Crypto World

Aave DAO Loses Its Core Technical Contributor

BGD Labs, a core technical contributor to the DeFi protocol Aave, announced it will conclude its involvement with the project’s DAO on April 1, ending a four-year collaboration that helped shape the protocol’s core subsystems. In a post on Aave’s governance forum, BGD cited an “asymmetric organizational scenario” and argued the DAO had not adequately accounted for contributors’ expertise. The team said the project had adopted an adversarial posture toward v3 in favor of features planned for v4, a shift it said impeded meaningful improvements. Nothing changes until April 1, but BGD signaled it will wind down its formal contributions while remaining engaged in certain areas through a defined transition. The forum note points to ongoing work on multiple fronts, even as the formal collaboration winds down.

Key takeaways

- BGD Labs will end its involvement with the Aave DAO on April 1 after four years of work.

- The departure is framed around an asymmetric organizational setup and perceived governance misalignment with technical contributors, particularly in the v3-versus-v4 prioritization debate.

- Until the wind-down date, BGD will continue work on v3, Umbrella, chain expansions, security, and asset onboarding, with no immediate off-boarding path but a transition-focused plan.

- A two-month, $200,000 security retainer has been proposed to support continuity beyond April as the community seeks a replacement for critical contributions.

- Reactions within the user base were mixed-to-positive toward BGD, tempered by concerns about the loss of a significant DeFi builder; Stani Kulechov publicly praised BGD’s contributions.

Sentiment: Neutral

Market context: The development underscores ongoing governance and talent-retention dynamics within DeFi DAOs, where centralized expertise must coexist with decentralized decision-making, and where transition plans can influence security and upgrade trajectories.

Why it matters

The departure of a long-standing technical contributor from a high-profile protocol like Aave highlights how DeFi projects balance governance with engineering depth. BGD Labs’ four-year involvement positioned it at the center of critical subsystems, meaning its exit could ripple through areas spanning core protocol stability, security reviews, and on-boarding of assets. When a DAO relies on a limited set of builders for foundational components, even routine changes can take on outsized importance. In this case, the forum discussion that accompanied the announcement suggests a broader tension between centralized expertise and DAO-driven governance, a stakes-laden issue for communities that prize decentralization but depend on specialized knowledge to maintain robust, scalable systems.

The situation also spotlights the challenge of aligning long-term technical progress with a governance model that is, by design, open to diverse stakeholders. BGD’s public characterization of an “asymmetric organizational scenario” reflects concerns that the DAO’s governance structure may not always create the conditions necessary for sustained improvement, particularly when competing priorities between v3 stabilization and v4 feature development emerge. Such tensions are not unique to Aave; they echo broader discussions across the ecosystem about how to evolve upgrades and enhancements without fracturing consensus or stalling critical work.

From a practical standpoint, the two-month security-retainer proposal signals a pragmatic approach to continuity, allowing time for a replacement to come online while limiting risk exposure. In a space where security, asset onboarding, and cross-chain capabilities are high-stakes, transitional mechanisms like retainers can help calm the nerves of users and developers who rely on steady maintenance. The move may also influence how other DAOs outline transition plans when a core contributor departs, potentially becoming a template for similar exits in the future.

For the broader market, the episode reinforces that DeFi projects remain highly collaborative efforts where governance decisions, technical leadership, and risk management intersect. Talent mobility — from one protocol to another or toward new ventures — is a reality of the space. The emphasis on sustaining critical subsystems while seeking a replacement provider reflects an industry-wide trend toward clearer transitional governance and more explicit continuity strategies as ecosystems scale and mature.

In the immediate term, the community’s reaction—largely positive toward BGD’s contributions while raising concerns about the loss of foundational expertise—highlights a nuanced sentiment: appreciation for past work alongside vigilance regarding ongoing development and security assurances. The public response from Aave’s founder suggests confidence in the ecosystem’s resilience, even as the project navigates a meaningful personnel shift.

“I respect BGD’s decision, though I am sad to see them go. The DeFi ecosystem is better for having a team like BGD in it and I hope they continue to build and make contributions to the industry.”

What to watch next

- April 1 milestone as BGD’s formal wind-down begins and responsibilities are reallocated or retired.

- Whether Aave’s DAO moves to nominate or contract a replacement for BGD’s technical leadership on v3, Umbrella, and related areas.

- Groundwork or approval for the proposed two-month, $200,000 security retainer or alternative continuity arrangements.

- Any governance updates or votes touching on the prioritization of v3 stabilization versus v4 feature development and how contributors are engaged in those decisions.

Sources & verification

BGD Labs exits Aave DAO after four years of technical leadership

BGD Labs, a core technical contributor to the DeFi protocol Aave, announced it will conclude its involvement with the DAO on April 1, ending a four-year collaboration that helped shape the protocol’s core subsystems. In a post on Aave’s governance forum, BGD cited an “asymmetric organizational scenario” and argued the DAO had not adequately accounted for contributors’ expertise. The team said the project had adopted an adversarial posture toward v3 in favor of features planned for v4, a shift it said impeded meaningful improvements. Nothing changes until April 1, but BGD signaled it will wind down its formal contributions while remaining engaged in certain areas through a defined transition. The forum note points to ongoing work on multiple fronts, even as the formal collaboration winds down.

The decision reflects BGD’s long-running role as a builder for the Aave ecosystem, involving substantial hands-on work across technical subsystems and security-related tasks. The forum post emphasizes that BGD’s work extended beyond a narrow scope, with the team frequently leading or collaborating on critical components that the community recognizes as part of Aave’s technical backbone. While the departure focuses on governance dynamics and organizational structure, the practical implications are real: what happens to ongoing maintenance, security audits, and cross-chain initiatives when a primary contributor steps back?

As part of the wind-down plan, BGD noted that “nothing changes” immediately after the announcement and that the group will continue supporting v3, Umbrella, chain expansions, security, and assets onboarding up to and beyond the April deadline. The firm argued that the current environment—where improvements to v3 are expected to be constrained by governance dynamics—undermined its ability to push forward effectively. It also proposed a two-month, $200,000 security retainer intended to bridge the gap while Aave searches for a suitable replacement and while the community weighs longer-term continuity options.

From a governance perspective, the episode illustrates a broader conversation about how DAOs sustain momentum when essential contributors depart. The Aave community’s response—varying from appreciation for BGD’s contributions to concern about the impact on ongoing development—mirrors a wider tension across the DeFi landscape: decentralization versus the practical need for specialized, ongoing expertise. Stani Kulechov’s public reply to the forum thread underscores the ecosystem’s resilience and willingness to recognize value created by core teams, even as leadership transitions take place.

In the weeks ahead, observers will be watching for concrete steps toward replacing BGD’s functions, the fate of the proposed security retainer, and any governance actions that influence the prioritization of v3’s stabilization versus v4’s feature set. The move also serves as an implicit reminder that even established contributors can re-evaluate alignment with a DAO’s evolving objectives, and that a thoughtful transition plan may prove essential to maintaining user trust and system reliability in a rapidly evolving DeFi environment.

Crypto World

Lightspark Teams Up with Cross River Bank for Fiat Payments via Bitcoin

The partnership pairs Bitcoin settlement with FedNow plumbing.

Lightspark, a Bitcoin Lightning Network startup founded by former Meta executive David Marcus, who oversaw the development of Meta’s Libra token, is pushing the idea of using BTC for everyday payments rather than long-term holding.

In a Wednesday announcement, Feb. 18, Lightspark said it had teamed up with Cross River Bank, a crypto-friendly, FDIC-insured bank, to support 24/7 settlement of Bitcoin network transactions through the U.S. banking system.

Cross River has become a key banking partner for crypto firms in the U.S., providing banking services to companies such as Circle, Coinbase and others, particularly across cards and stablecoin-linked programs.

Under the arrangement, Lightspark processes transactions on the Lightning Network, while Cross River settles the fiat legs via faster payment systems such as FedNow. The announcement says the collaboration targets B2B, cross-border and retail flows where immediate settlement materially changes cash management.

Usage Outpaces TVL

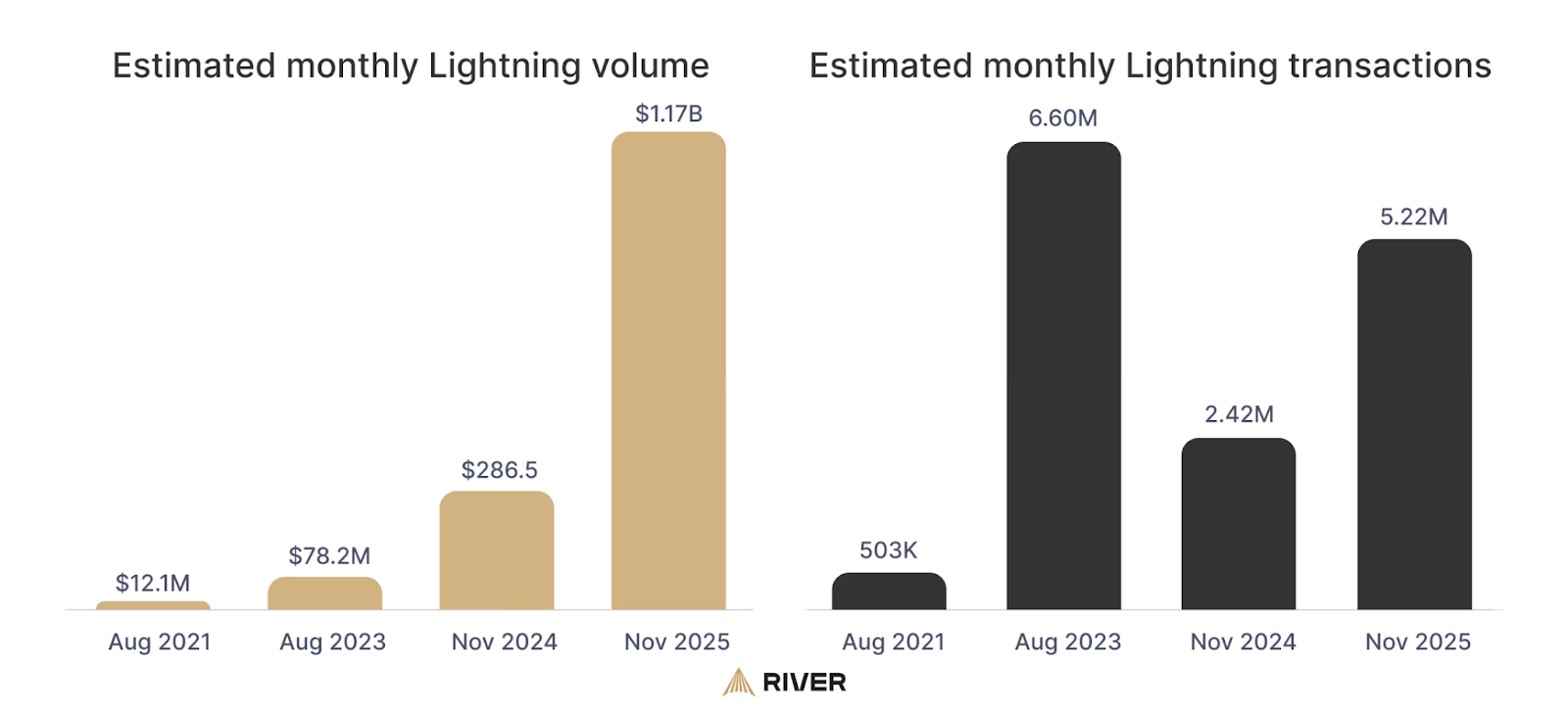

Lightning Network has had a strong but uneven run so far. Total network capacity climbed to new highs in late 2025 before easing slightly in mid-February of this year, while data from DefiLlama shows that total value locked stands near $338 million, a figure likely influenced by Bitcoin’s recent price pullback.

Despite the relatively low TVL compared to Ethereum Layer 2s, data cited by Sam Wouters, director of marketing at Bitcoin infrastructure firm River, shows the network processed an estimated $1.17 billion in volume in November 2025 alone across more than 5.2 million transactions, with the average Lightning transfer being around $223.

Still, Wouters noted that today the “most common use case for Lightning transactions is sending funds from and to exchanges,” highlighting how far the network still has to go as a retail payments rail.

At the same time, data from Mempoolspace shows growing infrastructure concentration, with more than 40% of Lightning nodes hosted on just two providers, Amazon and Google Cloud, with Amazon alone accounting for over a quarter of the network’s node power.

Crypto World

Why is Bitcoin difficulty surging at its fastest pace since 2021?

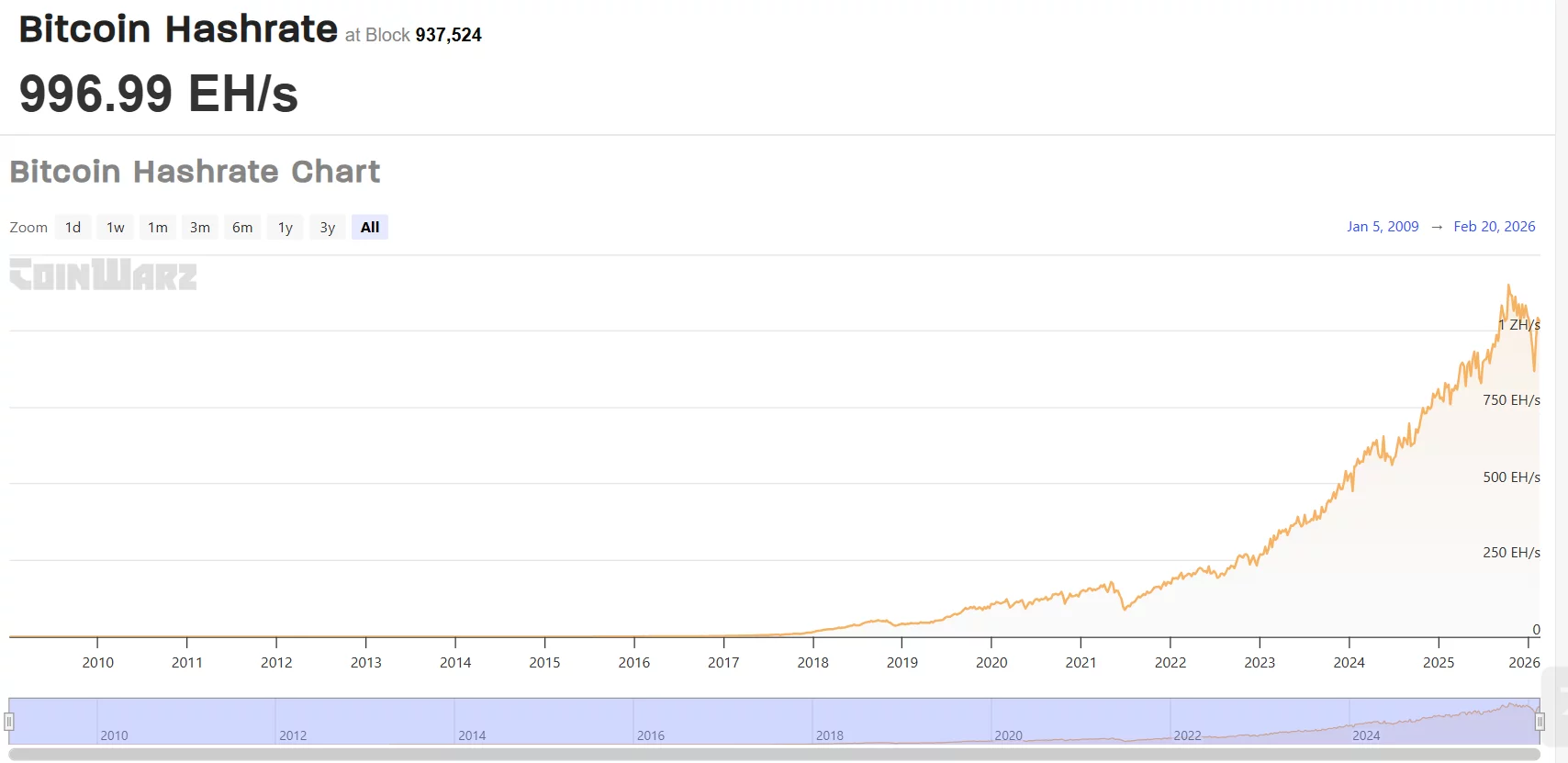

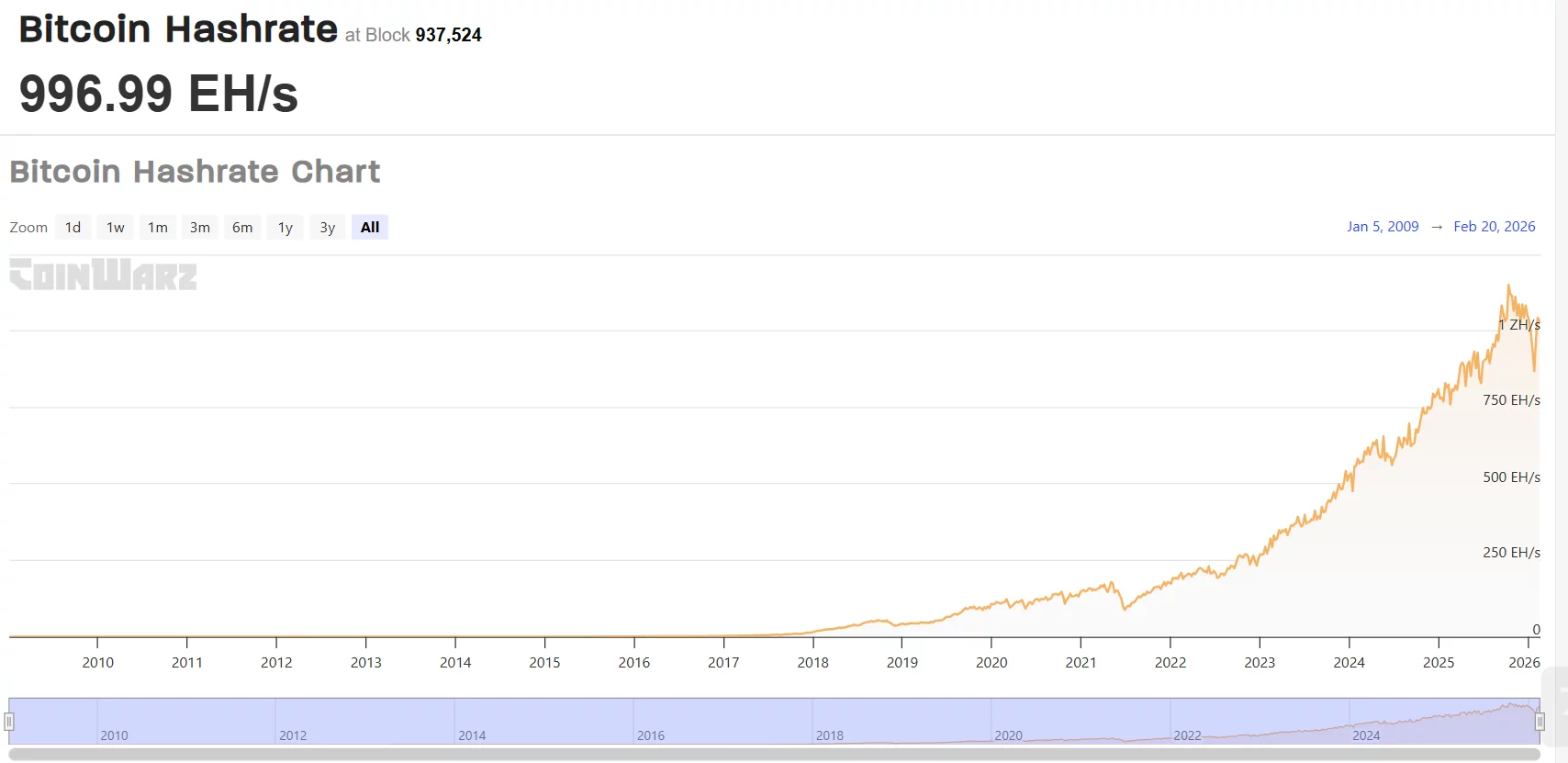

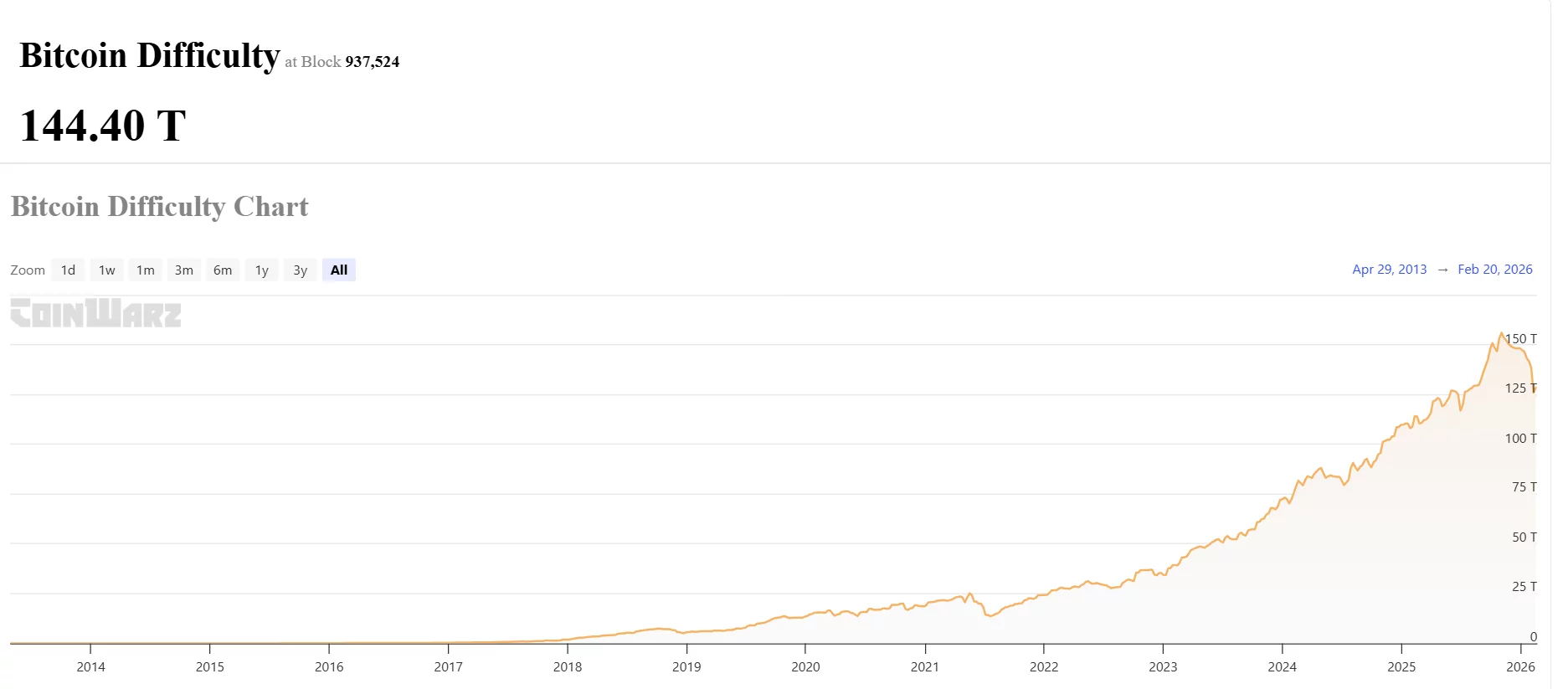

Bitcoin’s mining difficulty has climbed to 144.40 trillion (T) at block 937,524, marking one of the sharpest accelerations in network competition since the 2021 bull cycle.

Summary

- Bitcoin’s mining difficulty has climbed to 144.40 trillion at block 937,524, marking one of the fastest accelerations in network competition since the 2021 bull market.

- Total hashrate has jumped to 996.99 EH/s, just shy of the 1 zettahash per second (ZH/s) threshold, reflecting a sharp expansion in mining power through 2024 and 2025.

- While rising hashrate and difficulty strengthen network security and signal miner confidence, rapid growth could squeeze margins for smaller operators if Bitcoin’s price fails to keep pace.

At the same time, Bitcoin’s (BTC) total hashrate has surged to 996.99 EH/s, hovering just below the symbolic 1 zettahash per second (ZH/s) milestone.

For context, Bitcoin difficulty is an adjustment mechanism that ensures blocks are mined roughly every 10 minutes. When more computing power joins the network and hashrate rises, the protocol automatically increases difficulty to maintain that steady issuance schedule.

Bitcoin hashrate refers to the total computing power being used by miners to process transactions and secure the network. A higher hashrate means more machines are competing to validate blocks, making the network stronger and more resistant to attacks.

The two metrics are tightly linked, and together they help explain why the network is seeing its fastest pace of growth in years.

Bitcoin hashrate near 1 ZH/s

The hashrate chart shows a steep climb through 2024 and 2025, with computational power accelerating sharply in recent months. After dipping during prior market downturns, the network has staged a powerful recovery, pushing toward 1,000 EH/s or nearly 1 ZH/s a historic threshold for Bitcoin.

When hashrate rises rapidly, it signals that miners are deploying more machines and bringing new facilities online. This expansion is typically driven by improved profitability, access to capital, and infrastructure scaling.

The current pace mirrors the aggressive buildout last seen during the 2021 rally.

Bitcoin difficulty follows higher

Bitcoin’s difficulty adjusts roughly every two weeks to ensure blocks are mined every 10 minutes. As hashrate rises, the protocol increases difficulty to maintain balance.

The difficulty chart reflects that dynamic. After a brief pullback from a recent peak near the 150T level, difficulty remains elevated at 144.40T, a level that represents a dramatic increase from just a few years ago. The slope of the curve over the past year is among the steepest on record.

This sharp upward trend signals intense competition among miners, with more computational power chasing a fixed block reward.

Historically, sustained increases in hashrate and difficulty are seen as long-term bullish indicators. They reflect miner confidence and make the network more secure and resilient.

However, rapid difficulty growth can compress margins, particularly for smaller or higher-cost operators. If Bitcoin’s price does not keep pace with rising competition, weaker miners may face pressure, potentially leading to consolidation.

Crypto World

Leading AI Claude Predicts the Price of XRP, Solana and Dogecoin By the End of 2026

Feeding a well-crafted prompt into Claude reveals surprising 2026 forecasts for XRP, Solana and Dogecoin.

According to Claude’s projections, all three assets could rise at least 5x by Christmas.

Here’s a breakdown of why Claude is bullish on them.

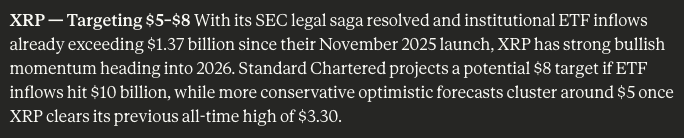

XRP ($XRP): Claude Charts a Long-Term Path Toward $8

In a recent update, Ripple reaffirmed that XRP ($XRP) sits at the center of its strategy to position the XRP Ledger as a global, enterprise-grade payments network.

Thanks to rapid transaction settlement and extremely low fees, XRPL is likely to corner two of crypto’s fastest-growing sectors: stablecoins and tokenized real-world assets.

With XRP currently trading around $1.39, Claude’s long-range model suggests the token could rally to $8 by the end of 2026, representing a near sixfold increase from today’s levels.

Technical indicators support this scenario. XRP’s Relative Strength Index (RSI) is relatively low at 38, while the price sits well below its 30-day moving average, signalling an attractive entry point.

Several catalysts could accelerate this move, including institutional inflows following the approval of U.S.-listed XRP ETFs, Ripple’s expanding list of partnerships, and the potential passage of the U.S. CLARITY bill this year.

Solana (SOL): Claude Forecasts a Push Toward $450

Solana ($SOL) currently hosts around $6.6 billion in total value locked (TVL) and has a market capitalization of nearly $48 billion.

Institutional interest has also intensified following the launch of Solana-linked exchange-traded funds from asset managers such as Bitwise and Grayscale.

Despite these tailwinds, SOL endured a lengthy correction in late 2025 and spent much of February trading below the $100 mark.

Under Claude’s most optimistic projection, Solana could climb from its current price near $82 to around $450 by Christmas. That move would deliver more than 5x upside while exceeding Solana’s previous ATH of $293, set in January 2025.

Additionally, major asset managers, including Franklin Templeton and BlackRock, are issuing tokenized real-world assets on the network, strengthening Solana’s position as a scalable platform for institutional finance.

Dogecoin (DOGE): Can the Original Meme Coin Break the $1 Barrier?

Launched as a parody in 2013, Dogecoin ($DOGE) has evolved into a major crypto asset with a market capitalization of roughly $17 billion, representing more than half of the $36 billion meme coin market.

DOGE last reached an ATH of $0.7316 during the retail-fueled bull run of 2021.

The Doge community has long targeted $1, and Claude’s outlook suggests a strong bull market could push Dogecoin past ATH to come close.

From its current price, a fraction under $0.10, a move to $0.90 and beyond would be an easy 9x.

Real-world adoption continues to expand.

Tesla accepts DOGE for selected merchandise, and major fintech platforms such as PayPal and Revolut now support Dogecoin transactions, reinforcing its use beyond speculation.

Maxi Doge: As Major Coins Eye New Highs, a New Meme Challenger Steps Forward

While XRP, DOGE, and SOL have 5x to 9x potential, the real moonshots can be found in meme coin presales.

Maxi Doge ($MAXI) is one of the most talked-about new meme coins of 2026, raising $4.6 million so far in its ongoing funding round.

The project revolves around Maxi Doge, a loud, gym-obsessed, unapologetically degen alpha doge, and a distant cousin and self-declared rival to Dogecoin.

The concept taps directly into the irreverent energy that powered the 2021 meme coin explosion.

MAXI is an ERC-20 token built on Ethereum’s proof-of-stake network, giving it a significantly lower environmental footprint compared to Dogecoin’s proof-of-work design.

Early presale participants can currently stake MAXI tokens for yields of up to 68% APY, with staking rewards reducing as the pool grows.

The token is priced at $0.0002805 in the current presale phase, with automatic price increases triggered at each funding milestone. Purchases are supported by any wallet, such as MetaMask and Best Wallet.

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Website Here.

The post Leading AI Claude Predicts the Price of XRP, Solana and Dogecoin By the End of 2026 appeared first on Cryptonews.

Crypto World

Is PUNCH the next viral Solana meme coin after 80,000% surge

PUNCH spikes ~22,290% in a week as analysts flag concentrated supply and rug‑pull risk.

Summary

- PUNCH has ripped more than 80,000% since launch, jumping 22,290.8% over the last week, with market cap briefly topping $30m and a 260% daily move as CoinGecko’s top gainer and top‑3 trending asset.

- On‑chain data shows one wallet buying about $226k of PUNCH, while Nansen reports public‑figure holdings up 89.69% in seven days as smart‑money and whale balances fall.

- Analysts allege the creator distributed ~100b PUNCH (10% of supply) shortly after launch, with three linked wallets controlling 7.75% and critics warning the structure looks like a tightly managed memecoin primed for a potential rug.

A new Solana meme coin called PUNCH has ripped more than 80,000% since launching earlier this month, morphing a viral baby macaque story into one of the most explosive on‑chain trades of 2026 — and a growing source of unease among seasoned market watchers.

PUNCH, inspired by a baby Japanese macaque named Punch and his plush “surrogate mother,” bills itself as a community token “built around emotion, comfort, and companionship,” with a fixed supply of 1 billion tokens, 0% tax, liquidity “locked and burned,” and ownership “renounced,” according to its website. One analyst even framed it as “gearing up to be the MOODENG of 2026,” capturing the speculative mood gripping Solana’s meme‑coin complex.

PUNCH goes parabolic

The numbers are brutal. Over the past week alone, PUNCH has jumped 22,290.8%, with its market cap briefly pushing above $30 million during early Asian hours and the token registering as CoinGecko’s top daily gainer with a 260% move, while also ranking among the site’s top three trending assets.

On‑chain data cited by analysts shows one wallet accumulating roughly $226,000 worth of PUNCH, while Nansen flagged that public‑figure holdings in the token spiked 89.69% over the last seven days even as so‑called smart‑money and whale balances fell.

Behind the frenzy, however, critics are mapping out what they describe as a tightly controlled supply structure. Crypto analyst StarPlatinum alleged that the creator wallet “distributed approximately 100 billion PUNCH tokens, equivalent to 10% of the total supply, soon after the token went live,” routing 48.2 billion tokens to an intermediary wallet that then seeded several of the largest holders. Three linked wallets reportedly control a combined 7.75% of supply, all traceable to that initial distribution. “This is how controlled memecoins are structured. Stay careful,” StarPlatinum warned.

Another commentator, the White Whale, pointed to “too perfect” bubble maps and liquidity that “simply cannot look like this due to how distribution takes place on the idiotic constant product pools,” arguing that “no coin gets that much support organically with liquidity just sitting around on the books in case of a dip” and cautioning, “We never know when the cabal is going to pull the rug.”

Broader crypto market

The parabolic move comes as digital assets continue to trade as the purest expression of macro risk appetite. Bitcoin (BTC) is hovering around $67,739, with a 24‑hour range between roughly $67,070 and $67,739. Ethereum (ETH) changes hands near $1,939, down about 1.5% over the last day on more than $17.2B in volume. Solana (SOL) trades around $83.77, up roughly 1.7% in 24 hours.

For traders piling into PUNCH, the lesson is old: meme‑coin manias can look orderly and unstoppable right up until the exit disappears.

Crypto World

Tokenized Real Estate Projects Surge in Dubai and Maldives

Dubai is moving ahead with a staged rollout of tokenized real estate, expanding a pilot program that couples regulated on-chain transfers with a real-world asset class. In parallel, the Maldives is drawing attention with a Trump-branded resort project that’s being explored for tokenization, signaling a broader push to finance large-scale developments through security tokens and distributed-ledger technology. The Dubai Land Department (DLD) said on Friday it would launch the second phase of its real estate tokenization pilot, following a prior milestone that tokenized roughly $5 million of property and produced about 7.8 million tradable tokens. The move underscores a growing belief among regulators and industry participants that tokenized real estate can unlock liquidity and widen investor access in markets where property is often illiquid and access is constrained. The effort uses a governance and settlement framework built by Ctrl Alt, a Dubai-licensed Virtual Asset Service Provider, to issue Asset-Referenced Virtual Asset management tokens intended for secondary-market trading. The on-chain transactions underpinning these tokens are recorded on the XRP Ledger (CRYPTO: XRP) and secured by Ripple Custody, illustrating a cross-border, regulated infrastructure that pairs real assets with blockchain settlement.

The plan, while ambitious, is grounded in concrete numbers. In its May 2025 forecast, Ctrl Alt and the DLD estimated that tokenization could contribute as much as $16 billion to Dubai’s real estate ecosystem by 2033—a figure equating to roughly 7% of the emirate’s overall property transactions over that period. Industry observers have noted that Dubai’s combination of a robust real estate market and a comparatively crypto-friendly regulatory environment helps explain why the emirate has emerged as a leading hub for tokenized assets. A veteran player in the Middle East crypto scene, Rep. Ripple’s footprint in the region has been discussed in multiple industry circles, including coverage linking Ripple’s leadership with regulatory engagement at the White House level.

The tokenization stack for the pilot hinges on Asset-Referenced Virtual Asset management tokens, a structure that allows the transfer of tokenized real estate units on secondary markets once the underlying property rights are tokenized and registered. Ctrl Alt, which operates with a Dubai license as a Virtual Asset Service Provider, is responsible for issuing these activity-backed tokens and enabling their circulation. All on-chain activity tied to these assets is recorded on the XRP Ledger (CRYPTO: XRP) and safeguarded by Ripple Custody, a custody solution designed for regulated digital assets. The architecture aims to pair familiar property investment mechanics with the transparency and settlement efficiency of blockchain rails, potentially broadening the pool of investors who can participate in high-value projects that historically required significant upfront capital.

While the DLD’s initiative is focused on Dubai’s boundaries, its implications resonate across the region. The project’s backers argue that tokenized real estate can unlock fractional ownership, streamline property sales, and enable more efficient price discovery in markets that have long relied on traditional, paper-based processes. In addition to the Dubai pilot, a related development is unfolding in the Maldives, where DarGlobal and World Liberty Financial—backed by interests connected to U.S. political circles—are pursuing a tokenization strategy for a Trump-branded resort development. The collaboration with Securitize aims to tokenize the development’s phased rollout, signaling a growing appetite among developers and fintech groups to use tokenized securities as a capital-raising tool for premium hospitality projects. A video presentation accompanying the Maldives project has circulated, with a public event at Trump’s Mar-a-Lago estate drawing notable attendees from both traditional finance and the crypto sector, including figures such as Goldman Sachs’ leadership and Coinbase’s chief executive, among others.

On a practical level, the Dubai project’s use of on-chain settlement backed by a regulated custodian reflects a broader industry trend: blending tokenized liquidity with real-world asset verification and custody to address risk and regulatory compliance. The CBD-led focus on asset-backed tokens aligns with ongoing discussions among policymakers about the role of digital assets in mainstream finance, particularly in real assets that can provide enduring value and tangible diversification for investors. The Dubai project’s framing as a pilot with a finite number of tokens and traceable on-chain activity helps test the viability of tokenized real estate as a legitimate financing mechanism rather than a speculative vehicle.

In parallel, the Maldives tokenization effort is framed as a tangible path for hospitality real estate to access a broader investor base. Ziad El Chaar, the CEO of DarGlobal, told Cointelegraph that tokenization could “take over the way other projects are being funded” by broadening participation beyond traditional high-net-worth circles. He emphasized that tokenization can democratize access to real estate investments by lowering the entry barrier for many potential investors who previously faced geographic, regulatory, or accreditation hurdles. World Liberty’s leadership championed the approach at a crypto-focused event hosted at Mar-a-Lago, highlighting the potential for tokenized offerings to accelerate capital formation for large-scale developments and to introduce new sources of liquidity to projects that were historically constrained by the capital markets’ tempo and risk profile. The event itself drew attention from a cross-section of participants, including leaders from traditional finance and the crypto industry, signaling that the lines between these realms continue to blur as digital asset structures mature.

As with any tokenization initiative, critical questions remain about regulatory alignment, investor protections, and the pace at which markets will absorb these instruments. The DLD’s May 2025 projection provides a target trajectory, but actual outcomes will depend on several factors, including the evolution of custody arrangements, the effectiveness of on-chain governance mechanisms, and the ability of the tokens to achieve reliable liquidity in secondary markets. Still, proponents argue that the Dubai model—grounded in a regulator-approved framework, a licensed tech partner, and a trusted custody solution—could serve as a blueprint for other jurisdictions seeking to harness tokenized assets to unlock liquidity in real estate while preserving investor protections. The Maldives project, if realized, would offer a high-profile test case for cross-border, hospitality-focused tokenization, potentially inspiring similar efforts in other tourism-heavy markets that require substantial capital for large-scale development projects.

For those tracking the intersection of crypto innovation and traditional property markets, these developments illustrate how nations with sophisticated real estate ecosystems are exploring how to use tokenization as a bridge to greater liquidity and broader investor access. While the path to broad adoption remains uneven and requires careful calibration of regulatory, custody, and market-making capabilities, the Dubai and Maldives initiatives underscore a wider move toward tokenized, asset-backed finance that could reshape how capital flows into real estate over the coming years.

Video and public discussions associated with the Maldives project are accessible via the accompanying materials, including a discussion that explored the role of tokenization in altering how projects are funded and who can participate in investment opportunities. A clip linked to the event and to related regulatory debates can be found here: Video discussion. The broader narrative around this trend includes references to policy dialogues and public-private collaborations that continue to shape how tokenized assets are perceived and regulated in different markets.

Related materials and commentary, including coverage of Ripple’s regulatory engagements and the evolving regulatory landscape for crypto-linked real estate, are referenced in the linked sources. For readers seeking to verify specifics, the primary documents and statements come from the Dubai Land Department’s press resources and Ctrl Alt’s official communications, as well as the associated press coverage of the Maldives project and the stakeholder discussions that accompanied the Mar-a-Lago event. The public-facing summaries of these initiatives highlight the ongoing collaboration between technology providers, property developers, and financial institutions as they experiment with tokenized real estate under regulated frameworks.

https://platform.twitter.com/widgets.js

Why it matters

The Dubai and Maldives tokenization initiatives capture a moment when regulated digital assets and real assets begin to converge in practical, high-value applications. Tokenized real estate has the potential to lower barriers to entry for investors, improve liquidity for often illiquid property markets, and stimulate faster price discovery through transparent on-chain activity. If the Dubai pilot scales toward the projected $16 billion by 2033, it could influence how developers structure funding for large projects and how regulators balance investor protection with the need to foster innovation. The Maldives project, connected to a high-profile hospitality development, underscores how tokenization could redefine project finance for premium destinations that require substantial upfront capital. Taken together, these efforts reflect a broader shift in capital markets where asset-backed digital tokens are increasingly viewed as tools for efficient liquidity, cross-border investment, and regulatory-compliant innovation.

At the same time, the path forward will require careful attention to custody, governance, and auditability. The use of the XRP Ledger with a regulated custody framework provides a credible model for secure settlement, while the involvement of a licensed VASP signals a regulatory track record that investors increasingly expect when dealing with tokenized real assets. The cross-border nature of these projects—spanning Dubai and the Maldives—also highlights the importance of harmonizing standards and ensuring that digital asset transactions remain compliant with local laws and international best practices. As institutions observe the outcomes of these pilots, the market will gain clarity on how tokenized real estate can coexist with traditional property markets, potentially unlocking a new spectrum of investment opportunities for both regional players and global capital pools.

What to watch next

- Milestones for Phase Two: timeline and go-live details from the Dubai Land Department.

- Secondary-market activity: liquidity, pricing, and investor participation metrics for tokenized assets in Dubai.

- Maldives project progress: partner confirmations with Securitize, issuance milestones, and regulatory updates.

- Regulatory updates: developments in asset-backed tokens, custody standards, and cross-border tokenization guidelines.

- Institutional interest: reactions from large financial players and potential participation in related tokenized offerings.

Sources & verification

- Ctrl Alt and Dubai Land Department press release announcing the Phase Two tokenization pilot and the $16 billion by 2033 forecast (https://www.ctrl-alt.co/press-releases/ctrl-alt-dld-phase-two).

- PR Newswire: Ctrl Alt and Dubai Land Department go live with tokenized real estate, forecasting $16B by 2033 (https://www.prnewswire.com/news-releases/ctrl-alt-and-dubai-land-department-go-live-with-tokenized-real-estate-forecasts-16b-market-by-2033-302464840.html).

- Reece Merrick, Ripple’s managing director for the Middle East and Africa, with a cited post referenced in coverage (https://x.com/reece_merrick/status/2024761451060351272).

- Cointelegraph coverage on the Maldives Trump-branded resort tokenization through DarGlobal and World Liberty Financial (https://cointelegraph.com/news/crypto-tradfi-execs-mingle-trump-crypto-event).

- Related coverage on Ripple’s regulatory interactions and White House meetings (https://cointelegraph.com/news/ripple-ceo-white-house-meeting-crypto-banking-clarity).

Tokenized real estate moves accelerate in Dubai and Maldives

Dubai’s ambitious plan to tokenize real estate is designed to test whether regulated, asset-backed tokens can deliver faster settlement, greater liquidity, and wider access to property investments without compromising investor protections. By recording transactions on the XRP Ledger (CRYPTO: XRP) and securing them with Ripple Custody, the pilot attempts to bridge the traditional real estate sector with the demands of modern digital asset markets. Ctrl Alt’s role as a licensed VASP stands at the center of this architecture, providing the issuance framework, governance oversight, and technical infrastructure required to support asset-backed token transfers that can move quickly on secondary markets. The stated objective is not merely to tokenize a property tranche but to establish a repeatable model that could be scaled across additional properties and markets, provided the pilots demonstrate robustness and regulatory alignment.

Meanwhile, the Maldives initiative showcases the willingness of developers to leverage tokenization for increasingly premium projects. The collaboration between DarGlobal, World Liberty Financial, and Securitize points to a future where hospitality ventures may seek multiple financing channels, combining traditional equity with digital securities that enable global participation. The public announcements and the presence of high-profile attendees at a Mar-a-Lago event signal that the tokenization story has moved from niche experiments to discussions with mainstream financiers and policymakers. If these pilots succeed, they could influence how other jurisdictions structure real estate finance, offering a model where property rights are tokenized, traded, and settled with the efficiency of blockchain rails while preserving the governance and due-diligence standards expected by regulated markets.

The trajectory hinges on several key levers: the ability to maintain secure custody and compliant on-chain settlement; the clarity of regulatory expectations for asset-backed tokens; and the market’s appetite for fractionalized real estate exposure in a risk-managed format. The Dubai pilot already demonstrates a potential pathway for real estate tokenization that emphasizes transparency, custody, and on-chain traceability, which could help build trust among institutional investors who demand rigorous risk controls. As the landscape evolves, the industry will watch how these pilots influence the broader ecosystem of tokenized assets, including potential spillovers into related sectors such as infrastructure financing, urban development projects, and cross-border investment strategies. For investors and builders alike, the Dubai and Maldives efforts offer a glimpse into a future where real estate can be financed and traded with the tools and efficiencies of digital asset markets, while anchored in the solidity of regulated frameworks and custody assurances.

Crypto World

The AI content flood is here, and tools like ZeroGPT are fighting to bring back academic integrity

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

As AI-generated content overtakes human-written material online, tools like ZeroGPT are becoming essential for education, journalism, and enterprise to safeguard authenticity.

Summary

- Studies show AI-generated content now accounts for over 50% of online material, raising concerns about misinformation, disinformation, and academic misconduct.

- Educational institutions face rising cases of AI-assisted cheating, with discipline rates climbing globally, driving demand for reliable AI-detection tools.

- Platforms like ZeroGPT offer high-accuracy AI detection, multilingual support, and accessible integrations via WhatsApp, Telegram, and APIs to help organizations protect integrity while reducing operational costs.

The internet continues to be inundated with massive machine-generated content ever since the launch of ChatGPT in 2022. AI-generated content has spread like wildfire, and a new category of detection tools like ZeroGPT are racing to keep up.

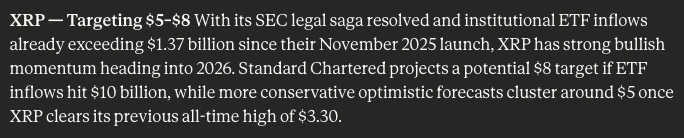

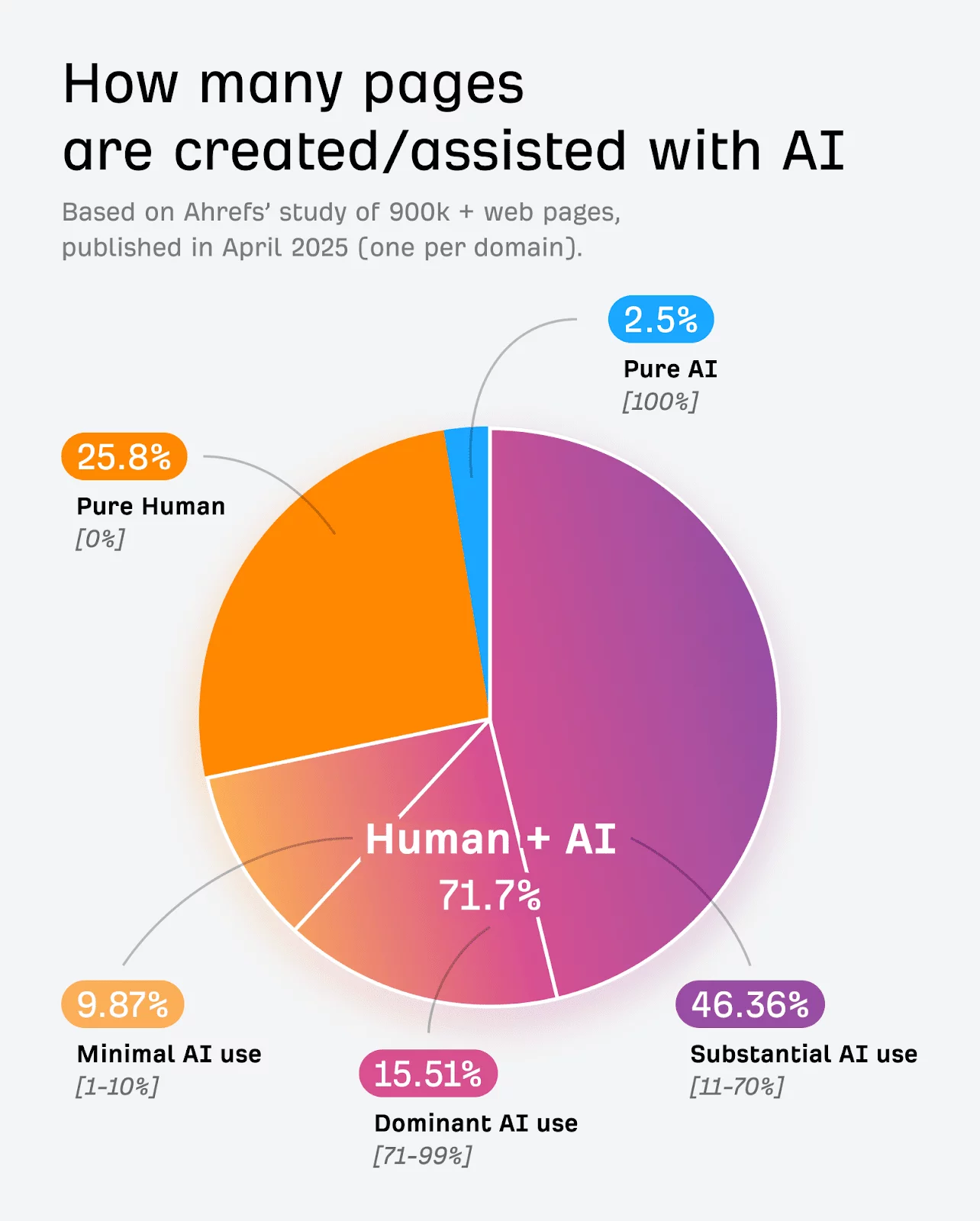

The numbers are striking. In November 2024, the number of AI-generated content published on the web had surpassed the volume written by humans. This milestone, uncovered by growth agency Graphite in an analysis of 65,000 English web pages, found that 50.8% of articles published that month were AI-generated.

Graphite’s discovery was no anomaly. In April 2025, SEO and marketing intelligence platform Ahrefs reported that 74.2% of content spanning 900,000 English-language URLs had some element of AI.

But volume is only part of the problem. What’s more concerning is that this sheer volume is fueling misinformation and disinformation campaigns and eroding academic integrity. The harder question that everyone is grappling with right now is: how can someone know what’s real?

The academic integrity crisis

The AI content surge has landed harder in education — a sector where the authenticity of written work is key. According to an investigation by Gurdian, 7,000 university students in the UK were caught cheating using AI tools in the 2023-24 academic year. This translates to 5.1 out of 1,000 students, up from 1.6 in the previous academic year. In the 2024-25 academic calendar, the number had gone up to 7.5 cases per 1,000 students.

Globally, student discipline rate for AI-related academic misconduct climbed from 48% in 2022–23 to 64% in 2024–25. Approximately 90% of students have confessed to knowing about ChatGPT, and 89% have used it for homework. The weight of the matter has pushed many institutions to impose strict regulations on AI use and adopt robust detection tools.

But having the will to detect AI content and having reliable tools to do it are two different things.

Enter the AI-content detectors

The detection market has grown in tandem with the problem it’s trying to solve. Tools like Turnitin, GPTZero, and Originality have moved from niche utilities to essential institutional infrastructure. Each takes a different approach to the same fundamental challenge of identifying the statistical and linguistic patterns that AI language models leave behind.

AI detector ZeroGPT, one of the most widely used tools on the market, has built its product on accessibility and accuracy. The platform was trained on massive text data collected from the internet, educational data, and its in-house AI datasets, and can detect content generated by ChatGPT, Google Gemini, Claude, DeepSeek, and many other major large language models with up 98% accuracy.

The platform also offers a plagiarism checker, a built-in paraphraser, grammar checker, summarizer, humanize AI, and translator, making it a multi-purpose writing toolkit rather than a single-use scanner.

What sets ZeroGPT apart from other detectors is its availability on WhatsApp and Telegram. Anyone can access ChatGPT’s features, such as AI detection, paraphrasing, and grammar error checking via a chatbot right inside WhatsApp and Telegram, without having to visit the official website.

Perhaps most striking is that ZeroGPT requires no sign-up for basic use. In a market where many competitors gate core features behind registration walls or paywalls, that accessibility has helped it reach millions of users across education, marketing, journalism, and enterprise compliance.

For organizations that need to embed detection into their existing workflows, ZeroGPT offers an API built around RESTful architecture with fast response times. The API can be integrated with learning management systems, editorial platforms, HR tools for reviewing application materials, and compliance monitoring systems.

The platform also supports multilingual detection across different languages. This feature matters the most in global academic settings where non-English AI content is equally prevalent.

The cost to keep academic integrity

The cost to keep academic integrity is placing a substantial financial burden on institutions. It is estimated that the administrative effort, legal review, and academic committee proceedings associated with one misconduct case cost an average of $3,200 to $8,500.

And that cost is just the tip of the iceberg because institutions are spending at least $50,000 per year to train their staff on how to identify AI-generated content. Institutions also suffer from enrolment declines when cases of academic scandals break out to the public.

The need for AI-content detectors in academia is no longer a luxury; it is a necessity. Tools like ZeroGPT are helping institutions safeguard academic honesty, while at the same time significantly cutting the expenses linked to academic misconduct investigations.

On a larger scale, AI detectors are helping to prevent what the researcher Aviv Ovadya calls infocalypse: an internet where synthetic media reduces public trust, as no one knows who created what they are looking at or the intent.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Blue Owl software lending triggers another quake in private credit

Blue Owl BDC’s CEO Craig Packer speaks during an interview with CNBC on the floor at the New York Stock Exchange (NYSE) in New York City, U.S., Nov. 19, 2025.

Brendan McDermid | Reuters

The latest tremor in the private credit world involved a deal that should’ve been reassuring to markets.

Blue Owl, a direct lender specializing in loans to the software industry, said Wednesday it had sold $1.4 billion of its loans to institutional investors at 99.7% of par value.

That means sophisticated players scrutinized the loans and the companies involved and felt comfortable paying nearly full price for the debt, a message that Blue Owl co-President Craig Packer sought to convey in interviews several times this week.

But instead of calming markets, it sent shares of Blue Owl and other alternative asset managers diving on fears of what could follow. That’s because as part of the asset sale, Blue Owl announced it was replacing voluntary quarterly redemptions with mandated “capital distributions” funded by future asset sales, earnings or other transactions.

“The optics are bad, even if the loan book is fine,” Brian Finneran of Truist Securities wrote in commentary circulated Thursday. “Most investors are interpreting the sales to mean that redemptions accelerated and led to forced sales of higher quality assets to meet requests.”

Blue Owl’s move was widely interpreted as the firm halting redemptions from a fund under pressure, even as Packer pointed out investors would get about 30% of their money back by March 31, far more than the 5% allowed under its previous quarterly schedule.

“We’re not halting redemptions, we’re just changing the form,” Packer told CNBC on Friday. “If anything, we’re accelerating redemptions.”

Coming amid a broad tech and software selloff fueled by fears of AI disruption, the episode shows that even apparently strong loan books aren’t immune to market jitters. This in turn forces alternative lenders to scramble to satisfy shareholders’ sudden demands for the return of their money.

It also exposed a central tension in private credit: What happens when illiquid assets collide with demands for liquidity?

Against a backdrop that was already fragile for private credit since the collapse of auto firms Tricolor and First Brands, the fear that this could be an early sign of credit markets cracking took off. Shares of Blue Owl fell Thursday and Friday. They are down more than 50% in the past year.

Early Thursday, the economist and former Pimco CEO Mohamed El-Erian wondered in social media posts whether Blue Owl was a “canary in the coal mine” for a future crisis, like the failure of a pair of Bear Stearns credit funds in 2007.

On Friday, Treasury Secretary Scott Bessent said that he was “concerned” about the possibility that risks from Blue Owl had migrated to the regulated financial system because one of the institutional buyers was an insurance company.

Mostly software

With skepticism over loans to software firms running high, one question from investors was whether the loans they sold were a representative slice of the total funds, or whether Blue Owl cherry-picked the best loans to sell.

The underlying loans were to 128 companies across 27 industries, the largest being software, the firm said.

Blue Owl indicated it was a broad swath of overall loans in the funds: “Each investment to be sold represents a partial amount of each Blue Owl BDC’s exposure to the respective portfolio company.”

Despite its efforts to calm markets, Blue Owl finds itself at the nexus of concerns around private credit loans made to software firms.

Most of the 200-plus companies Blue Owl lends to are in software; more than 70% of its loans are to that category, executives said Wednesday in a fourth-quarter earnings call.

“We remain enthusiastic proponents of software,” Packer said on that call. “Software is an enabling technology that can serve every sector and market and company in the world. It’s not a monolith.”

The company makes loans to firms “with durable moats” and is protected by the seniority of its loans, meaning that private equity owners would need to be wiped out before Blue Owl saw losses.

But, for now at least, the problem Blue Owl faces is one of perception bleeding into reality.

“The market is reacting, and it becomes this self-fulfilling idea, where they get more redemptions, so they have to sell more loans, and that drives the stock down further,” said Ben Emmons, founder of FedWatch Advisors.

Crypto World

Base AI Tokens Outperform Altcoin Market

Speculation is heating up as tokens like VVV and TIBBIR surge, while Vitalik Buterin calls out a new token launch.

Artificial intelligence (AI) tokens on Base are leading the market again, with established tokens like VVV and TIBBIR outperforming, while new launches are turning heads but also drawing criticism from Ethereum co-founder Vitalik Buterin.

TIBBIR and VVV are up 16% and 23%, respectively over the last 24 hours, and sentiment surrounding the AI sector continues to slowly make a comeback after flaming out in 2025.

As is tradition, new market leaders attract increased attention to new launches, and one making a lot of noise despite its relatively small valuation is CONWAY.

Developer Sigil Wen, a Fellow at Peter Thiel’s Thiel Fellowship, published an article on what he calls “Web 4.0,” in which AI is intended to earn and improve its own existence through automation and open web access.

Wen’s work has caught the attention of the broader AI development community beyond those who focus solely on crypto-adjacent work, and yesterday he announced that he will use fees accrued by the community-made CONWAY token to scale the “Conway Ecosystem”.

As a result, the CONWAY token soared to a market capitalization of $12 million before retracing sharply today.

Following the token’s brief explosion, Ethereum co-founder Vitalik Buterin took to X to criticize Wen’s vision, saying, “This is wrong.”

Buterin argued that putting more distance between humans and AIs is “not a good thing for the world” as “the point of Ethereum is to set *us* free, not to create something else that goes off and does some stuff freely while our own situation is unchanged or worsened.”

Wen, however, argues that the automation and issue Buterin is looking to avoid is inevitable, calling it “democratic input into AI.”

The back-and-forth has potentially shaken some $CONWAY holders’ confidence, and the token is down 55% over the last 24 hours, trading at a $3 million valuation. The market has seen a number of new “AI community-led tokens” in 2026, all of which have burned out quickly as developers distanced themselves from them.

The future of CONWAY remains to be seen, but while the trenches fight over the next big thing, established agentic AI tokens such as TIBBIR and VVV continue to lead the charge.

Crypto World

Can Washington advocacy help HYPE recover from its 2026 losses?

Hyperliquid price rebounded 6% on Friday shortly after the decentralized perpetual futures exchange revealed the launch of a new advocacy group in Washington. This fresh catalyst has investors questioning whether HYPE can finally recover from its losses throughout the year.

Summary

- Hyperliquid price rose 6% following the launch of the Hyperliquid Policy Center in the U.S.

- An upcoming token unlock and weakening on-chain stats could negate any short-term recovery attempts.

- HYPE price action has remained below a key descending trendline resistance since early February.

According to data from crypto.news, Hyperliquid (HYPE) price rebounded over 6% on Friday morning during Asian trading hours before settling around $29.23 at the time of writing.

HYPE’s price saw a notable uptick following the launch of the Hyperliquid Policy Center in Washington, D.C. This new advocacy and research nonprofit is dedicated to securing regulatory clarity for decentralized finance, specifically targeting on-chain derivatives and perpetual futures.

To jumpstart the initiative, the Hyper Foundation, the ecosystem’s independent growth arm, committed 1 million HYPE tokens, valued at approximately $29 million, as reported earlier by crypto.news.

As Hyperliquid takes on a leading role in framing the regulatory landscape for the decentralized industry, it is likely to benefit from the exposure and visibility, which could support long term adoption.

However, the impact of such a strategic move on HYPE’s long-term price action may be undercut as the project’s on-chain stats still point to weakness.

Data from DeFiLlama show that the total value locked in the network has dropped from $4.7 billion recorded on to $4.2 billion at the time of writing. At the same time, the weekly revenue generated by DeFi protocols on the network has slumped 55% to $11.83 million since Feb. 9.

Such a drop in TVL and revenue can be interpreted as a fundamental erosion of network utility and engagement, which inevitably dampens investor demand.

Looking ahead, another major headwind for Hyperliquid price is a 9.92 million token unlock set for March 6.

At press time, the upcoming unlock was worth around $291 million and represented 2.72% of the total circulating supply. Token unlocks can drive prices lower, especially if there’s not enough demand from new buyers to absorb the liquidity.

The latest recovery also follows a difficult period where the token fell over 25% from its yearly high of $37.84.

On the daily chart, Hyperliquid price has been trading under a descending trendline that has served as a dynamic resistance level since early February, suggesting that bears continue to dominate the market by capping any recovery attempts by bulls.

The ongoing bearish market, driven by Bitcoin’s failure to retain key support levels, has also added to investor caution and hurt HYPE price.

The Aroon indicator largely remains in support of a continuation of the bearish trend, with the Aroon Down at 92.86%, which means selling pressure still stands at an extreme level.

Meanwhile, the Relative Strength Index metric has formed a falling channel slipping below neutral territory, a sign that momentum remains weak.

For now, the key support for Hyperliquid price lies at $28, which aligns with the 38.2% Fibonacci retracement level, where bulls could lodge a defense and spark a healthy correction. However, a breach below this level could embolden bears to push for lower prices toward $21, the next key support level on the Fibonacci extension.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

Pi Coin under bear pressure as Pi Network turns one

- Pi Coin remains under pressure after losing over 90% from its peak.

- Migration delays and locked balances continue to hurt user confidence.

- Traders are watching the resistance at $0.18 and the support at $0.15 support closely.

Pi Coin is marking a difficult anniversary as selling pressure continues to weigh on the price.

The past year has been one of big promises, uneven delivery, and fading market confidence.

As the open mainnet clocks its first birthday, many holders are still waiting for clarity.

The token’s price action reflects that uncertainty.

A one-year milestone filled with mixed signals

The first year of the open Pi Network mainnet was supposed to be a turning point for the ecosystem. Instead, it has highlighted how far the project still has to go.

Pi Network has expanded its infrastructure and rolled out several technical upgrades.

These updates were meant to improve stability and prepare the network for broader use. At the same time, millions of users have successfully migrated to the open mainnet.

That progress shows the scale and ambition behind the project. Yet a large group of early participants remains stuck.

Many users report locked balances, incomplete migrations, or stolen coins.

KYC delays and new verification requirements have slowed access for others. This gap between development milestones and user experience has hurt sentiment.

Confidence is hard to rebuild when access to funds feels uncertain. That frustration has quietly spilt into the market.

Pi Coin price performance tells a harsh story

Pi Coin’s market performance over the past year has been unforgiving. After peaking near $3 shortly after trading began, the token has lost most of its value.

Recent data shows the price hovering near $0.17.

That represents a decline of more than 90% from its all-time high of $2.99. Short-term rallies have appeared, but they have not lasted.

Each bounce has been met with renewed selling pressure. Profit-taking has become a recurring theme.

Large token transfers to centralised exchanges suggest that holders are eager to exit on strength. Trading volume, however, remains modest compared to the size of the circulating supply.

This imbalance keeps upward momentum fragile, and the market is clearly struggling to find a strong base.

Pi Network adoption hopes clash with market reality

On paper, the ecosystem continues to grow with new tools, developer initiatives, and venture funding underway.

The idea is to build real use cases beyond speculation.

However, the market is focused on what exists today, not what may come later.

Liquidity remains thin relative to supply, and major exchange listings are still limited, restricting price discovery and keeping many institutional players on the sidelines.

While community optimism remains, it is more cautious than before. Many long-term supporters now want results instead of roadmaps.

Until access issues are resolved at scale, confidence may remain fragile. This tension between vision and execution defines the current phase.

Pi Coin price forecast

From a trading perspective, Pi Coin is sitting at a critical crossroads. The area around $0.18 has acted as a stubborn resistance zone.

Repeated failures to break above it suggest weak buying conviction. A daily close above this level would be the first sign of renewed strength.

Above $0.18, traders will be watching the $0.20 region closely.

That zone previously marked a short-term peak and heavy selling. On the downside, $0.17 is now an important psychological level.

A sustained move below it could expose support near $0.15. If selling accelerates, a deeper pullback toward $0.13 cannot be ruled out.

Momentum indicators remain mixed, leaning slightly bearish. This suggests consolidation or further downside before any meaningful recovery.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World4 days ago

Crypto World4 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video21 hours ago

Video21 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video4 days ago

Video4 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech3 days ago

Tech3 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Fashion4 hours ago

Fashion4 hours agoWeekend Open Thread: Boden – Corporette.com

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 days ago

Business3 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World1 day ago

Crypto World1 day ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

Politics4 days ago

Politics4 days agoEurovision Announces UK Act For 2026 Song Contest