Crypto World

As bitcoin (BTC) price extends declines, industry figures say it’s time to buy: Crypto Daybook Americas

By Francisco Rodrigues (All times ET unless indicated otherwise)

Bitcoin dropped for a third straight day after failing to remain above the $70,000 hit during the weekend recovery as spot trading volumes thinned and theCrypto Fear and Greed Index held in “extreme fear” territory.

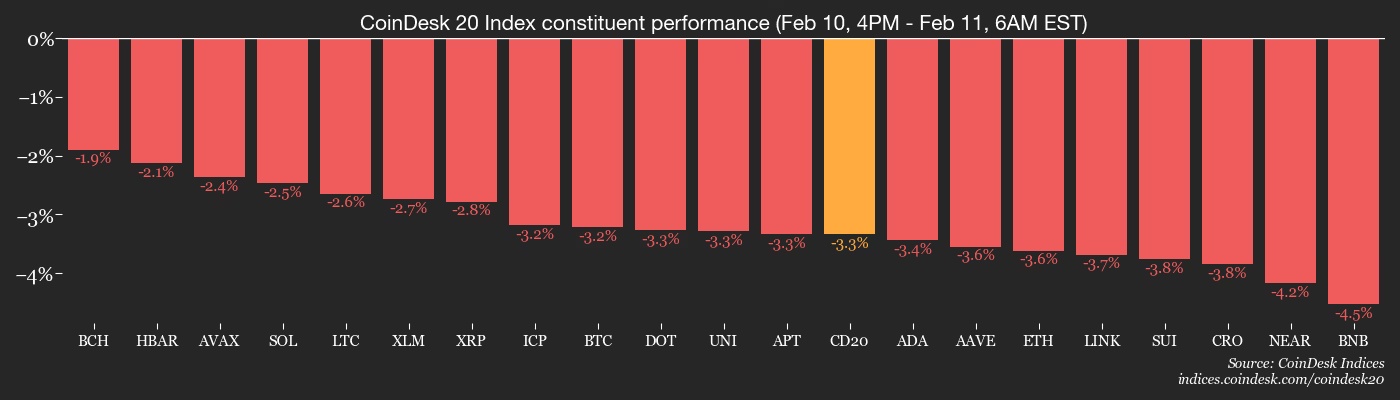

The broader crypto market capitalization has slipped to about $2.28 trillion, with the CoinDesk 20 (CD20) index losing 3.4% over the past 24 hours. Even so, onchain data aggregator Glassnode described the pullback as modest by past standards, with no signs of panic selling seen in prior cycle peaks.

Despite the lower volumes and poor sentiment, inflows to spot bitcoin ETFs have been steady over the past three days, helping absorb some selling pressure. The market is now in a price discovery phase, according to Wintermute.

“With spot volumes still relatively light, leverage is driving short term moves as was illustrated by BTC squeezing back up from the lows last friday on the back of heavily crowded perp shorts,” Wintermute desk strategist Jasper De Maere wrote in an emailed note. “It’s likely the market will continue to whip across this range as its still in price discovery.“

Major figures appear to remain bullish. Speaking at Consensus Hong Kong, Tom Lee, chief investment officer of Fundstrat and chairman of ether treasury firm BitMine Immersion (BMNR), told investors they should look for entry points rather than try to time a bottom.

On CNBC, Michael Saylor, executive chairman of bitcoin treasury firm Strategy (MSTR), reiterated his long-term bet on the cryptocurrency, saying he expects it to outperform traditional equities despite the drawdown.

Weak U.S. retail sales have moderately lifted U.S. interest rate-cut expectations and weighed on the dollar. Now, attention will switch to today’s nonfarm payrolls figures and inflation data, which could further influence risk appetite. Stay alert.

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Crypto

- Feb. 11: Immutable to complete the merge of Immutable X and Immutable zkEVM.

- Macro

- Feb. 11, 8:30 a.m.: U.S. nonfarm payrolls for January Est. 70K (Prev. 50K)

- Feb. 11, 8:30 a.m.: U.S. unemployment rate for January Est. 4.4%(Prev. 4.4%)

- Feb. 11, 8:30 a.m.: U.S. average hourly earnings for January YoY Est. 3.8% (Prev. 3.6%)

- Earnings (Estimates based on FactSet data)

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Governance votes & calls

- Feb. 11: Ripple to host XRP Community Day on X Spaces discussing XRP adoption, regulated finance and innovation.

- Unlocks

- Token Launches

- Feb. 11: Coinbase to list RaveDAO (RAVE), DeepBook (DEEP), and Walrus (WAL).

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

Market Movements

- BTC is up 0.25% from 4 p.m. ET Tuesday at $66,868.63 (24hrs: -3.14%)

- ETH is down 2.96% at $1,947.84 (24hrs: -3.25%)

- CoinDesk 20 is down 2.75% at 1,900.89 (24hrs: -3.53%)

- Ether CESR Composite Staking Rate is up 1 bp at 2.83%

- BTC funding rate is at -0.0023% (-2.536% annualized) on Binance

- DXY is down 0.3% at 96.50

- Gold futures are up 1.73% at $5,117.80

- Silver futures are up 6.22% at $85.39

- Nikkei 225 closed up 2.28% at 57,650.54

- Hang Seng closed up 0.31% at 27,266.38

- FTSE is up 0.50% at 10,405.94

- Euro Stoxx 50 is down 0.41% at 6,022.26

- DJIA closed on Tuesday up 0.1% at 50,188.14

- S&P 500 closed down 0.33% at 6,941.81

- Nasdaq Composite closed down 0.59% at 23,102.47

- S&P/TSX Composite closed up 0.71% at 33,256.83

- S&P 40 Latin America closed down 0.57% at 3,746.47

- U.S. 10-Year Treasury rate is down 1 bps at 4.135%

- E-mini S&P 500 futures are unchanged at 6,966.50

- E-mini Nasdaq-100 futures are unchanged at 25,218.00

- E-mini Dow Jones Industrial Average Index futures are up 0.13% at 50,338.00

Bitcoin Stats

- BTC Dominance: 59.12% (-0.29%)

- Ether-bitcoin ratio: 0.02914 (-0.81%)

- Hashrate (seven-day moving average): 1,002 EH/s

- Hashprice (spot): $33.56

- Total fees: 2.6 BTC / $179,640

- CME Futures Open Interest: 120,785 BTC

- BTC priced in gold: 13.1 oz.

- BTC vs gold market cap: 4.46%

Technical Analysis

- BTC/USD is currently hovering below the 200-week exponential moving average, a critical support level that must be reclaimed to prevent further downside.

- The market now awaits the weekly close to confirm whether this breach marks a definitive breakdown or a temporary deviation.

Crypto Equities

- Coinbase Global (COIN): closed on Tuesday at $162.51 (-2.83%), -3.39% at $157.00 in pre-market

- Circle Internet (CRCL): closed at $59.75 (-0.58%), -1.84% at $58.65

- Galaxy Digital (GLXY): closed at $21.19 (+0.19%), -1.75% at $20.82

- Bullish (BLSH): closed at $32.05 (+0.00%), -1.68% at $31.51

- MARA Holdings (MARA): closed at $7.66 (-4.96%), -3.13% at $7.42

- Riot Platforms (RIOT): closed at $14.83 (-0.94%), -2.29% at $14.49

- Core Scientific (CORZ): closed at $18.13 (-2.26%), -2.48% at $17.68

- CleanSpark (CLSK): closed at $10.03 (-1.57%), -2.49% at $9.78

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $42.62 (-2.76%)

- Exodus Movement (EXOD): closed at $10.86 (+1.12%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $133.00 (-3.93%), -3.12% at $128.85

- Strive (ASST): closed at $9.18 (-9.51%), -3.27% at $8.88

- SharpLink Gaming (SBET): closed at $6.65 (-6.47%), -0.60% at $6.61

- Upexi (UPXI): closed at $0.98 (-7.14%), +1.96% at $0.99

- Lite Strategy (LITS): closed at $1.03 (-1.90%)

ETF Flows

Spot BTC ETFs

- Daily net flows: $166.5 million

- Cumulative net flows: $54.98 billion

- Total BTC holdings ~1.27 million

Spot ETH ETFs

- Daily net flows: $13.8 million

- Cumulative net flows: $11.91 billion

- Total ETH holdings ~5.84 million

Source: Farside Investors

While You Were Sleeping

Crypto World

SOL Strategies Stock Climbs 21% on 691K SOL Milestone

TLDR

- SOL Strategies stock rose 20.97% to $1.50 after the company released its February business update.

- The STKESOL liquid staking platform surpassed 691,000 SOL staked within weeks of launch.

- The platform attracted 1,034 holders shortly after its rollout.

- The validator network expanded to 33,568 unique wallets in February.

- Total assets under delegation reached 3.87 million SOL, including treasury and third-party stakes.

SOL Strategies stock climbed 20.97% to $1.50 on Nasdaq after a strong February update. The company reported rapid growth in staking operations and liquid staking adoption. The update showed rising validator activity and expanding assets under delegation.

SOL Strategies Stock Jumps as Liquid Staking Gains Traction

The company said its STKESOL liquid staking platform surpassed 691,000 SOL staked within weeks of launch. It also confirmed that 1,034 holders joined the platform during the initial rollout. The figures came from its February business update, which highlighted expanding validator activity and rising delegated assets.

SOL Strategies stated that its validator network reached 33,568 unique wallets in February. That figure increased from about 31,000 wallets at the start of the month. The company said STKESOL growth supported higher validator participation and stronger network engagement.

The firm reported total assets under delegation of 3.87 million SOL in February. This total included treasury holdings and tokens delegated by third parties. Proprietary validators generated about 1,276 SOL in rewards during the month.

The company confirmed that users, delegated assets, and staking rewards all increased during February. These metrics reflect performance across validator and staking services. The company linked this expansion directly to the rollout of liquid staking services.

SOL Strategies said liquid staking allows users to earn rewards while keeping tokens liquid. It issues tokenized staking positions that users can trade or deploy elsewhere. The company described this product as an added revenue channel beyond validator services.

Revenue Growth Expands Across Staking Operations

Interim CEO Michael Hubbard said the company continues scaling infrastructure despite crypto market volatility. He stated, “The staking platform now has four revenue streams running simultaneously.” These include treasury staking, third-party delegated staking, liquid staking, and institutional staking services.

Hubbard confirmed partnerships form part of the institutional staking strategy. He cited a partnership with global asset manager VanEck as an example. The company reported that quarterly results rose 69% year on year.

Staking and validator rewards totaled 9,787 SOL during the quarter. This figure marked a 120% increase from the same quarter last year. The company linked this rise to expanded Solana-focused infrastructure operations.

SOL Strategies also reported growth in its Solana portfolio holdings. The portfolio increased to about 529,000 SOL from 139,726 previously recorded. The company attributed the rise to balance sheet growth and higher Solana exposure.

The February update included governance changes before the annual shareholder meeting on March 31. The company confirmed that Michael Hubbard will transition from interim to permanent CEO. SOL Strategies previously operated as Cypherpunk Holdings before rebranding in September 2024.

The company acquired SOL during the second quarter of 2024. It later rebranded to reflect its focus on Solana validators and staking services. SOL Strategies stock has declined 75.81% over the past six months despite the recent 21% rise.

Crypto World

iPhone Crypto Wallets Under Attack from State-Grade Malware

The era of assumed iPhone invincibility is over for mobile crypto traders. A sophisticated new threat, the ‘Coruna exploit kit’, is actively leveraging 23 disparate iOS vulnerabilities to bypass Apple’s top-notch security and drain crypto wallets.

According to a new Google TAG report, the kit does not just crash apps or serve ads. It silently scans for BIP39 seed phrase theft, extracts QR codes, and siphons private keys from unpatched devices. The funds are gone before the user realizes the browser has been compromised.

That matters. For years, advanced exploit chains were the exclusive domain of nation-state intelligence agencies. Coruna marks a terrifying regime change: state-grade surveillance tools have been repackaged for mass-market retail theft.

This iPhone crypto wallet warning comes as Chainalysis reported in 2025 that the crypto theft market is valued at over $75Bn, with wallet drainers accounting for a large amount of that figure.

How Coruna Exploits 23 iOS Vulnerabilities to Drain Crypto Wallets

The Coruna exploit kit is a highly efficient “1-click” attack that activates when a user visits a compromised site, often posing as a gambling or news platform.

It targets vulnerabilities in WebKit to breach the device, then uses local privilege escalation exploits to escape the browser’s sandbox.

Analyzing iOS versions 13.0 to 17.2.1, Coruna employs multiple entry points to deliver a crypto wallets drainer designed to steal blockchain assets.

It scans the file system for cryptocurrency-related strings, checks the photo library for QR codes, and extracts mnemonic phrases from the Notes app.

This automated exploitation can result in immediate and irreversible theft of assets, and any iPhone user who uses their device for crypto trading and asset storing needs to stay vigilant.

DISCOVER: Next Crypto to Explode in 2026

State-Grade Malware Goes Mass Market

Previously, exploit chains of this complexity were hoarded by entities like NSO Group for targeted surveillance of high-value targets—dissidents, journalists, or diplomats.

Coruna flips the script. It takes vulnerabilities weaponized in campaigns like Operation Triangulation, a suspected state-sponsored attack, and hands them to financially motivated criminal groups.

The barrier to entry for executing a sophisticated MetaMask hack or draining a Trust Wallet has collapsed, and even the most inexperienced tech heads can now carry it out.

This follows a disturbing pattern whereby tools developed for espionage inevitably leak into the broader cybercriminal ecosystem. The attackers behind Coruna are not looking for state secrets. They are looking for liquidity.

This is industrial-scale theft. The iVerify security firm documented the exploit affecting at least 42,000 devices, with total losses not yet announced.

Who Is Being Targeted and Why Mobile Crypto Traders Are Especially Exposed

If you trade on mobile and hold self-custody wallets, you are the target profile. The attack vectors are often embedded in sites that crypto users frequent: unregulated gambling interfaces, dubious token claim pages, and third-party app stores.

The malware explicitly targets data directories associated with major non-custodial wallets. It looks for the encrypted vaults of MetaMask, BitKeep (now Bitget Wallet), and Trust Wallet. If the encryption is weak, or if the user has stored the password in a compromised keychain or note, the wallet is drained.

The risk is compounded by user behavior. Mobile traders frequently interact with DApps and sign transactions on the go, often prioritizing speed over security hygiene.

Coruna exploits this complacency. It doesn’t need to trick you into signing a bad transaction; it simply steals the keys to the castle while you browse.

For now, proceed with caution and consider moving your crypto funds to cold wallet storage, such as a Ledger or Trezor.

EXPLORE: Best Crypto Presales to Buy in 2026

The post iPhone Crypto Wallets Under Attack from State-Grade Malware appeared first on Cryptonews.

Crypto World

OKB price skyrockets after NYSE parent company ICE invests in OKX

- OKX token OKB jumped more than 50% to highs of $124 after a major announcement.

- NYSE parent company has invested in OKX at a $25 billion valuation.

- ICE’s move signals a strategic pivot toward tokenized securities and derivatives trading.

OKB, the native token of OKX, surged past the $100 mark following news of a major investment from Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange (NYSE).

The token jumped from around $77.65 to a high of about $124 before giving back part of the gains.

The move came as the broader cryptocurrency market moved higher after a difficult start to the month.

ICE invests in OKX at $25 billion valuation

An announcement on March 5, 2026, said Intercontinental Exchange (ICE), the parent of the New York Stock Exchange, has taken a minority stake in OKX, valuing the crypto exchange at $25 billion.

The investment marks a notable endorsement of OKX by one of the world’s largest financial infrastructure providers. As part of the deal, ICE will take a seat on the company’s board and plans to support closer integration between traditional financial markets and digital assets.

The partnership will also see OKX provide ICE with live cryptocurrency price feeds. In addition, the exchange plans to list tokenized versions of NYSE-listed stocks and derivatives, making them available to its more than 120 million users.

The investment in OKX adds to ICE’s growing portfolio of digital asset initiatives as the company expands its strategy around blockchain and tokenized markets.

Earlier, ICE made a $2 billion investment in Polymarket at a $9 billion valuation and has also developed its own blockchain-based trading infrastructure.

Star Xu, founder and CEO of OKX, said in a statement:

“ICE has built and operated some of the most important financial infrastructure in the world, including the New York Stock Exchange and global derivatives and clearing platforms. Their decision to invest in OKX, and join our board, reflects a shared belief that digital asset technology will play an enduring role in the future of financial markets.”

OKB price outlook

OKB’s explosive rally reflects market enthusiasm for OKX’s enhanced legitimacy and growth potential.

The token’s daily trading volume surged by more than 1,600% to over $421 million as prices rose past $100.

The token’s price movement after the announcement helped bulls hit intraday highs last seen in December 2025.

As OKX’s utility token, OKB benefits from platform fees, staking rewards, and now tokenized TradFi products.

These avenues, likely to see further adoption impetus among institutional investors, could help bulls.

However, as the chart above shows, profit-taking has already pushed OKB to the key $100 level.

If the pullback from the intraday peak continues, immediate support lies at the $91 and the $80 levels.

Crypto World

Best Crypto to Buy Now: Pepeto Targets 100x Over DeepSnitch AI and ADA While Harvard and Abu Dhabi’s Mubadala Adopt Crypto ETPs

Harvard Management Company and Abu Dhabi’s Mubadala sovereign wealth fund have both adopted crypto exchange traded products according to Grayscale’s latest institutional report, and when the world’s richest university endowment and one of the Middle East’s largest sovereign funds both move into digital assets at the same time, it tells you the institutional wave is no longer a prediction, it is a fact.

The best crypto to buy now is the presale positioned to capture what follows before the listing reprices everything permanently.

Harvard and Abu Dhabi’s Mubadala Sovereign Fund Both Adopt Crypto ETPs

CoinDesk reported Grayscale’s 2026 outlook confirms Harvard Management Company and Mubadala have both adopted crypto exchange traded products, while CoinGlass data shows institutional positioning building across derivatives as pension funds and wealth managers complete their due diligence on digital assets.

When the smartest institutional money on the planet starts allocating, the best crypto to buy now is the one that gives retail traders the same infrastructure those institutions use, and Pepeto with $7.5M raised and a full exchange in development is exactly where that advantage lives.

What Is the Best Crypto to Buy Now as Institutions Flood Into Digital Assets?

Pepeto The Next 100x: The Exchange That Neutralizes the Institutional Advantage

The entry of sovereign wealth funds and university endowments into crypto highlights a critical reality: retail traders risk being outmaneuvered by institutions armed with superior data and limitless resources. Pepeto directly neutralizes this threat, which is exactly why investors call it the best crypto to buy now.

The exchange makes professional grade infrastructure available to every trader, providing the same cross chain bridging, zero fee execution, and risk scoring power that institutional desks access through expensive proprietary platforms. In simple terms, it puts every trader on the same playing field by connecting Ethereum, BNB Chain, and Solana into one liquidity layer where bridging, trading, risk scoring, and portfolio management all sit inside one interface.

The latest development milestone shows the exchange architecture is completely in development and functional, with a SolidProof audit backing every contract and a clean interface designed so both beginners and experienced traders can use it without friction.

The cofounder of the Pepe ecosystem who built a token to $7 billion leads the team, and with over $7.5M raised, the community is not just speculating, they are staking their conviction. More than 209% APY staking rewards are compounding daily, with a $10,000 position earning roughly $20,900 in yearly staking rewards, about $1,741 per month flowing into your wallet while the listing approaches and everyone else watches from the sidelines.

There is also growing confidence that Pepeto could list on major exchanges at $0.000000186, and the gap between presale pricing and listing valuation narrows every single day.

DeepSnitch AI Offers Analytics Without Exchange Scale

DeepSnitch AI positions itself as an AI powered intelligence platform with five agents for contract auditing and sentiment analysis, having raised roughly $1.8M. But the value depends on a narrow analytics niche with no exchange, no cross chain bridge, and no zero fee trading engine.

When Harvard and sovereign funds start flooding crypto with capital, traders need a platform to execute on, not just a dashboard to analyze, and the best crypto to buy now is Pepeto with the exchange infrastructure to capture that volume.

Cardano Recovers From $0.27 as Network Milestones Add Confidence

ADA is bouncing from $0.27 and attempting to reclaim $0.30 as AI price models and network milestones add confidence to the recovery thesis. But even the bullish $0.40 target is barely a 2x from current levels, and at $10 billion market cap, ADA needs sustained buying pressure for months.

The best crypto to buy now for the kind of returns that institutions are positioning for is the presale with exchange utility at a price that reprices the moment the listing arrives.

The Bottom Line

Harvard and Abu Dhabi’s sovereign fund are both in crypto now, and every time in this market’s history that the smartest institutional money moved in, the people who were already positioned before them made the kind of returns that changed everything about their financial future.

And Pepeto is that opportunity of 2026. The presale allocations are filling faster each week, the media has not even begun to cover what this exchange does, and every hour you hesitate is compounding profit flowing into wallets of people who already committed.

Visit the Pepeto official website and enter the presale before the institutional wave hits and this entry becomes the one you talk about with either pride or regret for the rest of the cycle.

Click To Visit Pepeto Website To Enter The Presale

FAQs

What is the best crypto to buy now?

The best crypto to buy now is Pepeto with exchange infrastructure in development. Visit the Pepeto official website.

Why does Harvard adopting crypto matter?

Harvard and Mubadala adopting crypto ETPs confirms institutional capital is arriving at scale, and the best crypto to buy now captures that wave before the listing reprices everything.

How does Pepeto compare to DeepSnitch AI?

Pepeto builds a complete exchange with bridging, zero fee trading, and risk scoring, while DeepSnitch AI offers analytics tools without any future adoption.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Fanatics and ZunaBet Face Off

Online gambling attracts entrants from unexpected directions. Sports merchandise empires and cryptocurrency startups both see paths forward.

Fanatics transformed sports retail dominance into gambling ambition. ZunaBet launched in 2026 with blockchain assumptions built into everything.

Two newer platforms. Two completely different visions.

The Fanatics Story

Fanatics became synonymous with sports merchandise. Licensed jerseys, collectibles, and fan gear built a retail empire.

Gambling seemed natural next. Existing sports customers already cared about games and outcomes.

Fanatics Sportsbook and Casino entered regulated American markets. State licensing determines where players access services.

The game library continues growing. Newer market entry means ongoing development.

Banking handles all transactions. Cards, transfers, e-wallets process through traditional financial systems.

Withdrawal timing follows standard patterns. Several business days covers most situations.

Welcome bonuses stay competitive. Deposit matches and credits attract new accounts.

FanCash connects gambling to merchandise. Rewards convert to spending money at Fanatics retail.

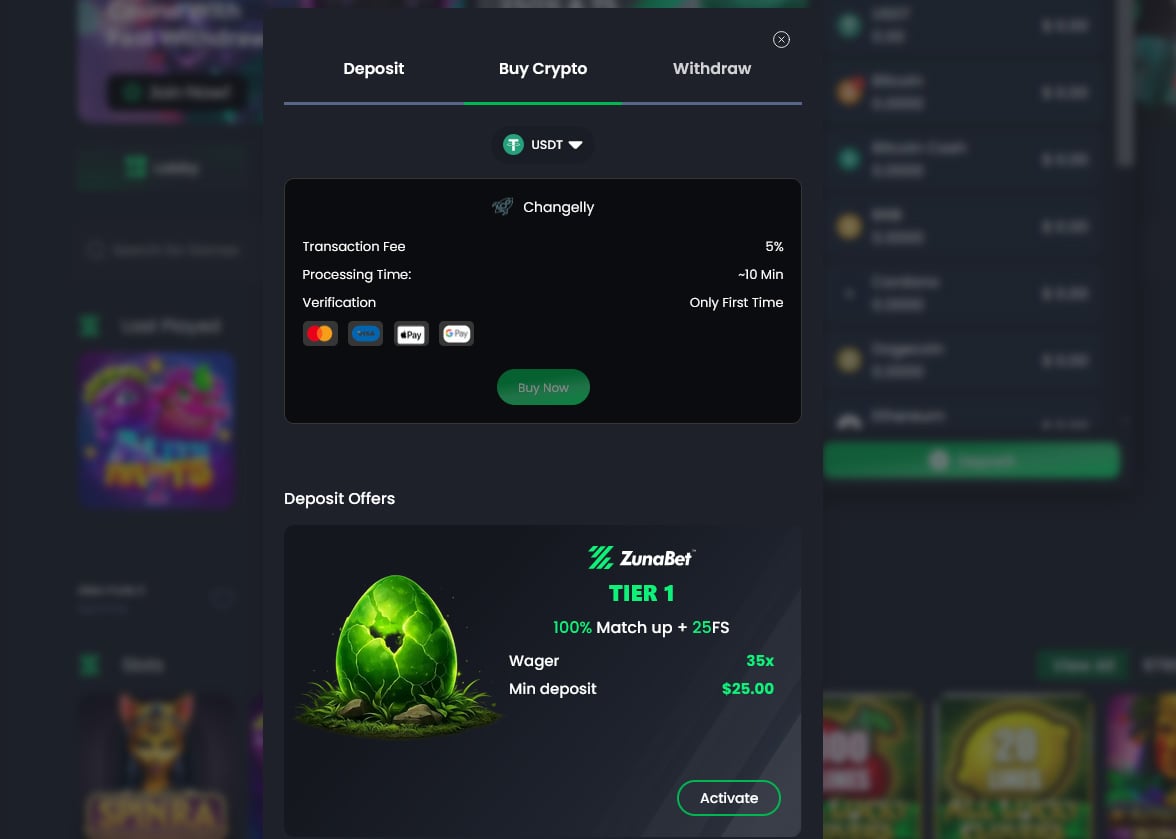

The ZunaBet Story

ZunaBet materialized in 2026 from different origins. Strathvale Group Ltd built specifically for cryptocurrency players.

Team experience exceeds 20 years combined. Anjouan licensing provides regulatory framework.

Game volume hit 11,000+ titles immediately. Sixty-three providers created instant depth.

Provider names include Pragmatic Play, Evolution, Hacksaw Gaming, Yggdrasil, BGaming. Recognized quality throughout.

Twenty-plus cryptocurrencies work natively. BTC, ETH, USDT, SOL, DOGE, ADA, XRP among options.

Platform fees remain zero. Withdrawal speed exceeds banking capability.

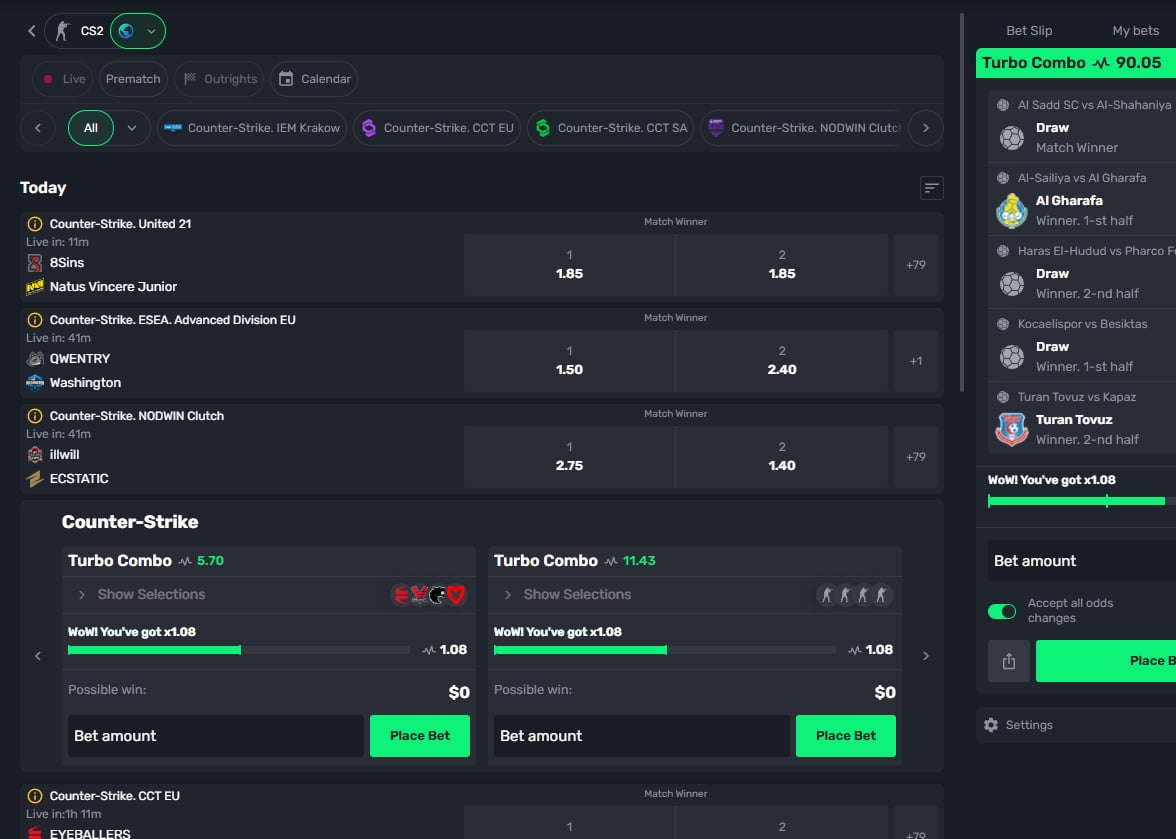

Full sportsbook runs alongside casino. Sports, esports, virtual events all active.

Breaking Down Bonuses

Fanatics competes within regulated frameworks. Welcome packages include deposit matches.

State and timing affect specifics. Checking current offers reveals details.

ZunaBet reaches $5,000 plus 75 free spins maximum. Three deposits capture everything.

First deposit gets 100% to $2,000 plus 25 spins. Second gets 50% to $1,500 plus 25 spins.

Third gets 100% to $1,500 plus 25 spins. Completion requires commitment.

Multi-deposit structure sustains engagement. Single offers often end quickly.

Terms apply everywhere. Reading conditions matters.

Contrasting Loyalty Models

Fanatics invented FanCash linking gambling and shopping. Points become merchandise spending power.

Jersey buyers and memorabilia collectors benefit naturally. Shopping rewards and gambling unite.

Players without merchandise interest gain less. Value requires retail participation.

ZunaBet engineered dragon evolution instead. Six tiers deliver increasing rakeback.

Squire begins at 1%. Warden provides 2%, Champion provides 4%.

Divine reaches 5%. Knight reaches 10%.

Ultimate peaks at 20% rakeback. Consistent play generates consistent returns.

Free spins climb to 1,000 through progression. VIP perks supplement core rewards.

Dragon mascot Zuno visualizes advancement. Progression feels like achievement.

Rakeback equals direct money. Merchandise credits require shopping.

Payment System Divide

Fanatics depends on banking entirely. Financial institutions process everything.

Cards deposit fast. Withdrawals queue behind processing.

Business hours govern timing. Weekends pause activity.

Bank statements show gambling clearly. Visibility may concern some.

ZunaBet operates outside banking. Wallets connect without intermediaries.

No bank involvement means no bank timing. Crypto speed governs.

Twenty-plus coins accepted. Multi-chain support included.

Platform fees nonexistent. Network fees only.

Privacy comes standard. Bank records untouched.

Game Selection Gap

Fanatics libraries continue development. Recent entry limits current scale.

State rules add complexity. Geographic availability varies.

Categories receive adequate attention. Slots, tables, live dealer present.

ZunaBet’s 63 providers create abundance. Eleven thousand games exist now.

Independent studios join major names. Unique titles appear.

Slots lead numerically. Tables and live complete offerings.

Evolution powers live dealing. Pragmatic powers slot volume.

Exploration takes dedication. The scale demands it.

Sports Betting Scope

Fanatics Sportsbook reflects retail DNA. American sports merchandise drives focus.

NFL, NBA, MLB, NHL dominate coverage. College sports supplement.

Brand alignment shapes priorities. Betting follows merchandising.

ZunaBet thinks globally. International coverage equals domestic.

World football alongside American leagues. Tennis, basketball, combat sports featured.

Esports goes deeper. CS2, Dota 2, League of Legends, Valorant active.

Virtual sports constant. No gaps between events.

Both unify casino and sportsbook. Single accounts serve both.

Using Each Platform

Fanatics apps cover iOS and Android. Browsers serve desktop.

Corporate sports design guides aesthetics. Functionality reliable.

ZunaBet spans iOS, Android, Windows, MacOS. Apps exceed browsers.

Dark themes look current. HTML5 speeds loading.

24/7 chat support available. Help exists constantly.

Mobile works both places. Transitions smooth.

Matching Players to Platforms

Fanatics attracts sports merchandise devotees. FanCash shoppers maximize value.

Banking users stay comfortable. Familiar methods continue.

Sports-centric bettors find brand alignment. Collecting and gambling connect.

ZunaBet attracts cryptocurrency holders. Coins integrate directly.

Bonus seekers find higher numbers. The $5,000 package leads.

Rakeback calculators should engage. Twenty percent compounds meaningfully.

Privacy seekers benefit structurally. Banks stay uninvolved.

Variety seekers discover abundance. Eleven thousand games await.

Industry Positioning

Fanatics leverages customer base enormously. Millions of retail customers exist.

Development follows compliance requirements. Growth proceeds steadily.

ZunaBet caught rising cryptocurrency waves. The 2026 timing worked.

Younger demographics own crypto. Native platforms feel right.

Dragon loyalty challenges merchandise models. Cash beats shopping credits.

Massive libraries attract curious players. Limited selection constrains.

Innovation energy flows toward crypto. Traditional builds incrementally.

Projecting Forward

Fanatics will expand gambling steadily. Resources and customers ensure continuation.

The retail connection differentiates uniquely. Jerseys plus jackpots works.

ZunaBet represents acceleration elsewhere. Crypto-first matches emerging preferences.

Eleven thousand games provides immediate depth. Twenty percent rakeback provides immediate value.

Neither suits everyone perfectly. Background determines appropriateness.

Merchandise lovers find Fanatics logical. Crypto holders find ZunaBet logical.

One merges shopping and gambling. One merges crypto and gambling.

Both newer brands compete differently. Both target different futures.

Fanatics bets on sports retail loyalty. ZunaBet bets on cryptocurrency adoption.

Current trends favor crypto trajectories. Younger players normalize it.

ZunaBet positioned accordingly. Game volume, bonus size, rakeback transparency align with generational shifts.

The question of competition resolves situationally. Different players answer differently.

For cryptocurrency believers seeking excitement, ZunaBet delivers more. Innovation and player value concentrate there.

For merchandise collectors seeking integration, Fanatics delivers more. Retail connection creates unique appeal.

Both can succeed serving different audiences. The market accommodates multiple approaches.

But momentum tells a story. Crypto-native platforms attract energy and attention.

ZunaBet exemplifies that momentum. A newer brand can absolutely compete.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

from the “unbrokeraged” to the universally invested

In today’s newsletter, Nick Ducoff, head of institutional growth at the Solana Foundation, draws a parallel between tokenization’s ability to democratize investment access and how the Internet facilitated access to banking over fifteen years ago.

Then, in Ask an Expert, the CoinDesk Research Team answers questions about stablecoin and tokenization trends from their February 2026 Stablecoins & Tokenization Assets Report. Read the full report here.

Internet capital markets: from the “unbrokeraged” to the universally invested

Fifteen years ago, over 60 million Americans were “unbanked,” shut out of basic financial services because traditional banks found them unprofitable. Then Chime, Revolut, and other fintech pioneers brought banking to smartphones, eliminating legacy barriers like minimum balances and penalty fees. Today, we face an even larger exclusion problem: billions of people are effectively “unbrokeraged,” with no access to capital markets and the investing opportunities to build generational wealth.

Enter Internet Capital Markets: global, always-on infrastructure where assets are born digital, traded mobile-first and available to anyone with a smartphone 24/7. With blockchain technology, Internet Capital Markets are poised to do for investing what fintech did for banking. And the opportunity is immense.

The scale of financial exclusion

The “unbrokeraged” encompasses two distinct but overlapping populations: those who lack brokerage accounts entirely, and international investors who can’t efficiently access high-quality U.S. dollar-denominated assets. Consider Pakistan, where, according to Bilal Bin Saqib, Chairman of the Pakistan Virtual Assets Regulatory Authority (PVARA) and CEO of the Pakistan Crypto Council, only 300,000 people hold brokerage accounts while 40 million have cryptocurrency wallets. The infrastructure exists, but financial products remain overwhelmingly inaccessible.

Even when access to U.S. markets exists through local brokers, international investors often pay significant premiums, to mention nothing of the large minimums and investor accreditation that the private markets require. These aren’t products accessible for the global middle class — they are built to serve the already-wealthy.

Tokenization expands the playing field

Blockchain tokenization transforms these dynamics by enabling fractional ownership, eliminating intermediary costs and operating 24/7 with instant settlement. The result: dramatically lower minimums and global accessibility. Consider Hamilton Lane, a leading alternative asset manager. Through Republic Crypto, investors can now access Hamilton Lane private market exposure for as little as $500. That’s a thousand-fold reduction in the entry barrier compared to traditional private fund minimums, and a signal of how internet-native market infrastructure can finally make fractional access more readily available.

The recent BitGo IPO also shows tokenization’s democratizing potential. When BitGo went public on the New York Stock Exchange, tokenized representation of BitGo stock was simultaneously tradable on Solana, allowing anyone globally with a Solana wallet to purchase BitGo stock immediately. This evolution toward real-time, global accessibility is now being validated by the world’s largest asset managers: BlackRock and Franklin Templeton have launched tokenized money market funds on public blockchains, allowing for 24/7 liquidity and transparency.

Why this infrastructure matters

Tokenization expands access rather than competing with traditional markets. The blockchain operates continuously, enabling investors in Jakarta, São Paulo, or Lagos to buy assets the moment they become available, not when their local markets open. Settlement happens instantly against stablecoins, eliminating the multi-day clearing processes and currency conversion fees that hinder retail investors outside of the U.S.

Speed and cost matter. High-performance blockchains like Solana, along with Layer 2 scaling solutions on Ethereum, can process thousands of transactions per second for fractions of a penny, making the economics of fractional ownership actually work. This is the foundation of “universal basic ownership,” where anyone with a phone can now have a stake in the global economy’s growth, even across asset classes like pre-IPO stocks and private credit, once strictly gatekept to institutions and the ultra-wealthy.

The advisor’s edge: strategy and accessibility

For financial advisors, this transition represents a strategic exposure play. Accessibility is now streamlined through regulated vehicles like spot Solana ETFs (e.g., SOEZ, QSOL, BSOL) and European ETPs, alongside user-friendly digital custody tools such as Phantom or Ledger wallets. Now, advisors can utilize sub-cent transaction costs to offer sophisticated, fractionalized portfolios to a much broader client base. This infrastructure lowers the “cost to serve,” making institutional-grade diversification available to the middle-class “mom and pop” investors through their financial advisers.

From unbrokeraged to universally invested

The fintech wave of the 2010s proved that financial exclusion is a design problem. Tokenization represents the next chapter in this story. A software developer in South Korea shouldn’t face barriers to investing in U.S. equities or accessing private credit returns. A small business owner in Argentina shouldn’t pay premium prices for the same stocks available cheaply to American investors. Sophisticated investment strategies shouldn’t remain exclusively in wealth management channels serving the top 1%.

The technology rails have been built, and regulatory pathways are becoming clearer. What remains is scaling this infrastructure and ensuring it serves its highest purpose of extending wealth-building opportunities to the billions currently locked out. While the work of banking the unbanked is far from done, it offers a blueprint for what we’re about to see: transforming the unbrokeraged into the universally invested.

– Nick Ducoff, head of institutional growth, Solana Foundation

Ask an Expert

Q: What are stablecoins and why are they important?

Stablecoins are a type of digital currency designed to maintain a stable value. This is usually achieved by “pegging” the stablecoin to a traditional asset, such as the U.S. dollar. Unlike other cryptocurrencies, such as bitcoin or ether, which may experience wide fluctuations in price, stablecoins are designed to allow users to hold or trade digital assets without exposure to price swings. Other use cases of stablecoins include serving as primary trading pairs, cross-border payments, decentralized finance (DeFi) lending and borrowing, and inflation hedging. The GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act), enacted in July 2025, creates a comprehensive federal regulatory framework for U.S. dollar-backed payment stablecoins.

Q: What is the current stablecoin landscape?

After rising for twenty-five consecutive months, the growth of the total stablecoin market capitalization has slowed over the past four months, though it continues to hover near its all-time high of $310 billion. CoinDesk’s latest research report indicates that as digital asset prices generally trend lower, the market dominance of stablecoins has surged. In February, Stablecoin market dominance surged to 13.3% (up from 11.2% in January), driven by the decline in price action of digital assets. Tether’s USDT continues to lead the sector with a 59.1% market share, while Circle’s USDC ranks second with 24.6%.

Q: What is the current traction for tokenized assets, and how quickly is the market for tokenized real-world assets growing?

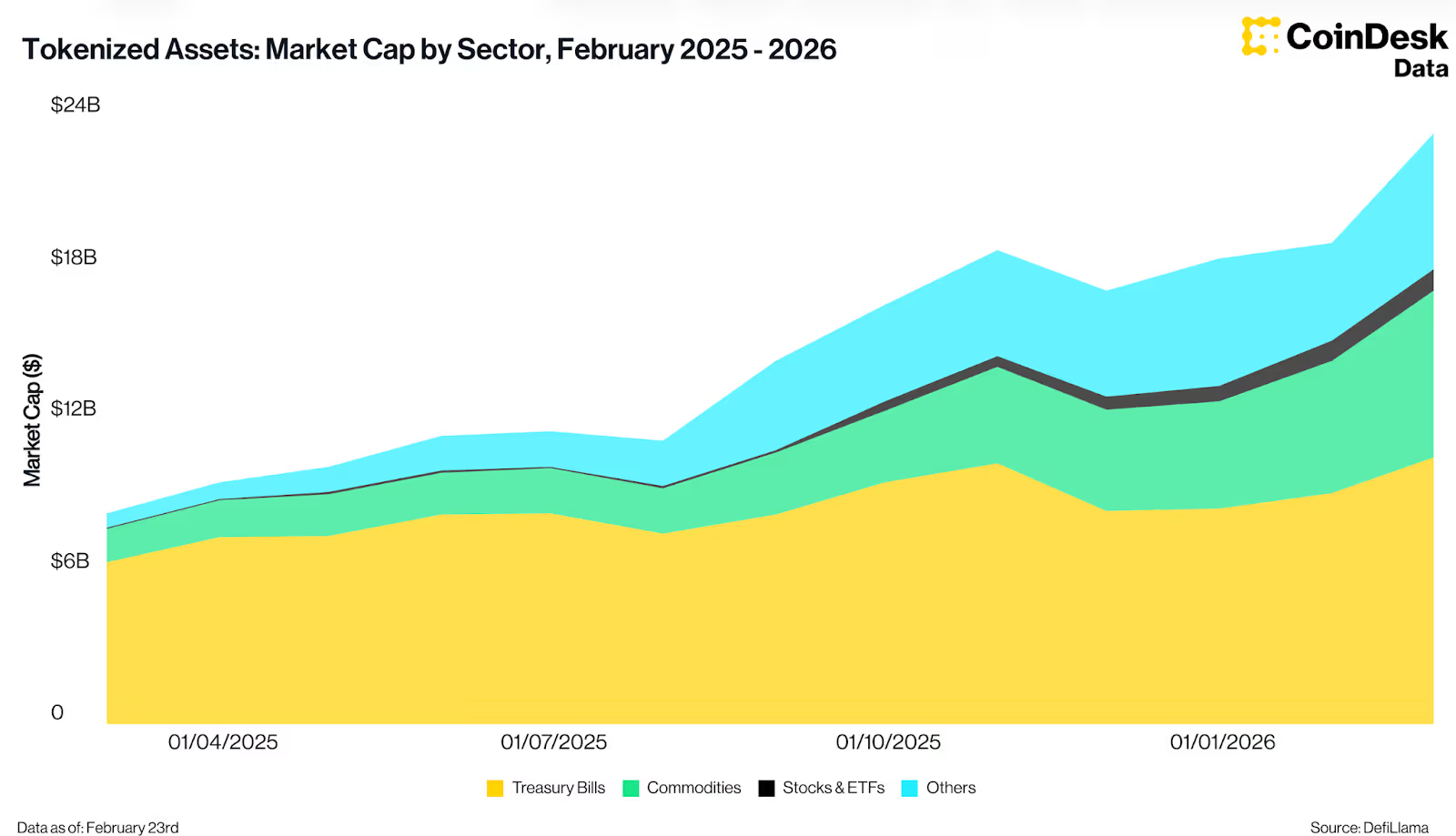

Tokenized real-world assets are continuing to gain meaningful traction in global financial markets, with the total tokenized market capitalization reaching a new all-time high of $23.4 billion by the end of February. This represents a 22.9% month-over-month increase from $19 billion in January, underscoring the accelerating pace of adoption across multiple asset classes. Much of this growth has been driven by tokenized Treasuries, which expanded 15.1% to $10.5 billion and now account for roughly 45% of the entire tokenized market. Meanwhile, tokenized commodities have emerged as a major secondary growth engine, surging 27% to $6.6 billion and representing 28.4% of the market. Other segments are also steadily developing. The Stocks & ETFs sector reached $804.7 million by late February, marking a 3.1% monthly increase and maintaining a 3.4% share of the overall tokenized ecosystem.

– Jacob Joseph, Specialist, Research, CoinDesk

Keep Reading

Crypto World

AI just bypassed the Cloudflare protection that DeFi needs

Despite launching countless branding exercises that feature the word “decentralization,” much of the crypto industry actually uses Cloudflare to defend large chunks of its user-facing infrastructure.

Indeed, Cloudflare protects crypto websites collectively processing billions of dollars worth of trades and receiving millions of visitors daily. However, this week, crypto learned that autonomous AI agents can apparently use an open-source library to walk right through several of Cloudflare’s lines of defense.

Most heard of the vulnerability from a headline about OpenClaw, an AI agent that runs on a Mac Mini or cloud server.

OpenClaws, formerly known as ClawdBots or MoltBots, can now use a free library called Scrapling to “bypass Cloudflare natively.”

“Scrape any website without getting blocked, with zero bot detection,” the developer wrote in a brief blurb on Github before releasing the code into the wild.

It soon rocketed to a #1 trending spot among Github repositories.

The age of homespun AI agents has arrived

Boasting concurrent, multi-session crawlers with realistic start/stop actions and proxy IP addresses, the Python library allows AI agents like OpenClaw and others to bypass “all types of Cloudflare’s Turnstiles and Interstitials.”

Not only that, its own benchmarks claim over 600 times the parsing speed of BeautifulSoup, a formerly impressive web crawler.

The age of homespun AI agents is here, and the traditional armor that crypto has employed to protect its websites against crawlers, spiders, Denial of Service (DoS) attacks, and hackers of all types is starting to crack.

Through the use of human-mimicking behavior and AI adaptation, an OpenClaw agent can trick sophisticated forms of bot detection. Even more devastatingly, it can operate on commodity hardware and volley attacks for a few cents.

DeFi keeps relying on Cloudflare while losing millions

Decentralized Finance (DeFi) has already learned — repeatedly and expensively — what happens when its Cloudflare-dependent front-ends fail.

Although it doesn’t have 1:1 similarity with the capabilities of Scrapling, the most obvious example of crypto’s reliance on Cloudflare remains BadgerDAO.

In December 2021, an attacker compromised a Cloudflare Workers API key.

The attacker used that key to inject a malicious script into BadgerDAO’s front-end, tricking users into signing token approvals. It drained $130 million.

Consider another example. Curve Finance suffered Domain Name System (DNS) hijacks in August 2022 and again in May 2025.

Each time, attackers accessed its registrar and redirected traffic away from Cloudflare’s nameservers to malicious clones.

The 2022 attack cost users over $500,000. The 2025 attack forced Curve to abandon its “.fi” TLD entirely and migrate to Curve.finance.

Read more: Saga becomes latest victim in DeFi hacking spree

The pattern only accelerated. In July 2024, a single DNS attack on Squarespace put 228 DeFi protocol websites at risk, including Compound and Celer Network.

Aerodrome Finance,a decentralized exchange (DEX) on Coinbase’s Base network, lost over $1 million in a November 2025 DNS hijack. OpenEden disclosed a DNS compromise on February 16, 2026. Curvance detected and blocked a front-end attack on the same day.

Every one of these attacks exploited the gap between decentralized smart contracts and the centralized web infrastructure that users actually touch: DNS records, content delivery network (CDN) scripts, and Cloudflare configurations.

Although Scrapling is too new to boast of any crypto hacks to date, there might be victims in coming days, unfortunately. Its primary intention is to scrape and download content, not hack Defi, of course. Hopefully, developers and OpenClaw users use it for its legal and intended purposes.

Scrapling lowers the Cloudflare shield

The traditional defense model assumed that bot detection, fingerprinting, and Cloudflare’s Turnstile challenges could keep automated traffic out. Scrapling breaks some of those assumptions through AI.

Its developer describes, in language probably only developers understand, about packaging TLS fingerprint spoofing, headless detection avoidance, Canvas noise generation, and WebRTC leak mitigation into a composable library.

A third party analysis noted that the core breakthrough “wasn’t a single new trick.” Instead, it was the combination of multiple AI skills to trick cybersecurity services.

Cloudflare’s own documentation warns developers to “never trust client-side validation alone.” Unfortunately, many DeFi frontends treat Cloudflare challenge widgets as sufficient, leaving backdoors open to tools that can fake a passed challenge on the client side.

The crypto industry spent five years and hundreds of millions in user losses learning that Cloudflare is a speed bump, not a wall. Scrapling just used AI to hop over again.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

here’s why the Dow Jones is crashing

The Dow Jones Index resumed its downward trend today, March 5, as the war in the Middle East continued and odds of a ceasefire happening between Iran and the United States fell on Polymarket.

Summary

- The Dow Jones Index retreated by over 500 points on Thursday.

- Traders on Polymarket believe that there will be no ceasefire any time soon.

- The index has formed a rising wedge pattern, pointing to more downside.

The Dow Jones Index, which tracks the performance of 30 large American companies, retreated by over 500 points. Similarly, the other top blue-chip indices like the S&P 500 and Nasdaq 100 fell by over 0.10%.

This retreat happened as Iran denied reports that it had reached out to the United States for talks on how to end the ongoing war. As a result, odds of a ceasefire happening this month tumbled to 27%. Similarly, the odds of a ceasefire happening in April fell by 23% to 48%.

As a result, the Fear and Greed Index continued falling, moving to the fear zone of 39. At the same time, the price of crude oil continued rising, with Brent moving to $85 and the West Texas Intermediate moving to $78.

A prolonged war in the Middle East is risky for the stock market because of the fresh supply chain shocks that will happen. It also risks stoking inflation, which will make it hard for the Federal Reserve and other central banks to cut interest rates soon.

Most companies in the Dow Jones Index were in the red, with Walmart falling by 3.90%. Merck shares fell by 3.2%, while Sherwin-Williams, Procter & Gamble, Johnson & Johnson,and Amen falling by over 2.50%.

Only four companies in the index rose today. Salesforce stock jumped by 4.46%, while IBM, Chevron, and Microsoft rose by 1.90%, 1.01%, and 0.60%. Chevron is benefiting from the ongoing crude oil and natural gas prices surge.

Dow Jones Index is at risk of falling further

The blue-chip Dow Jones Index has retreated substantially in the past few weeks. This retreat started after it moved to the psychological level of $50,000. It is common for an asset to retreat after testing such a significant level.

The stock retreated after the two lines of the rising wedge pattern neared their confluence. A rising wedge is a highly accurate reversal chart pattern.

It is now nearing the 23.6% Fibonacci Retracement level. Also, it has already moved below the 50-period moving average. Whenever an asset drops below that average, it is usually a sign that bears have prevailed.

The Average Directional Index has rebounded to 15, a sign that the sell-off is gaining momentum. Therefore, the most likely Dow Jones Index forecast is bearish, with the next key target being the 23.6% retracement level at $47,250.

Crypto World

Kraken’s xStocks Launches Unified Liquidity Layer for Tokenized Stocks

The new platform, xChange, enables cross-chain trading of over 70 tokenized stocks across Ethereum and Solana.

Kraken’s tokenized stock platform, xStocks, has unveiled xChange, a multi-chain execution layer for tokenized equity trading. The new platform enables cross-chain transactions on Ethereum and Solana, and supports over 70 tokenized stocks directly on-chain, according to an announcement from Kraken today, March 5.

By supporting cross-chain trading, xChange aims to boost liquidity and accessibility, allowing traders to operate seamlessly across two largest blockchain networks in DeFi by total value locked.

Ethereum and Solana, the two blockchains supported by xChange, have a DeFi TVL of approximately $58.6 billion and $8.2 billion, respectively, per data from DefiLlama.

The new execution layer for xStocks operates 24/5, per the announcement. Backed, the developer of xStocks, originally launched the tokenized equities alongside crypto exchange Kraken last June. By August, the platform reported $500 million in total on-chain transaction volume, while today’s announcement says that number has reached over$ 3.5 billion in total.

Kraken acquired Backed in December, as The Defiant reported. xStocks are available to traders outside of the United States, giving exposure to tokenized versions of U.S. equities that are backed 1:1 by underlying shares, today’s announcement notes.

This article was generated with the assistance of AI workflows.

Crypto World

BTC rally comes under pressure Thursday

Bitcoin’s early-week rally began to fade after U.S. markets opened Thursday, sending the cryptocurrency by nearly 2% over the past 24 hours to $71,400.

The move comes alongside declines in broad equity markets as the Iran war shows little sign of moving to a quick conclusion, sending oil higher by 5.3% to $78.70 per barrel. The Dow Jones Industrial Average is down 1.4% and S&P 500 by 0.7%.

The Nasdaq, though, is down just 0.4% as the previously battered software sector catches a major bid. The iShares Expanded Tech-Software Sector ETF (IGV) is ahead 2% and now up by about 9% over the past five sessions.

That divergence is notable, as bitcoin has been closely linked to the software sector, both tumbling in concert since October amid investor concerns over AI disruption and each bouncing from their lows in tandem in recent days.

New bull or bear market bounce?

Bitcoin “isn’t in the clear yet,” said Arthur Hayes, CIO of Maelstrom, noting that despite the rally to $74,000, the correlation with the IGV ETF remained. Whether Thursday’s decoupling will last remains to be seen, but software names pushing higher while bitcoin retreating is not what crypto bulls wanted to see. “It could be a dead cat bounce,” Hayes continued.

Traders today might also be taking some chips off the table ahead of Friday’s key U.S. jobs report for February. The economic data of late has mostly surprised to the upside, pushing down odds for a restart of Federal Reserve rate cuts.

Interest rate traders at the Chicago Mercantile Exchange now see an 88% chance that the Fed will keep rates steady not only at this month’s meeting but in April as well. A month ago, those odds were at 59%.

“We’re cautiously constructive, but the geopolitical tail risk demands humility,” said Bryan Tan, trader at Wintermute. He said improving flows into spot bitcoin exchange-traded funds (ETFs), which have recorded nearly $2 billion in inflows in the past week alone, alongside stabilizing trading volumes, are supporting the market, while muted reaction to disruptions around the Strait of Hormuz could leave room for bitcoin to climb toward the $74,000-$75,000 range.

Bitfinex analysts said there’s been a “notable increase in spot market strength,” indicating the recent move higher was driven by market buyers rather than speculative leverage.

“We consider there to be a possibility of relief over the coming weeks and months should this trend follow through,” they added.

-

Politics7 days ago

Politics7 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics2 days ago

Politics2 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech5 days ago

Tech5 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports6 days ago

The Vikings Need a Duck

-

NewsBeat5 days ago

NewsBeat5 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

Tech10 hours ago

Tech10 hours agoBitwarden adds support for passkey login on Windows 11

-

Entertainment3 days ago

Entertainment3 days agoBaby Gear Guide: Strollers, Car Seats

-

Tech6 days ago

Tech6 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Business7 days ago

Business7 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat4 days ago

NewsBeat4 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat3 days ago

NewsBeat3 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Crypto World7 days ago

Crypto World7 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

Tech4 days ago

Tech4 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video3 days ago

Video3 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business2 days ago

Business2 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

Confirmed & Analyzed

Confirmed & Analyzed

BREAKING: New "Coruna" iOS Exploit Targets Crypto Wallets!

BREAKING: New "Coruna" iOS Exploit Targets Crypto Wallets!