Crypto World

Balance Sheet Stable Unless BTC Falls Below This Critical Level

Strategy’s Bitcoin reserves cover debt, and only a prolonged drop to $8,000 could possibly force restructuring.

Strategy CEO Phong Le told investors on Thursday that the company’s balance sheet remains stable despite recent crypto market turbulence, though extreme scenarios could pose challenges.

The firm, the world’s largest corporate Bitcoin (BTC) holder, says it would only need to consider restructuring or additional capital if the cryptocurrency fell to $8,000 and remained there for five to six years.

Balance Sheet Holds Amid Bitcoin Sell-Off

According to reporting by The Block, Le, speaking during Strategy’s fourth-quarter earnings call, emphasized that even after recent market losses, the company’s Bitcoin reserves comfortably cover its convertible debt.

“In the extreme downside, if we were to have a 90% decline in Bitcoin price, and the price was $8,000, that is the point at which our Bitcoin reserve equals our net debt, and we would then look at restructuring, issuing additional equity, issuing additional debt,” he said.

The call came after a sharp sell-off across crypto markets, with BTC down roughly 7% in 24 hours, trading just under $66,000 at the time of writing. Strategy’s stock, MSTR, slid 17% to $107, erasing much of its gains from late 2025 and leaving it down about 72% over six months.

Analysts on social media noted that today’s session saw Bitcoin drop more than $10,000, the first time it has ever dipped by such an amount in a single day, according to The Kobeissi Letter. The dramatic loss in value was part of a structural market downturn that has wiped out $2.2 trillion in crypto market value since mid-October 2025.

Executive Chairman Michael Saylor also spoke in the call, dismissing concerns about quantum computing threats to Bitcoin as “horrible FUD” and outlining plans for a security initiative to support potential upgrades, including quantum resistance.

He reiterated that Strategy’s long-term approach is designed to withstand volatility, pointing to supportive U.S. regulatory developments and the growing integration of Bitcoin into credit markets and corporate balance sheets.

You may also like:

Strategic Outlook

Strategy is still expanding its Bitcoin holdings despite short-term price swings. Earlier this week, the company acquired 855 BTC for $75.3 million at an average price near $88,000, bringing its total reserves to over 713,500 units.

The buy followed a $25 billion accumulation in 2025 and a $1.25 billion purchase in early 2026, funded largely through capital raises.

Saylor has argued that the significance of Bitcoin treasury companies lies in credit optionality and institutional adoption rather than daily price action. According to him, firms holding BTC on balance sheets can leverage assets for debt issuance, lending, or financial services, giving them flexibility that ETFs lack.

While sentiment has deteriorated sharply in recent months, he framed these developments as part of a long-term integration of digital capital into global financial systems, rather than a short-term price event.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

How Low Can Pi Network’s PI Go? Shocking Bear-Market AI Scenarios After the Latest ATLs

After several consecutive all-time lows, where is PI’s bottom and how deep can it plunge?

It has been just under a year since the controversial project’s native token began trading on several exchanges. The journey so far has been quite underwhelming for investors, who saw the PI token rocket to an all-time high of $2.99 in late February 2025 and then experienced what can only be described as a massive cataclysmic nosedive.

PI dumped by more than 95% in less than a year. The past few weeks have been particularly painful as the token crashed to consecutive all-time lows, with the latest being at $0.1338 (on CoinGecko) after a 40% decline in a month. Although it has recovered slightly to nearly $0.145, overall sentiment has taken its toll, and the question is whether PI will drop even further.

New ATLs Ahead?

To gain a different perspective on the matter, we asked ChatGPT and Gemini. OpenAI’s alternative explained that PI’s inability to respond positively to recent network updates, which we have repeatedly highlighted, is a clear sign that its market structure and supply dynamics are dominating overall sentiment.

The steady decline to new lows suggests that the selling pressure remains persistent, the speculative demand is weak, and there’s insignificant external capital entering the market.

“Unlike more established altcoins, PI lacks deep liquidity buffers. When selling accelerates, price discovery to the downside can happen fast – as the recent crash demonstrated,” ChatGPT added.

It outlined a few scenarios ahead for PI, with the extreme bear-case predicting a massive plunge to $0.06-$0.08. This “true capitulation phase” would be possible if the token unlock pressure continues, liquidity remains thin, and the broader market sentiment deteriorates even further.

However, ChatGPT reiterated that this is an extreme scenario. Instead, it envisions a more likely decline to $0.10 before the token can bottom out and find more solid support.

Or Even Worse…

Gemini said the daily chart for PI paints a clear “stairway to hell” picture ever since it broke down beneath $0.20. Interestingly, it was even more bearish on PI’s future price performance since the token is now in “no man’s land” below $0.15.

You may also like:

If the asset fails to reclaim $0.16 by the end of the week, the next major technical liquidity pool sits at $0.05-$0.06, which would be another 65% crash from current levels. There’s another, even worse path ahead, which Gemini called “the zombie chain scenario.”

In it, PI would dump below $0.05 and will effectively become a “zombie coin” – high holder count, zero trading volume, and interest. However, the current odds for such a mindblowing crash are below 20%, Gemini explained, as it would require full investor capitulation, sell-offs by the Core Team, and overall market collapse.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

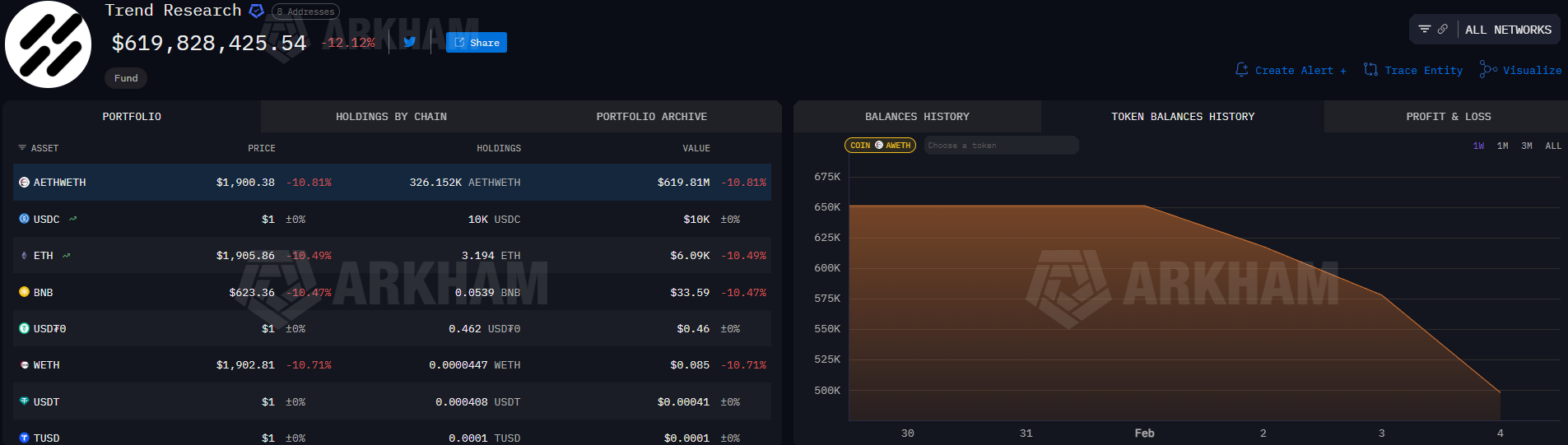

Trend Research Dumps Over 400K as Liquidation Risk Rises

Ethereum investment vehicle Trend Research continued to reduce its Ether exposure, as the latest market crash pushed the treasury company to sell off its assets to pay back loans.

It held about 651,170 Ether (ETH) in the form of Aave Ethereum wrapped Ether (AETHWETH) on Sunday. That amount dropped by 404,090, to about 247,080 on Friday, at the time of writing.

Trend Research transferred 411,075 ETH to cryptocurrency exchange Binance since the beginning of the month, according to blockchain data platform Arkham.

The transfers occurred as ETH price dropped almost 30% in the past week, to as low as $1,748 on Friday, according to CoinMarketCap. It traded at $1,967 at the time of writing.

Related: Sharplink pockets $33M from Ether staking, deploys another $170M ETH

Trend Research continues risk management as ETH liquidation level approaches

Trend Research has been tied to Jack Yi, founder of Hong Kong-based crypto venture firm Liquid Capital. Yi accumulated his Ethereum investment company’s holdings by purchasing ETH at an exchange, using that as collateral on Aave to borrow stablecoins, then using those funds to acquire more ETH.

Trend Research faces multiple ETH liquidation levels between $1,698 and $1,562, wrote blockchain data platform Lookonchain in a Friday X post.

Yi, said in a Thursday X post that he remains bullish despite admitting that he called for a bottom in crypto valuation too early and will continue to wait for a market recovery while “managing risk.”

Related: BitMine buys $105M Ether to kick off 2026, still holds $915M in cash

Trend Research came into the spotlight days after the $19 billion liquidation event of October 2025, when the investment firm began its aggressive Ether accumulation.

Trend Research would have ranked as the third-largest Ether holder in December, but as an unlisted company, it doesn’t appear on most tracking websites.

Bitmine, the largest public corporate Ether holder, was sitting on about $8 billion in unrealized profit on Friday.

Magazine: DAT panic dumps 73,000 ETH, India’s crypto tax stays: Asia Express

Crypto World

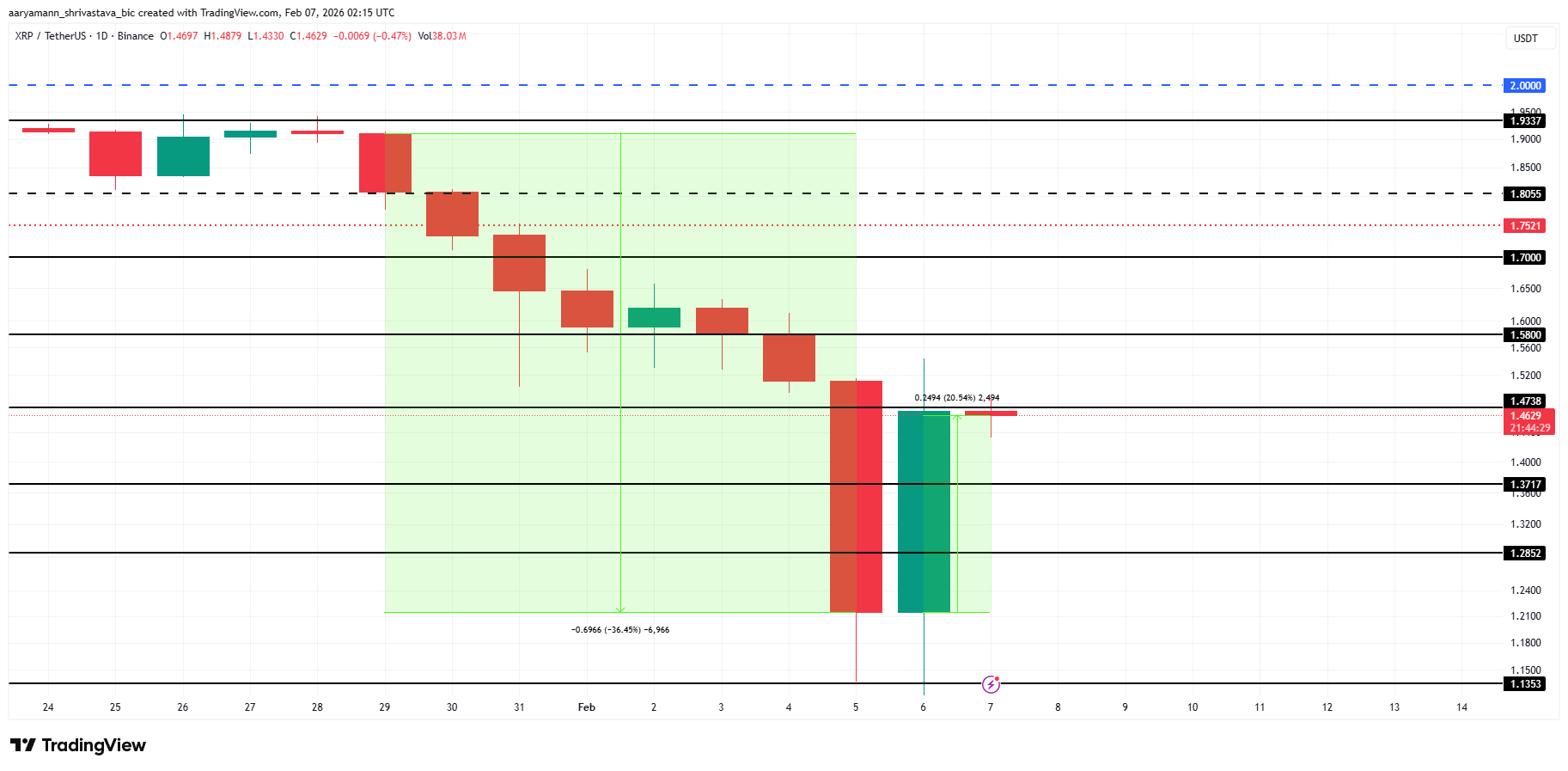

XRP Whales Just Bought Big, Will Price Recover to $2?

XRP has staged a sharp rebound after a steep sell-off rattled investor confidence across the market. The token had suffered heavy losses, triggering fear-driven exits among retail holders.

However, select investor cohorts viewed the decline as an opportunity. Their strategic accumulation has already begun shifting momentum in XRP’s favor.

Sponsored

Sponsored

XRP Holders Exhibit Substantial Support

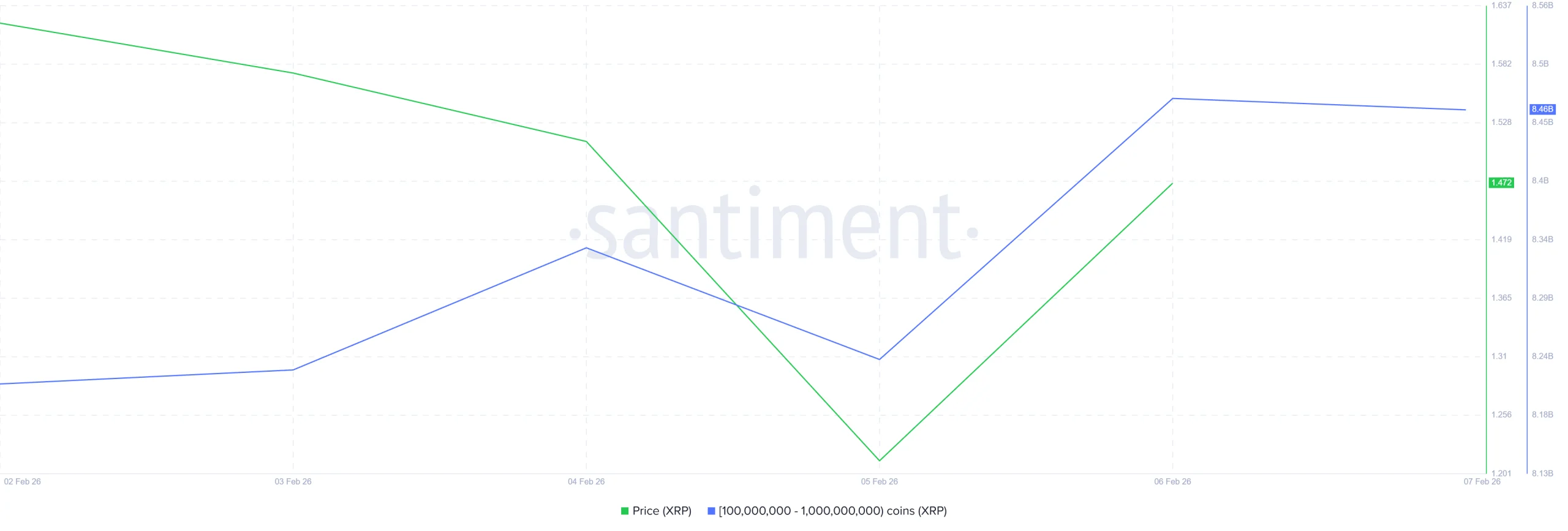

XRP whales have taken an active role in driving the recent recovery. Over the past 48 hours, wallets holding between 100 million and 1 billion XRP accumulated more than 230 million tokens. At current prices, this buying spree exceeds $335 million, signaling strong conviction among large holders.

This accumulation coincided with Friday’s rebound, highlighting whales’ influence on price direction. Large-scale buying reduces circulating supply and absorbs sell-side pressure.

Such behavior often acts as a catalyst during corrective phases, helping stabilize price and restore confidence when broader sentiment remains fragile.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

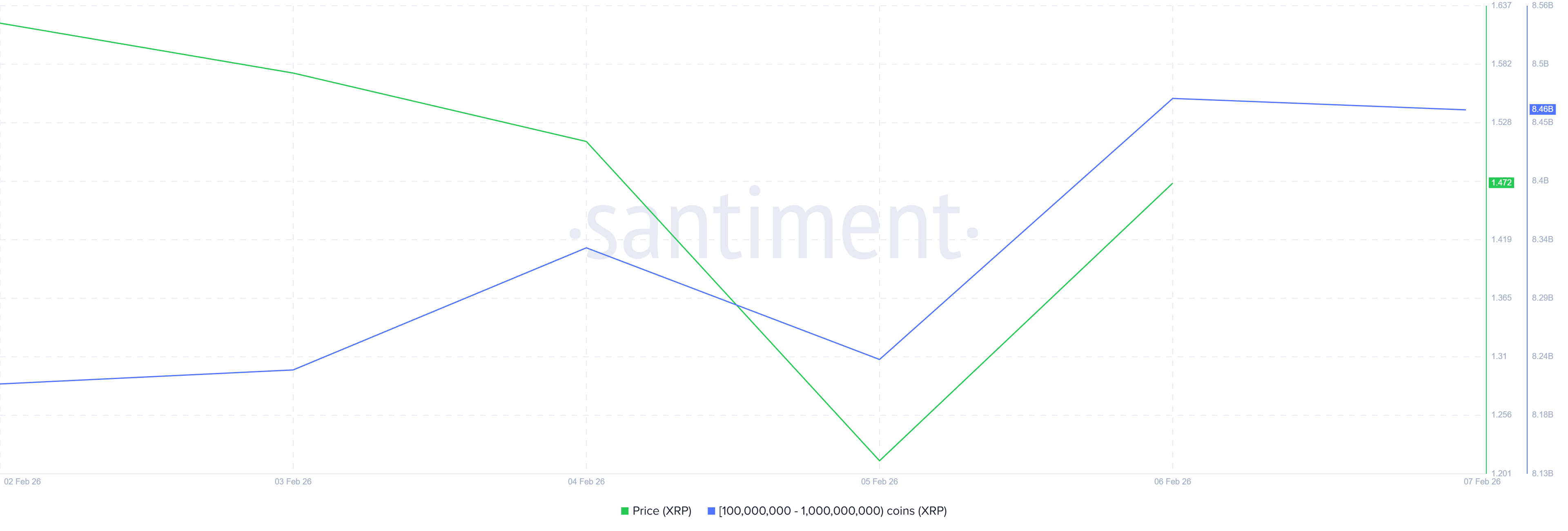

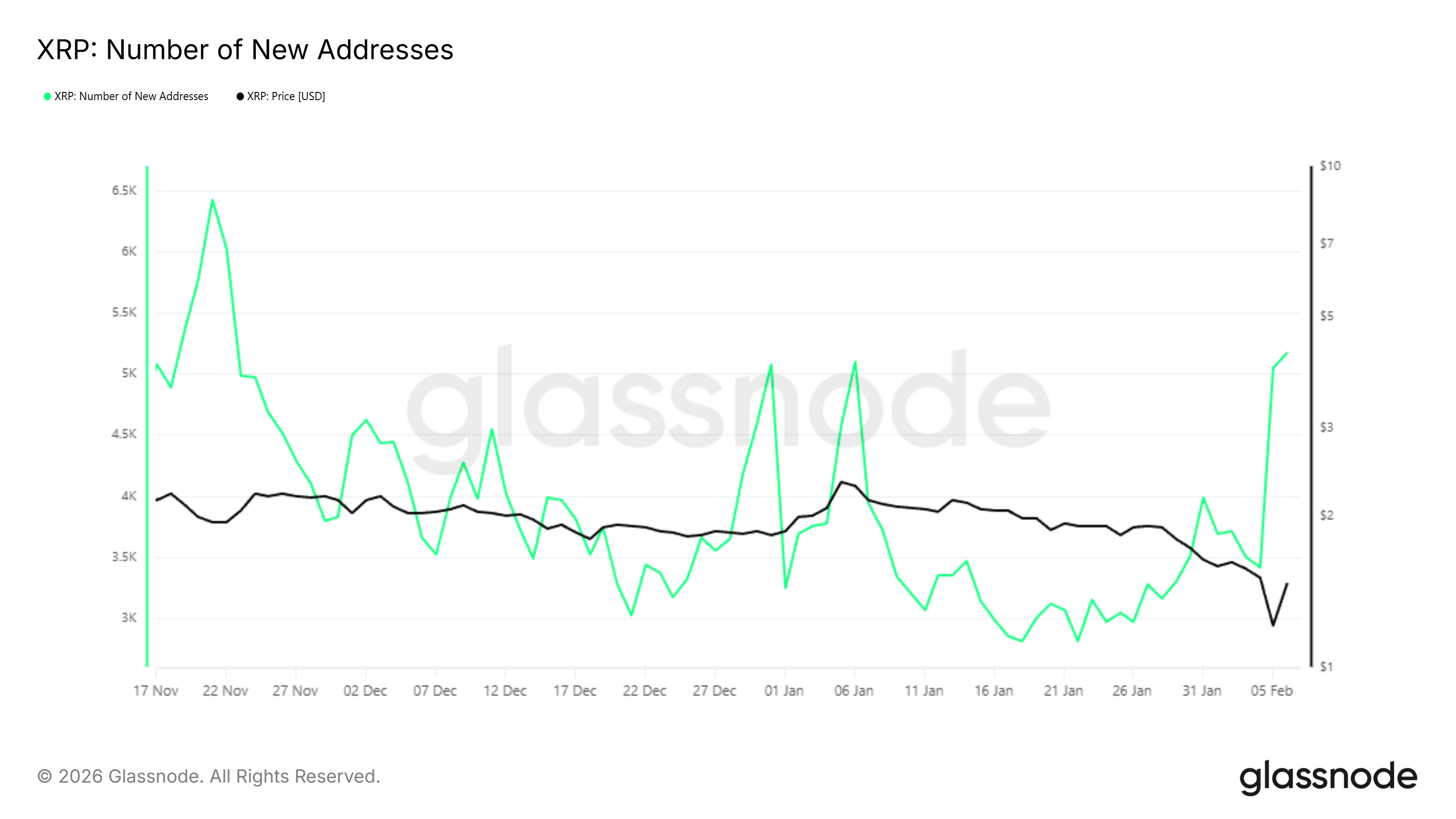

Network activity also supports the recovery narrative. New XRP address creation surged alongside whale accumulation. Over the same 48-hour period, first-time transacting addresses increased by 51.5%, reaching 5,182. This marks the highest level of new participation in roughly two and a half months.

Sponsored

Sponsored

An influx of new investors strengthens rallies by injecting fresh capital rather than recycling existing liquidity. Rising participation suggests growing interest beyond short-term speculation.

With new addresses expanding and whale support present, XRP’s recovery attempt gains structural backing at the macro level.

What Is XRP Price’s Next Target?

XRP is trading near $1.46 at the time of writing, hovering just below the $1.47 resistance. The altcoin rebounded 20.5% after a severe downturn that erased 36% of its value in a few days. This bounce reflects improving demand conditions following capitulation.

Whale accumulation and rising network activity increase the probability of further upside. A push toward $1.70 appears achievable in the near term. This level represents a key psychological barrier. A successful break would likely attract additional inflows and strengthen the recovery structure.

Downside risk remains if resistance holds. Failure to clear $1.58 could invite renewed selling pressure. Under that scenario, XRP may fall below $1.37 and slide toward $1.28. Such a move would invalidate the bullish thesis and erase a significant portion of the recent rebound.

Crypto World

Marathon Digital Moves 1,318 BTC to Institutional Wallets Amid Bitcoin Dip

TLDR:

- MARA moved 1,318 BTC (~$86.9M) to Two Prime, BitGo, and Galaxy Digital in a 10‑hour window.

- The largest transfer of 653.773 BTC went to Two Prime, indicating structured institutional flows.

- Transfer occurred as Bitcoin traded in the mid‑$60K range during recent market weakness.

- Marathon still holds ~52,850 BTC, keeping it among the top reported public holders.

Marathon Digital Holdings recently transferred 1,318 BTC (~$87 million) to institutional platforms, including Two Prime, BitGo, and Galaxy Digital, within about 10 hours.

Bitcoin traded near mid‑$64,000 during the transfers. Despite the outflow, MARA still holds roughly 52,850 BTC, ranking among the largest corporate holders of Bitcoin globally.

MARA’s Institutional Transfers and Strategic Management

Marathon Digital Holdings transferred 1,318 BTC, valued at approximately $86.89 million, to institutional wallets over a short period.

The recipients included Two Prime, BitGo, and Galaxy Digital, demonstrating intentional allocation rather than reactive selling.

Two Prime received the largest portion, including 653.773 BTC worth around $42 million, along with smaller tranches. This wallet suggests the coins may support collateralized yield, hedging, or other structured financing strategies.

This indicates operational planning rather than market panic. BitGo handled nearly 300 BTC, consistent with its custody-first service for secure storage, settlement, or pre-OTC positioning.

Galaxy Digital, linked via Anchorage wallets, received the remaining coins, reinforcing the institutional nature of these transfers and highlighting coordinated treasury management.

Even after moving 1,318 BTC, MARA still holds 52,850 BTC, ranking as the second-largest publicly reported holder. The transfers represent roughly 2.5% of total holdings, suggesting measured liquidity management.

These moves likely fund operations, manage debt, or prepare for market volatility without requiring large-scale liquidation. The timing of transfers coincided with Bitcoin trading around $64,840, down almost 10% in 24 hours.

While such a decline might appear bearish, the involvement of institutional wallets indicates that these moves were planned and strategic. MARA’s approach reflects controlled, professional treasury operations rather than panic-driven exits.

Bitcoin Price Movements and Market Absorption

During the same period, Bitcoin opened near $68K, but sellers quickly drove the price below $60K. This sharp drop reflects forced deleveraging and cascading long liquidations rather than organic market behavior.

Buyers entered aggressively near $62K, driving the price back above $64K and through $65K. The pattern formed higher lows, showing absorption of selling pressure and resilience among stronger market participants.

The market did not continue lower, reflecting controlled capital deployment despite volatility. By the end of the trading window, Bitcoin nearly retraced the full drawdown, stabilizing near $68K.

Combined with MARA’s structured BTC transfers, this indicates deliberate repositioning under stress rather than distressed selling. Large holders can move significant amounts while maintaining balance in the market.

These coordinated transfers, paired with price absorption, illustrate operational management and strategic liquidity positioning.

MARA’s actions show careful deployment of its Bitcoin holdings, emphasizing treasury oversight and market awareness.

Crypto World

Tether mints $1B USDT as stablecoin issuance tops $4.7B in a week

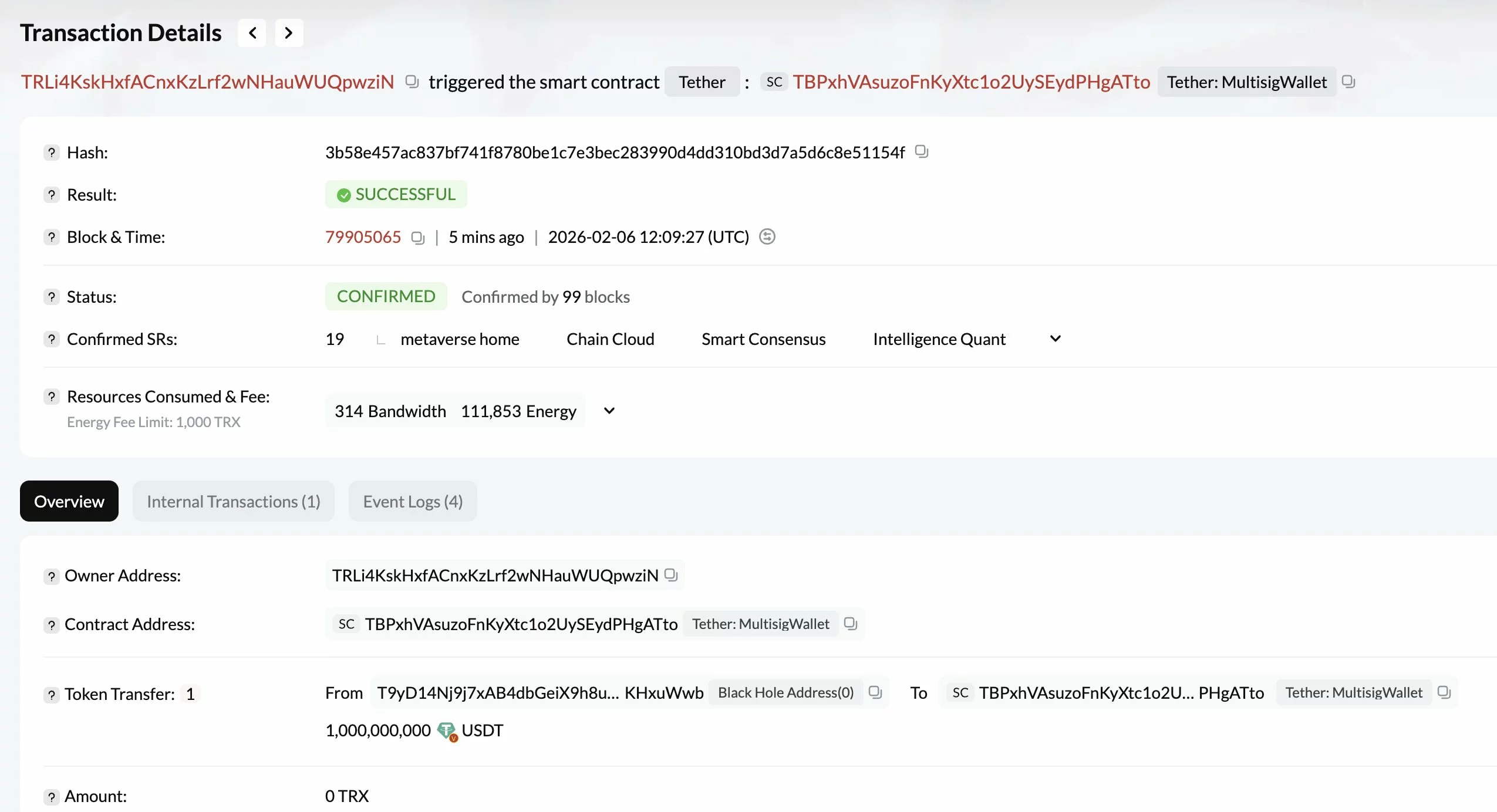

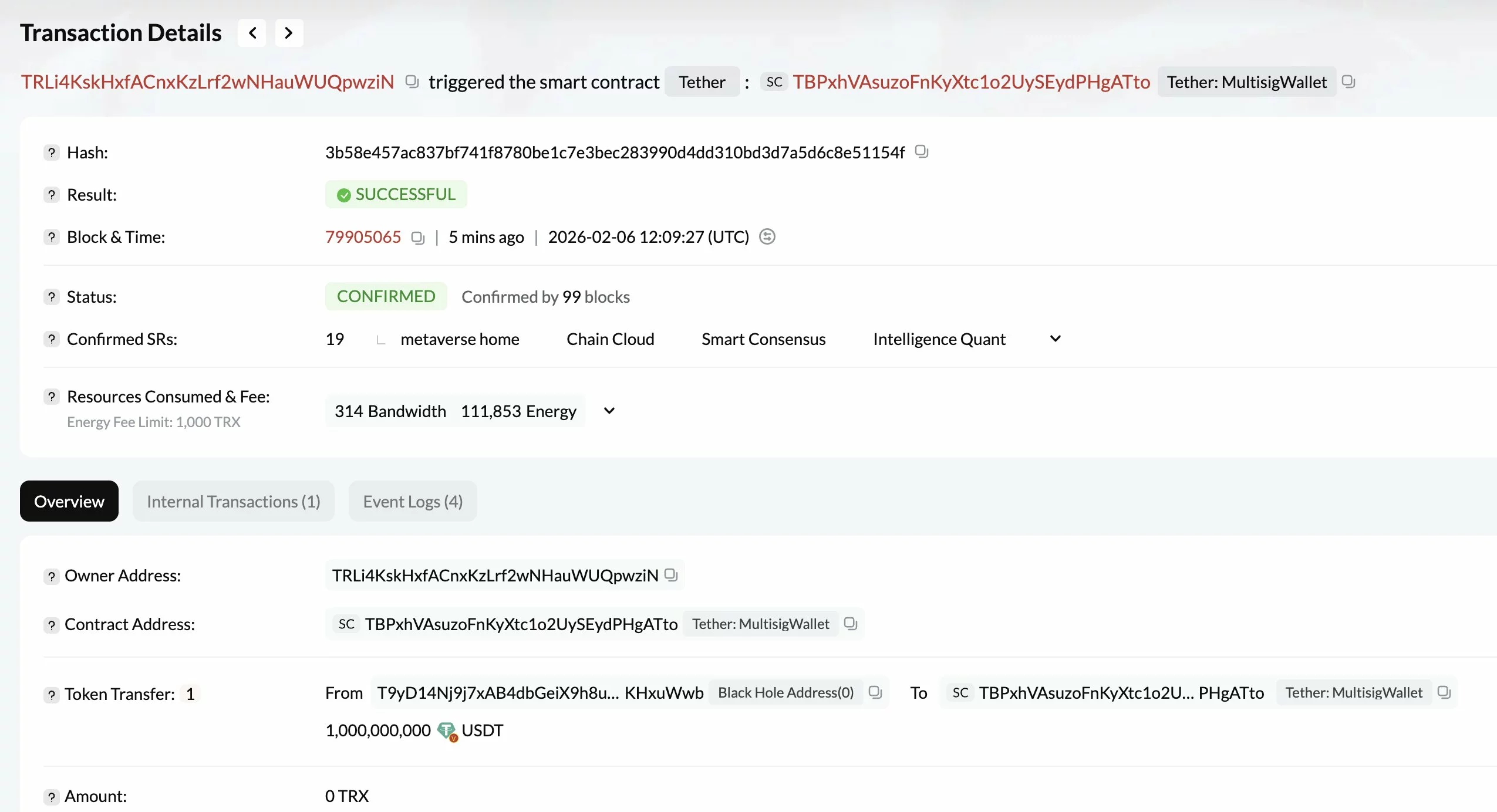

Stablecoin issuer Tether has minted another $1 billion worth of USDT, adding to a sharp rise in stablecoin issuance over the past week, according to on-chain analytics firm Lookonchain.

Summary

- Tether minted $1B USDT, adding to roughly $4.75B in stablecoins issued by Tether and Circle over the past week, according to Lookonchain.

- Analysts caution the surge is a liquidity signal, not a buy signal, noting that rising stablecoin supply has also coincided with choppy or falling Bitcoin prices.

- Markets are watching deployment, redemptions, and velocity, alongside macro factors like ETF flows and derivatives funding, for confirmation of bullish momentum.

The latest mint brings total stablecoin issuance by Tether and Circle to roughly $4.75 billion in the past seven days, highlighting a rapid expansion in crypto market liquidity even as broader markets remain under pressure.

Lookonchain noted that the most recent USDT mint occurred on the Tron network, as Bitcoin (BTC) continued to trade around the $66,000 level.

Liquidity signal, not a buy signal

Crypto analyst Milk Road cautioned that while large stablecoin mints are often framed as “dry powder” for a market rebound, the signal is more nuanced.

According to Milk Road, roughly $3 billion in stablecoin issuance over just three days points to liquidity building within the market’s infrastructure rather than an immediate directional bet on prices.

Historically, rising stablecoin supply has preceded bull runs, but similar conditions have also occurred during choppy or declining Bitcoin markets.

“Stablecoin supply growth alone isn’t a directional indicator,” Milk Road said, describing it instead as a liquidity and readiness signal.

What markets are watching

Analysts say the key indicators to monitor are whether stablecoin issuance is accompanied by low redemptions, improving velocity, and deployment onto exchanges, alongside supportive macro conditions such as ETF inflows and favorable derivatives funding rates.

Absent those signals, rising stablecoin supply may simply reflect market participants positioning capital, rather than actively deploying it.

As Milk Road put it, the market may be “loading ammunition, not pulling the trigger.”

Crypto World

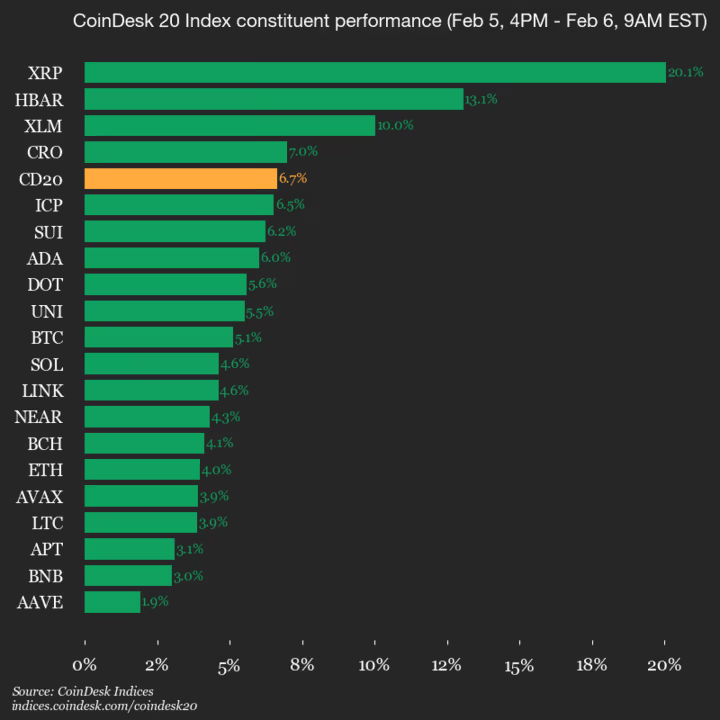

Ripple (XRP) Surges 20.1% as All Assets Trade Higher

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1944.26, up 6.7% (+121.31) since 4 p.m. ET on Thursday.

All 20 assets are trading higher.

Leaders: XRP (+20.1%) and HBAR (+13.1%).

Laggards: AAVE (+1.9%) and BNB (+3.0%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

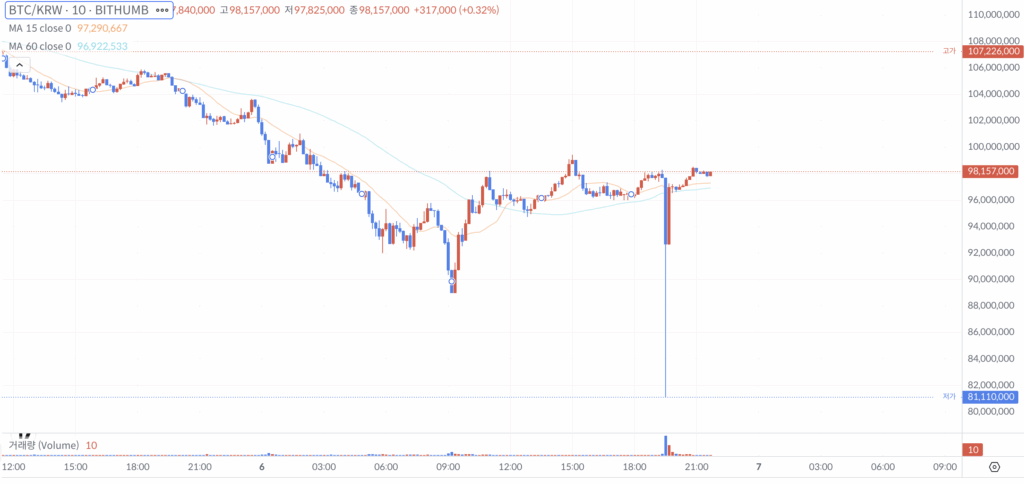

Bithumb Fixes Payout Error After Abnormal Bitcoin Trades

In South Korea, Bithumb disclosed it detected and corrected an internal payout error that briefly sent an abnormal amount of Bitcoin (CRYPTO: BTC) to a subset of users during a promotional event, triggering swift volatility on the exchange. In an official Friday notice, the operator explained that some recipients liquidated part of the mistakenly credited BTC, prompting a price dislocation that was halted within minutes as internal controls restricted affected accounts and prevented cascading liquidations. The exchange stressed this was not linked to any hack or security breach and that customer assets remained secure as trading, deposits and withdrawals continued normally. The incident underscores the operational risks embedded in real-time promotional activity at centralized venues, even as systems respond to anomalies in near real-time.

The firm also signaled that it had tightened its internal safeguards to avoid a repeat of the episode, while promising transparent follow-ups on steps taken to bolster payout accuracy and account-level safeguards. While the company did not disclose the exact amount involved, users on social media posited that several accounts may have been credited with as much as roughly 2,000 BTC, a figure that could not be independently verified at this stage.

In a broader context, the episode arrives amid ongoing scrutiny of how centralized exchanges handle rapid price moves and user activity during promotions. Bithumb’s January disclosure about dormant assets—roughly $200 million held across 2.6 million inactive accounts as part of a recovery effort—illustrates a continued effort to reconcile long-tail liabilities and improve asset management under regulatory expectations. The exchange’s public scrutiny comes as market data show Bithumb’s trading activity remains material, with CoinGecko reporting substantial 24-hour volume and a trust score reflecting observed risk elements in the platform’s operations.

As the sector contends with periodic operational frictions, the push to demonstrate robust risk controls has grown louder. Earlier in the year, Coinbase acknowledged that account restrictions could hamper user activity during stress periods, reporting improvements after deploying enhanced machine-learning models and upgraded infrastructure to reduce unnecessary account freezes by a meaningful margin. The lessons from these experiences feed into a wider narrative about how exchanges balance user experience, security, and liquidity during unpredictable market conditions.

During a separate episode last fall, a major crypto venue faced widespread user concerns that some traders could not exit positions during a sharp sell-off. While the exchange argued that its core infrastructure remained intact and that liquidity conditions in the market were the primary drivers of liquidations, it ultimately distributed a substantial compensation package to affected users. The episode underscored how a combination of market dynamics and technical hiccups can amplify user frustrations even when the underlying systems remain capable of handling the broader trading flow.

Taken together, the incidents spotlight a recurring theme in the crypto ecosystem: the fragility of operations under stress, even when asset custody remains sound. Bithumb’s public acknowledgement of the error, combined with the quick containment measures and commitment to future preventive steps, reinforces the industry’s emphasis on transparency and continuous improvement. For investors and users, the key takeaway is that while asset security is guarded, execution risk—whether from payout misfires, liquidity gaps, or automated processes—continues to test the resilience of centralized platforms.

Market reaction and key details

Beyond the immediate price movement, observers are watching how exchanges sanitize anomalies that arise from promotional events or internal misconfigurations. The incident at Bithumb shows that even minor missteps can ripple through intraday prices, prompting a swift response from risk teams to halt affected accounts and restore orderly trading. The episode also highlights the role of governance and internal controls as central levers for mitigating systemic risk within single venues, particularly when millions of dollars of daily volume can hinge on a handful of credited accounts.

For context, the broader market has navigated a string of operational challenges across major platforms. The Coinbase episode in mid-year highlighted the tension between security measures and user access, with the exchange reporting improvements in preventing unnecessary account freezes. Binance, on the other hand, faced widespread complaints when volatility surged, and while the firm maintained that core trading engines held up, it nonetheless issued compensation to users impacted by the disruption. These instances collectively emphasize that operational uptime, real-time risk controls, and transparent communications are becoming core differentiators for centralized exchanges in a crowded landscape.

Looking at liquidity and market sentiment, trackers show continued appetite for exchange participation, even as demand peaks temporarily during promotional campaigns. Bithumb’s reported metrics—coupled with its commitment to disclose corrective actions—signal a path toward restoring trust through accountability. The exchange also remains under the watchful eye of analysts tracking the health of liquidity providers and the ability of platforms to gracefully unwind unintended or erroneous credits without triggering cascading liquidations or systemic stress.

The episode’s significance extends beyond a single incident. It reinforces a broader narrative about how crypto markets are maturing: incidents are increasingly identified, contained, and followed by concrete governance steps. Investors now expect rapid disclosures, independent follow-ups, and demonstrable improvements in both on-chain and off-chain processes. While the immediate fallout may be contained, the long-term impact rests on whether exchanges translate lessons learned into durable practice that can withstand future shocks.

Why it matters

For users, the incident underscores the importance of robust account protections and the value of clear, timely communications from exchanges following any anomaly. For operators, it highlights the necessity of automated safeguards that can quickly detect unusual credit patterns and isolate affected accounts before they ripple outward to price and liquidity. The emphasis on transparent post-event action—detailing what went wrong, how it was fixed, and what changes will be implemented—helps restore confidence in a space where trust and reliability are paramount.

From a market perspective, the episode contributes to a growing realization that operational risk is an intrinsic component of centralized platforms. While custody and asset safety are critical, execution risk—particularly during promos and periods of high volatility—can shape user behavior and liquidity provisioning. The industry’s response, including better incident reporting, tighter internal controls, and proactive communication, is likely to influence how funds flow across exchanges and how investors price resilience into their risk models.

For builders and regulators, the event offers a case study in the balance between innovation and oversight. As platforms explore new products, incentives, and cross-border activities, the need for clear governance frameworks and standardized incident reporting becomes more acute. The ongoing dialogue between exchanges, users, and policymakers could set the groundwork for more robust operational standards across the crypto ecosystem.

What to watch next

- Follow-up disclosures from Bithumb detailing corrective actions and any independent reviews of the payout process.

- Any updates to internal controls and the redeployment of automated checks to prevent similar miscredits.

- Regulatory or industry-led audits assessing operational risk management on centralized exchanges in Korea and beyond.

- Monitoring by liquidity providers and market makers for signs of lingering price effects or liquidity gaps around the incident timeframe.

Sources & verification

- Bithumb official announcement: https://feed.bithumb.com/notice/1651924

- Dormant assets report referenced by Bithumb: https://cointelegraph.com/news/bithumb-dormant-crypto-assets-200m-inactive-accounts

- CoinGecko exchange page for Bithumb (trust score and volume): https://www.coingecko.com/en/exchanges#:~:text=As%20of%20today%2C%20we%20track,%2C%20Coinbase%20Exchange%2C%20and%20OKX.

- Binance support article cited for liquidity disruptions: https://www.binance.com/en/support/announcement/detail/3d45a1ab541f463982d59c8de85e36b8

- Scott Melker commentary referenced in discussion of the incident: https://x.com/scottmelker/status/2019812751150088197

Crypto World

Bithumb accidentally gave away 2,000 BTC and crashed its market

Bitcoin (BTC) has flash crashed 10% on the South Korean exchange Bithumb after a user sold 2,000 BTC that they received by mistake from a promotional airdrop.

Earlier today, X users noted that Bithumb’s listed BTC/South Korean Won (KRW) trading pair plummeted by 10% in the space of a minute before returning to its original price.

The account “Definalist,” which claims to be made up of five crypto traders based in China, noted the price drop and a “rumor” that someone dumped 2,000 BTC.

They also appeared to show a screenshot taken from the seller’s account while they were dumping the BTC, which in today’s less-than-stellar crypto markets would fetch $134 million.

Read more: Bithumb boosts security in wake of SK Telecom malware hack

Definalist later claimed that hundreds of users may have received 2,000 BTC accidentally after an employee typed BTC, instead of KRW, when sending out 2,000 KRW ($1.4) as part of a “random box prize” promotional giveaway.

Bithumb confirms it sent ‘abnormal’ sums of BTC to users

Bithumb has since confirmed some details of the incident, although it didn’t confirm the quantity of BTC nor the number of customers who received mistaken disbursements.

It admitted that an “abnormal” sum of BTC was paid to various users, and that BTC’s price “temporarily fluctuated sharply as some accounts that received the BTC sold it.”

It notes that it was able to restrict the accounts selling the BTC and added that “the market price returned to normal levels within five minutes, and the domino liquidation prevention system functioned normally, preventing chain liquidations due to the abnormal BTC price.”

“We want to make it clear that this incident is unrelated to any external hacking or security breach, and does not pose any issues with system security or customer asset management,” the exchange said.

If Bithumb did in fact send 2,000 BTC to at least 100 users, thats a minimum distribution of $13 billion.

BTC crashed almost 47% from its all-time high of $126,000 last October but has, for the time being, gradually begun to increase in price again.

The flash crash is another problem for Bithumb after South Korea’s financial competition watchdog raided its office last week over various promotions it advertised last year.

Protos has reached out to Bithumb for comment and will update this piece should we hear back.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Wall Street remains split after earnings miss

IREN’s (IREN) latest earnings offered a snapshot of a company mid-transition, with shares currently paying the price for that transition. The firm reported weaker-than-expected revenue and earnings as bitcoin mining took a back seat to its rapidly expanding AI cloud ambitions.

Crushed by record-low margins after the 2024 halving, bitcoin miners are recasting themselves as digital infrastructure players, converting power-hungry mining sites into AI-ready data centers in a bid for more stable, long-term revenue.

One of last year’s best-performing stocks, not just in crypto, but for the whole market, IREN has come back to earth a bit since hitting a record high near $77 in November. Down about 20% amid Thursday’s market crash, shares are flat on Friday at $39.77.

IREN has secured $3.6 billion in GPU financing tied to its Microsoft contract, alongside a $1.9 billion customer prepayment, funding that management says will cover roughly 95% of GPU-related capital expenditures as it scales its AI business, a development JPMorgan analysts Reginald Smith and Charles Pearce described as encouraging.

IREN’s fiscal second-quarter revenue fell sequentially as lower average hashrate, fewer coins mined and a quarter-over-quarter drop in bitcoin prices weighed on results, according to the Wall Street bank.

The drag from mining was partly offset by rapid growth in cloud services, where revenue more than doubled from the prior quarter to $17 million. That figure came in above JPMorgan’s $14 million estimate but well short of the Street’s $28 million forecast. Management said all GPUs currently energized are fully contracted, a signal the bank described as encouraging as the company pivots toward AI infrastructure.

Cost controls also helped cushion the quarter. Cash SG&A dropped sharply to $43 million, while power costs declined on lower average hashrate. As a result, adjusted EBITDA reached $75 million, beating the bank’s estimate, driven by lower operating and energy expenses. The bank has an underweight rating on the stock.

Investment bank B. Riley raised its price target on IREN to $83 from $74 while reiterating its buy rating, arguing that the recent pullback has created an attractive entry point.

The upgrade comes despite a softer fiscal second quarter, during which adjusted EBITDA of $75.3 million missed expectations. B. Riley said the earnings miss is overshadowed by IREN’s progress on its AI pivot, including $3.6 billion in low-cost GPU financing tied to its Microsoft deal, a $1.9 billion prepayment that covers about 95% of GPU capex, and an expanded power portfolio now exceeding 4.5 gigawatts (GW).

Compass Point analyst Michael Donovan reiterated a buy rating and a $105 price target on IREN, saying the latest earnings show a company better positioned for growth, even though recent results were weaker. He said IREN now has more secure power and a clearer plan to fund its expansion, which matters more than one soft quarter.

Donovan described the fourth quarter as a period of change. Revenue fell to $184.7 million as the company mined less bitcoin while shifting its facilities from older bitcoin-focused machines to newer chips used for artificial intelligence. Even so, the mix of revenue improved as AI-related services began to make up a larger share of the business.

He pointed to the $3.6 billion financing package linked to IREN’s Microsoft project as an important milestone. The funding is larger than originally planned and is structured so that money is drawn as construction moves forward and revenue contracts kick in.

Donovan expects IREN to begin recognizing revenue from Microsoft toward the end of the second quarter of 2026, with revenue increasing in stages after that. By the end of 2026, he sees a path for the business to generate about $3.4 billion in annualized revenue.

Read more: Weak earnings drag IREN, Amazon; bitcoin stocks rebound in pre-market

Crypto World

100% of Strategy’s convertible debt is now out-of-the-money

As if the week for Strategy investors wasn’t already bad enough, their capital stack has hit another, new low. Unfortunately, 100% of the company’s convertible debt is now “out-of-the-money.”

With the firm’s 2030A convertible bond notes, the final holdout from last week, joining the other five series in reaching out-of-the-money territory, all six series now have a conversion price above the price of MSTR, Strategy’s common stock.

In plain English, it’s now worse for bondholders to convert into common stock rather than just keeping their bonds as bonds.

As a result, Strategy will need to continue servicing their coupons, and principal cash repayments.

While all bondholders are out-of-the-money, in other words, these convertibles will not convert into MSTR and will, instead, continue to drag on the cash obligations of the company going forward.

These creditors will demand on-time interest payouts and principal repayment through June 2032, unless the price of MSTR starts to rally and sufficiently motivate them to exercise their convertible options.

Strategy’s bonds pay interest coupons of 2.25%, 0.625%, and 0%, depending on their upcoming maturities. The company has $8.2 billion worth of notional debt outstanding.

Read more: Michael Saylor missed out on a $33 billion profit at Strategy

Strategy must service its out-of-the-money debts

Bonds, in capital stack seniority, rank even higher than preferred shares in terms of the company’s cash obligations.

Unlike common stock at the bottom of the stack or preferred dividends which the company’s board of directors may suspend at any time, Strategy must service its debts unless it wants to default.

Defaulting is normally a catastrophic decision from a financial perspective, risking downgrades by credit analysts, uncertainty in pricing listed securities, and possible legal action by the bondholders.

Whereas an in-the-money cushion above the company’s convertibles is widely viewed as a sign of financial strength, all convertibles issued by Strategy have punctured through that safety net.

Sure, they helped the company raise money to buy bitcoin in the past, but now they have long-lasting consequences.

No longer able to convert them into MSTR — unless MSTR rallies substantially — founder Michael Saylor must continue to repay bonds with cash or drum up more demand for MSTR so that its price rallies above bondholders’ conversion price.

Conversion prices for Strategy bonds range from a low of $149.77 to a high of $672.40.

Options traders coined the term out-of-the-money when “the money” simply meant the actual, realizable, current cash value of a position.

Traders used out-of-the-money as a shorthand reference to having no immediate cash worth by exercising a right like an option or warrant.

An option whose strike, or conversion, price was already favorable relative to prevailing prices of the underlying was “in the money” because there was real money on the table.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World7 days ago

Crypto World7 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech9 hours ago

Tech9 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports19 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat15 hours ago

NewsBeat15 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business1 day ago

Business1 day agoQuiz enters administration for third time

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports51 minutes ago

Sports51 minutes agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat5 days ago

NewsBeat5 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 hours ago

NewsBeat2 hours agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World1 day ago

Crypto World1 day agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”