Crypto World

Aave Labs Proposes “Aave Will Win” Framework to Route All Revenue to DAO Treasury

TLDR:

- Aave Labs plans to send 100% product revenue directly to the DAO treasury

- Proposal seeks $25M stablecoins and 75K AAVE tokens for V4 development

- V4 will add fixed-rate lending and real-world asset support

- Community reaction shows strong support for better token value alignment

Aave Labs introduced the “Aave Will Win” framework to align product revenues with DAO value. Under the proposal, all revenue from Aave-branded products will flow to the DAO treasury.

In return, Aave Labs seeks funding to develop V4 with new features like fixed-rate lending and real-world assets. The move aims to strengthen the $AAVE token utility and long-term ecosystem growth.

Aave Introduces Token-Centric Revenue Framework

Aave shared the proposal through its official X account, presenting the “Aave Will Win” framework. The model directs 100% of gross revenue from Aave-branded tools to the DAO treasury. These tools include aave.com swaps, the mobile app, and Aave Card.

The proposal builds on existing protocol fees from Aave V3, which generate around $100 million per year. Product revenue is expected to add about $10 million annually. The plan follows earlier community debates about revenue sharing and intellectual property ownership.

Aave founder Stani Kulechov described the framework as a step toward routing all value to the AAVE token. Early community responses on X showed support for stronger alignment between products and token value.

The proposal requests $25 million in stablecoins and 75,000 AAVE tokens for Aave Labs. It also seeks growth grants to expand the ecosystem and develop new features.

Funding Request and Aave V4 Development Plans

The funding request focuses on building Aave V4, which aims to add fixed-rate lending and real-world asset support. The proposal outlines plans for broader product expansion while maintaining DAO ownership of revenue streams.

Aave Labs stated that the framework would allow the DAO to capture value from all Aave-branded products. The team would continue to build tools while contributing revenue directly to the treasury.

Community members had raised concerns in December 2025 about how product revenue should be shared. The new model addresses those concerns by aligning product monetization with DAO governance.

The proposal is now subject to community review and governance processes. Further steps depend on DAO voting and final agreement on funding terms and product development milestones.

Crypto World

Bitcoin Miners Start Unwinding BTC Treasuries as Industry Strains

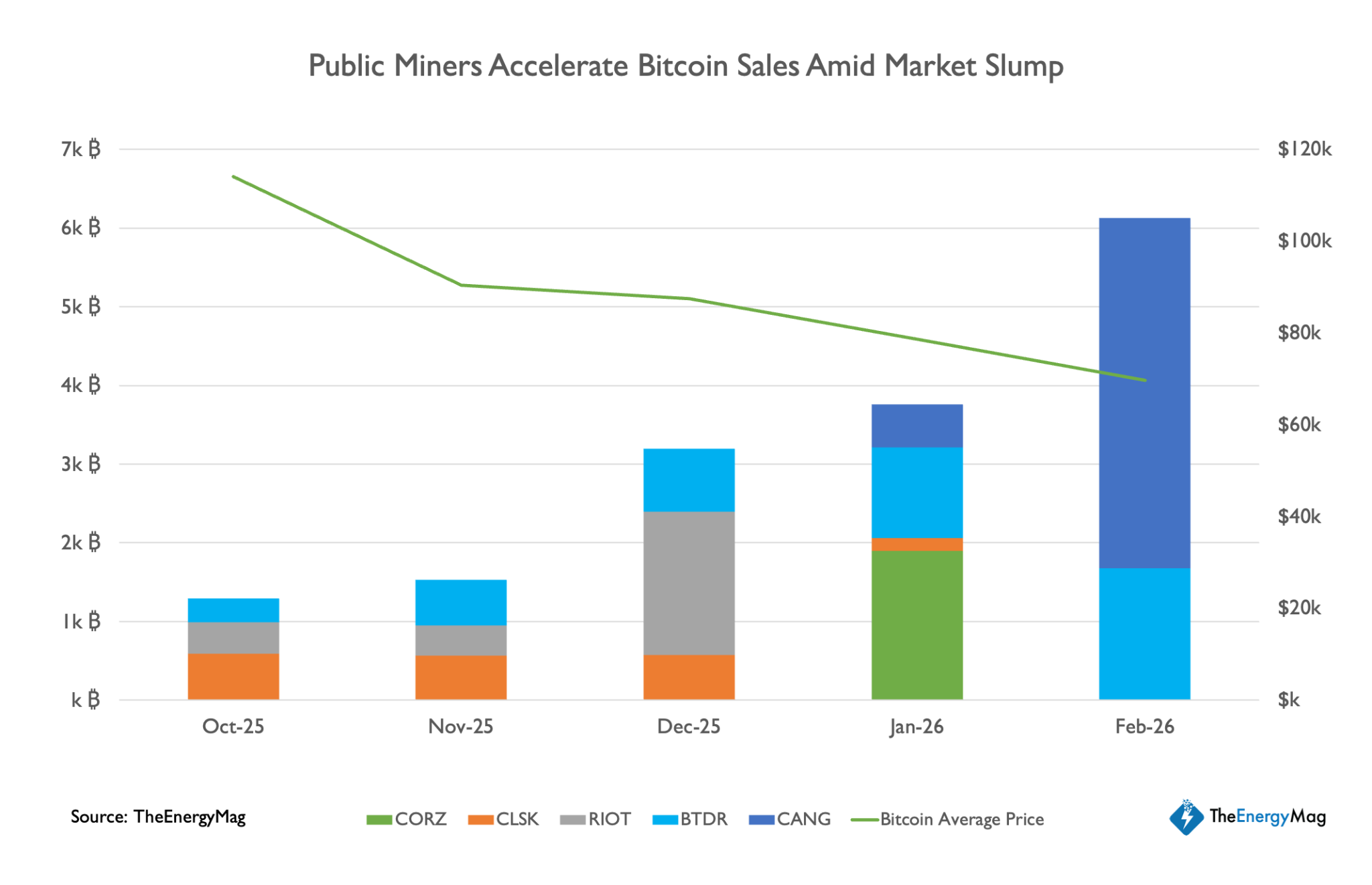

Bitcoin mining companies have offloaded a sizable portion of their Bitcoin reserves in recent months, signaling a shift away from the self-treasury strategy that dominated the industry during the 2024–2025 market upcycle.

According to TheEnergyMag’s Miner Weekly newsletter, publicly listed miners have sold more than 15,000 Bitcoin (BTC) since October. That month marked the market’s peak before a historic flash crash triggered widespread deleveraging across the industry.

Several large miners contributed to the sell-off. The newsletter highlighted Cango’s February sale of 4,451 BTC, equal to roughly 60% of its reserves, as well as Bitdeer, which reportedly liquidated its entire Bitcoin treasury last month.

It also pointed to Riot Platforms’ multiple BTC sales in December and Core Scientific’s plan to sell roughly 2,500 BTC during the first quarter.

MARA Holdings, the largest publicly traded Bitcoin mining company, drew attention this week after updated regulatory filings indicated it may both buy and sell Bitcoin to maintain flexibility and optionality.

Markets initially focused on the potential for sales, prompting vice president Robert Samuels to clarify the company’s position that the filing allows flexible sales but does not signal a majority liquidation.

MARA currently holds more than 53,000 BTC, making it the second-largest public corporate holder of Bitcoin, behind Michael Saylor’s Strategy.

Related: Bitcoin mining’s 2026 reckoning: AI pivots, margin pressure and a fight to survive

Mining companies shift strategy as margins tighten

Bitcoin miners’ recent sales mark a sharp departure from earlier cycle trends, when many companies adopted a de facto “treasury strategy” by holding a larger share of their self-mined BTC on their balance sheets.

At the time, research from Digital Mining Solutions and BitcoinMiningStock.io suggested the holding pattern reflected expectations of further price appreciation. It also coincided with efforts by several miners to strengthen their financial footing while expanding into adjacent businesses such as AI infrastructure, high-performance computing and data center services.

Industry conditions have deteriorated since October, however, with some observers describing the current environment as the harshest margin squeeze on record for mining companies.

The pressure has begun to show on balance sheets. CleanSpark, for example, repaid its Bitcoin-backed credit line in full, a move the company said was aimed at reducing financial risk amid tightening industry margins.

Related: American Bitcoin boosts hashrate with 11,298 new mining machines

Crypto World

Short seller Culper Research says ether tokenomics is ‘impaired’

Short seller Culper Research is betting against ether (ETH) and ETH-linked stocks such as BitMine (BMNR), arguing that the network’s economics deteriorated following Ethereum’s latest network upgrade.

The firm said in a Thursday report that the December 2025 upgrade dubbed Fusaka flooded the network with excess blockspace and has “impaired ETH tokenomics.” That drove transaction fees sharply lower. Because validators earn part of their income from those fees, the drop has reduced staking yields.

That dynamic could create a negative feedback loop, the report said, where declining validator yields reduce staking demand and network security.

The report also highlighted that Ethereum co-founder Vitalik Buterin sold nearly 20,000 ETH, worth around $40 million at current prices, this year, citing data from blockchain sleuth Lookonchain.

“Vitalik is selling, while bulls like Tom Lee are clueless as to ETH’s new reality,” the report said. “We’re with Vitalik.”

The report pushes back on bullish claims from Lee, chairman of Ethereum-centric treasury firm BitMine, who has pointed to rising transaction counts and active addresses as evidence of stronger network fundamentals.

Culper said those metrics are misleading. Its analysis claimed a significant share of the activity surge stems from address poisoning attacks, a scam tactic where attackers send small transactions to trick users into copying malicious wallet addresses. Culper estimated Ethereum fees have dropped roughly 90% since the upgrade.

“By Lee’s own logic, if utility is NOT going up, then ETH is in a death spiral,” the report said. “This is exactly what we believe is happening.”

The short thesis also targeted BitMine (BMNR), one of the largest corporate buyers of ether.

Since July, the company has accumulated roughly 4.4 million ETH as part of its treasury strategy. With ether prices down significantly from recent highs, those holdings are estimated to be 45% underwater, with BitMine sitting on roughly $7.4 billion in unrealized losses, DropsTab data shows.

BitMine did not return a request for comment by press time.

Read more: Vitalik Buterin reveals his bold new plan to fix Ethereum’s scaling problem

Crypto World

Three Reasons Why Pi Network (PI) Could Crash Again After Hitting a 3-Week High

Meanwhile, some market observers believe PI could eventually explode above $1.

The cryptocurrency market continues its impressive recovery, with Pi Network’s PI stealing the show with an impressive 15% daily surge.

However, certain factors suggest that its price could soon turn downward again.

Time to Cool Off?

PI is the best-performing top-100 cryptocurrency today (March 5), with its valuation soaring to a three-week high of $0.20 (per CoinGecko data). Its market capitalization exceeded $1.9 billion, thus making it the 43rd-largest digital asset.

Perhaps the most likely catalyst fueling the rally is the broader revival of the cryptocurrency sector. Bitcoin (BTC) briefly rose to almost $74,000, Ethereum (ETH) neared $2,200, while well-known altcoins like Monero (XMR), Aster (ASTER), and Toncoin (TON) have jumped by 6-7% on a 24-hour scale.

PI’s pump also coincides with the latest updates announced by the Core Team. As CryptoPotato reported, the protocol v19.9 migration was successfully completed. The next version is v20.2, and it is expected to be released before Pi Day 2026 (March 14).

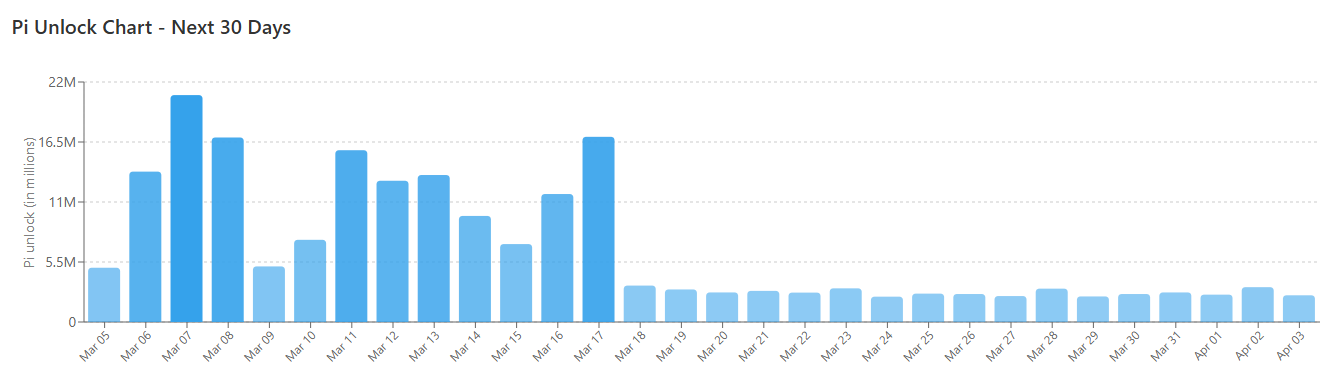

The upcoming token unlocks, though, indicate that PI may not be out of the woods yet. Data shows that a substantial amount of coins will be freed up in the coming days: a development that doesn’t guarantee a price decline but increases immediate selling pressure. March 7 is scheduled as the record day, when almost 21 million PI will be released.

The second bearish factor is the rising supply stored on exchanges, now sitting at roughly 365.5 million coins. Such a shift from self-custody toward centralized platforms is often interpreted as a pre-sale step.

You may also like:

Last but not least, we will touch upon PI’s Relative Strength Index (RSI). The technical analysis tool measures the speed and magnitude of the latest price changes and is used by traders to identify trend reversals. It runs from 0 to 100, and ratios above 70 signal that the asset has entered overbought territory and could be on the verge of a pullback. As of press time, PI’s RSI stands at around 72.

How About Further Gains?

Some market observers expect PI’s rally to continue in the short term. X user ALTS GEMS Alert predicted that the price might soar above $0.30 should it hold the key level around $0.19.

“Momentum building… breakout could send it much higher,” they added.

Whale Hunter forecasted that PI will move “small by small,” starting at $0.20, then $0.40, and eventually exploding to $0.70 and beyond $1. “That’s how crypto works. Finally, you are X5 to X10 profit,” they suggested.

Meanwhile, there has been growing speculation that the leading crypto exchange Kraken might list Pi Network’s native cryptocurrency on Pi Day. Such a move would increase liquidity, improve availability, strengthen its reputation, and potentially support a positive price reaction.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

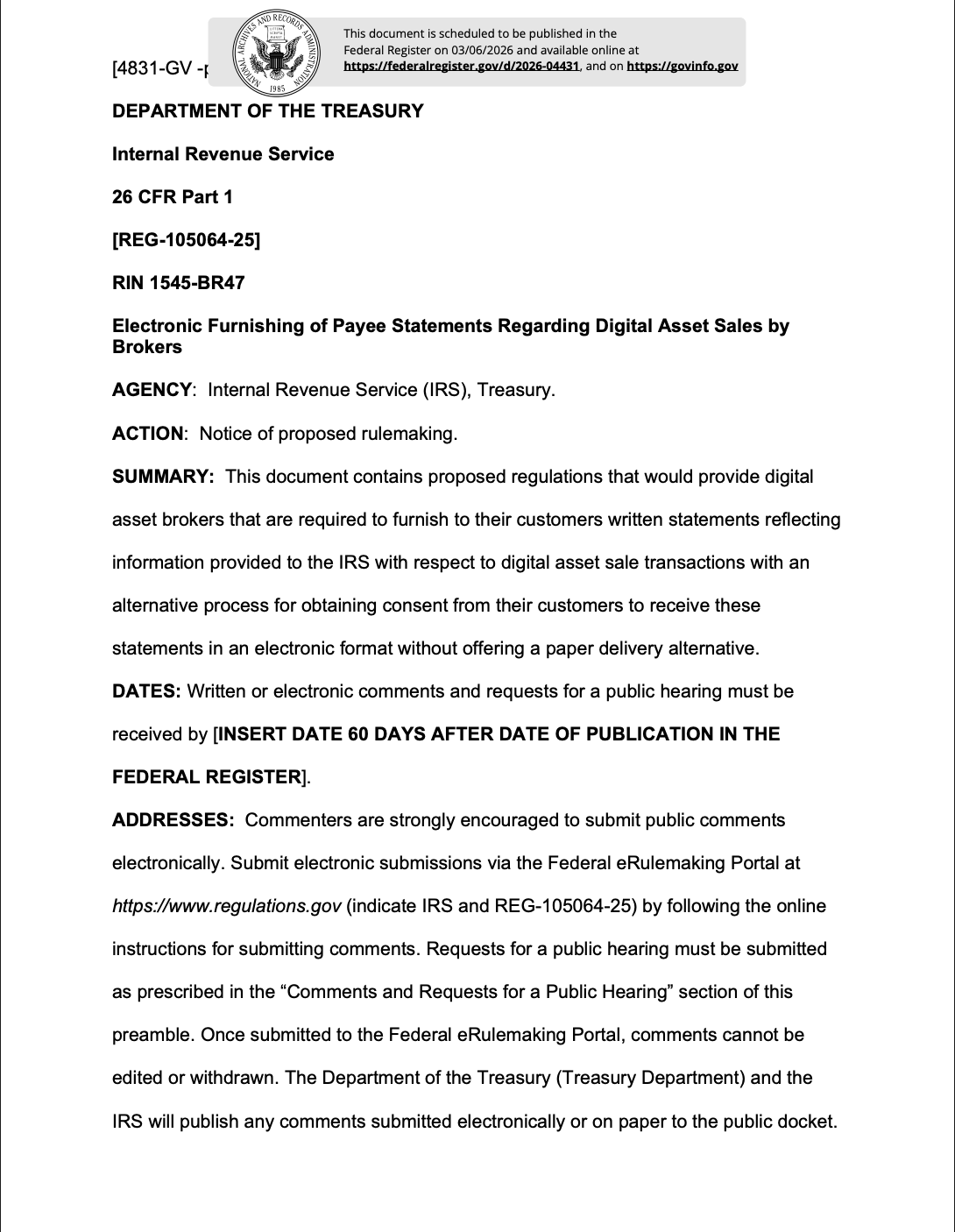

IRS Proposes Crypto Exchanges Shift to Mandatory Electronic Tax Documents

The US Internal Revenue Service (IRS) is seeking to require electronic delivery of tax forms to crypto exchange users.

Under the current rules, exchanges are required to provide paper copies of tax form 1099-DA, the IRS tax form used to document crypto transactions from a centralized exchange or broker, if users request paper forms.

The proposed new rules, slated to be published on Friday, remove this requirement and allow brokers to “terminate” their relationships with existing clients if they refuse electronic delivery of tax forms.

Additionally, the IRS proposal would also prohibit users from retroactively revoking consent for electronic forms.

The IRS requires all broker-dealers, platforms providing crypto services to users like exchanges, to report user proceeds from each transaction and to provide users with Form 1099-DA, detailing their transaction history for the tax season.

However, the exchanges are not required to track cost basis for the 2025 tax year; tracking cost basis, or the price paid for each investment purchase, is the investor’s responsibility. The IRS outlined the reporting requirements for brokers:

“Brokers required to make these returns must include identifying information of the customer, such as the customer’s name and tax identification number (TIN), and such other relevant information, including the gross proceeds from the transaction.”

One in five Americans, or about 55 million individuals, hold digital assets in the US, according to the National Cryptocurrency Association (NCA), a crypto advocacy group.

Tax compliance was one of the biggest impediments to adopting crypto, with 10% of the 54,000 respondents in the NCA survey citing digital asset taxes as an issue.

More than one-third of the respondents indicated that they wanted more education on the tax implications of digital assets, according to the NCA.

Related: Crypto lobby Blockchain Association pitches tax plan to Congress

Concerns resurface after Trump killed the controversial “DeFi broker rule,”

In December 2024, the IRS issued a rule classifying all front-end services, including decentralized exchanges (DEX) and decentralized finance (DeFi) platforms, as broker-dealers, subjecting them to tax reporting requirements.

This meant that DeFi platforms would have to collect know-your-customer (KYC) information and report proceeds from user sales to the IRS.

US President Donald Trump signed a resolution in April 2025 that killed the DeFi broker rule, which was well-received by the crypto industry.

However, crypto industry executives have sounded the alarm about ambiguous language in the stalled CLARITY market structure bill that could force KYC reporting requirements onto DeFi platforms and limit activity in the nascent sector.

Magazine: Clarity Act risks repeat of Europe’s mistakes, crypto lawyer warns

Crypto World

Ethereum price confirms rejection at $2,200 downside builds

Ethereum price has rejected the $2,200 resistance level after failing to sustain momentum above a key value area high. The rejection increases the probability of a rotational move toward lower support as bearish pressure begins to build.

Summary

- Resistance Rejection: Ethereum rejected the $2,200 level and closed below the value area high.

- Range Structure: Price remains trapped within a broader consolidation range.

- Downside Target: A rotational move toward the $1,826 support level is possible if resistance holds.

Ethereum’s (ETH) recent price action has shown clear signs of weakness after the asset attempted to reclaim the $2,200 resistance level but failed to hold above it. The rejection from this area has reinforced the broader range-bound structure that has been developing over recent sessions.

With price now trading back below the value area high, the market is beginning to show signals that a rotational move toward lower support may occur if selling pressure continues.

Ethereum price key technical points

- Key Resistance: $2,200 rejection confirms strong overhead supply.

- Value Area Structure: Price closed below the value area high, signaling weakening momentum.

- Technical Target: Potential rotation toward the $1,826 support level.

Ethereum recently approached the $2,200 region, which has acted as a strong resistance level within the current trading structure. This area coincides closely with the value area high, a key technical zone derived from the volume profile that often acts as a pivot for price direction.

When Ethereum briefly traded near this region, buyers failed to generate enough momentum to sustain a breakout. Instead, the market printed a clear rejection and quickly moved back below the level.

This rejection is technically significant because it confirms that the upper boundary of the current trading range remains intact. The value area high often acts as a distribution zone where selling pressure emerges, and the inability for price to hold above this level indicates that market participants may still be favoring a range-bound structure rather than a breakout continuation.

With the rejection confirmed through a close below the value area high, the probability of a rotational move within the established range increases. In range-bound environments, price typically oscillates between the value area high and value area low while searching for liquidity at both extremes. In this case, the lower support around $1,826 becomes the next logical technical magnet for price action.

Meanwhile, broader discussions within the ecosystem continue after Vitalik Buterin recently described Ethereum as part of a wider network of “sanctuary technologies,” open-source systems designed to protect freedom, privacy, and resilience in an increasingly uncertain world.

Market structure also supports the potential for a downward rotation. Ethereum has repeatedly struggled to establish higher highs above the $2,200 region, suggesting that buyers are losing control at this level. Without a strong influx of bullish volume to reclaim resistance, price is more likely to revisit lower liquidity zones where demand may re-enter the market.

Additionally, the proximity between the value area high and the broader range resistance strengthens the case for rejection. When multiple technical levels align in the same region, the probability of price reacting to that zone increases significantly, which likely contributed to the sharp rejection seen in recent candles.

Although Ethereum recently rebounded above the $2,000 psychological support level amid improving market sentiment and a large purchase of over 50,000 ETH by Bitmine, the confluence of resistance overhead continues to limit upside momentum.

If Ethereum continues to print multiple closes below the value area high, the market may gradually rotate toward the lower boundary of the range. Such movements are common in consolidation environments, where price action shifts between support and resistance until a decisive breakout eventually occurs.

What to expect in the coming price action

As long as Ethereum remains below the $2,200 resistance and continues closing below the value area high, the probability favors a rotational move toward the $1,826 support level.

A reclaim of the resistance zone would invalidate this bearish outlook, but until then, the broader market structure suggests that downside pressure may persist within the current trading range.

Crypto World

CleanSpark Sells 553 BTC for $36.6M in February as Miners Dump Bitcoin

Bitcoin (CRYPTO: BTC) miners faced a dual dynamic in February: cash-flow optimization through asset sales alongside aggressive capacity expansion to support AI-enabled data-center workloads. CleanSpark reported selling 553 BTC from its February production for roughly $36.6 million while mining 568 BTC during the month. By month-end, the company held 13,363 BTC in treasury and had just closed a second Texas campus that adds 300 megawatts of ERCOT-approved power capacity, broadening its footprint in a grid operated by the Electric Reliability Council of Texas. CleanSpark’s deployed fleet tallied 235,588 mining machines, delivering a peak hashrate of 50 EH/s and averaging 43.2 EH/s, underscoring the industry’s push toward scale to support denser, power-hungry operations.

Year-to-date, the miner reported 1,141 BTC produced through February, with 1,086 BTC of its holdings posted as collateral or receivable in connection with derivatives transactions, illustrating how mining revenue is increasingly hedged to manage price volatility and financing risk. The company framed this as part of a broader strategy to monetize power-dense assets beyond traditional crypto mining, aligning with a trend among miners to repurpose infrastructure for AI-friendly workloads and high-performance computing, as noted in industry analyses linked to the sector’s evolving business model.

As of the filing, CleanSpark’s stock was down about 7.5% on the day, while the sector-tracking CoinShares Bitcoin Mining ETF (EXCHANGE: WGMI) was down 6.4%, reflecting a broader risk-off tone in crypto equities on the publication date.

Miners sell off Bitcoin in 2026

CleanSpark is not alone in liquidating portions of its Bitcoin holdings to fund infrastructure expansion and AI-oriented data-center projects. Riot Platforms disclosed that it sold 1,818 BTC in December for about $161.6 million as part of a strategy to monetize energy and data-center assets while supporting AI workloads; the company reported holdings of 18,005 BTC as of Dec. 31, down from 19,368 BTC a month earlier, after producing 460 BTC during December. The move highlighted a broader shift across the sector toward leveraging hardware and data-center capacity for non-cryptocurrency applications.

In February, Bitdeer confirmed it liquidated its entire corporate Bitcoin treasury, producing 189.8 BTC during the period and selling the full amount along with an additional 943.1 BTC drawn from its existing reserves. The scale of these sales illustrates a mounting effort among miners to fund ongoing expansions and diversify revenue streams amid tight capital conditions and rising power costs.

Meanwhile, Core Scientific reported during its fourth-quarter earnings call on March 2 that it sold roughly 1,900 BTC for about $175 million in January, reducing its holdings to fewer than 1,000 BTC. In a separate move, the company announced a $500 million credit facility from Morgan Stanley to finance infrastructure capable of supporting high-density computing workloads, including AI and high-performance computing (HPC). The financing underscores how mining companies are increasingly balancing productive capacity with strategic investments in AI-ready data-center capabilities to capture new demand streams.

On the speculative front, MARA Holdings, the second-largest corporate Bitcoin treasury holder with 53,822 BTC, faced chatter about potential sales of its reserves. However, MARA’s investor-relations vice president, Robert Samuels, pushed back on X, saying the treasury strategy remained intact and unchanged. The market will be watching whether this resilience holds as macro conditions, energy prices, and the evolving regulatory landscape shape miners’ treasury management decisions in the months ahead.

Across the industry, the emphasis on powering AI and HPC workloads is driving a broader redefinition of mining infrastructure. Operators are pursuing power-dense facilities, optimized cooling, and robust electrical grids to support large-scale data processing, while balancing the volatility of Bitcoin prices with hedging strategies and longer-term capital investments. The tension between selling to fund growth and preserving Bitcoin holdings for balance-sheet resilience remains a central theme for miners navigating 2026’s mixed liquidity environment and the ongoing wave of AI-driven demand for compute power.

Why it matters

February’s disclosures paint a picture of miners simultaneously expanding physical footprints and trimming balance-sheet exposure through cash sales. The rapid deployment of additional Texas capacity, alongside continued production, demonstrates the sector’s commitment to scale despite a volatile price backdrop. For investors, the mix of reported BTC production, treasury holdings, and collateralized positions signals an industry that is increasingly integrating mining with broader data-center strategies and AI-capable operations, potentially affecting long-term profitability and cash-flow stability.

The trend toward monetizing dense data-center capacity beyond traditional mining could alter the competitive landscape. As AI and HPC workloads demand reliable, cost-efficient electricity and cooling, miners with expansive power portfolios may gain leverage in power markets and grid interactions. This could influence not just individual company valuations but also the resilience of crypto mining as a capital-intensive, infrastructure-driven business model, particularly in states like Texas where regulatory and market frameworks continue to evolve to accommodate large-scale digital infrastructure.

From a market structure perspective, the activity underscores the close relationship between crypto cycles, energy markets, and financial hedging. The fact that several operators are combining asset sales with debt facilities and non-crypto revenue streams indicates a maturing sector that is learning to weather volatility by diversifying revenue and stabilizing capital expenditure. For builders and developers, the move toward AI-ready data centers signals opportunities to repurpose existing sites or accelerate new builds in power-rich regions, while for regulators, it raises considerations about grid reliability, energy pricing, and the environmental footprint of intensive compute operations.

What to watch next

- CleanSpark’s next quarterly and monthly updates to confirm ongoing production volumes, treasury changes, and any further capacity additions in Texas.

- Public disclosures from Riot Platforms, Bitdeer, and Core Scientific on their 2026 treasury strategy, financing arrangements, and any additional asset sales or hedging activities.

- The utilization and performance of Morgan Stanley’s $500 million facility at Core Scientific, including milestones for deploying AI/HPC workloads on new infrastructure.

- Industry-wide capacity additions beyond 300 MW Texas expansions and any regulatory developments affecting energy-intensive mining and data-center operations in ERCOT and other jurisdictions.

- BTC price trajectories and macro liquidity conditions that influence mining profitability, treasury management, and investor sentiment toward mining equities and related ETFs.

Sources & verification

- CleanSpark February 2026 operational update detailing BTC production and treasury changes, including 13,363 BTC in treasury and 300 MW Texas campus expansion.

- ERCOT and Texas campus capacity information corroborating the 300 MW expansion and grid context.

- Riot Platforms’ December 2025 sale of 1,818 BTC for about $161.6 million and holdings of 18,005 BTC as of Dec 31, plus 460 BTC produced in December.

- Bitdeer’s February 2026 liquidation of its entire corporate treasury and 189.8 BTC produced, plus 943.1 BTC sold from reserves.

- Core Scientific’s January 2026 sale of approximately 1,900 BTC for $175 million and the announcement of a $500 million Morgan Stanley facility to fund AI/HPC infrastructure.

- MARA Holdings’ balance-sheet context and public comments from Robert Samuels on X addressing treasury strategy.

Bitcoin miners expand capacity as cashing out accelerates in 2026

Crypto World

Revolut, Zerohash Pursue US National Banking Charters

The global fintech applied to become a federally regulated, FDIC-insured bank, while the crypto infra firm is looking to become a national bank trust.

Two crypto-adjacent firms just applied to be federally regulated banks in the United States.

Today, Revolut — a UK-headquartered, retail-focused global neobank that offers crypto trading — announced it has officially filed for a national bank charter in the U.S. as part of its strategic push to expand financial services in the United States.

Just yesterday, March 4, digital asset infrastructure company, zerohash, announced that it has applied for a national trust bank charter in the U.S.

Both firms applied to the U.S. Office of the Comptroller of the Currency (OCC), and the charters would let them operate across all U.S. states. Revolut is also applying to the Federal Deposit Insurance Corporation (FDIC), as it seeks to be full-service, federally regulated bank in the U.S.

Revolut also announced today that it has appointed a new U.S. CEO, Cetin Duransoy.

Zerohash, which specializes in settlement services for digital assets and stablecoins, is seeking an OCC National Trust Bank license, which would restrict the firm to custody and trust services. The firm’s chief legal and compliance officer said in the release:

“Applying for a National Trust Bank Charter is a natural next step in offering robust global licensing coverage and continuing to expand our product offering.”

Zerohash’s press release also notes that the trust bank charter will let the firm “expand its services offerings under a federal framework, including those activities that fall under the GENIUS Act.”

A Growing Trend

Though it’s generally known as a fintech and neobank, Revolut has rapidly expanded its offerings into digital assets, adding crypto trading as early as 2017.

The trend of crypto-native and crypto-friendly firms pursuing traditional banking licenses is driven by a dual need for regulatory compliance and the desire to expand service offerings within the traditional financial system.

Since last year, several major crypto firms — including Ripple, Paxos and Circle — applied for national bank and national trust bank charters in the U.S.

Last week, Crypto.com received conditional approval from the OCC to establish its national trust bank, as The Defiant reported.

This article was generated with the assistance of AI workflows.

Crypto World

Is Ethereum Waking Up? Binance ETH Turnover Hits 6-Month High as Volatility Returns

Analysts say high exchange turnover often reflects traders repositioning portfolios quickly during periods of rising volatility.

Ethereum (ETH) trading activity on Binance has jumped dramatically, with around 29.6 million ETH changing hands on the exchange over the past 30 days, the highest turnover recorded since September 2025.

The spike suggests traders are cycling the same supply through the market at a faster pace as volatility returns and derivatives positioning shifts.

Binance ETH Turnover Climbs

Data shared by Arab Chain on March 5 shows the 30-day Ethereum exchange liquidity ratio on Binance has climbed to 8.47. The metric compares the amount of ETH traded during a set period with the total supply available on the exchange.

Binance currently holds around 3.5 million ETH in exchange reserves, yet trading volume during the last month reached almost 29.6 million ETH. That means the same coins have been traded multiple times within a relatively short period.

According to Arab Chain, high turnover levels often appear during periods when traders actively reposition portfolios or when price volatility increases.

“Historically, high turnover rates have often coincided with increased market liquidity and faster asset movement between wallets and exchanges, reflecting heightened risk appetite among traders,” noted Arab Chain.

The latest reading is the highest since September last year, a period that also saw strong price swings in the market.

Presently, ETH has climbed past the $2,000 level, gaining about 4.6% in the last 24 hours. On longer timeframes, the asset is up about 2% in the past week and just over 6% in the last two weeks, although it remains about 9% lower over the last 30 days.

You may also like:

Shifting Market Behavior

Alongside the spike in spot turnover, derivatives indicators point to changes in trading behavior across both Ethereum and Bitcoin. This is according to market analyst Moreno, who noted that net taker volume in derivatives markets has started to move back into positive territory after months of aggressive selling.

Net taker volume measures the difference between traders placing market buy orders and those executing market sells, which helps show who is actively pushing prices. Per the analyst, when the metric flips positive after a long stretch of negative readings, the first phase often reflects short covering and the unwinding of hedge positions rather than fresh long-term demand.

Ethereum’s derivatives activity can also appear distorted because the asset is widely used as collateral in decentralized finance strategies. Many traders hold spot ETH while at the same time shorting perpetual futures contracts to maintain delta-neutral positions, which creates persistent selling pressure in derivatives markets.

Another signal of demand came from the Coinbase premium for both Bitcoin and Ethereum. According to analyst CW, the premium is positive, suggesting buyers on the U.S. exchange are paying slightly higher prices than global markets.

Combined with rising exchange turnover and shifting derivatives flows, the data shows traders are becoming more active again as Ethereum holds above the $2,000 level.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Ripple adds Coinbase’s BTC, ETH, XRP, SOL futures to its $3 trillion prime brokerage

Ripple, the blockchain firm closely associated with the XRP Ledger (XRP) network, said Thursday that clients on its Ripple Prime platform can now trade the full range of crypto futures listed on Coinbase Derivatives.

The move gives institutions a new way to access regulated crypto derivatives within a market overseen by the Commodity Futures Trading Commission. Ripple said that its Prime platform cleared more than $3 trillion in trading volume in 2025.

The offering includes nano bitcoin and nano ether (ETH) futures, which are smaller contracts designed to lower the capital needed to trade. Coinbase also lists futures tied to Solana and XRP in both standard and smaller sizes. The contracts are cleared through Nodal Clear, a U.S. clearing house.

Crypto derivatives have become one of the fastest growing parts of the digital asset market. Many large trading firms prefer futures because they allow investors to gain exposure to price moves or hedge risk without holding the underlying tokens. Regulated futures markets in the U.S. have also drawn interest from institutions that need clear rules and centralized clearing.

The new service builds on Hidden Road, a futures commission merchant and prime broker Ripple acquired last year for $1.25 billion. The firm now operates as Ripple Prime and offers brokerage, clearing and financing services across several asset classes.

Ripple has been on an acquisition spree over the past year, buying a slew of companies to complement the firm’s digital assets offering for institutions and enterprises. On top of Hidden Road, the company bought stablecoin payments firm Rail for $200 million, and also acquired treasury technology provider GTreasury and crypto wallet infrastructure startup Palisade.

Crypto World

Bitcoin price rejected at $74,000, failed auction points to downside

Bitcoin price has confirmed a failed auction at the $74,000 range-high resistance after a sharp rejection. With price now losing the value area high, the probability of a corrective move toward the $60,000 support is increasing.

Summary

- Failed auction at $74K: Strong rejection at range-high resistance confirms weakness.

- Value Area High lost: Signals a shift toward bearish rotational structure.

- $60K support in focus: Previous weekly low becomes the next major downside target.

Bitcoin’s (BTC) latest price action is showing clear signs of weakness after failing to sustain a breakout above the $74,000 resistance level. The rejection from this range high, combined with a confluence of technical resistance from VWAP, has created a failed auction structure.

This development suggests that bullish momentum has stalled, increasing the likelihood of a deeper corrective rotation within the current trading range.

Bitcoin price key technical points

- Range-high rejection: Bitcoin failed to hold above the $74,000 resistance level.

- VWAP confluence: Additional resistance reinforced the failed breakout attempt.

- Downside risk: Loss of value area high increases the probability of a move toward $60,000.

Bitcoin recently attempted to break above the key range-high resistance situated around $74,000. However, the breakout quickly failed as price was met with strong selling pressure near this level. The market briefly traded above the resistance before reversing sharply and closing back below it, forming what traders refer to as a failed auction. This type of structure typically occurs when price attempts to push into higher levels but lacks sufficient demand to sustain the move.

A critical factor contributing to this rejection was the confluence with the volume-weighted average price (VWAP), which acted as an additional resistance layer. When multiple technical resistance levels align, they often strengthen the probability of a rejection. In this case, the presence of VWAP at the range high reinforced the selling pressure and prevented Bitcoin from establishing acceptance above $74,000.

Following this rejection, Bitcoin has now lost the value area high, a key level that previously supported price within the trading range. The loss of this level is a significant technical development because it suggests that buyers are no longer in control of the short-term market structure.

When the value area high is lost, price often rotates toward the value area low as the market seeks a new balance within the range. Meanwhile, Bitwise Asset Management has also announced a $233,000 donation to Bitcoin open-source developers, marking its second annual contribution tied to the success of its spot Bitcoin ETF.

This rotation dynamic increases the probability that Bitcoin will test lower support levels. The most notable support currently sits around $60,000, which also aligns with the previous weekly low. Historically, such levels tend to attract liquidity, as traders often place orders around these key areas of interest. If bearish momentum continues to build, the market may gravitate toward this zone as it searches for demand.

Another important consideration is the internal rotation taking place within the current trading range. Markets frequently move between the value area high and value area low as liquidity is redistributed. With price now accepted below the range-high resistance and the value area high, the probability of a move toward the lower end of the range increases significantly.

In addition, resting liquidity typically accumulates around major support levels such as the value area low. As price rotates through the range, these liquidity pools often become targets for market participants. This process can accelerate downward momentum, especially if sellers remain in control and bullish attempts to reclaim higher levels continue to fail.

The broader market environment also supports the possibility of further downside. Repeated bearish candle closes near resistance often indicate sustained selling pressure and a lack of strong buying demand. In such conditions, range highs tend to act as strong rejection zones, reinforcing the probability of continued rotational movement within the market.

What to expect in the coming price action

From a technical perspective, Bitcoin remains vulnerable to further downside after confirming a failed auction at the $74,000 range high. As long as price remains below this resistance and the value area high continues to act as resistance, the probability favors a rotation toward the $60,000 support region.

A strong reclaim of the lost resistance would invalidate this bearish outlook, but until then the market structure suggests that deeper corrective movement remains likely.

-

Politics7 days ago

Politics7 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics3 days ago

Politics3 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech5 days ago

Tech5 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports6 days ago

The Vikings Need a Duck

-

NewsBeat5 days ago

NewsBeat5 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech15 hours ago

Tech15 hours agoBitwarden adds support for passkey login on Windows 11

-

Entertainment4 days ago

Entertainment4 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports3 hours ago

Sports3 hours ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Tech6 days ago

Tech6 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat3 days ago

NewsBeat3 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Crypto World7 days ago

Crypto World7 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

Tech5 days ago

Tech5 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video3 days ago

Video3 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business2 days ago

Business2 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial