Crypto World

Bhutan Sold $22.4M in Bitcoin Amid Portfolio Decline of Over 70%

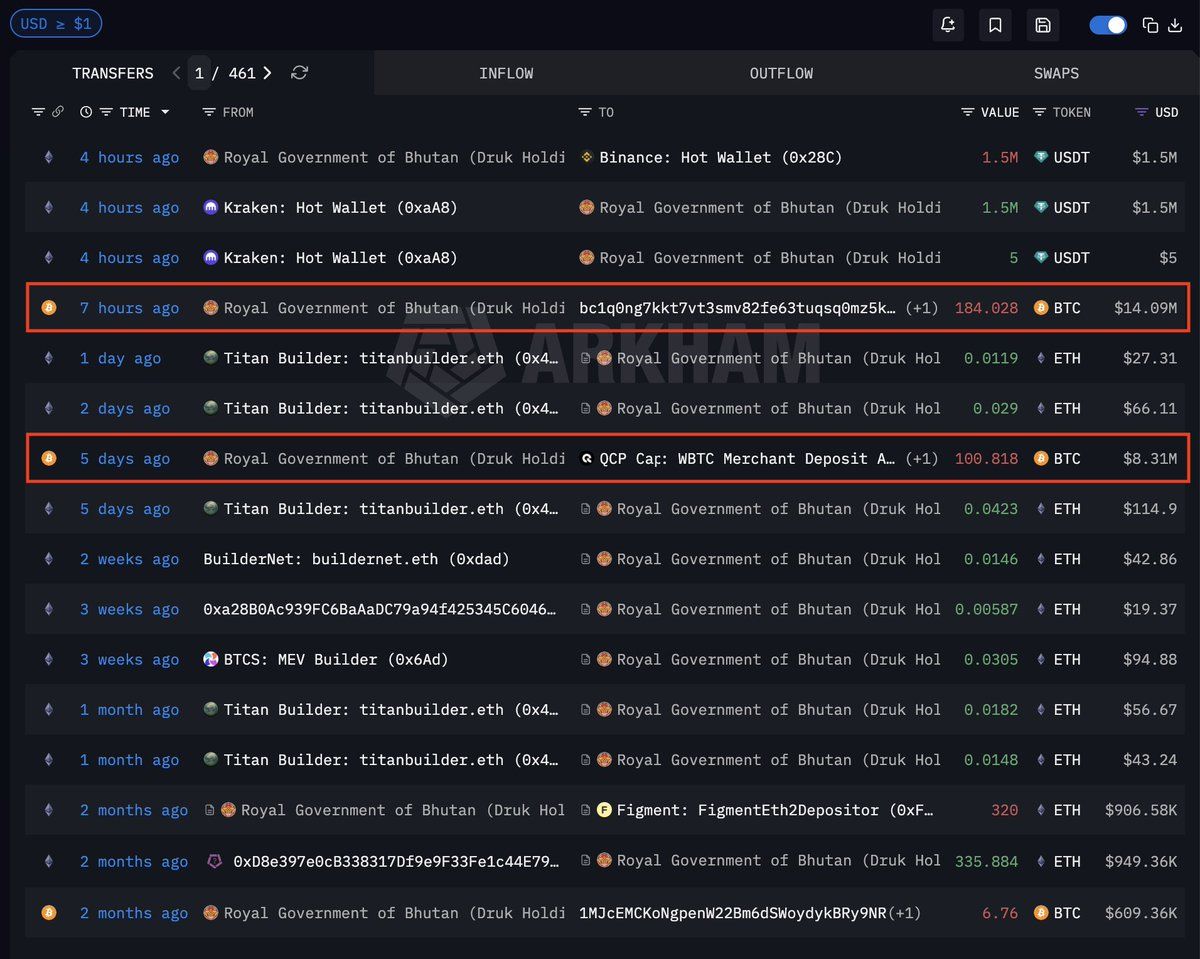

Bhutan moved $22.4 million in Bitcoin out of sovereign wallets this week, including a direct transaction to institutional market maker QCP Capital. The Himalayan nation’s crypto portfolio has dropped from a $1.4 billion peak to about $412 million.

The outflows continue a pattern of periodic liquidations by the Royal Government of Bhutan, which began mining and holding Bitcoin in 2019. These recent transactions highlight questions facing sovereign crypto strategies amid ongoing market pressures.

Sponsored

Sponsored

Recent Bitcoin Sales and Transaction Patterns

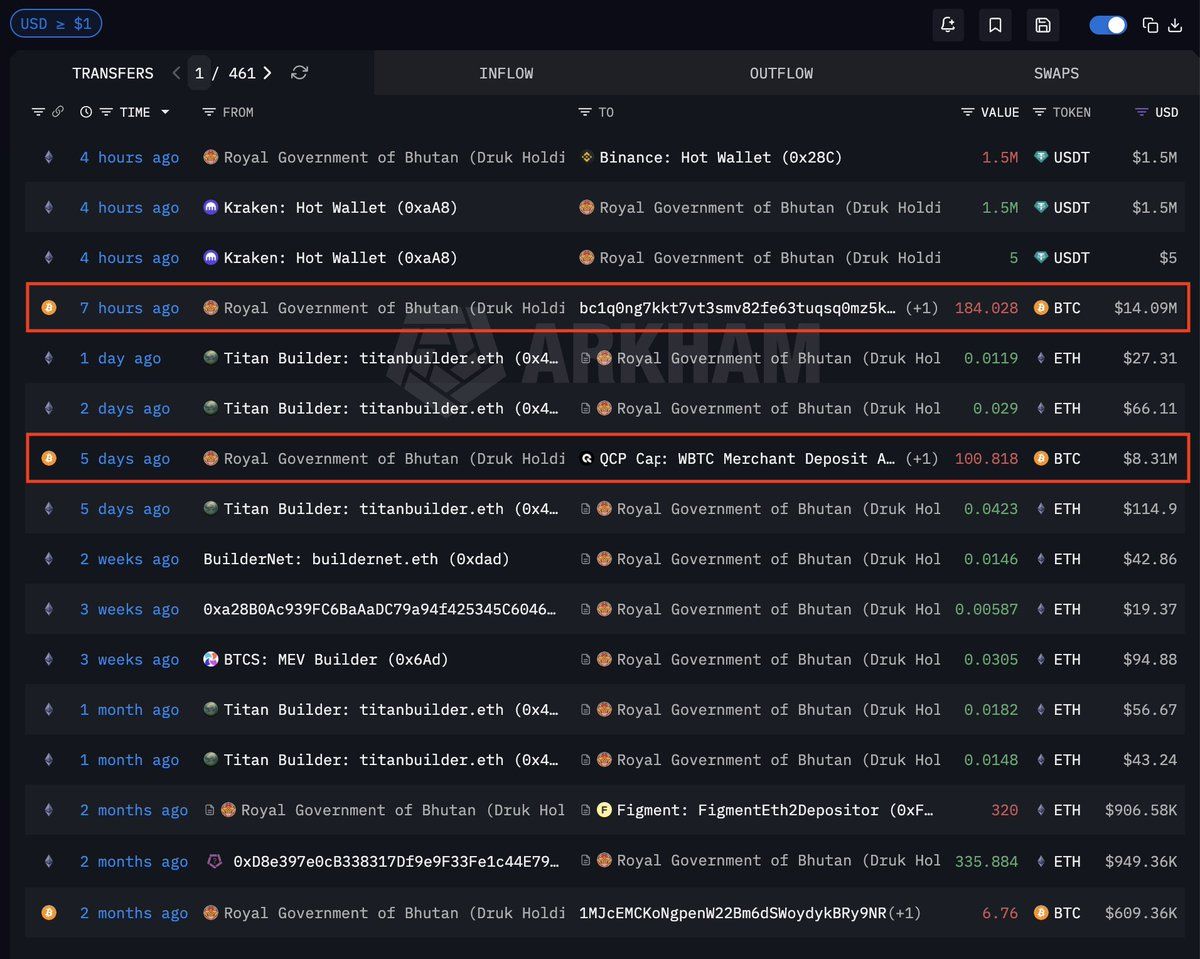

Blockchain analytics platform Arkham confirmed the Bitcoin sales. Two major outflows came from Druk Holding Investments (DHI), Bhutan’s sovereign investment arm. The transactions included 184.03 BTC, worth $14.09 million, and 100.82 BTC, valued at $8.31 million, five days earlier. The latter went directly to labeled addresses tied to QCP Capital, a Singapore-based institutional market maker active in derivatives and spot markets.

According to Arkham’s analysis, Bhutan usually sells Bitcoin in roughly $50 million tranches. Historical data shows especially heavy sales between mid and late September 2025, with multiple transactions surpassing $50 million each. The current $22.4 million in weekly outflows is smaller than past sales, suggesting either more measured liquidation or reduced holdings.

The QCP Capital transaction signals a strategic liquidation rather than distressed selling. Market makers such as QCP enable large block trades without major market disruption. This allows sovereigns to exit positions while minimizing price impact, unlike direct exchange deposits that may trigger sharper reactions.

Sponsored

Sponsored

Bhutan’s Bitcoin Mining Operation and Profitability

Bhutan’s Bitcoin strategy began in 2019, with DHI launching a mining operation powered by the country’s abundant hydroelectric resources. Arkham estimates that Bhutan has generated over $765 million in Bitcoin profits since its inception, while total energy costs were about $120 million. Hydropower has kept costs low compared with competitors that rely on fossil fuels.

The 2024 Bitcoin halving fundamentally changed mining economics. This event, which occurs about every four years, halves block rewards. The halving essentially doubled the cost to mine one Bitcoin, making operations less efficient. Data indicate that Bhutan mined most of its holdings before April 2024 and then sharply cut back production.

Pre-halving profit margins enabled Bhutan to amass substantial holdings at favorable costs. However, reduced efficiency after halving likely pushed the nation to monetize its reserves rather than continue energy-intensive mining at lower returns. This strategic shift from accumulation to selective selling mirrors a wider industry trend as sector profitability compresses.

Portfolio Decline and Current Holdings

Bhutan’s cryptocurrency portfolio has experienced a dramatic contraction. Arkham Intelligence data show DHI’s on-chain assets currently total about $412 million, down over 70% from the $1.4 billion peak. The portfolio consists mostly of 5,700 BTC, with negligible holdings in Ethereum and other tokens.

The portfolio decline is due to ongoing sales and depreciation in the Bitcoin price. Some value erosion came from strategic liquidations for profit or fiscal needs, but broader market conditions during 2025 and early 2026 also contributed. Bhutan’s peak holdings aligned with Bitcoin’s price highs, amplifying the percentage drop as prices corrected.

Transaction history shows DHI’s main exchange partners are Binance—which has $261 million in transferred value, or 68% of activity—and Celsius Network, with $118 million (31%). Smaller amounts moved through Kraken. These exchange interactions, combined with direct transactions with market makers, show a sophisticated approach to treasury management by Bhutan.

The Druk Holding and Investments entity manages these digital assets along with traditional investments as part of Bhutan’s broader diversification strategy. The integration of cryptocurrency into the sovereign treasury positions Bhutan among a select group of nations involved directly in digital asset markets. Whether Bhutan’s continued liquidations indicate a full exit or just portfolio rebalancing remains an open question as observers track sovereign crypto adoption trends.

Crypto World

WTI Oil Prices Volatile Ahead of Potential Talks

As the XTI/USD chart shows, the price of a barrel rose above $65 yesterday, reacting to the risk of talks between Iran and the United States on the nuclear deal breaking down. These negotiations could begin on Friday.

According to Axios, Arab world leaders have urged Donald Trump not to follow through on his threats to withdraw from the talks and shift towards military action after demands put forward by Iran. This news prompted a pullback in prices below $64.

The news backdrop is further complicated by conflicting reports regarding India’s refusal to purchase Russian oil, alongside other global factors. All of this is contributing to heightened volatility in the oil market, a trend also confirmed by the ATR indicator.

Technical Analysis of XTI/USD

On 14 January, we:

→ analysed swings in WTI crude prices to identify a breakout from a descending channel (shown in red) and outline an upward trajectory (shown in blue);

→ noted that the breakout level (around $58.35) was acting as support;

→ suggested that the market was vulnerable to a corrective move.

Indeed, on the same day (as indicated by the blue arrow), the price formed a bearish impulse towards this support, where the market found some balance.

However, geopolitical developments since the second half of January have supported higher prices, providing grounds to draw a broad ascending channel (shown in purple). In this context:

→ its lower boundary is acting as support, with the long lower wick on the 3 February candle confirming aggressive buying interest;

→ the $65 level appears to be a key resistance. Broad price swings formed there on 29–30 January — a sign of “smart money” activity — after which prices declined. Yesterday, the market again reversed sharply from this level.

It is therefore reasonable to assume that this resistance will pose a significant hurdle for bulls if they attempt to keep prices within the ascending purple channel. At the same time, the further direction of WTI oil price movements will most likely be determined by developments surrounding Friday’s Iran–US nuclear talks in Oman.

Start trading commodity CFDs with tight spreads (additional fees may apply). Open your trading account now or learn more about trading commodity CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Crypto Cards Rival Stablecoin Transfers as Spending Tops $18 Billion: Artemis

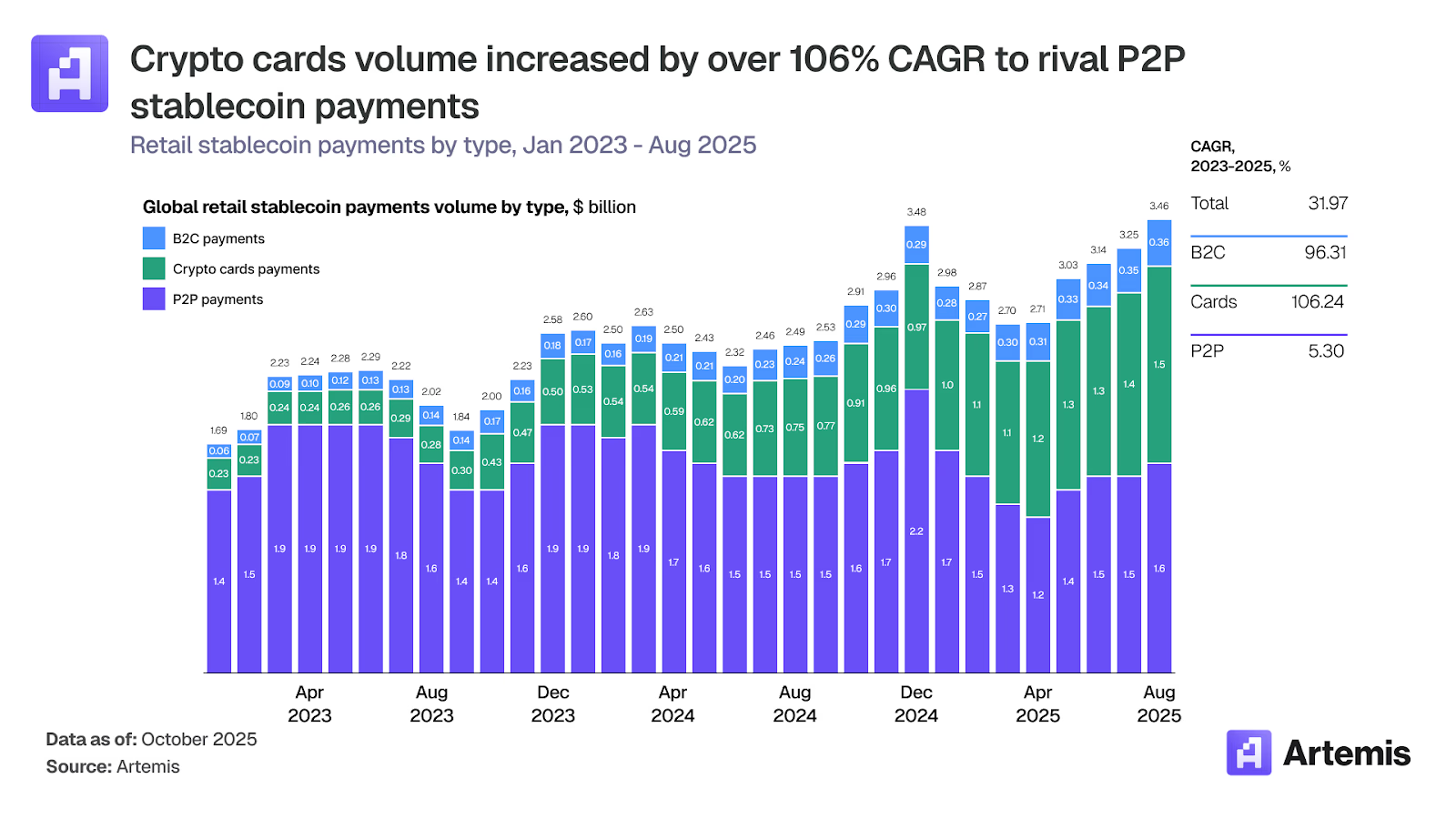

Crypto-linked cards are emerging as a key channel for stablecoin usage, with annualized volumes now catching up to peer-to-peer on-chain transfers.

Crypto-linked payment cards have become one of the fastest-growing bridges between stablecoins and everyday commerce, according to Artemis, a blockchain analytics firm.

In a Jan. 15 research report compiling estimates from on-chain settlement data and card network disclosures, Artemis found that monthly crypto card volume surged from about $100 million in early 2023 to more than $1.5 billion by late 2025.

“Annualized, the market now exceeds $18 billion, rivaling peer-to-peer stablecoin transfers ($19 billion), which grew just 5% over the same period,” the report reads.

While crypto cards can be funded with a range of assets, the report notes that Circle’s USDC and Tether’s USDT account for nearly 96% of deposited collateral on cards issued via Rain, an infrastructure platform that enables businesses to issue Visa cards.

Visa has also emerged as the dominant payment network in the sector, capturing more than 90% of on-chain card volume despite having a similar number of programs as Mastercard. As Artemis explains, this divergence is likely thanks to Visa’s “early partnerships with infrastructure providers.”

Visa’s stablecoin-linked card spending alone reached a $3.5 billion annualized run rate in late 2025, growing about 460% year over year, according to the report.

A geographic breakdown of stablecoin usage shows India and Argentina as “true global outliers,” where USDC accounts for 47.4% and 46.6% of usage, respectively.

By comparison, USDT dominates stablecoin activity across most other markets, including Turkey, China and Japan, according to the data.

However, even with the rapid growth of crypto cards, Artemis doesn’t expect direct crypto acceptance to fully replace card networks in the near term, citing their “slow relative growth in volume in comparison to cards.”

Crypto World

Bitcoin back up above $71,000

Bitcoin clawed its way back above $71,000 on Thursday after a sharp selloff earlier in the day dragged prices briefly below the $70,000 mark, mirroring tentative stabilization across global markets.

The move came as a broader rout in technology stocks showed signs of fatigue. Futures tied to the Nasdaq 100 edged higher after two bruising sessions that erased the index’s gains for the year, while European stocks steadied and Asian markets trimmed losses.

Bitcoin had fallen as much as 7% over the previous 24 hours as investors reduced risk across assets tied to growth and leverage. The slide coincided with renewed pressure in precious metals, where silver plunged as much as 17%, extending a brutal reversal after last month’s record rally.

Gold also slipped, underscoring how quickly speculative trades across markets have been unwound.

In crypto, the bounce above $71,000 appears more like short covering than a renewed rush of buyers. Trading volumes remain elevated, but demand in the spot market has thinned, according to analysts.

Stablecoin balances on exchanges have also been drifting lower, suggesting fresh capital is staying on the sidelines rather than stepping in aggressively on dips.

Macro uncertainty continues to weigh on sentiment. Investors are recalibrating expectations around US interest rates amid speculation over Federal Reserve leadership and the risk of a stronger dollar, which typically pressures assets like bitcoin that thrive on easy liquidity.

Some firms remain cautious. Galaxy Digital has warned that, without a clear catalyst, bitcoin could still revisit lower levels if selling resumes.

Others see the bulk of the drawdown as already behind the market, with estimates clustering around a potential bottom in the low-to-mid $60,000 range.

Crypto World

CFTC Formally Withdraws Biden-Era Proposal to Ban Sports and Political Prediction Markets

The agency called the 2024 rule a “frolic into merit regulation” and said it will pursue new rulemaking grounded in the Commodity Exchange Act to provide clarity for prediction market operators.

Commodity Futures Trading Commission Chairman Michael S. Selig has formally withdrawn a 2024 notice of proposed rulemaking that would have banned political, sports and war-related event contracts, marking the clearest signal yet that the agency intends to regulate prediction markets rather than restrict them.

Key Takeaways:

– The CFTC scrapped both its 2024 proposal to ban event contracts and a 2025 staff advisory that had warned firms away from sports-related markets.

– Chairman Selig dismissed the earlier ban as a politically driven “frolic into merit regulation” and committed to building a new rules-based framework.

– The move lands as Kalshi, Polymarket and Coinbase fight a wave of state lawsuits alleging their sports contracts amount to unlicensed gambling.

The agency also rescinded CFTC Staff Letter 25-36, a September 2025 advisory that had warned regulated entities to exercise caution when facilitating sports-related event contracts due to ongoing litigation. In the remarks following the decision, Selig said:

“The 2024 event contracts proposal reflected the prior administration’s frolic into merit regulation with an outright prohibition on political contracts ahead of the 2024 presidential election.”

The CFTC does not intend to issue final rules under the withdrawn proposal, according to the press release.

Instead, the commission will advance a new rulemaking framework anchored in the Commodity Exchange Act, aiming to establish clear standards for event contracts and provide legal certainty for exchanges and intermediaries.

Selig Frames Withdrawal as First Step Toward Comprehensive Event Contracts Rulemaking

The announcement follows remarks Selig delivered on January 29 at a joint CFTC-SEC harmonization event alongside Securities and Exchange Commission Chairman Paul Atkins. As reported, Selig used his first public speech as chairman to outline a broader reset of the agency’s approach to prediction markets.

“For too long, the CFTC’s existing framework has proven difficult to apply and has failed our market participants,” Selig said. “That is something I intend to fix by establishing clear standards for event contracts that provide certainty to market participants.”

Selig also directed staff to reassess the commission’s participation in pending federal court cases where jurisdictional questions are at issue, signaling that the CFTC may intervene to defend its exclusive authority over commodity derivatives.

Prediction Market Platforms Navigate Booming Growth and State-Level Legal Battles

The withdrawal arrives as prediction markets experience rapid expansion and intensifying regulatory friction. Combined trading volumes on Polymarket and Kalshi, the two largest platforms, reached $37 billion in 2025, drawing in major exchanges eager to compete.

Coinbase launched prediction markets through a partnership with Kalshi, a federally regulated designated contract market, in late January. Crypto.com recently spun out its prediction business into a standalone platform called OG. Polymarket returned to the U.S. market in December after receiving CFTC no-action relief, and Gemini secured a designated contract market license for its Titan platform.

Meanwhile, state gaming regulators have pushed back. Nevada filed a civil enforcement action against Coinbase this week, arguing that event contracts tied to sports constitute unlicensed gambling. Coinbase has sued regulators in Michigan, Illinois and Connecticut over similar claims.

The NCAA has also urged the CFTC to halt college sports prediction trading, warning that the sector exposes student-athletes to integrity risks and operates outside state-level safeguards.

Selig, who was sworn in on December 22, has not provided a firm timeline for the new rulemaking, but positioned event contracts as a priority alongside the agency’s broader “Project Crypto” initiative with the SEC.

The post CFTC Formally Withdraws Biden-Era Proposal to Ban Sports and Political Prediction Markets appeared first on Cryptonews.

Crypto World

Bitcoin ETFs ‘Hanging In There’ Despite Price Plunge: Analyst

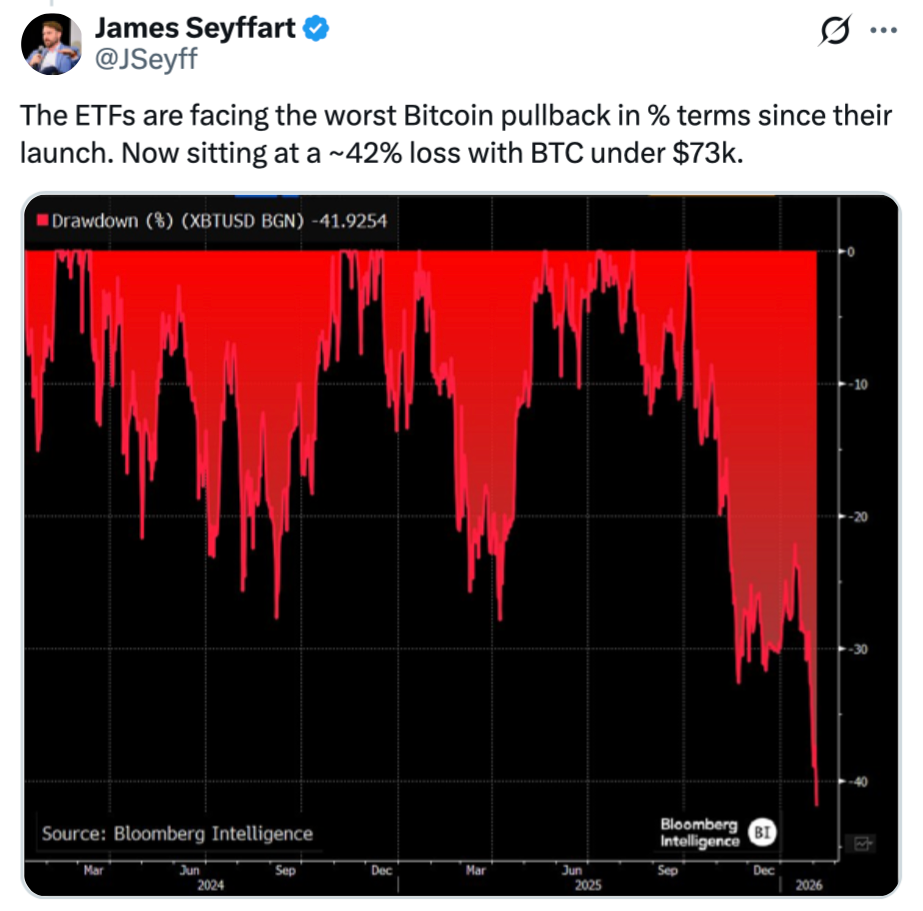

US-based spot Bitcoin exchange-traded fund (ETF) holders are showing relatively firm conviction despite a four-month Bitcoin downtrend, according to ETF analyst James Seyffart.

“The ETFs are still hanging in there pretty good,” Seyffart said in an X post on Wednesday.

While Seyffart said that Bitcoin (BTC) ETF holders are facing their “biggest losses” since the US products launched in January 2024 — at a paper loss of around 42% with Bitcoin below $73,000 — he argues the recent outflows pale in comparison to the inflows during the market’s peak.

Bitcoin ETF holders are “underwater and collectively holding.”

Before the October downturn, spot Bitcoin ETF net inflows were around $62.11 billion. They’ve now fallen to about $55 billion, according to preliminary data from Farside Investors.

“Not too shabby,” Seyffart said.

Meanwhile, investment researcher Jim Bianco said in an X post on Wednesday that the average spot Bitcoin ETF holder is 24% “underwater and collectively holding.”

Bitcoiners are being “very short-sighted.”

Crypto analytics account Rand pointed out in an X post on Tuesday that this is “the first time in history there have been three consecutive months of outflows.”

The extended outflows come as Bitcoin’s spot price has fallen 24.73% over the past 30 days, trading at $70,537 at the time of publication, according to CoinMarketCap.

Some analysts argue that Bitcoin investors are overlooking the bigger picture.

Related: XRP traders more optimistic as BTC, ETH mood turns sour: Santiment

ETF analyst Eric Balchunas said on Jan. 28 that Bitcoiners are being “very short-sighted,” given that Bitcoin’s performance since 2022 has been up over 400%, compared with gold at 177% and silver at 350%.

“In other words, bitcoin spanked everything so bad in ’23 and ’24 (which ppl seem to forget) that those other assets still haven’t caught up even after having their greatest year ever and BTC being in a coma,” Balchunas said.

Meanwhile, CryptoQuant CEO Ki Young Ju said in an X post on Wednesday that “every Bitcoin analyst is now bearish.”

Magazine: South Korea gets rich from crypto… North Korea gets weapons

Crypto World

Base App Pivots to ‘Trading-First’ Six Months After SocialFi Rebrand

Base lead Jesse Pollak said the web3 app will focus more on trading features, dialing back its social-heavy approach.

Jesse Pollak, Coinbase’s head of Base and Base App, announced that the Base App will shift its product focus to trading after mixed user feedback on its social-heavy features.

In an X post on Wednesday, Jan. 14, Pollak said the centralized exchange is now refocusing the Base App “to be trading-first,” signaling a shift to a finance focus for the web3 app after months of debate over its direction.

Base is the Ethereum Layer 2 developed by Coinbase, while Base App is the rebranded version of what was Coinbase Wallet, the CEX’s self-custody web3 wallet app.

After the company positioned the rebranded product as a “super app” in July of last year — combining crypto wallet, trading, social, and other functions — Pollak said “hundreds of thousands” of users indeed tried it for creating, trading, and building. But, as Pollak revealed this week, the response to the Base App’s social features was mixed.

“The app felt overly focused on social,” he wrote, adding it felt “too close to web2” and didn’t reflect the range of assets people want to trade. Pollak also wrote that users are asking for “more high quality assets” and a feed that shows not only social tokens.

Finance-First UX

“We’re going to lean into a finance-first UX. We believe it makes more sense to layer social features on top of finance, than the other way around,” Pollak wrote on X.

The shift follows a similar move by Farcaster, a prominent SocialFi protocol that recently stepped back from its original social-first model to focus more on trading.

Commenting on Base’s refocus, Dragonfly Capital partner Rob Hadick said in an X post on Jan. 15 that the move reinforces the view that blockchains work best for moving money, saying that “Base may have been the last meaningful hold out” of the social-first approach in web3.

The change also follows Coinbase CEO Brian Armstrong’s public request for feedback late last year, in which he questioned whether the Base App should prioritize trading, social features, or a mix of both.

Crypto World

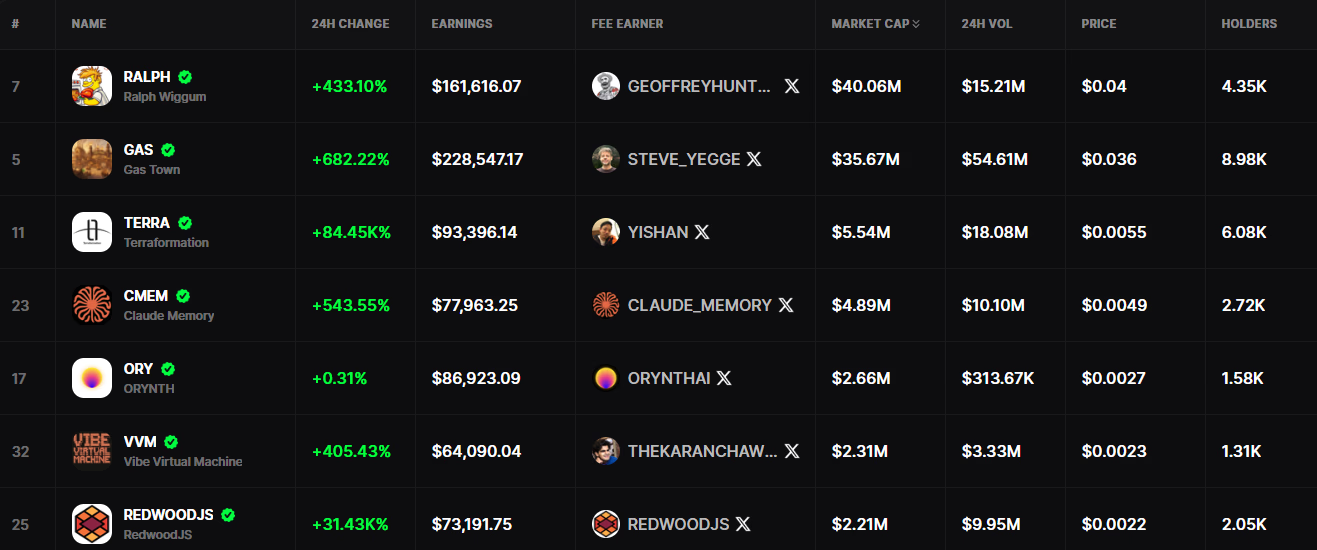

Bags Launchpad Activity Surges After GAS Token Soars 700%

The Solana-based launchpad is gaining market share amid a resurgence in creator-linked coins.

Activity on Bags.fm, a Solana-based token launchpad, is spiking this week after the success of Gas Town’s token (GAS) drew traders to the platform.

Over the past 24 hours, several Bags.fm tokens posted significant gains: GAS surged 682%, Ralph Wiggum (RALPH) spiked 433%, Claude Memory (CMEM) climbed 543%, and Vibe Virtual Machine (VVM) gained 405%.

Meanwhile, Terraformation (TERRA) and RedwoodJS are up a whopping 84,000% and 31,000%, respectively, after launching earlier this morning.

The momentum is making waves across the launchpad sector. On Jupiter’s launchpad leaderboard, Bags ranked second by market share over the past day, with roughly 33.5% share and $293 million in volume, behind pumpfun at 51.2% and $448 million.

Jupiter data also shows that Bags volume remained relatively muted through late December 2025 and early January, before jumping yesterday as GAS rallied.

How exactly is Bags different?

Bags markets itself as a way for creators, artists, and entrepreneurs to fund ideas by launching coins that anyone can trade, while earning a cut of trading activity as royalties.

Gas Town, for example, is an open-source AI coding-agent orchestrator created by software engineer Steve Yegge. After the project gained traction online, a token linked to Gas Town (GAS) was launched on Bags, and trading activity quickly surged, Yegge explained in a Medium blog post.

As GAS trading picked up, it also generated large fee payouts for the account listed as the token’s “fee earner” (in this case, Yegge), which helped bring more attention to the Bags ecosystem.

The surge echoes recent “attention-driven” crypto cycles, where viral moments lead to sudden onchain revenue. Last year, onchain social platform Zora hit record daily revenue after Base-linked posts sparked a speculative frenzy, even as other metrics, like active addresses and total value locked (TVL), were flat or down.

On its website, Bags says creators earn 1% of trading volume from their coin and can claim the fees after verifying the linked social account. It also encourages creators to build communities around their tokens, with holders benefiting if the coin grows.

The Bags team did not immediately respond to The Defiant’s request for comment.

Crypto World

Binance Says Assets Increased During Suspected Bank Run Attempt

Binance said assets on its on-chain addresses increased during what appeared to be an attempted bank run, after a wave of social media posts urged users to pull funds from the world’s biggest crypto exchange.

Co-founder He Yi described the episode on X as a coordinated withdrawal push from parts of the community. She said she still did not understand why deposits appeared to outweigh withdrawals once the campaign started, and she framed routine, large-scale withdrawals across platforms as a useful stress test for the industry.

She also urged users to slow down when moving funds, warning that mistakes on blockchain transfers are permanent once confirmed.

In the same post, she pointed users toward self-custody options, including Binance Wallet and Trust Wallet, and suggested a hardware wallet alternative for those who want added reassurance.

Binance Outage Sparks Renewed Talk Of Exchange Risk On Social Media

The comments landed after Binance briefly paused withdrawals on Tuesday, a disruption that revived familiar nerves in a market still sensitive to exchange solvency rumours.

The company first posted, “We are aware of some technical difficulties affecting withdrawals on the platform. Our team is already working on a fix, and services will resume as soon as possible.” Follow-up updates said the issue was resolved in about 20 minutes.

The short outage quickly turned into a talking point on X, with some users drawing parallels to past exchange failures, such as FTX, and framing the withdrawal push as a stress test of Binance’s plumbing.

He Yi’s message pushed back on that narrative by pointing to net inflows, not outflows, during the campaign window.

Zhao Denies Bitcoin Dump Claims Amid Weekend Selloff

On Monday, Binance co-founder Changpeng Zhao also weighed in, arguing that the market was recycling blame stories as crypto prices slid.

He called the allegations “pretty imaginative FUD” and rejected claims that Binance sold $1B of Bitcoin to trigger the weekend sell-off, saying the funds belonged to users trading on the platform.

Zhao also took aim at the idea that he could steer the market cycle through public comments. “If I had that power, I wouldn’t be on Crypto Twitter with you lot,” he wrote, after some users joked that he “canceled the supercycle” by sounding less confident about the thesis.

The back-and-forth played out as crypto traders stayed jittery and liquidity thinned across venues, conditions that tend to amplify rumours and accelerate crowd behaviour. It also revived a familiar fault line in the market, between traders who keep assets on exchanges for speed and those who see periodic withdrawals as the only credible check.

Binance has leaned on transparency reports to counter those concerns. CoinMarketCap’s Jan. 2026 exchange reserves ranking put Binance at the top with about $155.64B in total reserves, reinforcing its status as the largest liquidity hub in the sector.

The post Binance Says Assets Increased During Suspected Bank Run Attempt appeared first on Cryptonews.

Crypto World

Bhutan Quietly Sells Over $22M in Bitcoin, Triggers Speculation Over Possible Sell-Offs

The Royal Government of Bhutan has moved over $22 million in BTC out of sovereign wallets over the past week alone, drawing attention from the crypto community.

One transaction, 5 days ago, was directly sent to addresses linked to market maker QCP Capital, Arkham data revealed. The moves align with Bhutan’s periodic sales of BTC since it began mining the crypto in 2019.

“From our observations, Bhutan periodically sells BTC in clips of around $50M, with a particularly heavy period of selling around mid-late September 2025,” Arkham wrote.

Besides, the Himalayan Kingdom’s crypto portfolio has gone down more than 70% from its $1.4 billion peak to $412 million, following market depreciation.

Per Bitcoin Treasuries, Bhutan remains the seventh-largest government Bitcoin holder.

Bhutan Heavily Mined BTC in 2023 – Data

Bhutan has been mining Bitcoin since 2019 and saw more than $765 million in BTC profit.

“They mined most of their BTC before the halving in 2024, and tapered heavily after that,” said the Arkham report. “This is because the cost to mine a single Bitcoin roughly doubled, which made mining less efficient.”

Further, the nation seems to have mined 8,200 BTC in 2023 alone, making it the heaviest mining year. It approximately mined 1800 BTC in 2022 and 300 BTC in 2024.

Wallet Transfers Show No Sign of Liquidation

The BTC transfers from the government wallet in the past week come after Bitcoin has been slumping to $70,000. The largest crypto has tumbled 7.36% over the last 24 hours, outpacing the broader crypto market’s 6.39% fall.

Despite the heavy transfers, blockchain data analysts note that they are more likely to be internal reallocation or custodial arrangements rather than liquidation. The country’s wallet balances remain largely unchanged.

Bhutan has made similar mass wallet moves in the past without triggering market crashes.

The post Bhutan Quietly Sells Over $22M in Bitcoin, Triggers Speculation Over Possible Sell-Offs appeared first on Cryptonews.

Crypto World

Can XRP price hold $1.45 demand zone as key metric peaks?

XRP price is testing a critical demand zone near $1.45 as rising on-chain velocity and falling open interest hint at a decisive move ahead.

Summary

- XRP trades near $1.44 after sharp weekly losses, with sellers still dictating short-term direction.

- On-chain velocity has surged to yearly highs, suggesting heavy re-positioning as price weakens.

- A firm hold above $1.45 could spark a short bounce, while a breakdown risks deeper losses.

XRP was trading near $1.44 at press time, down about 10% over the past 24 hours, sliding to its lowest level since November 2024. The token has weakened across all major timeframes, falling 23% over the past week and nearly 40% over the past month.

Price action over the last seven days has remained confined between $1.44 and $1.88, with sellers maintaining control. Even so, market activity has picked up. XRP (XRP) recorded $5.07 billion in trading volume in the past 24 hours, up 25%. This points to heavy participation during the sell-off.

Derivatives data show a more cautious tone. CoinGlass figures indicate futures volume rose 17% to $7.94 billion, while open interest slipped 1.8% to $2.61 billion. This mix suggests that traders reducing leverage while spot activity rises, a setup that can appear near short-term turning points.

XRP velocity spikes as supply shifts hands

A Feb. 4 analysis by CryptoQuant contributor CryptoOnchain highlighted a sharp move in XRP Ledger activity. The seven-day SMA of XRP velocity climbed to 0.013 on Feb. 3, matching the highest levels seen since January 2025.

In previous cycles, this level has appeared at key moments. During this instance, the velocity increase coincided with a price decline, suggesting rapid coin movement rather than steady accumulation. Such conditions are often linked to older holdings changing hands or aggressive short-term trading during periods of stress.

According to the analyst, when velocity reaches its upper range while price struggles, it can mark a high-friction phase in the market. Whether this activity marks late-stage selling or the early stages of stabilization depends on how the price reacts around key support.

In a separate note, CryptoOnchain pointed to a sharp drop in XRP open interest on Binance, which has fallen to $405.9 million, the lowest level since November 2024.

A market reset of this size suggests that leverage has been significantly reduced. The probability of more forced sales drops as positions are unwound. This eases the influence of derivatives on short-term price moves.

Under these conditions, if spot demand holds up, any rebound is more likely to develop in a gradual and orderly way.

XRP price technical analysis

XRP is testing a clearly defined demand zone at $1.45, which has held during prior drops. The token is trading well below its 20-day moving average, placing the price in a stretched position.

XRP has also slipped below the lower Bollinger Band, which points to shrinking volatility. Instead of sellers running out of steam, the price action suggests heavy selling pressure pushing straight into support.

The relative strength index is in the low-30s, indicating that momentum is weak but getting closer to levels where selling pressure often slows.

Smaller bodies and longer wicks on recent candles suggest that sellers are meeting more resistance close to the current price. So far, the $1.45 level has not given way on a daily close.

If buyers continue to defend this zone, a short-term bounce toward $1.60–$1.70 becomes possible, driven by oversold conditions and reduced leverage. For the price to stabilize further, XRP would need to reclaim $1.80 and hold it.

Failure to hold $1.45 would change the picture quickly. A clean break below that level could open the door to deeper losses, as visible support becomes thinner beneath current prices.

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech1 day ago

Tech1 day agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World1 day ago

Crypto World1 day agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards

Gemini Clears Key CFTC Approval to Launch Prediction Market Platform in US

Gemini Clears Key CFTC Approval to Launch Prediction Market Platform in US