Crypto World

ASTER Price is 80% Below ATH as Accumulation Builds Near $0.50

TLDR:

- ASTER trades near $0.50, almost 80% below its all-time high within a defined descending channel.

- MACD compression and RSI stability show weakening selling pressure and controlled price behavior.

- The $0.35–$0.50 zone attracts long-term positioning as volatility remains low and structure holds.

- A close above $0.72 could confirm a shift from accumulation into a new expansion phase.

ASTER currently trades around $0.49, down over 80% from its all-time high near $2.42. Price is showing a developing accumulation phase within the descending channel.

Indicators are suggesting that selling pressure is fading. Traders are monitoring for a close above resistance to confirm a potential structural shift.

Price Structure and Accumulation Zone

ASTER trades near $0.50 after declining from its all-time high of $2.43. This level places the asset close to 80% below peak value.

Price has continued to respect both channel resistance and channel support, showing controlled movement rather than disorderly selling. A crypto market analyst reported that this pattern reflects a transition from distribution into accumulation.

Market participants’ attention is on the accumulation range between $0.35 and $0.50. This zone aligns with historical demand and the lower boundary of the channel.

Traders are aware of downside risk within this range but are still maintaining exposure to long-term upside. The structure favors laddered entries instead of single large positions.

Volatility remains compressed, which reduces emotional trading behavior and supports gradual positioning.

Attention remains fixed on the $0.72 resistance level as the main structural trigger. A close above this area would break the descending channel from resistance to support.

Such a move would signal the end of accumulation and the start of expansion. This would likely attract capital that waits for confirmed structural reversals.

Indicator Signals and Long-Term Price Framework

ASTER price continues hovering near $0.56 after several weeks of sideways movement. Such compression usually appears after extended bearish momentum has weakened.

A market observer stated that slow price action often marks late-stage weakness rather than renewed selling cycles.

The MACD remains below the zero line, confirming that the broader trend has not turned bullish. However, the histogram has flattened, and the signal lines remain tightly compressed.

This configuration shows that selling strength is declining instead of increasing. RSI trades between 38 and 40 and forms higher lows while the price remains flat.

Technical analysts have described this pattern as controlled weakness combined with gradual absorption of supply.

Long-term resistance levels provide a roadmap for future price movement. The first resistance zone stands near $1.38, followed by a potential all-time high retest around $2.41.

Extended targets near $5 and $10 correspond with macro expansion phases if structure shifts upward. ASTER long-term accumulation now depends on patience, defined support, and confirmation above $0.72.

Current market conditions favor positioning during compression rather than chasing momentum during expansion.

Crypto World

Michael Saylor’s Strategy sheds $6 billion in a day — again

On March 20, 2000, Strategy (formerly MicroStrategy) co-founder and then-CEO Michael Saylor lost $6 billion in one day — more money than any public company executive had ever previously lost in a single day.

He — and Strategy shareholders — lost even more yesterday.

Strategy opened for trading yesterday at a 52-week low after missing out on a $33 billion profit. Somehow, things got even worse by dinnertime.

By 5pm, Saylor’s company admitted to losing $42.93 per share of MSTR in diluted earnings within the final three months of 2025. The stock also declined another 20% to below $102 — incinerating another $7 billion in market capitalization within 24 hours.

With a share price of just $102, the company posted a $15.23 per share loss for the 2025 calendar year.

$6 billion in more missed profit

The bad news continued. The foregone $33 billion profit that it had missed out on by Wednesday night had turned into a $39 billion missed profit just 24 hours later.

Strategy’s ex-general counsel Shao Wei-Ming sold another 3,000 shares of MSTR. The company posted an operating loss of $17.4 billion for Q4 2025 — 16.4x higher than Q4 of the prior year.

Its net loss per common share on a diluted basis was $42.93, as mentioned above, which calculates to a year-over-year increase of 1,316% in the wrong direction.

Dilution of MSTR continues

Its capital-raising abilities showed continued reliance on common stock dilution — despite months of attempts by management to switch the mix toward preferred shares.

From October 1, 2025 through February 1, 2026, the company’s at-the-market share sales relied on MSTR dilution for 79%: $7.8 billion compared to just $1.6 billion from preferreds.

Worse, revenues from product licenses from the company’s actual operating business, enterprise software sales, plummeted 48% from $15.2 million in Q4 2024 to less than $7.8 million in Q4 2025.

Revenue lines labeled Product Support and Other Services also declined, with only Subscription Services posting a year-over-year increase. General and Administrative costs also ticked higher.

Read more: Michael Saylor doesn’t believe BTC is digital money

Dividend payments to preferred shareholders — which did not exist in 2024 — dragged another $381.3 million out of the company in 2025.

The company’s flagship series of preferred, Stretch, which is the top focus of the company’s “laser-eyed” devotion, closed trading yesterday 6.3% below its intended $100 price, despite paying an 11.25% dividend and running X ads to motivate demand.

The company’s bitcoin (BTC) yield, a measure of management’s ability to accrete BTC per share by operating a good business and avoiding MSTR dilution, has slowed to a crawl in 2026.

As of February 1, BTC yield for common shareholders is just 0.3% year-to-date, which compares with formerly impressive figures of 7.3% in 2022, 74.3% in 2023, and 22.8% in 2024.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Ripple lays out institutional DeFi blueprint for XRPL with XRP at center

Ripple and XRPL contributors have outlined a growing set of “institutional DeFi” building blocks on the XRP Ledger that aim to make the network viable for regulated financial activity, per a Thursday blog.

XRP’s utility as a settlement and bridge asset is being highlighted as central to that infrastructure, with usecases ranging from from forex and stablecoin rails to tokenized collateral and native lending markets.

The latest roadmap emphasizes features already live — such as multi-purpose token standards (MPT), permissioned domains with compliance tooling, credential-backed access and batch transactions — alongside upcoming releases that extend XRPL into credit markets and privacy-preserving workflows.

Unlike many smart contract chains that bolt on compliance after the fact, XRPL’s approach has been to embed identity and control primitives at the protocol layer.

Permissioned domains and credentials allow markets to gate participation by verified entities, a requirement institutions often cite as a barrier to onchain integration.

On the payments and FX side, XRP’s role as an auto-bridge between assets continues to be cited as a demand driver, with stablecoin corridors and remittance flows adding to onchain volume and fee activity. Token escrows and object reserves denominated in XRP further tie network usage back to the native asset.

Looking ahead, the introduction of XLS-65/66 — the XRPL lending protocol — is slated to offer pooled and underwritten credit on ledger without entirely offloading risk logic onchain.

Single asset vaults, fixed-term lending and optional permissioning tools are designed to feel familiar to institutional risk managers while operating in an onchain settlement context.

Privacy features like confidential transfers for MPTs, arriving in the first quarter, aim to satisfy enterprise and regulatory expectations around transaction-level anonymity and controlled disclosure.

Critics have long pointed to XRPL’s lack of EVM-style programmability as a hindrance. The new EVM sidechain — bridged via the Axelar network — is meant to address this by letting Solidity developers tap into XRPL liquidity and identity features while accessing familiar tooling.

XRP prices are down 22% over the past seven days, in line with a broader market drop.

Crypto World

NFT Market Cap Returns to Pre-Hype Levels Near $1.5B

The global non-fungible token (NFT) sector fell below $1.5 billion in total market capitalization, returning to levels last seen before the sector’s rapid expansion in 2021.

The retracement unfolded alongside a broader crypto market downturn over the past two weeks, CoinGecko data shows. On Jan. 23, total crypto market capitalization stood at about $3.1 trillion, before falling to $2.2 trillion on Friday.

Major assets like Bitcoin (BTC) slid from around $89,000 to about $65,000, while Ether (ETH) fell from $3,000 to near $1,800 throughout the same time frame. Bitcoin and Ethereum are the top two networks for NFTs in terms of 30-day trading volume, according NFT data aggregator CryptoSlam.

The NFT market cap drop follows several high-profile closures and exits, highlighting the sector’s continued contraction.

Rising supply collides with falling demand

The market reset has been compounded by a growing imbalance between NFT supply and buyer demand.

As reported by Cointelegraph on Dec. 31, total NFT supply continued to expand even as sales and prices declined, pushing the sector into a high-volume, low-price structure.

CryptoSlam data showed that the number of NFTs in circulation rose to nearly 1.3 billion in 2025, up by 25% compared to 2024. Total NFT sales fell 37% year-over-year to $5.6 billion, while average sale prices slipped below $100.

The divergence suggests that while minting became cheaper and barriers to issuance fell, buyer participation and spending failed to keep up.

Related: US prosecutors drop OpenSea NFT fraud case after appeals court reversal

Corporate exits and platform closures add pressure

The drop follows a series of high-profile retreats that mirror the market’s pullback. On Jan. 7, footwear giant Nike quietly offloaded RTFKT, the digital collectibles studio it acquired at the height of the NFT boom.

The reported sale followed the company’s decision to shut down operations amid an investor lawsuit.

In addition, marketplace shutdowns have accelerated. Nifty Gateway, one of the earliest NFT platforms, said it will close on Feb. 23 and has entered withdrawal-only mode. The Gemini-owned platform cited a prolonged market downturn as it winds down.

On Jan. 28, social NFT platform Rodeo announced it would cease operations after failing to scale sustainably. Rodeo said it would transition to read-only mode before shutting down entirely in March.

Magazine: Digital art will ‘age like fine wine’: Inside Flamingo DAO’s 9-figure NFT collection

Crypto World

Gemini shutters operations across Europe and Australia to focus on the U.S. and prediction markets

Gemini Space Station Inc. (GEMI) is shutting down operations in the U.K., the European Union (EU) and Australia.

The crypto exchange is also reducing its staff by 25%, according to a blog post on Thursday that suggests it is focusing resources into prediction markets.

“Effective 6 April 2026, Gemini will be ceasing operations in the United Kingdom,” the crypto trading platform said in an email sent to customers seen by CoinDesk which does not mention Australia or Europe. “Starting 5 March 2026, all customer accounts in these regions will be placed in withdrawal mode.”

New York-based Gemini stated that it had partnered with brokerage platform eToro to assist customers with their offboarding process. It instructed customers to sign up with eToro so they could “assist in transferring your assets.” Full closures of all accounts will follow in April, the New York-based company said. New account creation and incentive programs will also be disabled.

Crypto equities have lagged broader markets as risk sentiment shifted in early 2026. While major stock indices have posted gains, leading digital-asset–linked equities have slid, reflecting waning investor appetite and tightening liquidity. This underperformance underscores a retrenchment of speculative capital from crypto-linked stocks.

Tyler and Cameron Winklevoss, CEO and President of Gemini, cited difficulties gaining traction in the U.K., Europe and Australian markets as their reason for exiting them, while saying the U.S. has been great to them.

“The reality is that America has the world’s greatest capital markets and America has always been where it’s at for Gemini,” they said. “So it’s time for Gemini to focus and double down on America.”

Tyler and Cameron also shared their view that prediction markets would outgrow capital markets, saying they have plans to venture into this sector.

“Our thesis is that prediction markets will be as big or bigger than today’s capital markets,” they said. “Our investment in securing a license to launch our own prediction marketplace positions us as an early mover on this new and exciting frontier.”

They added that more than 10,000 users have traded over $24 million since the debut of Gemini Predictions in mid-December.

Gemini, which went public in September, has seen its shares fall about 23% since the start of 2025 amid a broader downturn in crypto prices. The stock was down 2.8% on Thursday.

Read more: SEC dismisses lawsuit against billionaire Winklevoss twins-backed Gemini over Earn product

Crypto World

IREN and AMZ down on earnings miss, as BTC equities bounce back

IREN (IREN) earnings showed weaker than expected headline results, with the company missing consensus on both revenue and earnings per share (EPS) as it accelerates its transition from bitcoin mining to AI Cloud.

Financially, Q2 revenue declined to $184.7 million, missing expectations and down from $240.3 million in Q1, while the company reported a net loss of $155.4 million, also below consensus.

IREN secured $3.6 billion of GPU financing for its Microsoft contract which together with a $1.9 billion customer prepayment is expected to cover around 95% of GPU related capex.

Tech giant Amazon (AMZ) also missed expectations on EPS but beat on revenue, according to investing.com. Investor focus shifted to management’s plan to spend around $200 billion on capex in 2026, primarily AI related. Amazon shares are down 10%.

Pre-market update

Bitcoin rebounded from around $60,000 to $66,000, driving a broad rally across crypto exposed equities. Strategy (MSTR), the largest publicly traded holder of bitcoin, rose 7% in pre-market trading, mirroring a 7% gain for Galaxy (GLXY) and MARA Holdings (MARA) while Coinbase (COIN) increased by 6%.

Crypto World

Crypto market rebounds after BTC price tumbles to 2024 low: Crypto Markets Today

Thursday’s selloff was one of the sharpest and most devastating in crypto market history: More than $2.6 billion was liquidated as bitcoin tumbled to $60,000 to mark its lowest point since October 2024.

The drawdown led to bitcoin being the third most “oversold” in its history, according to the relative strength index (RSI), a momentum oscillator that tracks market conditions. Oversold conditions of this magnitude historically precede a major bounce.

The situation grew a bit brighter as Asia woke up, with bitcoin bouncing from $60,000 to above $65,000 while ether came off a low of $1,750 to trade back at $1,920.

Even so, the broader crypto market remains in a bear market. Privacy coin zcash has lost 34% of its value over the past week, while optimism , solana and ether are all dealing with losses of around 30%.

Traditional markets have also struggled in recent days. The Nasdaq 100 index dropped 6% since Jan. 28, and precious metals gold and silver are down by 12% and 38%, respectively, over the same period.

Derivatives positioning

- The crypto futures market is worth less than $100 billion for the first time since March 2025, as traders continue to reduce risk as prices slide and liquidations cause wealth destruction.

- Over $2.6 billion in leveraged futures bets have been liquidated, or forced closed, by exchanges due to margin shortage in 24 hours. Out of that, over $2.10 billion were long bets. This shows the degree of bullish leverage that was deployed around the pivotal $70,000 support, which was breached Thursday.

- Open interest (OI) has declined in futures tied to all major tokens, including recent outperformer HYPE.

- Annualized perpetual funding rates for major tokens such as BTC, SOL, XRP and DOGE have flipped negative as price crashes triggered demand for bearish bets. The negative rates could see arbitrageurs resort to reverse cash and carry bets.

- Bitcoin’s annualized 30-day implied volatility surged to nearly 100% late Thursday as traders scrambled to buy puts, with some snapping up these bearish bets at strike prices as low as $20,000. Since then, volatility has pulled back to under 70%. A similar pattern is seen in ether’s implied volatility.

- Still, bitcoin and ether short-term put options continue to trade at a volatility premium of 20 or more points to calls, a sign of lingering downside worries. Puts remain pricier at the long end as well.

- Options tied to BlackRock’s IBIT ETF saw record activity Thursday, with traders rushing to buy puts. The one-year skew rose to over 25 points, reflecting a massive premium for put options, indicating peak fear.

Token talk

- The altcoin sector presented a couple of unlikely winners despite the broader market decline on Thursday. Privacy-focused decred rose by 31% in 24 hours, seemingly unperturbed by the carnage as it added to a rally that has lifted it from $17.4 to $24.2.

- HyperLiquid’s HYPE token continues to perform well, relatively speaking, as it remains up 11% this week despite falling 4% in the past 24 hours.

- XRP was one of the most volatile altcoins, plunging by more than 30% before bouncing by 21%. Trading volume topped $14 billion, a 143% rise over 24 hours.

- The CoinDesk 20 (CD20) and CoinDesk 80 (CD80) both fell by around 6% in the past 24 hours, but the concerning corner of the market was DeFi, with the DeFi Select Index (DFX) underperforming the wider market with a decline of more than 10%.

- CoinMarketCap’s “altcoin season” indicator is now at 24/100, down from Wednesday’s high of 32/100, suggesting investors are seeking safer, less volatile assets like bitcoin or stablecoins.

Crypto World

Building Digital Economies with Metaverse Blockchain Games

For years, metaverse games were treated as experimental digital spaces, immersive, creative, but largely positioned as merely entertainment projects. However, that perception is changing rapidly.

Enterprises and forward-looking studios are no longer investing in metaverse blockchain games just to create virtual worlds. The focus is on building persistent digital economies where users socialize, trade, own assets, and generate value.

The shift is subtle but powerful. Metaverse game development is evolving from experiences into economic ecosystems. Businesses that understand this transition are positioning themselves at the forefront of the next digital economy wave. It is because the next generation of digital platforms will not simply be social networks or apps; they will be immersive environments where commerce, community, and ownership converge.

From Virtual Spaces to Economic Systems

A traditional virtual world offers exploration and interaction. On the other hand, a metaverse blockchain game introduces something far more powerful that is economic permanence. When assets exist on-chain & transactions are verifiable, the environment becomes more than just a playground, it becomes a marketplace and a functioning economy.

These ecosystems are built on several pillars:

- Digital Ownership

True digital ownership changes user psychology. When players genuinely own assets like characters, land, skins, or tools, they tend to treat them as investments rather than consumables. For enterprises, this increases willingness to spend and builds long-term emotional attachment. - Asset Scarcity

Scarcity drives perceived value. Limited or time-bound assets create collectability and stimulate secondary markets. When managed strategically, scarcity supports demand cycles and stabilizes ecosystem value. - Tokenized Economies

Tokens are not just rewards, they are economic instruments. At the time when structured properly, they guide participation, governance, and ecosystem sustainability. Enterprises can use tokenomics to align user incentives with platform growth. - Interoperable Assets

Assets usable across environments hold higher value. Interoperability reduces user risk and encourages deeper investment. It also enables cross-platform partnerships and larger ecosystem reach. - Transparent Transactions

Blockchain-backed transparency builds trust. Every trade and transfer is verifiable, thereby reducing disputes & reinforcing fairness both of which are critical for long-term economic health.

Players stop being mere participants. They become stakeholders. For enterprises, this transforms games into economic platforms.

Why Businesses Are Paying Attention

Decision-makers increasingly view metaverse blockchain games as strategic digital infrastructure rather than creative experiments.

- Brand Engagement at Depth

Unlike short campaigns, immersive worlds host users for hours. This builds emotional connection and stronger brand recall. - Digital Commerce Opportunities

Virtual goods, land, access passes, and collectibles open recurring revenue streams. These are not one-off purchases but parts of ongoing economies. - Loyalty & Membership Ecosystems

Ownership-based loyalty outperforms point systems. NFT or token memberships carry tradable value and exclusivity, driving retention. - Community-Led Growth

Users who own assets become advocates. When ecosystem success benefits participants, organic growth follows. - First-Mover Positioning

Early adopters gain insights, data, and ecosystem maturity before competitors enter. This builds defensible advantages.

It is exactly the reason why metaverse initiatives are now discussed in boardrooms, not just marketing teams.

Want to Build a Full-Scale Digital Gaming Economy?

The Role of Blockchain in Making Economies Work

Without blockchain, virtual economies rely on centralized control, which weakens trust and portability. The introduction of blockchain brings in:

- Verifiable Ownership

Ownership recorded on-chain gives users real control, not platform-dependent licenses. - Trustless Transactions

Peer-to-peer transactions reduce reliance on intermediaries, lowering costs and friction. - Smart Contract Automation

Rules execute automatically. Royalties, revenue splits, and governance can function without manual oversight. - Transparency

Open ledgers help reduce fraud and simplify the audit process. - Interoperability Potential

Shared standards allow assets to travel across platforms, increasing lifespan and utility.

When users trust the system, they invest more time and capital. That trust fuels sustainable economies.

Where Many Projects Go Wrong

Not every metaverse blockchain game succeeds. A number of them fail due to economic misdesign rather than technical flaws.

- Speculation-Driven Models

Short-term hype collapses without utility. - Inflationary Reward Systems

Over-issuance devalues tokens and drives users away. - Weak Governance

Without rules, economies tend to destabilize. - Poor Onboarding

Complex wallet flows deter mainstream users. - Infrastructure Gaps

Systems must be built to scale over time. Performance failures damage credibility.

What Sustainable Metaverse Economies Require

Persistent economies demand disciplined planning.

- Economic Modeling

Balanced supply-demand and token sinks maintain value. - Scalable Infrastructure

Cloud and blockchain must work together for real-time experiences. - Security Frameworks

Audited contracts and secure wallets protect ecosystems. - Governance Systems

Clear rules build confidence. - Live Economy Management

Economies need monitoring and tuning. - Content Pipelines

Fresh content sustains demand and engagement.

The Strategic Value for Businesses

Enterprises that invest thoughtfully gain:

- Recurring monetization channels

- High-value digital communities

- Long-term retention

- Behavioral data insights

- Brand differentiation

- Platform-level control over engagement

Instead of chasing users, they build environments users return to.

The Competitive Reality

The metaverse space is no longer empty. Major brands, gaming studios, and tech firms are actively experimenting and investing. As more players enter, the cost of late adoption rises.

Businesses that wait will have to face:

- Higher user acquisition costs

- Saturated virtual spaces

- Reduced novelty advantage

- Fewer partnership opportunities

Early movers, however, shape standards and user expectations. They build ecosystems before markets mature. This is not about rushing blindly; it’s about strategic timing. Businesses that plan now can enter with clarity rather than urgency later.

Why Development Expertise Matters

Metaverse blockchain games sit at the intersection of:

- Game design

- Blockchain engineering

- Economic architecture

- Security infrastructure

- Community mechanics

Poor execution doesn’t just create bugs; it destabilizes economies. A capable game development company understands how these layers interact to build sustainable ecosystems.

Final Thoughts

Metaverse blockchain games are no longer novelty projects. They are evolving into persistent digital economies where ownership, engagement, and value intersect. Enterprises recognizing this shift are not building games; they are building digital nations.

Antier, as a reliable metaverse game development partner, works with enterprises & studios to develop blockchain games designed for scalability, sustainability, and long-term economic participation. It is because the future of digital economies won’t just be visited, they’ll be lived in.

Frequently Asked Questions

01. What is the main shift in the perception of metaverse games?

The perception is shifting from viewing metaverse games as mere entertainment projects to recognizing them as platforms for building persistent digital economies where users can socialize, trade, own assets, and generate value.

02. How does digital ownership impact user behavior in metaverse games?

True digital ownership changes user psychology, leading players to treat their assets as investments rather than consumables, which increases their willingness to spend and fosters long-term emotional attachment.

03. What are the key pillars that support metaverse economic ecosystems?

The key pillars include digital ownership, asset scarcity, tokenized economies, interoperable assets, and transparent transactions, all of which contribute to a functioning economy within the metaverse.

Crypto World

Novo Nordisk (NVO) Stock Drops as Legal War Erupts Over $49 Wegovy Knockoff

TLDR

- Novo Nordisk shares fell 7% Thursday when Hims & Hers introduced a $49 compounded Wegovy pill, compared to Novo’s $149 branded version

- The Danish pharmaceutical company plans legal action, labeling the product “illegal mass compounding” that threatens patient safety

- Eli Lilly stock also declined 7% as investors worried about increased market competition for weight loss medications

- Hims & Hers argues its compounded version is legal as a “personalized” treatment with different formulation, despite semaglutide patents running through 2032

- Novo’s stock has crashed 50% in 2025 and dropped another 15% in 2026 following guidance predicting sales declines between 5% and 13%

Novo Nordisk experienced a 7% stock decline Thursday following Hims & Hers’ announcement of a $49 compounded Wegovy weight loss pill. The Danish drugmaker swiftly responded with plans for legal action.

The telehealth platform priced its alternative at $49 for the initial month and $99 monthly thereafter with a five-month plan. This represents a substantial discount from Novo’s $149 branded pill price.

Eli Lilly shares tumbled 7% alongside Novo on competitive concerns. Hims stock briefly rallied before retreating after legal threats emerged.

Novo condemned the launch as “illegal mass compounding that poses a risk to patient safety.” The company vowed to pursue legal and regulatory measures to protect its patents and the drug approval process.

“This is another example of Hims & Hers’ historic behaviour of duping the American public with knock-off GLP-1 products,” the company stated. The FDA previously cautioned Hims regarding deceptive GLP-1 product advertising.

Compounding Controversy

Semaglutide maintains U.S. patent protection through 2032. Hims contends its version qualifies as legal personalized compounding.

The company states its compounded product employs a different formulation and delivery mechanism than FDA-approved oral semaglutide. Hims previously sold compounded injectable semaglutide and now offers pills.

Novo produces Wegovy pills using specialized SNAC technology to facilitate oral absorption. The effectiveness of Hims’ alternative formulation remains uncertain.

The two companies briefly collaborated in 2025 on discounted weight loss shots. Novo severed the partnership within two months, accusing Hims of “deceptive” marketing.

Novo Faces Headwinds

The dispute intensifies pressure on Novo Nordisk during a challenging stretch. Shares plummeted nearly 50% throughout 2025, marking the company’s worst annual performance.

The stock has dropped an additional 15% in 2026 year-to-date. Investors question Novo’s capacity to maintain revenue growth against strengthening competition.

Novo forecasted last week that 2026 sales and profits would fall 5% to 13%. The company cited U.S. pricing challenges and patent expiration in markets including Canada and China.

CEO Mike Doustdar noted 170,000 patients started taking Wegovy pills since the January rollout. He framed the pessimistic outlook as temporary pain for future benefit.

“We are creating affordability for the patients, millions of patients that are right now in need of GLP-1 products, but simply could not afford it,” Doustdar explained.

Market Dynamics Shift

Eli Lilly plans to introduce its weight loss pill, orforglipron, in the first half of 2026 subject to FDA clearance. The company anticipates 25% sales growth this year, contrasting with Novo’s negative projection.

Leerink analyst Michael Cherny noted Hims should explore similar opportunities for upcoming weight loss medications as the market expands.

Eli Lilly did not provide comment on the Hims development. Novo launched its Wegovy pill in the United States during early January 2026.

Crypto World

ARK offloads $17 million of Coinbase, adds $18 million of Bullish amid crypto rout

ARK Invest sold $17.4 million worth of Coinbase (COIN) stock and bought a similar amount in Bullish (BLSH) stock on Thursday as crypto equities were routed.

Cathie Wood’s investment management company sold 119,236 COIN shares, worth $17.4 million as of Thursday’s close. COIN lost 13.3% on the day to close at $146.12 amid ongoing tanking of the crypto market which has seen bitcoin fall as low as $60,000, its lowest point since November 2024.

ARK also bought 716,030 shares in crypto exchange Bullish, according to an emailed disclosure. The shares are worth $17.8 million, based on BLSH’s closing price of $24.90, nearly 8.5% lower on the day. Bullish is also the parent company of CoinDesk.

It is common to see ARK Invest make sizeable purchases of crypto-adjacent companies when their prices slide due to broader downturns in the cryptocurrency market. The Florida-based company attempts to capitalize on the chance to capture greater value from equities and rebalance the holdings of its funds to reflect the different prices.

However, it is somewhat rarer to see ARK use this as a window to offload shares in a major crypto holding such as Coinbase.

Crypto World

Bitcoin (BTC) price recovery still faces macro risks: Crypto Daybook Americas

By Omkar Godbole (All times ET unless indicated otherwise)

Friday’s crypto markets are a sea of green, bouncing from yesterday’s brutal drubbing in a classic oversold rebound. But real risks linger, threatening any lasting recovery.

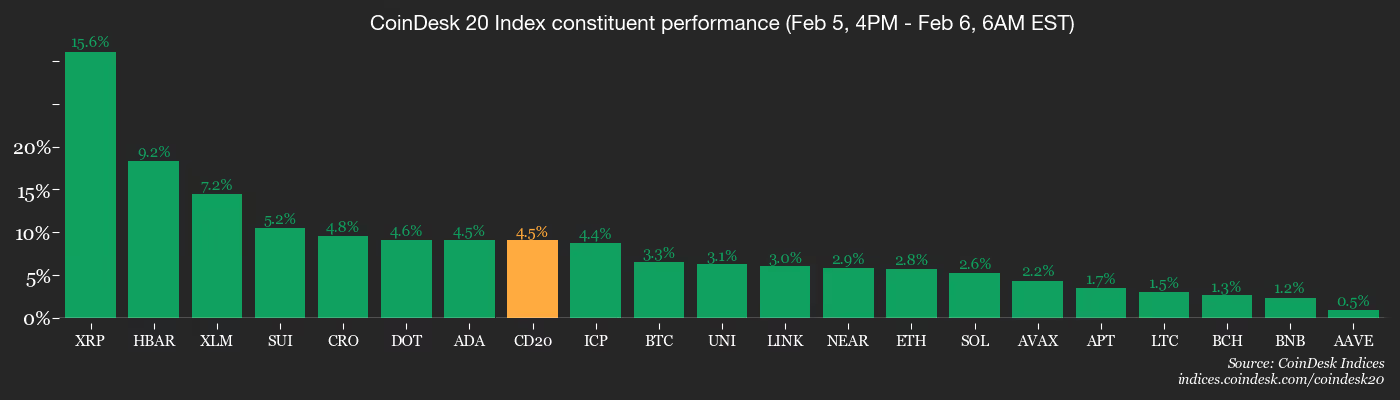

Bitcoin has climbed back to $65,000 after flirting with $60,000, with BlackRock ETF action hinting at capitulation, that is, long-term holders dumping at a loss, often the bear market’s final gasp. The broader market has perked up, too, with XRP, SOL, ETH and other tokens regaining some poise, while the CoinDesk 20 Index added nearly 9% since midnight UTC.

Still, put options on bitcoin remain in demand, signaling persistent downside fear. It makes sense for a couple of key reasons: First, macro risks have eased, but aren’t gone. President Donald Trump signed a funding bill Tuesday to end the government shutdown, but the Department of Homeland Security cash runs dry in eight days, which means there could be another circus by Feb. 14.

Meanwhile, oil prices are buoyant on both sides of the Atlantic on concerns the Iran-U.S. tensions will escalate. A spike there could add to global inflation, triggering a flight to safety and hammering risk assets like crypto.

Most critically, the recent crash has pushed many holders and digital-asset treasuries underwater. Many of those may capitulate and become marginal sellers in the market, potentially capping rallies. Plus, confidence tends to rebuild only slowly after a crash, which is why snapback recoveries always crawl.

These things taken together indicate that the market may not be out of the woods yet. Stay alert!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Crypto

- Macro

- Feb. 6, 8:30 a.m.: Canada unemployment rate for January (Prev. 6.8%)

- Feb. 6, 10 a.m.: Canada Ivey PMI index for January (Prev. 51.9)

- Feb. 6, 10 a.m.: U.S. Michigan Consumer Sentiment preliminary for February (Prev. 56.4); Michigan inflation expectations (Prev. 4%)

- Earnings (Estimates based on FactSet data)

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Governance votes & calls

- Feb. 6: Chainlink to host an X Spaces session on “Building with the Chainlink Runtime Environment.”

- Unlocks

- Token Launches

- Feb. 6: MOVA (MOVA) to be listed on LBank, BingX, KuCoin, MEXC and others.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

Market Movements

- BTC is up 4.55% from 4 p.m. ET Thursday at $66,022.00 (24hrs: -6.74%)

- ETH is up 4.14% at $1,924.90 (24hrs: -7.3%)

- CoinDesk 20 is up 4.75% at 1,905.03 (24hrs: -7.49%)

- Ether CESR Composite Staking Rate is up 39 bps at 3.48%

- BTC funding rate is at -0.0142% (-15.5862% annualized) on Binance

- DXY is unchanged at 97.81

- Gold futures are down 0.19% at $4,880.30

- Silver futures are down 4.39% at $73.35

- Nikkei 225 closed up 0.81% at 54,253.68

- Hang Seng closed down 1.21% at 26,559.95

- FTSE is up 0.01% at 10,309.76

- Euro Stoxx 50 is up 0.27% at 5,941.80

- DJIA closed on Thursday down 1.20% at 48,908.72

- S&P 500 closed down 1.23% at 6,798.40

- Nasdaq Composite closed down 1.59% at 22,540.59

- S&P/TSX Composite closed down 1.77% at 31,994.60

- S&P 40 Latin America closed down 1.01% at 3,616.07

- U.S. 10-Year Treasury rate is down 1.8 bps at 4.192%

- E-mini S&P 500 futures are up 0.3% at 6,841.00

- E-mini Nasdaq-100 futures are up 0.36% at 24,740.50

- E-mini Dow Jones Industrial Average Index futures are up 0.16% at 49,075.00

Bitcoin Stats

- BTC Dominance: 58.77% (+0.47%)

- Ether-bitcoin ratio: 0.02917 (0.43%)

- Hashrate (seven-day moving average): 913 EH/s

- Hashprice (spot): $29.76

- Total fees: 5.59 BTC / $377,330

- CME Futures Open Interest: 115,230 BTC

- BTC priced in gold: 13.5 oz.

- BTC vs gold market cap: 4.4%

Technical Analysis

- The chart shows bitcoin’s weekly price swings in candlestick format since 2019.

- Prices are rapidly approaching their average over 200 weeks, represented by the red line.

- BTC has consistently put in bear-market bottoms around this average, suggesting the current pullback could be in its final stages.

Crypto Equities

- Coinbase Global (COIN): closed on Thursday at $146.12 (-13.34%), +5.97% at $154.84 in pre-market

- Circle Internet (CRCL): closed at $50.23 (-8.76%), +5.40% at $52.94

- Galaxy Digital (GLXY): closed at $16.84 (-16.47%), +6.35% at $17.91

- Bullish (BLSH): closed at $24.90 (-8.46%), +3.98% at $25.89

- MARA Holdings (MARA): closed at $6.73 (-18.72%), +6.39% at $7.16

- Riot Platforms (RIOT): closed at $12.06 (-14.71%), +5.14% at $12.68

- Core Scientific (CORZ): closed at $14.81 (-8.27%), +1.99% at $15.11

- CleanSpark (CLSK): closed at $8.27 (-19.13%), -3.33% at $7.99

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $35.23 (-12.56%), +2.24% at $36.02

- Exodus Movement (EXOD): closed at $9.42 (-11.96%), -1.27% at $9.30

Crypto Treasury Companies

- Strategy (MSTR): closed at $106.99 (-17.12%), +6.71% at $114.17

- Strive (ASST): closed at $9.86 (-16.75%)

- SharpLink Gaming (SBET): closed at $6.07 (-14.27%), +4.12% at $6.32

- Upexi (UPXI): closed at $1.09 (-19.85%), +7.34% at $1.17

- Lite Strategy (LITS): closed at $0.95 (-10.27%)

ETF Flows

Spot BTC ETFs

- Daily net flows: -$434.1 million

- Cumulative net flows: $54.3 billion

- Total BTC holdings ~1.27 million

Spot ETH ETFs

- Daily net flows: -$80.8 million

- Cumulative net flows: $11.86 billion

- Total ETH holdings ~5.87 million

Source: Farside Investors

While You Were Sleeping

Bitcoin surges back above $65,000 after $700 million wipeout in Asia whipsaw (Coindesk): Bitcoin rebounded above $65,000 after its worst one-day drop since November 2022. About $700 million in leveraged crypto positions were liquidated in a few hours,

Stocks reel as AI fears dominate market action (Reuters): Global markets retreated as a stock rout on Wall Street spread worldwide, with volatility gripping precious metals and cryptocurrencies while AI fears weighed on equities.

Weak earnings drag IREN, Amazon; bitcoin stocks rebound in pre-market (CoinDesk): IREN earnings were weaker than expected, while Amazon missed EPS estimates and beat on revenue.

Big tech to spend $650 billion this year as AI race intensifies (Bloomberg): The high spending projections raise concerns about energy supplies, prices, and the potential distortion of economic data, raising questions about whether the companies can afford the costs.

-

Crypto World7 days ago

Crypto World7 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Politics7 days ago

Politics7 days agoWhy is the NHS registering babies as ‘theybies’?

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports3 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business19 hours ago

Business19 hours agoQuiz enters administration for third time

-

Crypto World7 days ago

Crypto World7 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business7 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat1 day ago

NewsBeat1 day agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World19 hours ago

Crypto World19 hours agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”