implications for its future.

The integration with the Solana Program Library ensures native compatibility. Patos can be easily supported by the entire ecosystem of Solana wallets, explorers, and decentralized applications (dApps). This makes it far simpler to integrate into liquidity pools, yield farms, or new utility-driven products than cross-chain solutions.

This native integration simplifies trading dramatically. On Solana, investors can execute trades through highly efficient, liquid decentralized exchanges (DEXs). This streamlined experience contrasts sharply with the often-cumbersome process of swapping Ethereum tokens, which can involve complex approvals and high slippage on top of transaction fees.

By adhering to this standard, the Patos team is prioritizing future utility and accessibility. The goal is to build a coin that is not just speculative, but also fundamentally integrated into the burgeoning Solana economy. The project intends to offer superior trading capability, unmatched liquidity, and future use cases that go far beyond what many simple meme coins achieve.

Diversification Play: Why Meme Coin Traders are Looking Beyond Ethereum

Meme coin traders are rarely known for their long-term, passive-holding strategies. They are active, opportunistic, and constantly searching for the highest potential returns. This means they are highly attuned to emerging market cycles and new opportunities.

A strategic realization is now spreading among veteran market participants. Concentrating exclusively on a single network, such as Ethereum, can be incredibly risky during periods of high congestion. To maximize their returns, investors are actively diversifying their portfolios.

This new mindset naturally benefits projects like Patos. Experienced traders are moving capital into other ecosystems with strong fundamentals and booming activity. Solana, with its high-speed performance and dynamic community, is the primary beneficiary of this asset rotation.

The Patos project is carefully designed to attract this exact type of market player. The project offers these traders a fresh opportunity to participate in a viral asset class with significantly reduced technical friction. This makes it an appealing and pragmatic addition for any well-rounded crypto portfolio exploring the high-reward potential of meme coins.

Analyzing the Contenders: How Patos Stacks Up Against Pepe and Shiba Inu

When analyzing a new meme coin, it’s necessary to examine the existing competitive landscape. The ERC-20 tokens Pepe (PEPE) and Shiba Inu (SHIB) currently sit at the pinnacle of the meme economy, boasting massive followings. They are, essentially, the benchmarks against which all new projects are measured.

Pepe, for example, achieved its massive valuation through rapid, viral internet culture. This success was achieved despite the high transaction fees that frequently occurred during its peaks. This phenomenon demonstrated the pure, irrational power of community sentiment.

Similarly, Shiba Inu built an extremely loyal community of proponents known as the “ShibArmy.” This group championed the coin’s development of a native decentralized exchange and other ecosystem components.

The strategy behind Patos Meme Coin appears to be to leverage the strengths of both models while avoiding their primary weakness. By launching on Solana, Patos intends to cultivate the same fervent, organic community engagement while also offering a practical, cost-effective trading platform. The aim is to prove that high-speed, minimal-cost transactions can accelerate community growth more effectively than any ERC-20 network.

From Hype to Utility: The Long-Term Plan for Patos

The initial success of any meme coin is almost always fueled by speculation, community engagement, and a good narrative. However, sustaining that interest over months or years is an entirely different challenge. Longevity in the crypto space requires practical utility.

A persistent criticism of tokens like Dogecoin has been their lack of tangible real-world application. The Patos team is aiming to proactively address this critical point by outlining a long-term roadmap that goes beyond the initial launch phase.

The whitepaper for Patos outlines planned expansions and partnerships that are intended to give the token a genuine purpose. These proposed use cases include potential integrations into future gaming initiatives, NFT staking systems, and even exclusive access to unique physical merchandise.

The plan is to leverage the unique advantages of the Solana network—such as its low costs—to make microtransactions, rewards, and in-game items economically feasible. By integrating the token into functional applications early in its life cycle, Patos aspires to transition from a purely speculative meme coin into a resilient utility asset within the Solana ecosystem.

Risks and Rewards: A Balanced View of the Meme Coin Market

It is absolutely essential for every investor, from absolute beginners to professional funds, to understand that the meme coin market is an inherently high-risk, speculative environment. These assets are incredibly volatile, with prices that can fluctuate dramatically in very short periods.

Investing in a new project, especially one still in its presale phase, like Patos Meme Coin, carries unique risks. The success of any new cryptocurrency depends on countless factors, from achieving widespread adoption to the simple execution of a technological roadmap. Any participant must approach these investments with extreme caution.

The primary lure of this sector is, of course, the potential for staggering returns. Meme coins, when successful, have demonstrated the ability to generate unparalleled profits for their early backers, often yielding returns that are simply impossible in traditional equity or commodity markets.

A prudent approach is paramount. This requires thorough research, a deep understanding of the project’s fundamentals, and a clear comprehension of the potential pitfalls. Investors are strongly advised to commit only capital they can afford to lose and to carefully manage their risk exposure in highly speculative markets like cryptocurrency.

Community and Culture: The Essential Recipe for Viral Success

In the decentralized world of cryptocurrency, the strength and dedication of a project’s community are arguably more important than its underlying code or technological breakthroughs. Without a passionate group of advocates, a new asset is simply code on a ledger.

The entire team behind Patos Meme Coin is acutely aware of this fundamental principle. This realization has shaped their entire strategy, placing a paramount focus on building a robust, engaged, and authentic community from day one. This effort is already visible in their organic growth across various social media platforms.

The project is actively encouraging user participation. This strategy extends beyond simple token ownership and involves fostering a creative culture of meme sharing, community-driven content, and active participation in decentralized governance decisions.

By emphasizing transparency and authentic engagement, the project aims to build an inclusive ecosystem where every holder feels a deep sense of shared ownership and purpose. This focus on building a sustainable culture may prove crucial for maintaining momentum and ensuring the project’s resilience in an incredibly crowded market.

Cross-chain to Solana for a generational SPL token

The impending launch of Patos Meme Coin marks another potential milestone for the rapidly maturing Solana ecosystem. By prioritizing efficiency, affordability, and community above all else, the new project represents a direct and potent challenge to the established order of the Ethereum-based meme coin market. This unique value proposition may prove highly effective.

Whether this new initiative can truly capture the viral imagination and replicate the staggering success of its predecessors remains to be seen. However, its arrival is yet another undeniable signal that the meme coin economy is rapidly evolving, with capital and attention continuing to flow toward high-performance, cost-effective networks. Market participants would be wise to continue to monitor these developments closely.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Here’s why Pi Coin price is in a bull run amid the crypto crash

Pi Coin price is in a technical bull run after soaring by 56% from its lowest level this year. It has soared to its highest level in over two weeks despite the ongoing crypto crash.

Summary

- Pi Coin price has moved into a technical or local bull market.

- The rally is happening despite the ongoing crypto crash.

- Technical analysis suggests that the token will continue soaring.

Pi Network (PI) token jumped to $0.2010 on Friday, continuing an uptrend that started on March 10. This rally is likely driven by potential announcements next week when the world will mark Pi Day.

Pi Day is an annual celebration of the mathematical constant and is celebrated on March 14. In most cases, the event is celebrated in schools by doing fun activities. Some people also celebrate it by eating pies.

Historically, Pi Network marks the day by making some major announcements. For example, in a recent post, the team noted that they hope that the current phase of the Pi Network upgrade will end on that day.

Some crypto traders hope that other major announcements will be made on Pi Day. For example, some are speculating that Kraken, a top American exchange, may decide to list it on that day. It added it to its listing roadmap for the year in February.

Another possible announcement on that day is the decentralized exchange, automated market maker, and token generation feature. The developers hope that this feature will lead to more demand for the token over time.

Pi Coin price is also rising as investors buy the dip after it dropped to a record low in February. It is common for investors to buy whenever an asset falls and to short it whenever it moves to a record high. A good example of this is Zcash (ZEC), which has moved into a bear market after hitting its all-time high last year.

Pi Coin price chart analysis

The eight-hour chart reveals that the Pi Coin price has staged a strong comeback after falling to $0.1300. This rally happened amid the crypto crash. It has moved above the ultimate resistance level of the Murrey Math Lines tool.

The token has jumped above the 50-period moving average. Crossing above this indicator is a sign that the bull market is continuing. Another sign that the momentum is continuing is that the Average Directional Index has soared to 32.

Therefore, the token will likely continue soaring in the coming days as buyers target the key resistance at $0.2500.

Crypto World

Price Predictions 3/6: BTC,ETH,BNB,XRP,SOL,DOGE,ADA,BCH,HYPE,XMR

Bitcoin (CRYPTO: BTC) faced a renewed test after a brief relief rally, sliding back below the $68,500 mark as sellers reasserted control. The move comes after the asset briefly flirted with the $74,000 threshold, a level that previously functioned as a ceiling during the latest ascent. Traders now eye whether the crypto bellwether can defend the $68,000–$70,000 zone to sustain any upside or if renewed selling pressure could push Bitcoin toward the lower end of its recent range. On-chain analytics add a cautious tone: CryptoQuant notes that its Bear Score Index remains firmly in bearish territory, suggesting the current bounce may be a relief rally rather than the onset of a sustained trend reversal.

Ether (CRYPTO: ETH) attempted to clear the $2,111 barrier but could not sustain the breakout, slipping back below the level and signaling that demand remains uncertain. The broader narrative across the top assets is one of mixed momentum, with several major altcoins retreating from overhead resistance as selling pressure persists. The market has also been grappling with a sense of caution, as traders weigh whether the recent rally was a temporary reprieve or the precursor to a longer-term bottom formation.

Bitcoin’s price action sits at a crossroads as the $69,000 region now acts as a critical fulcrum. A sustained bounce off the 20-day exponential moving average near $69,003 would keep hopes alive for another test of the higher ceiling around $74,508. If bulls manage to clear that resistance, the next target could be an ascent toward $84,000, a move that would bolster the view that a bottom may be forming after last year’s volatility. Conversely, a collapse below the $69,000 level could open the path to the support line, potentially pulling the pair down toward the $60,000 area and inviting renewed bearish sentiment.

Beyond Bitcoin, the price action across the broader top-10 cohort remains telling. Bitcoin Cash (CRYPTO: BCH) shows the bears pressing at the $443 support, with a rally back to $476 failing to gain traction. A breakdown below $443 would underscore a bearish continuation pattern, while a breakout above the 20-day EMA near $488 could ignite a move toward the 50-day simple moving average around $533 and, in turn, toward $600 if momentum sustains. Cardano (CRYPTO: ADA) has also flirted with the 20-day EMA near $0.27 but has not sustained gains above it, leaving the downside risk contained near $0.25 for now. A decisive rebound could push ADA back toward the channel’s upper boundary, but a close below $0.25 would open the door to a retest of the lower support around $0.15.

XRP (CRYPTO: XRP) traded above the 20-day EMA near $1.41 briefly but could not maintain the gain, and bears are working to push the price below the $1.27 support. If that support gives way, the下降 pattern could steer XRP toward the lower boundary of its current channel. On the flip side, a sustained move above the 20-day EMA could signal a reclaim by bulls and set up a test toward $1.61, a level that has repeatedly presented a challenge in recent sessions.

Solana (CRYPTO: SOL) experienced a rejection at $95, slipping below the 20-day EMA around $86. The market appears balanced, with the 20-day EMA and the relative strength index hovering near midpoints, suggesting a digestion period in which SOL could oscillate between roughly $76 and $95 for several days. A close above $95 would shift the balance toward a run to the $117 mark, while a drop below $76 could accelerate downside moves toward broader support levels.

Dogecoin (CRYPTO: DOGE) showed a brief uptick above the 20-day EMA near $0.10 but failed to clear the 50-day moving average at $0.11. The next decisive benchmark lies at the $0.12 breakdown level, where a sustained push could clear intermediate resistance and trigger a rally toward higher targets. A move below $0.09 would increase the likelihood of a retest of the February lows, with potential downside to $0.08 or lower if selling pressure intensifies.

Bitcoin-related altcoins aren’t alone in the tug-of-war. Hyperliquid (CRYPTO: HYPE) has pulled back toward major moving averages, a zone that will determine whether buyers regain control or sellers extend the range. If the price can rebound with vigor off the moving averages and clear the $36.77 overhead resistance, the onset of a fresh upmove could be on the cards. If the price breaks below the moving averages, HYPE could remain trapped in a $20.82–$36.77 corridor for a while longer.

Monero (CRYPTO: XMR) is contending with uphill resistance near the $360 threshold as buyers attempt to push higher. The crucial line in the sand remains the 20-day EMA around $347; a bounce from that level could lift XMR toward the 50-day SMA near $396 and, if momentum persists, toward the 61.8% Fibonacci retracement at $414. A drop below the EMA could keep XMR range-bound between roughly $384 and $302 for an extended period.

Among the most watched charts, Ethereum’s predecessor narratives persist, with traders keeping a close eye on whether the broader market can sustain any updrafts. The balance of evidence suggests a market that is more cautious than euphoric, with risk appetite still tethered to macro signals and liquidity conditions rather than a clear, durable uptrend. The next few sessions could prove pivotal in determining whether the bounce collects steam or dissolves into another leg lower.

What the movement means for the market

The current pattern highlights the fragility of any sustained rebound in the near term. While there are clear pockets of buoyancy in assets such as ETH and select layer-1s, the macro tone remains cautious, and traders are wary of fading rallies that fail to hold key support. The stubbornness of oversold levels around the 20-day EMAs across multiple coins suggests that a broad-based acceleration will require a decisive catalyst—be it a macro shift, favorable ETF-related flows, or a notable improvement in on-chain metrics that overturn the prevailing Bear Score tone.

From a risk-management perspective, the emphasis appears to be on defense at notable support zones. Traders are closely watching whether Bitcoin can anchor in the $68k–$70k corridor, as a break below this band would likely reintroduce selling pressure and push the market toward more pessimistic pricing. Conversely, any sustained move above critical resistance levels, especially for BTC near $74,508 and ETH near $2,328, could inject optimism and invite more aggressive positioning in the days ahead.

Why it matters

For investors, the present environment underscores the importance of discerning genuine trend reversals from bear-market rallies. The interplay between major assets and the resilience (or lack thereof) of their support and resistance levels provides insight into the health of liquidity in the sector. If the relief rally proves ephemeral, market participants may opt for selective exposure to assets showing relative strength in the face of headwinds, rather than broad, all-encompassing bets on a full-blown bull cycle.

Developers and builders in the space will be watching how market dynamics affect user onboarding, product launches, and ecosystem activity. A sustained dip could delay capital deployment in areas like DeFi and NFT-related applications, while a credible revival might spur renewed interest in network upgrades and cross-chain interoperability initiatives. Regulators and institutional participants are likewise assessing risk tolerance and liquidity considerations, which could influence future product offerings and filing activity, including potential ETF developments and institutional custody solutions.

As always, risk remains the defining theme. This cycle continues to emphasize capital preservation, careful risk assessment, and a disciplined approach to position sizing, especially in the absence of a clear macro-driven momentum shift. The trajectory over the next several weeks will help determine whether the market is contending with a deeper structural bottom or simply oscillating within a longer consolidation channel before the next phase of volatility.

What to watch next

- Bitcoin must hold the $68,000–$70,000 zone; a sustained close above $74,508 would be a tape-reading cue for possible upside toward $84,000.

- Ether needs to clear and sustain above $2,111, with a breakout above the 50-day SMA at $2,328 opening the door to around $2,600.

- A sustained move above $670 for BNB would recalibrate the short-term bias toward $718 and potentially $790, while a break below $570 could deepen near-term downside.

- XRP: a break above the 20-day EMA near $1.41 could set the stage for a rally toward $1.61; a drop below the $1.27 support would tilt sentiment bearish.

- SOL: a daily close above $95 would suggest a revival toward the $117 level, while a close below $76 could signal further consolidation or downside.

Sources & verification

- Bitcoin price action and key levels around $74,508 and the 20-day EMA near $69,003 as discussed in the market analysis.

- Ether’s struggle to sustain above $2,111 and next potential target after clearing the 50-day SMA around $2,328.

- BNB’s resistance near $670 and the implications of a move above or below the 20-day EMA at about $637.

- XRP’s price dynamics with the 20-day EMA near $1.41 and the critical $1.27 support level.

- Solana’s action around $95 and the balancing zone between $76 and $95, with a potential move to $117 on breakout.

- Dogecoin’s test of the 50-day SMA at $0.11 and the support zone around $0.09 to $0.08.

- Monero’s attempts to push above $360, with key levels at the 20-day EMA ($347), 50-day SMA ($396), and $414 as the 61.8% retracement target.

Tickers mentioned

Tickers mentioned: $BTC, $ETH, $BNB, $XRP, $SOL, $DOGE, $ADA, $BCH, $HYPE, $XMR

Sentiment

Sentiment: Neutral

Market context

Market context: The current price action unfolds in a cautious environment where liquidity and risk appetite are sensitive to macro signals, while on-chain metrics temper any optimism with a note of caution about potential further volatility.

Why it matters

The ongoing tension between support and resistance across major assets suggests that traders should distinguish between temporary bounces and durable trend reversals. A confirmed break of key levels could reframe the outlook for the next phase of the cycle, while persistent lack of follow-through may keep markets in a prolonged consolidation. For developers and investors alike, this environment emphasizes risk discipline, selective exposure, and attention to cross-asset correlations as the market digests incoming liquidity and regulatory signals.

What to watch next

- Bitcoin holds above the $68,000–$70,000 band; a weekly close above $74,508 would be a meaningful bullish signal.

- Ether sustains above $2,111 and closes above $2,328 to open a path toward $2,600.

- Bullish continuation for BNB requires a breakout above $670, with local targets around $718 and $790.

Sources & verification

Crypto World

Bitcoin price eyes reversal as IFP indicator flips bullish

Bitcoin price is showing early signs of a possible trend shift after a key on-chain indicator flashed a rare bullish signal, even as the market continues to consolidate.

Summary

- Bitcoin’s Inter-exchange Flow Pulse crossed above its 90-day moving average for the first time since early 2025.

- BTC is consolidating between $67K and $72K after a sharp drop from the $95K region.

- A breakout above $72K could open the path toward the $75K–$78K resistance zone.

Bitcoin (BTC) was changing hands at around $70,080 at the time of writing. That represents a 3.7% decline over the past 24 hours. Even so, the price remains close to the top of its weekly trading band, which currently spans from $63,176 to $73,669.

Short-term weakness hasn’t erased the gains seen over the past week. BTC is still up about 5.8% during that period. Over the last month, however, the trend is slightly negative, with the asset down around 8%. Compared with its October 2025 peak of $126,080, Bitcoin is still trading roughly 44% below its all-time high.

Market participation has also slowed. During the last 24 hours, trading volume dropped to $47.99 billion, a decline of more than 32%. Such pullbacks in activity are common during consolidation phases, when traders step back and wait for clearer direction.

The derivatives market tells a similar story. Data from CoinGlass shows trading volume in derivatives contracts falling by 23% to $72 billion. Open interest also slipped, declining 8% to $45 billion as some leveraged positions were closed.

IFP indicator signals renewed risk appetite

Amid this quieter market environment, fresh on-chain data is drawing attention. Analysts at CryptoQuant report that Bitcoin’s Inter-exchange Flow Pulse has moved above its 90-day moving average.

The shift marks the first time the metric has crossed that level in roughly a year, according to a March 6 report by CryptoQuant contributor RugaResearch.

To understand why this matters, it helps to look at what the indicator measures. The IFP tracks Bitcoin transfers between spot exchanges and derivatives platforms.

A rise in flows toward derivatives venues often signals that traders are preparing leveraged positions in anticipation of potential upside. When the movement heads toward spot exchanges instead, speculation in the market usually declines.

Looking back at historical data adds more context. Since 2016, similar IFP crossovers have frequently appeared near the early stages of bullish cycles. That said, the signal does not always translate into immediate price rallies. In some cases, the market took time to react.

The indicator had spent nearly a full year below its long-term average before this latest development. It turned bearish in early 2025 and remained there throughout much of the year, making it one of the longest negative stretches recorded for the metric.

Bitcoin price technical analysis

On the price chart, Bitcoin appears to be stabilizing after a steep fall earlier in the year. The drop began in the $95,000–$100,000 range and eventually pushed the price down to around $63,000, where buyers finally stepped in.

Since reaching that level, price movement has been largely sideways. This type of behavior often signals that selling pressure is easing while demand slowly returns.

For several weeks now, BTC has traded within a relatively tight corridor between $67,000 and $72,000. Markets often behave this way during accumulation phases, when participants quietly re-position before the next significant move.

The immediate hurdle sits at $72,000. If buyers manage to push the price above that level and secure a strong daily close, a breakout from the range could follow. In that case, attention would likely shift toward the $75,000–$78,000 region, where another supply zone is expected.

Below the current price, support continues to hold around $67,000. A deeper demand area can be found near $63,000, the same region that previously stopped the earlier sell-off.

That dip toward $63,000 may not have been accidental. In many markets, prices briefly fall below a key support level to trigger stop-loss orders before reversing direction.

This type of move is often referred to as a liquidity sweep. Bitcoin quickly rebounded after touching that area, reclaiming $67,000 soon afterward as buying pressure absorbed the sell-off.

Volatility has also been shrinking as the range tightens. Historically, quieter phases like this tend to precede stronger directional moves.

A breakout above $72,000 would likely strengthen bullish momentum and open the path toward higher resistance levels. On the other hand, losing support at $67,000 could weaken the recovery structure and bring the $63,000 demand zone back into focus.

Crypto World

Will Polkadot price rebound as 21Shares launches first DOT ETF?

Polkadot price retreated by 3% today, March 6, even as market participants waited for the first DOT ETF and tokenomics overhaul.

Summary

- 21Shares will launch the first spot DOT ETF today.

- The fund will be seeded with $11 million.

- History suggests that the fund may struggle to attract inflows.

Polkadot (DOT) token dropped to $1.4753, down substantially from this month’s high of $1.745. This retreat happened ahead of the launch of the 21Shares DOT ETF today.

Bloomberg’s Eric Balchunas noted that the fund has been seeded with $11 million in assets. This is a substantial amount considering that the three Dogecoin ETFs have accumulated $7.45 million in inflows and have $9.27 million in net assets.

In theory, the launch of the DOT ETF should boost its price as it will make it available to American retail and institutional investors. However, data shows that demand for altcoin ETFs is limited.

Spot Avalanche ETF has added just $8.98 million in inflows. It has had no inflow since February 24. Similarly, spot Hedera and Chainlink ETFs have had less than $100 million in inflows since their launch.

Polkadot’s situation is worse because of its smaller ecosystem than the other chains. For example, while Ethereum holds over $165 billion in stablecoins, Polkadot’s parachains hold less than $100 million.

DOT price will also react to the upcoming tokenomics overhaul on March 12. This overhaul will cap the supply to 2.1 billion and cut emissions by 53.6%. Staking unbonding days will drop from 28 days to between 24 and 48 hours.

Polkadot price prediction: technical analysis

DOT token has pulled back in the past few days, moving from this month’s low of $1.7445 to the current $1.4673. A closer look shows that it has retested the neckline of the double-bottom pattern that happened at $1.2260. A break and retest pattern is a common continuation sign.

The coin has also formed a bullish flag pattern. This pattern has a flagpole and a descending channel, resembling a hoisted flag. Therefore, the coin may attract bids in the next few days. If this happens, the next key target to watch will be at $1.7445. A break above that price will point to more gains, potentially to $2.

Crypto World

How Ethereum buys are powering the next wave of utility protocols

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Institutional accumulation of Ethereum signals rising confidence and renewed momentum for DeFi expansion.

Summary

- Institutional Ethereum inflows are boosting new DeFi protocols like Mutuum Finance, which has raised over $20.7m from 19k holders.

- Mutuum Finance builds non-custodial crypto lending on Ethereum, using mtTokens and debt tokens to manage liquidity and loans.

- Mutuum Finance expands DeFi lending with over-collateralized loans, letting users borrow against assets without selling them.

The top crypto market is currently witnessing a concentration of capital as institutional players increase their holdings of Ethereum (ETH). This trend of accumulation is providing a foundation of liquidity that often precedes a broader expansion in the decentralized finance (DeFi) sector.

As large-scale purchases signal growing confidence in the Ethereum network, the focus of the market is shifting toward utility-driven protocols that utilize this infrastructure to provide automated financial services.

Ethereum

Recent market data highlights a substantial increase in Ethereum accumulation. On March 2, the firm BitMine executed a significant acquisition of 50,928 ETH. This purchase brings the company’s total holdings to approximately 3.71% of the total Ethereum supply, moving them closer to their stated target of 5%.

Several analysts have noted that such large-scale movements often indicate potential growth for the asset regardless of short-term price fluctuations. Technical indicators like the Chaikin Money Flow (CMF) and Money Flow Index (MFI) currently suggest a high level of investor confidence and sustained buying pressure.

At present, Ethereum is trading within a range that has established a market capitalization of several hundred billion dollars. Following this recent accumulation, market observers are watching key resistance zones near the $3,800 and $4,000 levels. If the asset can maintain its support above $3,400, it may provide the necessary stability for the rest of the ecosystem to grow.

How massive Ethereum buys power utility protocols

Large Ethereum purchases do more than just influence the price of ETH; they act as a catalyst for the next wave of utility protocols. When institutional capital enters the Ethereum ecosystem, it validates the network’s security and longevity.

This confidence encourages developers and investors to explore new complex protocols like Mutuum Finance (MUTM), which is building a non-custodial framework for automated lending and borrowing. According to its official whitepaper, Mutuum Finance aims to create a decentralized environment where digital assets can be managed through code rather than human intermediaries.

The project has already achieved significant milestones, raising over $20.7 million in funding and establishing an investor base of 19,000 participants. The MUTM token is currently priced at $0.04. By building on the Ethereum network, protocols like Mutuum Finance benefit from the deep liquidity and security provided by the massive ETH accumulation currently taking place.

The Protocol’s mechanics

The economic model of Mutuum Finance relies on a transparent system of receipts and obligations. When a user deposits an asset like ETH into a liquidity pool, the protocol issues mtTokens (such as mtETH) as a yield-bearing digital receipt. These tokens represent the user’s share of the pool. As borrowers pay interest, the value of the mtToken increases. For example, if a pool has a 5% Annual Percentage Yield (APY), a user who deposits 20 ETH will find that their 20 mtETH is redeemable for 21 ETH after one year.

To manage the other side of the transaction, the protocol uses Debt Tokens. When a user borrows against their collateral, the system mints these tokens to track the principal and the accrued interest in real-time. The safety of these loans is managed by the Loan-to-Value (LTV) ratio. If the LTV for a specific asset is set at 75%, a user providing $4,000 in ETH as collateral can borrow a maximum of $3,000 in another asset, like a stablecoin. This ensures that every loan remains over-collateralized, protecting the protocol from potential bad debt.

Furthermore, this mechanism benefits the borrower by allowing them to access liquidity without having to sell their original assets. By borrowing against their ETH instead of selling it, the user can obtain liquidity for immediate use while still maintaining their investment position. If the value of the ETH increases during the loan period, the borrower still gains from that price growth.

The V1 protocol and risk-free testing

The Mutuum Finance V1 protocol is currently the primary environment for testing these features. It focuses on high-liquidity assets including USDT, ETH, WBTC, and LINK. By using the V1 testnet, users can interact with the system’s automated smart contracts. This provides a risk-free environment to understand how mtTokens grow in value, how Debt Tokens track interest, and how LTV ratios function under different market conditions.