Crypto World

Aptos-Incubated Decibel Launch Protocol-Native Stablecoin Pre-Mainnet

Decibel Foundation is moving to embed an on-chain stablecoin into its Aptos-native derivatives ecosystem. The protocol-native token, USDCBL, issued by Bridge, is set to back on-chain perpetual futures trading as Decibel gears up for its February mainnet launch. The dollar-denominated asset is designed to internalize reserve economics, reducing dependence on third-party stablecoin issuers and giving the protocol more control over collateral dynamics. Decibel, incubated by Aptos Labs, plans to debut in February with a fully on-chain perpetual futures venue that relies on a single cross-margin account. The platform’s December testnet reportedly attracted more than 650,000 unique accounts and exceeded 1 million daily trades, figures that have yet to be independently verified.

Key takeaways

- Decibel will launch a protocol-native stablecoin, USDCBL, issued via Bridge’s Open Issuance platform, ahead of its Aptos-based perpetual futures exchange mainnet.

- USDCBL reserves will be backed by a mix of cash and short-term U.S. Treasuries, with yield retained within the protocol to support on-chain economics.

- Onboarding flow converts deposits of USDC into USDCBL, enabling on-chain collateral for perpetual futures and reducing reliance on external stablecoin issuers.

- The project emphasizes that USDCBL is infrastructure for the exchange rather than a standalone retail token, signaling a broader push toward ecosystem-native stablecoins.

- The announcement situates Decibel within a wider trend toward native stablecoins across crypto and traditional finance, with examples like Hyperliquid’s USDH and institutional tokens from JPMorgan and PayPal.

- Bridge’s Open Issuance ties Decibel to a broader stablecoin issuance framework, underscored by Bridge’s acquisition by Stripe in late 2025.

Sentiment: Neutral

Market context: The emergence of ecosystem-native dollar tokens across crypto platforms and traditional finance mirrors a broader move toward internalized collateral and on-chain settlement. The trend includes initiatives such as Hyperliquid’s native stablecoin USDH, JPMorgan’s tokenized deposits with JPM Coin, and PayPal’s PYUSD, all highlighting a shift toward dollars inside networks rather than relying solely on external issuers. The regulatory environment is also evolving, with proposals for stablecoin licensing and oversight under consideration in the United States.

Why it matters

The Decibel initiative marks a meaningful shift in how on-chain derivatives ecosystems anchor liquidity and risk management. By issuing USDCBL through Bridge’s Open Issuance platform, the project creates a fully collateralized stablecoin designed to live entirely within the protocol’s rails. The approach aims to reduce counterparty risk and minimize dependence on third-party stablecoin issuers, potentially lowering external liquidity constraints for the exchange’s perpetual futures venue.

From a tech perspective, a cross-margin architecture on a fully on-chain perpetuals venue can streamline settlement and collateral management. The onboarding flow—deposit USDC and convert to USDCBL— ties user funds to a native collateral pool that is governed by on-chain rules and reserves that are auditable in real time. The reserve model anchors value in a mix of cash and short-term U.S. Treasuries, with yield returned to the protocol rather than shared with external issuers or custodians. That design could improve capital efficiency and enable more aggressive reinvestment into ecosystem development and product enhancements, provided risk controls remain robust.

Market observers note that the broader push toward ecosystem-native stablecoins is not limited to crypto-native platforms. In parallel, traditional financial players are deploying tokenized dollar instruments within their networks to support real-time settlements and liquidity optimization. The PayPal PYUSD program and JPM Coin’s deployment for institutional settlement illustrate how “inside-network” dollars can reshape flow dynamics across both crypto and conventional finance. In the case of PayPal, for example, a 2025 rewards program tied to PYUSD holdings further integrates the stablecoin into consumer and merchant ecosystems, signaling how stablecoins can extend beyond trading into everyday payments and incentives.

Hyperliquid’s USDH example underscores the potential of native stablecoins to serve as platform-wide collateral. USDH is minted on the platform’s HyperEVM layer and is designed to act as collateral across the exchange, aiming to reduce reliance on off-platform issuers. This demonstrates a broader appetite among developers to align stablecoins with the specific risk profiles and liquidity needs of their ecosystems, rather than “one-size-fits-all” stablecoins that depend on external issuers.

As the ecosystem experiments with native stablecoins, the role of issuance infrastructure becomes another critical variable. Bridge’s Open Issuance framework enables projects to create regulated, fully collateralized stablecoins with integrated on- and off-ramps, linking on-chain finance more tightly to real-world assets. Bridge’s acquisition by Stripe in late 2025 highlights how stablecoin tooling is increasingly intertwined with mainstream fintech infrastructure, potentially accelerating adoption and interoperability across networks.

In short, Decibel’s USDCBL blueprint reflects a broader thesis: native stablecoins embedded within a platform’s governance and risk framework can improve liquidity, reduce external dependencies, and enable more sustainable funding for ecosystem development. Whether such models gain traction will depend on risk controls, regulatory clarity, and the ability of on-chain venues to demonstrate durable, auditable reserve management while delivering reliable user experiences.

What to watch next

- February mainnet launch of the Aptos-based perpetual futures exchange and the onboarding flow for USDCBL.

- Details on reserve composition, collateralization ratios, and on-chain governance updates tied to USDCBL and Bridge’s issuance framework.

- Regulatory developments around stablecoin licensing and compliant issuance pathways, including mentions of licensing proposals in the U.S. context.

- User adoption metrics from the testnet and early mainnet phases, including net deposits into USDCBL and cross-margin activity.

Sources & verification

- Decibel Foundation’s announcement about USDCBL and its use as collateral for on-chain perpetual futures.

- Decibel’s X post detailing reserve backing and income retention within the protocol.

- Bridge’s Open Issuance platform and its role in issuing regulated, fully collateralized stablecoins; Bridge’s 2025 Stripe acquisition.

- December testnet performance metrics (650,000+ unique accounts; 1,000,000+ daily trades).

- Comparative examples of ecosystem-native stablecoins, including Hyperliquid’s USDH, JPM Coin, and PayPal’s PYUSD.

Decibel’s on-chain stablecoin aims to underpin Aptos perpetuals

The Decibel Foundation’s plan centers on USDCBL, a protocol-native stablecoin issued by Bridge, designed to operate as collateral for on-chain perpetual futures on Decibel’s upcoming Aptos-based exchange. Depositors will convert USDC (CRYPTO: USDC) into USDCBL (CRYPTO: USDCBL) as part of the onboarding flow, with USDCBL issued via Bridge’s Open Issuance platform. The intention is to create a fully collateralized, internal reserve mechanism that reduces exposure to external stablecoin issuers while maintaining familiar price stability for traders. Bridge, which had been acquired by Stripe in late 2025, serves as the issuance backbone for USDCBL, aiming to deliver a seamless on-ramp and off-ramp experience for users across the ecosystem.

At launch, the exchange will feature a single cross-margin account for on-chain perpetual futures, simplifying risk management for users who hold USDCBL as collateral. The December testnet reportedly attracted hundreds of thousands of users and a high level of trading activity, underscoring pent-up demand for on-chain derivatives experiences on Aptos. However, as with many new testnet figures, independent verification remains pending, so market participants will be watching the February mainnet rollout closely to assess real-world engagement and liquidity.

USDCBL reserves are described as a mix of cash and short-term U.S. Treasuries, with yield generated by those assets retained within the protocol. This approach could reduce the need to rely on trading fees or token incentives as primary revenue streams, freeing capital to be reinvested into ecosystem development and product enhancements. The foundation emphasized that USDCBL is not merely another stablecoin; rather, it is “core exchange infrastructure” intended to support the mechanics of a fully on-chain venue rather than serve as a broad retail token. This framing reflects a design choice that prioritizes platform integrity and reliability over standalone consumer use cases.

In the broader context, Decibel’s move sits alongside a wave of native-stablecoin experiments across both crypto-native projects and traditional financial institutions. Hyperliquid’s USDH, minted on the platform’s HyperEVM, illustrates how a platform-specific token can function across an exchange’s liquidity and collateral framework. The inclusion of widely discussed developments like JPM Coin (institutional tokenization for settlement) and PYUSD (PayPal’s dollar-backed token integrated into its payments network) further demonstrates the industry’s interest in dollars entrenched within networks rather than external issuers alone. Taken together, these examples depict a landscape where stablecoins are increasingly tailored to the governance and risk profiles of individual ecosystems, rather than deployed as generic, market-wide instruments.

Crypto World

Trump’s National Cyber Strategy Backs Crypto Security in Post-Quantum Era

US President Donald Trump’s newly released National Cyber Strategy outlines federal support for strengthening the security of cryptocurrencies and blockchain systems, including protections against future threats posed by quantum computing.

Key Takeaways:

- Trump’s National Cyber Strategy includes federal support for securing cryptocurrencies and blockchain networks.

- The plan promotes post-quantum cryptography to protect digital infrastructure from future quantum computing threats.

- The strategy comes as the crypto industry debates how Bitcoin and other blockchains should prepare for quantum-era security risks.

The strategy, published Friday by the White House, states that the administration intends to ensure the United States remains “unrivaled in cyberspace.”

The document highlights the role of secure digital infrastructure and emphasizes that Americans should take steps to safeguard their online activities while the government works to reinforce broader cybersecurity protections.

Trump Cyber Strategy Highlights Crypto and Blockchain Security

Within that framework, the strategy includes a specific focus on emerging technologies tied to the digital asset sector.

According to the document, the administration plans to “build secure technologies and supply chains that protect user privacy from design to deployment,” while also supporting the security of cryptocurrencies and blockchain networks.

The strategy also calls for promoting post-quantum cryptography, encryption systems designed to withstand attacks from future quantum computers, alongside the development of secure quantum computing technologies.

The mention of crypto security comes as debate intensifies within the digital asset industry over whether major blockchain networks are prepared for a future where quantum machines could break current encryption methods.

Quantum computers remain largely experimental, but researchers have warned that sufficiently powerful versions could one day crack cryptographic systems used by Bitcoin and other blockchains.

Such a development would require networks to migrate to new encryption standards capable of resisting quantum attacks.

Some figures in the crypto sector argue the risk remains distant. Michael Saylor, co-founder of Bitcoin-focused firm Strategy, has said concerns about quantum threats are exaggerated, though he acknowledges that developers should remain prepared for technological shifts.

Other projects have begun exploring upgrades more actively. Ethereum co-founder Vitalik Buterin proposed a “quantum roadmap” earlier this year aimed at preparing the blockchain for a future where quantum computing could undermine existing cryptographic protections.

Trump’s cybersecurity plan arrives alongside other policy actions that touch the digital asset sector.

On the same day the strategy was released, the president signed an executive order targeting cybercrime, part of a broader effort to strengthen the country’s digital defenses.

Trump Expands Pro-Crypto Agenda With Bitcoin Reserve and CBDC Ban

Since returning to office, Trump has taken several steps aimed at reshaping US crypto policy. Last year, he approved the creation of a strategic Bitcoin reserve held by the federal government.

The reserve currently contains Bitcoin seized in criminal cases, and the administration has not indicated plans to acquire additional assets.

Earlier executive actions also included a sweeping review of digital asset policy and a prohibition on the development of US central bank digital currencies, reflecting the administration’s stance against government-issued digital money.

Meanwhile, Trump has intensified pressure on Jerome Powell, including threats of a criminal investigation, but the Federal Reserve has again held interest rates steady, citing solid growth and still-elevated inflation.

Powell declined to comment on the investigation and defended the Fed’s independence, warning that politicizing monetary policy would undermine the institution’s credibility.

As reported, Bitcoin has shed roughly 25,000 millionaire addresses in the year since Donald Trump returned to the White House, even as US policy shifted toward a more crypto-friendly stance.

Blockchain data shows the number of addresses holding at least $1 million in BTC fell about 16% year over year, suggesting regulatory optimism has not translated into sustained on-chain wealth growth.

The post Trump’s National Cyber Strategy Backs Crypto Security in Post-Quantum Era appeared first on Cryptonews.

Crypto World

US Treasury Says ‘Lawful’ Crypto Users Have Valid Reasons To Use Mixers

The Treasury’s report to the US Congress was commissioned as part of directives under the GENIUS stablecoin regulatory framework.

The United States Treasury Department acknowledged the legitimate use of mixers, which obfuscate crypto transfers to preserve user privacy, in its report to Congress on “Innovative Technologies to Counter Illicit Finance Involving Digital Assets.”

“As consumers increase their use of digital assets for payments, individuals may want to use mixers to maintain more privacy in their consumer spending habits,” the report said. The Treasury report continued:

“Lawful users of digital assets may leverage mixers to enable financial privacy when transacting through public blockchains. For instance, individuals may use mixers to protect sensitive information on personal wealth, business payments or charitable donations from appearing on a public blockchain.”

However, the report also noted the dangers of “darknet” or non-custodial, decentralized mixers. The Treasury said that non-custodial mixers are used for money laundering or shifting illicit funds by cybercriminals, including North Korea-linked hackers.

The authors suggested that custodial mixers, centralized services that take possession of user funds during the process, could provide identifying information that could be used to track users and transaction flows.

Privacy in crypto became a hot-button issue in 2025, as financial surveillance increases and US lawmakers attempt to impose know-your-customer (KYC) requirements on digital asset service providers and even decentralized finance (DeFi) platforms.

Related: Dash Evolution chain integrates Zcash Orchard privacy pool

DeFi leaders and seasoned investors warn about the threat to privacy

DeFi leaders and advocates sounded the alarm on ambiguous language in the Digital Asset Market Clarity Act of 2025, also known as the CLARITY bill, that could force DeFi platforms to collect identifying information from users.

The bill also lacked sufficient protections for open-source software developers in the US, according to Alexander Grieve, vice president of government affairs at crypto investment company Paradigm.

Former hedge fund manager Ray Dalio also warned that central bank digital currencies (CBDCs), onchain fiat currencies managed by a central banking institution or the government, are coming and pose a major risk to digital privacy.

In an interview with independent journalist Tucker Carlson, Dalio said CBDCs are a “very effective controlling mechanism” for the government.

Magazine: Can privacy survive in US crypto policy after Roman Storm’s conviction?

Crypto World

Curve Stablecoin Pool Outperforms Uniswap With Higher Volume Efficiency

TLDR:

- Curve’s USDC/USDT pool processes 75% of Uniswap volume with only one eighth of the liquidity available.

- Liquidity providers earn about 2.5% base yield on Curve compared with under 1% across Uniswap pools.

- Curve’s stablecoin focused AMM concentrates liquidity near parity to increase capital efficiency.

- Maximum boosted rewards can lift liquidity provider returns on Curve pools to about 5.5% APR.

New data reveals a sharp efficiency gap between Curve and Uniswap in stablecoin trading pools. A USDC and USDT pool on Curve processed major trading activity despite holding far less liquidity than similar Uniswap pools.

The pool generated comparable trading volume while operating with only a fraction of the capital. The development has renewed focus on how automated market maker designs influence liquidity efficiency and returns.

Curve Stablecoin Pool Shows Higher Volume Efficiency Than Uniswap

Data shared on X indicates the USDC and USDT pool on Curve holds about $5 million in liquidity. Comparable pools on Uniswap V3 and V4 hold around $37 million combined.

Despite that difference, Curve recorded roughly $33 million in trading volume during the same period. Uniswap pools handled about $43 million in volume.

The comparison shows Curve processing nearly 75% of Uniswap’s combined volume while using about one eighth of the liquidity. That efficiency stems from Curve’s automated market maker design built for stablecoin trading.

Curve’s system concentrates liquidity around tight price ranges for assets with similar values. Stablecoins such as USDC and USDT typically trade near parity.

Michael Egorov, the founder of Curve, commented on the data through X. He noted that the Curve pool outperformed comparable Uniswap pools in both utilization and annual yield.

Egorov also pointed out that average trading fees inside the Curve pool exceeded those in the comparable Uniswap V4 pool. The data suggests higher utilization of available liquidity inside Curve’s market structure.

Higher APR on Curve Stablecoin Pool Boosts Liquidity Provider Returns

Liquidity providers in the Curve pool also receive stronger base yields. Data shared by market analyst CredibleCrypto shows base returns around 2.5%.

Comparable pools on Uniswap generate lower base yields. Uniswap V3 produces about 0.6% while Uniswap V4 returns around 0.95%.

The gap means Curve liquidity providers earn roughly 2.5 to five times more yield from base fees alone. That difference reflects higher trading activity relative to capital size.

Additional incentives further increase potential returns on Curve. Liquidity providers can earn up to about 5.5% annual percentage rate with a maximum boost.

These boosts come from Curve’s reward structure tied to veCRV governance participation. The mechanism increases rewards for users who lock tokens and participate in governance.

The structure encourages long term liquidity commitments while raising effective yield for active participants. As a result, Curve maintains strong capital efficiency even with smaller pools.

The comparison between Curve and Uniswap highlights a broader design difference between automated market makers. Curve specializes in stable asset trading while Uniswap supports a wider range of tokens and markets.

Crypto World

Pi Network, Polkadot, US inflation data

The crypto market will likely maintain its volatility this week as the war in Iran continues and the US releases its consumer inflation report on Wednesday. This article looks at some of the top crypto news to watch this week.

Pi Network in the spotlight ahead of Pi Day

One of the top crypto news this week will be on Pi Network. The network will conclude the current phase of the network upgrade on March 12. This upgrade is part of that transition from v19 to v23 of the Stellar consensus.

Pi Network price will also react to the upcoming Pi Day event on March 14. This is a major event meant to commemorate and celebrate the mathematical constant pi.

Pi Network uses the event to make major announcements that often moves prices. There is also speculation that Kraken will decide to list the coin on this day.

Polkadot tokenomics upgrade

The other key crypto market news this week will be the upcoming Polkadot tokenomics upgrade that happens on March 12.

This is a major overhaul that will reduce the number of DOT tokens in circulation to 2.1 billion and reduce emissions by 53.6%. The upgrade will also reduce the number of unbonding days from 28 days to between 24 and 48 hours.

The new upgrade aims to introduce the concept of scarcity and capital efficiency. It also comes a few days after 21Shares launched the first DOT ETF on Friday.

US-Iran war and US inflation data

The other key crypto news to watch this week will be the ongoing war in Iran. The three sides – Iran, the United States, and Israel – have all vowed to continue the fight, leading to higher crude oil prices.

Signs that the war will continue for longer will be highly bearish for the crypto market as Bitcoin’s role as a safe-haven asset has been decimated. Instead, investors have turned to gold and the Swiss franc.

In line with this, the US will publish its inflation report on Wednesday this week. Economists expect the upcoming numbers to show that inflation rose from 2.4% in January to 2.5% in February. This inflation comes a few days after the US published weak jobs numbers.

It is unclear whether the upcoming inflation report will have an impact on crypto prices because investors are now focusing on the impact of the ongoing Iran war and its impact on crude oil prices.

Crypto World

US Lawmakers Demand ‘Permanent’ CBDC Block

A group of US lawmakers is uniting to prevent the US central bank from ever issuing a Central Bank Digital Currency (CBDC), warning that proposed legislation only delays it until 2031.

“We write to you to express the dire need to prohibit a Central Bank Digital Currency from ever happening in the United States,” US Congressman Michael Cloud wrote in a letter on Friday addressed to House Speaker Mike Johnson and US Senate majority leader John Thune, joined by 28 other members of Congress in support.

It follows a proposed amendment to the Federal Reserve Act that would bar the US central bank from issuing a CBDC until 2031. The amendment is part of the 300-page “21st Century ROAD to Housing Act” (HR 6644), which was released on Monday by the Senate Committee on Banking, Housing, and Urban Affairs.

However, Cloud and the other lawmakers argued that the temporary block isn’t strong enough to protect Americans.

“A prohibition of a Central Bank Digital Currency must be permanent,” the letter said, adding that CBDCs “would expose Americans to unconstitutional financial surveillance and give the unelected Federal Reserve unprecedented power over Americans’ finances that would violate their civil liberties and financial freedom.”

US lawmakers argue it must end “before it is too late”

“A CBDC is inherently anti-American and a looming issue we must put an end to before it is too late,” the letter said.

The lawmakers argued that the amendment “includes a watered-down version” of the “Anti-CBDC Surveillance State Act” (HR 1919), which was introduced in June 2025 by Congressman Tom Emmer.

The bill passed the House on July 17 but has yet to receive full Senate approval.

Related: Trump’s National Cyber Strategy pledges to support crypto and blockchain

The letter pointed out that the amended bill does not prohibit the Federal Reserve from studying a CBDC. “The strong language of H.R.1919 must be restored,” the letter said.

A separate standalone bill, the No CBDC Act (S 464), was introduced by Senator Mike Lee in February 2025 to prohibit the Federal Reserve or Treasury from issuing a CBDC, but it stalled in Congress.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

Bitcoin ‘Bull Trap’ Forming As Bear Market Middle Stage Approaches: Analyst

Bitcoin could experience a short-term rally that catches investors off guard before the broader downtrend resumes, according to on-chain analyst Willy Woo.

“Bull trap forming,” Woo said in an X post on Saturday, referring to a fake breakout suggesting that the market is entering a sustained uptrend. He added that it may last “out to [the] end of April.”

Woo said his outlook is based on liquidity conditions rather than price levels. “If capital comes back in force with the right type of long-term investors, then I’ll happily change my views,” Woo said.

Bitcoin is “solidly” in the middle of a bear market

From a long-range liquidity perspective, Woo said Bitcoin (BTC) is “solidly in the middle of its bear market.” “Typically, after fast downward flushes like we have had, BTC likes to go sideways and mount a rally where resistance is tested,” Woo said.

Bitcoin has fallen approximately 46.82% since reaching its October all-time highs of $126,000, trading at $67,012 at the time of publication, according to CoinMarketCap.

Woo said that this level isn’t the bottom for Bitcoin and the asset may see further downside. Crypto sentiment platform Santiment shared a similar view on Saturday, pointing to whales aggressively selling while retail investors buy below $70,000.

“When retail buys while whales sell, it typically signals that the correction is not yet over,” Santiment said.

Bitcoin investor flows have been in “consistent recovery”

Woo said that despite Bitcoin failing to hold the “mid-70s” range after it soared to $74,000 on Wednesday, investor flows have been in “consistent recovery” since the middle of February.

Related: Bitcoin relief rally hits wall as spot ETFs log $228M in outflows

Woo isn’t the only analyst who thinks Bitcoin is in a bear market. Crypto analyst Benjamin Cowen recently told Magazine that 2026 is a “bear market year” for Bitcoin and unlikely to bring new all-time highs.

On-chain analytics company CryptoQuant said on Thursday that “Bitcoin is still in a bear market despite the recent rally.”

It comes after the Crypto Fear and Greed Index, one of the most widely used gauges of crypto investor sentiment, fell back to “extreme fear” levels after briefly recovering on Wednesday.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

RWA Market Tops $24.9B as Tokenized Gold, Stocks, and Treasuries Reshape Crypto Finance

TLDR:

- Tokenized RWAs hit $24.9B in Feb 2026, up 289% YoY as six asset classes cross the $1B mark.

- BlackRock’s BUIDL leads tokenized Treasuries at $2.2B after surging 239% over the past year.

- Tokenized stocks reached $786M since mid-2025, growing independently of Bitcoin’s price swings.

- Only 11.8% of $8.49B in RWA stablecoins are active in DeFi due to KYC and whitelist barriers.

The tokenized real-world asset market crossed $24.9 billion in February 2026. That figure marks a 289% increase from $6.4 billion just one year prior.

Six asset classes now individually exceed $1 billion in tokenized value. The market is no longer driven by a single sector. It is diversifying fast.

Treasuries, Gold, and Equities Drive Explosive RWA Expansion

U.S. Treasuries remained the largest segment. They grew 183% year-over-year, reaching $10.8 billion, according to data compiled by Nexus Data Labs.

Active products expanded from 35 to 53, with entries from Fidelity, ChinaAMC, and VanEck. BlackRock’s BUIDL fund now leads the space at $2.2 billion, up 239% in 12 months.

Ondo Finance’s combined Treasury exposure reached $2 billion across OUSG and USDY.

Superstate’s USTB grew 499% to $0.8 billion. WisdomTree’s WTGXX surged 759%. The top-three concentration in this market dropped from 61% to 48%, per Nexus Data.

Tokenized stocks are the newest category and the fastest-growing. They scaled from near-zero to $786 million since mid-2025.

Platforms including Ondo Finance, Backed Finance, Dinari, and Robinhood now offer onchain access to NVDA, TSLA, GOOGL, SPY, and QQQ. Growth continued even while Bitcoin dipped below $70,000.

Tokenized gold also posted strong gains. Circulating supply on Ethereum nearly doubled, from 687,000 to over 1.3 million troy ounces in 12 months.

The spot price of gold rose 80% over the same period, from $2,963 to $5,327. Supply growth outpaced price gains. That signals active minting, not passive price appreciation.

88% of RWA-Backed Stablecoins Remain Locked Outside DeFi Protocols

The stablecoin side of the RWA story tells a different tale.

Total RWA-backed stablecoin supply stands at $8.49 billion, per DeFiLlama. Only $1 billion of that, roughly 11.8%, is actively deployed in DeFi protocols.

DAI dominates by market cap at 53%, or $4.48 billion. USDY from Ondo Finance holds 15% of supply. But when filtered for active DeFi usage, USDY drops to just 1.99% of utilization. YLDS, at $598 million in supply, disappears from DeFi entirely.

The gap comes down to access restrictions. KYC requirements and whitelisting walls block permissioned tokens from integrating with permissionless DeFi contracts.

Permissionless assets show a stark contrast. reUSD posts 96.7% DeFi utilization. USDtb reaches 29.5%. Legacy FRAX sits at 28%.

That leaves $7.49 billion, roughly 88% of all RWA-backed stablecoin supply, sitting outside DeFi. The infrastructure exists. The capital is onchain.

Composability remains the gap between presence and productivity.

Crypto World

CEXs Have Zero Motive to Aid Terrorists as Court Dismisses Case

In a setback for plaintiffs seeking to link Binance to terrorist financing, a U.S. federal court in New York dismissed a broad claim that the exchange helped move funds for terrorist groups. The ruling comes as Binance and its founder CEO, Changpeng Zhao, have repeatedly argued that centralized crypto exchanges operate on economic incentives that make it irrational for criminals to use legitimate platforms for funding violent acts. The decision, while narrow in scope, underscores the challenges in tying crypto trading venues to specific acts of violence, even amid heightened scrutiny over sanctions and compliance practices.

Key takeaways

- The Southern District of New York judge dismissed the case at the pleading stage, citing an insufficient link between Binance’s operations and the listed attacks.

- The plaintiffs represented 535 individuals connected to 64 attacks dating from 2016 to 2024, attributed to groups including Hezbollah, Hamas, ISIS, al-Qaeda and Palestinian Islamic Jihad.

- Changpeng Zhao (CZ) asserted on X that centralized exchanges have “zero motive” to assist terrorists, arguing that such activity would not generate trading revenue and would likely be short-livedDeposits.

- The court’s decision narrows the path for victims pursuing anti-terrorism claims under statutes such as the US Anti-Terrorism Act and the Justice Against Sponsors of Terrorism Act.

- Binance has faced separate scrutiny over sanctions-related transactions and Iran-linked activity, including pushback against Senate probes and media reports that alleged extensive ties to sanctioned entities.

Sentiment: Neutral

Market context: The ruling arrives amid a broader backdrop of intensified regulatory scrutiny of centralized exchanges, including debates over sanctions enforcement, AML/KYC standards and the role of crypto platforms in cross-border law enforcement efforts. While the decision limits one legal avenue for victims, it does not resolve ongoing questions about how large exchanges respond to illicit activity and geopolitical sanctions.

Why it matters

The SDNY’s dismissal signals that, at least in this case, plaintiffs faced a high bar in proving direct, actionable links between Binance’s services and the specific terrorist attacks cited in the complaint. The decision emphasizes the difficulty of proving causation for criminal actions that occur through a broad, permissionless ecosystem where many intermediaries and third parties could be involved. For traders and institutions watching regulatory risk, the ruling reinforces the boundary between platform responsibility and the broader ecosystem in which crypto assets circulate.

From a policy vantage point, the case highlights the tension between victims seeking redress under anti-terrorism statutes and the practical standards courts apply to show that a platform’s compliance practices materially facilitated or enabled wrongdoing. The judge’s ruling does not absolve Binance of potential wrongdoing in other contexts, but it does illustrate how courts assess linkages between a platform’s operations and the crimes alleged. In the process, it preserves the possibility that future amendments to complaints, if sufficiently grounded, could reframe liability questions under different facts or legal theories.

Beyond the courtroom, Binance’s public posture remains that it endeavors to operate within regulatory expectations while contesting allegations that rely on incomplete or mischaracterized information. The exchange has repeatedly argued that its internal controls, risk models and cooperation with authorities are designed to prevent illicit activity, and it has asserted that certain allegations—particularly those tied to sanctions evasion—are overstated or unfounded. The recent court decision, while narrow, interacts with a broader narrative about how exchanges balance rapid, global crypto trading with stringent compliance obligations.

What to watch next

- Whether plaintiffs pursue an amended complaint within the 60-day window noted by the judge, potentially re framing allegations or adding new evidence to strengthen causation links.

- Binance’s ongoing responses to regulatory inquiries, including statements addressing Senate probes and sanctions-related reporting, and how the company frames its compliance posture in light of evolving rules.

- Regulatory developments surrounding Iran-related and other sanctions-compliance matters, as policymakers weigh enforcement priorities and the role of major crypto platforms in monitoring cross-border flows.

- Subsequent court activity, including any appeals or related actions that might test different legal theories or damages frameworks under anti-terrorism statutes.

Sources & verification

- U.S. District Court for the Southern District of New York dismissal order (PDF) detailing the court’s rationale for ruling at the pleading stage.

- Original court filing referenced in coverage, including the inclusion of 535 plaintiffs connected to 64 attacks (2016–2024).

- Changpeng Zhao’s X post remarking on the economics of centralized exchanges and their lack of motive to engage with terrorists.

- Binance’s response to Senate inquiries and related reporting discussed in coverage of sanctions and Iran-linked activity.

Binance court ruling and regulatory scrutiny

The decision in the SDNY case marks a notable moment in crypto litigation, illustrating how courts evaluate the relationship between a large exchange’s operations and criminal acts pursued by external actors. While the ruling narrows the path for the plaintiffs, it does not preclude other lawsuits or investigations that might pursue different factual or legal avenues. In the immediate aftermath, Binance pressed a cautious but defiant stance on the sanctions-related allegations, reiterating that a February inquiry relied on information the firm described as false and lacking credible substantiation. The exchange emphasized its commitment to compliance and cooperation with authorities while warning against conflation of isolated incidents with systemic failures.

As the industry navigates a landscape of looming regulatory expectations, the case underscores the importance of robust AML/CFT controls, transparent transaction monitoring, and proactive risk management—elements that policymakers argue are essential to preserving the integrity of crypto markets. It also highlights how defendants in high-profile cases must balance public diplomacy with legal strategy, especially when countering narratives that tie crypto platforms to violent acts or sanctioned networks. In this environment, market participants—ranging from retail traders to institutional buyers—will be closely watching how courts interpret platform responsibilities and how regulators adapt their guidance to evolving technologies and use cases.

What to watch next

- The 60-day window for an amended complaint, which could shift pleadings and potentially introduce new factual claims.

- Binance’s continued engagement with U.S. lawmakers and regulators as scrutiny around Iranian-linked transactions and broader sanctions compliance persists.

- Any new court actions related to similar theories of liability, including potential appeals or separate lawsuits that challenge platform practices or risk controls.

Crypto World

Bitcoin ETFs post $568M inflows after $1.15B buying wave

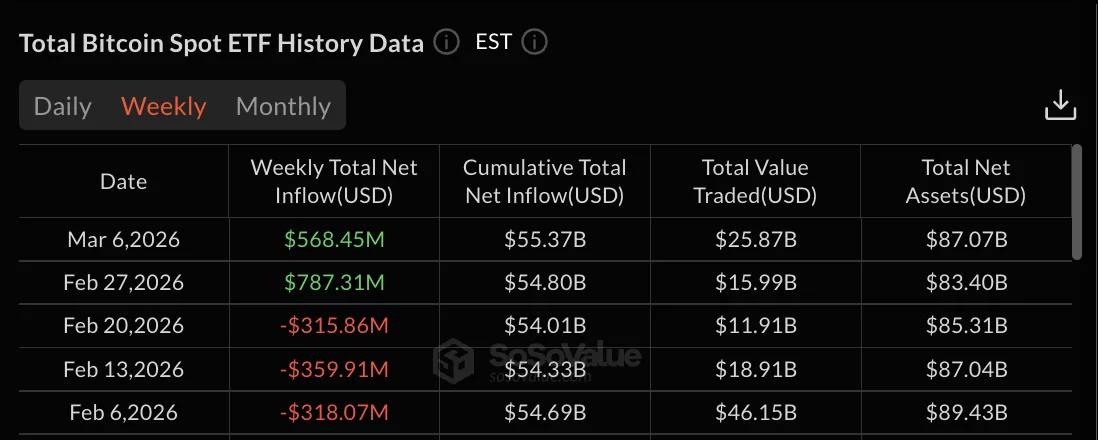

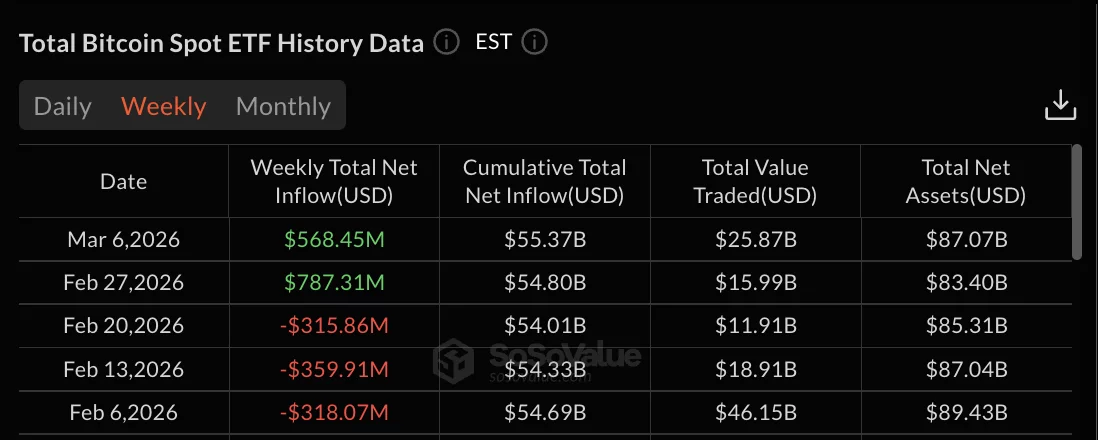

Bitcoin spot ETFs recorded $568.45 million in net inflows for the week ending March 6 and were the second consecutive week of positive flows.

Summary

- Bitcoin ETFs recorded $568.45M weekly inflows.

- A $1.15B buying wave from March 2–4 offset $576M in late-week outflows.

- Ethereum ETFs added $23.56M, but heavy redemptions erased most midweek gains.

Three days of strong buying from March 2-4 totaling $1.15 billion offset outflows on March 5-6 that drained $576.66 million, leaving the week with net positive flows.

Bitcoin (BTC) traded below $67,000 after dropping 2% over 24 hours, while total net assets for Bitcoin ETFs reached $87.07 billion.

March 2-4 buying wave brings $1.15 billion before reversal

March 2 and March 4 posted nearly identical inflows of $458.19 million and $461.77 million respectively, bracketing March 3’s $225.15 million in positive flows.

The three-day streak brought $1.15 billion into Bitcoin ETF products. March 5 recorded $227.83 million in outflows, followed by March 6’s larger $348.83 million in redemptions.

The two-day withdrawal period removed just under half of the prior three days’ gains but left the week with $568.45 million in net inflows.

Weekly trading volume reached $25.87 billion for the period ending March 6, up from $15.99 billion during the week ending February 27.

Total net assets climbed from $83.40 billion on February 27 to $87.07 billion on March 6.

Ethereum posts modest $23.56 million in weekly inflows

Ethereum spot ETFs recorded $23.56 million in net inflows for the week ending March 6, down sharply from the prior week’s $80.46 million.

March 4 posted the strongest single-day performance at $169.41 million before two consecutive days of heavy outflows.

March 5 saw $90.94 million in redemptions, followed by March 6’s $82.85 million in outflows.

The two-day withdrawal period nearly wiped out March 4’s gains. March 2 added $38.69 million in inflows while March 3 posted a modest $10.75 million in outflows.

Total net assets for Ethereum products reached $11.28 billion with cumulative total net inflow at $11.63 billion. Ethereum price also traded below $1,900 after the 2% daily decline.

Crypto World

Kalshi, Polymarket Discuss Fundraising at $20B Valuations: Report

US President Donald Trump’s newly released National Cyber Strategy outlines federal support for strengthening the security of cryptocurrencies and blockchain systems, including protections against future threats posed by quantum computing.

Key Takeaways:

- Kalshi and Polymarket are exploring fundraising rounds that could value each platform at around $20 billion.

- The potential valuations would mark a sharp increase from their latest funding rounds of $11 billion for Kalshi and $9 billion for Polymarket.

- Rapid growth in prediction markets is attracting investor interest even as regulatory scrutiny rises.

The strategy, published Friday by the White House, states that the administration intends to ensure the United States remains “unrivaled in cyberspace.”

The document highlights the role of secure digital infrastructure and emphasizes that Americans should take steps to safeguard their online activities while the government works to reinforce broader cybersecurity protections.

Trump Cyber Strategy Highlights Crypto and Blockchain Security

Within that framework, the strategy includes a specific focus on emerging technologies tied to the digital asset sector.

According to the document, the administration plans to “build secure technologies and supply chains that protect user privacy from design to deployment,” while also supporting the security of cryptocurrencies and blockchain networks.

The strategy also calls for promoting post-quantum cryptography, encryption systems designed to withstand attacks from future quantum computers, alongside the development of secure quantum computing technologies.

The mention of crypto security comes as debate intensifies within the digital asset industry over whether major blockchain networks are prepared for a future where quantum machines could break current encryption methods.

Quantum computers remain largely experimental, but researchers have warned that sufficiently powerful versions could one day crack cryptographic systems used by Bitcoin and other blockchains.

Such a development would require networks to migrate to new encryption standards capable of resisting quantum attacks.

Some figures in the crypto sector argue the risk remains distant. Michael Saylor, co-founder of Bitcoin-focused firm Strategy, has said concerns about quantum threats are exaggerated, though he acknowledges that developers should remain prepared for technological shifts.

Other projects have begun exploring upgrades more actively. Ethereum co-founder Vitalik Buterin proposed a “quantum roadmap” earlier this year aimed at preparing the blockchain for a future where quantum computing could undermine existing cryptographic protections.

Trump’s cybersecurity plan arrives alongside other policy actions that touch the digital asset sector.

On the same day the strategy was released, the president signed an executive order targeting cybercrime, part of a broader effort to strengthen the country’s digital defenses.

Trump Expands Pro-Crypto Agenda With Bitcoin Reserve and CBDC Ban

Since returning to office, Trump has taken several steps aimed at reshaping US crypto policy. Last year, he approved the creation of a strategic Bitcoin reserve held by the federal government.

The reserve currently contains Bitcoin seized in criminal cases, and the administration has not indicated plans to acquire additional assets.

Earlier executive actions also included a sweeping review of digital asset policy and a prohibition on the development of US central bank digital currencies, reflecting the administration’s stance against government-issued digital money.

Meanwhile, Trump has intensified pressure on Jerome Powell, including threats of a criminal investigation, but the Federal Reserve has again held interest rates steady, citing solid growth and still-elevated inflation.

Powell declined to comment on the investigation and defended the Fed’s independence, warning that politicizing monetary policy would undermine the institution’s credibility.

As reported, Bitcoin has shed roughly 25,000 millionaire addresses in the year since Donald Trump returned to the White House, even as US policy shifted toward a more crypto-friendly stance.

Blockchain data shows the number of addresses holding at least $1 million in BTC fell about 16% year over year, suggesting regulatory optimism has not translated into sustained on-chain wealth growth.

The post Kalshi, Polymarket Discuss Fundraising at $20B Valuations: Report appeared first on Cryptonews.

-

Politics5 days ago

Politics5 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business2 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion2 days ago

Fashion2 days agoWeekend Open Thread: Ann Taylor

-

NewsBeat7 days ago

NewsBeat7 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech3 days ago

Tech3 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment6 days ago

Entertainment6 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports3 days ago

Sports3 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat7 days ago

NewsBeat7 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat6 days ago

NewsBeat6 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Sports13 hours ago

Sports13 hours agoThree share 2-shot lead entering final round in Hong Kong

-

Fashion7 days ago

Fashion7 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Video6 days ago

Video6 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business4 days ago

Business4 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat6 days ago

NewsBeat6 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Sports3 hours ago

Sports3 hours agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Crypto World6 days ago

Crypto World6 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown

-

NewsBeat3 days ago

NewsBeat3 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Tech6 days ago

Tech6 days agoCynus Chess Robot: A Chess Board With A Robotic Arm

-

Video6 days ago

Video6 days agoLPP + Financial Maths + Numerical Applications | One Shot | Applied Maths | Target Board Exams 2026

-

NewsBeat6 days ago

NewsBeat6 days agoHandcuffed presenter Jonathan Ross’ sweet admission about marriage to wife of 38 years

![Ripple CTO Made an ENCRYPTED Message... "DO NOT SELL XRP EARLY" GET READY XRP HOLDERS! [MUST SEE]](https://wordupnews.com/wp-content/uploads/2026/03/1772957034_maxresdefault-80x80.jpg)